Chaos Labs launches AAVE v3 Risk Bot

Table of Contents

Introduction

Earlier this month Chaos released the Aave V3 Collateral At Risk dashboard. Since the release, we’ve been thinking about ways to make risk monitoring more proactive.

A crucial monitoring component is the ability to be notified of major protocol actions. To solve this, we built monitoring & messaging capabilities on top of our data pipelines to push alerts to stakeholders.

Overview

The Aave v3 Alert Bot leverages data pipelines built for the Aave V3 Collateral At Risk dashboard to send major liquidations alerts and daily summaries.

What you can expect to see on our Bot’s Twitter account - @ChaosAaveAlerts:

- Daily Risk summary: This daily report includes high-level risk metrics separated into two main categories:

- At risk - positions that are close to liquidation

- For standard wallets, health ranges between 1-1.5

- For e-mode wallets, it is ~1.0-1.1

- Eligible for liquidation - Wallets with health under 1.0 that should be liquidated

*****(felipe: can you swich the ab to numbers?*****

- At risk - positions that are close to liquidation

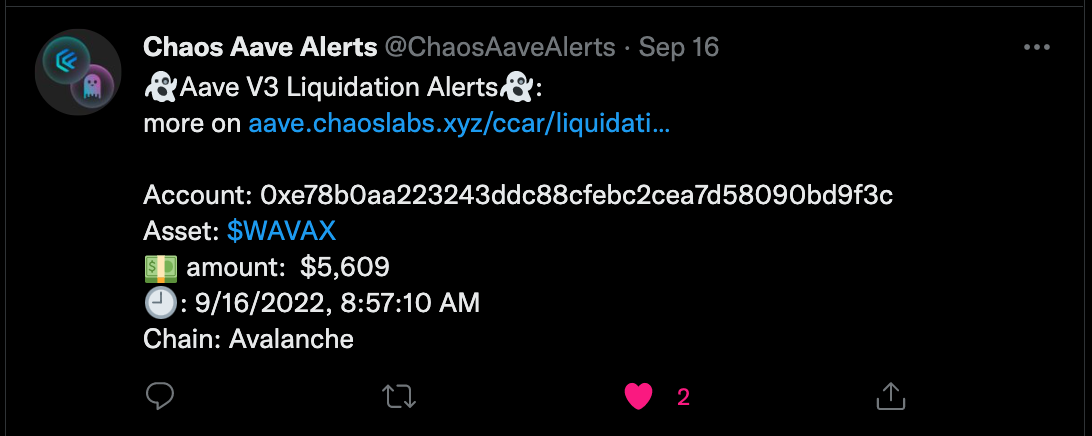

- Major Liquidations Alert: Every hour the bot will tweet out major liquidations (over $5k value) on any of the v3 deployment chains - with a link to our dashboards for deeper analysis. We decided to only track larger liquidations to make sure the bot is focusing on significant events and isn’t too noisy.

Next Steps

We launched v0 with a Twitter bot and plan to add other communication channels based on community feedback (forums, discord, and more).

We expect to add more alert types in the future and would love your thoughts on what would be most impactful!

About Chaos Labs

Chaos Labs is a software company building a simulation platform to allow teams to efficiently test protocols and understand how they will react to adversarial market environments. The backbone of our technology is a cloud-based, agent- and scenario-based simulation platform that allows users to orchestrate blockchain state, test new features, and optimize risk parameter selection.

Our technology allows users to:

- Orchestrate protocol/blockchain state

- Generate wallets with behavioral attributes

- Test protocol performance in chaotic market conditions

- Optimize risk parameters

Our mission is to secure and optimize protocols through verifiable agent- and scenario-based simulations.

The Chaos Labs simulation platform is built to emulate a production environment. Each simulation runs on a mainnet fork with the chain's current state so that your simulations include up-to-date account balances and the latest contracts and code deployed across DeFi. You cannot look at your protocol in a silo when you're testing adversarial environments. You must ensure you understand how external factors such as cascading liquidations, oracle failures, variable gas fees, liquidity crises, and more will impact your protocol in various situations.

Chaos Labs Asset Protection Tool

Chaos is unveiling a new tool to measure price manipulation risk and protect against it. Introducing the Chaos Labs Asset Protection Tool

Chaos Labs Dives Deep Into AAVE v3 Data Validity

Chaos Labs, a cloud security platform for DeFi applications, has discovered

Risk Less.

Know More.

Get priority access to the most powerful financial intelligence tool on the market.