dYdX Chain: End of Season 1 Launch Incentive Analysis

Overview

Chaos Labs is pleased to provide a comprehensive review of the first trading season on the dYdX Chain. This analysis encompasses all facets of exchange performance, emphasizing the influence of the Launch Incentive Program.

We are diligently fine-tuning the incentives, ensuring they effectively meet their intended goals. By monitoring a broad spectrum of indicators, we aim to acquire a complete understanding of the dynamics and outcomes of the rewards program.

Key Stats:

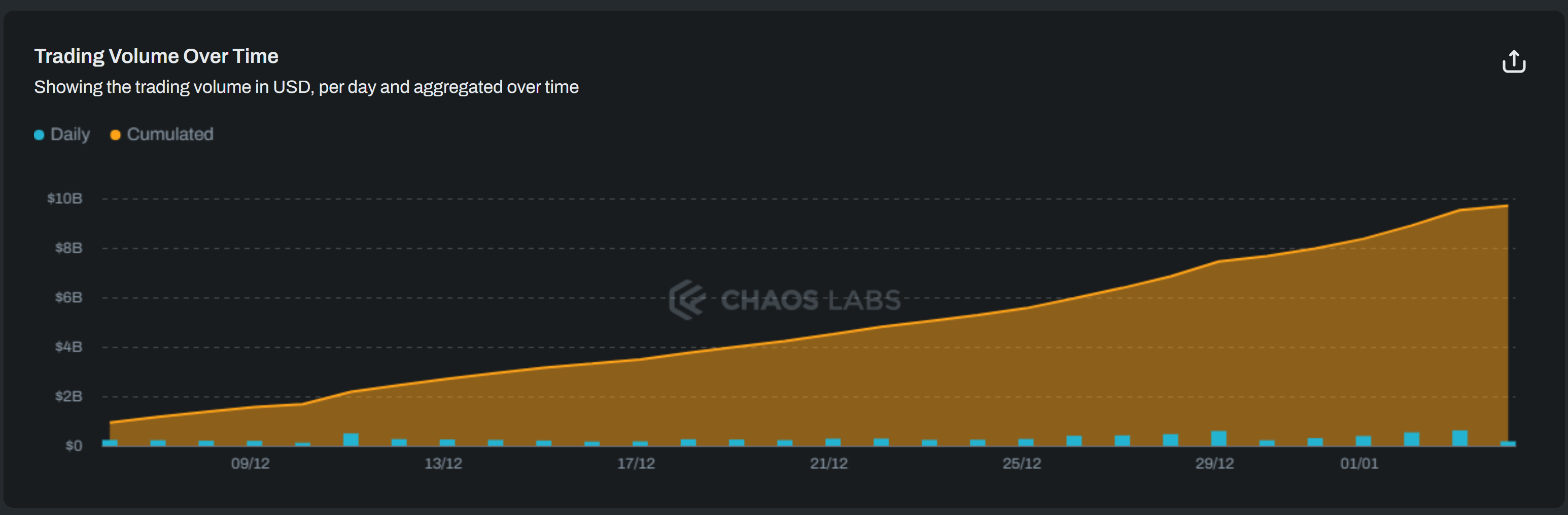

- The platform has seen more than $9.5b in trading volume spread across 34 different markets.

- Over 2265 traders and 1225 market makers are actively earning points through the Launch Incentives Program.

- To date, there have been over $19m in total liquidations, contributing approximately $100k to the insurance fund, which is now at over $1.2m.

- Since November 28th, the majority of markets have experienced positive realized funding rates.

- The dYdX Chain has attracted over 31m USDC in deposits.

dYdX Chain Trading

There has already been over $9.5 billion in trading volume across 34 markets. This compares reasonably favorably to over $34.5 billion across dYdX v3 markets over this period, $5.2 billion across GMX v2 markets during this period, and $2.3 billion on GMX v1.

The launch incentive program’s focus on rewarding traders migrating their activity to dYdX Chain early has had a significant effect as daily volumes have grown to sustain around 50% of v3 for the past 7 days.

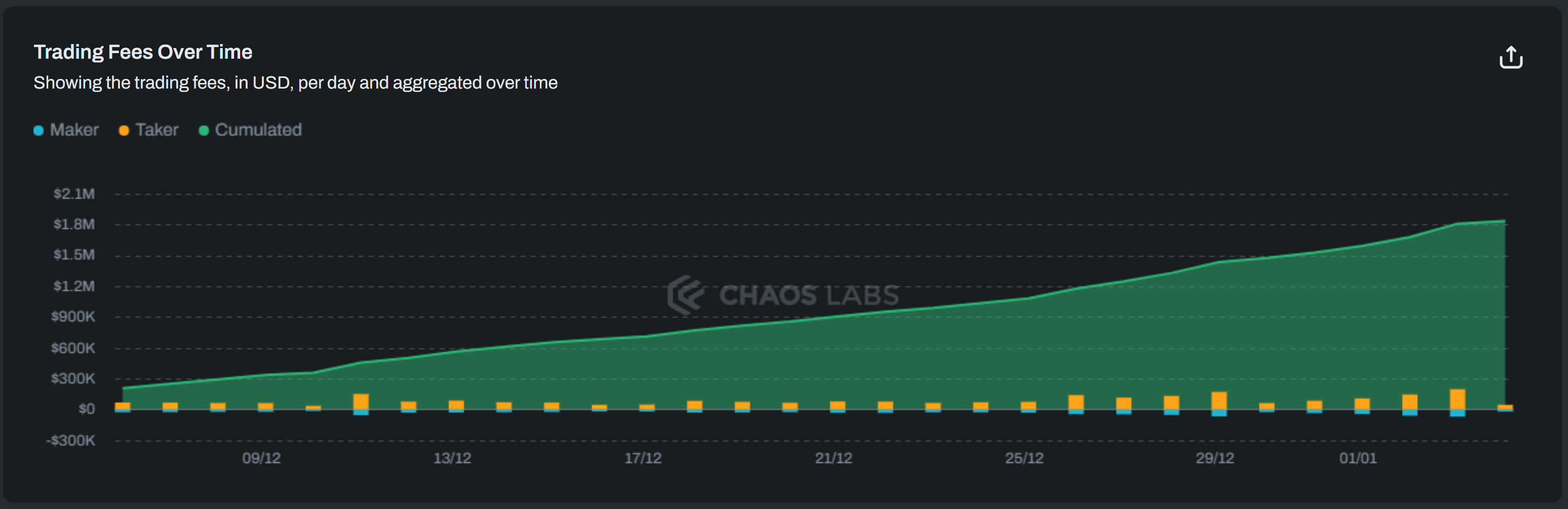

Over $1.8m in net trading fees have been paid by traders. Driving volumes and fees is the primary objective of the launch incentive program.

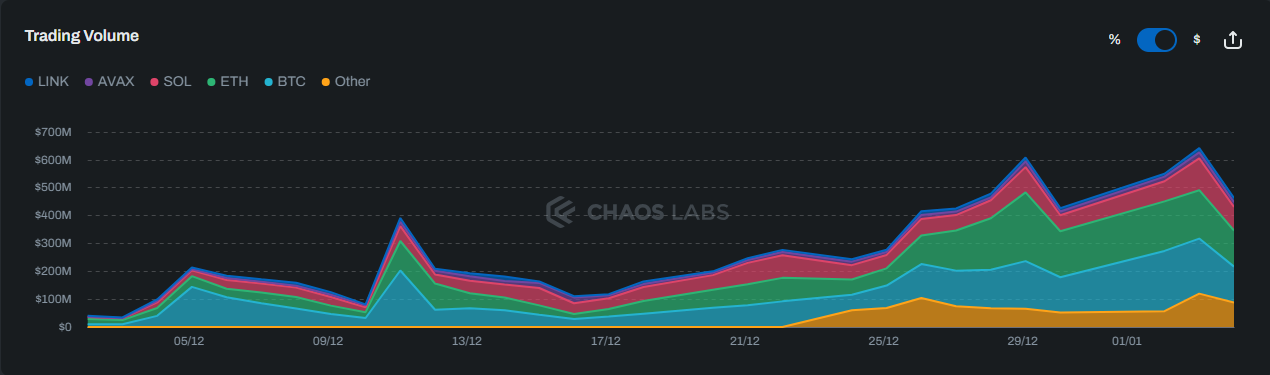

Daily open interest and volumes have both continued to grow. January 3rd recorded the highest daily volumes to date, with over $600m across all markets. Open interest also peaked that day, right before the market correction liquidated $800m in open interest. Open interest is already returning, though.

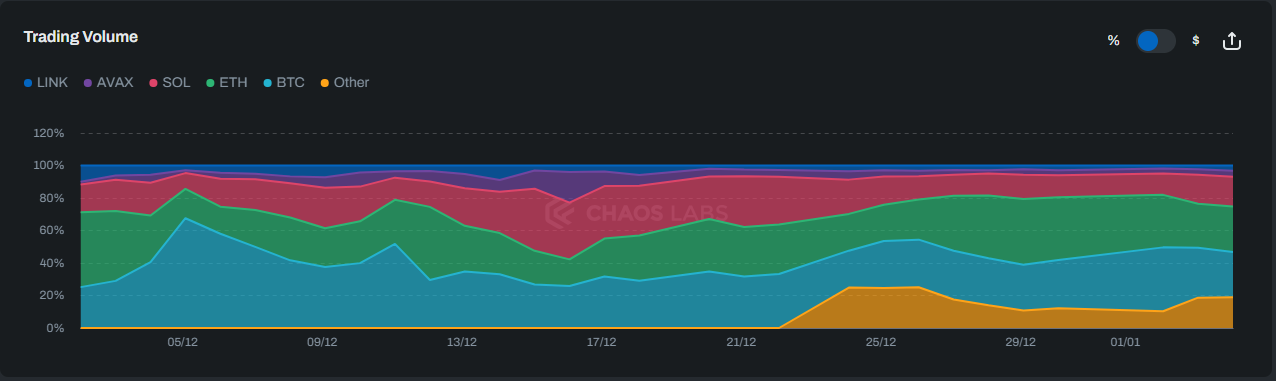

Interestingly, long-tail markets have started adding significantly to both open interest and trading volumes since our mid-season report. The share of trading volumes across the major markets now more closely resembles v3, which we interpret as a positive early sign for the migration of activity.

Season 1 Leaderboards

Leaderboards have launched with over 2,265 traders and 1225 market makers earning points already.

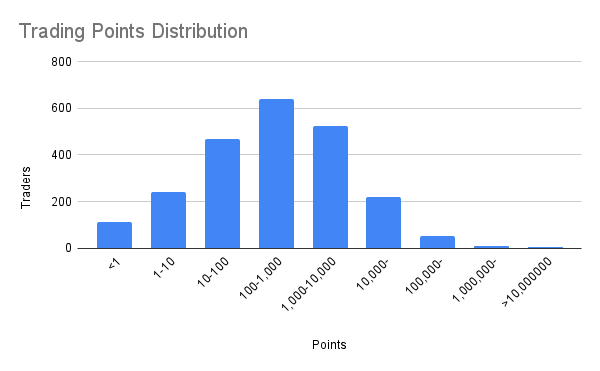

Over 118m trading points have been earned with the following distribution of points earned by bucket:

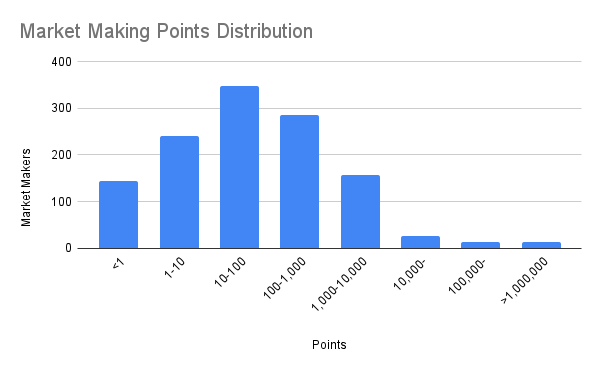

Over 30m market-making points have been earned with the following distribution of points earned by bucket:

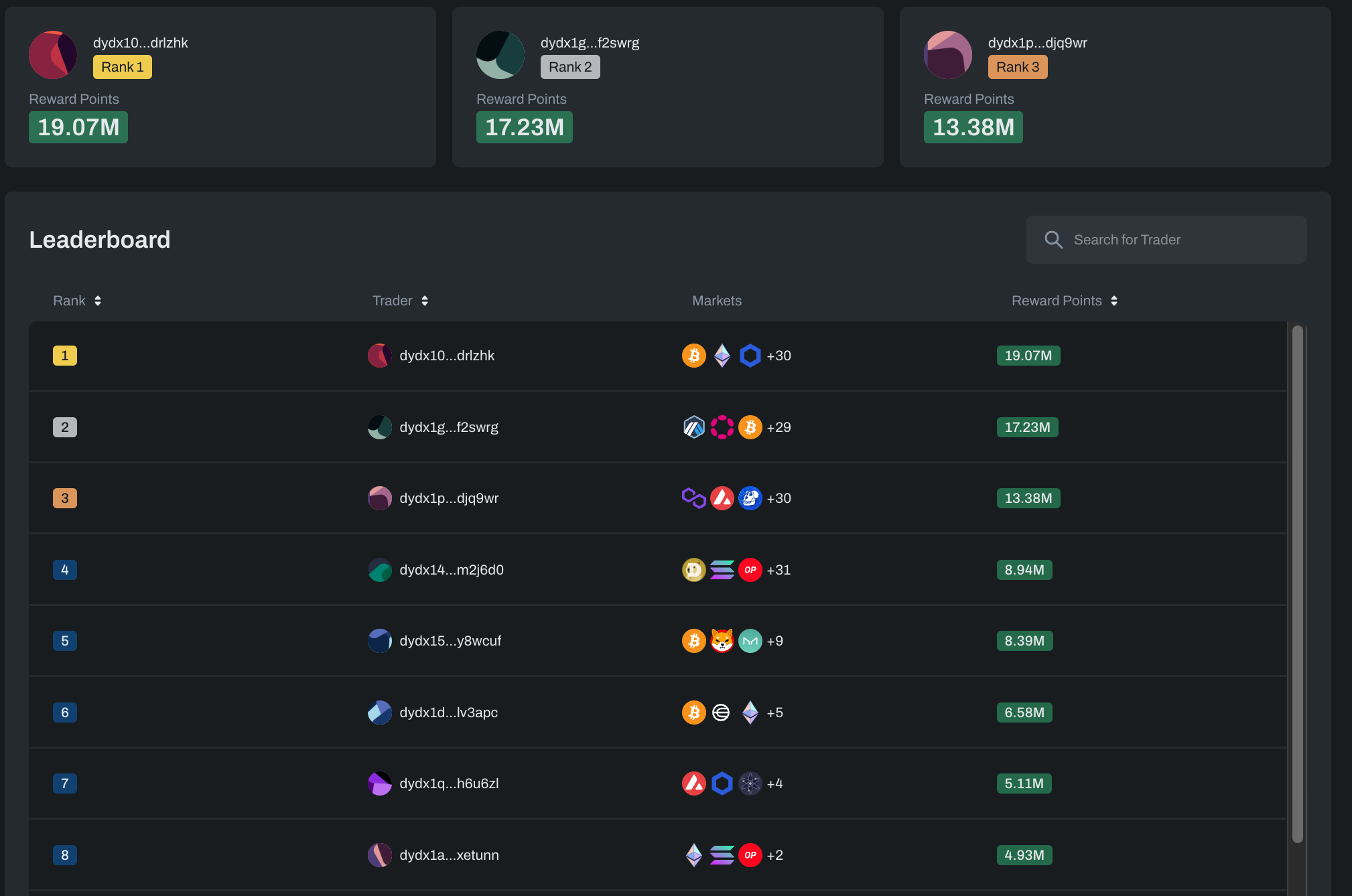

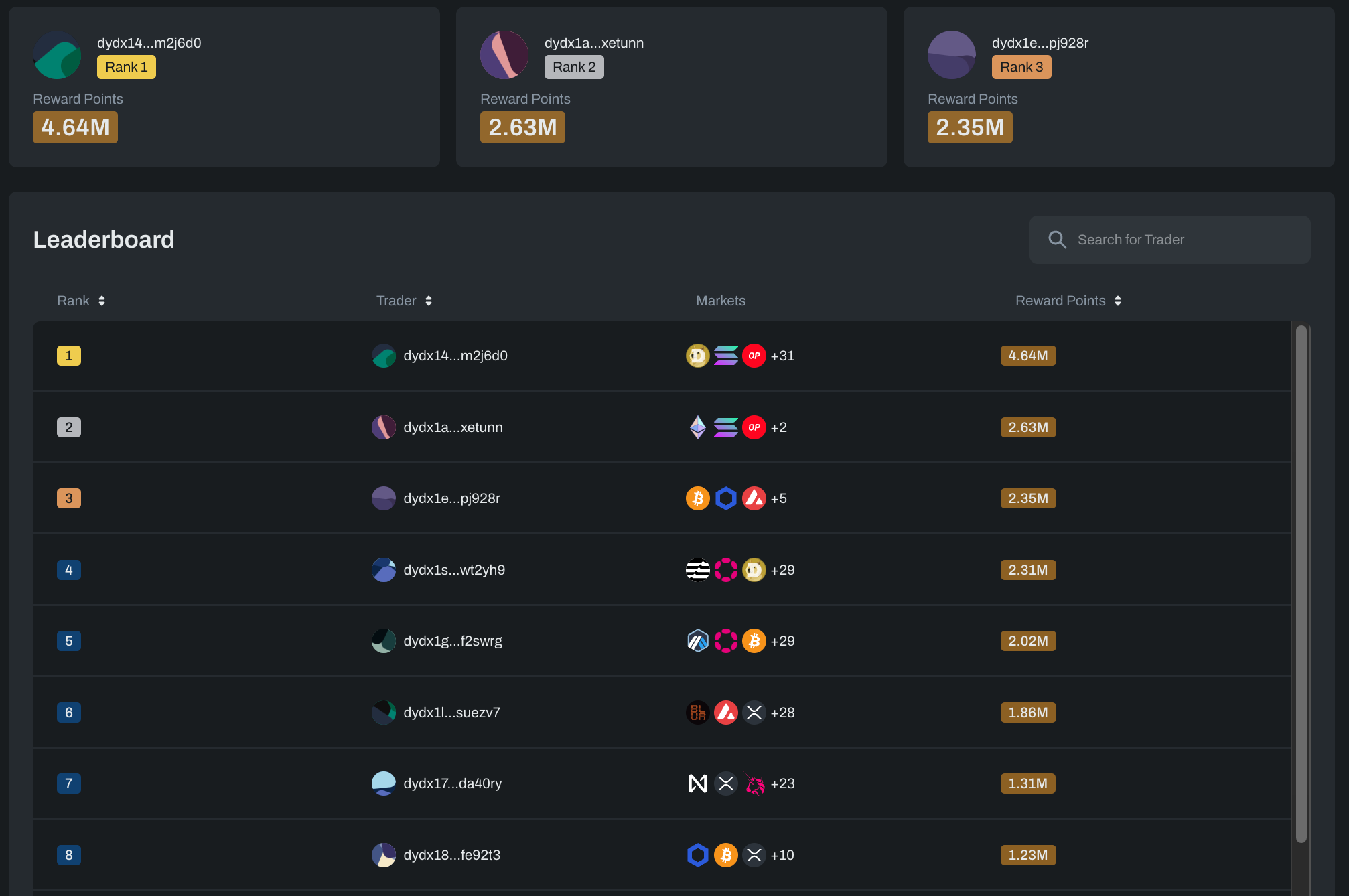

Both trading rewards and maker rewards are quite heavily dominated by the top earners. 75% of trading rewards and 67% of maker rewards have currently accrued to the 10 top accounts in each category. This is before any wash trading removal, which is covered in a separate report.

Trading Leaders

Market Making Leaders

dYdX Chain Liquidity

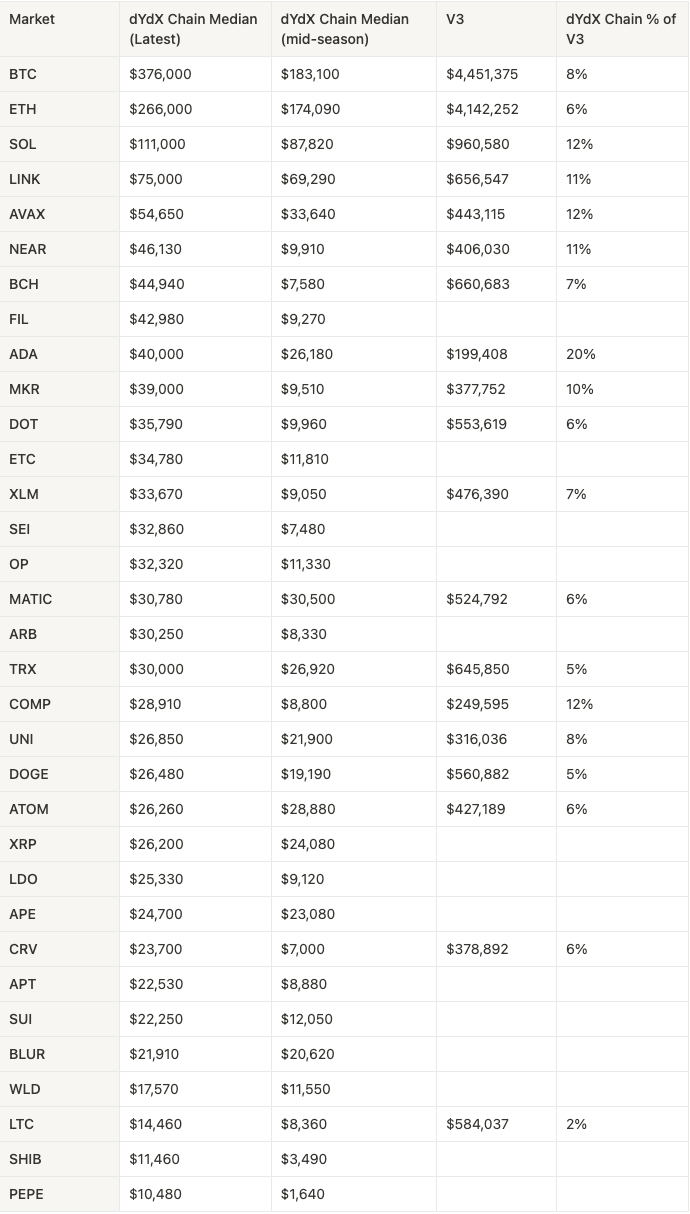

Liquidity on dYdX Chain is still bootstrapping and has a way to go before getting on par with v3 as a benchmark. The v3 liquidity benchmark is measured as the 95th percentile least observed liquidity during epoch 29, while because the dYdX Chain is expanding, the median is used as a fairer comparison.

Most markets’ order books are deeper on December 19th than the median over the season, showing growth in order book liquidity over the season.

Orderbook Liquidity within 40bps of the Mid Price

Most liquidity remains close to the touch, competing for maker volume to earn maker rewards. At this stage, most open positions outside the top three markets have been less than $100,000 meaning this is not an issue at this stage. As open interest and position sizes continue to grow, the total quantity of liquidity will need to grow, and this dynamic will continue to be monitored.

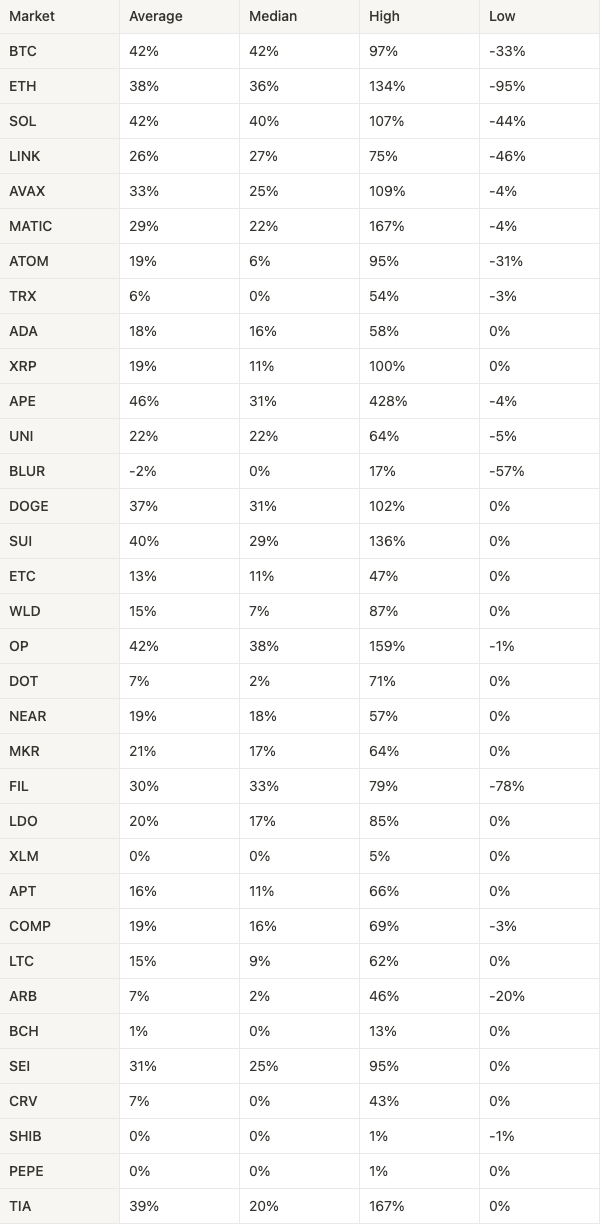

Funding

Markets have mostly traded with positive realized funding rates since November 28th. This could be a function of positive market price action over this period or due to early retail adopters having a natural long bias.

There was one instance on December 7th, where the APE market averaged over 400% funding, which took three days to resolve to the point it averaged under 100% on December 10th.

Daily Average Realized Funding Rates Annualized %

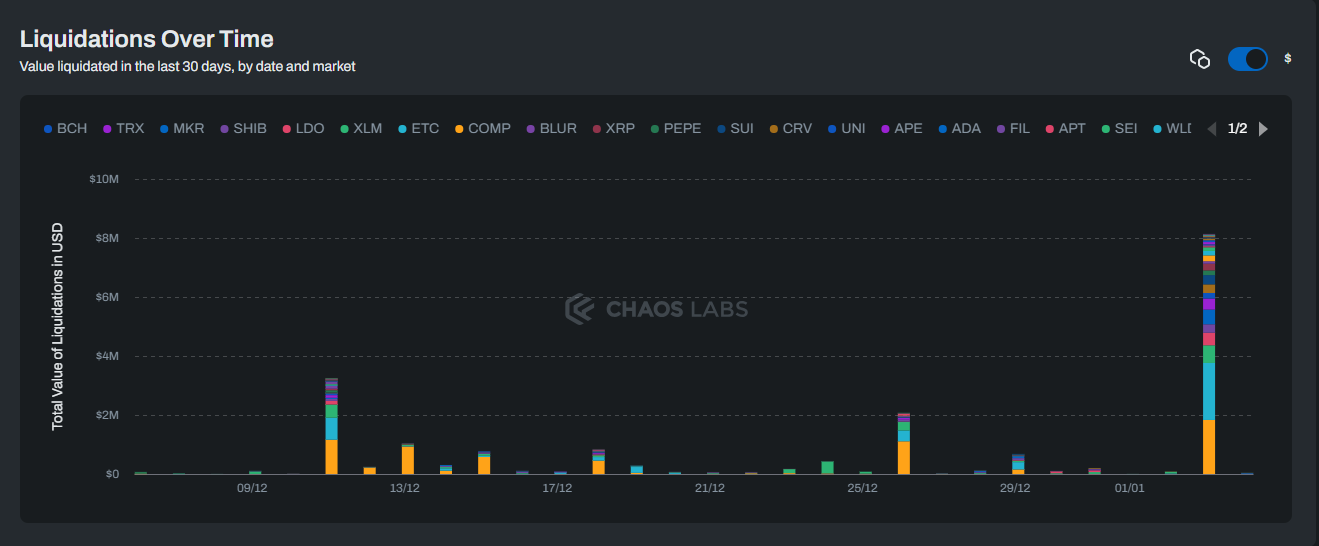

Liquidations

dYdX Chain has cleared over $19m in total liquidations so far, earning approximately $100k for the insurance fund. These were mostly long positions liquidated on December 11th and January 3rd. The insurance fund now holds over $1.2m.

TVL and Deposit Metrics

USDC deposits continue to grow, providing a potential leading indicator to further growth in trading volumes.

There are currently approximately 30m USDC deposited on the dYdX Chain, up from 18m USDC mid-season.

There is still much room to grow towards the approximately $350m TVL in dYdX v3.

Summary

We are eagerly anticipating Season 2 and the ongoing growth of the dYdX Chain! We encourage the community to keep sharing their valuable feedback, which we aim to integrate as the program moves forward.

Disclaimer

This report is for informational purposes only and does not constitute an offer to sell, a solicitation to buy, or a recommendation for any security, nor does it constitute an offer to provide investment advisory or other services by Chaos Labs. No reference to any specific security constitutes a recommendation to buy, sell, or hold that security or any additional security. Nothing in this report shall be considered a solicitation or offer to buy or sell any security, future, option, or other financial instrument or offer or provide investment advice or service to any person in any jurisdiction. Nothing contained in this report constitutes investment advice or offers any opinion with respect to the suitability of any security, and the views expressed in this report should not be taken as advice to buy, sell, or hold any security. The information in this report should not be relied upon for investing. In preparing the information in this report, we have not considered any particular investor's investment needs, objectives, and financial circumstances. This information has no regard for the specific investment objectives, financial situation, and particular needs of any specific recipient of this information, and the investments discussed may not be suitable for all investors. Any views expressed in this report were prepared based on the data available when such views were written. Changed or additional information could cause such views to change. All information is subject to possible correction. Information may quickly become unreliable, including market or economic changes.

Throughout the program, Chaos Labs' role is confined to providing recommendations regarding the allocation of rewards. The actual implementation and distribution of said rewards are subject to the formal approval process of the dYdX Chain governance votes. Any actions pertaining to reward distribution shall only be executed following affirmative governance votes within the dYdX Chain framework.

Oracle Risk and Security Standards: An Introduction (Pt. 1)

Chaos Labs is open-sourcing our Oracle Risk and Security Standards Framework to improve industry-wide risk and security posture and reduce protocol attacks and failures. Our Oracle Framework is the inspiration for our Oracle Risk and Security Platform. It was developed as part of our work leading, assessing, and auditing Oracles for top DeFi protocols.

sBNB Oracle Exploit Post Mortem

Chaos Labs summarizes the snBNB oracle exploit affecting the Venus LST Isolated Pool. The post-mortem focuses on the event analysis and risk management efforts following the exploit.

Risk Less.

Know More.

Get priority access to the most powerful financial intelligence tool on the market.