Arbitrum STIP Risk Analysis | Case Study #1: Vertex

Preamble

As part of our recent election as the Risk Member on the Arbitrum Research & Development Committee (ARDC), Chaos Labs is excited to share a blog post detailing our first case study for the ARDC: Vertex. This is the first case study of a three-part series that entails an in-depth analysis of the risk and efficiency of the Arbitrum STIP on three major protocols, the first of which is Vertex.

As requested by the DAO advocate for the ARDC, L2BEAT, Chaos Labs has begun conducting case studies on STIP recipients. This case study provides an in-depth analysis of the Arbitrum STIP program’s impact on the Vertex Protocol, focusing on its efficiency and associated risks. This analysis is part of a broader series that evaluates the STIP program across three major protocols.

We will begin by introducing the STIP program and giving an overview of Vertex, followed by our team's full case study.

Introduction

To comprehensively understand the specific risks and efficiency factors influencing the Vertex STIP allocation, a thorough bottom-up analysis of the protocol is essential. The initial section of this report delves into all pertinent aspects of the Vertex Protocol’s functionality, providing necessary context and reference.

Subsequently, detailed analyses of efficiency and risk are conducted, leveraging insights from the protocol deep-dive. This examination aims to identify all factors that could potentially lead to negative outcomes. The findings are then used to derive both positive and negative insights from the Vertex STIP incentive program, which will inform the design of future incentive schemes.

Incentive Amount: 3m ARB

Incentive Uses: Trading rewards (85%), liquidity incentives (15%)

Grant Matching: Yes

Following this, detailed analyses of efficiency and risk are conducted, using the insights gained from the protocol deep-dive as a foundation. This analysis aims to identify all factors that could potentially result in negative outcomes. These findings are then used to derive positive and negative insights from the Vertex STIP incentive program, which will inform the design of future incentive schemes.

Vertex Overview

Vertex is an Arbitrum-native, vertically integrated decentralized exchange that offers spot trading, perpetual futures, and integrated money markets with universal cross-margin. The protocol’s liquidity is driven by a hybrid model that combines a unified central limit order book with an integrated automated market maker. This liquidity is further enhanced by pairwise market making vaults powered by Elixir.

Overview

Vertex Liquidity

Orderbook:

Vertex’s orderbook, called Edge, operates as an off-chain node layered on top of the smart contracts and contained within the Arbitrum protocol layer. Edge creates a central hub of liquidity that can be consumed concurrently by instances on different chains. As a result, Edge is capable of matching inbound orders from one chain with the combined orderbook liquidity of all of the base layers plugged into the Vertex sequencer.

Both sides of the trade are filled out, and the sequencer (Edge) takes the opposite side of the inbound trades — automatically hedging and rebalancing liquidity on the back-end between chains.

Notably, the sequencer only mirrors resting liquidity (e.g., maker orders) across the sharded states of the Vertex Edge instances on different base layers. Taker orders remain unchanged and are submitted directly from an independent Vertex Edge instance, such as Vertex Arbitrum, to the sequencer’s unified liquidity layer.

Vertex charges a flat fee for interactions with the Vertex Sequencer, denominated in USDC, to compensate for the gas paid to the underlying blockchain while allowing for a faster trading experience via lightning-fast order matching.

Edge is significant because it eliminates user costs for placing market orders that consume liquidity during the STIP program's duration. Fees for withdrawal, liquidation, and minting/burning of LP tokens will still apply. Being off-chain, Edge also constitutes an external dependency for both the Vertex smart contracts and the Arbitrum ecosystem. Should Edge experience downtime, Vertex will rely solely on the AMM for spot liquidity, and the perpetual market liquidity will cease.

AMM:

The pooled liquidity of the AMM is integrated with the bids and asks on the Vertex spot order book. This AMM liquidity is combined with liquidity from automated traders facilitated by the sequencer, creating a unified source of liquidity against which users can trade.

Vertex Universal Cross Margin

Vertex user’s margin is shared across all spot, perpetual and money market positions. The improved capital efficiency of this differentiates Vertex from other single product exchanges.

This is apparent in the ease that arbitrageurs can monetize Vertex funding rates completely within the protocol, accessing leverage from the money market and offsetting positions from the spot DEX.

Vertex External Interactions

The Vertex Protocol is mostly self-contained, being primarily focused on perpetual futures trading. The two major external touch points are with the Elixir Network as the liquidity strategies powering Vertex liquidity vaults, and Vertex Edge as the cross-chain liquidity engine running as an off-chain component.

Use of Incentives

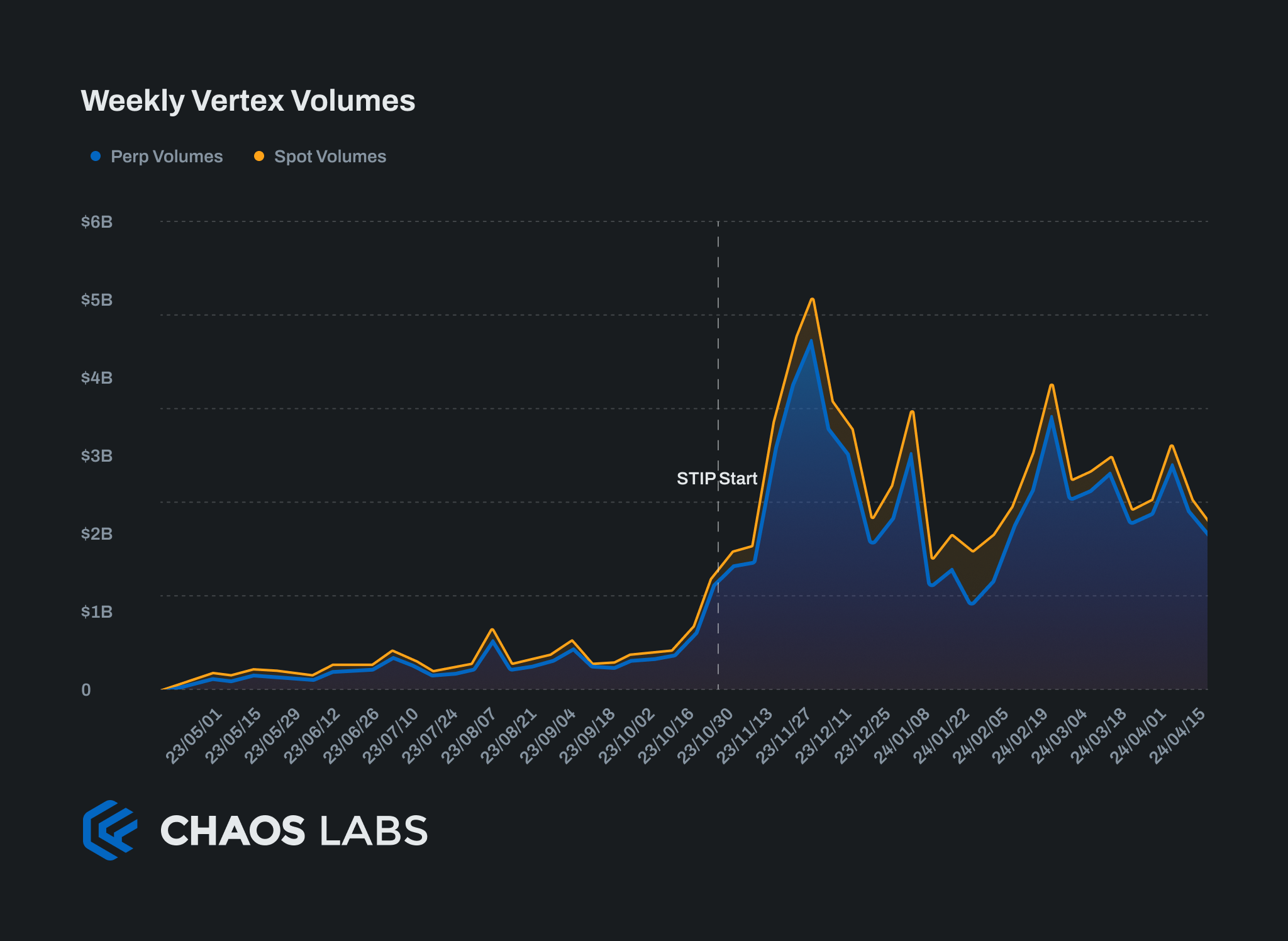

Vertex deployed all ARB incentives to boost trading volumes across its spot and perpetual markets. As the platform primarily concentrates on trading activity, it is reasonable that the perpetual markets will attract the bulk of this activity.

Trading Rewards:

Rewards on trading fees are capped at up to 75% of the taker fee paid. However, this percentage may be lower if the fees paid exceed 133% of the dollar amount of allocated weekly incentives (approximately $200k initially). In such cases, incentives are distributed proportionally to the fees paid. Conversely, if the fees paid are less than 133% of the dollar amount of allocated weekly incentives, then the full allocated amount is not utilized. The unused portion is then carried over to the following week.

Incentivize Community-Based Market-Making (Elixir):

Vertex launched Elixir’s Fusion Pools on its platform at the beginning of the STIP, setting a baseline annual percentage rate (APR) from ARB incentives at 15%. If the total value locked (TVL) in these pools does not reach the maximum capacity at any time, the remaining incentives will be carried over to the following week.

Other Uses

Vertex also removed sequencer fees for takers interacting with Vertex Edge for the duration of the program.

Pace of Spending

In early January, the Arbitrum DAO voted to extend the deadline for spending incentives from January 31 to February 29. Vertex responded by reducing the weekly incentive disbursements, allowing the funds to stretch over an extended period.

Vertex Incentives Impact

The objective of this impact assessment is to evaluate the effects of the incentive program on protocol activity, specifically examining the demand for trading liquidity (takers) and the supply provided by Fusion vaults. This detailed, bottom-up analysis scrutinizes individual components of the STIP, which are unique to Vertex. This allows a clear prescription of how this results of the program were obtained and how this could be applied to other protocols.

Despite the STIP program's short-term nature, this report assesses its prolonged benefits by analyzing protocol usage data following the program’s conclusion. The intention is to identify persistent activity changes, and what drove them.

The effectiveness of Vertex's incentives is thoroughly examined across various dimensions, initiating with a comprehensive analysis of trader reactions:

- Were the incentives appealing to new traders?

- How effectively were traders retained?

- What impact did the incentives have on traders' average trading volumes, and how does this vary across different trader categories?

- How these individual trader changes drove overall trading volumes?

- How were traders' demands for exposure affected?

- What was the effect on overall TVL, segmented by token category?

- How did this activity influence other Arbitrum uses, such as blockspace demand?

- Did this stimulate additional trading activity on Arbitrum, or did it cannibalize existing activity?

Additionally, the impact of liquidity incentives intended to bootstrap Fusion pools is evaluated:

- How swiftly did liquidity reach the pools’ cap?

- Was this liquidity sticky after the incentives ended?

The distribution of the incentives is also analyzed to gain insight into the structural efficiency of this program.

Trader Reactions

Throughout this section a trader is defined as a unique subaccount on Vertex. This will likely differ from the number of human traders, but serves as a useful proxy.

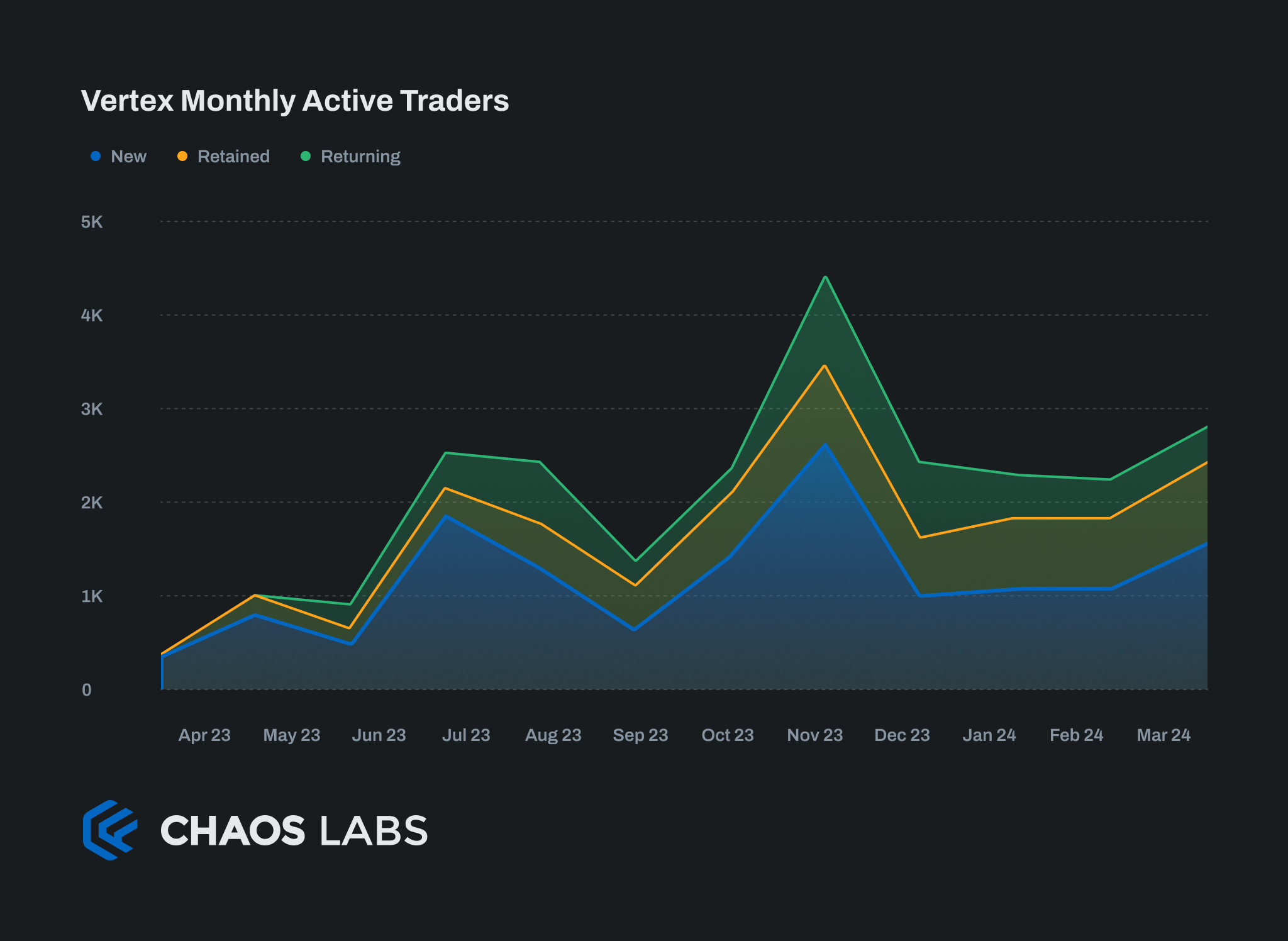

New Trader Acquisition

Throughout the STIP, 5,764 new traders executed at least one taker order on Vertex, only marginally more than the 5,208 new traders in the prior four months. At first glance, it appears that the Vertex STIP's fee rebate structure did not greatly influence new trader acquisition. However, several other factors must be considered.

The period before the STIP likely saw sybil activity aiming to benefit from the VRTX TGE in November 2023. This probably inflated the count of actual human traders far more than during the STIP when sybil activity had no advantage.

The incentives from competing trading platforms also play a crucial role. Two other exchanges received significantly larger STIP grants than Vertex, potentially making trader acquisition harder during this time.

The rise in new traders after the program ended suggests that acquiring new traders did not decelerate post-program.

We conclude that Vertex's fee rebates moderately impacted trader acquisition. Due to the challenges in accounting for competing protocol incentives and prior airdrop farming, the exact impact remains uncertain and warrants further investigation, considering the competitive ecosystem.

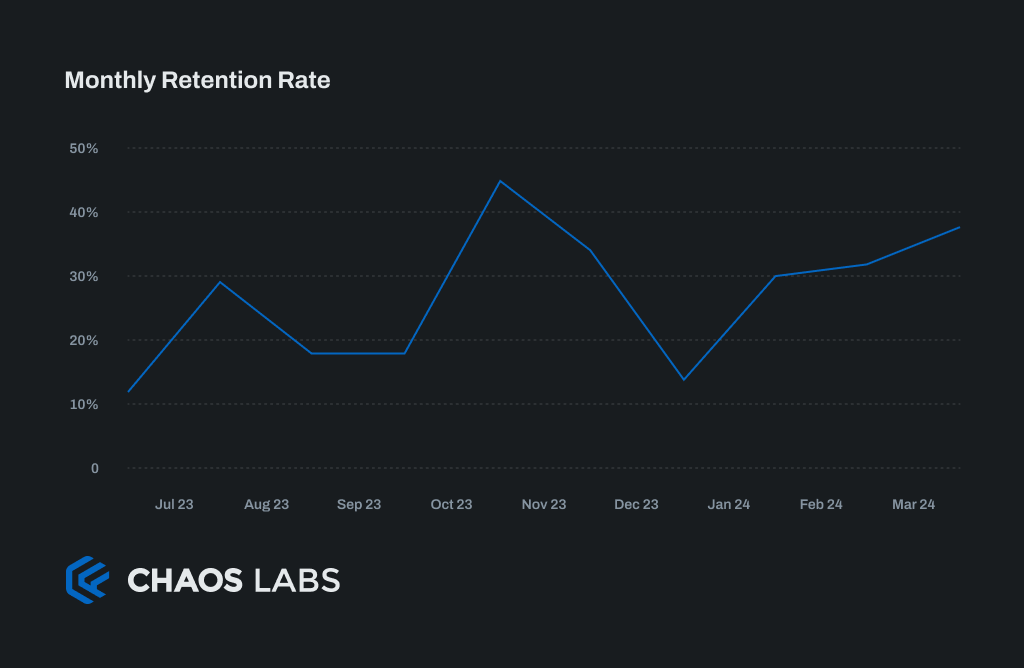

Trader Retention

The monthly retention rate at Vertex is defined as the percentage of traders who engaged in at least one trade in the previous month and continued to trade in the current month.

Vertex has experienced a steady improvement in its monthly retention rate throughout its operational history, contributing to signs of compounding user growth over time.

The noticeable decline in December is primarily attributed to the large number of new traders joining Vertex during the initial month of the STIP, and is regarded as a temporary anomaly. Subsequently, the monthly retention rate has resumed its upward trend.

Our analysis concludes that traders involved in Vertex during the STIP have shown reasonable retention levels. There is no evidence to suggest that the program was predominantly exploited by short-term, opportunistic traders. The rebate mechanism has successfully attracted long-term traders who continue to use the platform even after the incentive period has ended.

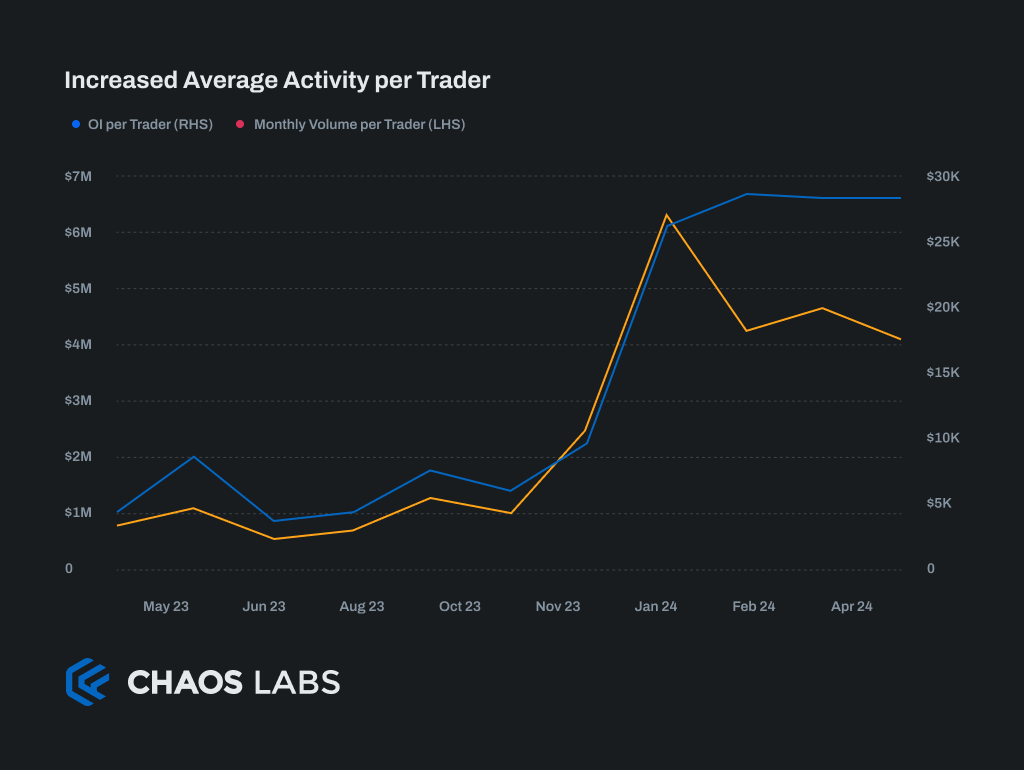

Existing Trader Activity Growth

There is a clear correlation between the incentives offered and the average monthly trading volume per trader, which began to diverge in January 2024. During this period, while open interest per trader increased, trading volumes declined. This change coincided with the decision to reduce weekly trading incentives by half to extend their duration until the new end date in February.

This pattern indicates that while trading volume is highly responsive to the rate of incentives, open interest is considerably more stable. This persistent open interest likely played a crucial role in supporting trading volumes even after the incentive program ended.

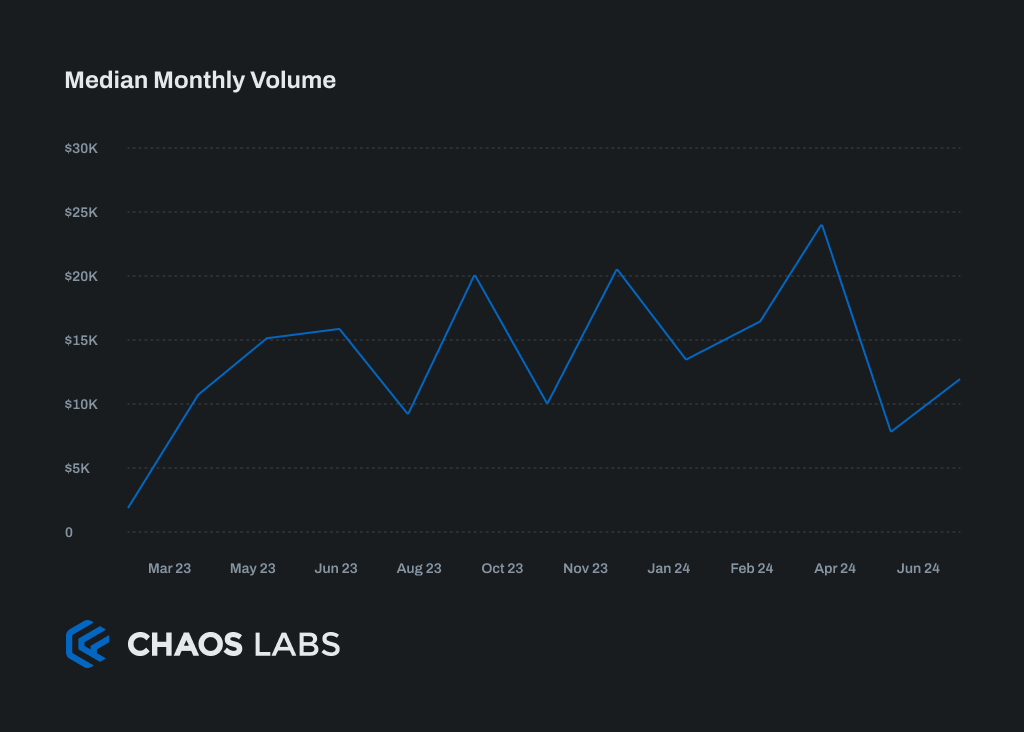

Segmenting traders by their percentile of monthly volume provides insights into trends and elasticities among different trader segments. The segments analyzed are:

- The median trader, who represents the retail segment and typically trades between $10,000 and $20,000 per month.

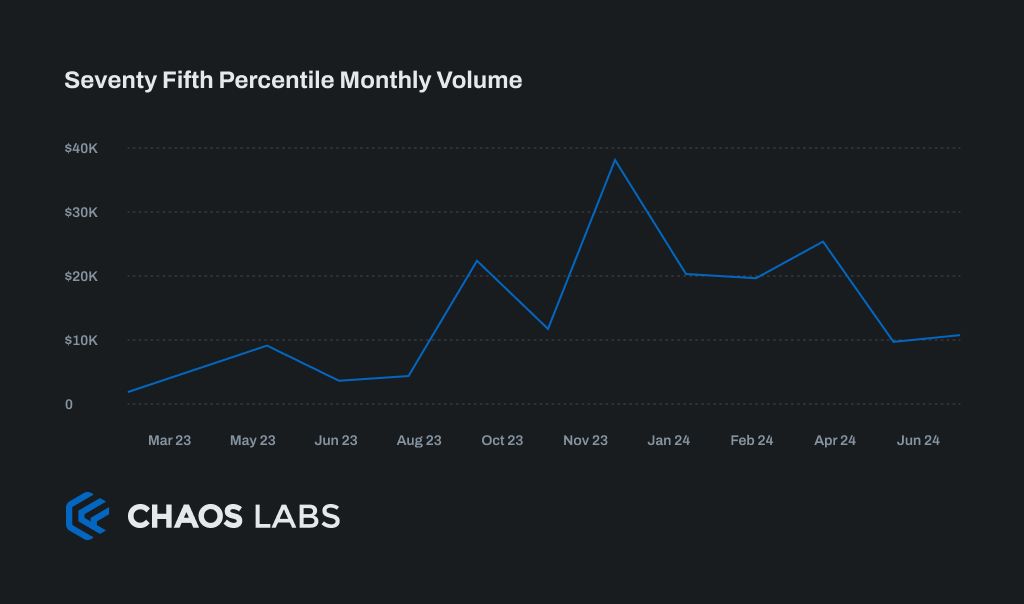

- The 75th percentile trader, who represents power retail traders and typically trades between $100,000 and $400,000 per month.

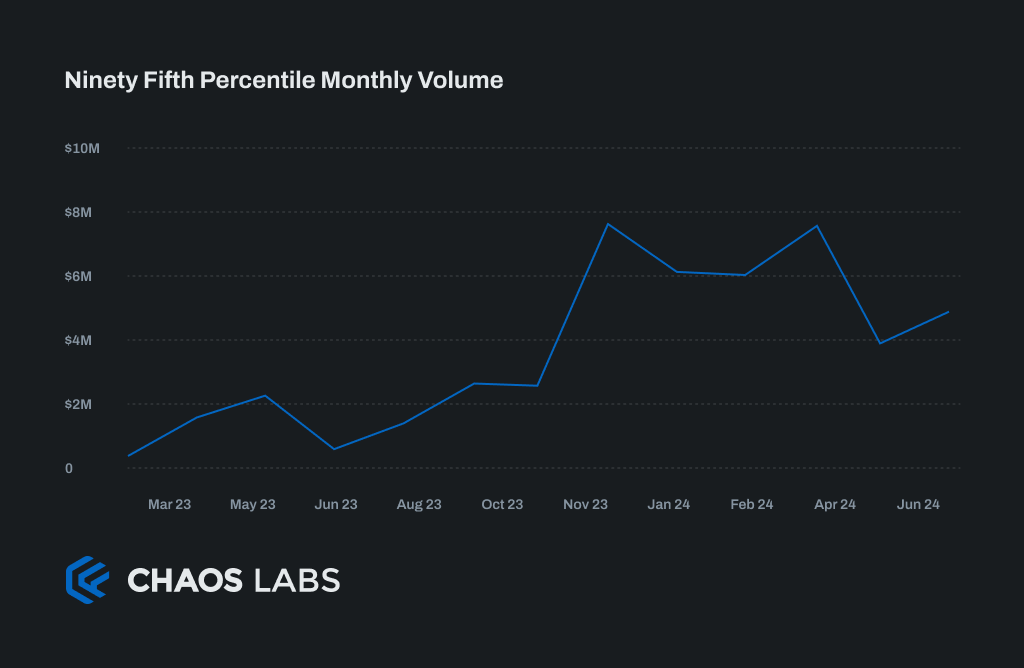

- The 95th percentile trader, who represents small to mid-sized trading firms and typically trades between $4 million and $8 million per month.

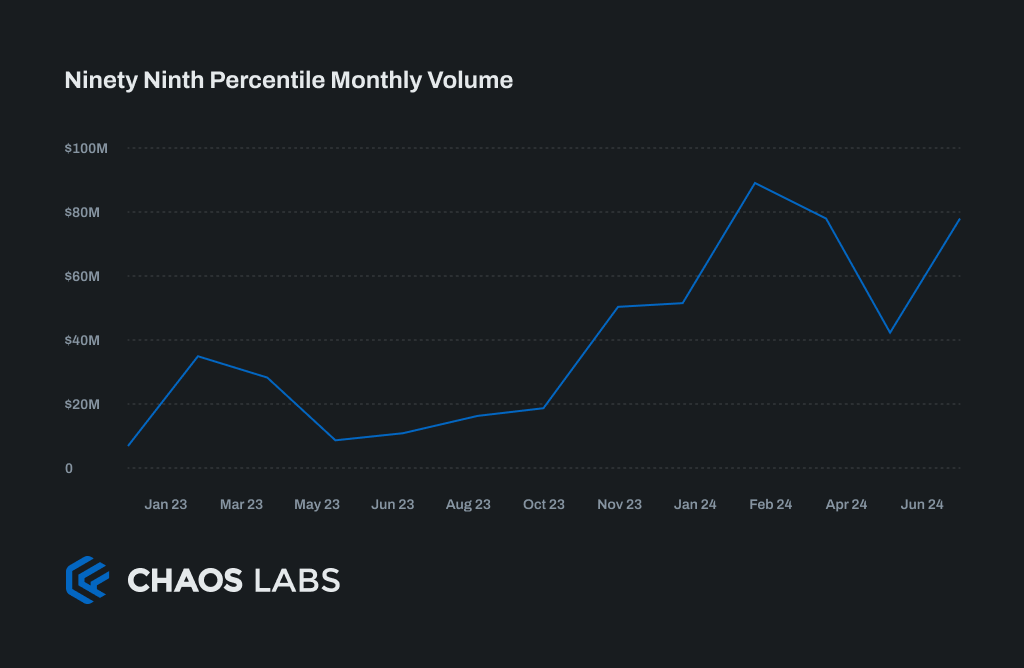

- The 99th percentile trader, who ranks among the top 10 traders by volume and typically trades over $30 million per month.

The charts below display the monthly trading volumes for each segment. The median trader gradually increased their trade size over the duration of the STIP, followed by a significant reduction, with early signs of recovery in April. This segment shows limited elasticity to incentives, with no noticeable increase at the program’s outset or sustained drop at its conclusion.

The 75th percentile trader saw rapid increases in trading volume until the incentives were reduced in January. This segment appears most responsive to fee rebates, with trading volumes reverting to initial levels immediately after the STIP concluded, and no significant increase in April.

Small to mid-sized trading firms showed trends similar to the power retail segment but were less sensitive to changes in incentives. Their trading volumes did not decline immediately after the incentive reduction in January. Post-program, their volumes decreased but remained significantly above pre-program levels.

The highest volume traders consistently increased their trading volumes during the first three months of the STIP, then decreased in February. Their volumes have since rebounded, suggesting that the STIP had a highly positive impact on their activity. The rebate incentives appear to be effectively targeted at these traders, facilitating the expansion of their operations and integration of their infrastructure.

Overall Activity Growth

Weekly trading volumes on Vertex result from the combination of the number of traders and their average activity. Much of the credit for the sustained weekly volumes after the program ended should be attributed to the growth in the overall trader base, driven by an excellent retention ratio and the consistent onboarding of new traders each month. Additionally, the increase in trading volumes from the highest volume traders has an outsized impact, as aggregate volume typically follows a power law.

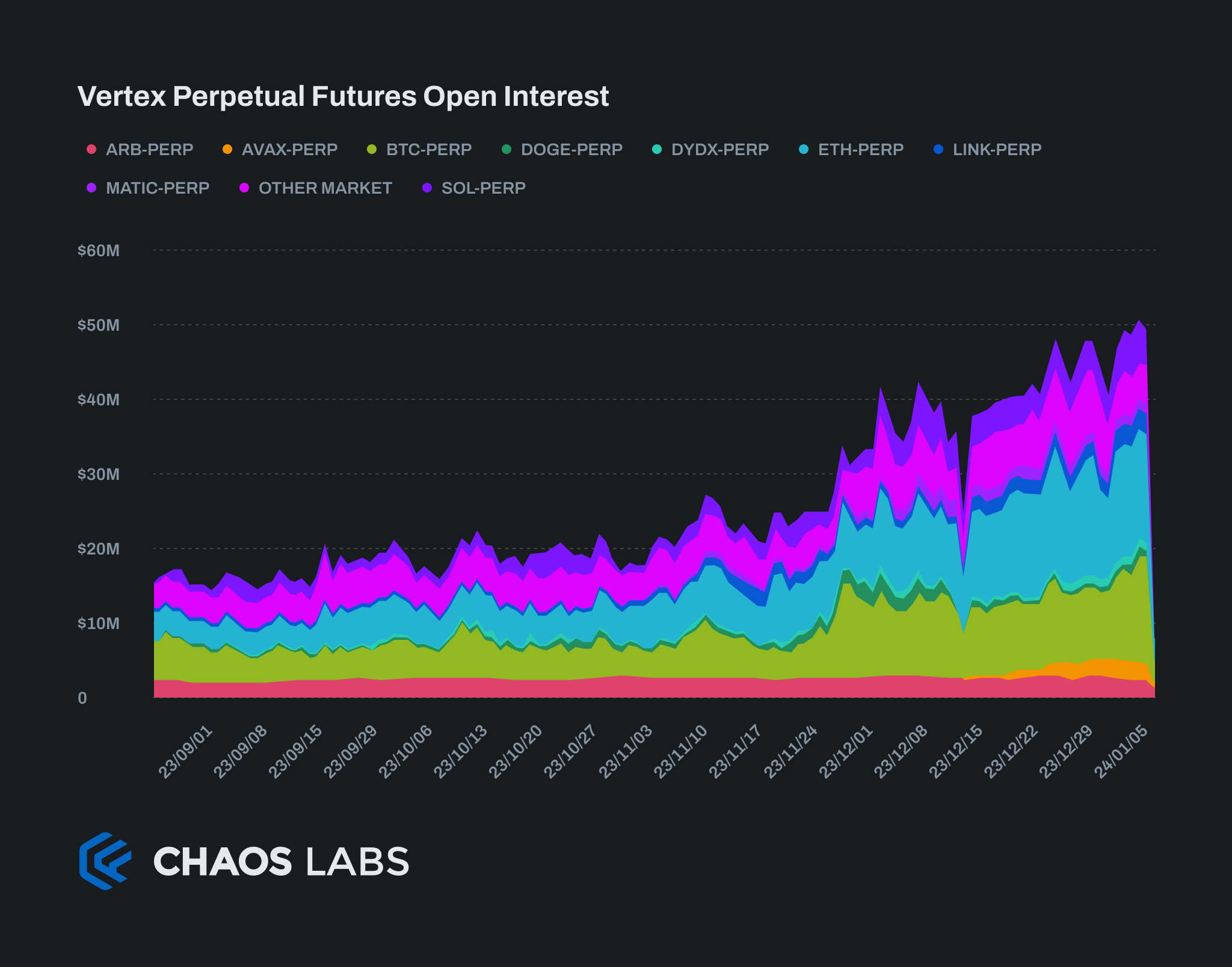

The demand for exposure to token prices in trading can be proxied by the amount of open interest. This has continued trending higher, with a clear change in slope around the start of the STIP.

What is interesting about this is that open interest is not directly incentivized, but more a second order effect of trading activity on the exchange.

The Vertex Protocol design, with integrated spot and perpetual markets also aids in retaining open interest. Vertex is unique in how it allows traders to hedge their collateral tokens through perps on the exchange with no liquidation risk. This has the added benefit of internalizing perpetual funding rates on the protocol through these funding rate arbitrage strategies, and could explain the retention in open interest. Incentives play a crucial role in growing this open interest which then retains, while keeping funding rates better contained than externally, further supporting trading activity.

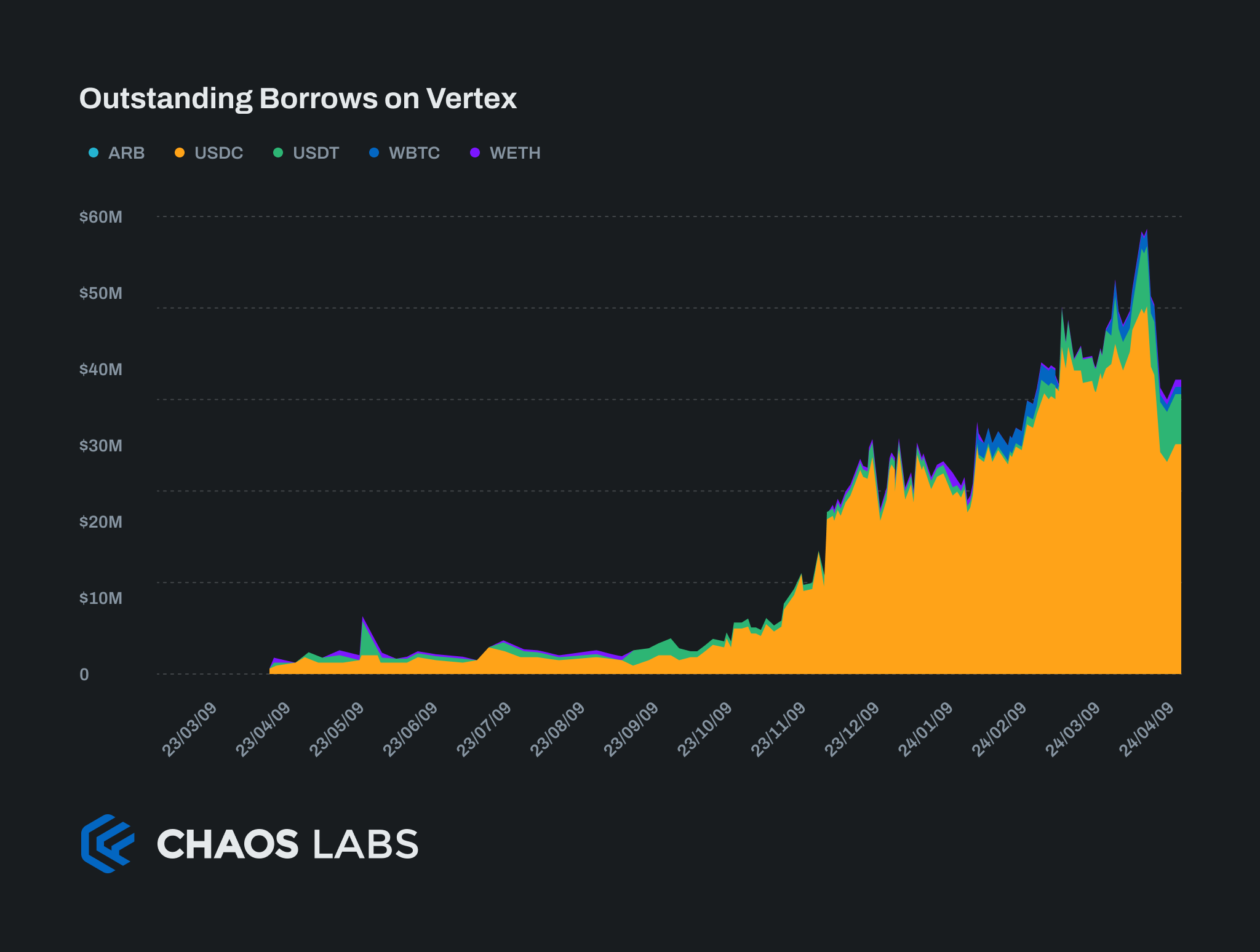

TVL Growth

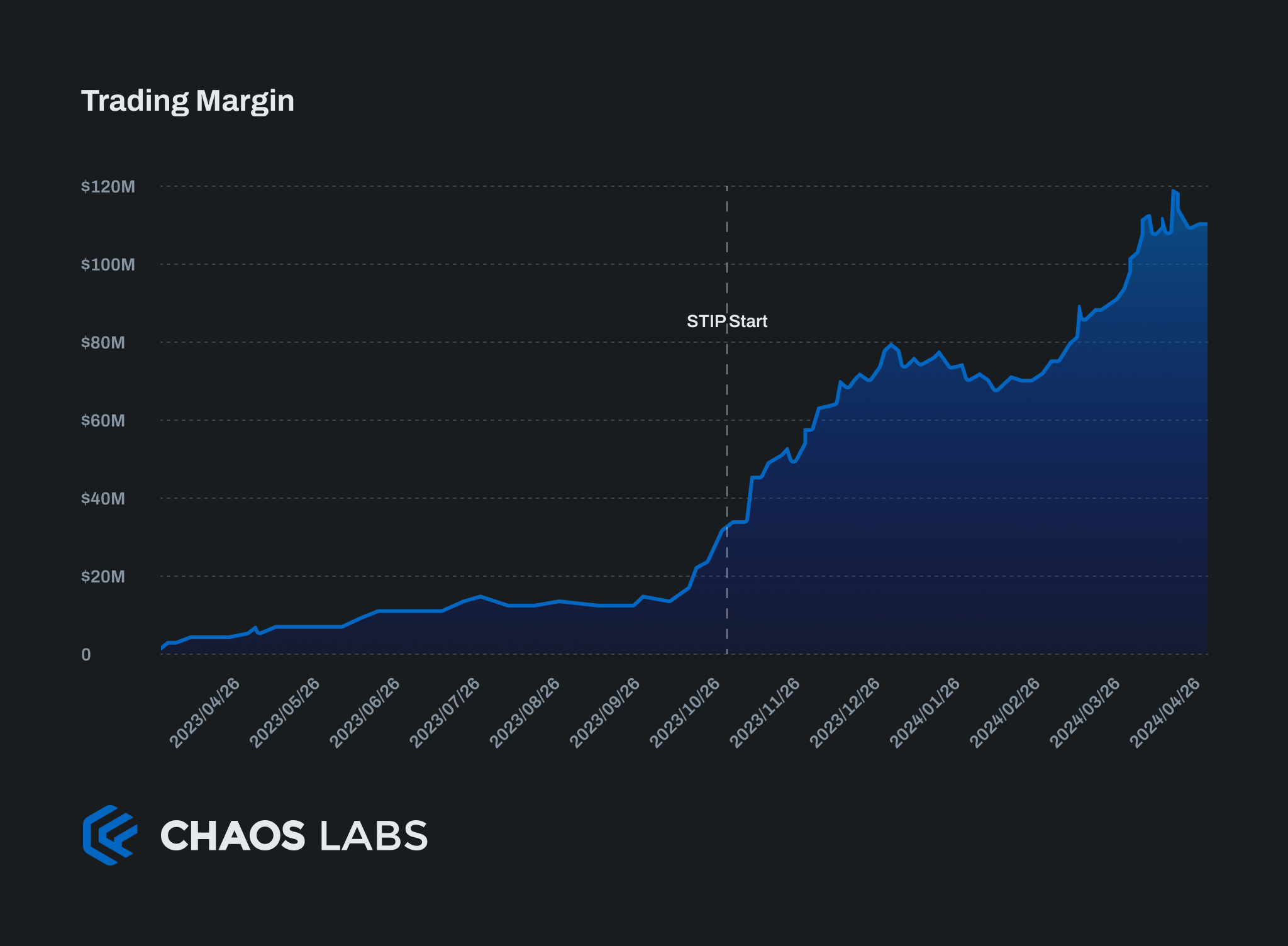

Vertex trading margin growth over the period of the STIP program is clearly evident from the chart below. The approximate 5 months leading up to the program saw limited growth, which immediately accelerated from ~$18m at the outset to over $60m within two months. Trading margin remained around this level for the third month of the program.

It is impressive that the STIP program provided the impetus that initiated the growth in Vertex trading margin, which has continued to grow from ~$61m at the end of the program to ~$92m currently (25 April 2024). The benefits in terms of growth in trading margin have clearly persisted with continued growth beyond the program end.

Stablecoins and bridged tokens (e.g. WETH, WBTC, etc.) are significantly more valuable TVL for a rollup ecosystem such as Arbitrum than native tokens (e.g. ARB, VRTX) as they grow ecosystem TVL rather that allocate it amongst protocols.

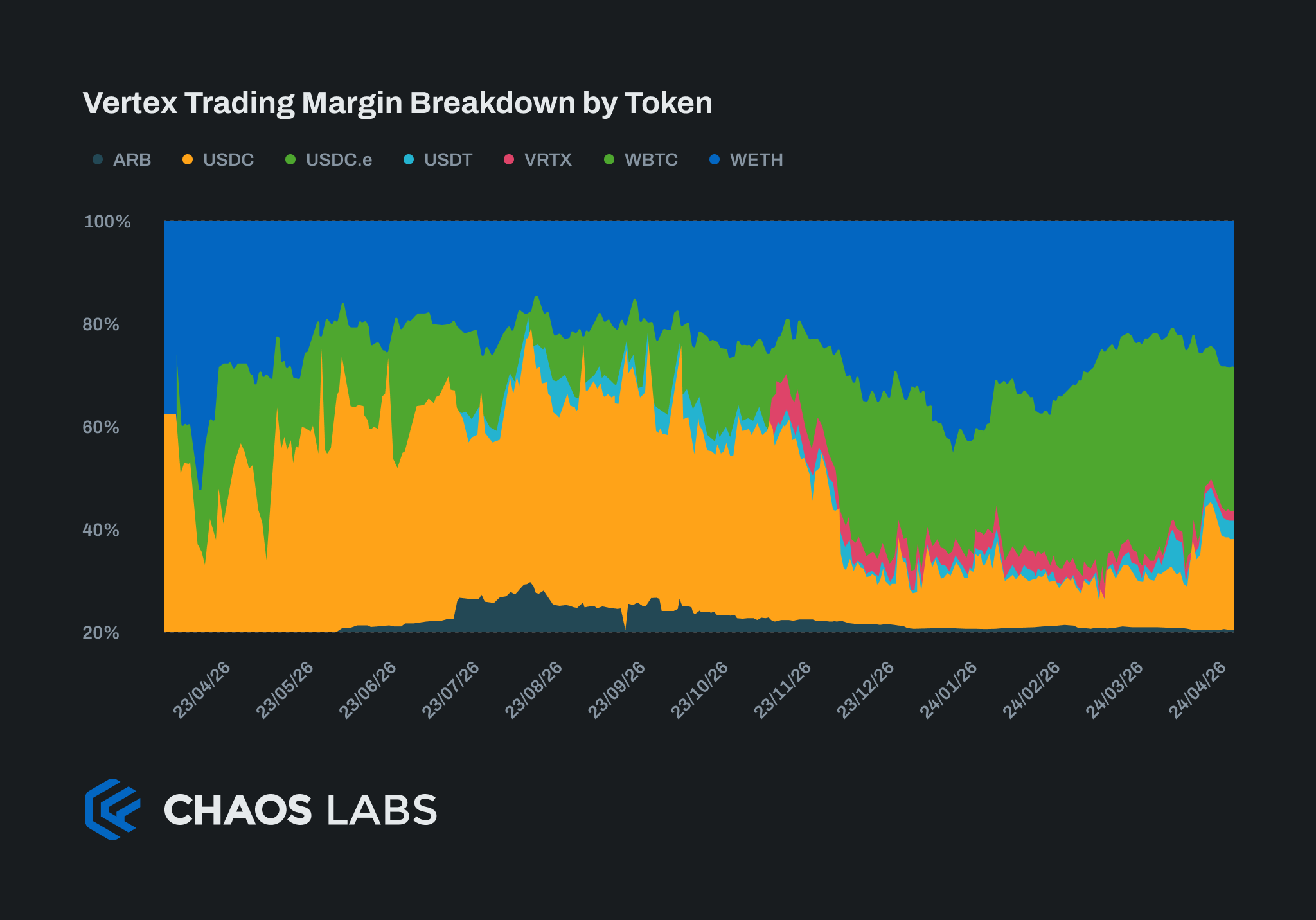

The chart below showing the breakdown of Vertex trading margin by token over time shows that native tokens have never made up a significant share.

The chart shows shift away from a majority of USDC collateral to a majority of bridged ETH and BTC collateral. This is primarily due to a significant portion of USDC being borrowed in the Vertex money market which provides a yield source for traders collateral - another differentiator from other perpetual futures DEXs.

The growth in ETH and BTC collateral could also be a cleaner way for funding rate arbitrage or other arbitrage strategies that can manage their exposure better with collateral correlated to their exposure.

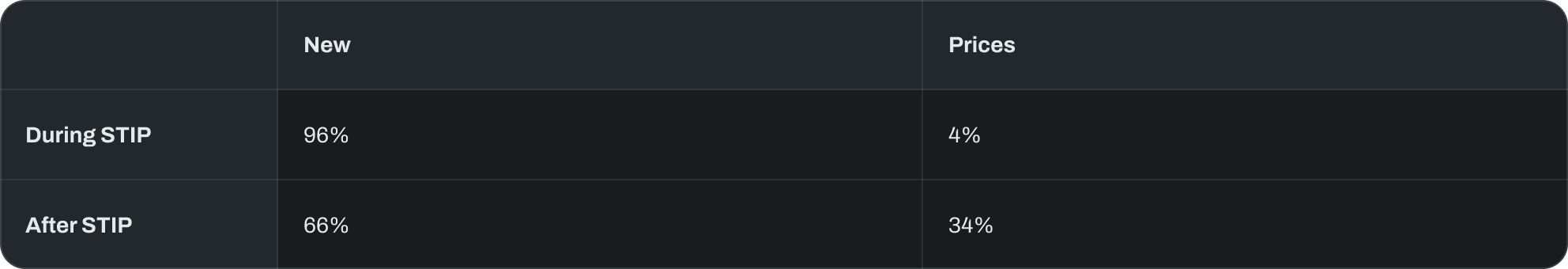

One aspect to note in the growth of trading margin over this period is the increase in token prices. Only 30% of Vertex trading margin is held in stablecoins meaning variance in token prices will affect this metric. Before the STIP most trading margin TVL comprised of USDC, however this began changing almost immediately after the STIP launched.

Estimating this impact over the period of the STIP, the change in trading margin TVL is broken down into the change due to price changes and the change due to net new TVL $\Delta TVL = \Delta TVL_{price} + \Delta TVL_{new}$. Here the change in TVL due to price changes is defined as $\Delta TVL_{price} = \sum{TVL^i_0 \times (P^i_T - P^i_0)}$, and the change in TVL due to incremental activity as $\Delta TVL_{new} = \sum{P^i_T \times (TVL^i_T - TVL_0^i)}$.

$P^i_0$ represents the price at time 0 of token i, and similarly

$TVL^i_T$ represents the TVL at time T of token i

Time 0 corresponds with the beginning of the STIP program and T with the end.

The results show that despite the price increases over the program, the vast majority of the increase in TVL can be attributed to net new flows into the clearinghouse. Even after the end of the STIP, when most price increases have occurred, approximately 2/3 of the continued increase can be attributed to incremental capital flows.

Breakdown of Trading Margin TVL Growth

Other Arbitrum Relevant Metrics

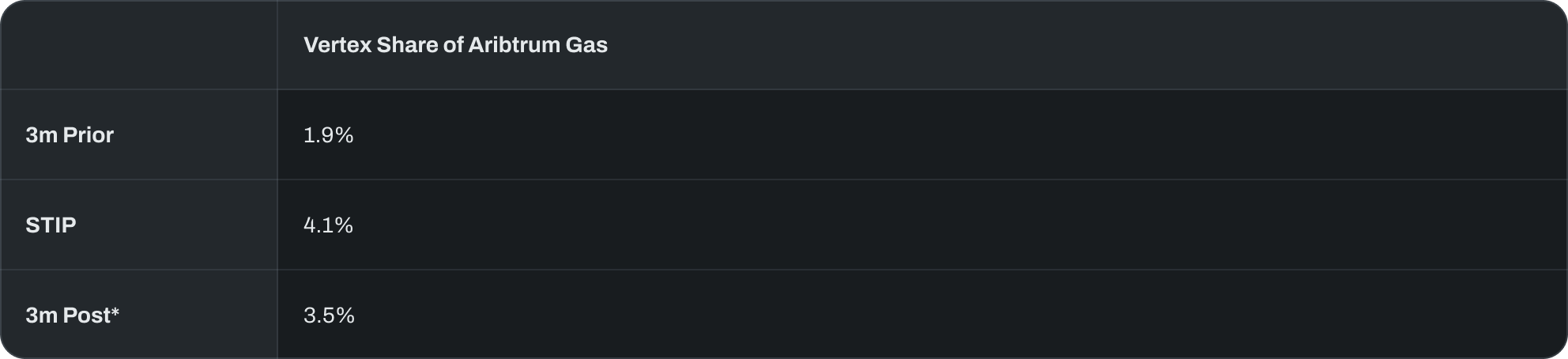

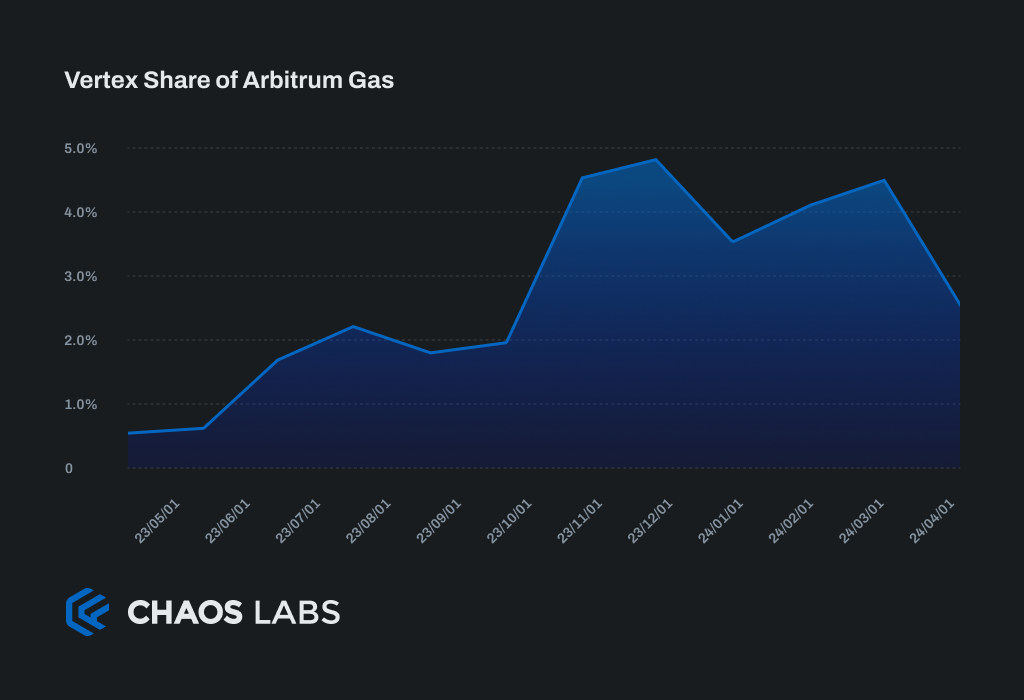

Another way that protocols can create value for Arbitrum is through the demand they create for block space. As a trading protocol, users of Vertex will perform regular transactions and therefore drive substantial storage and compute fees to the Arbitrum sequencer.

It is clear from the share of total Arbitrum gas that Vertex grew its activity as a proportion of the total on Arbitrum over the course of the STIP. This is valuable to Arbitrum as Vertex is contributing significantly to sequencer revenue, a major long-term revenue driver for the DAO.

* Small drop off mainly due to Vertex disproportionally benefitting from the Dencun upgrade. This should persist going forward.

Organic vs Canabalistic Growth

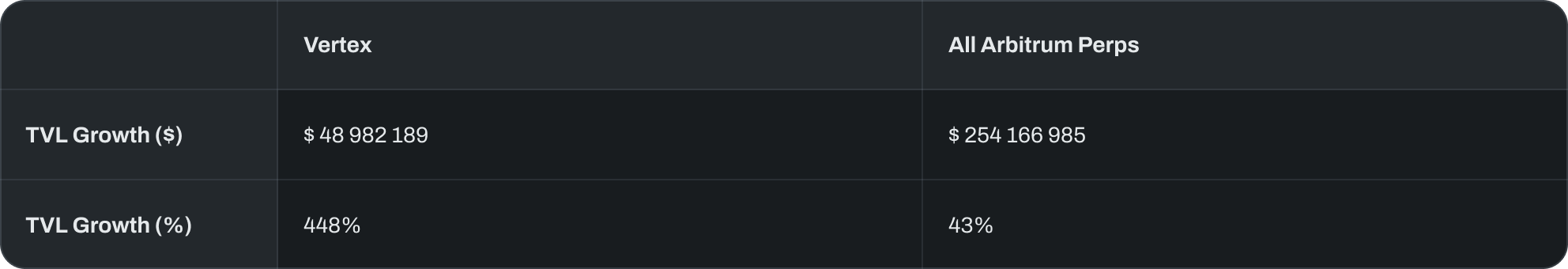

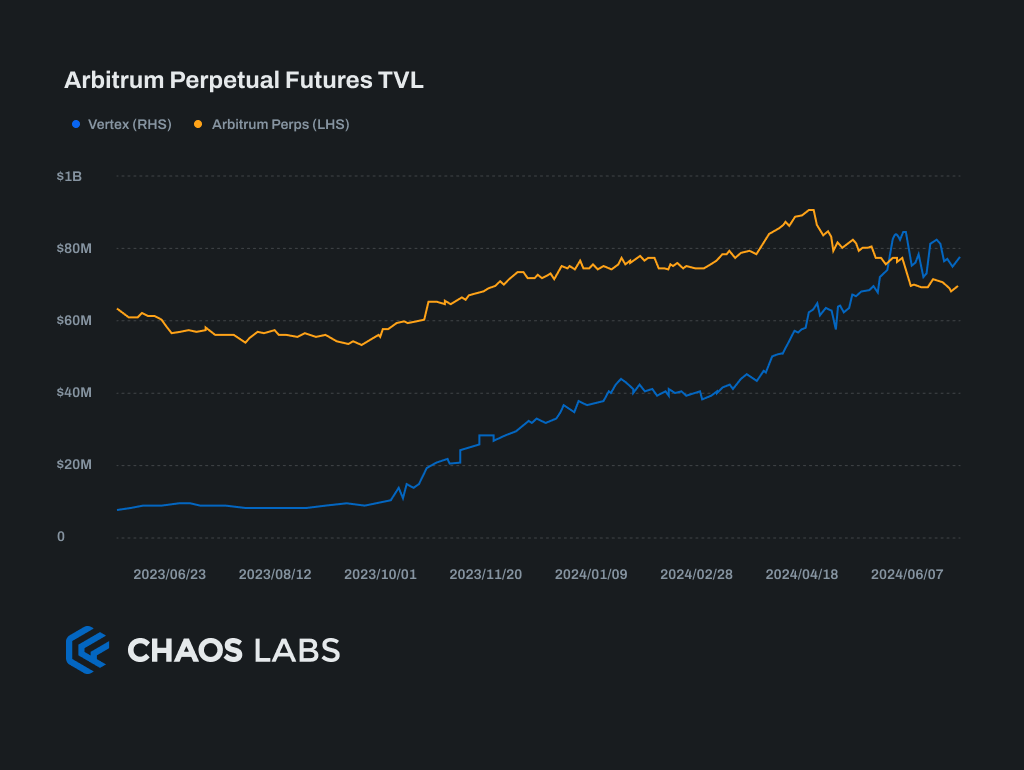

The growth in Total Value Locked at Vertex appears to consist largely of net new capital, without detracting from other perpetual exchanges on Arbitrum.

To assess this, we compared the changes in TVL at Vertex against those across all Arbitrum perpetual exchanges during the STIP. While TVL across Arbitrum increased by approximately $250 million, Vertex contributed about 20% to this growth. Notably, Vertex's TVL expanded ten times faster than the average for other Arbitrum exchanges in percentage terms. Given the consistent direction of growth and its modest share of the total increase, it is evident that Vertex's growth is predominantly organic and represents new TVL.

Furthermore, Vertex's TVL performance is impressive relative to the broader ecosystem. Despite a general decrease in interest for leveraged trading and the end of incentives, Vertex’s TVL has remained near its highs, whereas the industry generally has fallen by 20%. This resilience suggests that Vertex's focus on incentivizing organic activity through rebates is creating sustainable outcomes.

Vertex Liquidity Reaction

The initial $3m cap for Vertex Fusion Vaults powered by Elixir was hit on the first day. The subsequent $10m cap was hit within 2 days and remained within 15% of this cap throughout the STIP and beyond. It is reasonable to conclude that the assigned incentives were at least high enough to bootstrap this liquidity.

The vaults have subsequently increased in size with TVL remaining after STIP incentives ended, confirming the sustained benefit of bootstrapping these pools.

Vertex Incentive Distribution

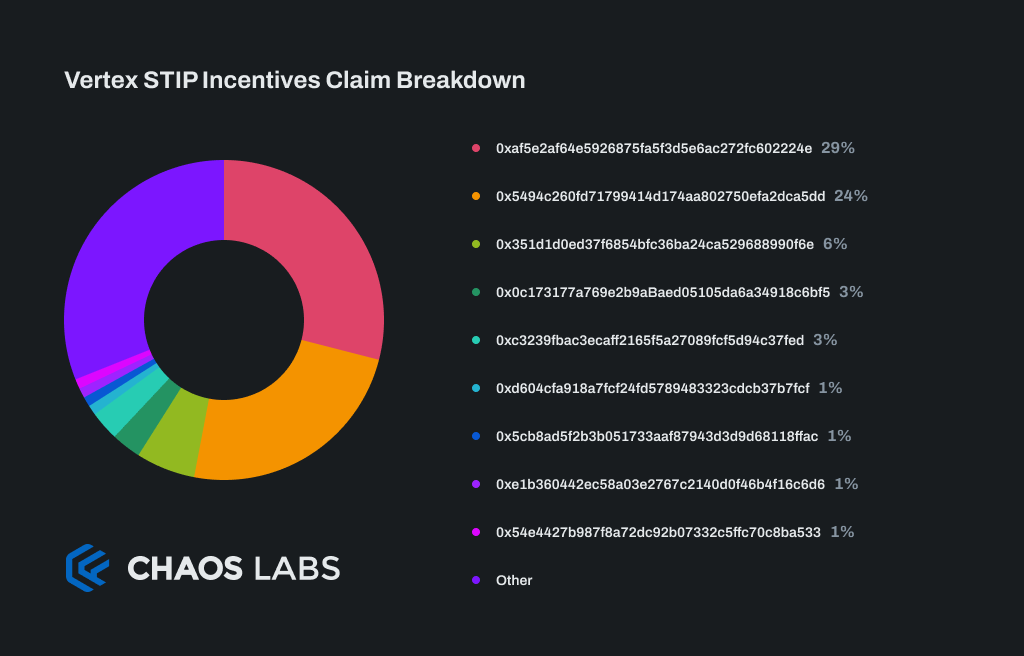

One notable aspect of the Vertex STIP incentives is that 53% of the incentives have been claimed by just two accounts. While it is common for trading volumes on venues to be highly concentrated among the most active traders, this level of concentration is unusually high.

To obtain an objective metric for the concentration of incentives distributed, we use the Herfindahl-Hirschman Index (HHI). The HHI is a common measure of market concentration, typically applied to firms in an industry. It applies well to the distribution of incentives as Vertex can be seen as a marketplace with individual traders transaction on it. The resulting index is generally interpreted as follows:

- An HHI of less than 1,500 is considered a competitive marketplace

- An HHI of 1,500 to 2,500 is moderately concentrated

- An HHI of 2,500 or greater is highly concentrated

The Herfindahl-Hirschman Index (HHI) for the Vertex incentives stands at 1475, which is considered competitive. Beyond the two largest claimants, there exists a long, substantial tail of rewards recipients, suggesting a healthy and well-distributed rewards program. Excluding the two largest claimants, the HHI falls to 334, indicating an extremely competitive environment.

However, the efficiency of Vertex’s incentive distribution could have been improved if the two largest claimants had not received over half of the rewards. This concentration may have diluted the program's overall benefits.

Incentive Risk Analysis

The incentive risk analysis uses the above deep bottom-up analysis of the Vertex Protocol informing the specific potential manifestations of these risks in a protocol specific context.

Vertex Risk Factors Under Investigation

- Vertex incentives create excessive speculation: This could destabilize aspects of the protocol, cause excessive user losses, or potentially affect ecosystem partners.

- Vertex incentives skew the natural growth of trading activity and liquidity: This could cause risks such as bad debts from liquidation slippage, poor user experience, or markets depegging from their underlying index prices.

- Vertex incentives distort the growth of Arbitrum perpetual trading: Vertex growth could come at the expense of competing DEXs, rather than onboarding net new activity.

- Vertex incentives do not grow liquidity over the long term: Liquidity leaves once STIP incentives end.

- Incentives do not lead to sustained trading activity: Trading activity leaves once STIP incentives end.

- Incentives counteract the wind down of bridged USDC.e on Arbitrum: Futures collateral on Vertex is USDC.e meaning growth in TVL would increase the demand for USDC.e on Arbitrum.

- Vertex incentives cause protocol infrastructure malfunction: The increase in activity could cause external elements such as the Vertex Edge liquidity connection, or the Elixir liquidity connection to fail.

Each of these risks are individually covered in detail below.

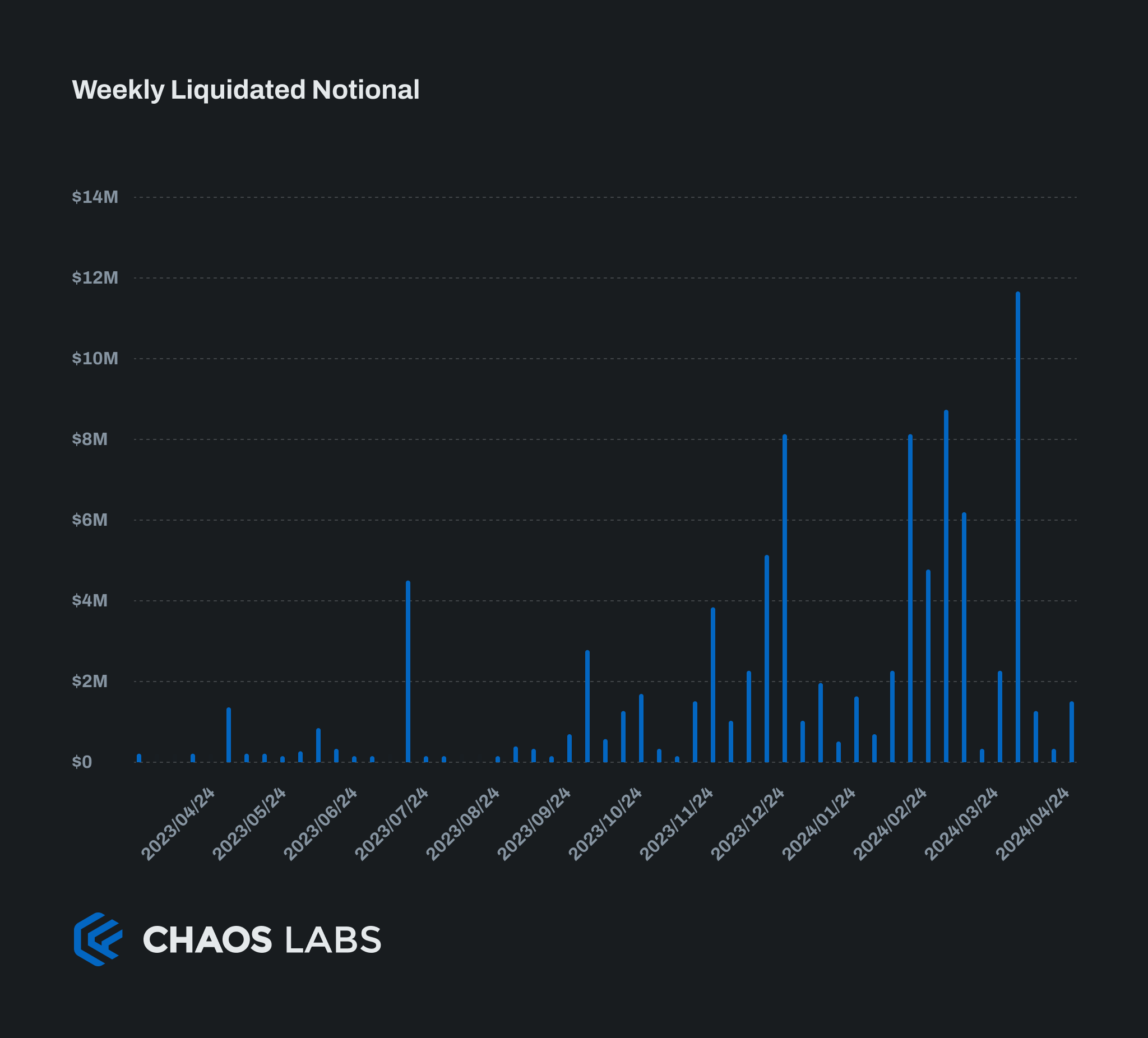

Vertex incentives create excessive speculation

To evaluate the risk of excessive speculation, we use the volume of weekly liquidations as an indicator. Liquidations, often triggered by overly leveraged positions, pose a significant risk to perpetual trading protocols.

Although liquidations increased during the STIP, corresponding with a rise in open interest, the increase was not disproportionate. Therefore, we conclude that the incentives did not lead to excessive speculation that threatened the stability of the protocol or the broader ecosystem.

Vertex incentives skew the natural growth of trading activity and liquidity

Incentives creating an artificial bias in protocol activity is typically the result of highly opinionated incentive design. Vertex simple trading incentives rebating trading fees are unlikely to cause any artificial skew in protocol activity, and therefore this risk is viewed as negligible in this case.

Vertex incentives distort the growth of Arbitrum perpetual trading

This risk was addressed previously in the analysis of TVL growth across Arbitrum's perpetual futures market. There was no significant evidence to suggest that Vertex's growth materially cannibalized its competitors within the ecosystem; Vertex's growth during the STIP accounted for only 20% of the overall increase in TVL.

Furthermore, Vertex's straightforward incentive structure and its role as an alternative to centralized exchanges do not adversely affect the overall development of perpetual trading on Arbitrum.

Vertex incentives do not grow liquidity over the long term

The persistence of TVL in the Vertex Fusion vaults since the ending of the STIP indicates that the incentives were successful in bootstrapping sustained liquidity on Vertex.

Incentives do not lead to sustained trading activity

This topic is discussed in more detail above. While it's true that activity in certain segments has declined since the program ended, new traders continue to join at a steady rate. Furthermore, the retention rate of these traders is improving, and the average trading volumes across most segments remain higher than they were prior to the program.

Incentives counteract the wind down of bridged USDC.e on Arbitrum

Vertex migrated all USDC in its smart contracts from bridged to native USDC on 12 January 2024. In addition from this date onwards all staking rewards were distributed in native USDC. This mitigated this risk completely.

Vertex incentives cause protocol infrastructure malfunction

There were no outages reported over the course of the STIP or after. Vertex has handled the extra load of incentivized trading without issue.

Key Takeaways

Vertex Incentive Positives

Using Incentives to Amplify New Protocol Upgrades and Announcements

Vertex launched its Elixir market making vaults at the same time the program commenced creating additional hype. Three weeks after launch its native token VRTX launched drawing further attention to the protocol and its incentive program.

Linking the STIP incentives to bootstrapping the both liquidity in the Elixir vaults, and trading activity played an important role in the sustained yields in these vaults over the long term as activity growth provided a native yield source for the liquidity.

Together these appear to have played a key role in making the program discoverable, and drawing in users in a competitive space.

Keeping the Incentive Criteria Clear and Simple

Vertex incentives were extremely easy to understand, and optimize for. Traders would receive up to 75% of their trading fees back, and LPs would earn 15% APY on their capital. This told traders exactly what they needed to do to earn rewards, and set clear expectations around the degree of incentivization.

Focusing on the Demand Side of the Market

Vertex incentives were heavily weighted towards incentivizing trading activity with 85% of incentives going to trading fee rebates. This brought fee-paying activity which then transitioned into a sustainable yield source for liquidity providers.

Getting the balance between supply and demand right is a complex challenge and in hindsight Vertex has managed this extremely well.

Mitigating Wash Trading by Ensuring Users Incur a Small Cost

Maintaining a positive cost to trade is essential in avoiding wash trading and mercenary rewards farming. Vertex STIP rewards were intentionally designed to only rebate 75% of taker fees, making it unprofitable to trade solely to farm rewards.

Vertex Incentive Potential Improvements

Less Concentration Amongst Two Large Accounts

Healthy trading venues thrive on diverse trading activity, which enables liquidity providers to offset risk and ensures the market functions optimally. However, a high concentration of rewards, with 53% allocated to just two accounts, diminishes the distribution of rewards to other participants, potentially undermining the intended effects.

Power-Retail Traders Did Not Sustain Their Activity

Power-retail traders, who we identify as the 75th percentile with the highest monthly volume of trades, dropped in average monthly volume to their original level. An allocation of incentives specifically targeted at this segment, such as trading competitions, could have better retained their engagement.

Vertex STIP Useful Resources

Applications:

Bi-weekly updates:

Disclaimer

The reports, and other information and materials (“Materials”) made available by Chaos Labs, Inc. (“Chaos”) are made available “AS IS” and “WITH ALL FAULTS.” YOU USE AND RELY ON THE MATERIALS AT YOUR OWN RISK. For the avoidance of doubt, unless otherwise set forth in a separate written agreement between Chaos and you, Chaos makes no representation or warranty with respect to the Materials or any other services provided or actions or omissions by or on behalf of Chaos or any other party, including without limitation the Arbitrum Foundation, Arbitrum Research and Development Collective (the “ARDC”), the Arbitrum Decentralized Autonomous Organization (the “DAO”), or any individual member of any of the foregoing entities (collectively, the “Arbitrum Parties”). Chaos disclaims any and all representations and warranties with respect to the Materials and any services performed by Chaos in connection with the ARDC, whether express, implied, statutory or otherwise, including without limitation warranties of merchantability, noninfringement, fitness for a particular purpose, and any warranties or conditions arising out of the course of dealing or usage of trade. Chaos specifically does not represent that the Materials will be error-free. The Materials may include content, software, information, and data provided or made available by third parties, including Arbitrum Parties (“Third-Party Materials”). Chaos has no obligation to investigate the source of such Third-Party Materials and does not represent that such Third-Party Materials are accurate or secure, nor that you have a right to use any such Third-Party Materials.

For the avoidance of doubt, Chaos will not be liable to you or any third party under any theory of liability for any claims or causes of action arising from or related to the actions or omissions of any Arbitrum Parties, and you agree that you will not, and will not cause or permit any third party to, bring any claim against Chaos in connection with any of the Arbitrum Parties’ actions or omissions. Chaos is not, and shall not be deemed, a partner, fiduciary, or other legal representative or agent of any of the foregoing.

dYdX Chain: End of Season 4 Launch Incentive Analysis

Chaos Labs presents a comprehensive review of the fourth trading season on the dYdX Chain. The analysis encompasses all facets of exchange performance, emphasizing the impact of the Launch Incentive Program.

Chaos Labs Oracle Risk Portal

Chaos Labs is excited to announce the launch of our Oracle Risk Portal. This portal is a public resource designed to offer an accessible overview of oracle feed performance, enabling stakeholders to efficiently assess and compare deviations in oracle data.

Risk Less.

Know More.

Get priority access to the most powerful financial intelligence tool on the market.