Chaos Labs Risk Portal 2.0 Launch

Chaos Labs is proud to announce the official launch of the latest version of our Risk Hub. Available to all customers for all protocol versions and deployments, this upgraded interface has an impressive array of innovative features and an improved navigation system.

Spotlight on New Features

- Unified User Interface: We have merged the risk-monitoring, asset listing, and parameter recommendation interfaces into one unified platform. This brings ease in toggling between risk monitoring and recommendations data for any given market or asset.

- Optimized Product Navigation: To enhance user experience, we have rebuilt the navigation system across all screens. This revamp includes an additional navigation layer and a new dropdown selector, simplifying the switch between different protocols and across assets and chains within a specific protocol.

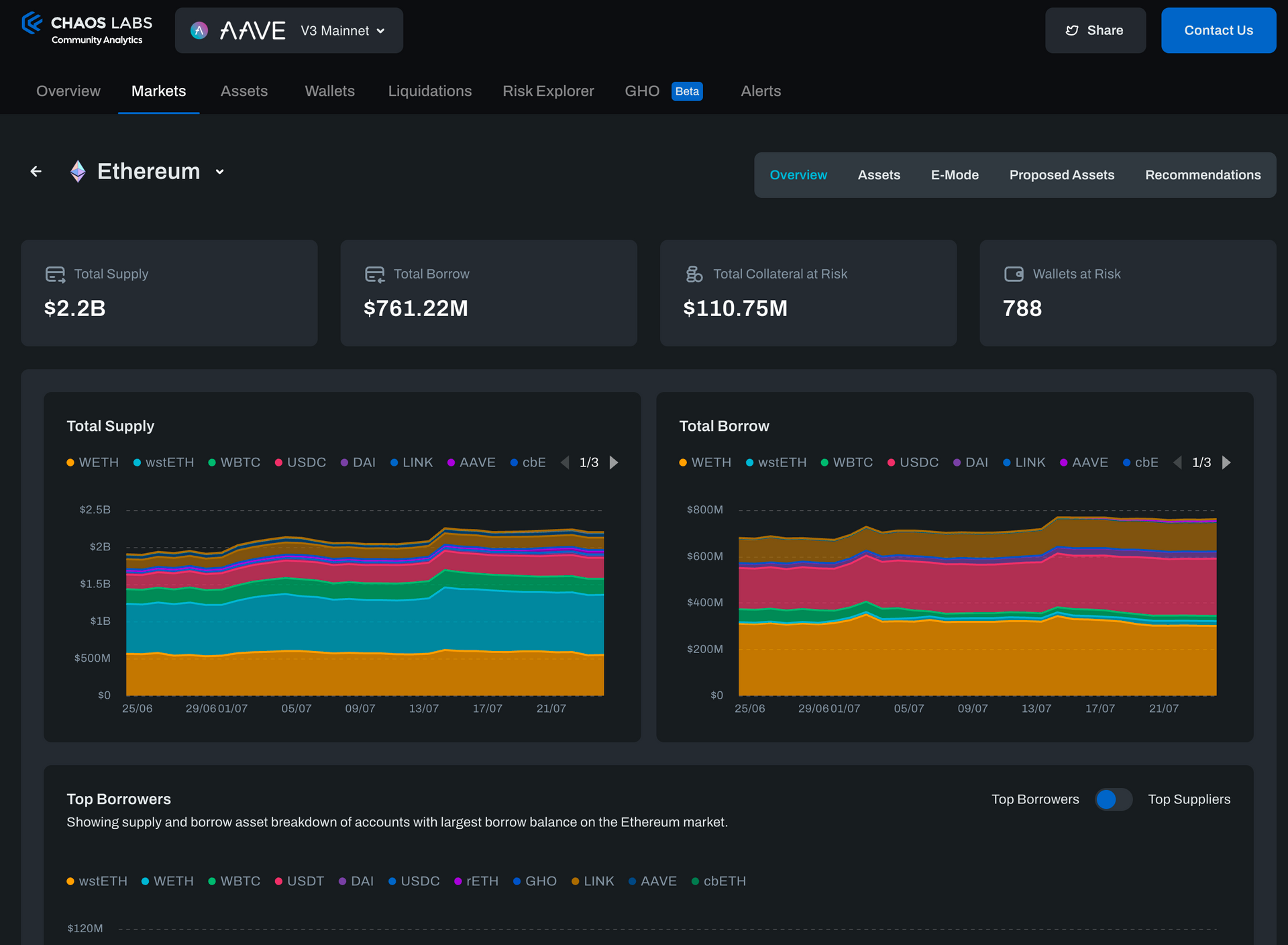

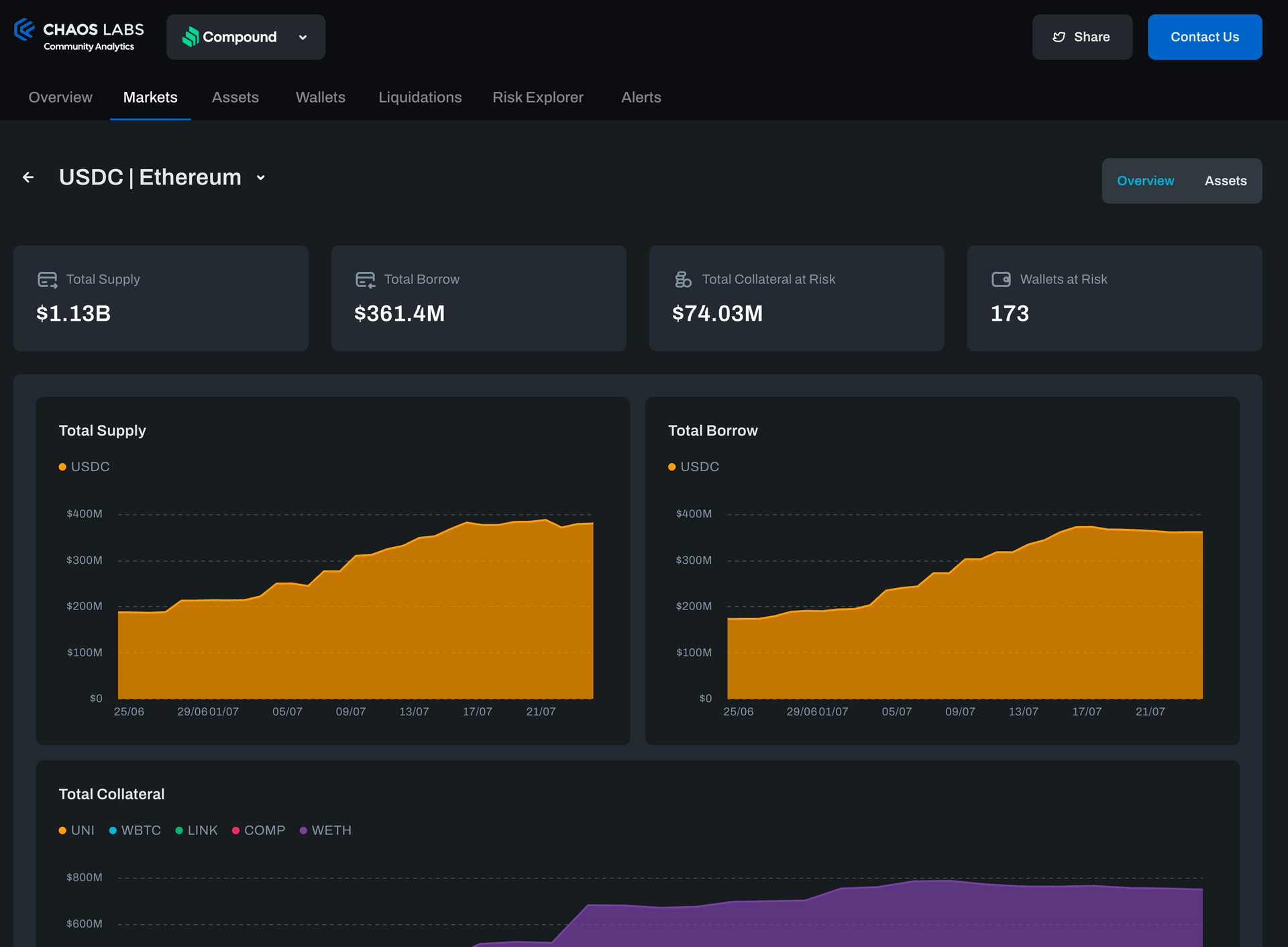

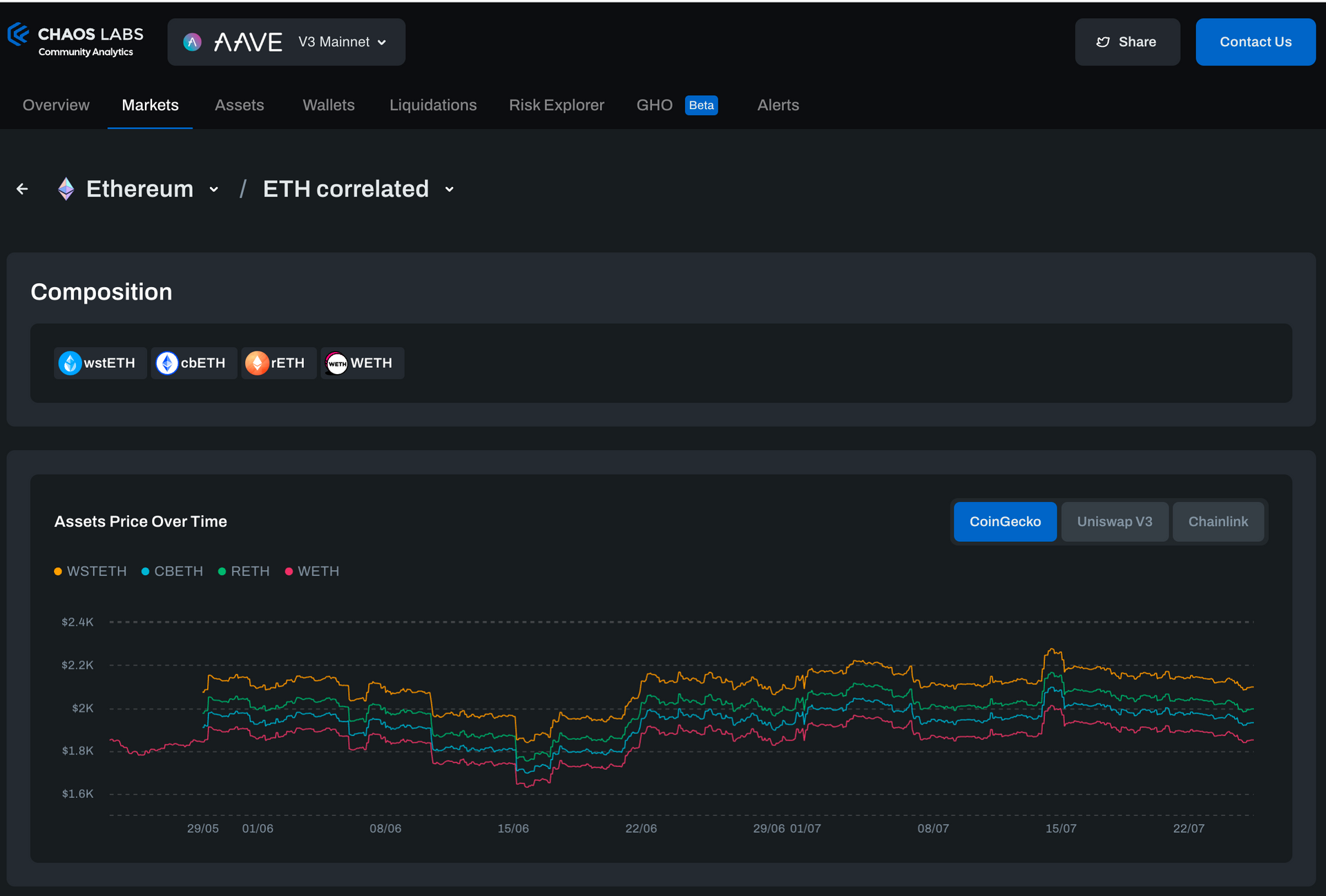

- Redesigned Markets Tab: We've revamped the Markets tab and introduced a new Market page. This allows for a comprehensive overview of a specific market, such as the Ethereum market on Aave or the Ethereum-USDC borrow market on Compound, before delving into a specific asset within that market.

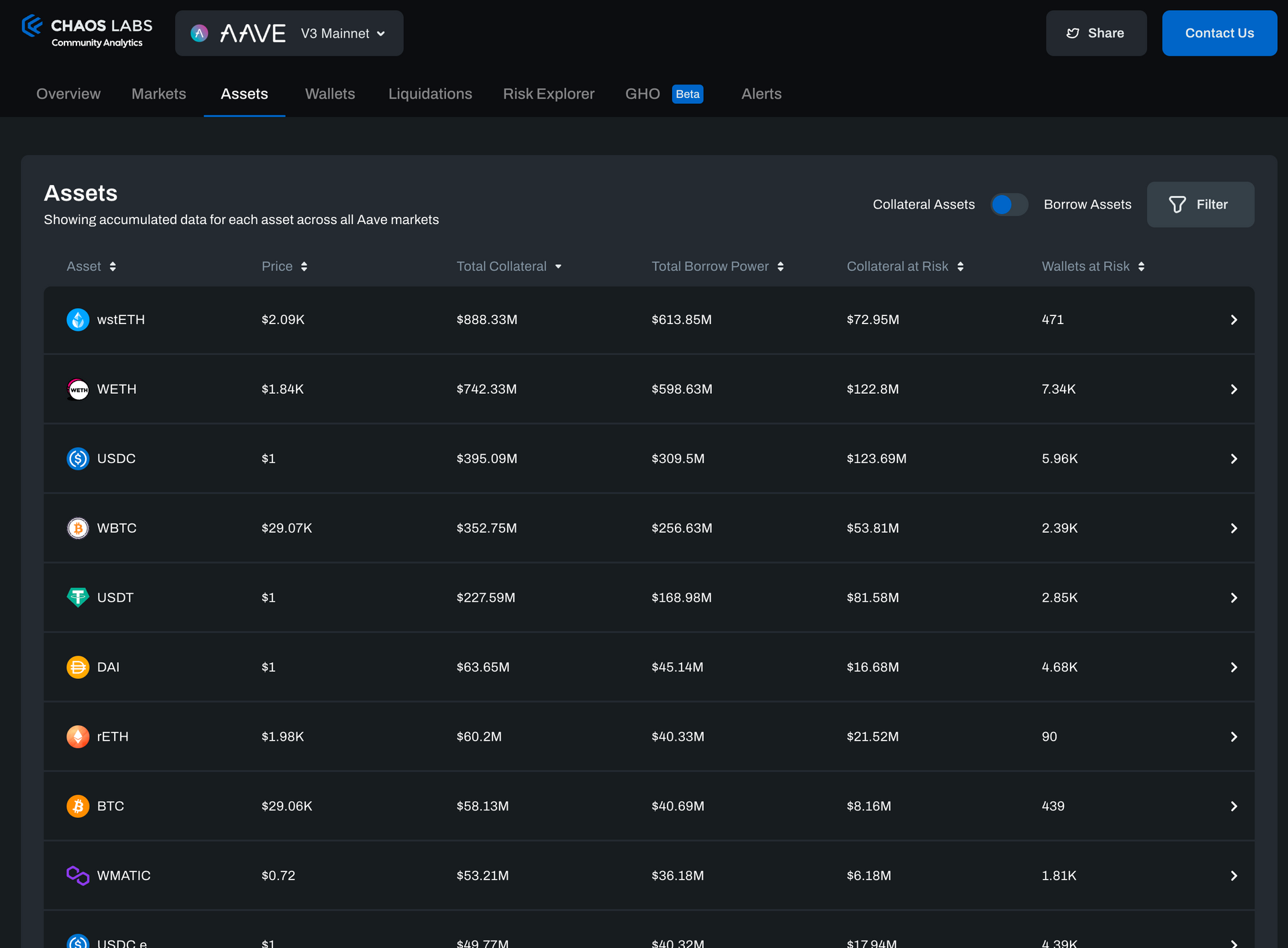

- Cross-Chain Risk Monitoring: We created a new Assets tab for multi-chain protocols, consolidating data from all markets and chains where the asset is supported. This helps to expose cross-market and cross-chain risk vectors. We are gradually rolling this feature to all multi-chain protocols, starting with Compound V3 and Aave V3.

- Improved Alerts Center: To simplify real-time risk monitoring and observability, the Alerts Center has been redesigned with improved user experience and added capabilities to filter and browse alerts more efficiently.

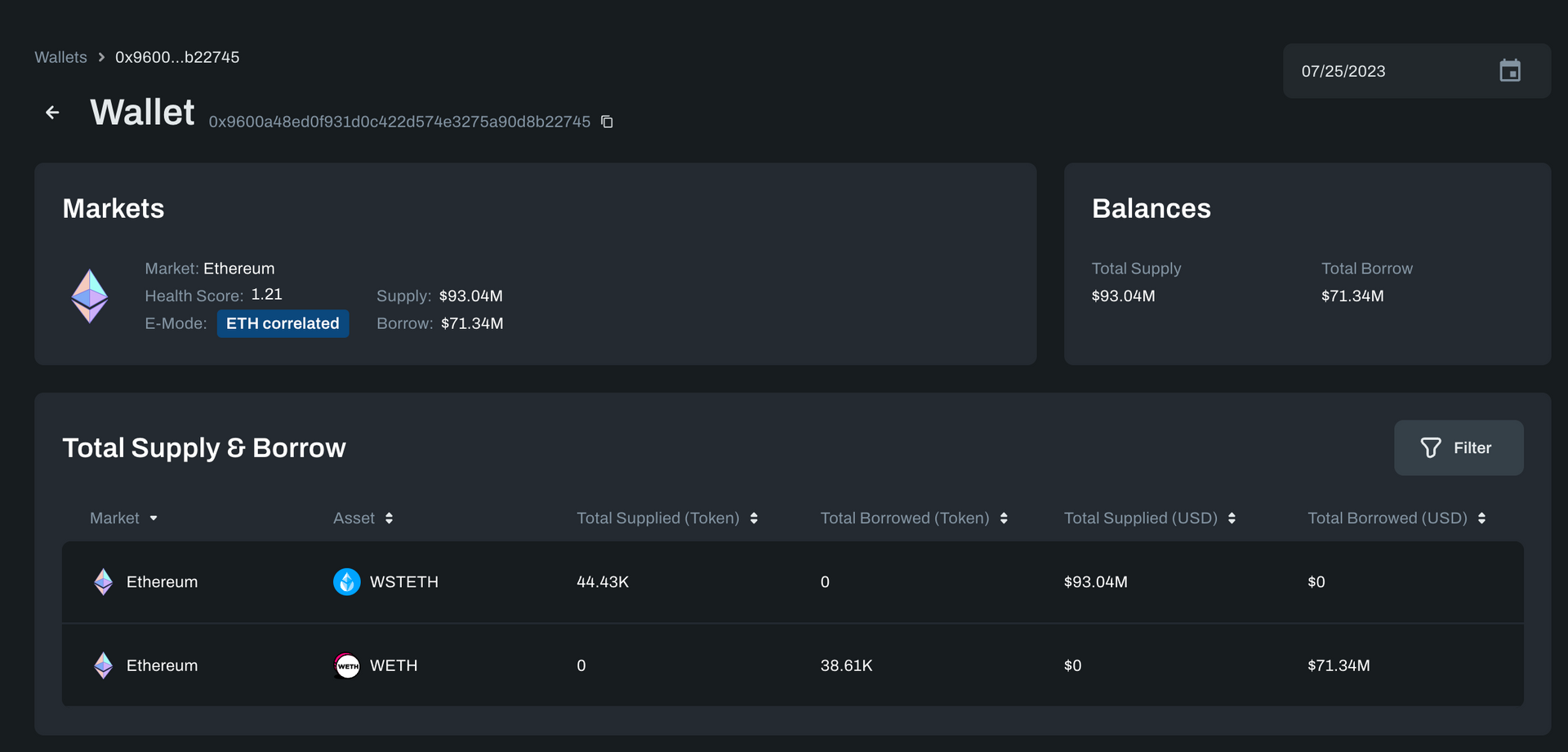

- Wallet Time Machine: This feature provides a new viewing mode, showing a specific wallet's composition and balance at any historical time.

- Insight into Top Borrowers and Suppliers: We have introduced a new view, surfacing the Top Borrowers and Top Suppliers for each market and asset.

- Historical Supply and Borrow Data: Users can now view a time series of supply and borrow data with the historic token amounts and the existing USD value.

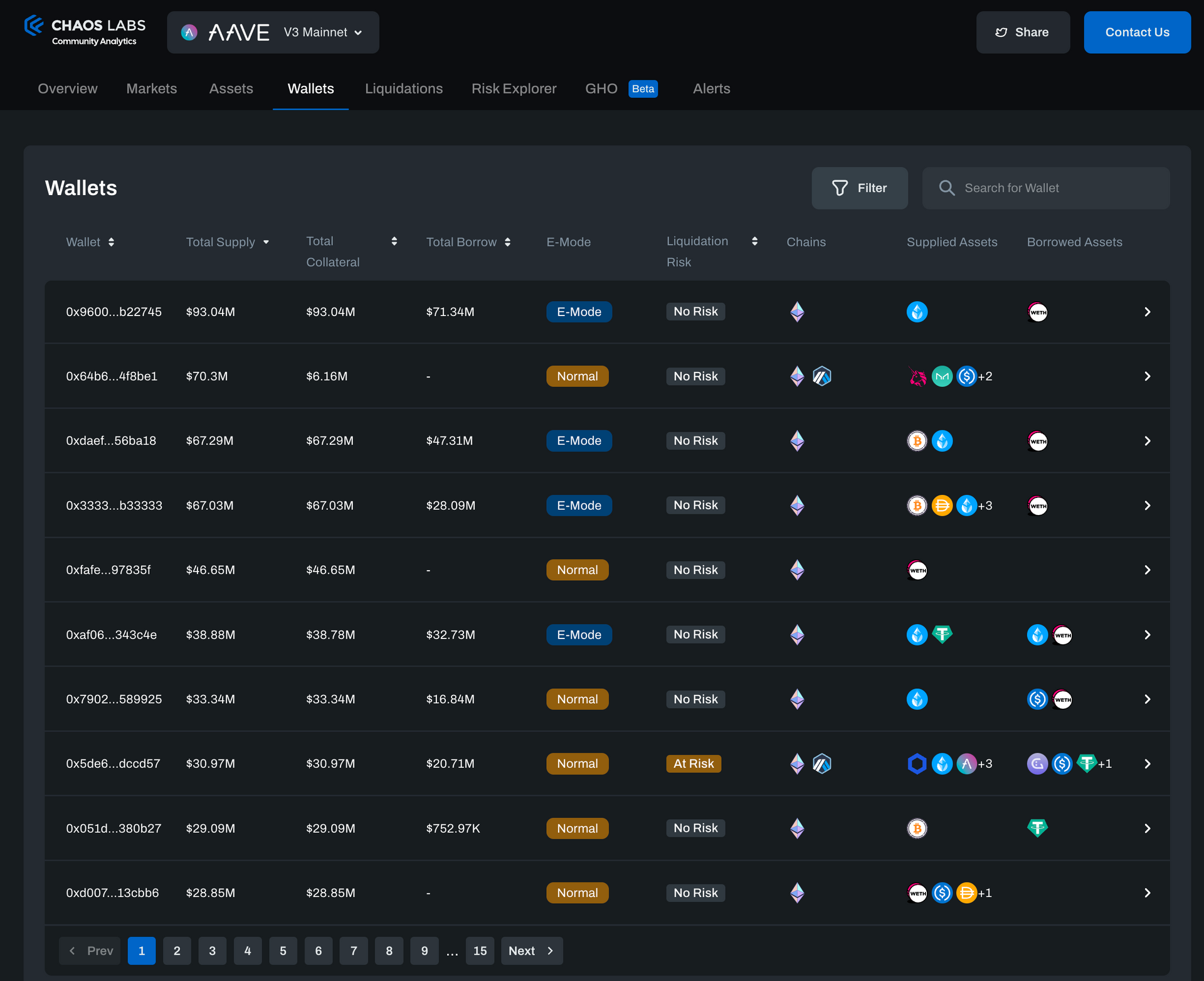

- Aave V3 E-mode Support: We've included full support of E-Mode, a key feature of the Aave V3 protocol, with risk monitoring capabilities for E-Mode pools and a clear indication on each wallet if it’s in E-mode.

Unified User Interface 🦄

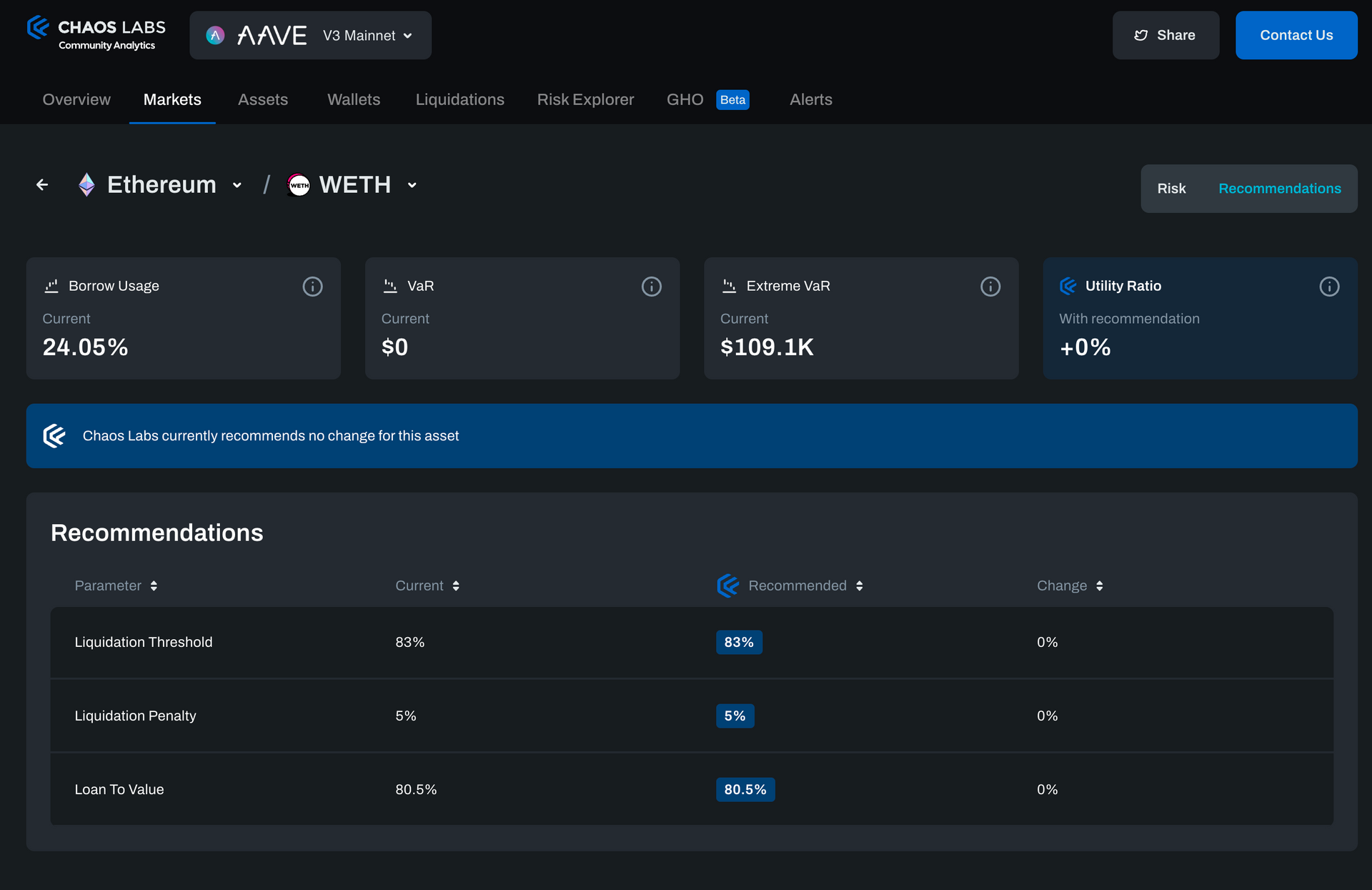

We have unified the Chaos Labs Risk Hub, Asset Listing Portal, and Recommendation Portal into a single user interface, making it easy to see recommendations with all their backing and relevant risk monitoring data.

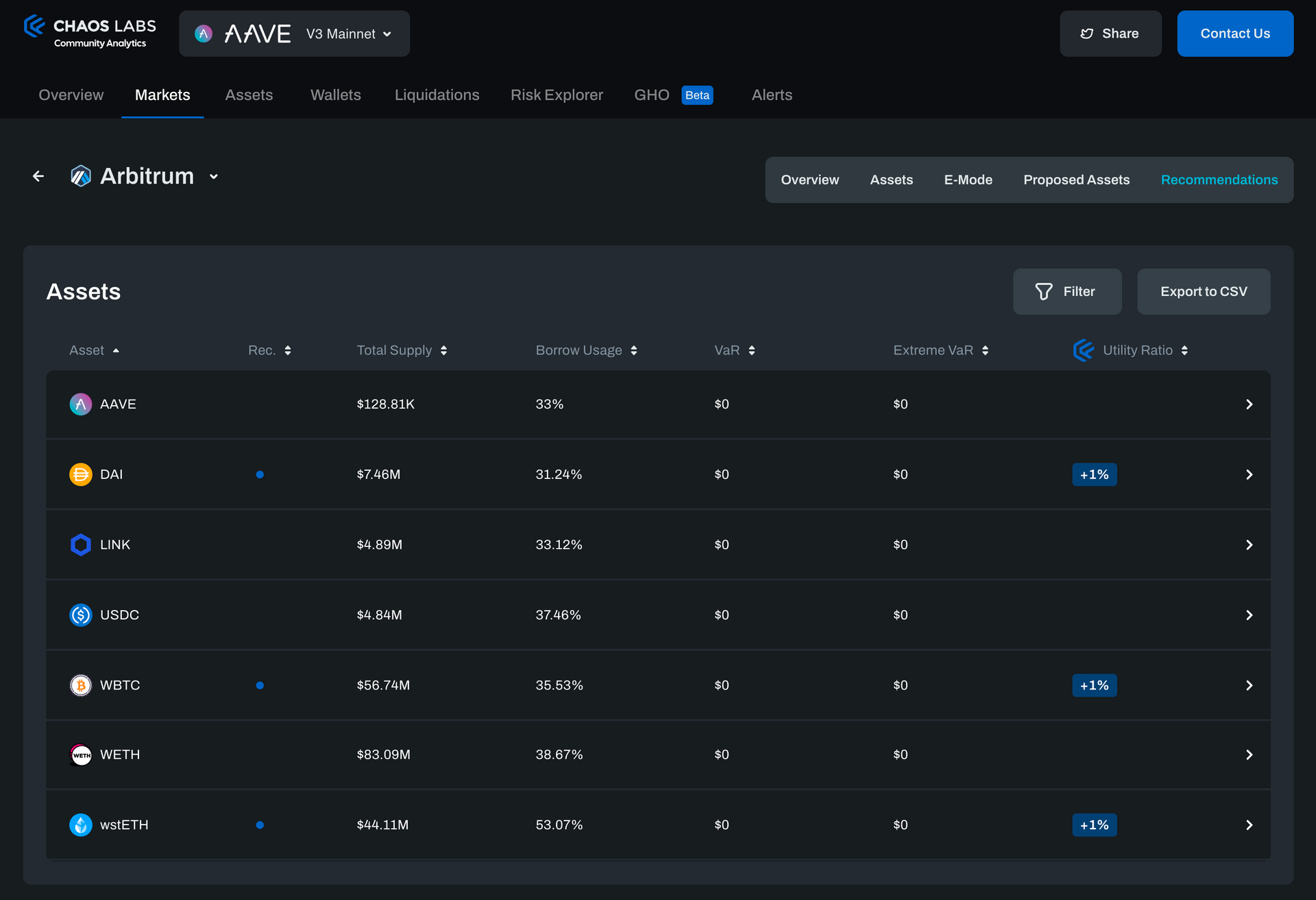

Market Risk and Recommendations On the Market page, switching to the Recommendations tab will show all risk parameter update recommendations from Chaos Labs for all assets on that market.

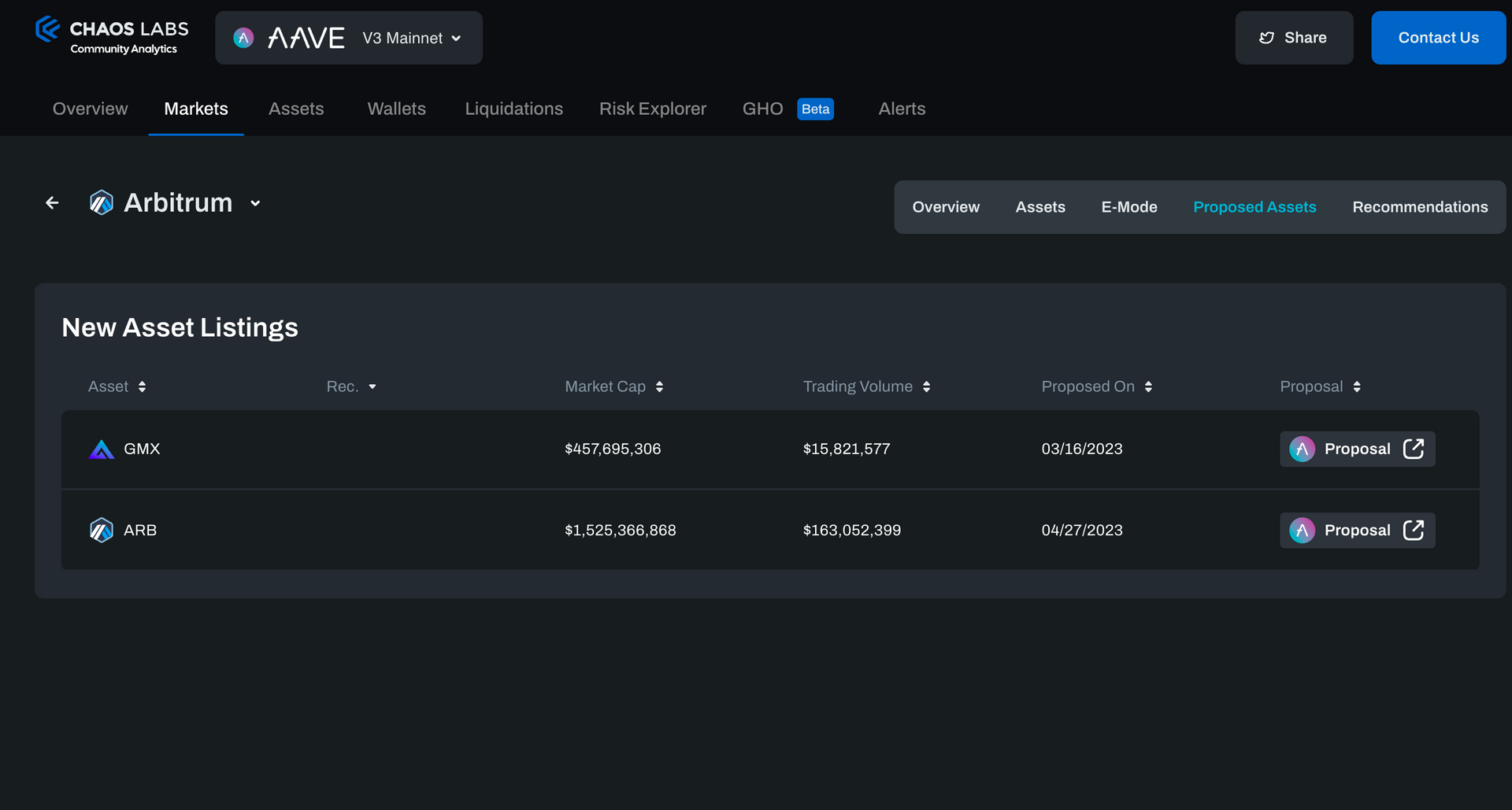

The Proposed Assets tab shows all assets proposed to be listed on that market, with their relevant parameter risk recommendations from Chaos Labs.

Asset Risk and Recommendations

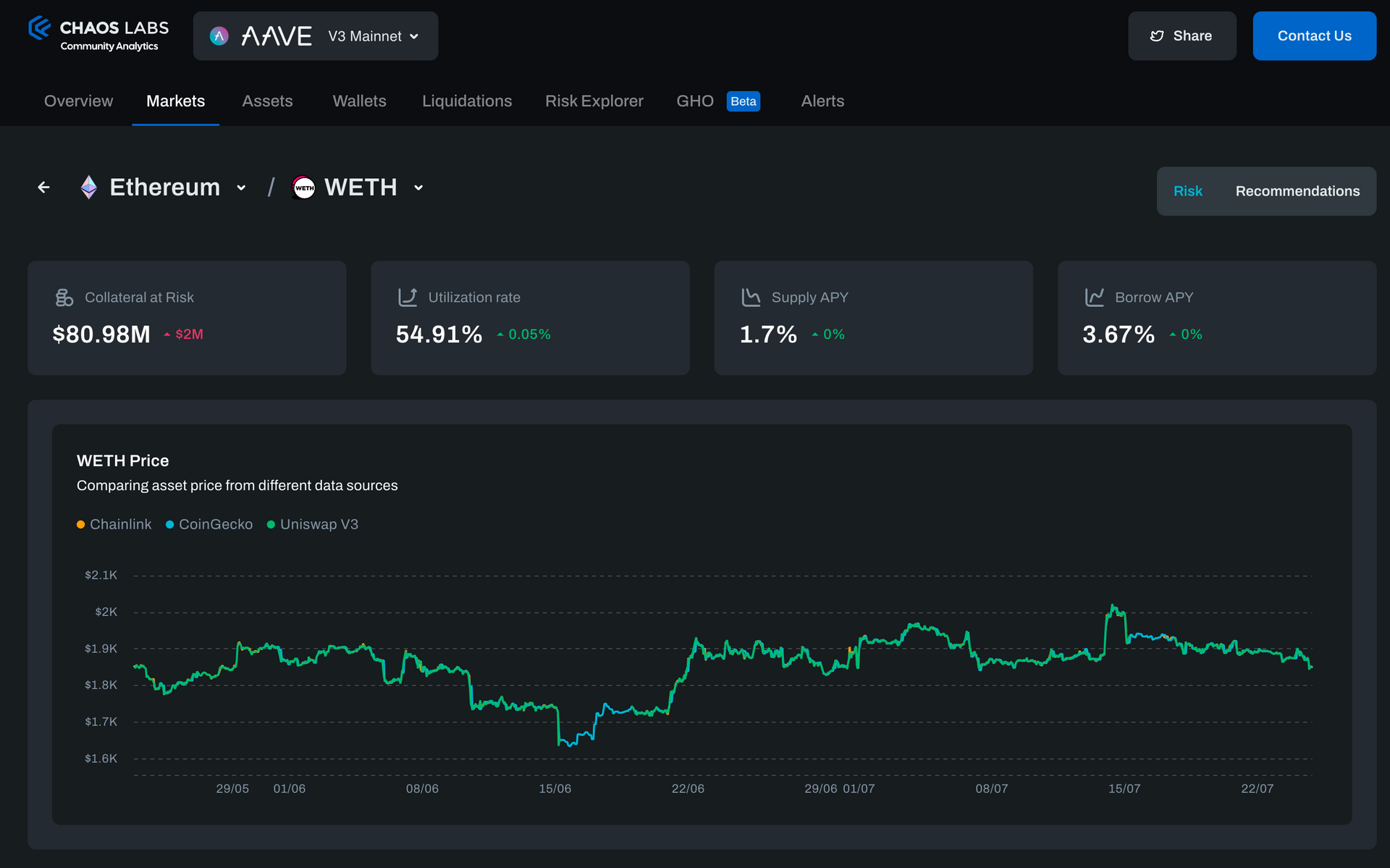

On the specific asset page, switching between Risk and Recommendations will show relevant information about risk monitoring or recommended risk parameter updates for that asset. Having Risk and Recommendations as side-by-side tabs is aimed to provide all relevant risk monitoring context while viewing specific asset recommendations and, similarly, provide a detailed view of the asset's current and recommended risk parameter values when monitoring and analyzing risk from that asset.

Improved Navigation 💫

In the latest version of our product, which spans Risk Monitoring, Recommendations, and Alerts, we have significantly improved the navigation experience. This upgrade saw us reconstruct the product navigation from scratch. Now, it features an additional layer of tabs, plus quick-switch options for protocols, markets, and assets. This comprehensive redesign simplifies navigation and ensures all data is readily accessible for our users.

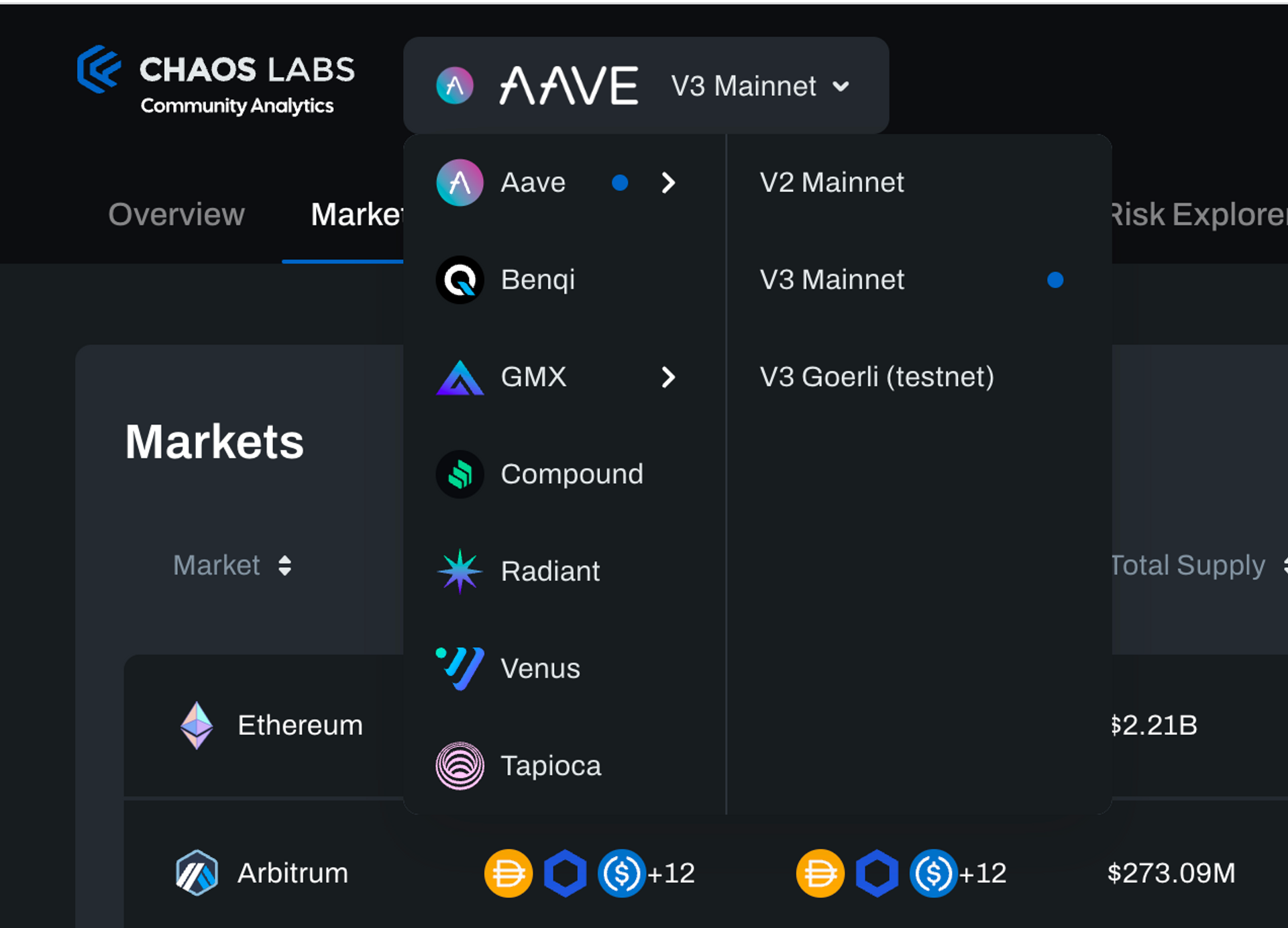

Enhanced Protocol Navigation

The Protocol Switcher is a new feature designed to streamline navigation between protocols within various versions of a specific protocol when multiple versions or deployments are supported. A blue dot indicates the currently selected protocol, simplifying orientation and ensuring effortless navigation through the platform.

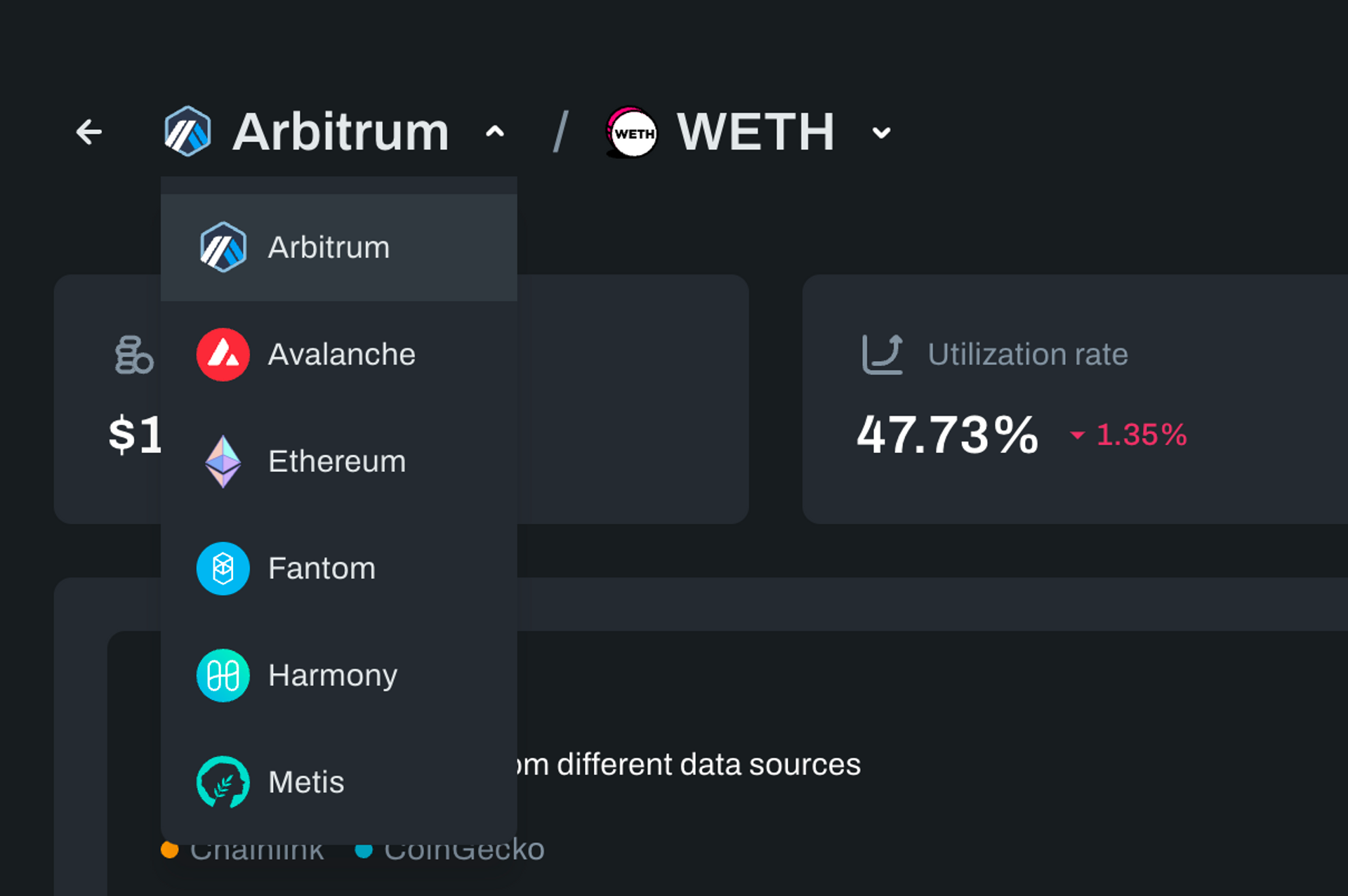

Effortless Navigation Between Markets

Our newly introduced Markets dropdown allows seamless switching between markets on protocols supporting multiple markets (such as Aave, Compound, and Tapioca). Now, users can navigate directly from one market to another right from the market page, bypassing the need to revert to the market table. Additionally, the feature enables users to switch between markets from the asset page, eliminating the need to navigate back to the markets table.

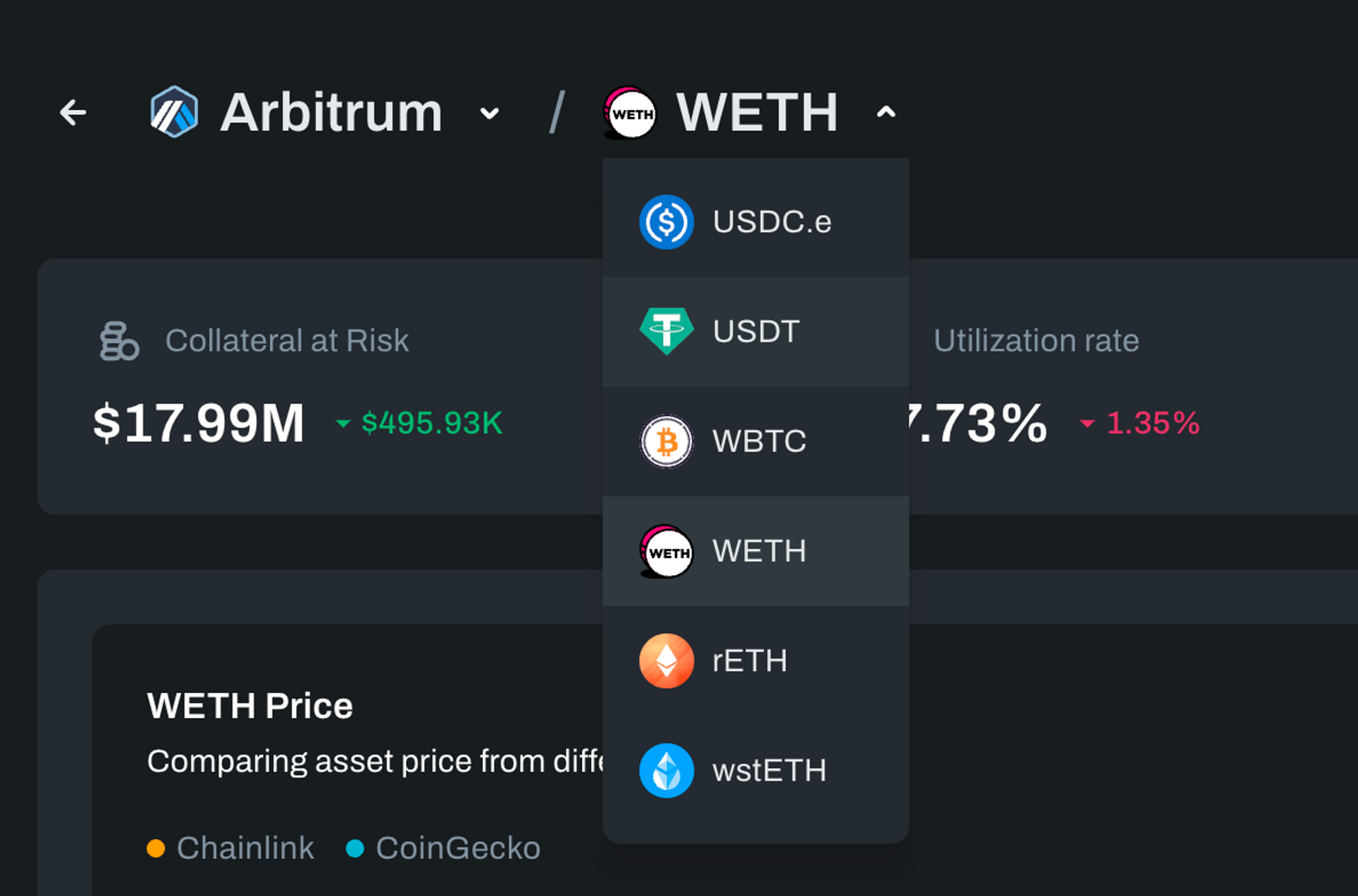

Simplified Navigation Between Assets

We have introduced an assets dropdown feature on the asset page title, enabling easy navigation between assets. This feature is available for both single-market and multi-market protocols. Users can now shift directly from one asset to another from the asset page, removing the need to navigate back to the assets table. This further enhances the usability of our platform and ensures a smoother user experience.

Markets 🛍

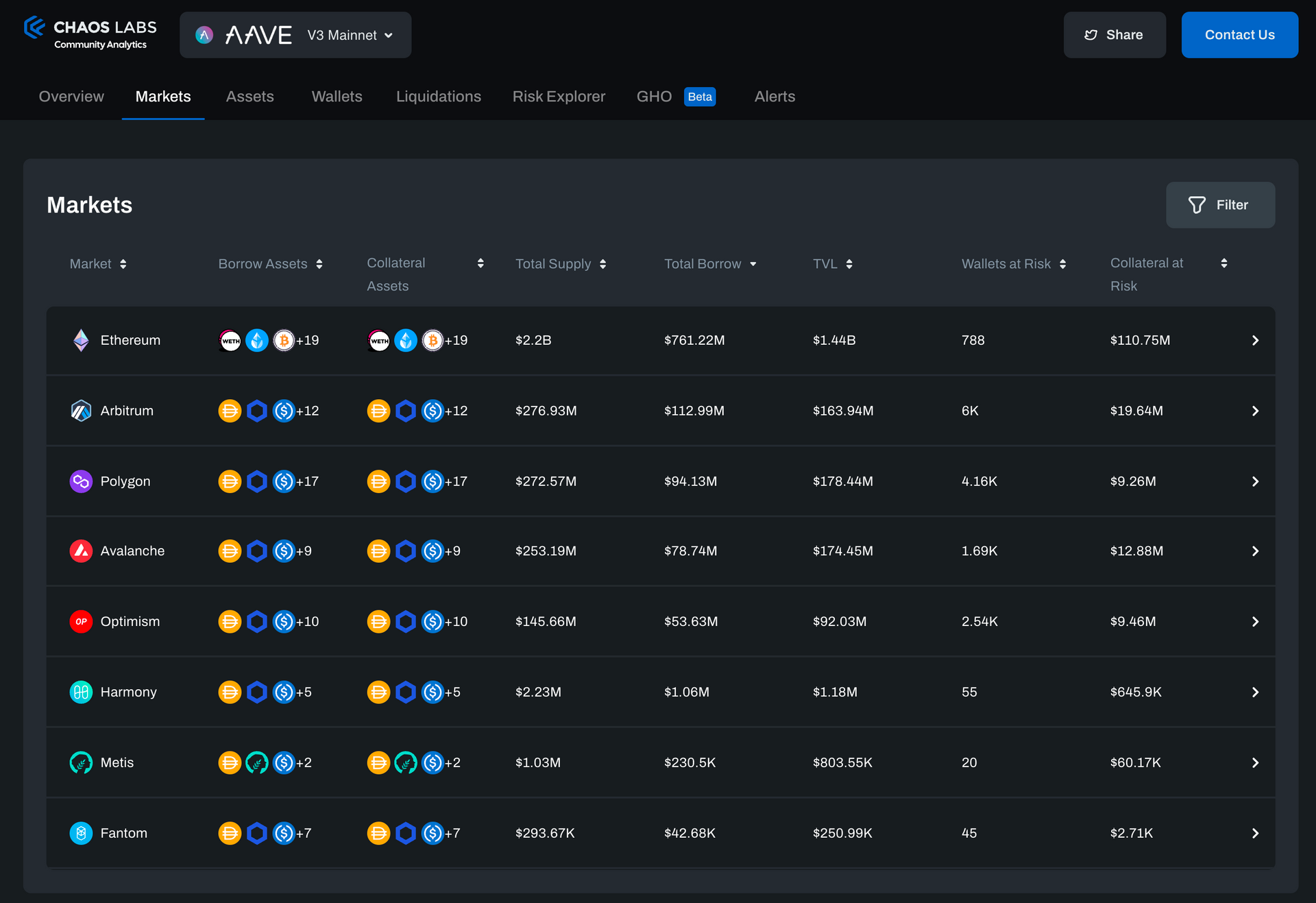

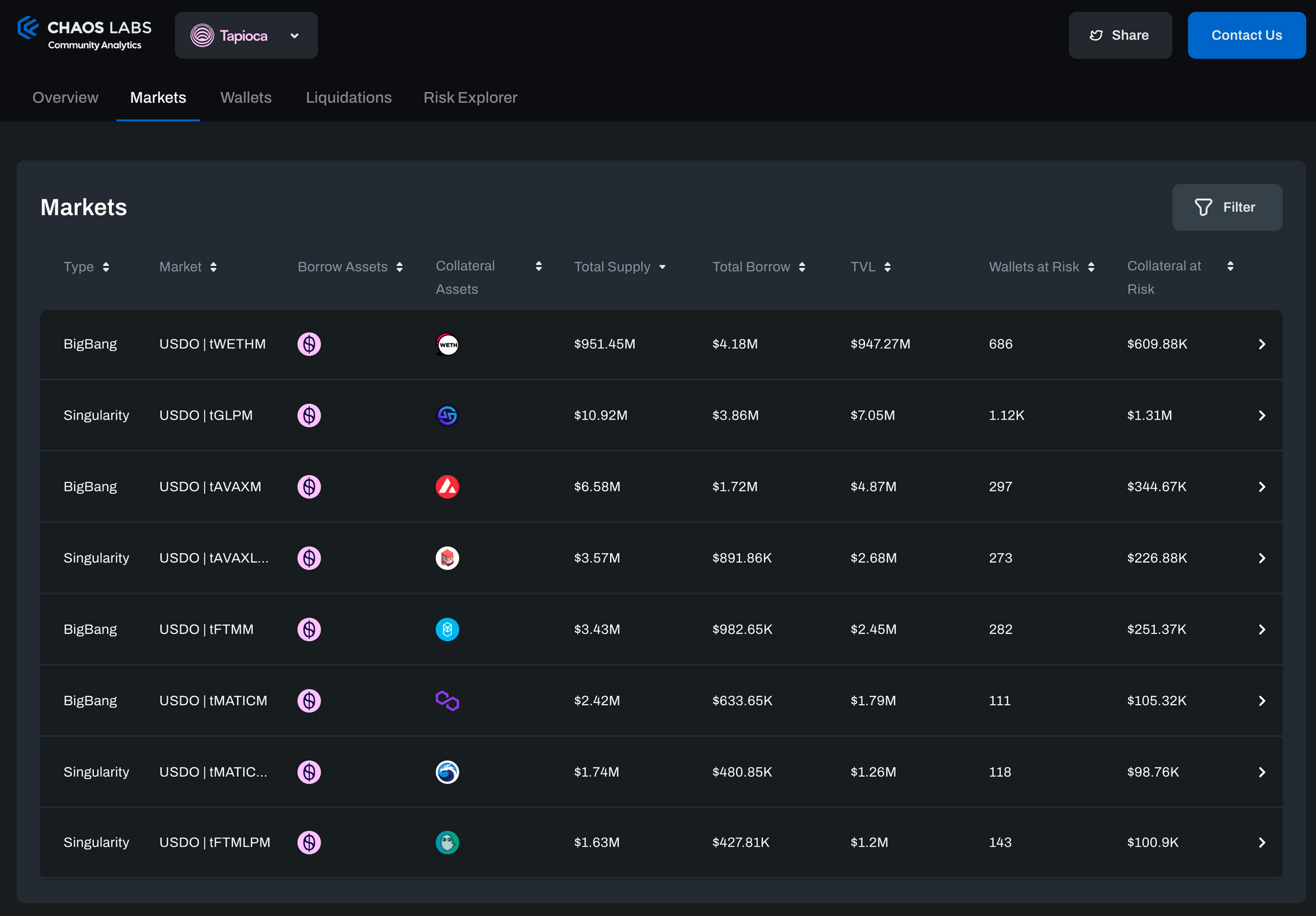

Revamped Markets Tab

The reimagined Markets tab offers a comprehensive view of all markets, including the list of Borrow and Supply assets for each. It also presents critical metrics such as total borrow, supply, TVL (Total Value Locked), wallets, and collateral at risk. These are calculated over all positions in each market where health is nearing the liquidation point.

In-depth Market Details

Interacting with any market in the Markets table opens the market details page. This page presents granular data such as the total supply and total borrow in that market, broken down by asset and shown over time. Additionally, it displays the top borrowers and suppliers in this market and recent events, offering a comprehensive snapshot of market activity.

Cross-Chain Risk Monitoring 🔮

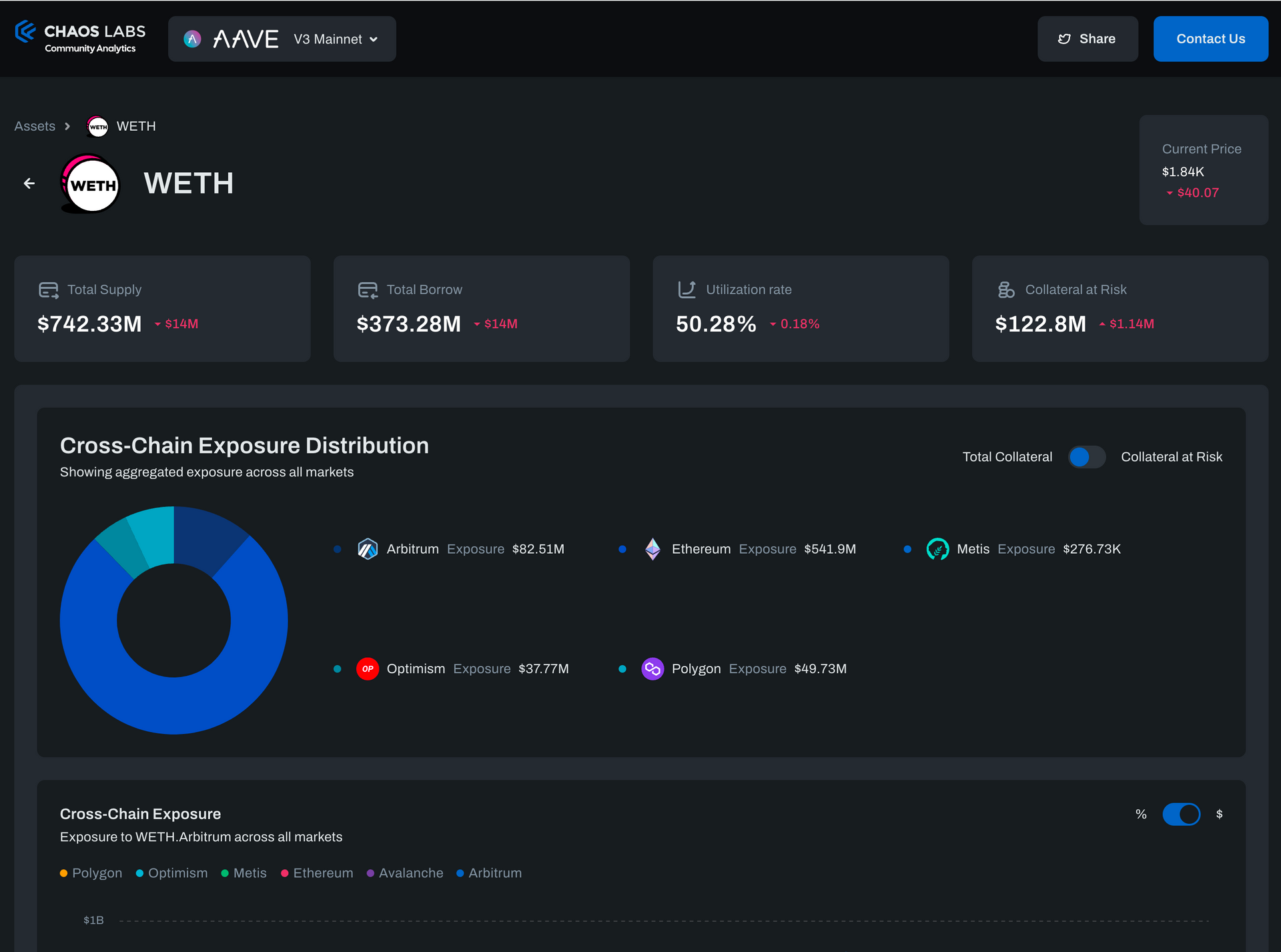

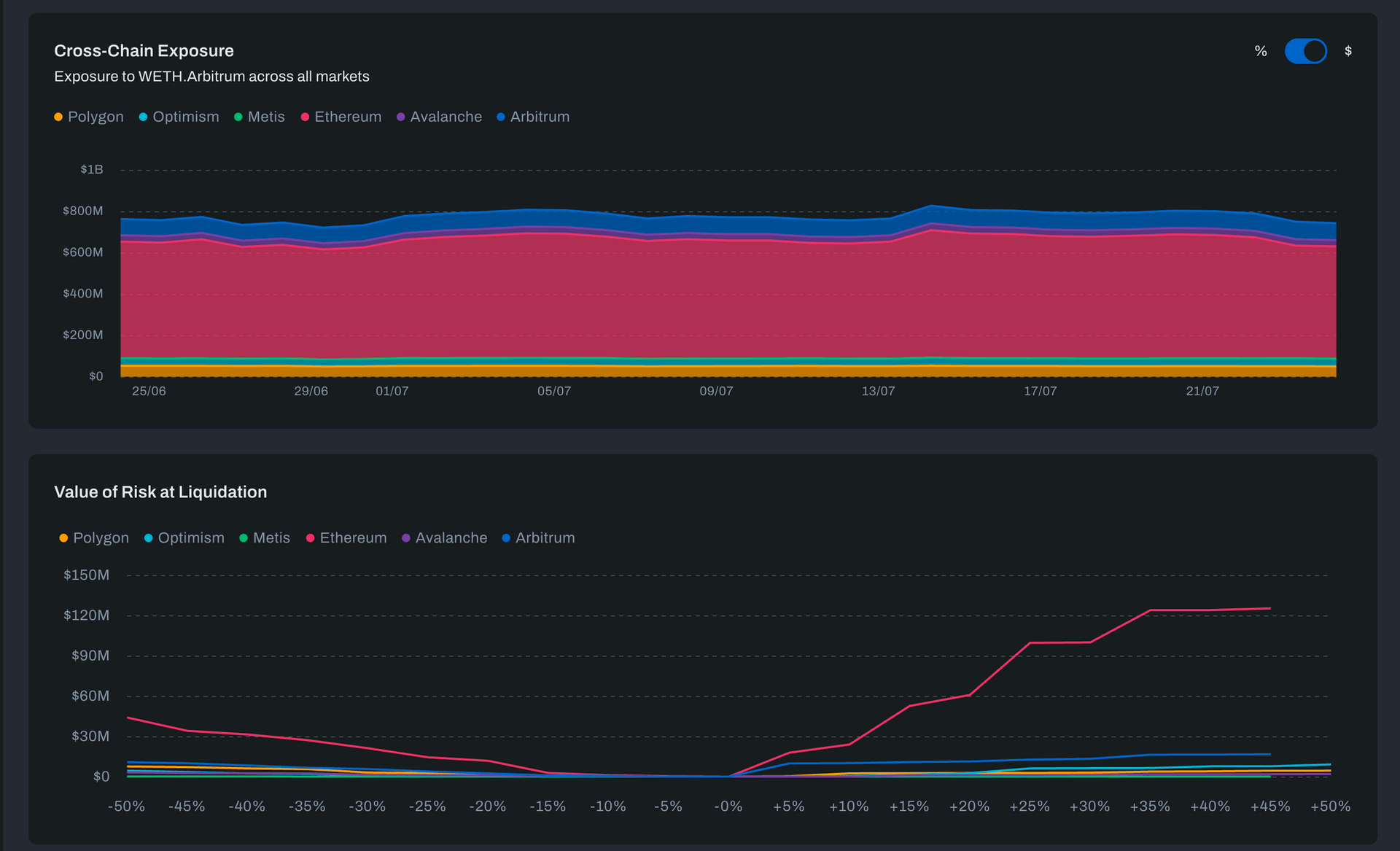

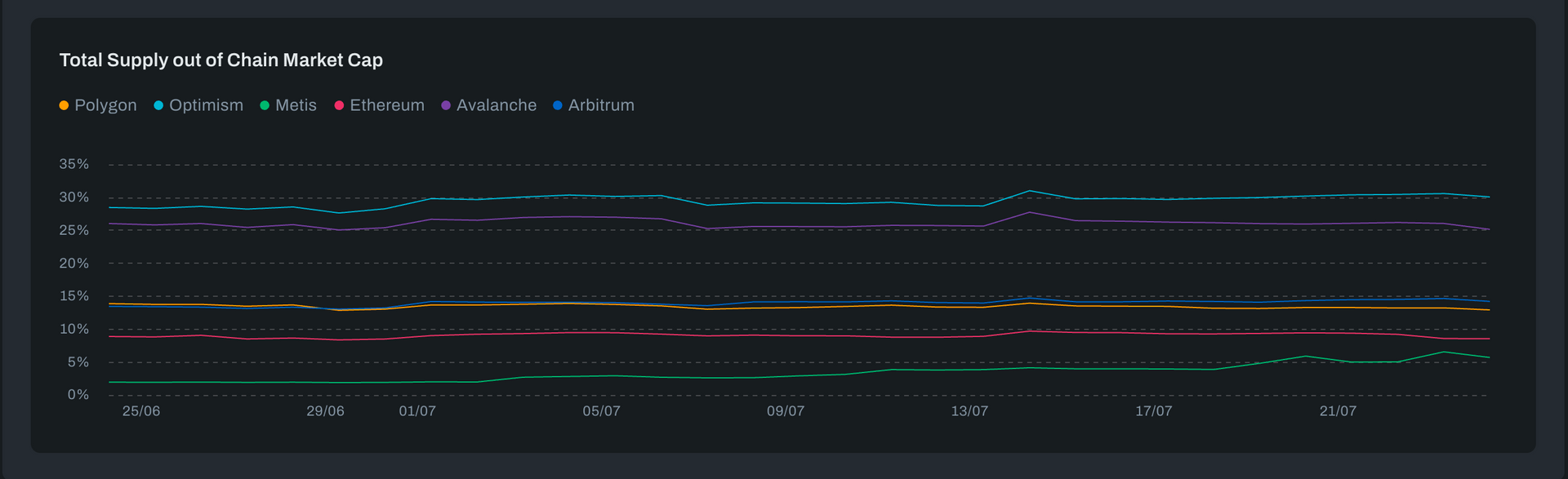

The Assets page now presents aggregated details for each supply or borrow asset across all markets and chains. This enhancement provides a comprehensive understanding of a protocol's exposure to any asset across all chains. Specifically, the 'Collateral at Risk' and 'Wallets at Risk' columns consolidate data from positions with low health values on the verge of liquidation across all markets. This provides a clear and unified view of potential liquidations at risk in the event of an asset price change.

We are gradually rolling this feature to all multi-market protocols, starting with Compound V3 and Aave V3.

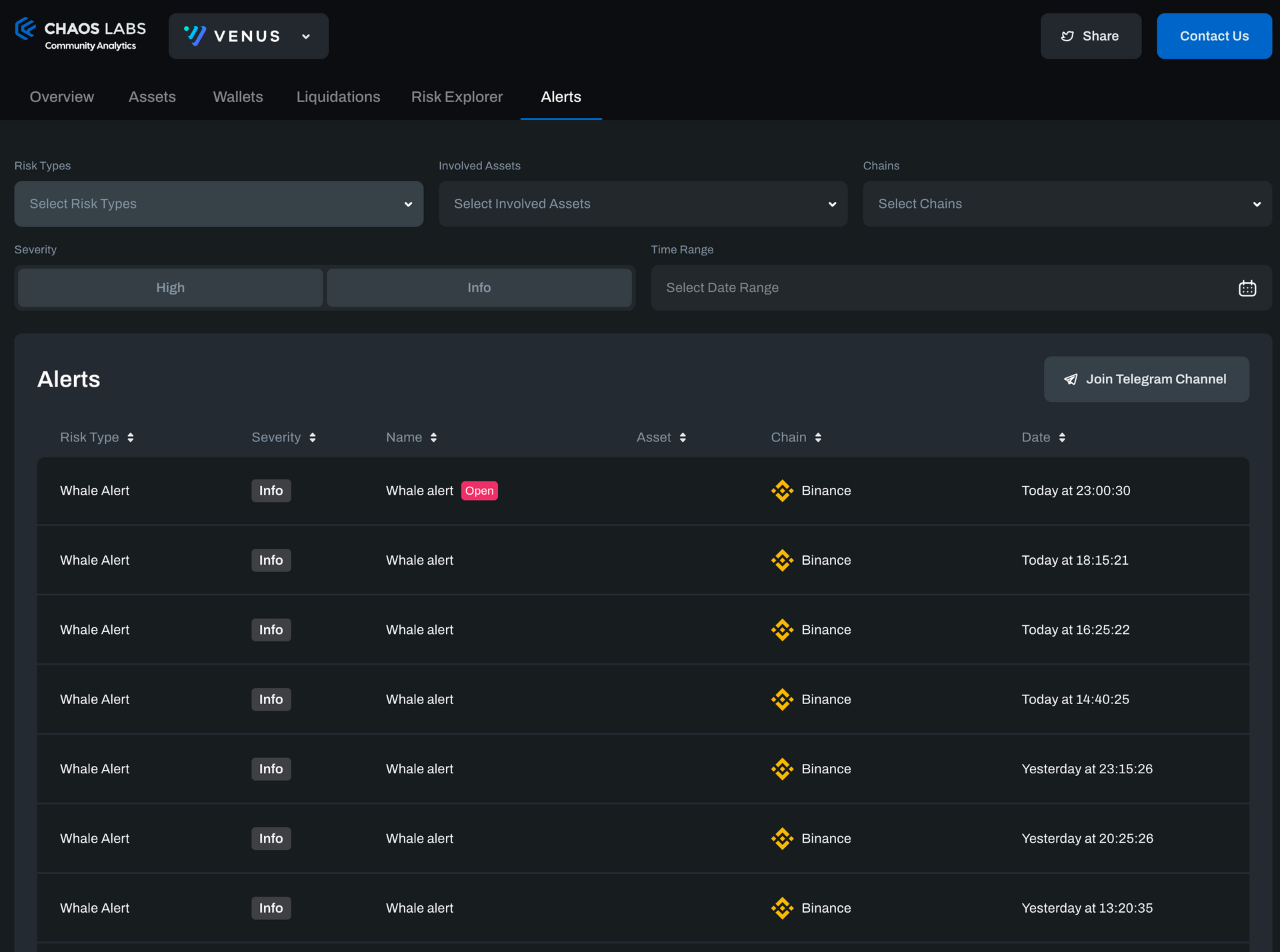

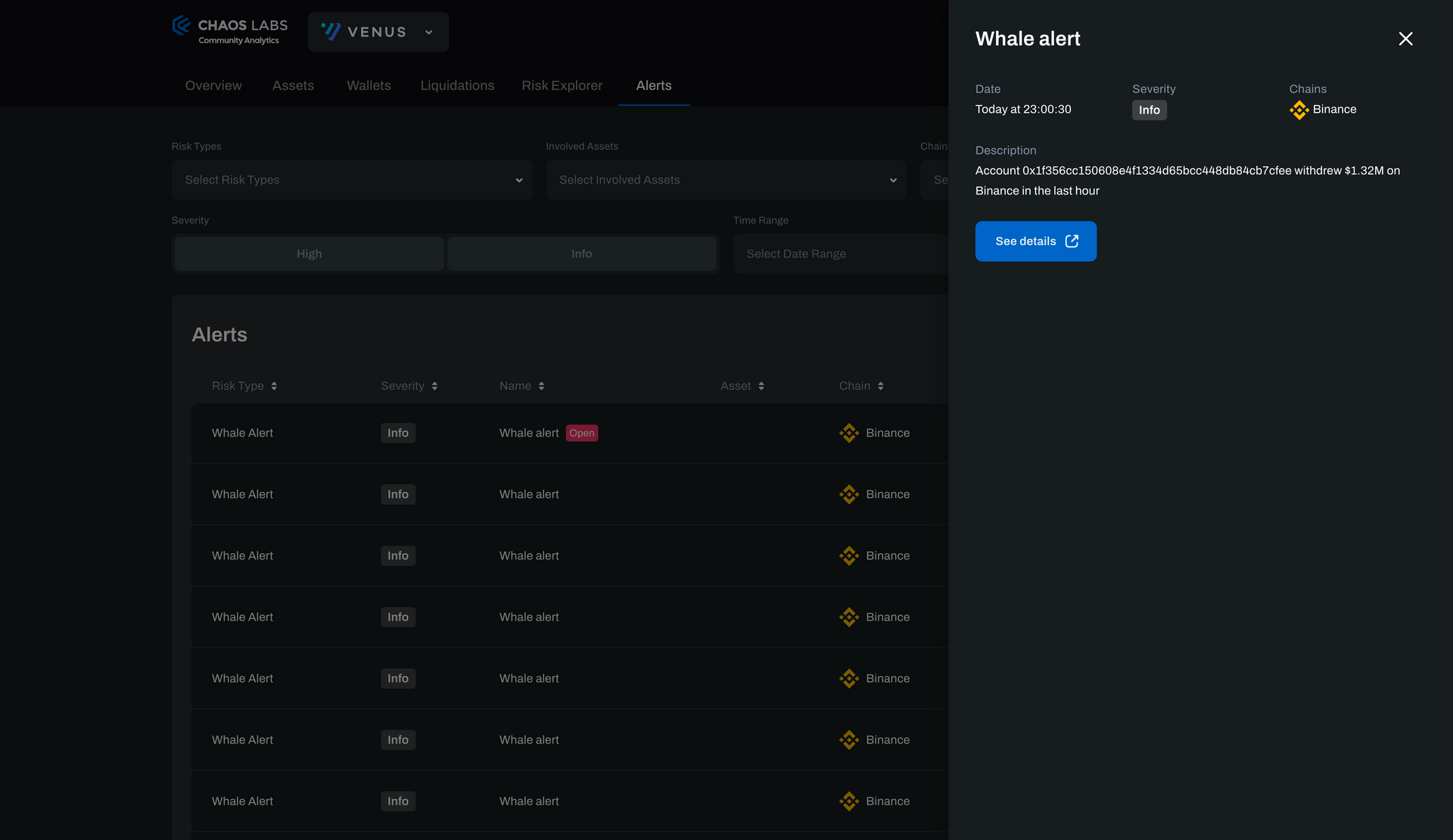

Enhanced Alerts Center 📣

Our Alerts Center has undergone a significant redesign to accommodate the wide variety of alert types incorporated into the observability system over time. These alerts encompass a wide range of categories, including price alerts, liquidation alerts, bad debt alerts, whale alerts, and many others, offering a comprehensive monitoring experience.

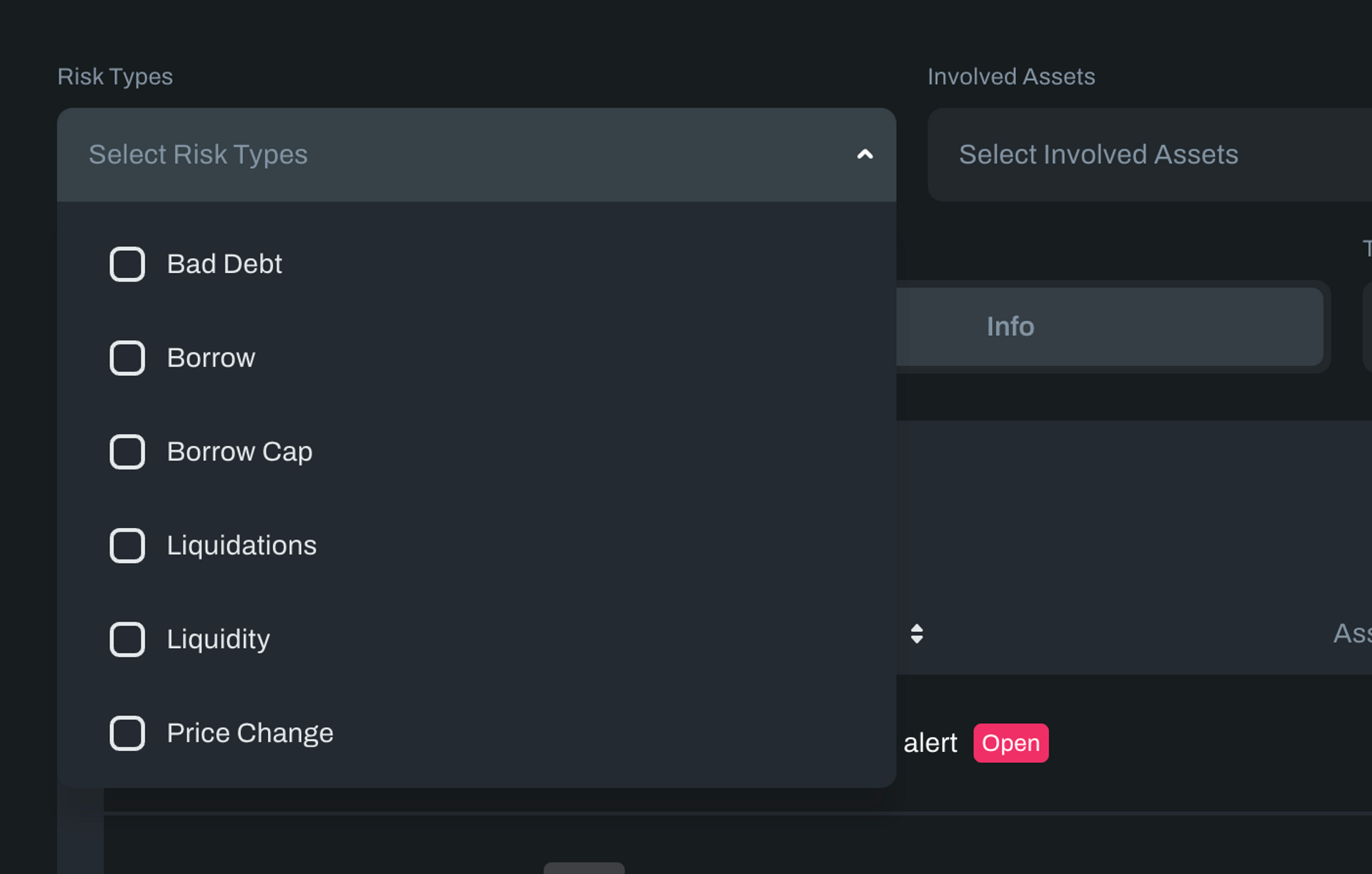

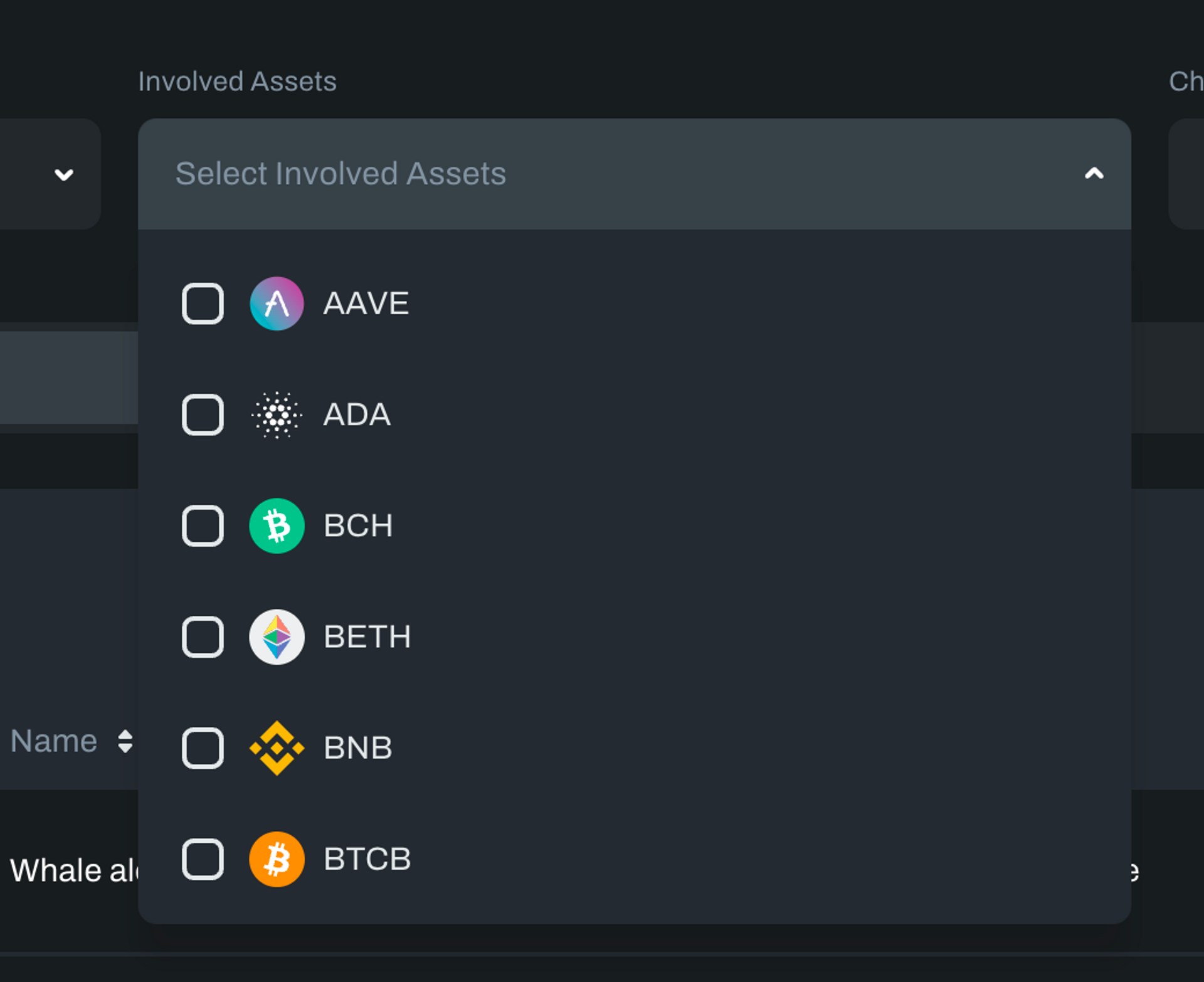

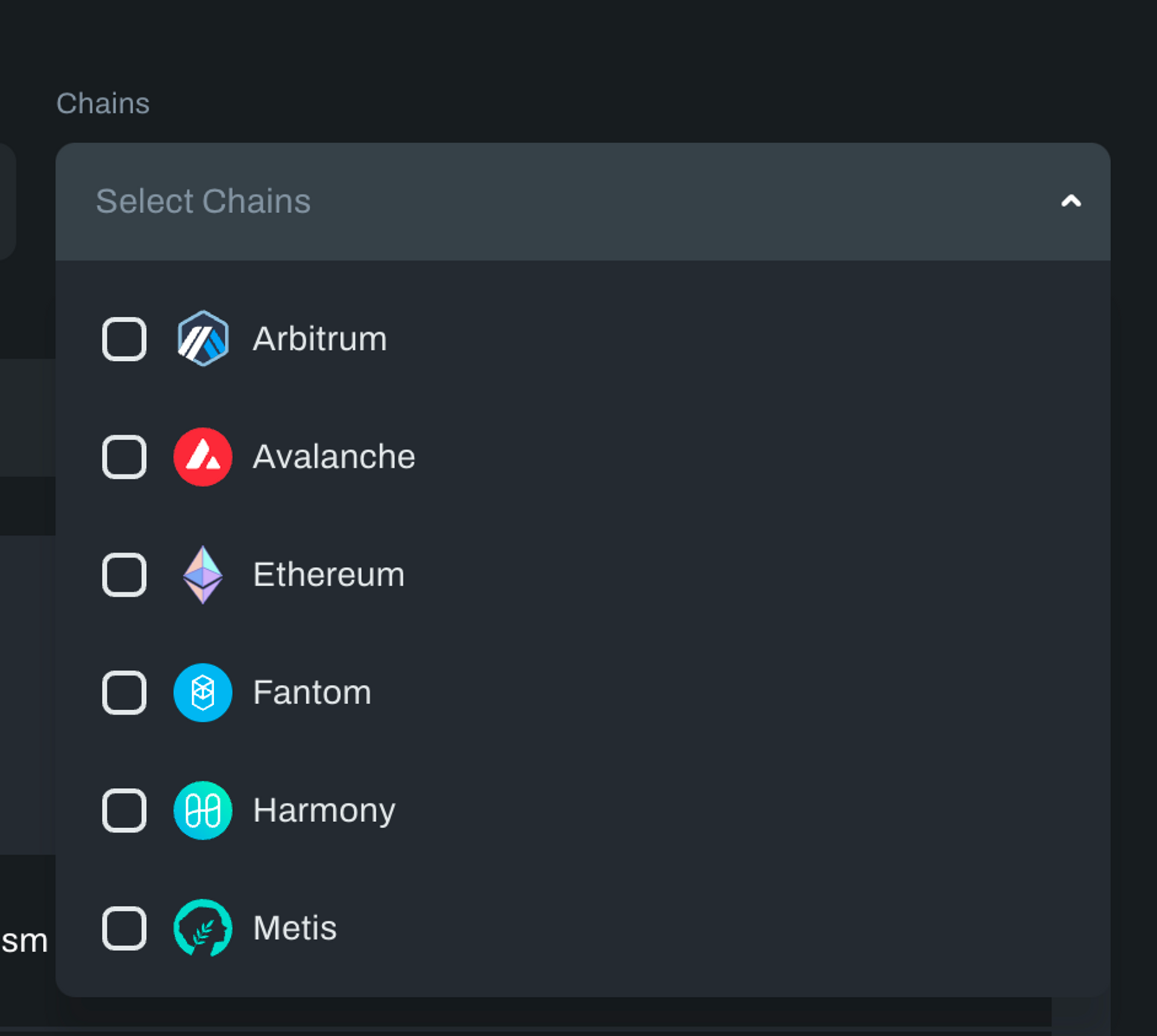

Alert Filters

It is now possible to filter alerts by severity, type, date, chain, and relevant assets; multiple filters can be combined to zoom in on specific areas and risk scenarios.

Alert Detailed View

Clicking on any specific alert opens the detailed information panel, with all information about that alert showing as an overlay on top of the table to avoid losing and pagination or filtering context when browsing over alerts.

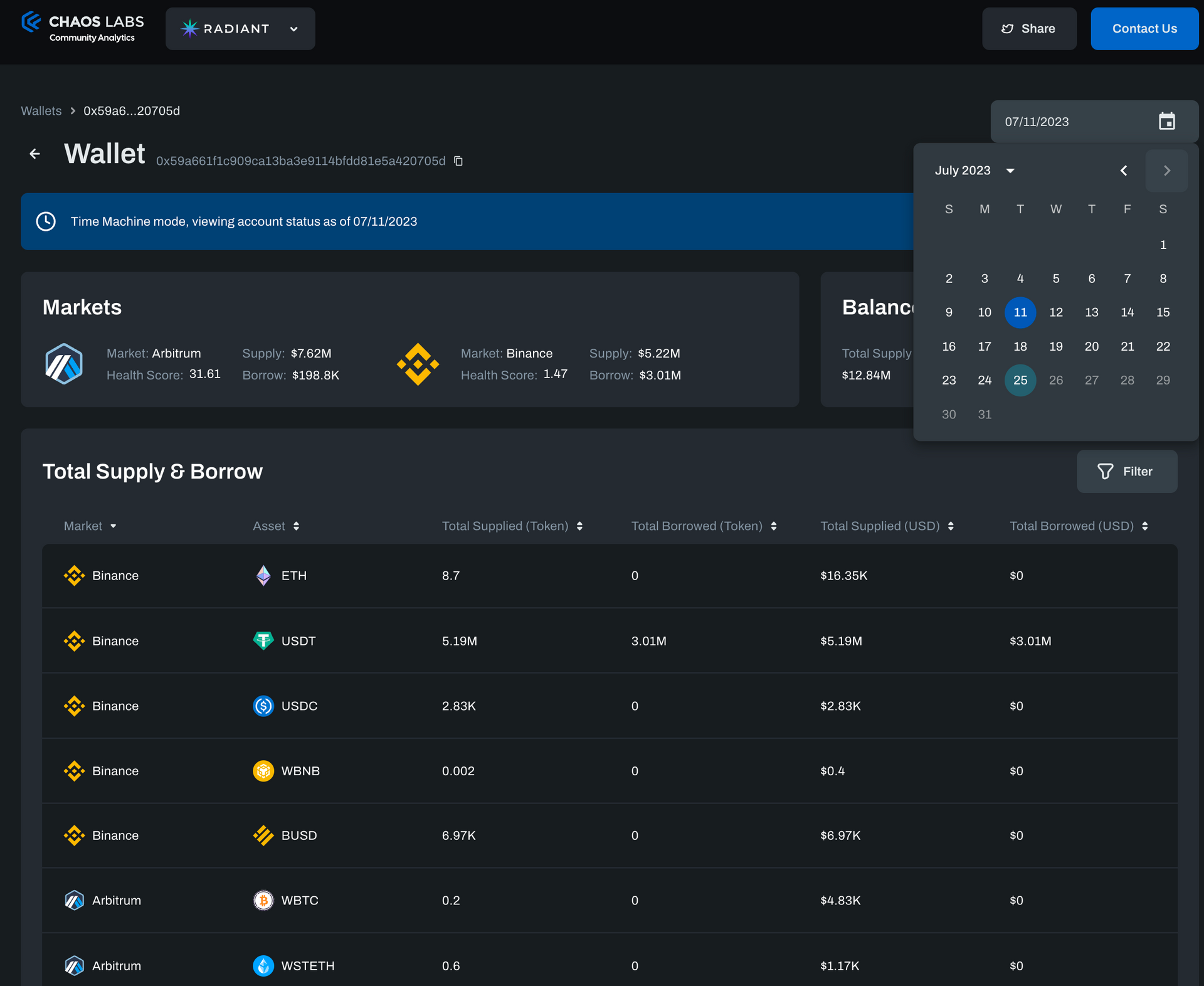

Wallet Time Machine 🕓

We've introduced an exciting new feature for viewing specific wallets. The 'Time Machine' mode, accessible at the top right corner of the Wallet page, allows users to explore the wallet's balance on a selected historic date. This enhancement significantly eases the research and debugging process for historical events related to that wallet. When the Time Machine is enabled, a visible marker indicates that all the values displayed represent historical data.

Top Borrowers and Suppliers 🌟

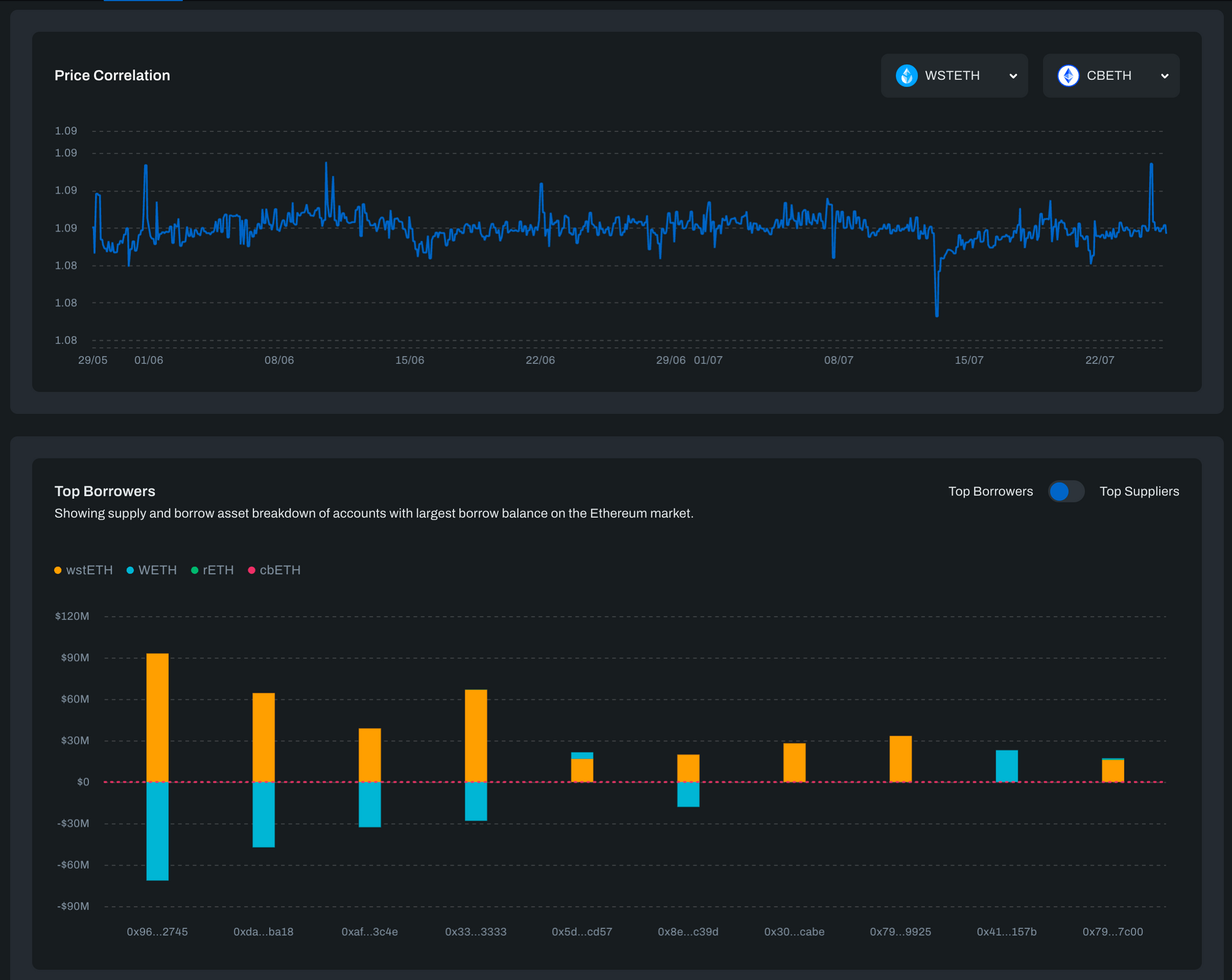

A new feature has been added to showcase the top borrowers and suppliers for a specific market or asset. This view is displayed on the main Overview screen for single-market protocols, highlighting protocol-level top borrowers and suppliers. This view is displayed on the market overview for multi-market protocols, pinpointing the top borrowers and suppliers within that specific market. Additionally, Top Borrowers and Suppliers for a specific asset are displayed on the asset page for single and multi-market protocols.

Both the Top Borrower's and Top Supplier's views offer comprehensive insights by showing the full position, which includes all borrow and supply assets. Supply assets are presented above the x-axis, and borrow assets are showcased below the x-axis. Clicking on any specific wallet displayed in the chart will open the relevant wallet page in a new tab, providing a detailed overview for deeper analysis.

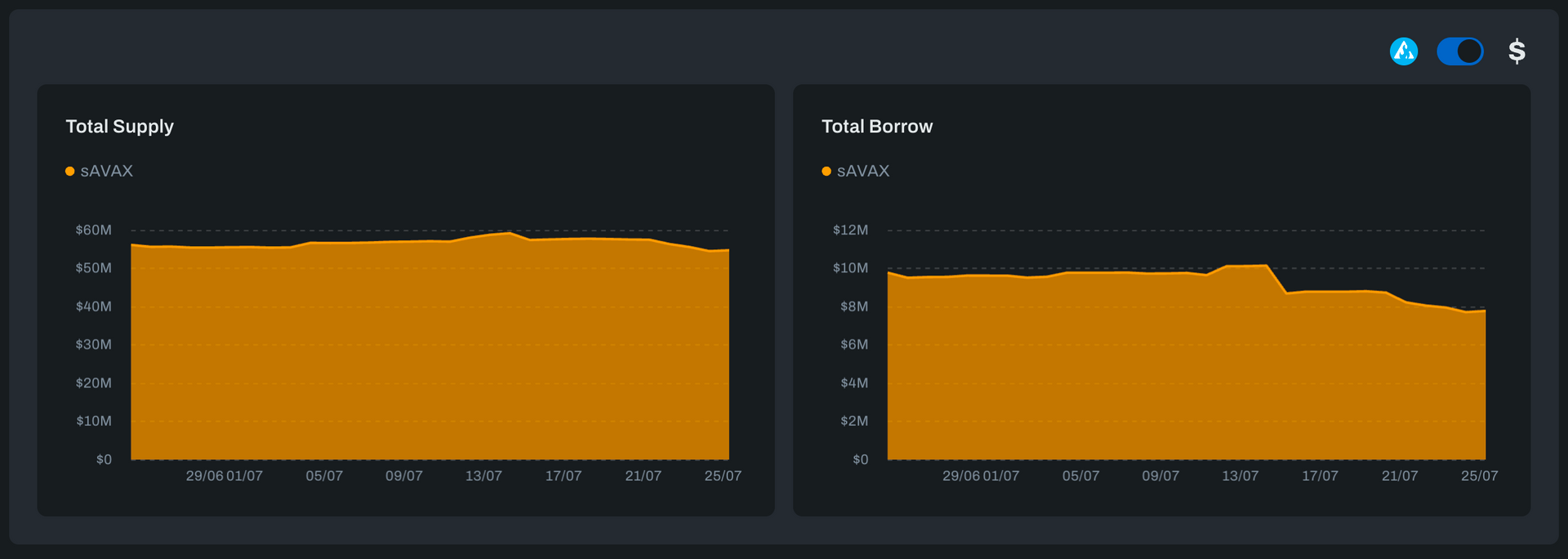

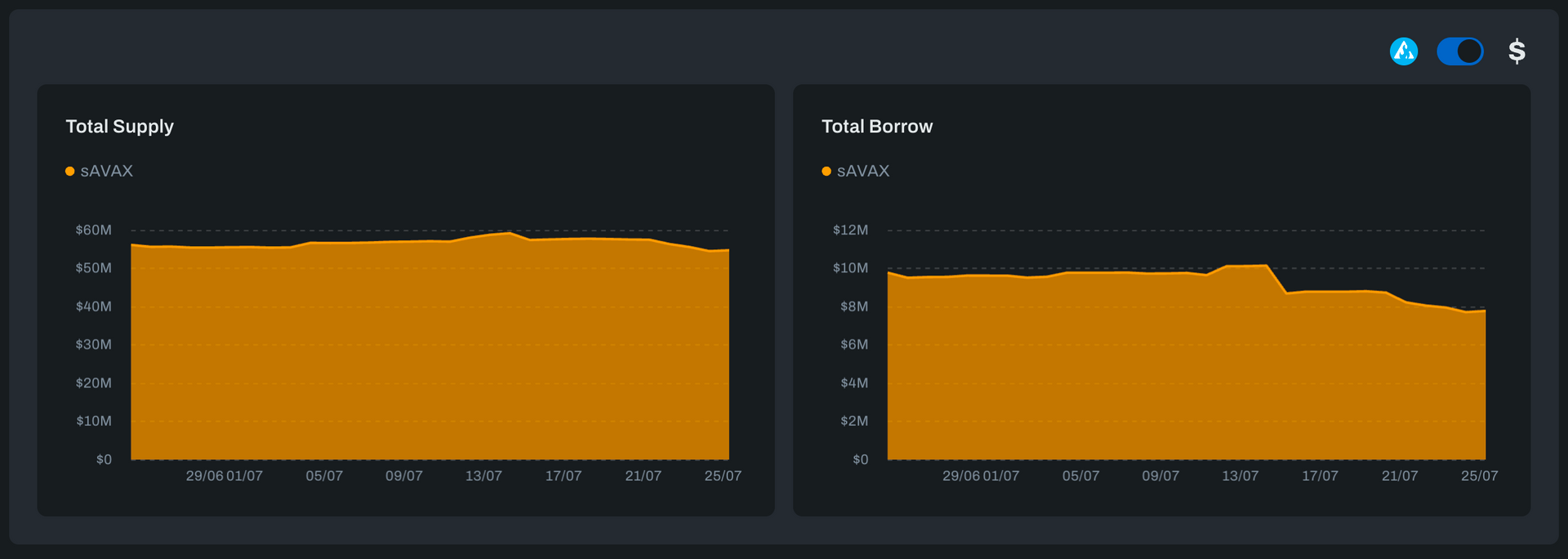

Borrow and Supply in Token Value 💰

In our latest update, users can now view historical token values and the existing USD values when examining a specific asset's supply and borrow balance over time. This upgrade facilitates the identification of supply and borrowing trends by isolating them from token price fluctuations, thereby providing a more direct and precise analysis.

Aave V3 - High-Efficiency Mode (E-Mode) Support 🔋

High-Efficiency Mode, or "E-Mode," is a crucial feature of the Aave V3 protocol designed to maximize capital efficiency when collateral and borrowed assets have price correlation. Upon activating the High-Efficiency mode, borrowers can acquire specific assets with substantially higher Loan-To-Value (LTV) thresholds than the regular mode. This is possible by selecting specific assets with high price correlation into E-Mode pools. Our new version introduces comprehensive support for Aave E-Mode, including:

- An easily visible E-Mode indicator on the wallets table within the Wallets tab.

- A filter for E-Mode wallets in the Wallets tab.

- A clear indication within the wallet page if the wallet is in E-Mode on any market.

- An E-Mode table within each market displays all E-Mode pools within that market. Clicking on any pool opens the E-Mode details page.

- An E-Mode details page that provides relevant risk data for that E-Mode pool, including historical price correlation between any pair of assets in the pool.

Next Steps 🚀

We at Chaos Labs are fueled by our relentless commitment to improving user experience and delivering cutting-edge functionality to our platform. Our team is continuously working on refining our product and introducing enhancements to support additional protocols and cover new risk verticals and attack scenarios.

Your thoughts and opinions are invaluable to us in this process. Please share your feedback, suggestions, and experiences with the new platform using the Contact Us button on the product header. Your input directly contributes to our ongoing improvement efforts and helps us tailor our products to meet your needs better.

The Role of Oracle Security in the DeFi Derivatives Market With Chainlink and GMX

The DeFi derivatives market is rapidly evolving, thanks to low-cost and high-throughput blockchains like Arbitrum. Minimal gas fees and short time-to-finality make possible an optimized on-chain trading experience like the one GMX offers. This innovation sets the stage for what we anticipate to be a period of explosive growth in this sector.

Uniswap V3 TWAP: Assessing TWAP Market Risk

Assessing the likelihood and feasibility of manipulating Uniswap's V3 TWAP oracles, focusing on the worst-case scenario for low liquidity assets.

Risk Less.

Know More.

Get priority access to the most powerful financial intelligence tool on the market.