Chaos Labs Partners with Jupiter Protocol

Chaos Labs Partners with Jupiter for Risk Management, Optimization, and Oracle Security

Chaos Labs is thrilled to announce our strategic partnership with Jupiter, a non-custodial DEX aggregator and perpetual futures exchange on Solana. Our partnership represents a deep commitment to enhancing protocol resiliency and growth, fortifying Jupiter's market position, and cultivating a safer, more robust trading environment.

Parameter Optimization

We will optimize protocol risk parameters through agent-based simulations. These parameters will also account for market configurations on competing protocols and centralized exchanges to ensure Jupiter retains a competitive edge and counteracts potential assaults such as basis trading. Our initiative ensures Jupiter's parameters foster capital efficiency, minimalize unhealthy liquidations, and protect against bad debt, all while maintaining a transparent dialogue with the community about the trade-offs involved.

| Parameter | Definition |

|---|---|

| Open & Close Position Fees | Fees for position opening/closing |

| Borrowing Fees | Fees paid by perpetual traders throughout the positions’ lifetime for borrowing reserves from the pool |

| Max Position Size | Maximum size of a position |

| Max Leverage | The maximum allowed leverage in every market |

| Open Interest Limit | The maximum OI for long and short positions across the protocol |

| JLP Mint & Withdrawal Fees | Fees for minting and withdrawing into/from the pool |

| AUM Limit | The maximum size of the pool |

| Spot Swap Fees | Swap fees for trading spot assets in the JLP |

| Target Index Weight | Target weight of every asset in the JLP |

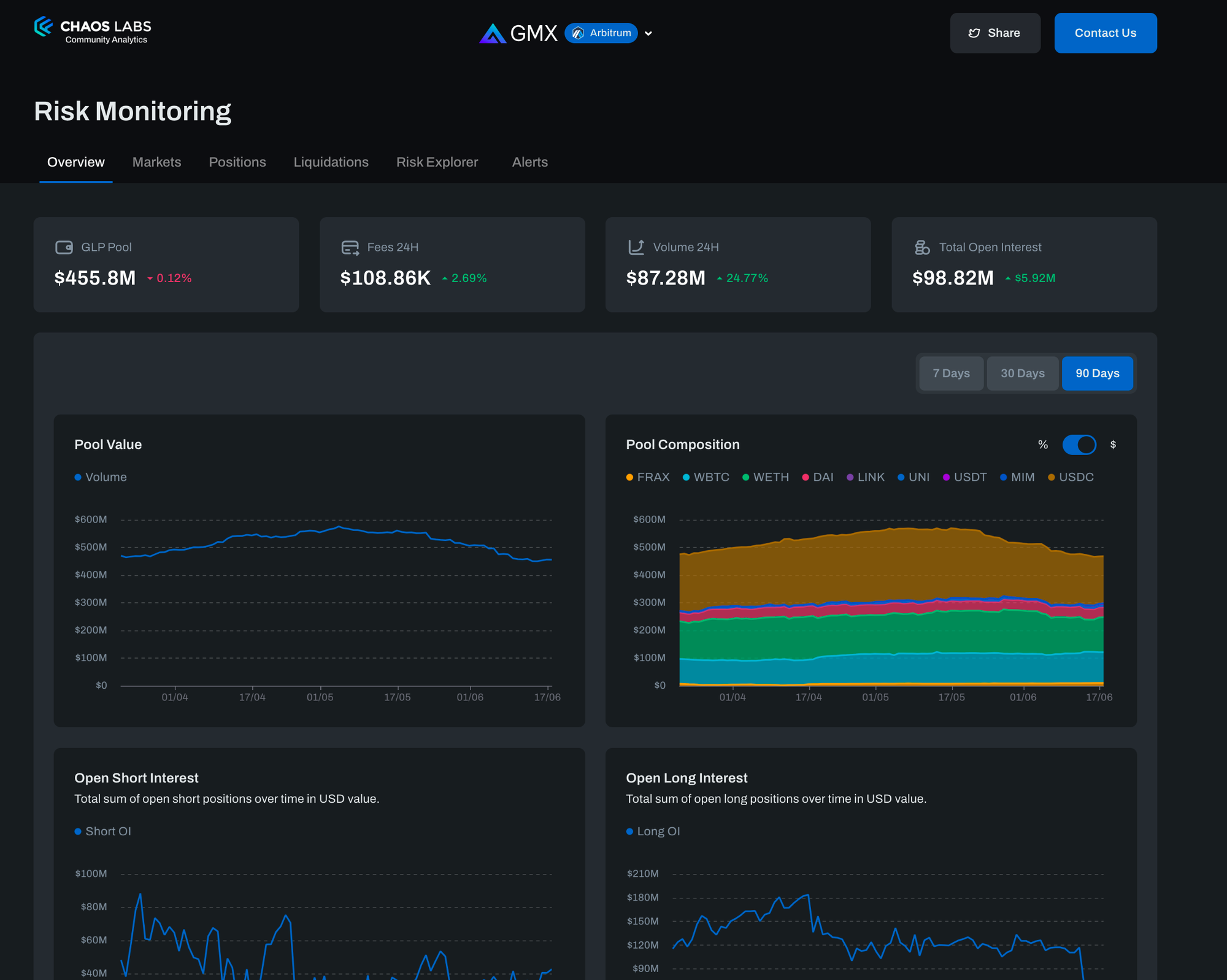

Risk Platform

The Jupiter Risk Platform will offer a comprehensive suite of real-time tools for monitoring protocol and account health. This includes custom dashboards and an integrated alert system to identify and respond to potential risks promptly. Our commitment to enhancing the platform with ongoing feedback ensures it remains the foremost resource for trading data, fostering a secure and growth-oriented ecosystem.

By granting the Jupiter community access to a publicly available platform for protocol health monitoring, Chaos Labs empowers users with the tools to understand and navigate the ecosystem's intricacies. This platform facilitates detailed risk analysis and ensures users are alerted to on-chain activities that may impact protocol stability, promoting proactive engagement and decision-making.

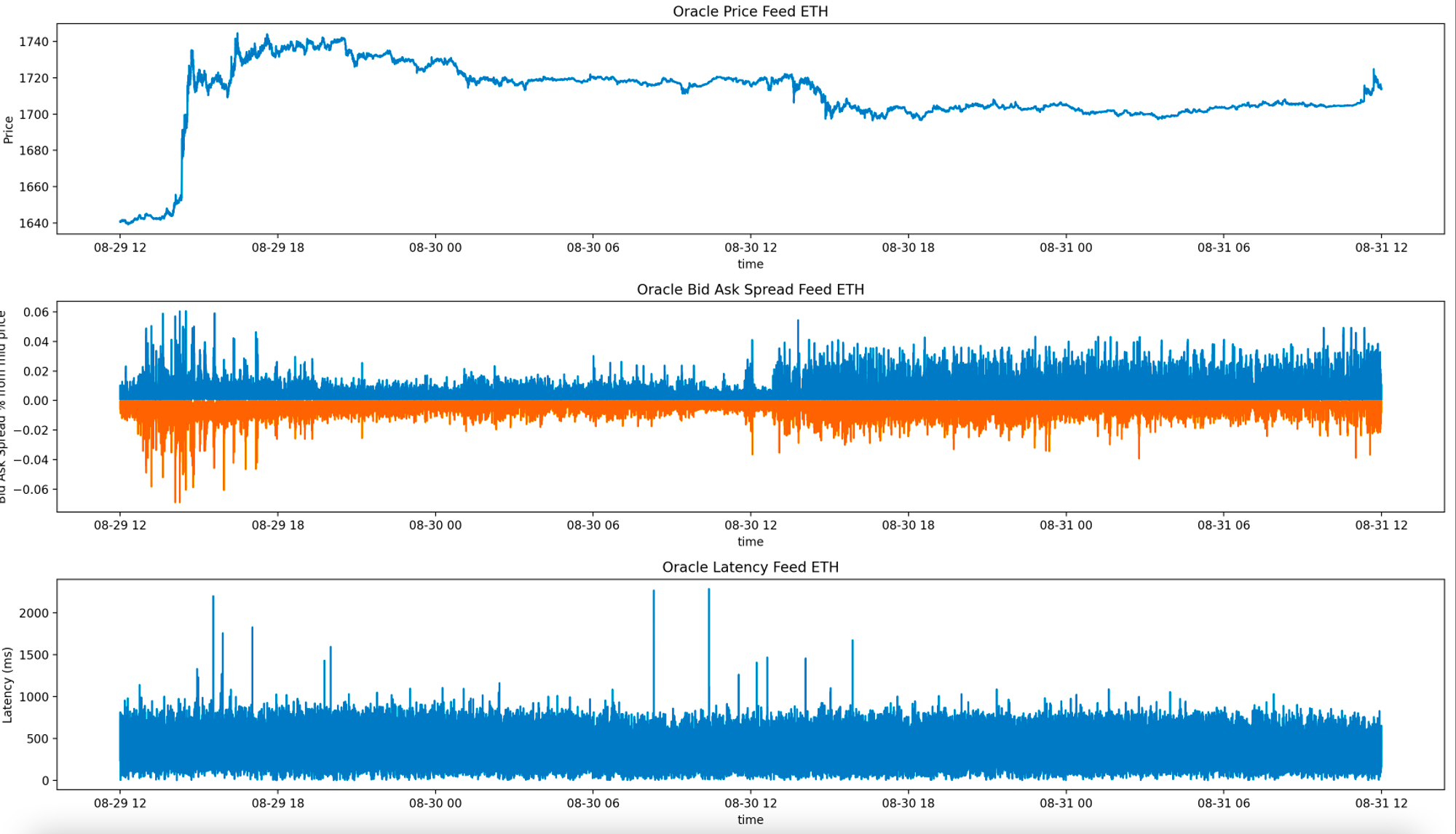

Oracle Analysis

Jupiter's perpetual markets necessitate high-fidelity, low-latency price feeds to uphold platform integrity while delivering an optimal user experience and minimizing potential avenues of economic exploitation. Chaos Labs will deploy a monitoring system to ensure the continuous performance of Jupiter’s price feeds, analyzing price composition, availability, latency, precision, and manipulation risk.

Forward Together

As we embark on this exciting journey with Jupiter, our focus remains on advancing the safety, efficiency, and transparency of the DeFi ecosystem. This partnership is not just about facing current challenges but about pioneering the future of the on-chain perpetual markets. Stay tuned for more updates as we push the boundaries of what's possible in DeFi risk management and security.

Additionally, we are excited to collaborate closely with Jupiter to design new features that will further benefit the protocol. As we progress, we stand ready to introduce new parameters alongside the ones we recommend, ensuring a dynamic and adaptable framework at the forefront of DeFi risk management and security.

About Chaos Labs

Chaos Labs is a pioneer in perpetual exchange risk management. We manage risk, collaborate on mechanism design and parameter optimization, and develop liquidity incentive programs with leading on-chain perpetual exchanges, including dYdX, GMX, Vertex, SynFutures, Bluefin, Ostium, and more.

Oracle Risk and Security Standards: Price Composition Methodologies (Pt. 3)

This chapter delves into the intricate world of Price Composition Methodologies, a foundational pillar of Oracle risk and security. It encompasses an in-depth analysis of data source selection and validation, an exploration of the limitations of rudimentary pricing methods and opportunities for improvement, concluding with an examination of the tradeoffs between price aggregation techniques grounded in real-world examples. This holistic overview guides readers through the practices and innovations that exemplify the relationship between price composition and Oracle security.

Chaos Labs Partners with SynFutures

Chaos Labs is thrilled to announce our partnership with SynFutures. Our collaboration, which started in February, is centered on evaluating and enhancing SynFutures V3's pioneering Oyster AMM that allows Single-Token Concentrated Liquidity for Derivatives and a Fully On-Chain Order Book.

Risk Less.

Know More.

Get priority access to the most powerful financial intelligence tool on the market.