Chaos Labs USDC Depeg - War Room Summary

Table of Contents

Analyzing the USDC Depeg Events: notes from the war room

Overview

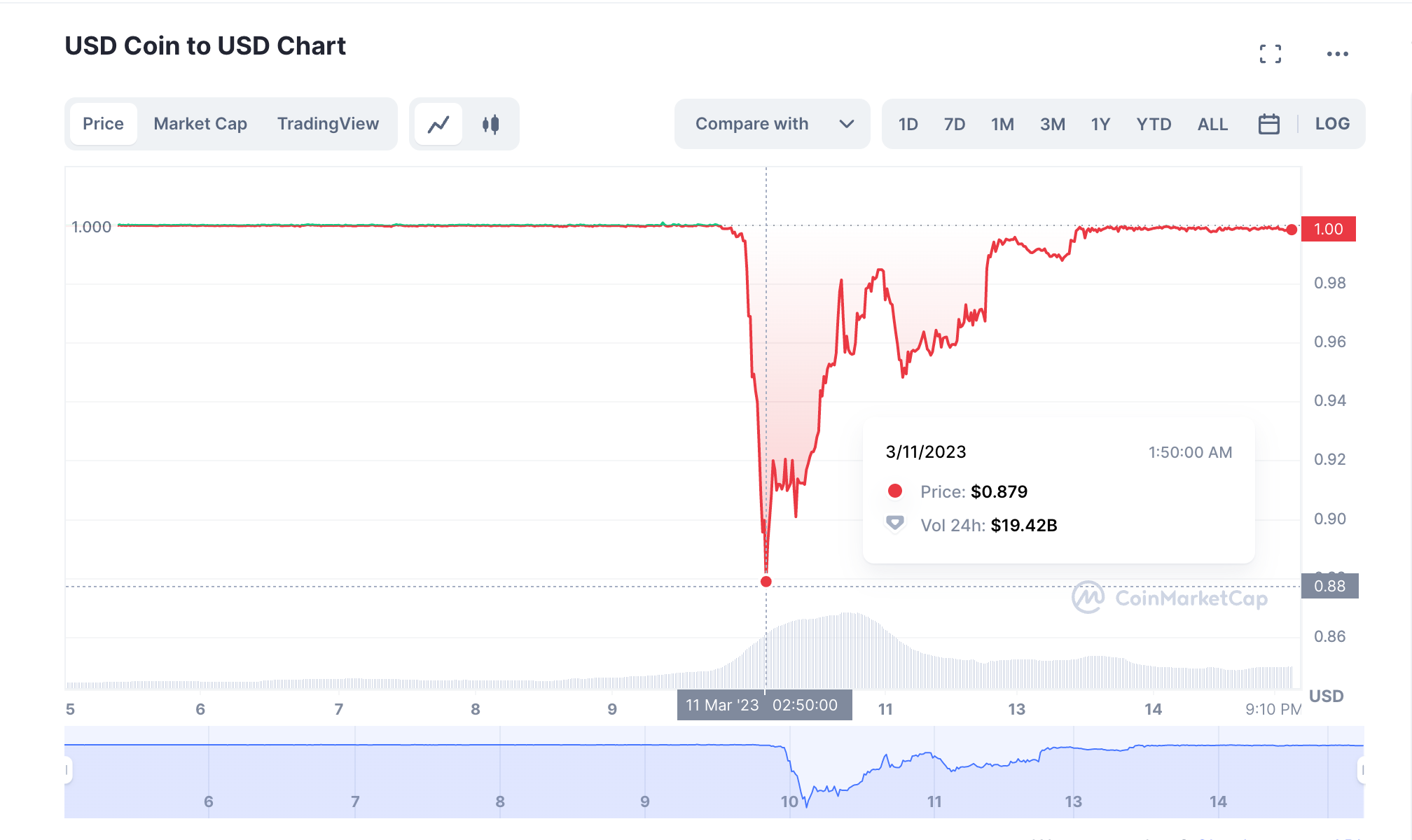

On the morning of March 11th, the cryptocurrency market experienced a sudden wave of volatility and uncertainty triggered by the depegging of USDC, one of the most popular and widely used stablecoins. Stablecoins are designed to maintain a fixed value pegged to a fiat currency, such as the US dollar, but they can deviate from their peg based on market confidence, leading to chain reactions of price movements and liquidations in the crypto ecosystem.

The USDC depeg was primarily caused by the announcement that California financial regulators had closed Silicon Valley Bank (SVB) on March 10th, leading to uncertainty regarding the percentage of deposits backed by assets and the potential for a haircut for depositors.

Before the event, USDC had announced that it used up to seven banks to distribute its cash holdings backing the stablecoin, accounting for approximately 25% of its total assets. Of this amount, $3.3 billion (~7.8%) was held at SVB, which was now in question. The uncertainty surrounding the stability and liquidity of USDC led to a sudden drop in its price as investors became concerned about its value. USDC briefly fell to a low of less than $0.88, well below its pegged value of $1

Source: CoinMarketCap

As part of our ongoing research and risk management efforts, we conducted an analysis of the USDC depeg events, examining the causes, effects, and implications for our DeFi partners, including Aave and Benqi, as well as others that remain undisclosed.

Chaos War Room

After the initial news of SVB and the resulting uncertainty around the potential impact on USDC and other stablecoins, the Chaos team immediately sprang into action. Recognizing the potential risks and challenges posed by this depeg event, the team began closely monitoring the markets, primarily utilizing our Risk Monitoring Platforms (Benqi, Aave) and analyzing the situation to identify potential risks for our clients and develop effective strategies for mitigating them.

During this time, we worked closely with stakeholders across the industry to develop effective solutions and strategies for navigating this turbulent period.

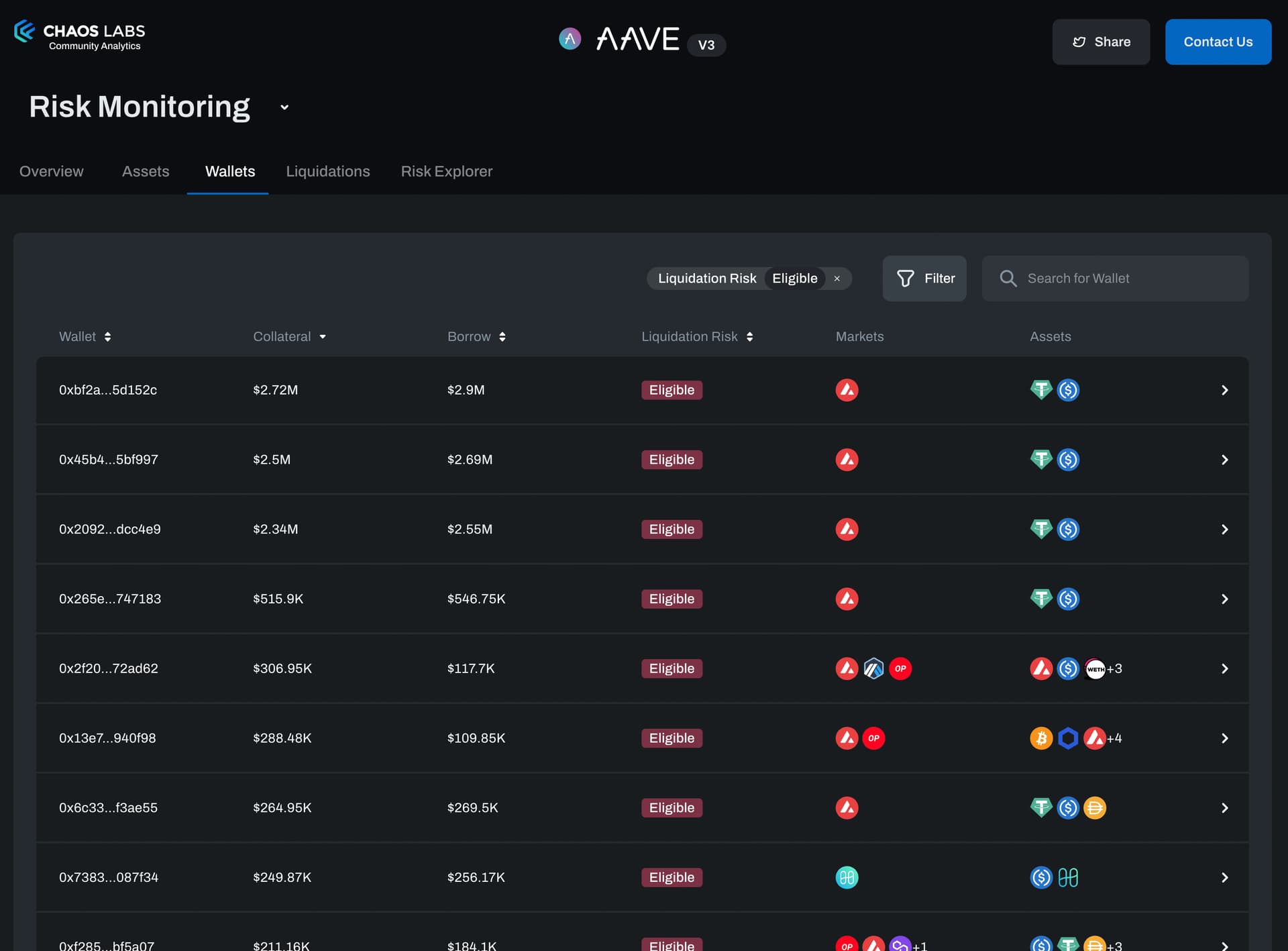

One of the most significant impacts was the liquidation of many E-Mode positions on Aave V3. This feature allows users to access additional borrowing power using a higher collateralization ratio. Since the depegging of USDC caused a sudden drop in its value, many E-Mode positions were liquidated, resulting in losses for the affected users and bad debt for Aave.

Taking Action

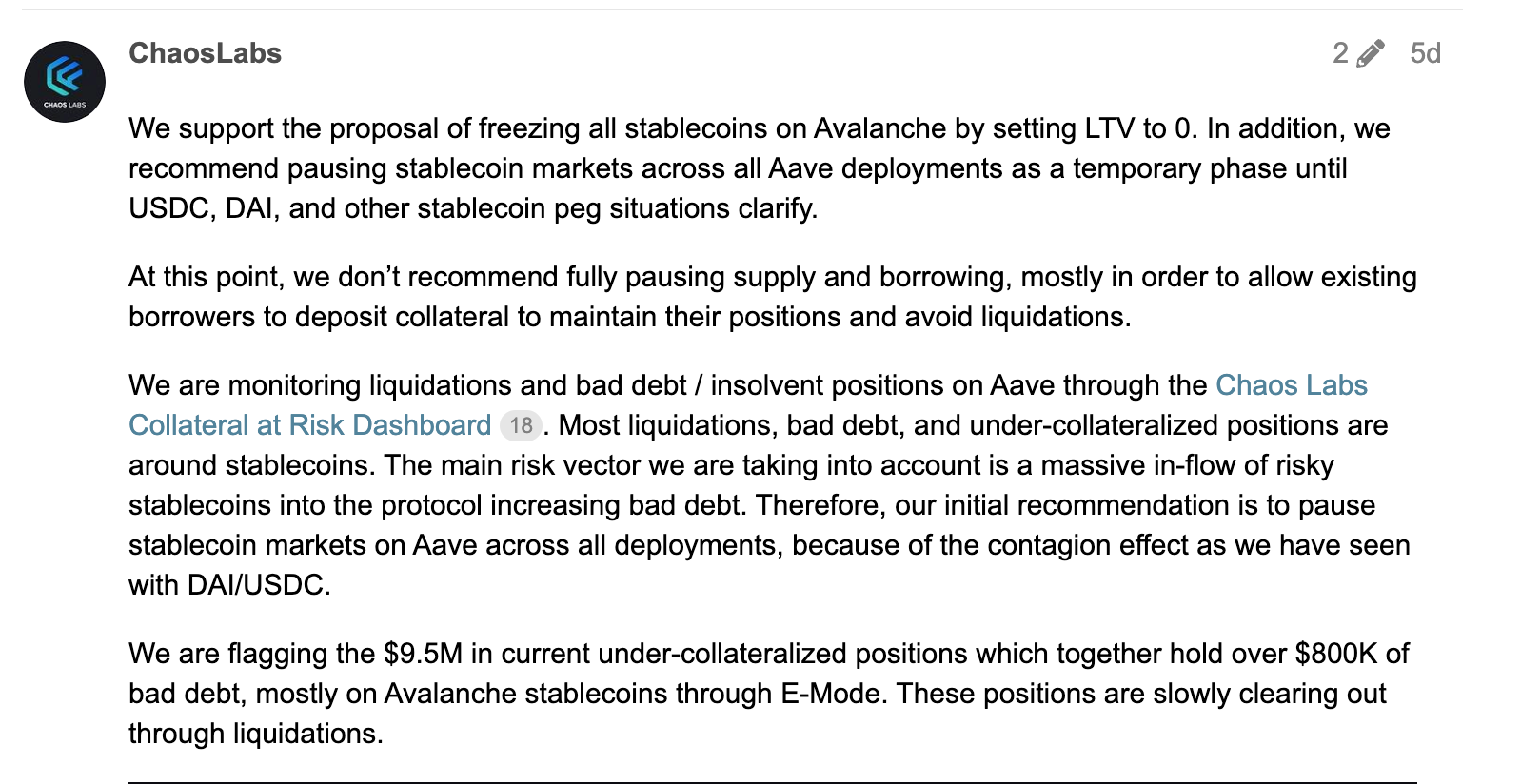

The first step was to evaluate the most effective action to mitigate potential risks and limit the impact on existing positions. After careful consideration, it was decided that a freeze on new stablecoin deposits would be the most appropriate course of action.

This decision was based on a thorough analysis of the potential risks of liquidations and bad debt and aimed to prevent any further exposure to these risks by limiting new deposits. As a result, both Benqi and Aave took immediate action by initiating a freeze on stablecoins on their respective platforms.

It's worth noting that this freeze was implemented exclusively on V3 Avalanche for Aave, as other deployments required on-chain votes to enforce immediate action of freezing reserves.

Nonetheless, the swift action taken by both Benqi and Aave demonstrates their commitment to the safety and stability of their platforms and their ability to respond to potential risks and challenges.

The view above shows wallets eligible for liquidation on Aave V3

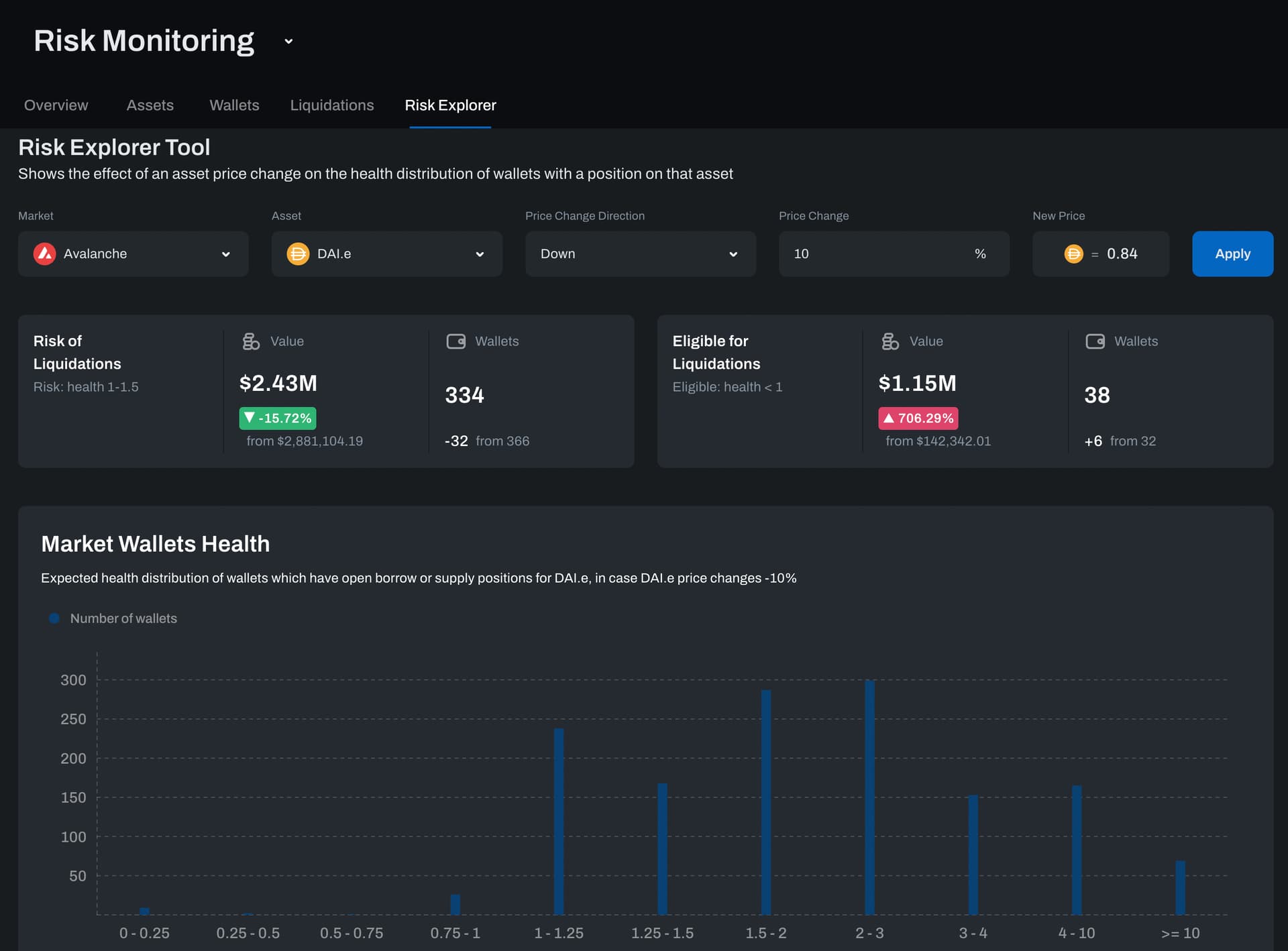

Utilizing the risk explorer on the Chaos Risk Monitoring Platform, we simulated further depegs of various stablecoins to recommend risk-mitigating actions

Recommendations to Aave & decision-making process

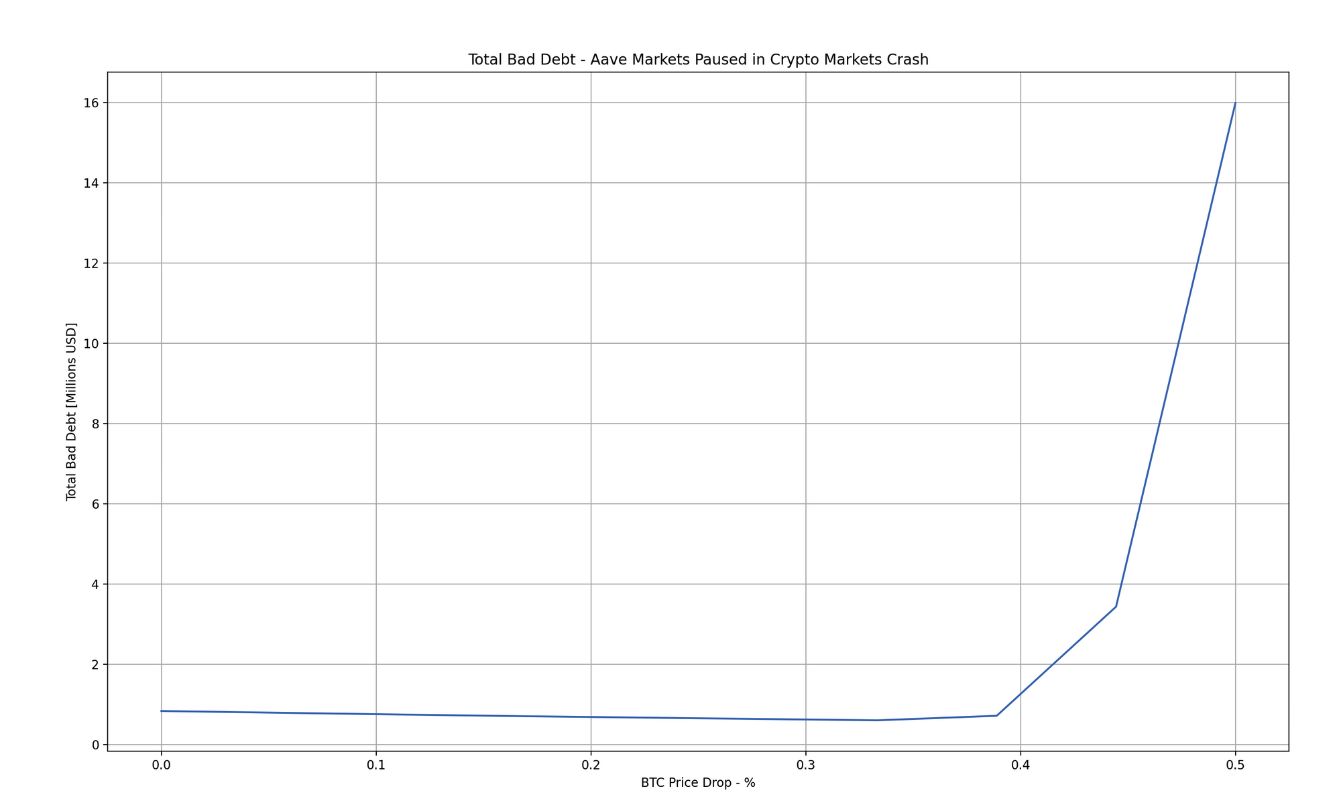

After freezing deposits on Avalanche, the Aave community deliberated on the possibility of pausing all markets on the protocol. This would effectively disable all new actions, including deposits, borrows, and liquidations, which would be the most conservative decision in effectively pausing protocol usage but would most effectively mitigate additional unanticipated bad debt.

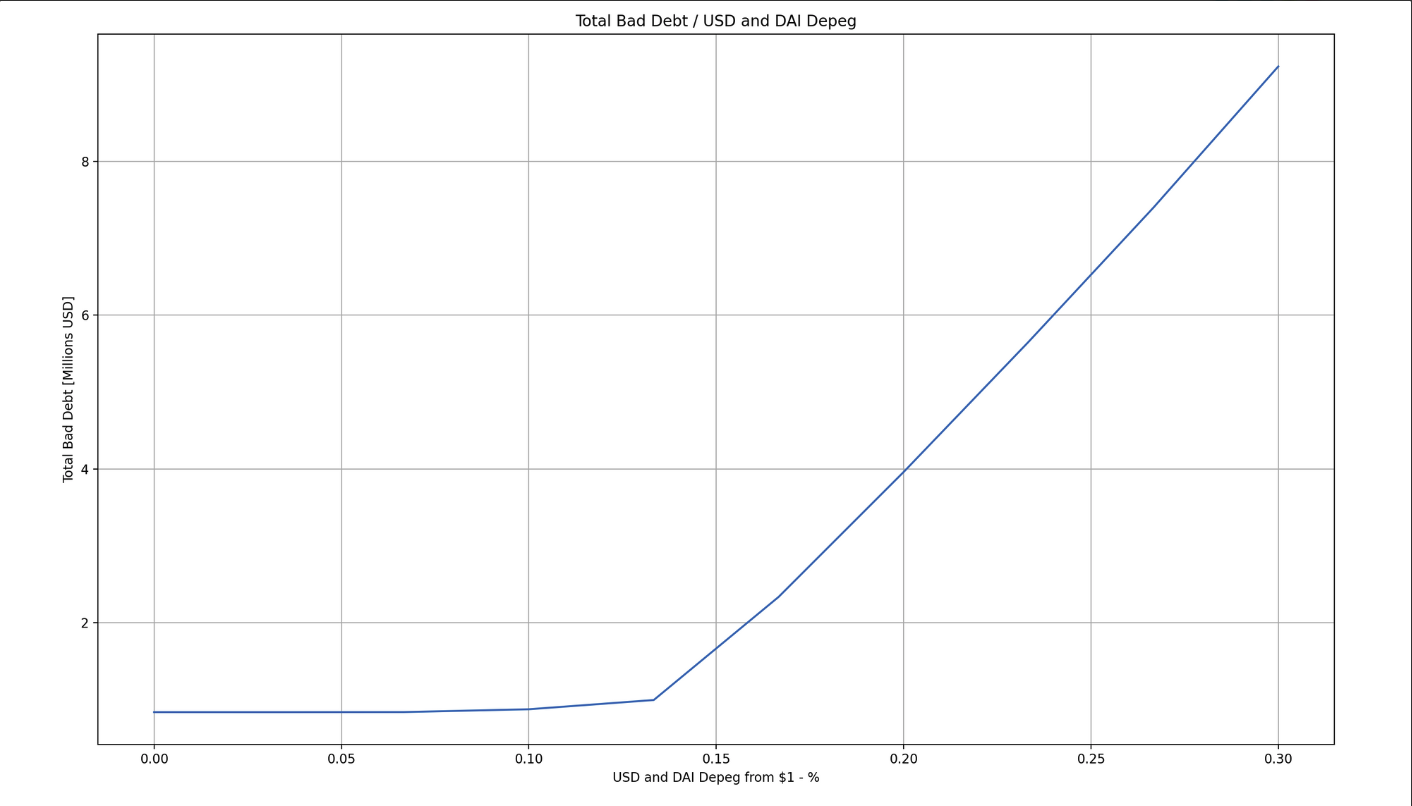

However, this approach also carried the risk of bad debt due to the inability to liquidate assets in the case of a broader market downturn and is thus not without risks of its own. The team analyzed holder positions and market trends to make an informed decision, leveraging our simulation platform to quantify potential losses under different scenarios and price drop trajectories. By taking a data-driven approach, the Aave community could carefully evaluate the potential benefits and risks of pausing all markets and make a well-informed decision.

Based on our holder analysis and evaluation of various scenarios, including the possibility of USDC regaining its peg and the potential for USDC to continue trading at a discount level (8% at the time of analysis), we ultimately recommended against pausing all Aave reserves.

During our analysis of the USDC depeg events, we observed that USDC had already started to recover by the time of our analysis. Our risk assessment determined that the risk of incurring bad debt due to failed liquidations of other assets outweighed the risk of further depegging of USDC. Disabling liquidations would only have increased the potential for bad debt and increased the risk to the protocol. Therefore, we recommended that our DeFi partners continue to operate normally, with appropriate risk management and monitoring tools to mitigate the risks associated with stablecoin depegging events.

It is worth highlighting that pausing the protocol would drive traders away from Aave to other platforms, which would be disadvantageous. In general, volatile markets tend to attract more traders, and implementing this pause would have hindered the usage of the protocol.

The graph above displays the total potential bad debt across various depeg values for both USD and DAI.

The graph above displays the potential bad debt across Aave markets for various BTC price drops if the markets were paused.

Aftermath

The stablecoin market eventually regained stability and returned to its peg after the announcement that SVB deposits would be accessible, rendering further risk mitigation actions unnecessary. Based on our analysis, we recommended that the proposed risk mitigation measures be reversed, and normal activity resumed.

Overall, the USDC depeg events serve as a reminder of the need for continuous risk assessment and management in the rapidly changing and interconnected DeFi world. Aave, Benqi, and other DeFi platforms must remain vigilant and proactive in identifying and addressing new risks and challenges while engaging with the community to promote transparency, trust, and innovation.

We thoroughly analyzed the impact of the USDC depeg event and reviewed all relevant protocol parameters to ensure they are optimized for risk management and capital efficiency. Based on our analysis, we have provided updated recommendations to our partner protocols, including Aave and Benqi, to help mitigate potential risks of future depeg events and evolving market conditions.

Our updated recommendations include optimizing parameters such as liquidation thresholds and collateral ratios to ensure the protocols are better equipped to handle sudden market shifts and avoid bad debt. We also recommend ongoing monitoring of stablecoin liquidity and banking partner risk to proactively address potential issues before they significantly impact the protocol.

Additionally, we published our evaluation of the stablecoin e-Mode category for Aave. In this analysis, we examined several alternatives to mitigating future shortfalls due to stablecoin depegs while examining their impact on risk and protocol reward.

Overall, we are committed to providing ongoing risk management and optimization support to our partner protocols and the broader DeFi community to help mitigate risks and ensure the ecosystem's long-term success.

Chaos Risk Dashboard Launches Live Alerts for Real-Time Risk Management

Chaos Risk Dashboard has rolled out new functionality that provides real-time alerts covering crucial indicators on the Aave v3 Risk Dashboard and BENQI Risk Dashboard.

Chaos Labs Asset Protection Tool

Chaos is unveiling a new tool to measure price manipulation risk and protect against it. Introducing the Chaos Labs Asset Protection Tool

Risk Less.

Know More.

Get priority access to the most powerful financial intelligence tool on the market.