crvUSD Risk Monitoring And Alerting Platform

Table of Contents

Chaos Labs is excited to announce the crvUSD Risk Monitoring and Alerting Platform launch. This advanced system provides comprehensive analytics and observability, offering the Curve community a gateway to abundant data and risk intelligence associated with crvUSD, all under one unified platform.

The platform is designed to give users a more profound understanding of the stablecoin overall risk. This will support high-level decision-making processes by delivering critical data on positions spread across various markets and detailed wallet-level monitoring with real-time insights for each wallet and borrow position.

Platform Deep Dive

For those who prefer a video tutorial, please view our Loom recording.

Overview Page

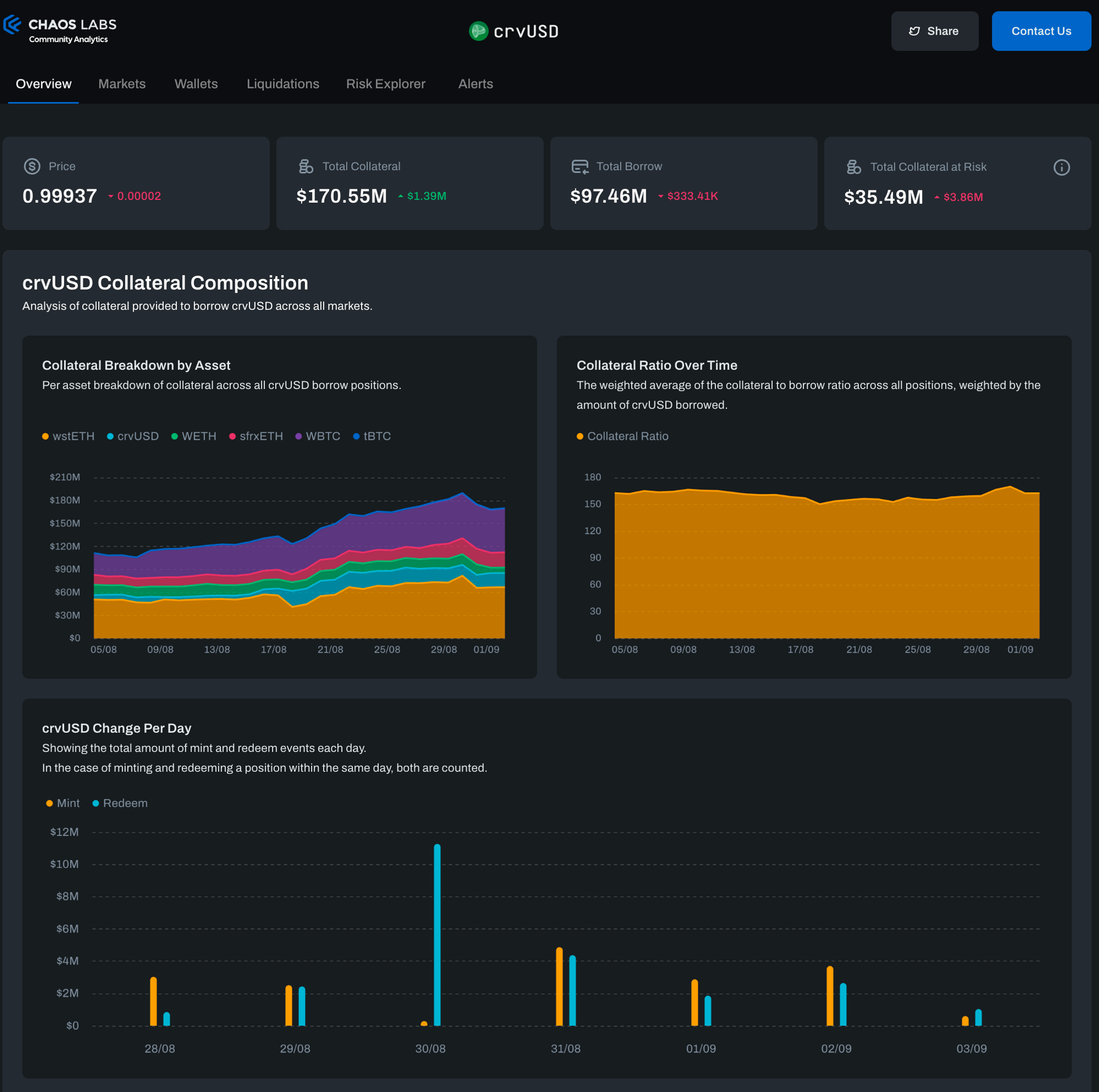

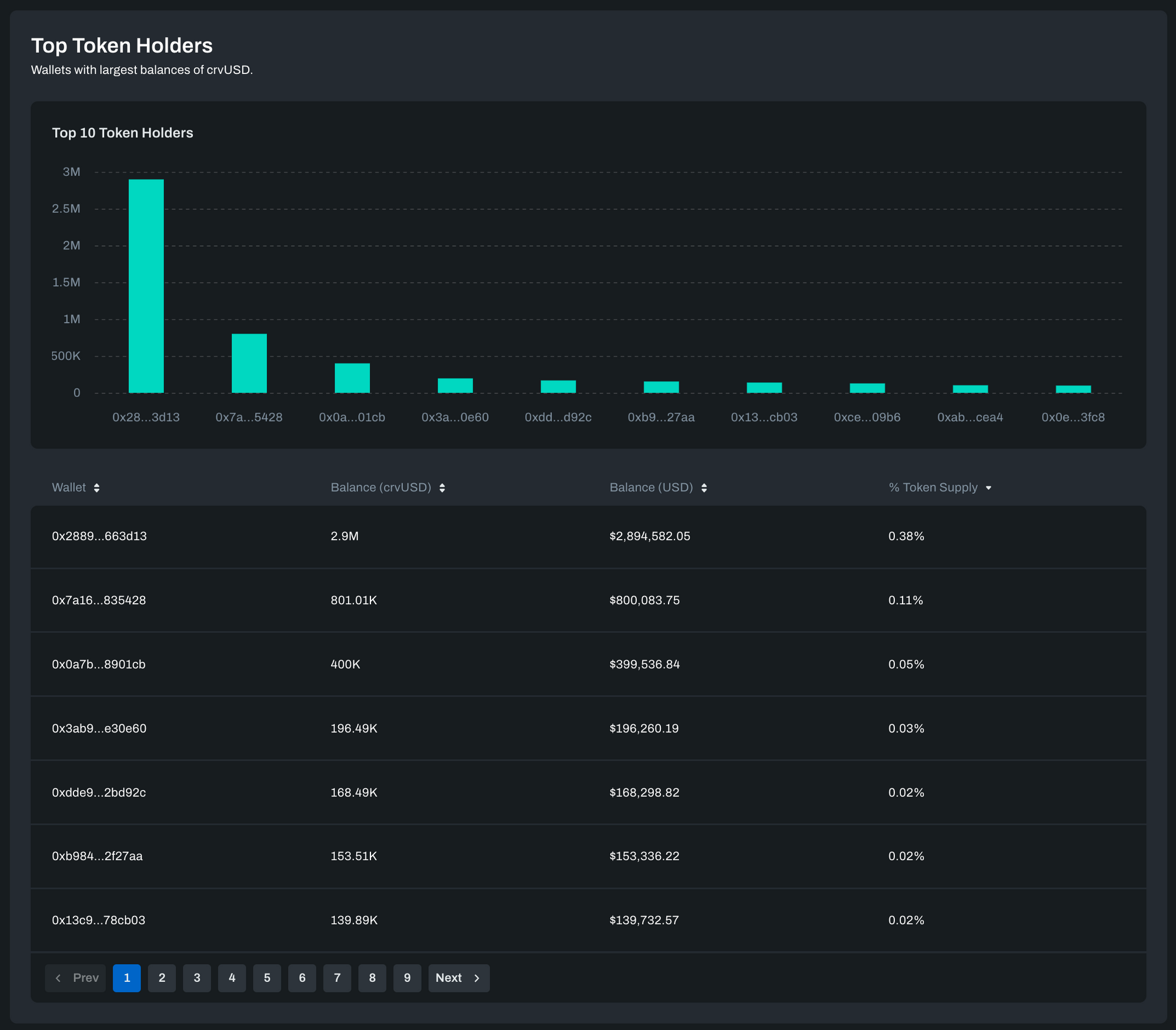

The main section of the Risk Monitoring and Alerting platform provides high-level metrics aggregated across crvUSD markets, including total supply, total borrow, TVL, the sum of collateral at risk of liquidation, and more. In addition, essential information about the stablecoin usage and health, including holders and liquidity.

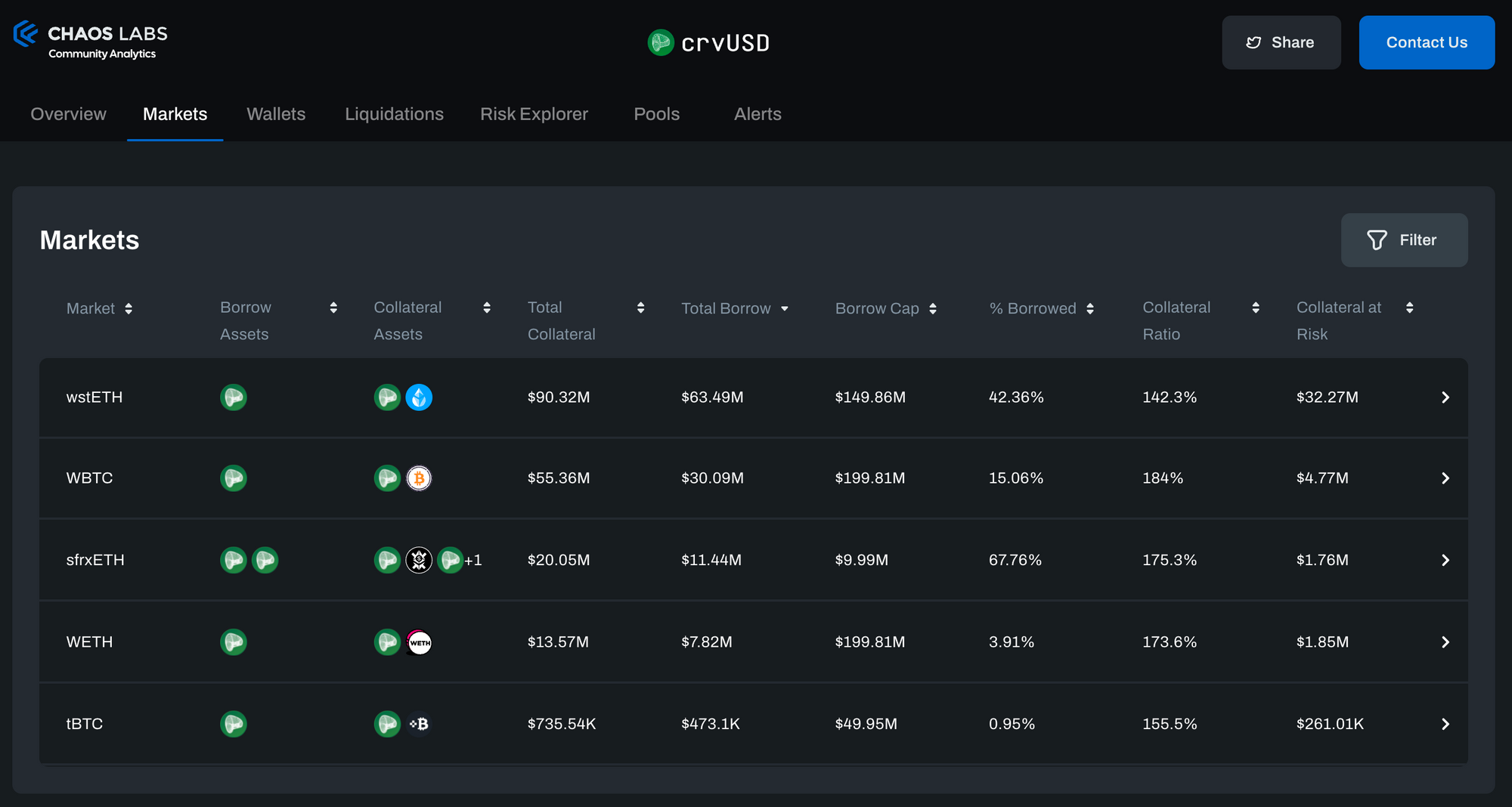

Markets Page

The Markets page shows aggregated details for each crvUSD market, enabling a detailed understanding of the protocol exposure to any collateral asset. Specifically, the Collateral at Risk column aggregates collateral value from positions with low health values approaching liquidation.

Clicking any market in this table opens the Market Detail view. This page consolidates all information about the market, including borrow and supply status, APYs, and collateral at risk.

LLAMMA

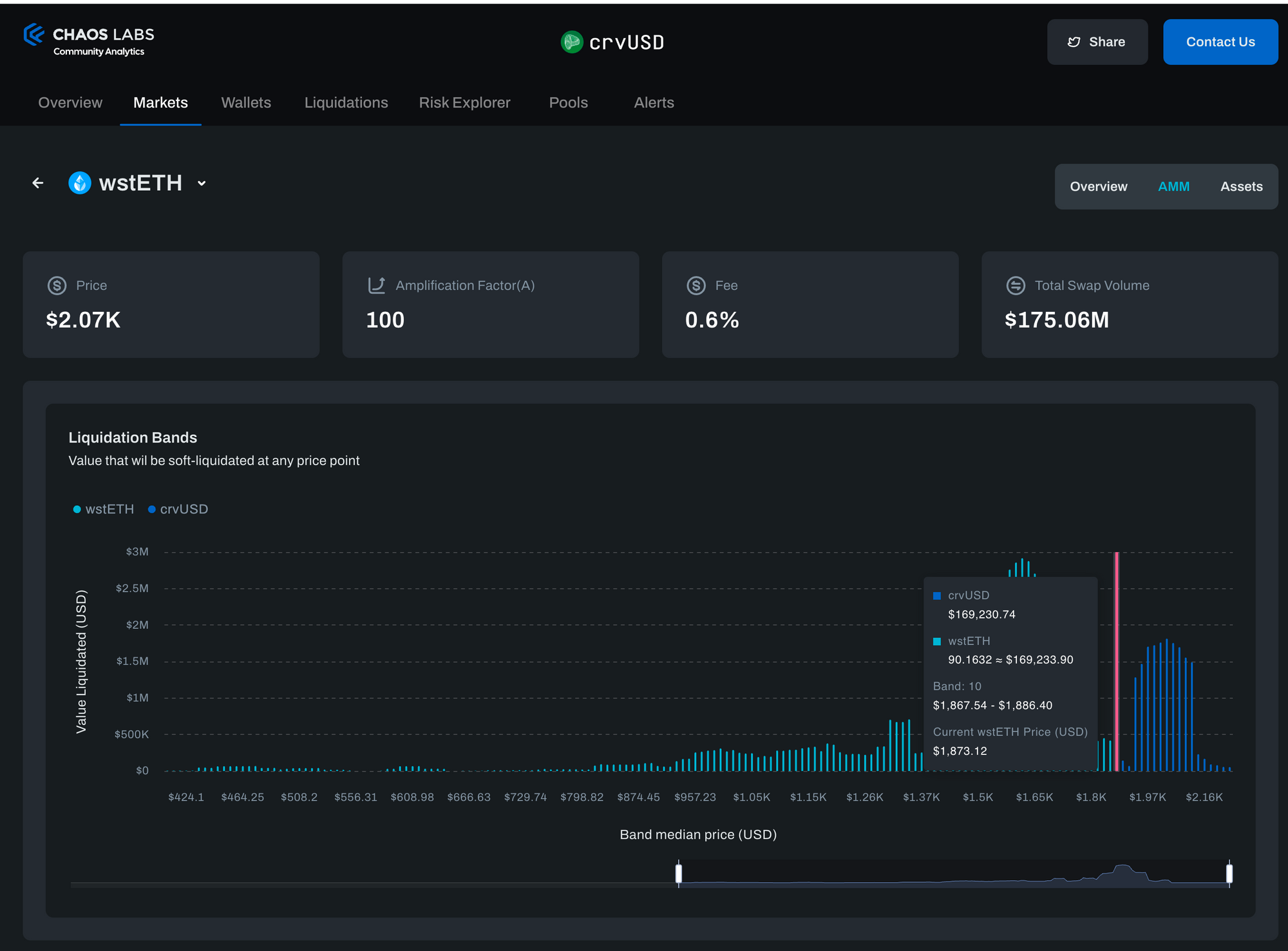

LLAMMA (Lending-Liquidating AMM Algorithm) is the market-making contract that rebalances collateral deposited in this market. As the name suggests, this contract is responsible for lending and liquidating collateral. Every market has its own AMM containing the collateral asset and crvUSD.

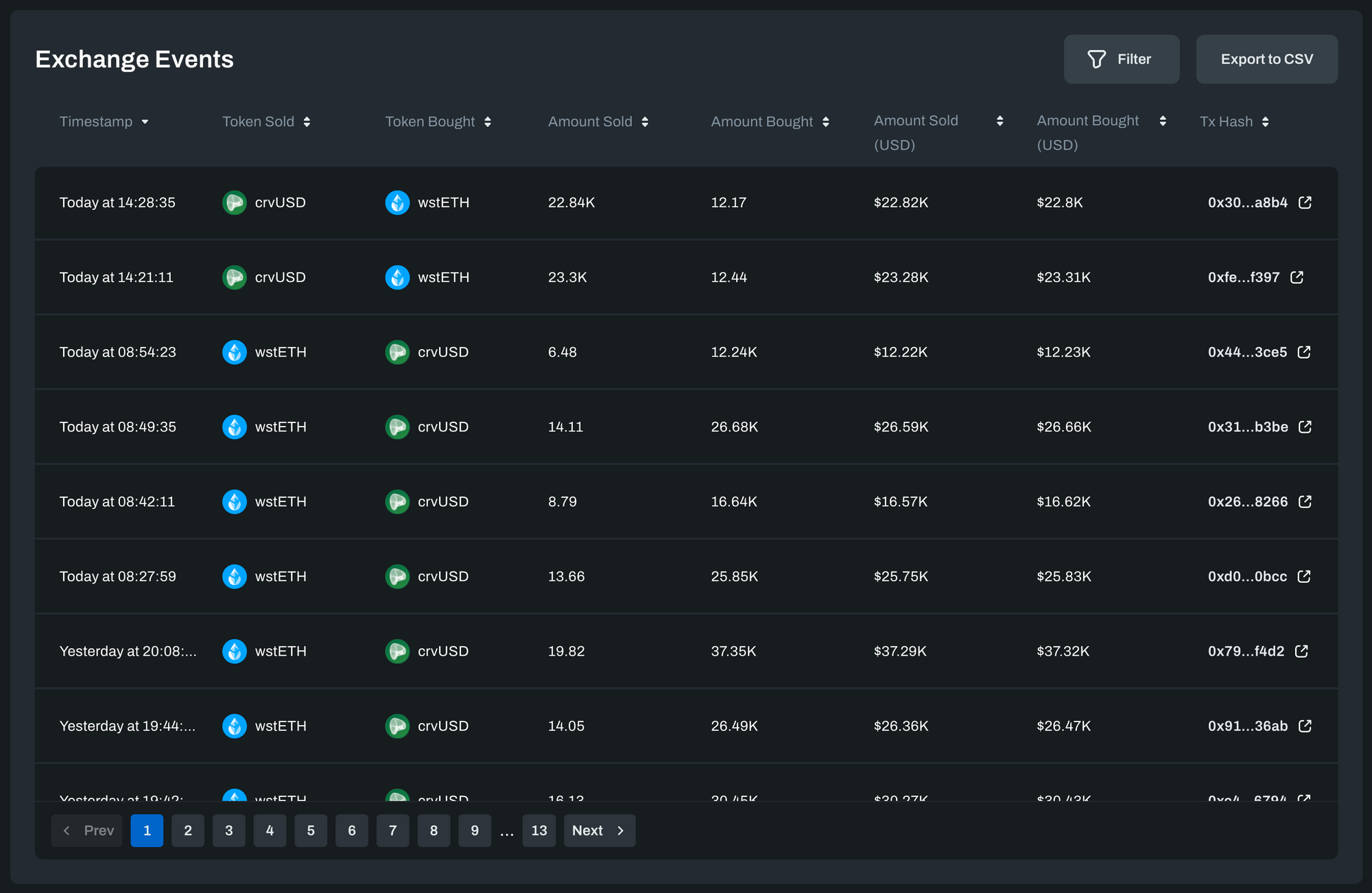

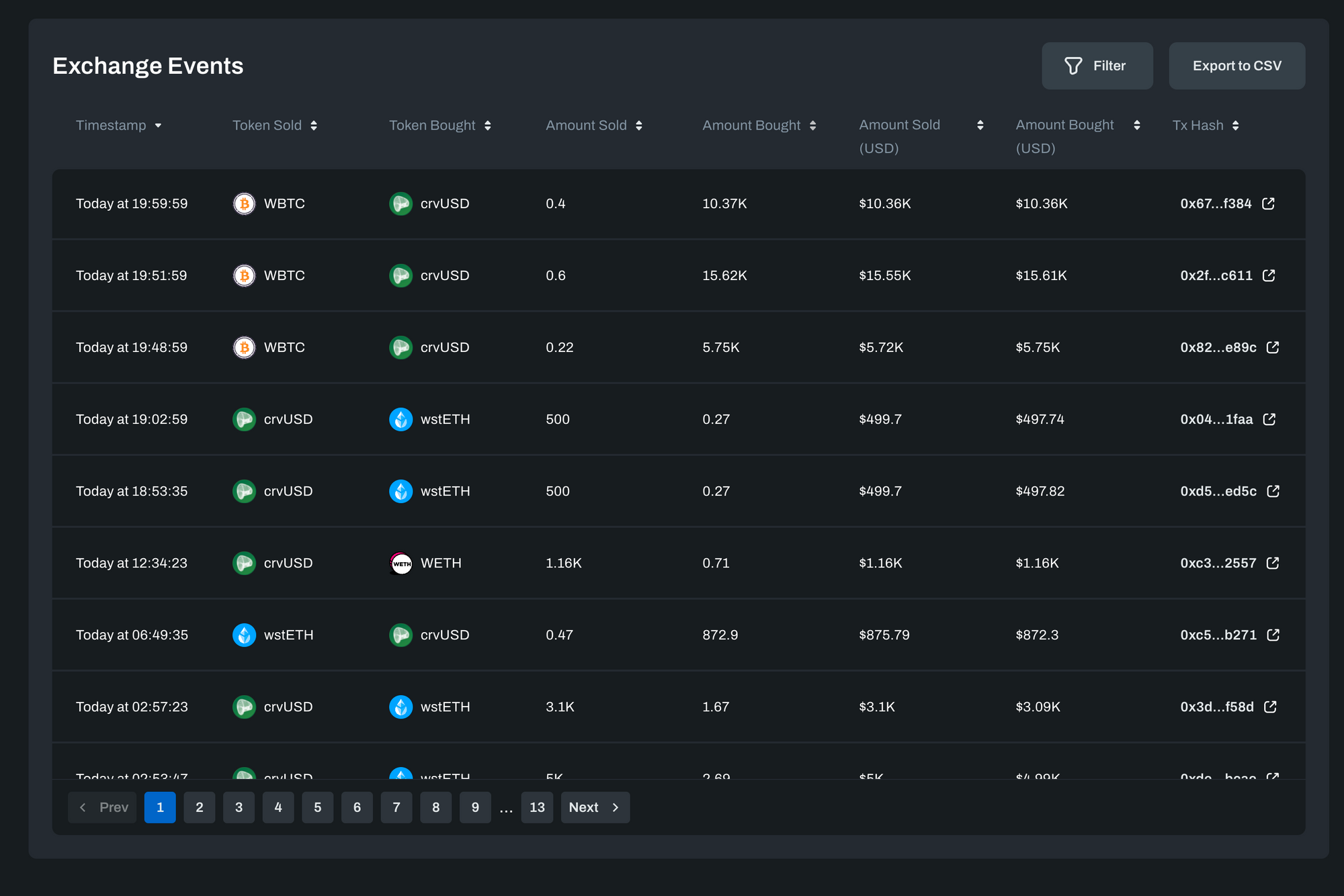

Within a specific market page, using the navigation bar on the top right corner, it is possible to dive deep into the market AMM data by navigating to the AMM page, showing data about the AMM associated with this market, including the current amplification factor (A), AMM Fee, bands distribution as well as historic exchange events and the aggregated sum of all exchange events.

Wallets Page

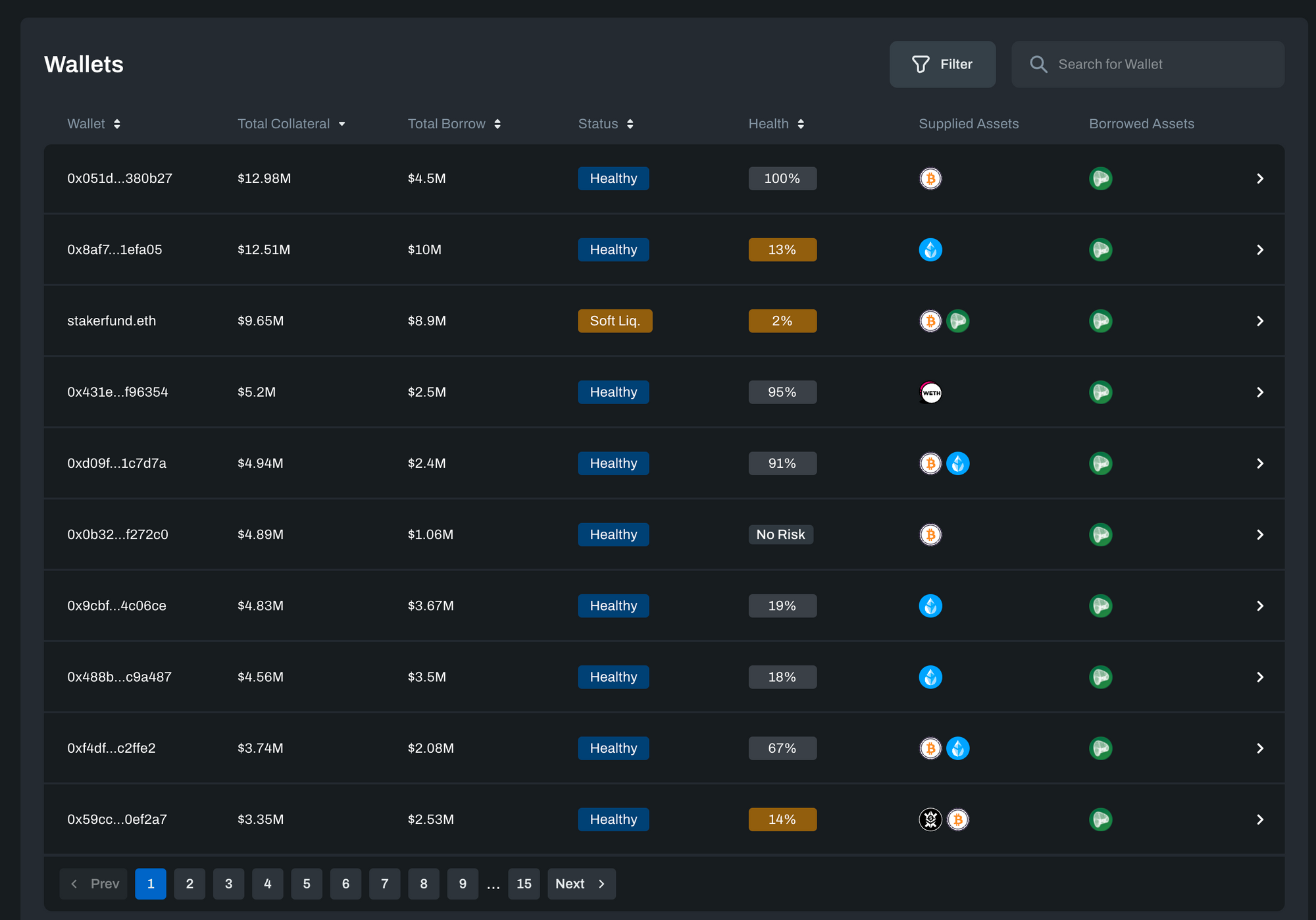

The wallets page presents a comprehensive table that showcases all wallets with borrow positions of crvUSD in one or more markets. Users can conveniently search for specific wallet addresses or the wallet ENS name. Users can also leverage the advanced filtering functionality to filter wallets by liquidation risk level, supply, or borrow assets.

By selecting a specific row in the wallets page, users will be directed to the wallet detail page.

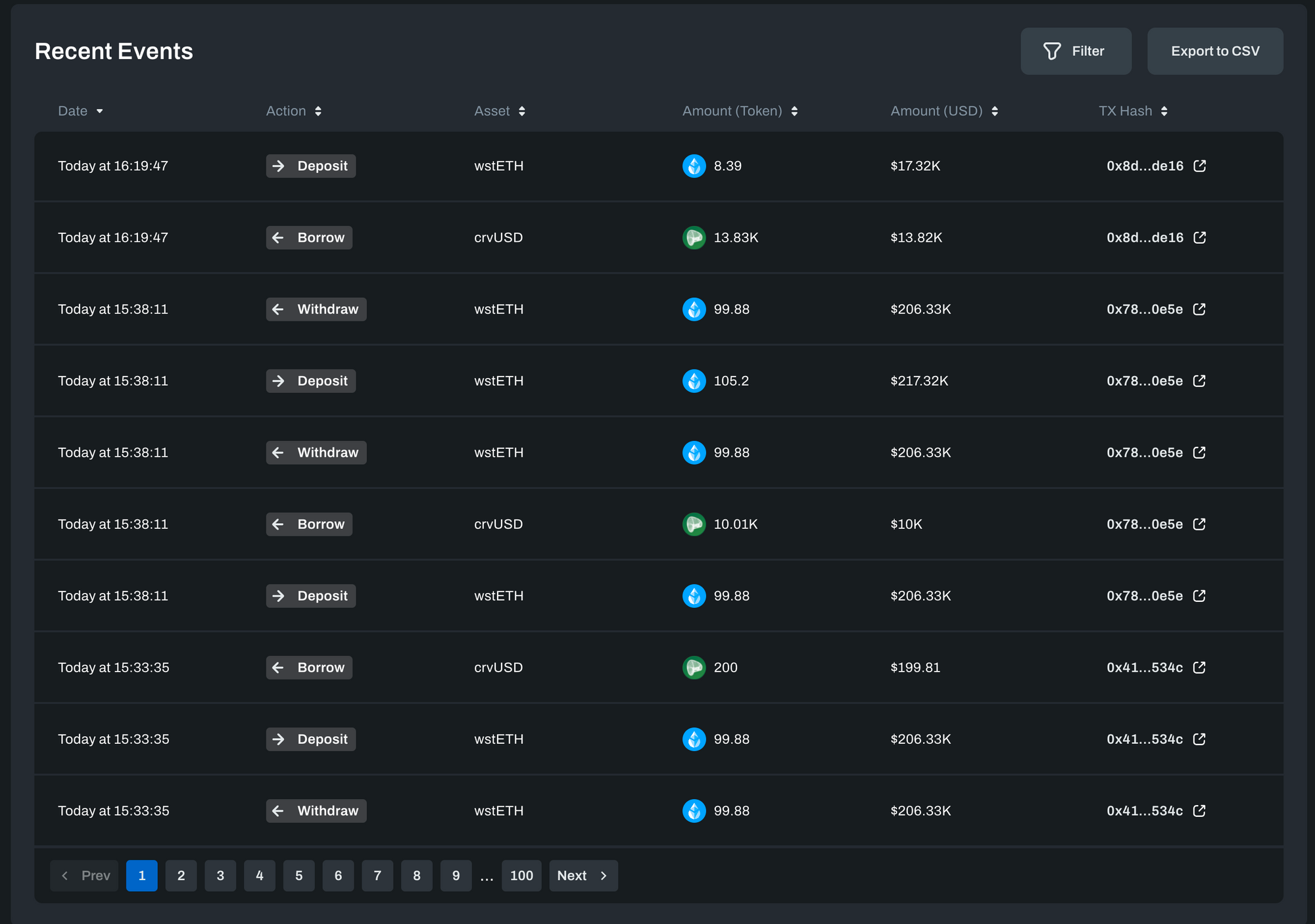

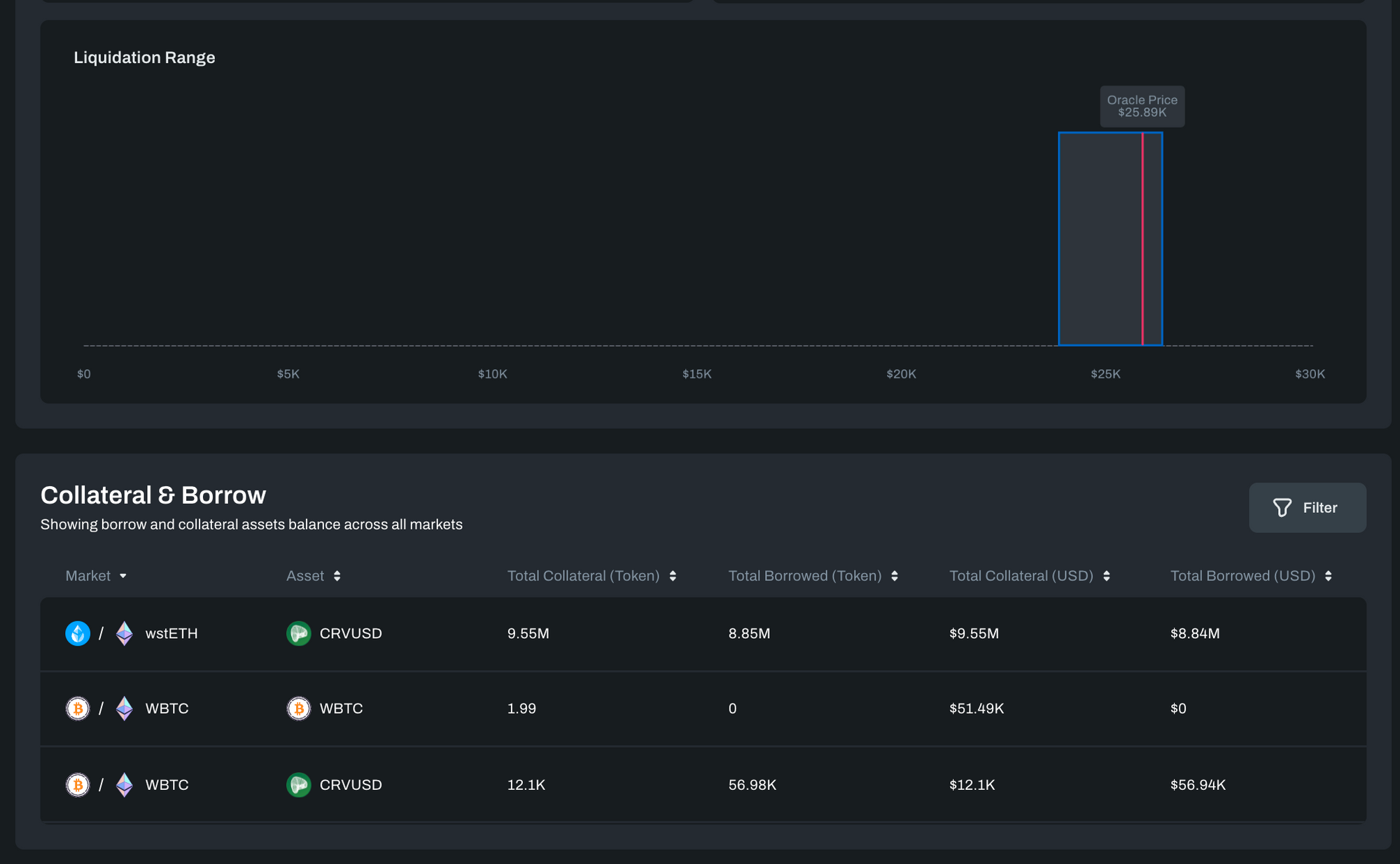

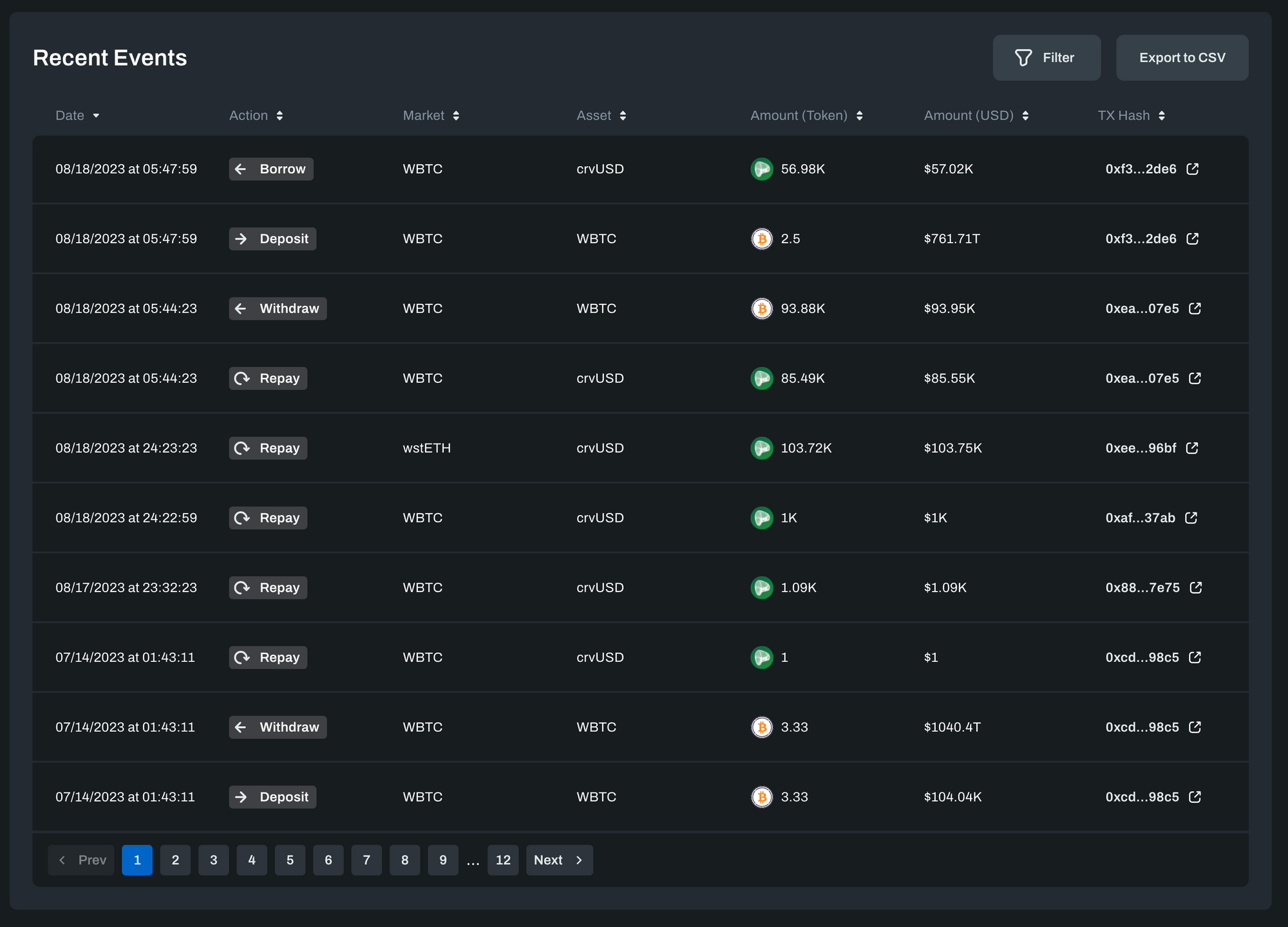

The Wallet detail page displays the wallet health and liquidation status across all markets, together with all crvUSD borrow positions for that wallet. The wallet detail page shows the selected wallet’s liquidation bands and recent events.

By default, the Wallet Page shows current position data that updates in real-time; however, it is possible to view the wallet balance and state at a selected point in time using the Time Machine mode in the top-right corner. In addition, historical values over time are shown, including collateral, borrow, and loss metrics.

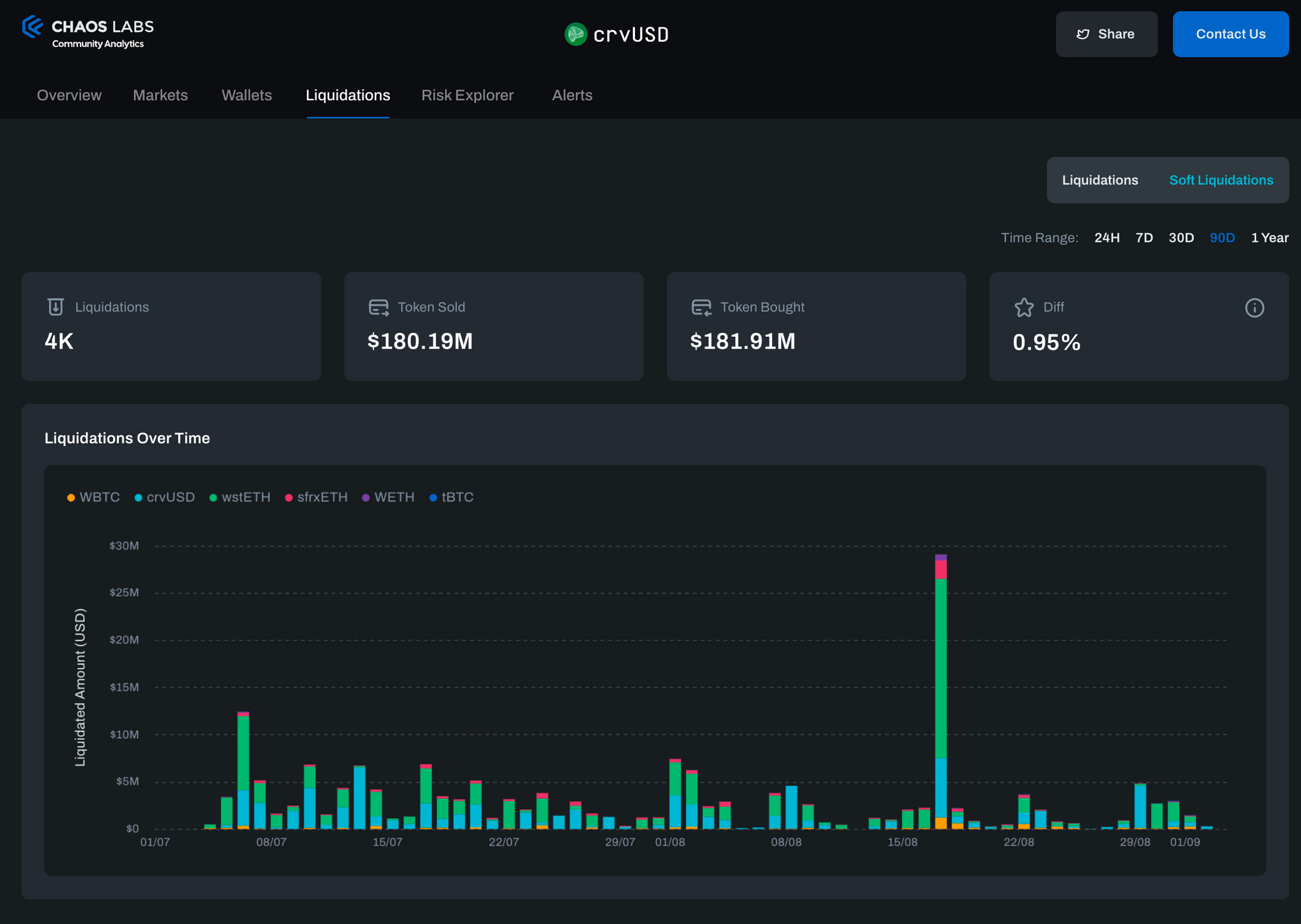

Liquidations

crvUSD has two types of liquidations, where position collateral is sold:

- Exchange Events (‘Soft liquidations’), where the AMM converts collateral into crvUSD as the collateral price decreases, and vice versa, converts crvUSD back into the collateral asset when prices rise.

- “Hard” liquidations, where the user collateral is sold off, and the position is closed (just as in regular liquidations)

In both cases, the functionality and stability of crvUSD depend on the protocol's ability to sell off or exchange collateral, and both types can be monitored under the liquidations tab.

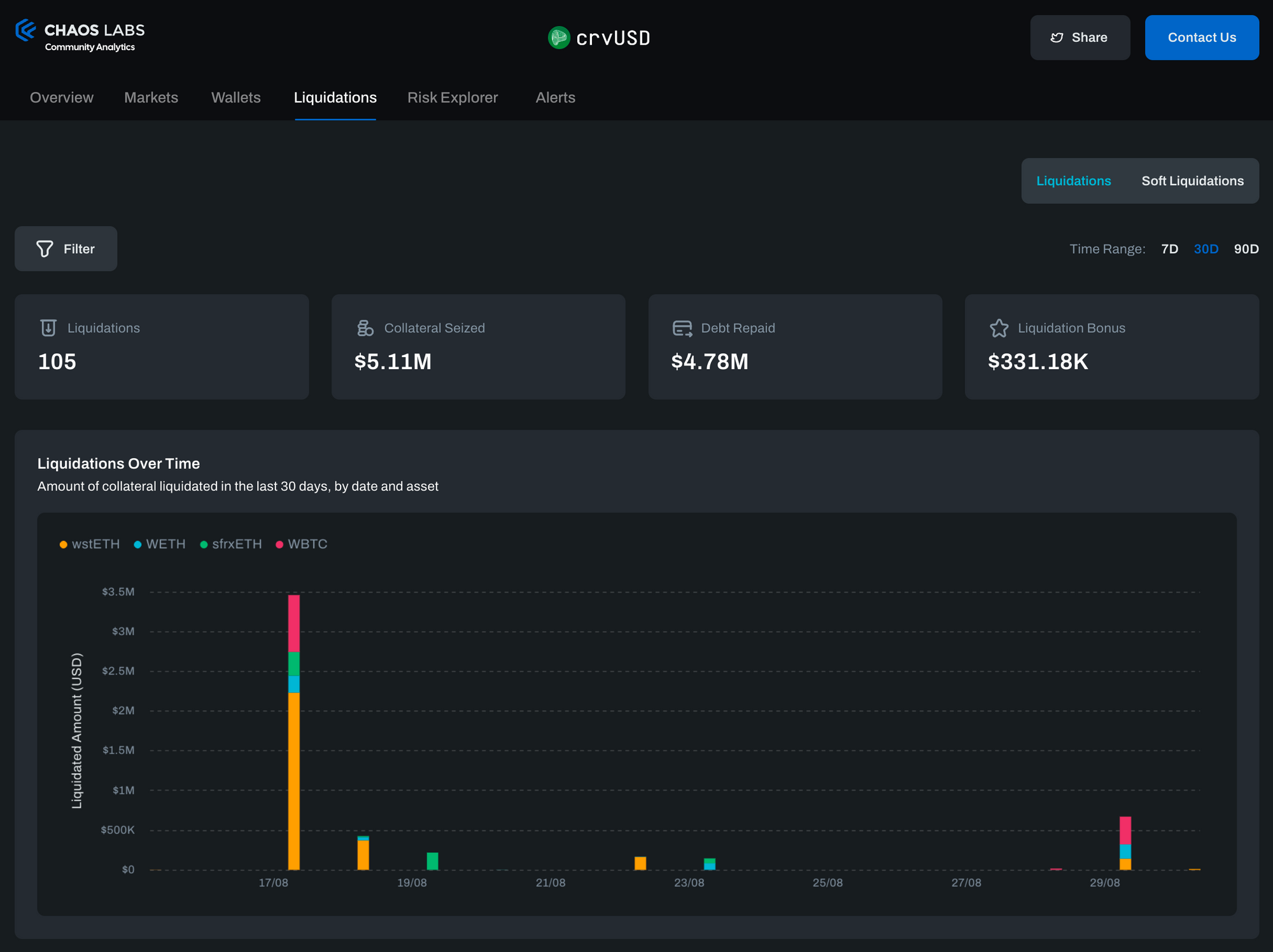

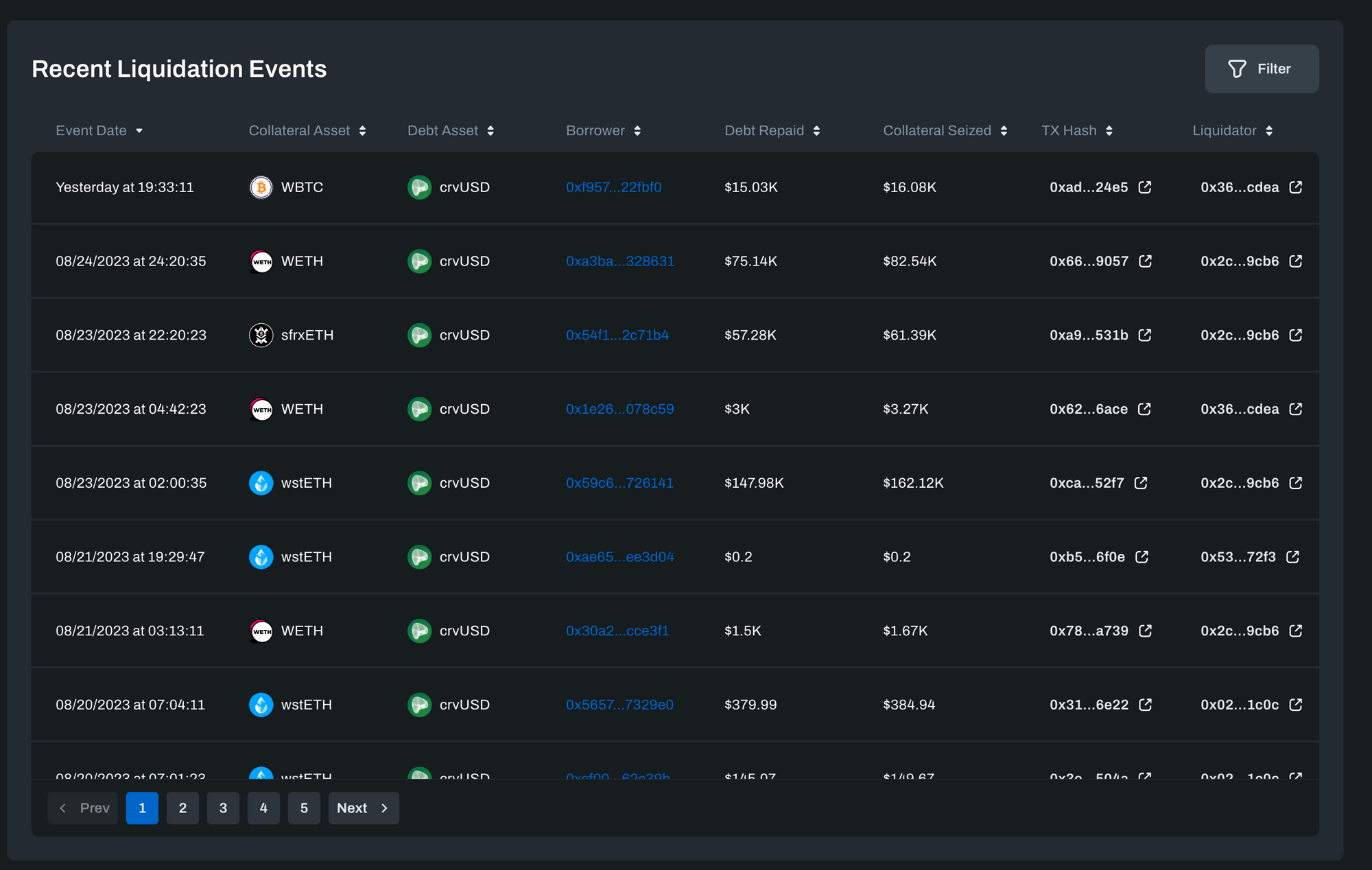

Hard Liquidations

The Liquidations tab presents aggregated data on protocol hard liquidations from all markets spanning 7, 30, and 90-day time frames, showing the number of liquidations, collateral seized, debt repaid, and aggregated liquidation bonus.

Soft Liquidations

The Soft Liquidations tab presents aggregated data on protocol exchange events from all markets spanning 7, 30, and 90-day time frames, showing the number of exchange events, tokens sold to the AMMs, tokens bought by the AMM, and the price diff between bought and sold values.

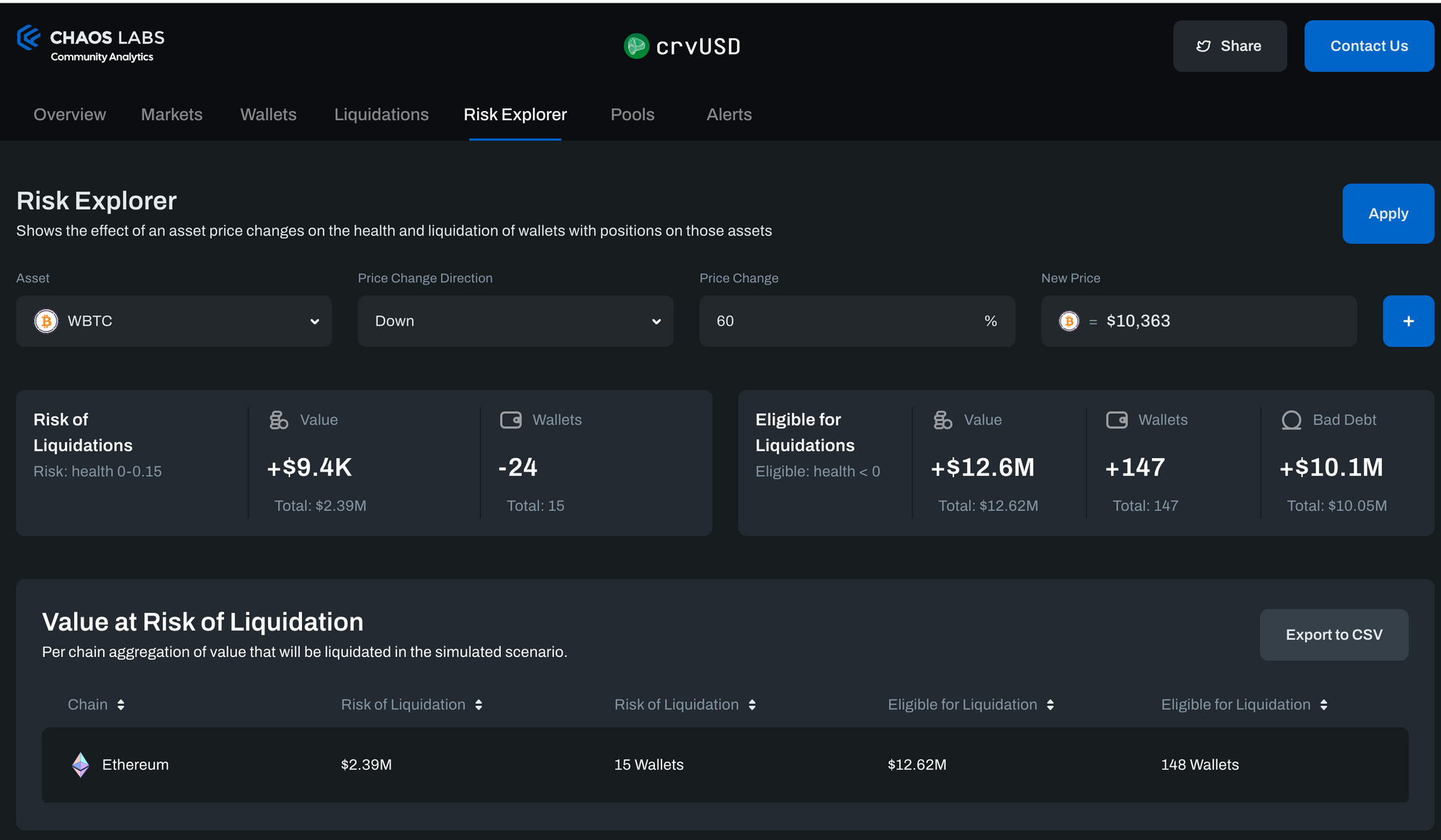

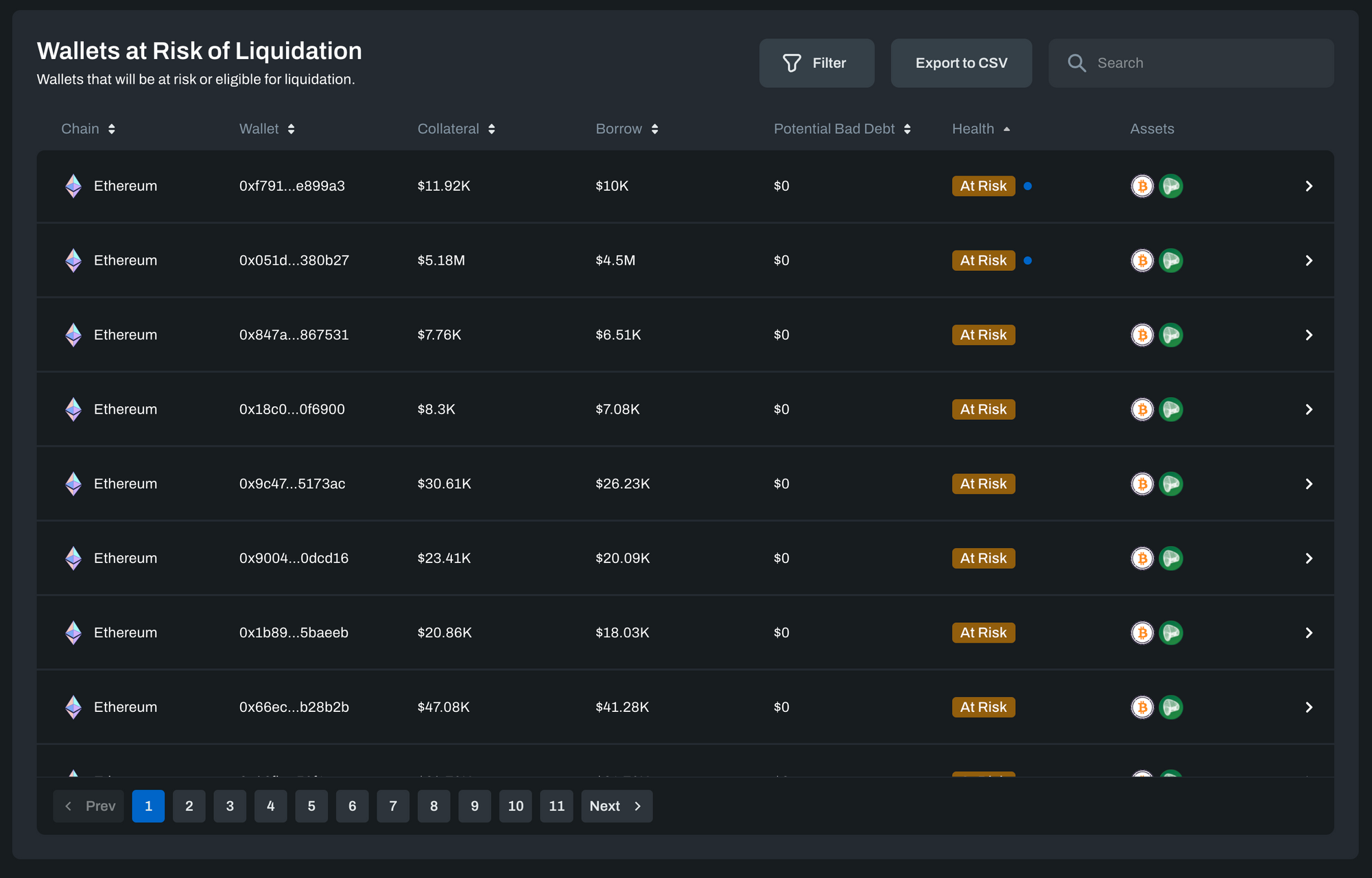

Risk Explorer

Risk Explorer allows users to explore risk scenarios by simulating the effect of sudden token price changes on crvUSD borrow positions to stress test the protocol. It should be noted that crvUSD has various built-in mechanisms to protect borrowers against collateral price movements - detailed information on price oracles and other LLAMMA dynamics is available in this article. As a result, positions may withstand significant price drops over time.

Risk Explorer simulates the effect of an extreme market condition of sudden and instant change in collateral price rather than a gradual one. In such a scenario, position collateral value will drop, and some positions will be liquidated (hard liquidations).

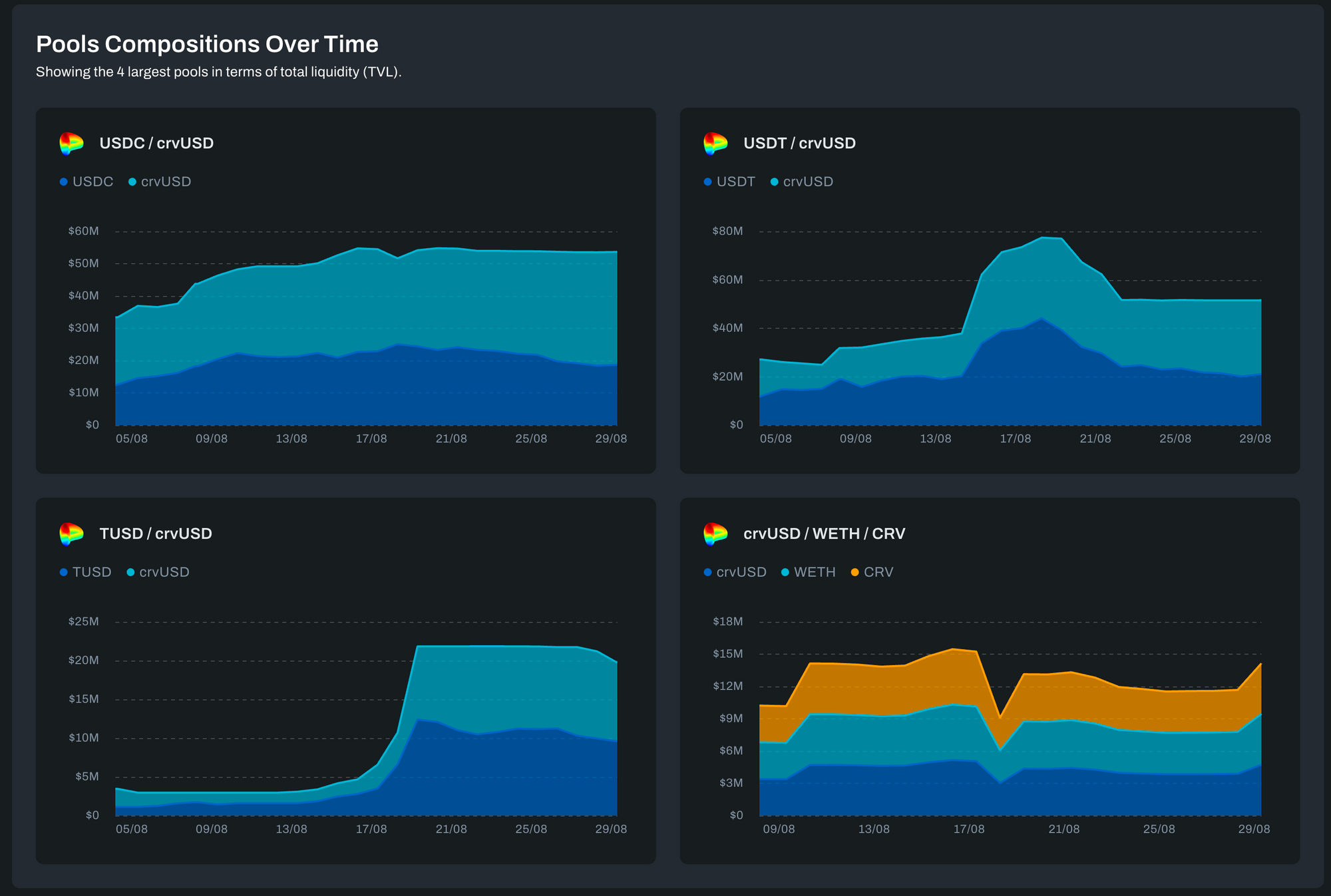

Pools

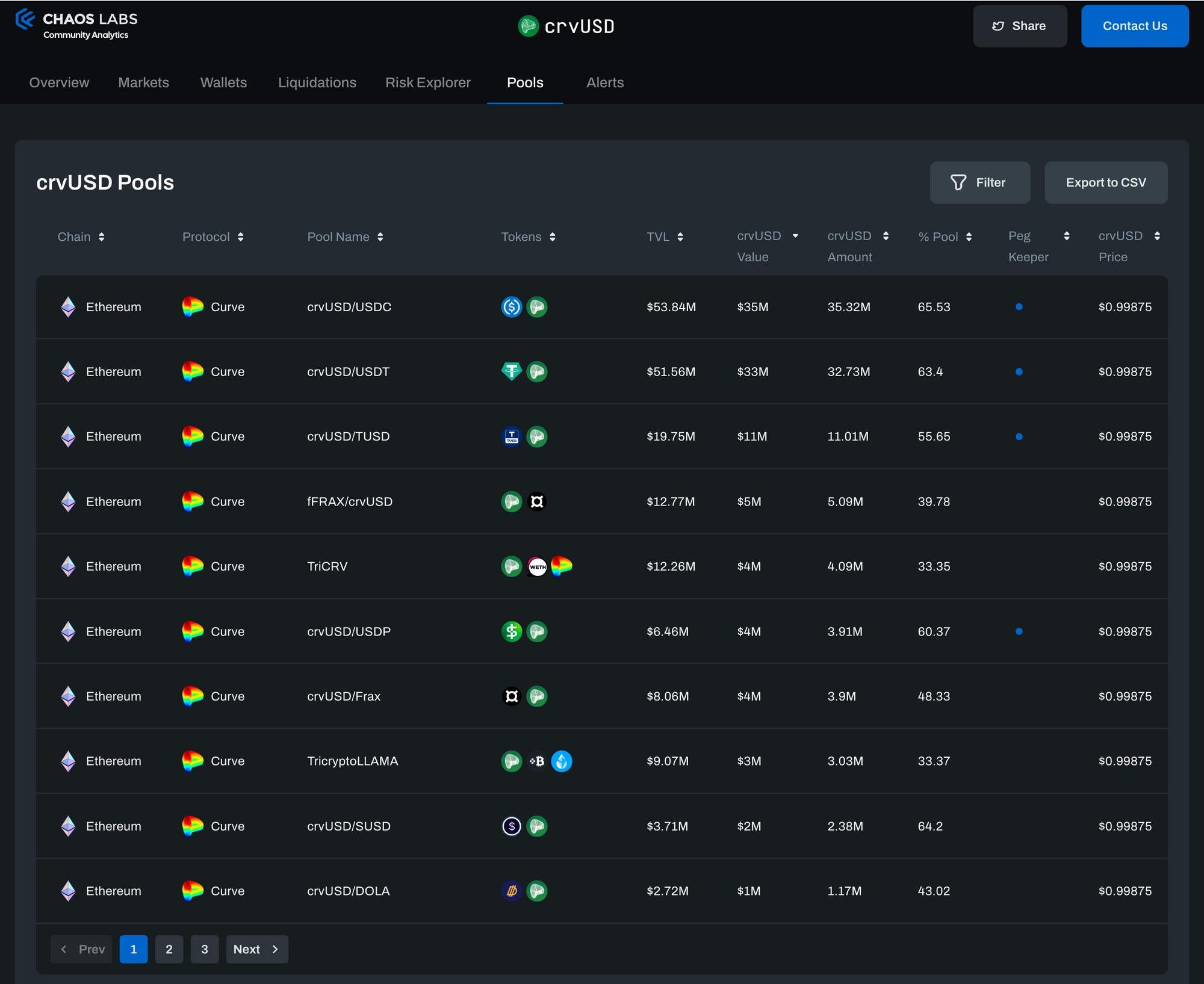

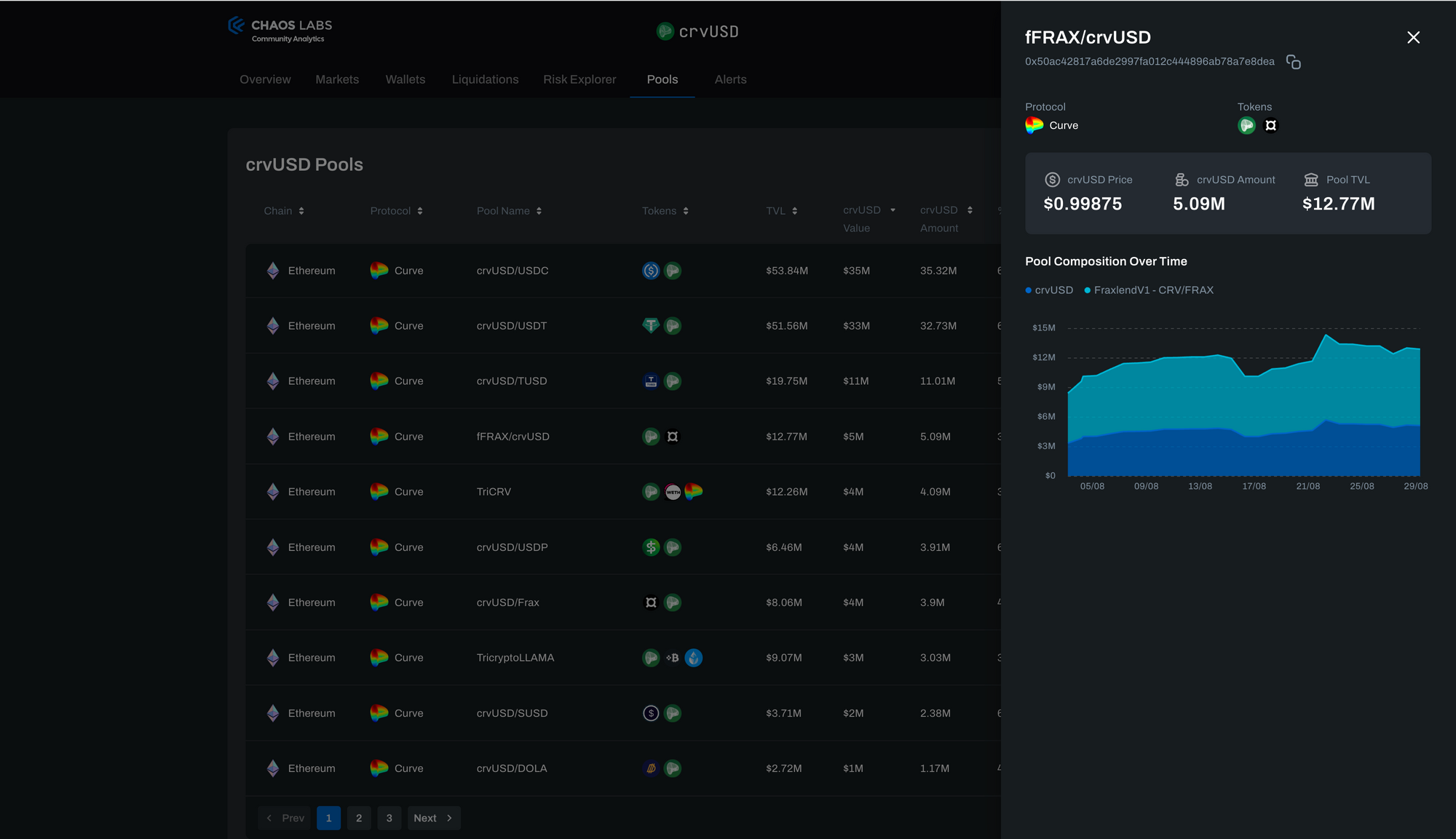

The pools page shows crvUSD liquidity pools across various decentralized exchanges (DEXes). Data for each pool includes TVL, the pool composition, ratio and amount of crvUSD in the pool, and the crvUSD price in the pool (in USD).

Clicking on any pool opens the pool information panel, showing the pool composition over time.

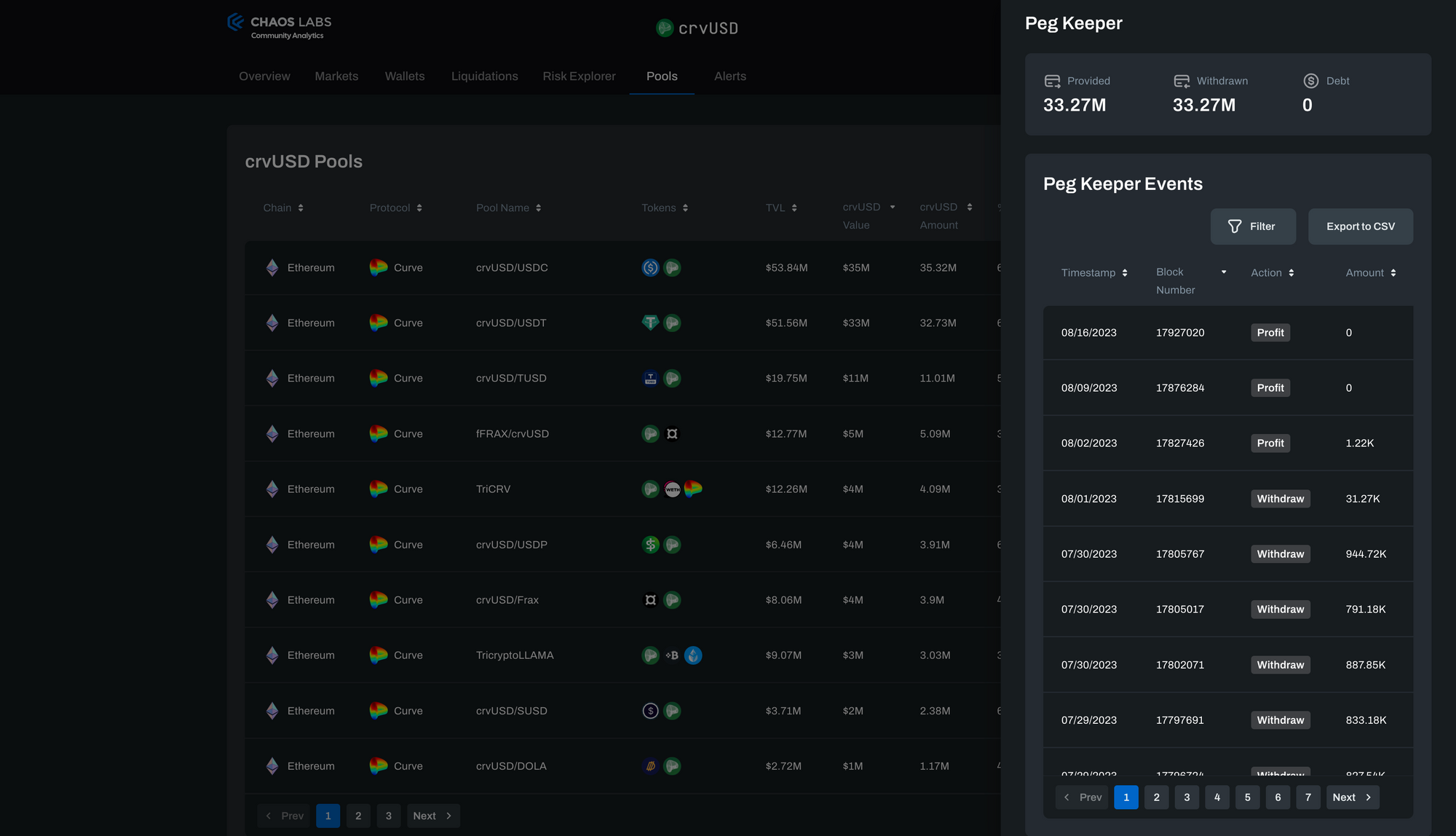

Peg Keepers

Peg Keepers are contracts that help stabilize the peg of crvUSD. They are allocated a specific amount of crvUSD to secure the peg. Each peg keeper is assigned to a specific pool. The underlying actions of the PegKeepers can be divided into two actions:

- crvUSD price > 1: The PegKeeper mints and deposits crvUSD single-sided into the pool to which it is linked. This increases the supply of crvUSD in the pool, decreasing the price.

- crvUSD price < 1: PegKeepers, if they hold a balance of the corresponding LP token, can withdraw and burn crvUSD from the liquidity pool. This action reduces the supply of crvUSD in the pool and should subsequently increase its price.

The pools table shows an indication to mark pools to which a Peg Keeper is linked; clicking on any Peg Keeper pool opens the pool information panel showing aggregated and historical data about the peg keeper, including the sum of tokens provided, withdrawn, and any debt, as well as recent events.

Alerts Center

The alerts tab offers real-time notifications on crvUSD. Each alert links to the corresponding account detail or market detail pages.

It is possible to filter alerts by severity, type, date, and relevant assets; multiple filters can be combined to zoom in on specific areas and risk scenarios.

Clicking on any specific alert opens the detailed information panel, with all information about that alert showing as an overlay on top of the table to avoid losing and pagination or filtering context when browsing over alerts.

Summary & Next Steps

We are excited to share this new crvUSD Risk Monitoring platform with the Curve community and look forward to hearing your thoughts and opinions about it. Please share your feedback, suggestions, and experiences with the new platform using the Contact Us button on the product header. Your input directly contributes to our ongoing improvement efforts and helps us tailor our products to meet your needs better.

The Role of Oracle Security in the DeFi Derivatives Market With Chainlink and GMX

The DeFi derivatives market is rapidly evolving, thanks to low-cost and high-throughput blockchains like Arbitrum. Minimal gas fees and short time-to-finality make possible an optimized on-chain trading experience like the one GMX offers. This innovation sets the stage for what we anticipate to be a period of explosive growth in this sector.

Uniswap V3 TWAP: Assessing TWAP Market Risk

Assessing the likelihood and feasibility of manipulating Uniswap's V3 TWAP oracles, focusing on the worst-case scenario for low liquidity assets.

Risk Less.

Know More.

Get priority access to the most powerful financial intelligence tool on the market.