Arbitrum STIP Risk Analysis | Case Study #2: Silo Finance

Preamble

As part of our recent election as the Risk Member on the Arbitrum Research & Development Committee (ARDC), Chaos Labs is pleased to share a blog post detailing our second case study for the ARDC: Silo Finance. This is the second case study of a three-part series that entails an in-depth analysis of the risk and efficiency of the Arbitrum STIP on three major protocols, the second of which is Silo Finance.

As requested by the DAO advocate for the ARDC, L2BEAT, Chaos Labs has been conducting case studies on STIP recipients. This case study provides an in-depth analysis of the Arbitrum STIP program’s impact on Silo Finance, focusing on its efficiency and associated risks. This analysis is part of a broader series that evaluates the STIP program across three major protocols.

Following our previous analysis of Vertex, we now turn our focus to Silo Finance to provide a comprehensive evaluation of its performance and risk profile.

Introduction

To comprehensively understand the specific risks and efficiency factors influencing the Silo Finance STIP allocation, a thorough bottom-up analysis of the protocol is essential. The initial section of this report delves into all pertinent aspects of Silo Finance’s functionality, providing necessary context and reference.

Subsequently, detailed analyses of efficiency and risk are conducted, leveraging insights from the protocol deep-dive. This examination aims to identify all factors that could potentially lead to negative outcomes. The findings are then used to derive both positive and negative insights from Silo Finance’s STIP allocation, which will inform the design of future incentive schemes.

Incentive Amount: 1m ARB

Incentive Uses: Incentivize borrowing and lending in existing and new markets, subject to the existence of a robust oracle.

Grant Matching: Yes - The equivalent of 1M $ARB in $SILO tokens as part of the Silo V2 launch (pending DAO’s approval). The DAO plans to launch Silo V2 on Arbitrum before any other chains.

Silo Overview

Overview

Silo is a risk-isolated lending market that allows users to deposit tokens to earn interest or as collateral to borrow other tokens.

Silo assets are separated into bridge assets, which are common to all pools, and base assets, which are unique to each pool. Bridge assets on the Arbitrum deployment are currently only USDC.e and WETH. This design ring-fences the risk of each pool, allowing a wider range of assets to be onboarded than more common single pool protocols. Any markets with willing-lenders, such as Curve LP tokens and Pendle PT tokens, can be created.

Base and Bridge Assets

Silo categorizes assets as either bridge or base assets. Bridge assets are defined assets per deployment useable as collateral in any silo, while base assets are any asset other than bridge assets.

Bridge assets refer to predefined assets that may be used as collateral or deposited into any silo in a deployment.

Bridge Asset deposits are only exposed to the silo they are deposited into. For example, if $USDC is deposited into the $ARB silo, its exposure is limited to $ARB (the base asset) and $ETH (the secondary bridge asset) only. An exploit in the $PENDLE silo will not affect $USDC deposits in the $ARB silo since they are standalone markets.

Bridge Asset deposit rates are derived from the IRM configuration for that specific silo. More aggressive models may be applied to riskier silos (e.g., low on-chain liquidity), allowing counterparty lenders to receive more interest to reflect risk exposure.

Base assets refer to any non-bridge asset that has a lending market on Silo. Base assets can theoretically be any token, including standard and esoteric tokens.

Base assets can only be used as collateral in their own market. For example, $ARB can only be used as collateral to borrow from bridge lenders in the $ARB silo - it cannot be used in the $PENDLE silo, which only accepts $PENDLE as base asset collateral.

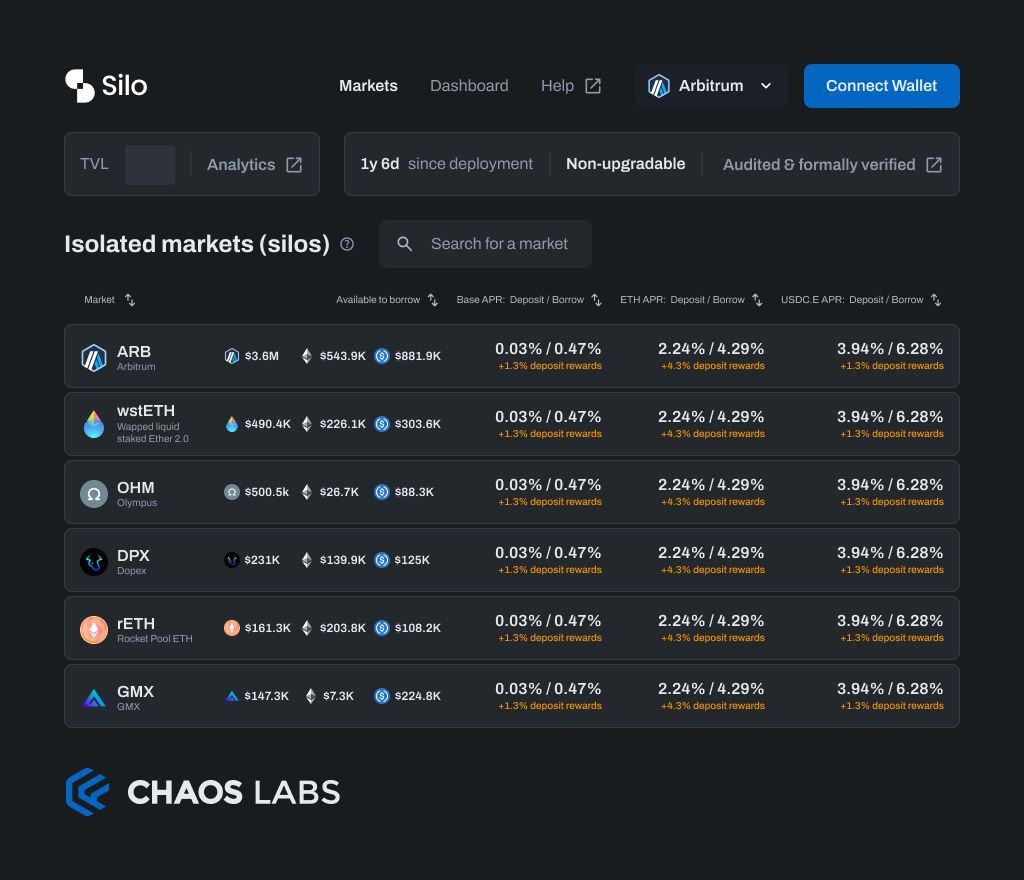

Markets

Each market on Silo Arbitrum consists of the base asset, which defines the market, and the two bridge assets, USDC.e and WETH. This is shown visually in the screenshot below:

Interest Rate Model

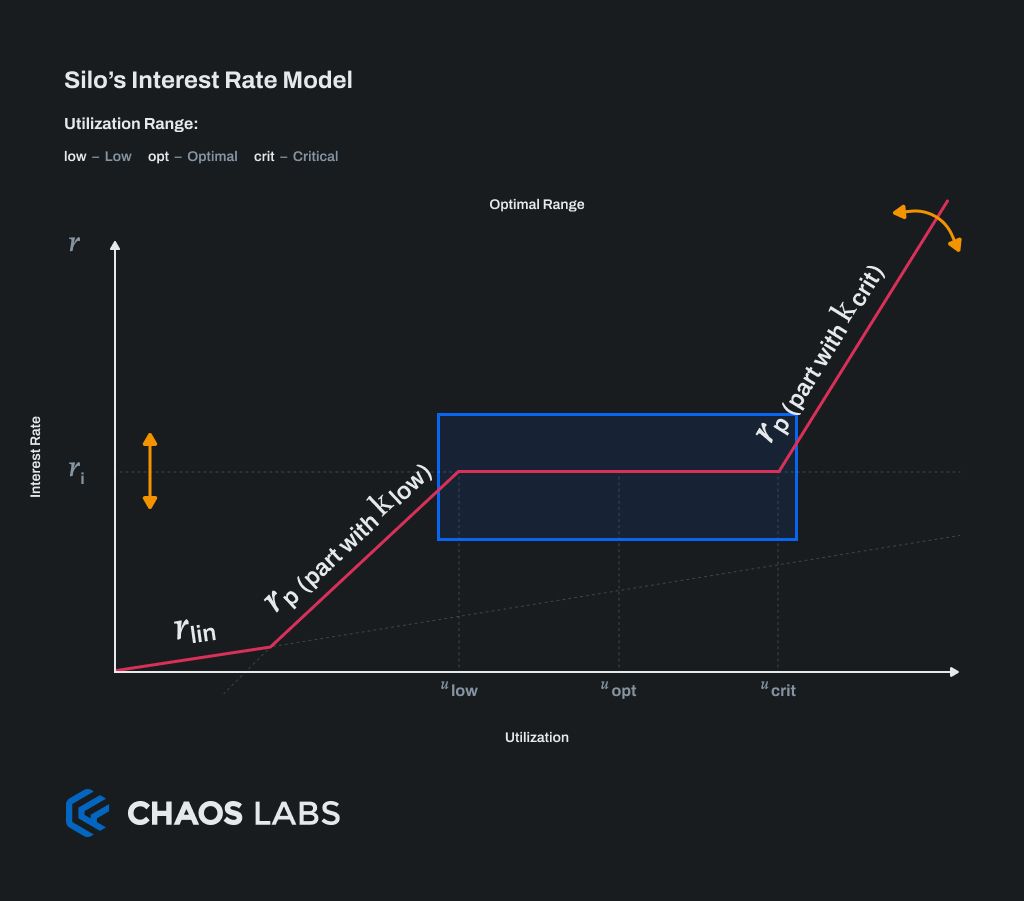

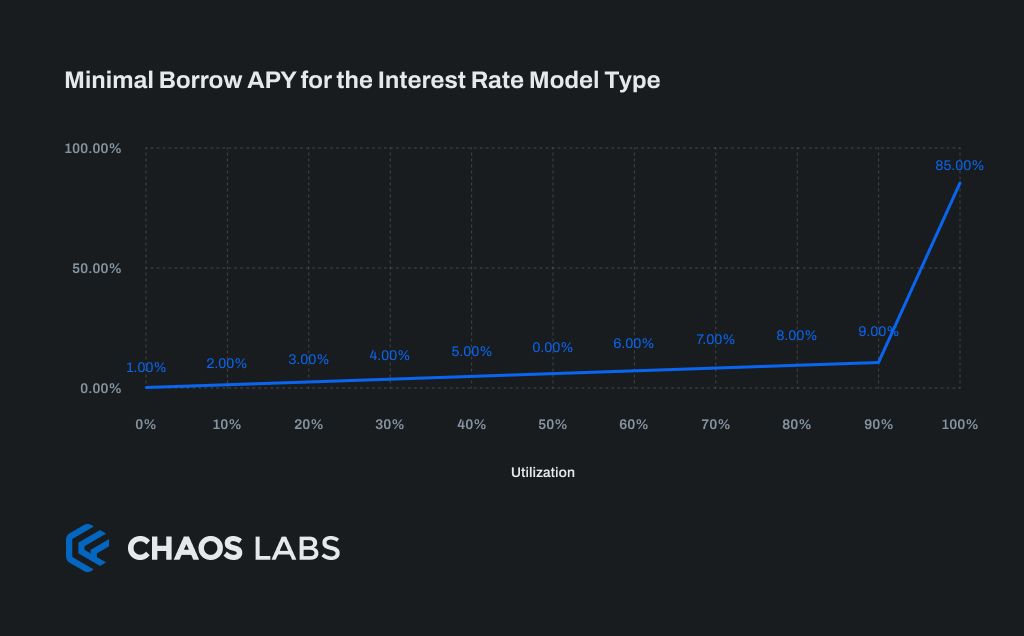

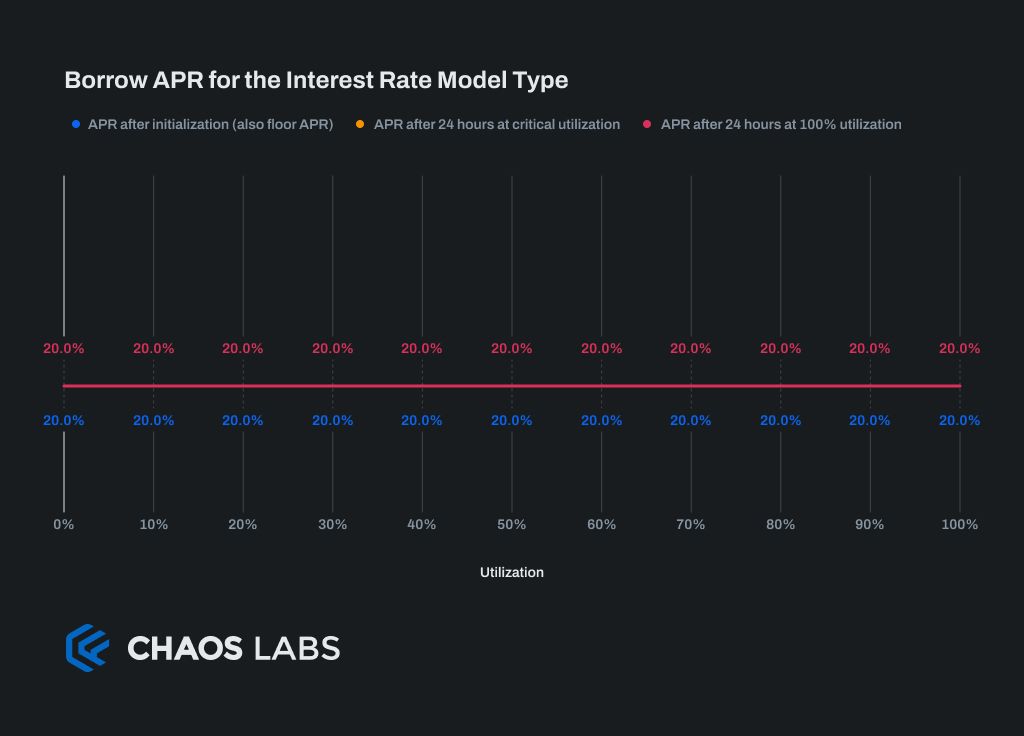

Silo has multiple interest rate models that react differently to different levels of utilization. The isolated design enables exceptional interest rate customizability on a per silo per asset basis to suit different market conditions.

There are currently three interest rate model designs available:

- Dynamic IRM with PI Controller: This system aggressively adjusts rates to target an optimal utilization range rather than a point, as is usually the case.

- Kink IRM with Multiplier: A typical kinked IRM with a moderate borrow rate increases up to an optimal utilization point, and a steeper borrow rate increases beyond this.

- Fixed IRM: The fixed IRM is inelastic to changes in utilization, meaning borrowers will pay the same interest rate at all utilization rates. Lender APR remains floating since it is a function of the utilization rate.

Risk Mitigants

Ring-fenced risk on Silo significantly reduces its risk surface area. The risk parameters are defined at an asset level and apply to the assets in all silos.

Max Loan To Value: Sets the maximum borrowing power against each collateral.

Liquidation Threshold: Sets the point at which a borrow position is considered undercollateralized against each collateral.

Health Factor

The HealthFactor on Silo is a ratio that indicates how close a position is to being liquidated. With a HealthFactor of 0%, the position is signaled for liquidation.

The HealthFactor is calculated as:

HealthFactor = 1 - (CurrentLTV / LiquidationThreshold)

Liquidations

Liquidation is an event that may occur if a borrower’s Health Factor reaches 0%. When this occurs, a liquidator may repay the outstanding loan and seize all the collateral for the position. Liquidators will use the sale proceeds to repay the position’s outstanding loan and keep the difference between proceeds and loan as a liquidation fee. Borrowers will lose their collateral but may keep their borrowed tokens.

There are no partial liquidations on Silo, all liquidations happen in full.

Oracles

Silo Finance uses Chainlink, Redstone, DIA, Uniswap v3, and their own custom oracles as price feeds to monitor positions’ CurrentLTV and, therefore, its health.

Integrations

Silo, as a lending market, acts as a base layer primitive for users and DeFi protocols to build on top of. Bootstrapping new integrations through incentives was a major feature of Silo’s STIP program. Silo offers integrators with a risk-isolated means of leveraging strategies.

Use of Incentives

The objectives of Silo’s use of the STIP incentives were to stimulate deposits and utilization of existing markets while focusing on creating sustainable network effects around deposits that do not rely on long-term incentives.

This was implemented by directing most of the incentives towards base asset deposits while allocating a large portion to base asset borrowing. A 5% allocation was used for base asset deposits in most markets to encourage their use.

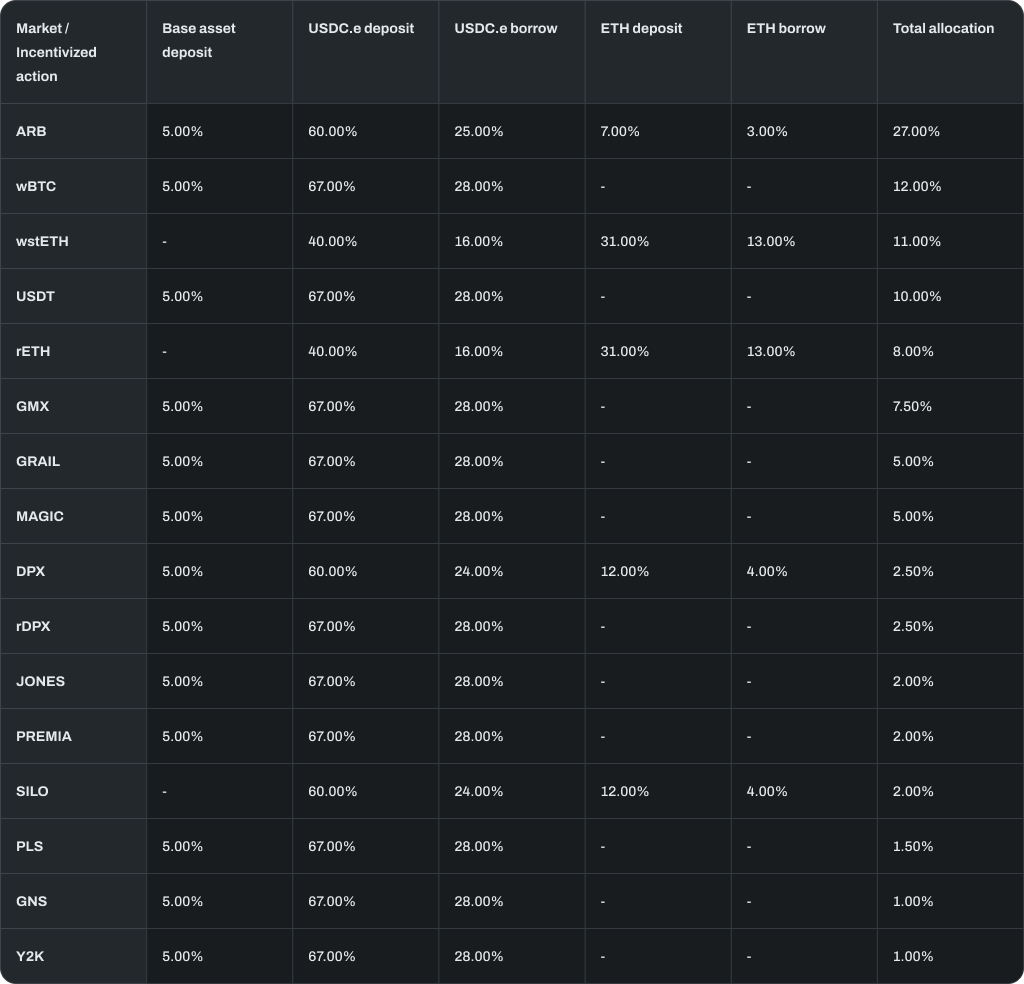

The specifics of the initial incentive breakdown are shown in the table below, this evolved using incoming data and as new markets were launched:

The success metrics were defined as:

- Borrowed TVL in existing lending markets

- Borrowed TVL in newly-launched lending markets

Silo Incentives Impact

The objective of this impact assessment is to evaluate the effects of the incentive program on protocol activity, specifically examining the demand for borrowing and lending of base and bridged tokens separately. This detailed, bottom-up analysis scrutinizes individual components of the STIP, which are unique to Silo. This approach allows for a clear understanding of how the program’s results were achieved and how these insights could be applied to other similar protocols.

Despite the STIP program’s short-term nature, this report assesses its prolonged benefits by analyzing protocol usage data following the program’s conclusion. The aim is to identify any persistent changes in activity and the factors driving them.

The primary use case on Silo is to deposit base assets and borrow bridged assets. Therefore, the impact analysis will focus on the effects of the incentives on the growth of the supply of bridged assets available for borrowing (the supply side) and the growth in the borrowing of these bridged assets (the demand side).

The effectiveness of Silo’s incentives is thoroughly examined across various dimensions:

- How did the incentives affect the total amount of bridged asset lending?

- Was the impact the same for USDC.e and WETH?

- How did the incentives affect the total amount of bridged asset borrowing?

- Was the impact the same for USDC.e and WETH?

- How did the incentives affect base asset lenders?

- Did this stimulate additional trading activity on Arbitrum or cannibalize existing activity?

The distribution of the incentives is also analyzed to gain insight into the structural efficiency of this program.

All data is up to 19 May 2024.

Bridged Asset Lender Reactions

Lenders on Silo deposit tokens into markets to earn yield or use them as collateral for borrowing.

Users depositing tokens to earn yield typically provide bridge assets. Occasionally, there is demand to borrow base assets for purposes like shorting, hedging, or yield arbitrage, which generates yield for lenders. GMX, PENDLE, RDNT, LUSD, and weETH were generally the base tokens that generated the most yield.

Users depositing tokens as collateral usually deposit base tokens and borrow either USDC.e to leverage their exposure to the base token price or borrow WETH to leverage their exposure to the token’s yield.

Impact on Total Bridged Asset Lending

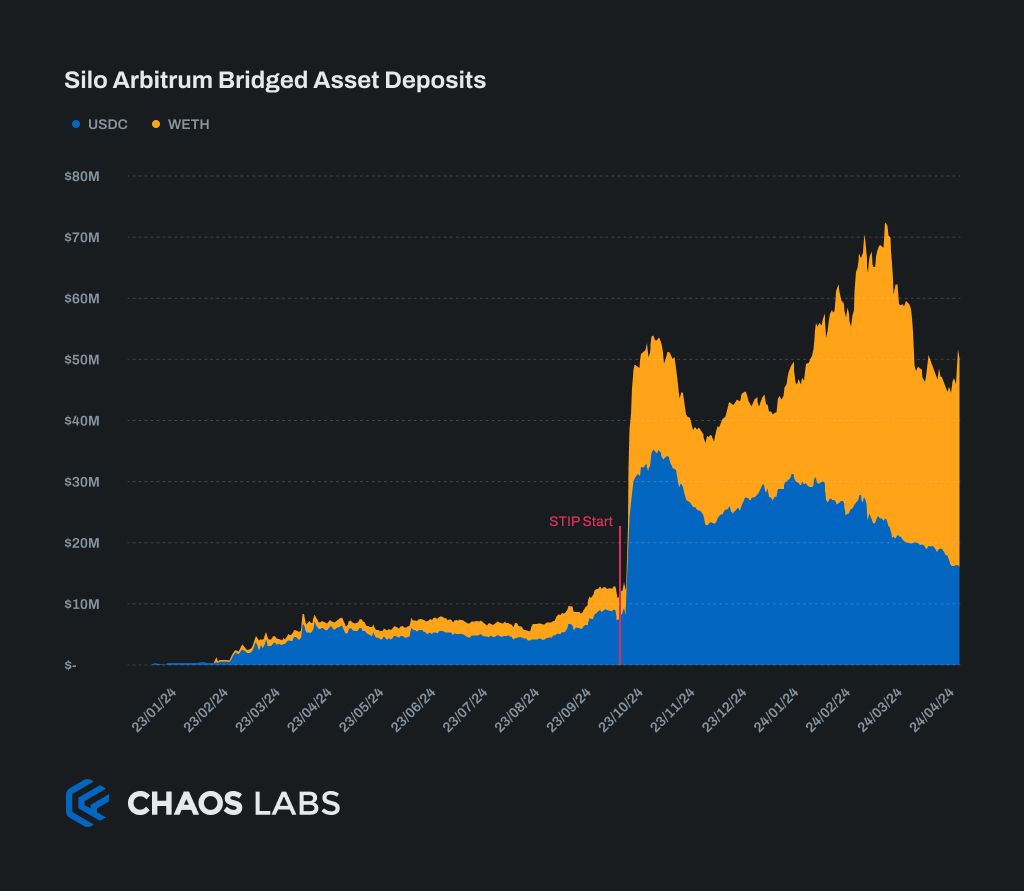

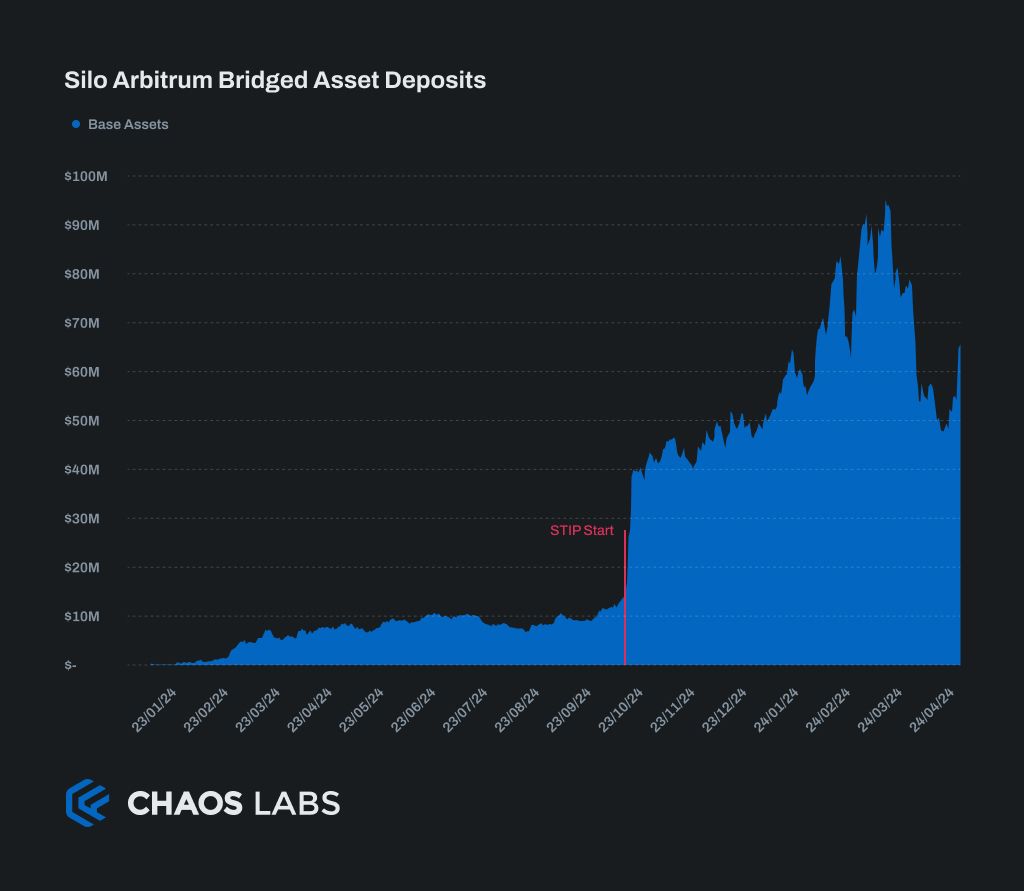

The launch of STIP rewards was transformative for Silo Finance in attractive lending capital. USDC.e deposits received most of the incentives, but over time, as Pendle PT markets and LRT markets launched, WETH deposits overtook them in total value supplied.

Over the course of the STIP program, total bridged assets supplied increased 332% from $13m to $56m. The total dollar amount of this growth was relatively evenly split between USDC.e and WETH; however, when measured in percentage terms, the growth of WETH is much higher at 581% vs 229% for USDC.e.

Since the end of the STIP program, USDC.e deposits have fallen 46% from $30m to $16m. This highlights how sensitive USDC.e suppliers are to incremental yield. The conclusion of the STIP program also coincided with a general spike in stablecoin yields across DeFi which could have cannibalized some of Silo’s yield-earning suppliers.

WETH deposits, however, have continued to grow, increasing a further 36% since the program ended. The favorable environment of yield and airdrop farming of LRTs via looped lending on Silo directly and through Pendle PT tokens has supported this growth. The successful bootstrapping of these markets on Silo over the STIP has worked out favorably for Silo and Arbitrum DeFi generally, as leverage seekers have a deep, liquid venue for their strategies.

Currently USDC.e supplies are up 76% since the start of the STIP program, and WETH supplies up 825%. This leaves bridged asset supplies up 3x, a similar level to the end of the program. This clearly demonstrates a significant, lasting impact from the use of incentives in growing bridged asset lending.

Bridged Asset Borrower Reactions

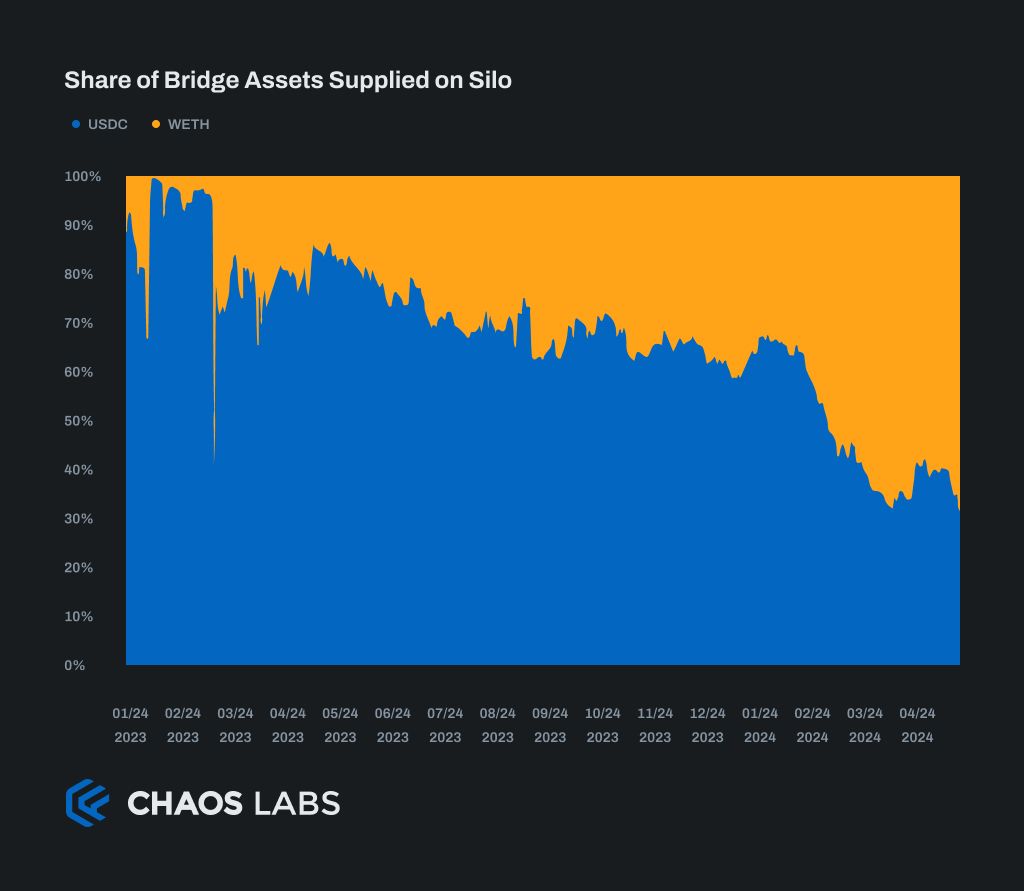

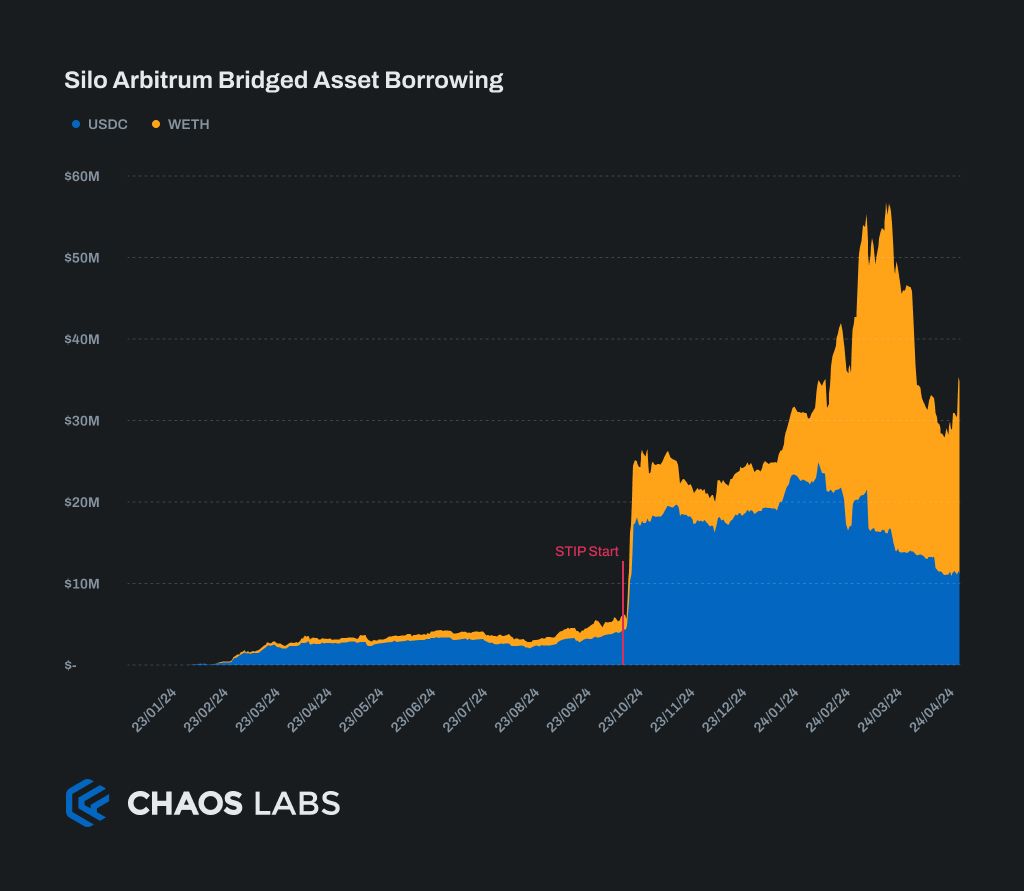

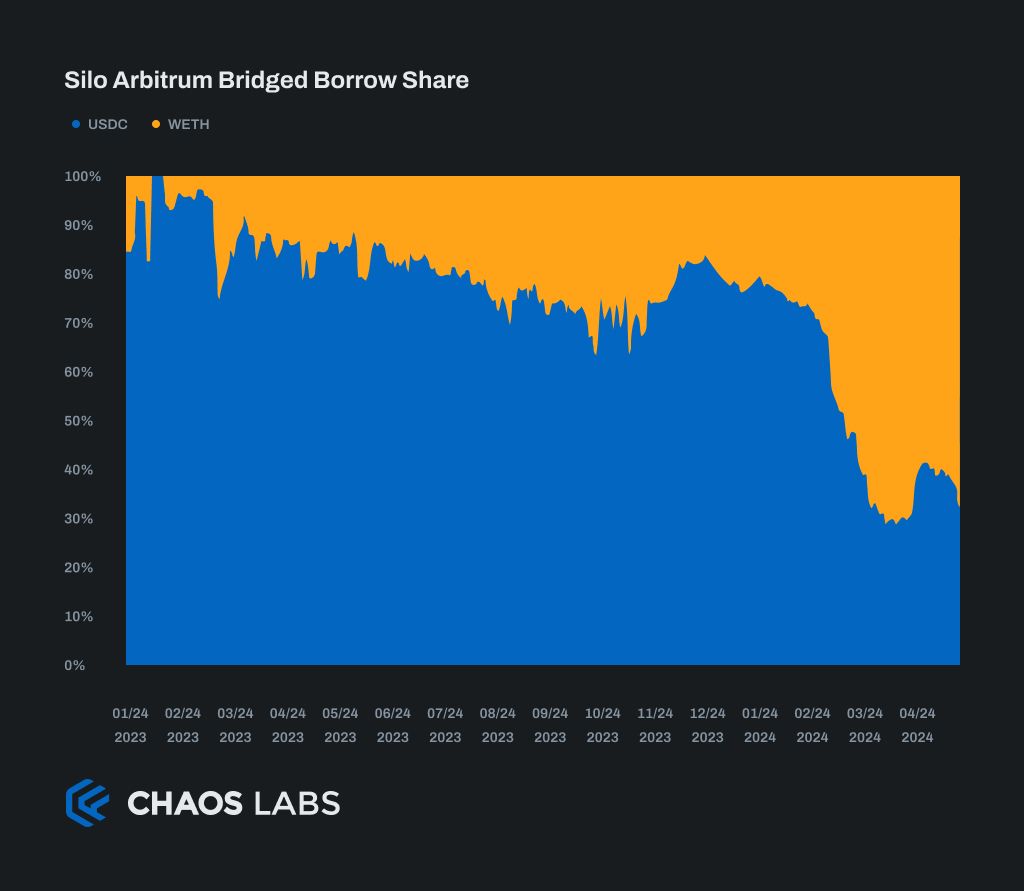

As the supply of bridged assets flowed to Silo at the start of the STIP, it was immediately lent out. Initially bridged asset borrowings mostly consisted of USDC.e to leverage exposure, but from January this began to switch to WETH, completely reversing once incentives ended.

USDC.e borrowings increased 481% over the STIP, while WETH borrowings increased 466%.

Most incremental USDC.e borrowing came from growing in existing markets.

The demand for WETH borrowing continued aggressively after the program ended, and WETH borrowing is currently up 1148% from the start of the program at $23.46m. Integrations played a key role here with most of the increase in WETH borrowing coming from new markets.

The STIP clearly played a crucial role in bootstrapping borrowing on Silo to the point where the markets have retained and even grown total borrowing. The strategy of onboarding and incentivizing new markets, unavailable elsewhere has proved successful for Silo and Arbitrum as a whole.

The share of total borrowing shifted aggressively from mostly USDC.e at the end of the STIP to mostly WETH currently. This shift in borrowing is more pronounced than the shift in supply.

Base Asset Lender Reactions

Like bridge assets, base assets supplied began flowing into Silo immediately after the start of the STIP. A lot of these deposits were initially for leverage purposes and used to borrow USDC.e against. Once LRTs and Pendle PT tokens were onboarded to Silo, another wave of base asset deposit growth started against which WETH was borrowed.

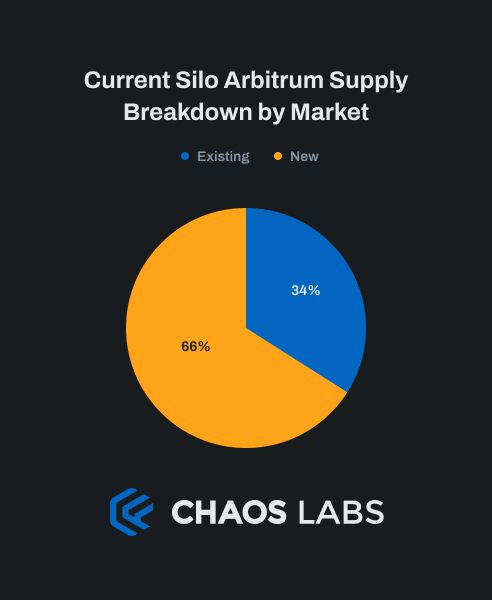

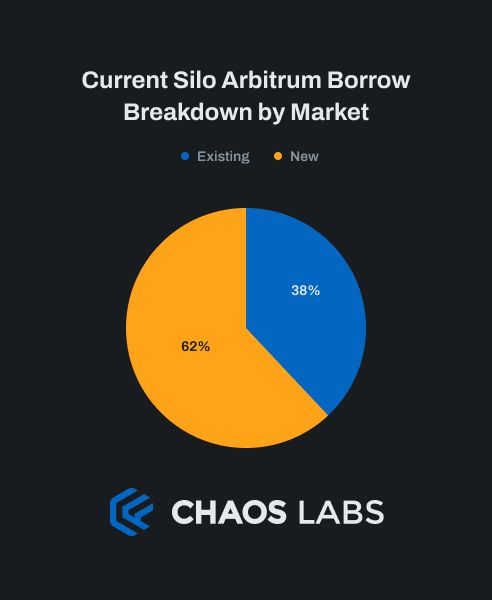

Impact of New Markets

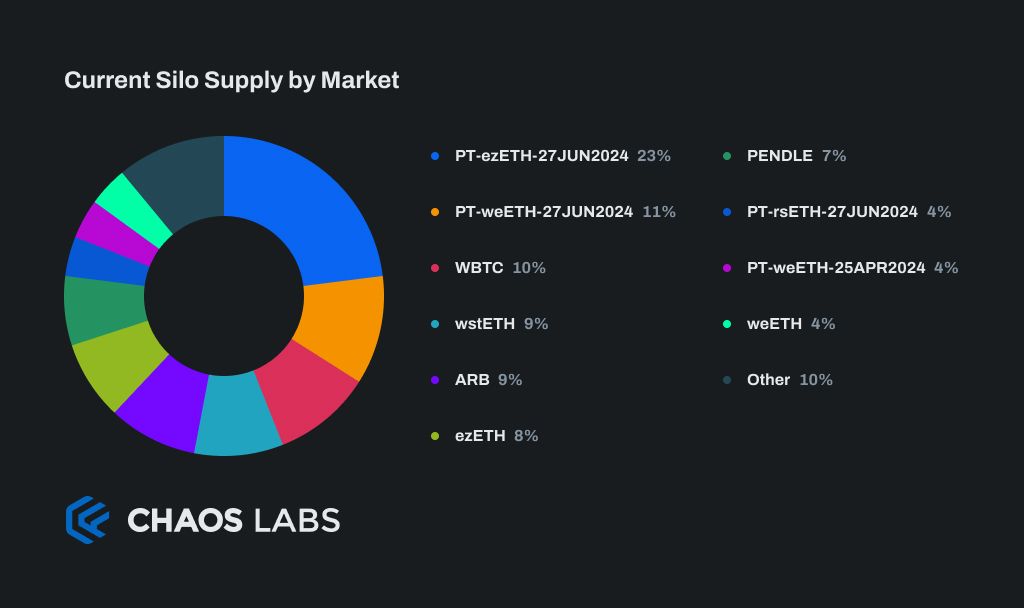

New markets currently account for 66% of the total supply on Silo, and 62% of total borrowing. While existing markets have seen approximately 2x growth in supplies and borrows from the start of the STIP to the current, new markets have added almost $100m in incremental supply and $30m in incremental borrows.

This is a massive achievement in using the program to solve the cold start problem of growing lending markets, and probably the most important factor in Silo’s success with the STIP.

Arbitrum Ecosystem Reaction

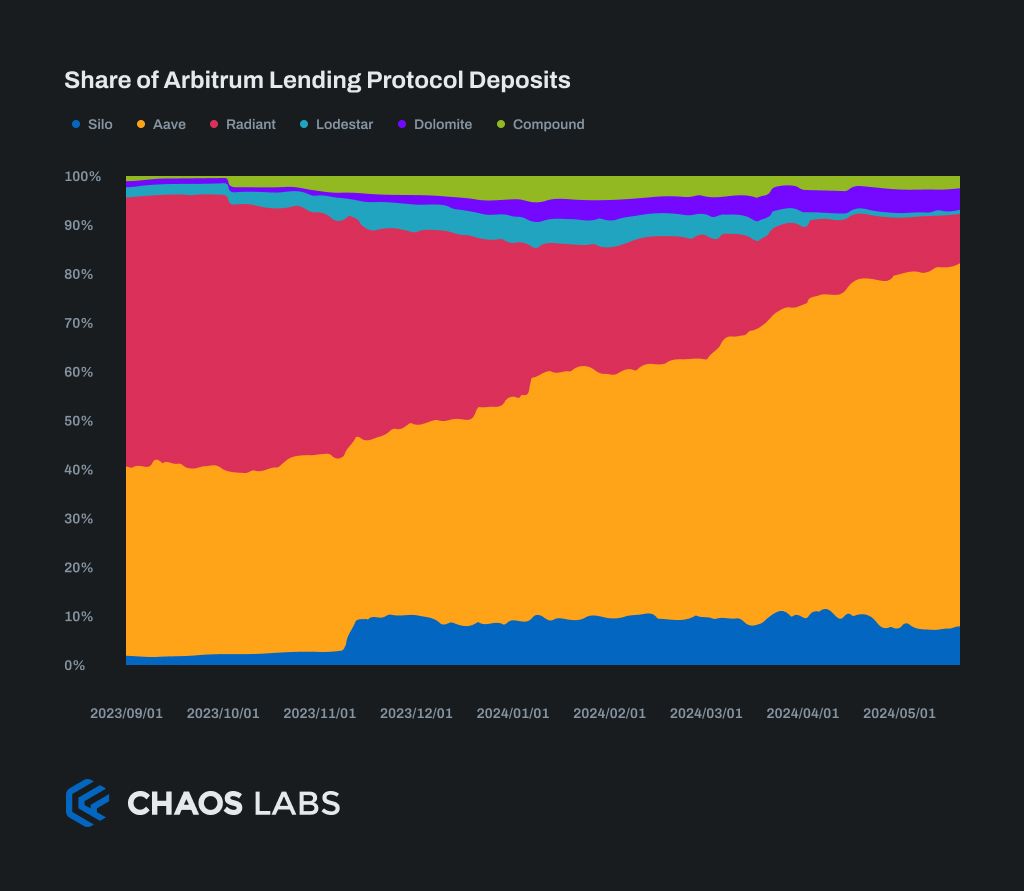

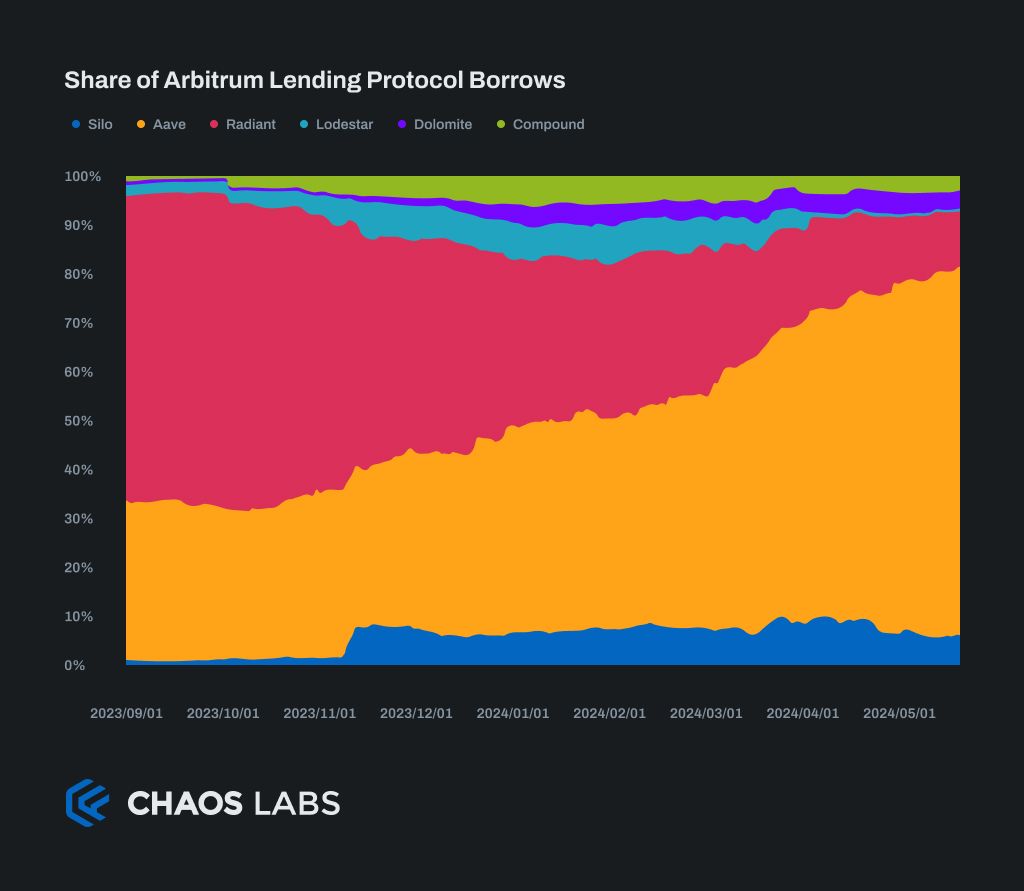

It is reasonable to conclude that Silo has used the STIP incentive program to successfully attract capital to its niche use cases, and retain this capital thereafter. Its share of total Arbitrum borrowing and lending initially increased from 2% to 9%, and has remained at this level since.

The lack of drop in share of either action since incentives ended demonstrates a stickiness, and long term benefit for Silo and Arbitrum as a whole. It is unlikely that if the incentives mostly attracted farmers, or users from alternative protocols that the capital would have remained as constant as a share of total Arbitrum activity. This is especially true when large competitors like Aave received no incentives so would have disproportionally benefited from the program ending, as is evident in all competing lending protocols.

Incentive Distribution Breakdown

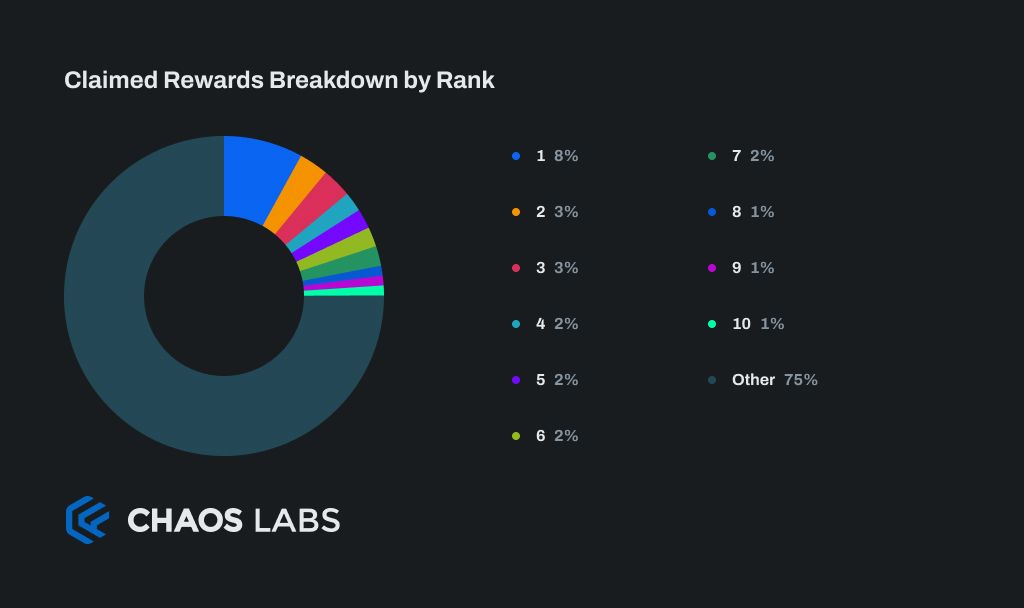

Silo rewards were distributed across 2421 wallets with limited concentration amongst the highest earners. Only 25% of rewards went to the top 10 wallets, which is much lower than typically seen. The highest earner only earned 8% of total rewards.

This, combined with the observation that there was no benefit to sybil activity, leads us to conclude that the program’s rewards materially benefited a large number of users.

Incentive Risk Analysis

The incentive risk analysis uses the above deep bottom-up analysis of Silo Finance, informing the specific potential manifestations of these risks in a protocol-specific context.

Silo Risk Factors Under Investigation

- Silo incentives create an unsustainable imbalance between lending and borrowing: Incentives can drive behavior that would not naturally occur with only market forces. This can result in an oversupply of lending or an overuse of borrowing, creating an unsustainable outcome and undesirable second-order effects.

- Silo incentives distort the growth of Arbitrum money markets: Incentivized protocols could grow over the short term at the expense of incentivized alternatives.

- Silo incentives do not grow Silo or Arbitrum money market activity over the long term: Short-term incentives run the risk of being farmed by mercenary capital that leaves as soon as the incentives end.

- Silo incentives inhibited the program from migrating bridged to native USDC: Arbitrum integrated native USDC via Chainlink CCIP in July 2023. Incentivizing the growth of bridged USDC.e runs the risk of stalling migration.

Each of these risks are individually covered in detail below.

Silo incentives create an unsustainable imbalance between lending and borrowing

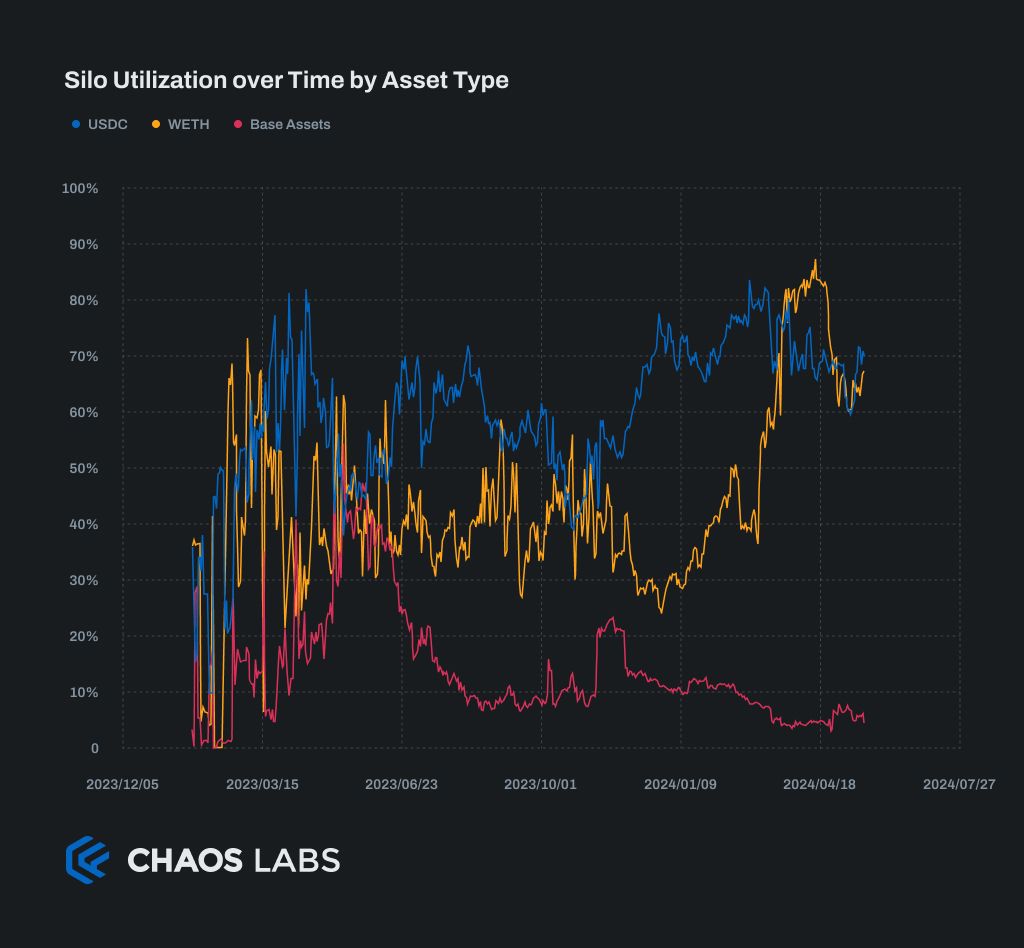

It is clear from the chart below that the average utilization of bridge assets increased on Silo over the duration of the STIP. This has moderated in both USDC.e and WETH since, indicating that the incentives did have an effect on utilization.

Higher utilization is a good thing unless it reaches excessive levels, affecting the liquidity and stability of the protocol. Neither token’s utilization reached much over 80% for a sustained period over the STIP, and we conclude that the growth in utilization was neutral to healthy for Silo.

Silo incentives distort the growth of Arbitrum money markets

The charts above showing the share of lending and borrowing across Arbitrum lending protocols shows Silo immediately gaining around 10% market share on Arbitrum before remaining constant at that level.

Aave v3 as a comparable received no incentives and has grown market share consistently over the STIP period. There is no evidence that the incentives caused Silo to cannibalize other lending protocols activity on Arbitrum.

Silo incentives do not grow Silo or Arbitrum money market activity over the long term

Silo borrowing and lending has retained well. There has been a reduction of USDC.e activity since the incentives ended. However, both lending and borrowing of USDC.e is still significantly higher than before the STIP, indicating a long-term benefit from the incentives.

Silo incentives inhibited the program from migrating bridged to native USDC

This risk played out as Silo has yet to onboard native USDC on Arbitrum, and incentivized growth in the legacy bridged USDC.e token.

Key Takeaways

Silo Incentive Positives

Iterated on Incentive Weights using Usage Data

Silo began using performance data to update market weights from the third week of the program and continued to iterate throughout. This effort paid off as early markets such as the WBTC market, with a large potential size and good elasticity with respect to incentives, grew rapidly, growing supplies and borrowing on the protocol.

Another important trend Silo leant into was the rise of levereged restaking using Pendle and LRTs. This accounted for a significant portion of growth, and directing incentives to these markets aggressively helped significantly.

Grew External Integrations

Silo announced many external integrations over the course of the STIP, broadening their funnel of value into the protocol. The most successful of these, with Pendle, now makes up the two largest markets.

Simple Incentive Criteria

Incentives subsidized borrowing and lending where the Silo team determined they would be most impactful. This resulted in easy to understand and optimize for incentive criteria, allowing a wide range of users to see benefits and onboard to Silo.

Horizontal Expansion by Launching New Markets

New markets drove significant growth on Silo, which continued after the STIP ended. Twelve new markets were launched over the STIP, with 6 now in the top ten markets on the protocol.

Maintaining Momentum with a Native Token Incentive Program

After the completion of the STIP, Silo launched a native incentive program to continue their momentum. This has likely played an important role in the continued growth in activity.

Silo Incentive Potential Improvements

Onboard and Incentivize Native USDC instead of Legacy Bridged USDC.e: Silo incentives focused on a legacy version of USDC, and there could be a future challenge migrating to native USDC. This poses a long-term risk to the effectiveness of incentives targeted at USDC as TVL could migrate in the migration process, or it could cost significant future incentivization.

Silo STIP Useful Resources

Chaos Labs Partners with Gearbox

Chaos Labs is excited to announce our strategic partnership with Gearbox Protocol, a DeFi leader known for its Credit Account abstraction that unifies lending and prime brokerage. This collaboration aims to pioneer risk management strategies and ensure the secure and resilient growth of the Gearbox ecosystem.

Arbitrum STIP Risk Analysis | Case Study #1: Vertex

As part of our recent election as the Risk Member on the Arbitrum Research & Development Committee (ARDC), Chaos Labs is excited to share a blog post detailing our first case study for the ARDC: Vertex. This is the first case study of a three-part series that entails an in-depth analysis of the risk and efficiency of the Arbitrum STIP on three major protocols, the first of which is Vertex. As requested by the DAO advocate for the ARDC, L2BEAT, Chaos Labs has begun conducting case studies on STIP recipients. This case study provides an in-depth analysis of the Arbitrum STIP program’s impact on the Vertex Protocol, focusing on its efficiency and associated risks. This analysis is part of a broader series that evaluates the STIP program across three major protocols. We will begin by introducing the STIP program and giving an overview of Vertex, followed by our team's full case study.

Risk Less.

Know More.

Get priority access to the most powerful financial intelligence tool on the market.