Arbitrum STIP Risk Analysis | Case Study #3: Pendle Finance

Preamble

As part of our recent election as the Risk Member on the Arbitrum Research & Development Committee (ARDC), Chaos Labs is pleased to share a blog post detailing our third case study for the ARDC: Pendle Finance. This is the third and final case study of a three-part series that entails an in-depth analysis of the risk and efficiency of the Arbitrum STIP on three major protocols, the third of which is Pendle Finance.

As requested by the DAO advocate for the ARDC, L2BEAT, Chaos Labs has been conducting case studies on STIP recipients. This case study provides an in-depth analysis of the Arbitrum STIP program’s impact on Pendle Finance, focusing on its efficiency and associated risks. This analysis is part of a broader series that evaluates the STIP program across three major protocols.

Following our previous analyses of Vertex and Silo Finance, we now turn our focus to Pendle Finance to provide a comprehensive evaluation of its performance and risk profile.

Introduction

An in-depth, bottom-up analysis of the protocol is essential to comprehensively understand the specific risks and efficiency factors influencing the Pendle STIP allocation. The initial section of this report delves into all pertinent aspects of Pendle Finance's functionality, providing context and reference.

Following this, detailed analyses of efficiency and risk are conducted, using the insights gained from the protocol deep-dive as a foundation. This analysis aims to identify all factors that could potentially result in adverse outcomes. These findings are then used to derive positive and negative insights from the Pendle STIP incentive program, which will inform the design of future incentive schemes.

Incentive Amount: 2m ARB

Incentive Uses: Liquidity incentives (55%), trading incentives (40%), Ecosystem integrations (5%)

Grant Matching: Yes

Pendle Overview

Pendle is a permissionless yield-trading protocol where users can execute various yield-management strategies. This is achieved by first wrapping yield-bearing tokens into Standardised Yield (SY) tokens. SY tokens are compatible with the Pendle AMM and can be split into its principal and yield components, PT (principal token) and YT (yield token), respectively. This process is called yield tokenisation and allows both PT and YT to be traded on Pendle’s AMM.

By creating a yield market in DeFi, Pendle unlocks the full potential of yield, enabling users to execute advanced yield strategies, such as:

- Fixed yield (e.g. earn fixed yield on stETH)

- Long yield (e.g. bet on stETH yield going up by purchasing more yield)

- Earn more yield without additional risks (e.g. provide liquidity with your stETH)

- A mix of the above strategies

Each PT and YT has a maturity date. For PT, you can redeem the full underlying yield-bearing token after this date. For YT, the yield of the yield-bearing token is only accrued up until the maturity date, after which YT has no value.

Pendle Liquidity

Pendle liquidity comes from holders of yield-bearing tokens wrapping and depositing them into AMM pools. These liquidity providers then earn swap fees, PENDLE rewards, and any other incentives on top of the tokens' native yield. The fixed maturity nature of these pools also means that if LPs keep providing liquidity until maturity, there will be no impermanent loss, and they will receive their initial tokens back along with the additional yield.

During the STIP, Pendle launched an Order Book system alongside its AMM to enable peer-to-peer trading of PT and YT. This allows users to place limit orders to buy or sell at a specified implied APY.

Together, the Order Book and AMM enhance market liquidity, facilitating smoother trading on Pendle.

The total liquidity in a pool impacts slippage and is therefore crucial for user experience and seamlessly offering the use cases users desire.

Pendle Trading

Liquidity pools in Pendle V2 are set up as PT/SY, e.g. PT-aUSDC / SY-aUSDC. Swapping PT is a straightforward process of swapping between the two assets in the pool, while swapping YT is enabled via flash swaps in the same pool.

Flash swaps are possible due to the relationship between PT and YT. As PT and YT can be minted from and redeemed to its underlying SY, we can express the price relationship:

P(PT) + P(YT) = P(Underlying)

Knowing that YT price has an inverted correlation against PT price, we use this price relationship to utilise the PT/SY pool for YT swaps.

Traders on Pendle obtain SY tokens by depositing yield-bearing tokens, and swap them to gain exposure to the token of their choice. As yields change they then have the option to trade further to alter their exposures.

Pendle Yield Token Integrations

A key feature of Pendle’s principal and yield tokens is their ability to support strategies that create specific exposures for users, enabled by ecosystem integrations with other protocols. Pendle offered incentives for depositing PT or LP positions into specific pools on other protocols to foster the broader ecosystem, liquidity, and trading activity. This initiative began in Week 5 of the program and was adjusted based on general market sentiment.

Use of Incentives

The objectives for the STIP, as stated by Pendle, were:

Increasing yield trading volume, inciting activity on the platform, deepening liquidity on existing pools as well as an additional incentive for users to bootstrap liquidity for newly listed Pendle markets Arbitrum, and finally to encourage activity on protocols built on top of Pendle.

This was implemented by allocating 55% of incentives towards liquidity providers on Pendle, 40% towards trading incentives, and 5% to ecosystem incentives.

Liquidity Incentives:

Slightly over half of the total incentives were allocated to boosting additional yield for LPs, aiming to encourage deeper liquidity and reduce slippage on Pendle.

Initially, Pendle distributed liquidity incentives based on vePENDLE votes for Arbitrum pools. However, this approach soon proved suboptimal as the incentives were neither distributed broadly nor targeted at the most active markets or new markets needing support. Starting from week 3, the Pendle team took over the allocations, using metrics such as the most active yield markets and new pools requiring initial liquidity. Additionally, there was significant experimentation and iteration in the weekly allocations.

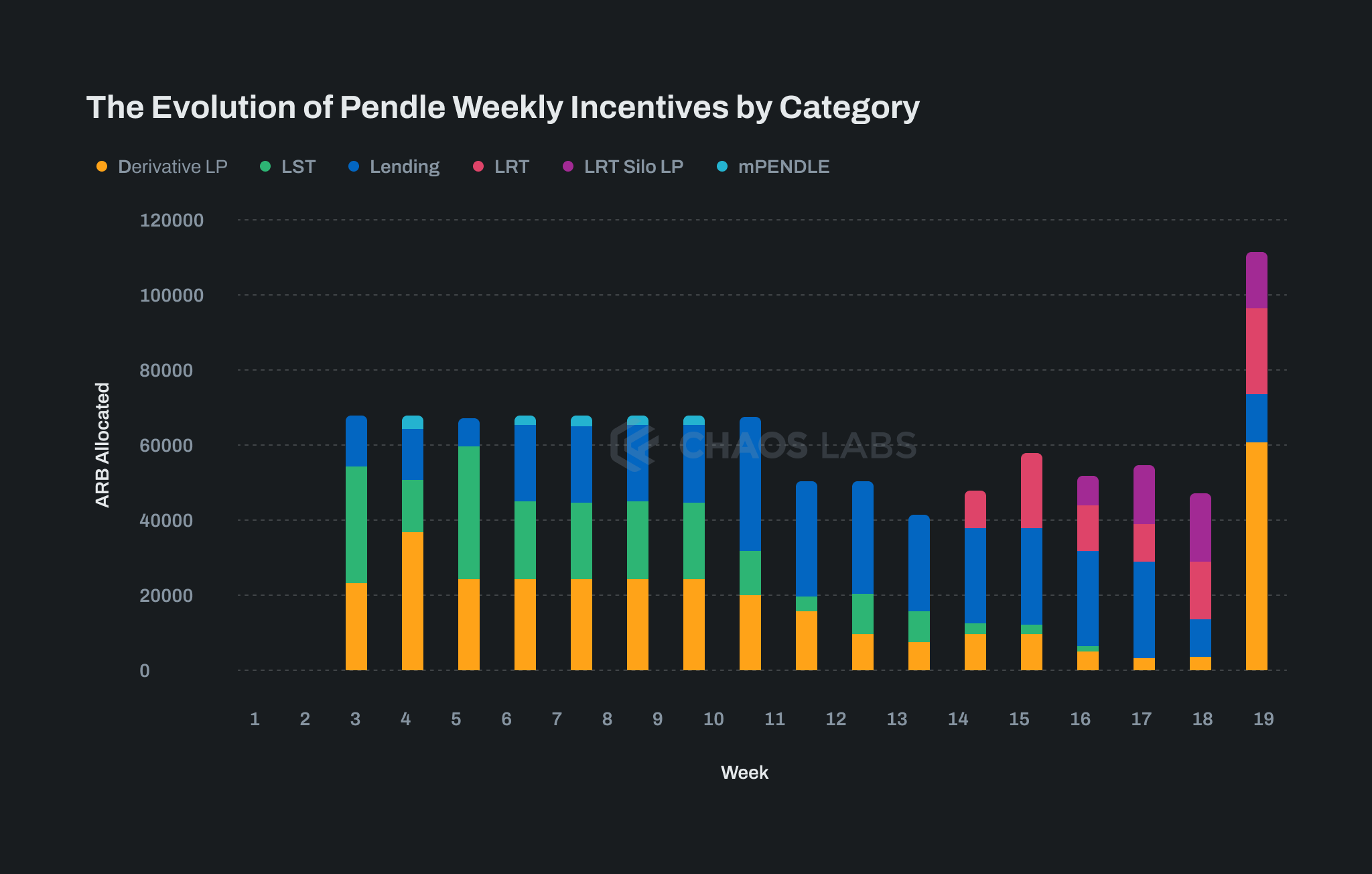

The chart below shows the evolution of weekly incentives by category. Over the course of the STIP, incentives were redirected from LST and derivative LP markets to lending, LRT, and Silo Pendle LP markets in response to market interest.

Trading Incentives:

Trading incentives were designed as campaigns targeted at increasing trading activity on Pendle. The initial STIP application suggested that there would be “at least one campaign per month will be done to keep things fresh and to entice users to keep trying out the campaigns.” Over the course of the STIP, the following campaigns were conducted:

- Swap fee rebates: This campaign refunded a portion of traders' swap fees with ARB tokens. The rebate was set below 100% to ensure wash trading remained unprofitable, starting at 75% and reducing to 50% in week 9. This campaign ran for the entire duration of the STIP.

- Trading leaderboard with prizes for the most successful traders: An in-app leaderboard showcased the top-ranked users based on percentage gain. These top performers received ARB rewards to stimulate more trading volume and TVL. Performance-based prizes also incentivized traders to improve their strategies, aiding in long-term retention.

- Supercharged swap fee rebates: For a limited time, certain pools had their swap fee rebates increased to 120% to further incentivize trading activity.

- Maker incentives to promote the new limit order book feature: Rewards were provided for using Pendle’s newly launched limit order feature. Filled limit orders earned ARB rewards proportional to the order size, drawing attention to this innovation. Pendle's limit orders were initially launched on Arbitrum.

Ecosystem Incentives:

Ecosystem incentives were designed to integrate Pendle tokens further into the broader DeFi ecosystem by encouraging their use on partner protocols. Large lending pools that accepted Pendle LP or PT tokens as collateral received ARB incentives to boost their usage. The incentivized protocols included Stella, Dolomite, Timeswap, Silo, and Teller.

Similar to the liquidity incentives, the focus of these incentives evolved throughout the STIP. Notably, in February 2024, the incentives shifted to emphasize leveraged strategies using LRT PT tokens, aligning with the development of these markets.

Pendle Incentives Impact

The objective of this impact assessment is to evaluate the effects of the incentive program on protocol activity, specifically examining the demand for holding Pendle PT and YT tokens, trading activity and liquidity provision on Pendle’s AMM. This detailed, bottom-up analysis scrutinizes individual components of the STIP, which are unique to Pendle. This allows a clear prescription of how the results of the program were obtained and how this could be applied to other protocols. The unique nature of the Pendle protocol makes direct comparison impossible, but important incentive principles can be gleaned from their program strategy.

Despite the STIP program's short-term nature, this report assesses its prolonged benefits by analyzing protocol usage data following the program’s conclusion. The intention is to identify persistent activity changes and what drove them.

Pendle accepts deposits of yield-bearing assets, wraps these into standardized yield (SY) tokens, and splits these into Principal (PT) and yield (YT) tokens. These PT and YT tokens are then bought and sold on the Pendle AMM, with Arbitrum end users primarily leveraging their PT positions or holding YT for yield.

Therefore, the impact analysis will focus on the effects of the incentives on the growth of the supply of yield-bearing assets available for trading (the supply side), the growth in the trading of Pendle yield tokens (trading activity), and the growth of ecosystem TVL.

The effectiveness of Pendle's incentives is thoroughly examined across various dimensions:

- How did the incentives affect the supply of yield-bearing assets by LPs?

- How did the incentives affect trading activity on the Pendle AMM?

- Did they attract new users?

- How did incentives affect retention?

- How did incentives affect the average volume per user?

- How did incentives affect the ecosystem growth of Pendle tokens?

The distribution of the incentives is also analyzed to gain insight into the structural efficiency of this program.

Liquidity Provider Reactions

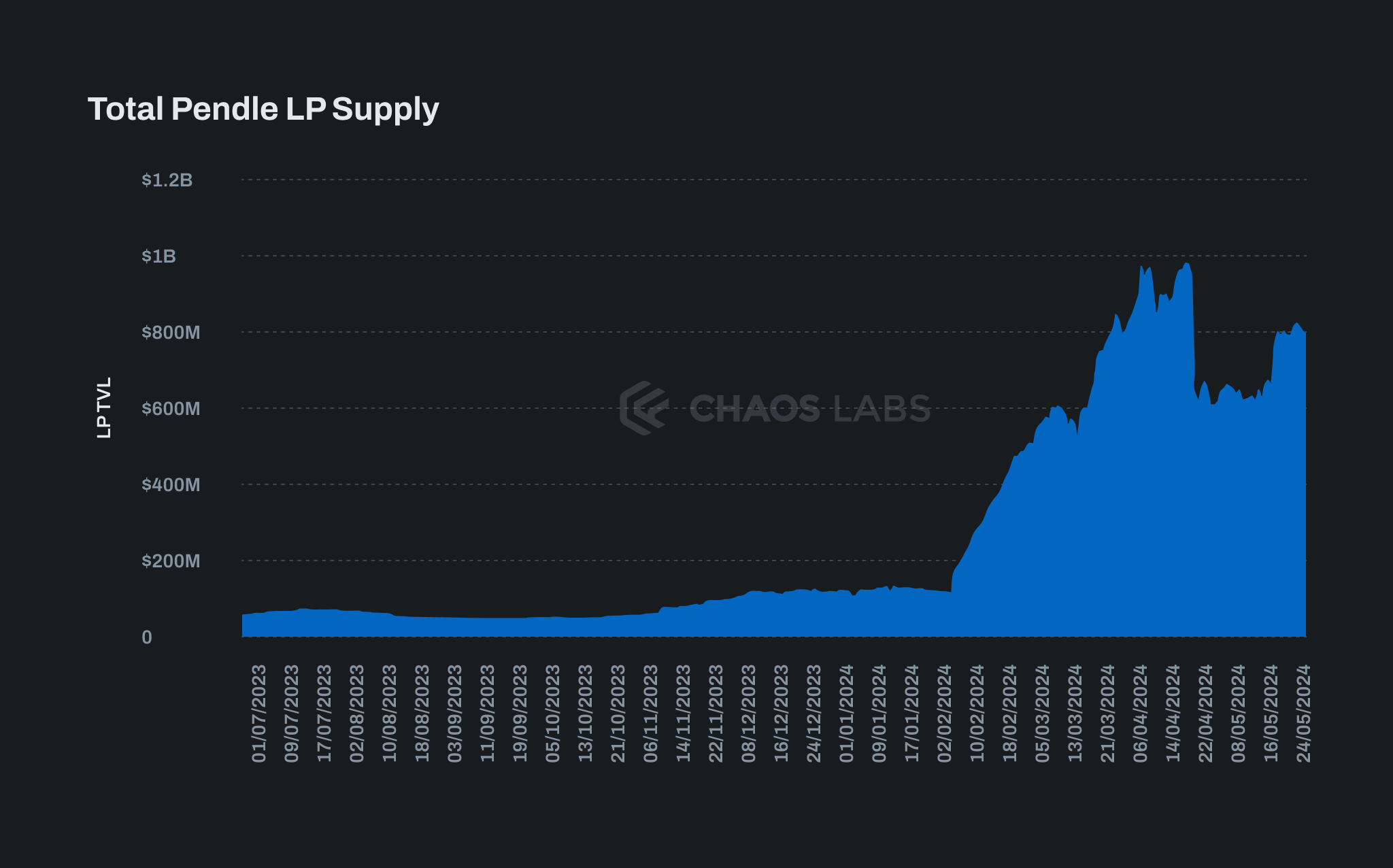

Liquidity from AMM LPs on Pendle grew from $52 million to $723 million over the STIP period. Most of this growth occurred between February and March 2024, driven by points programs on Liquid Restaking Tokens (LRTs) that were ideally suited to Pendle’s products. The increase in LRT TVL during this period was clearly due to the demand for Pendle’s offerings, although this growth on Arbitrum was positively affected by the STIP use.

Pendle’s focus on Arbitrum during this time, enhanced by STIP incentives, brought significant LRT TVL to Arbitrum and added considerable value to the chain. Without these incentives, LRT strategies on Pendle Arbitrum would have been less attractive, and the supply may not have grown as it did. It is also important to highlight how the attention flywheel established Arbitrum as a prominent hub for leveraged LRT strategies, with the incentives having a highly asymmetric effect on its success.

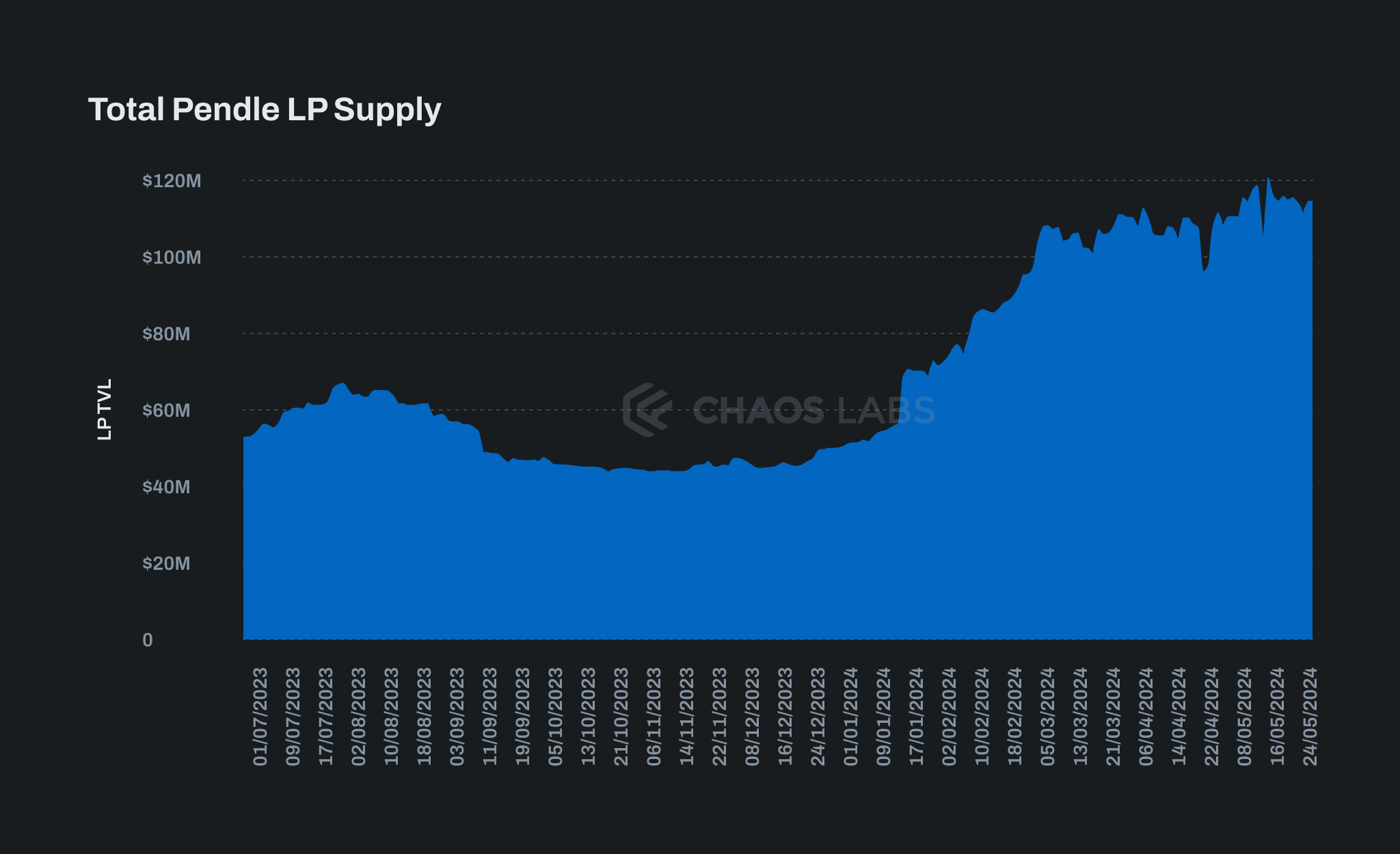

The aggressive growth observed after the launch of LRTs overshadows the performance during the first three months of the STIP. Focusing on the period from July 1, 2023, to January 31, 2024, a clear trend emerges with LP supply increasing from $52 million to $116 million by the end of January. Most of this growth occurred within the first six weeks of the STIP, before the launch of ecosystem incentives. It remains unclear whether these alternative avenues for accessing STIP rewards competed with LP supplies or if an equilibrium was reached between demand and supply, making the timing coincidental.

Trading Activity

These metrics focus on Pendle’s AMM activity. This is where fees are generated on the protocol.

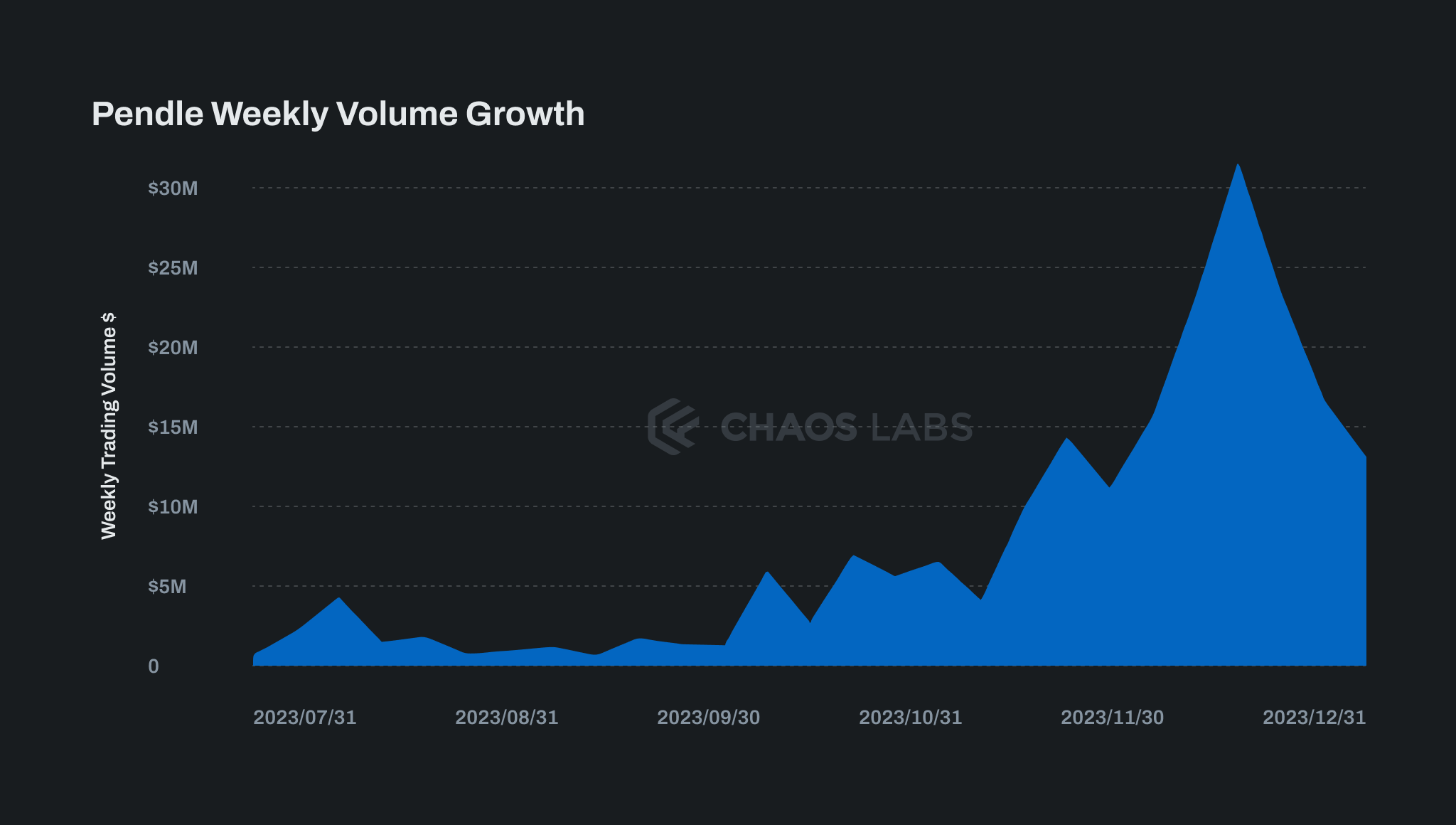

Weekly Trading Volume

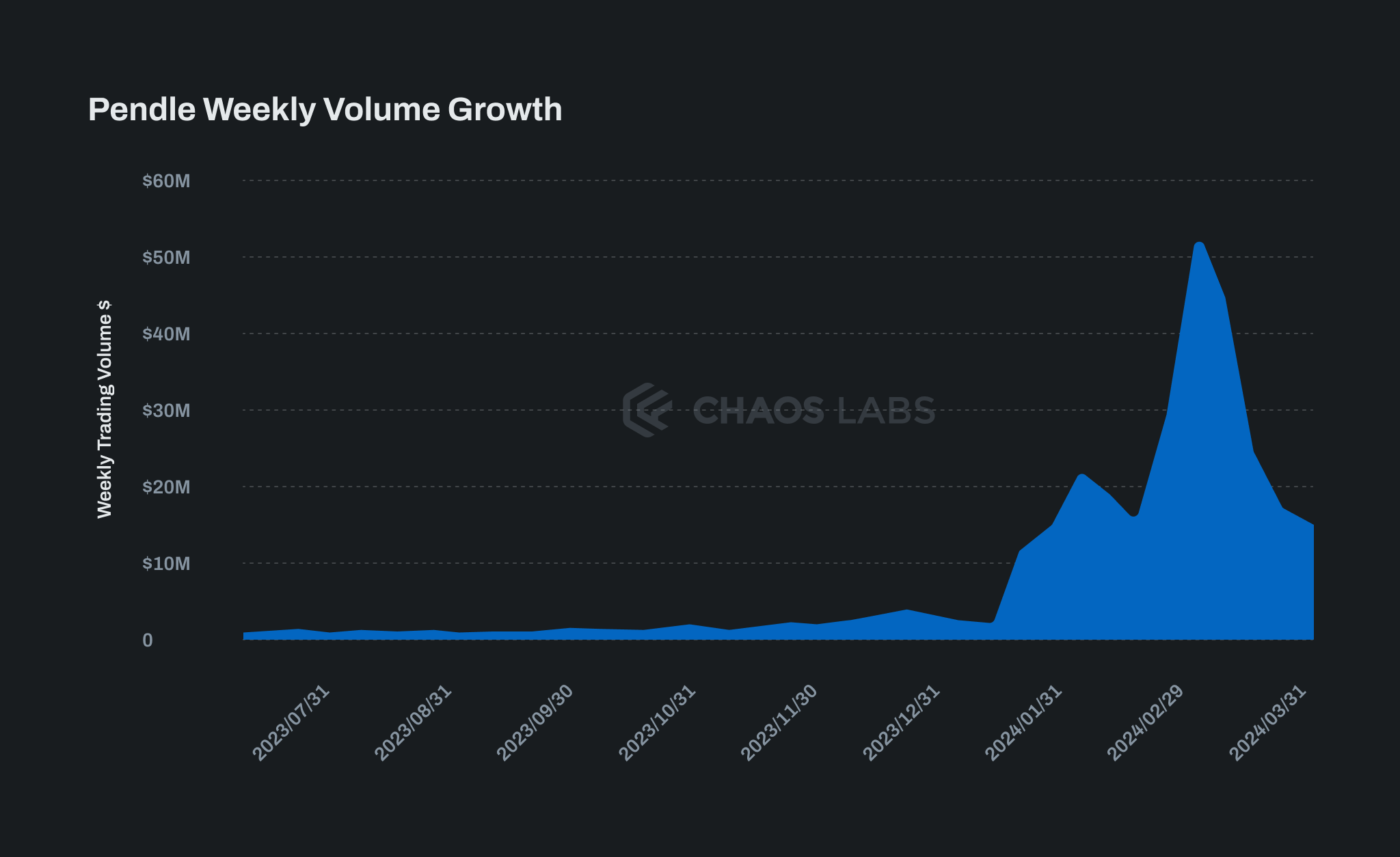

Like AMM supply, trading activity skyrocketed once LRTs launched. Weekly trading volumes grew from approximately $4m before the STIP to approximately $450m at its conclusion. This far exceeded the initial stated goal of 20m in monthly volume.

The scale of Pendle’s growth once LRTs launched masks its earlier growth trajectory, which was impressive enough in its own right. Zooming in on Pendle volumes to the end of January 2024 shows two distinct growth phases in Pendle trading volumes before the third LRT-driven acceleration in March 2024. At the program's outset, weekly volumes immediately tripled before remaining at this level for four weeks. Rebalancing incentives from LSTs to derivatives LP markets in early December 2023 reignited trading growth

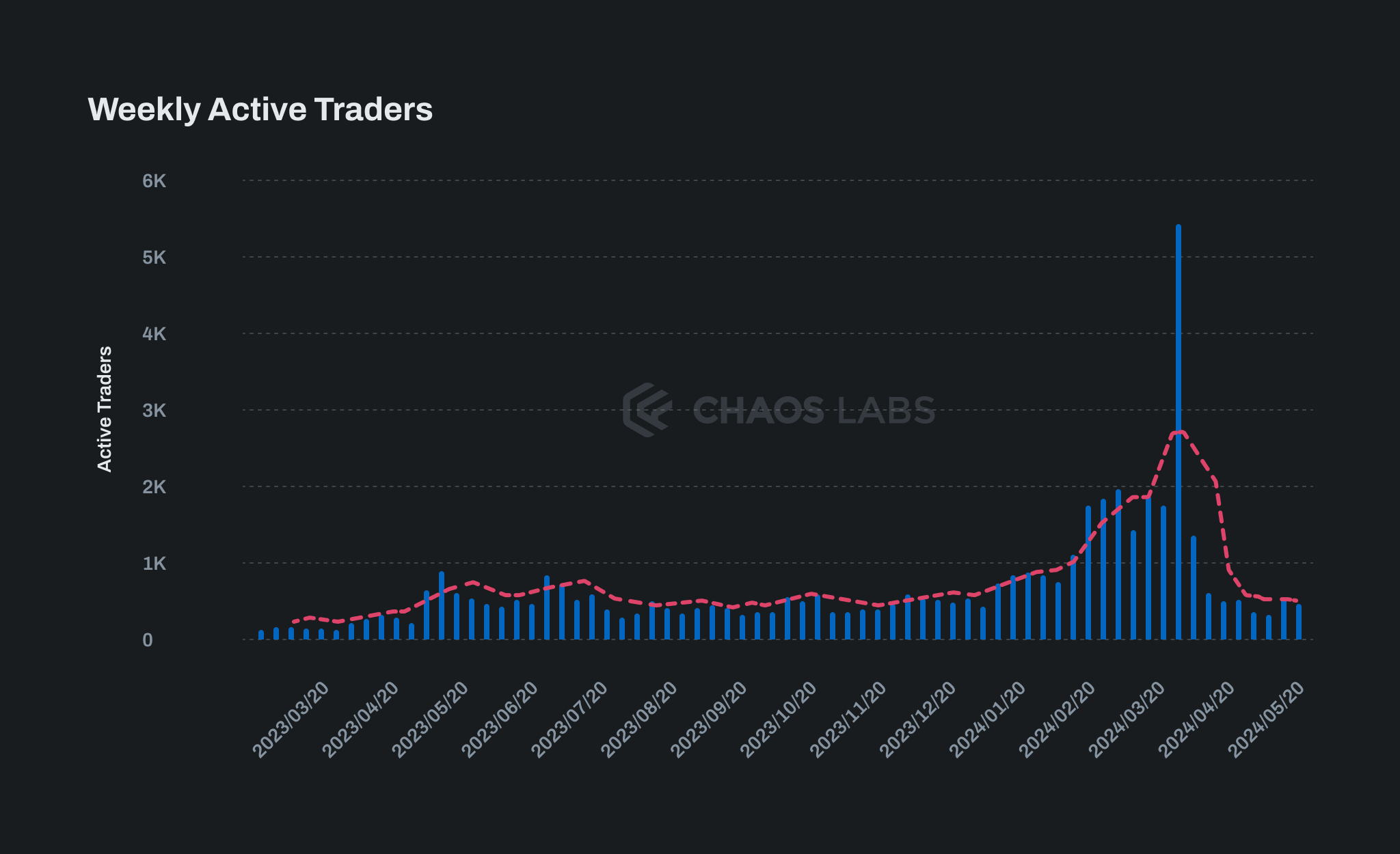

Total Trader Numbers

Trader numbers increased only slightly until February 2024, when LRTs launched. Earlier incentives targeting derivative LPs, LSTs, and lending aTokens had no discernable impact on trader numbers.

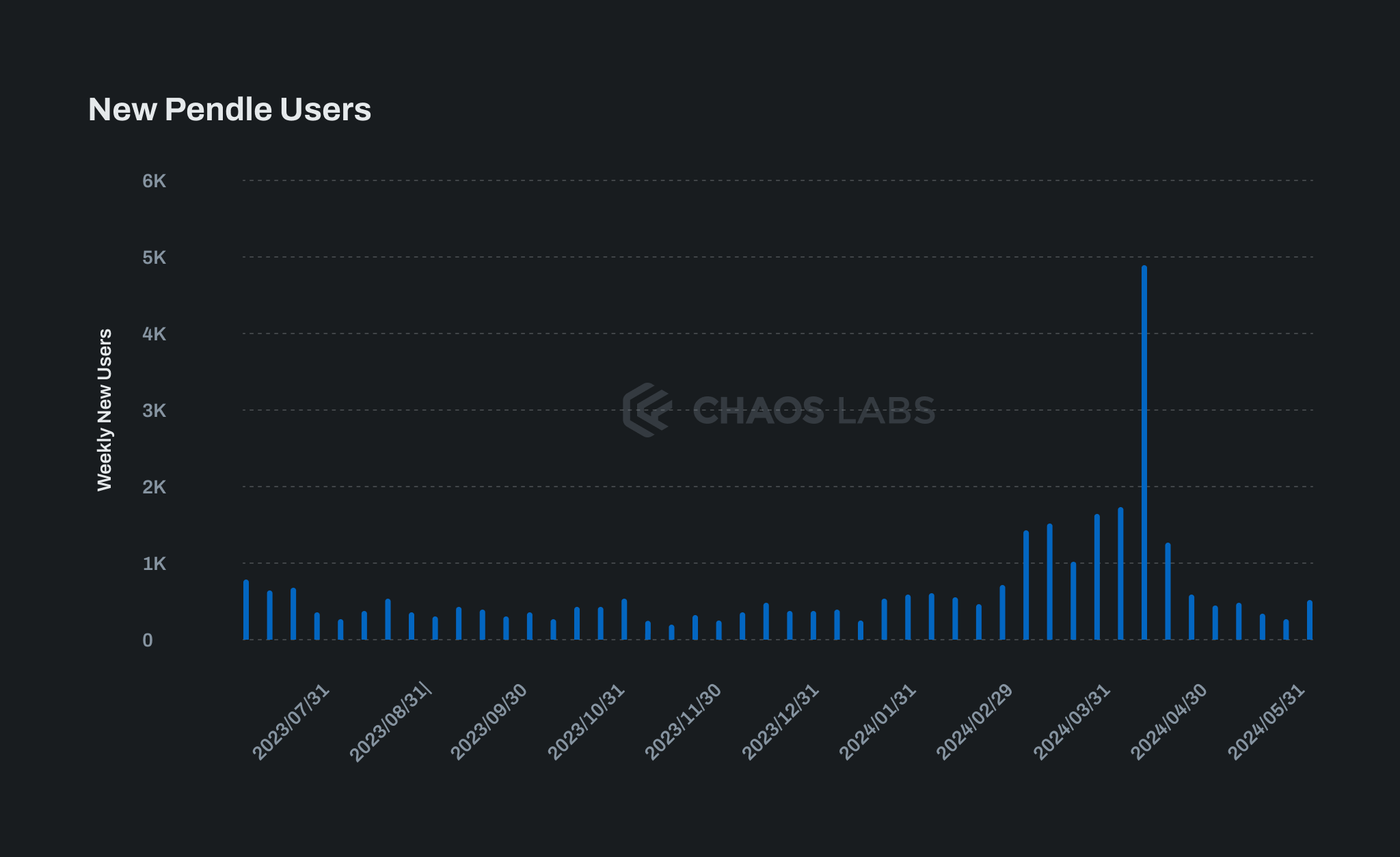

New User Acquisition

Throughout the STIP, 10,556 new users interacted with Pendle. There was no noticeable increase in the rate at which new users were onboarded to Pendle over the STIP until LRTs were onboarded until February 2024. This acceleration in new users was caused more by market developments than by the STIP, and we conclude that the incentives had little impact on attracting new users.

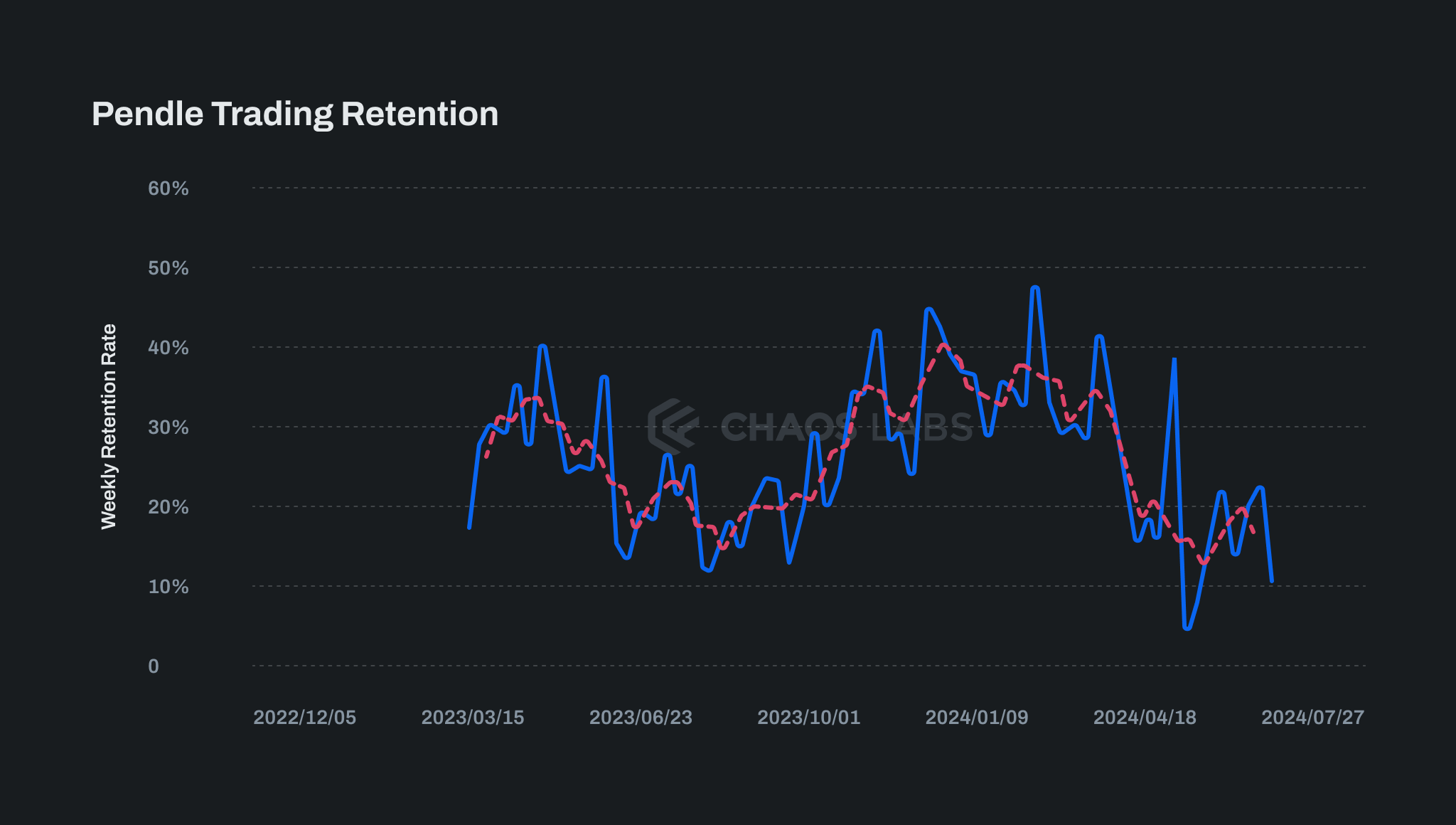

User Retention

The weekly retention rate on Pendle is defined as the percentage of traders who engaged in at least one trade in the previous week and continued to trade in the current week.

Overall, the chart below shows the weekly retention rate in blue and the 4-week m.a. (red dots) clearly improving significantly for the duration of the STIP before dropping to prior levels after. We interpret this as a signal that traders who were attracted to try Pendle by the STIP rewards valued the program and remained engaged throughout the program.

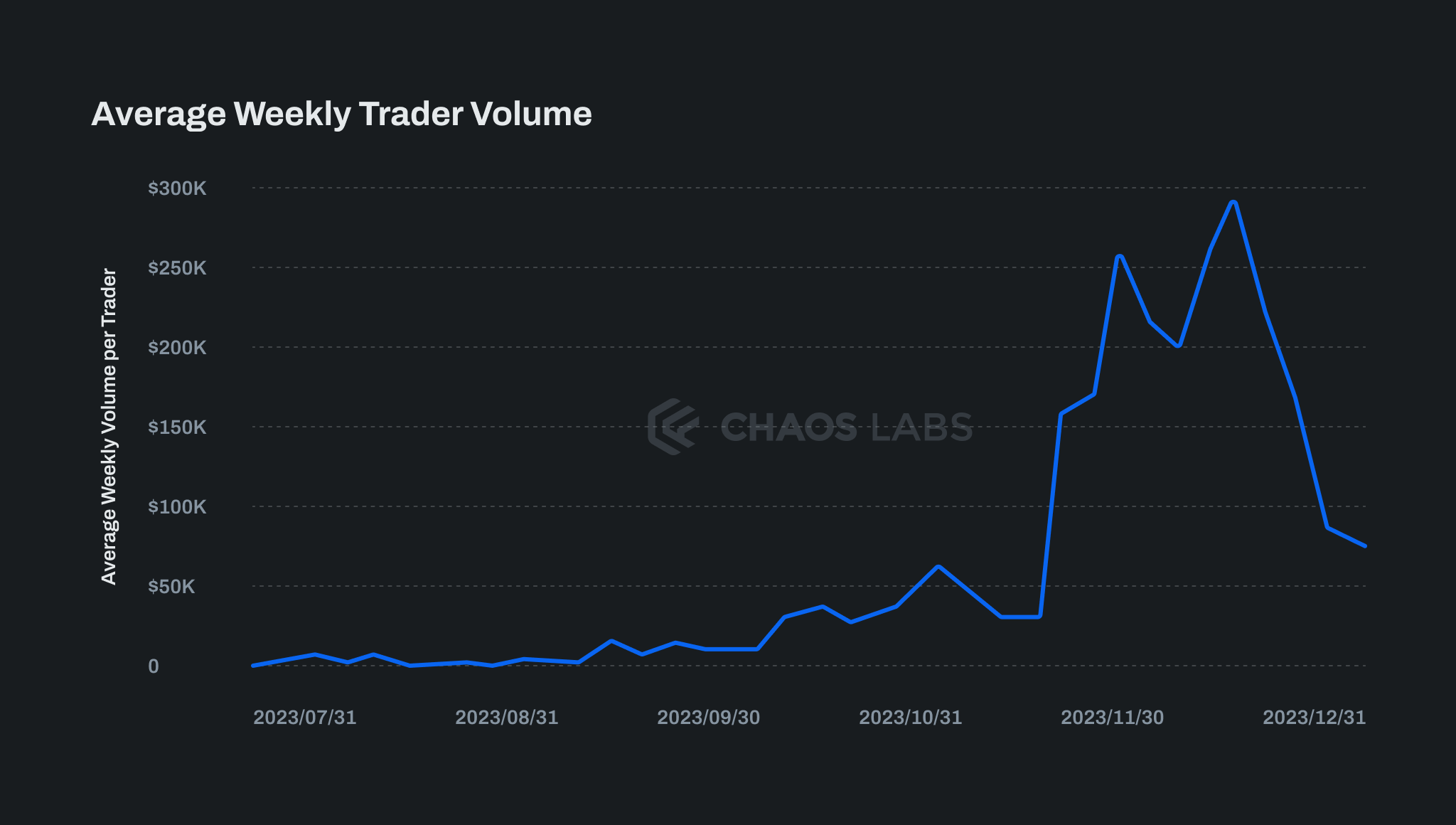

Average Weekly User Volume

Most of the growth in trading volume on Pendle came from the increasing average weekly volume per trader rather than an increase in the number of traders.

The trader segment attracted by LRTs is clearly users with a higher volume, who are able to increase their weekly trading volume significantly.

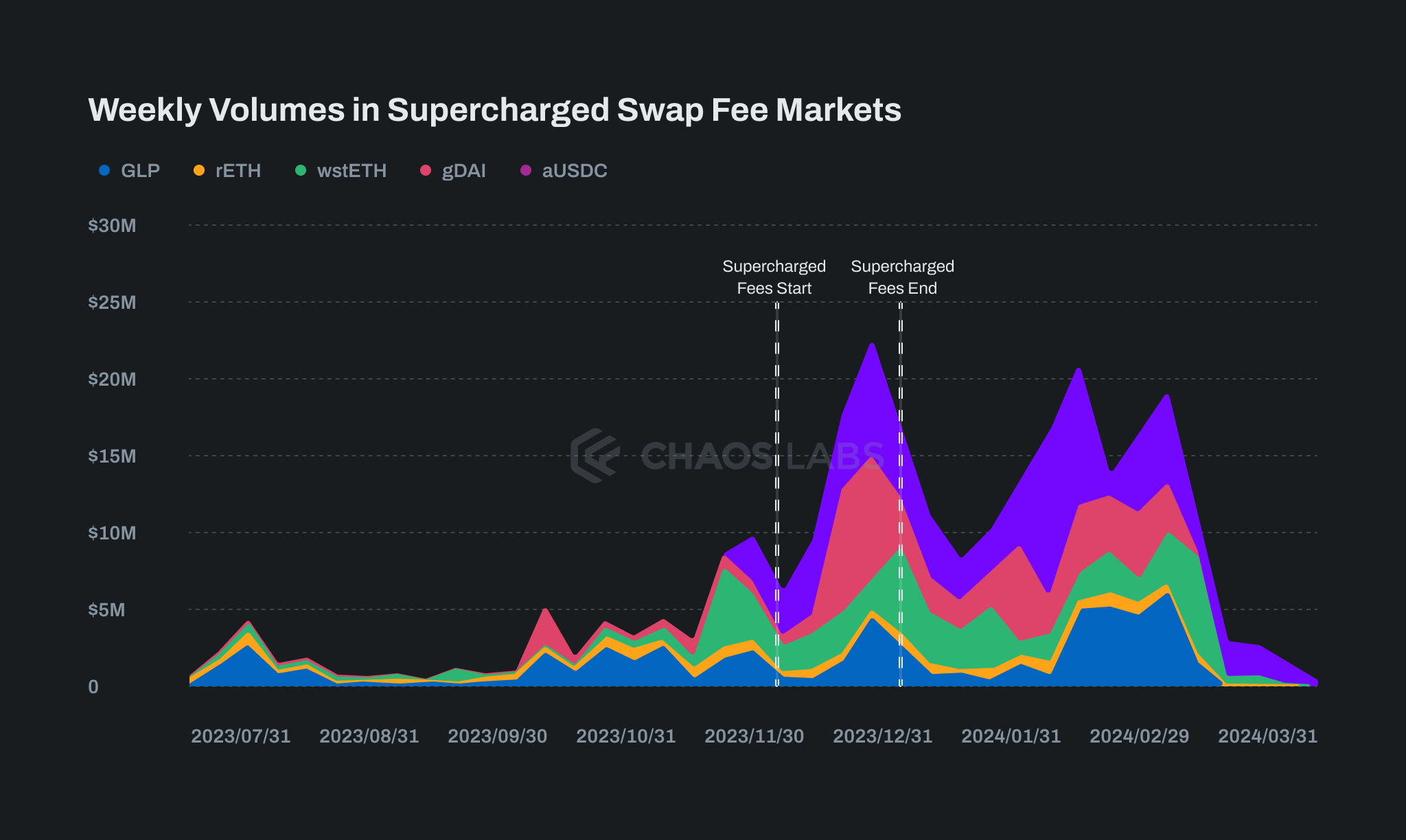

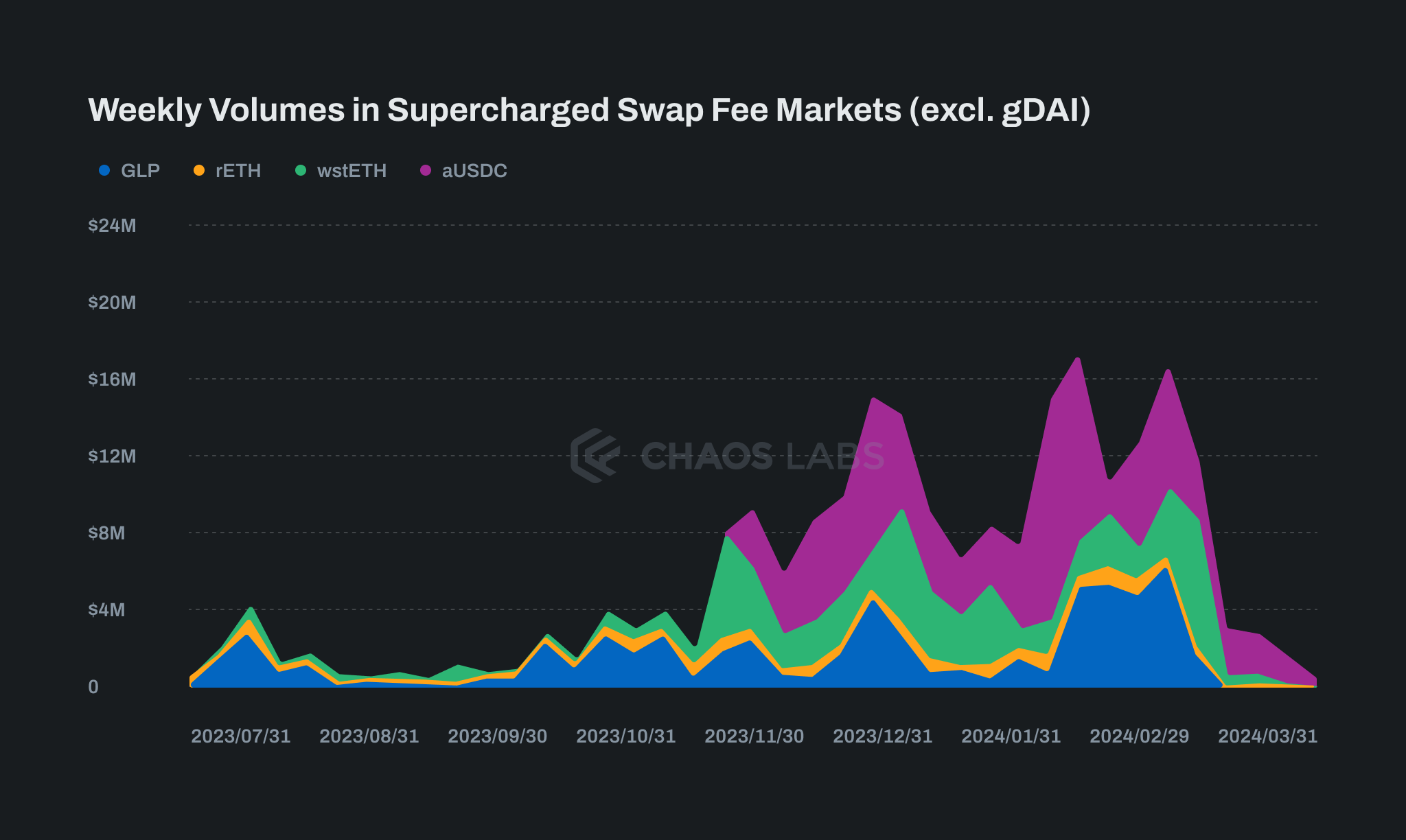

Supercharged Swap Fees

The 120% supercharged swap fee rebate creates the potential for inorganic wash trading. The rapid growth of over 400% in just four weeks suggests some signs of wash trading activity, particularly in the gDAI market. However, aside from the gDAI market, the supercharged markets maintained higher weekly volumes even after the period ended. We conclude that while there may have been some wash trading in the gDAI market, the increased activity in other markets was mainly unrelated to wash trading.

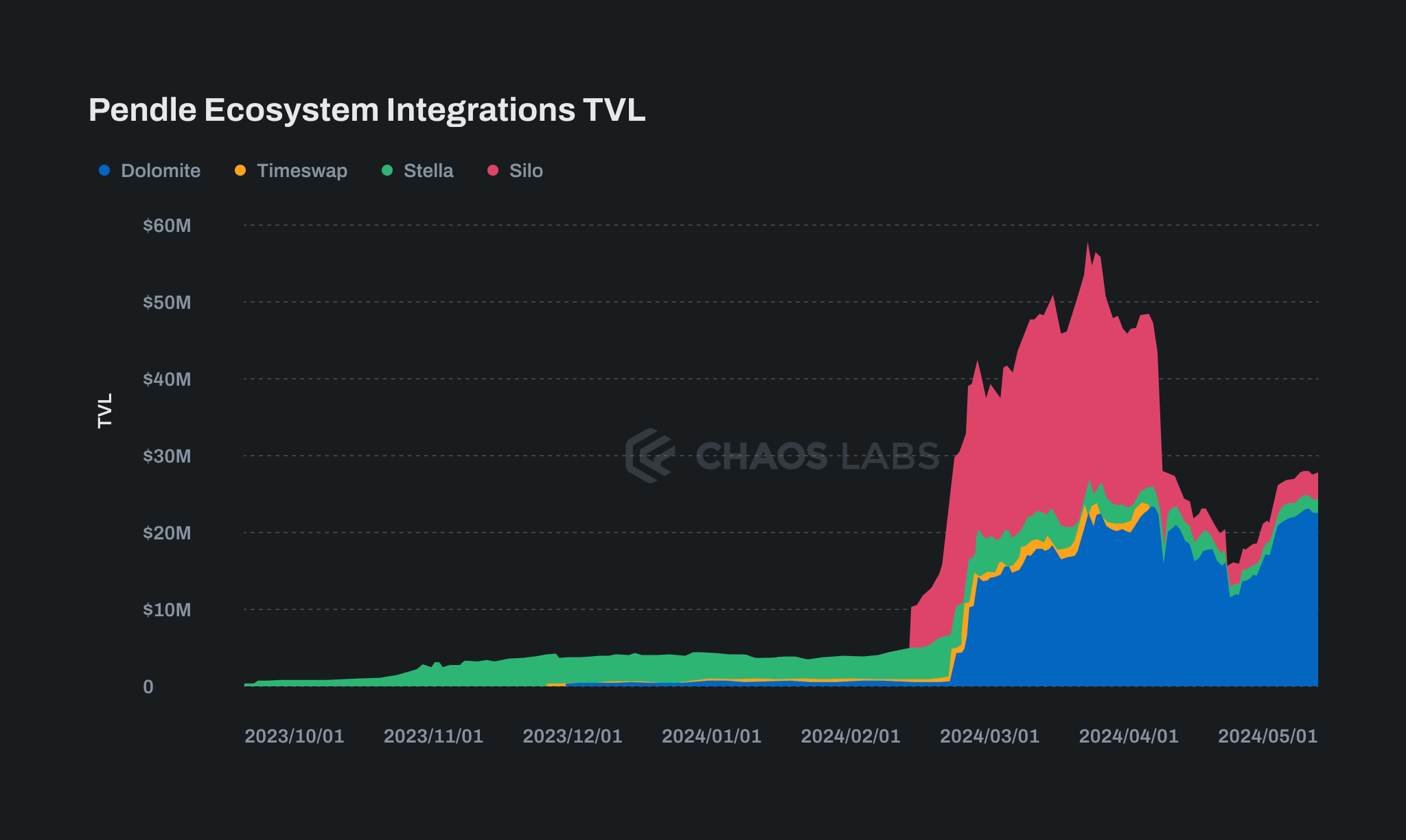

Ecosystem Growth

For most of the STIP, the growth of TVL in ecosystem-incentivized pools was relatively muted. However, there was a clear growth in Stella of PT pools, justifying the majority of ecosystem incentives flowing there.

In the last month of the Program, Pendle switched the focus of this incentive segment, directing most incentives to the Silo eETH PT pool initially and two Dolomite LRT PT pools in the last four weeks. The impact here was dramatic, with TVL in these pools growing from $5m to $58m over five weeks.

Pendle Incentive Distribution

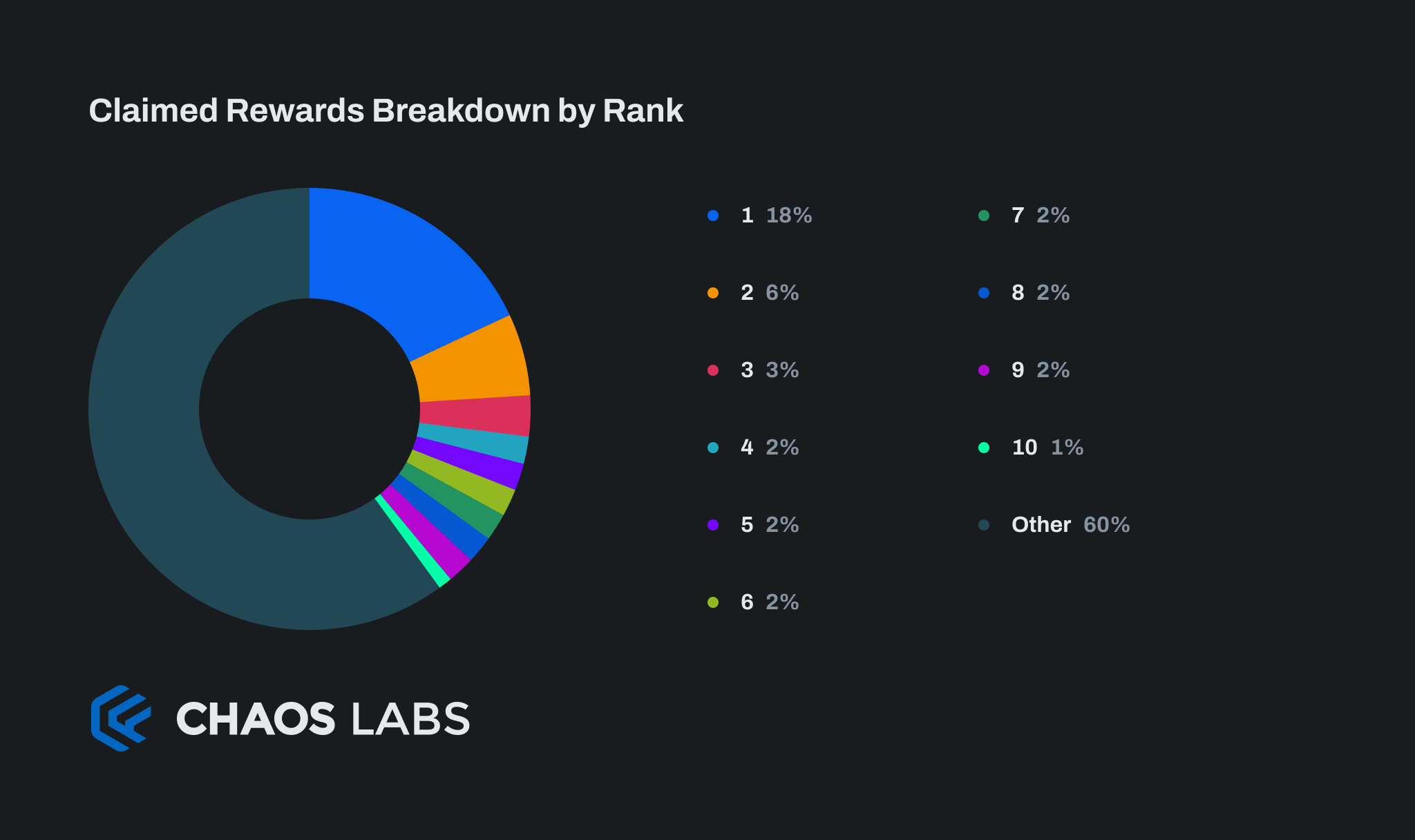

Pendle rewards were distributed across 4489* wallets with limited concentration amongst the highest earners. Only 40% of rewards went to the top 10 wallets, which is much lower than typically seen. The highest earner only earned 18% of total rewards.

This, combined with the observation that there was no benefit to Sybil activity, leads us to conclude that the program’s rewards materially benefited a large number of users.

- Rewards claimed by the Penpie pool are further broken down by the end users claiming them. Only wallets claiming at least 1 ARB are counted.

Incentive Risk Analysis

The incentive risk analysis uses the above deep bottom-up analysis of the Pendle Protocol to inform the specific potential manifestations of these risks in a protocol-specific context.

Pendle Risk Factors Under Investigation

- Pendle incentives create excessive speculation: This could destabilize aspects of the protocol, cause excessive user losses, or potentially affect ecosystem partners.

- Pendle incentives skew the natural growth of trading activity and liquidity: This could cause risks such as bad debts from liquidation slippage, or poor user experience.

- Pendle incentives do not grow liquidity over the long term: Liquidity leaves once STIP incentives end.

- Incentives do not lead to sustained trading activity: Trading activity leaves once STIP incentives end.

Each of these risks are individually covered in detail below.

Pendle incentives create excessive speculation

Despite significant enthusiasm for leveraged strategies involving Pendle yield tokens, there has been limited destabilizing behavior or liquidations. We conclude that, to date, there has been no evidence of excessive speculation spilling over to negative externalities.

Pendle incentives skew the natural growth of trading activity and liquidity

There are currently no direct yield token competitors on Arbitrum, so this use case is novel to Pendle. There is no unnatural growth because of the incentives.

Pendle incentives do not grow liquidity over the long term

Although it fluctuates according to market conditions, Pendle liquidity remains more than 60x where it started at the beginning of the STIP.

Incentives do not lead to sustained trading activity

Similar to liquidity, trading volumes have increased by over 40x from the beginning of the STIP.

Key Takeaways

Pendle Incentive Positives

Using Incentives to Amplify New Protocol Upgrades and Announcements

This often-overlooked aspect of incentive programs can go almost unnoticed. Pendle allocated significant incentives to the most exciting new pools, enabling them to scale rapidly. Similarly, new ecosystem pools received early incentive support. The introduction of limit orders also garnered more attention due to maker order incentives throughout the entire second half of the program.

Keeping the Incentive Criteria Clear and Simple

The incentive criteria on Pendle were extremely clear, even though they iterated throughout the program. Liquidity providers in incentivized pools received incremental yield in the form of ARB tokens.

Growing The Protocol Through Incentivized Integrations

This was an important focus area for Pendle, unlocking incremental utility for its yield tokens.

Iterating and Experimenting

Pendle aggressively experimented and culled underperforming strategies on a fortnightly basis using market data.

Some positive examples included:

- The focused but aggressive iteration in liquidity pools incentivized. Pendle targeted incentives aimed at increasing activity where the market was at almost every week. This enabled hypergrowth in LRT markets in February, almost since launch.

- Iteration in ecosystem incentives, resulting in the highly productive growth in Silo pools, offering leverage and growing YT token utility.

- Experiments in trading campaigns.

Pendle Incentive Potential Improvements

Grow the Rate of New User Acquisition As Well As TVL and Activity

For most of the STIP Pendle active users, there was little change from the prior period. While it is true that volumes increased significantly, growing the user base along with overall volumes and TVL could have great long-term benefits.

Pendle Ecosystem Integrations on Dolomite and Timeswap GLP, wstETH and rETH Markets Had a Poor ROI while Continuing Receiving Incentives

Dolomite rETH and GLP markets received 31 500 ARB over 14 weeks during the STIP, but only grew to a combined $345k in TVL. Timeswap GLP received 10,000 ARB and only grew to $485k. Both of these pools continued receiving incentives despite poor ROI, and these incentives could have likely been better used in alternative ways.

Pendle STIP Useful Resources

Application:

Bi-weekly updates:

Chaos Labs Partners with ether.fi

Chaos Labs is thrilled to announce our strategic partnership with ether.fi, the number one restaking protocol in DeFi

Chaos Labs Partners with Gearbox

Chaos Labs is excited to announce our strategic partnership with Gearbox Protocol, a DeFi leader known for its Credit Account abstraction that unifies lending and prime brokerage. This collaboration aims to pioneer risk management strategies and ensure the secure and resilient growth of the Gearbox ecosystem.

Risk Less.

Know More.

Get priority access to the most powerful financial intelligence tool on the market.