dYdX Chain: Launch Incentives Season 3 Mid-Season Review

Summary

Chaos Labs presents this mid-season review of the third season of full trading on the dYdX Chain. All aspects of the exchange performance are covered with a focus on the impact of the launch Incentives Program.

Incentives continue to be closely monitored and tailored to specifically target their objectives as efficiently as possible. A wide range of indicators are tracked to gain holistic insights into the cause and effect of the rewards program.

Key Stats:

- $28bn trading volume over the first 21 days of season 3, up 117% on the same period in season 2.

- Cumulative trading volume of over $70bn on the dYdX Chain since launch.

- Over $265m in open interest, up almost 3x since the beginning of the season.

- There are 3,879 traders earning points in season 3 in the Launch Incentive Program.

- Over $140m in TVL, up from $57m at the beginning of the season.

- 16 new markets launched during season 3 so far.

dYdX Chain Trading

Volumes

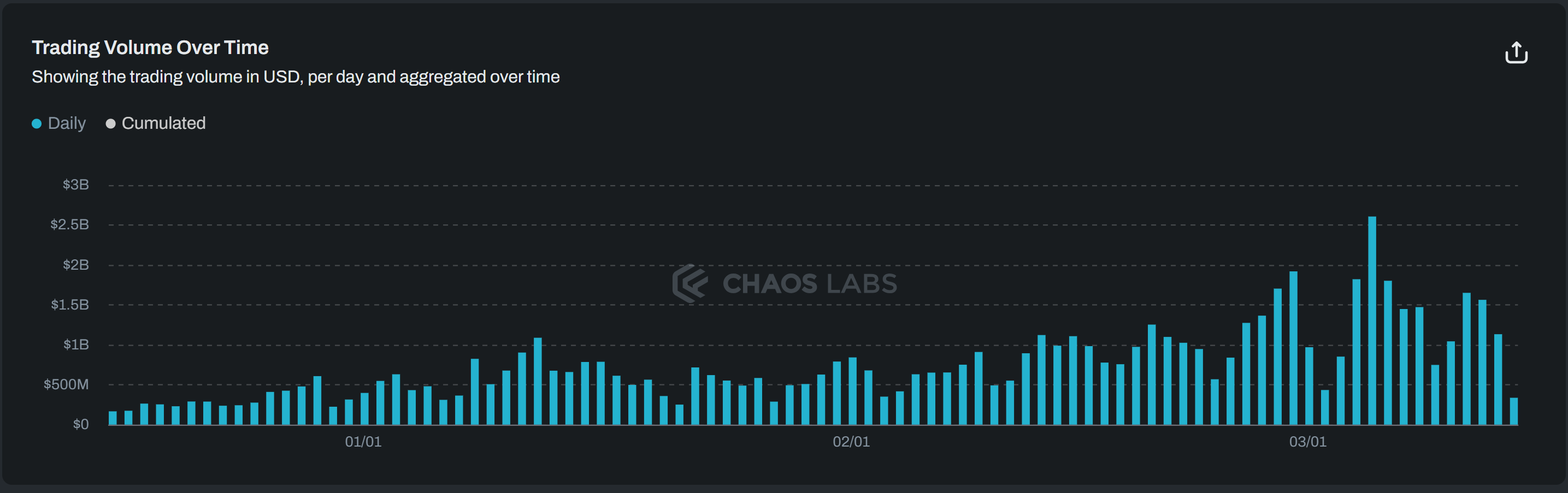

There has been over $28bn in trading volume across the 55 live markets in season 3 so far, up 118% from the same period in season 2. The busiest day exceeded $2.5bn on 5 March.

The launch incentive program’s focus on rewarding traders migrating their activity to the dYdX Chain early has had a significant effect as daily volumes have continued to trend higher.

Open Interest

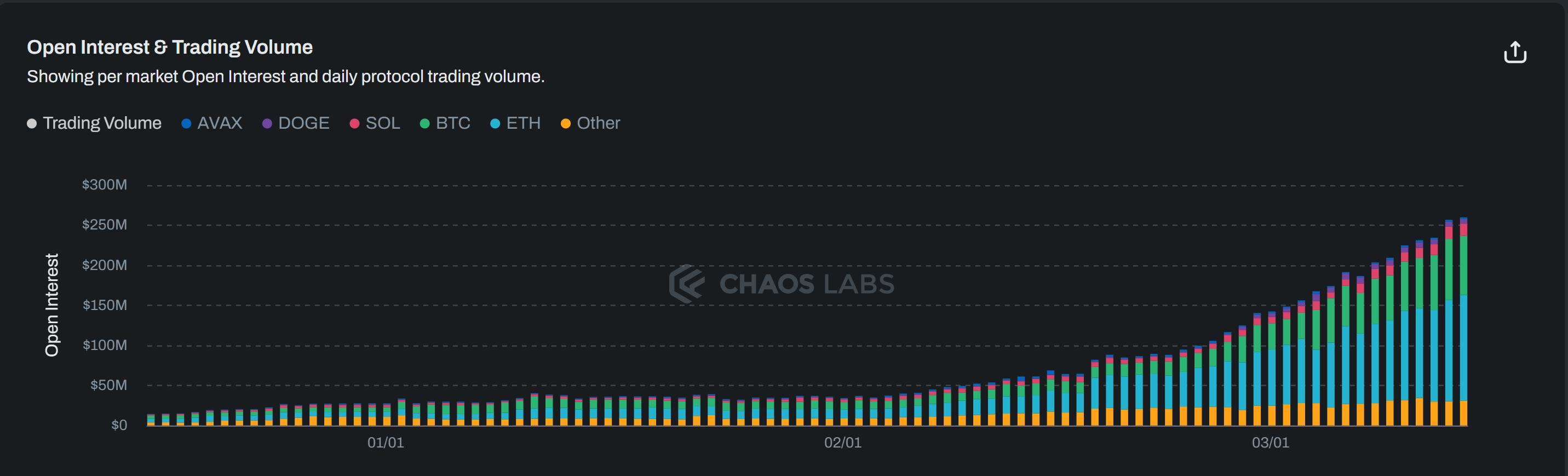

A major feature of season 3 of the Launch Incentive Program has been the growth in open interest on the dYdX Chain. Open Interest has grown by almost 3x from $90m to $266m over three weeks.

Most of this growth has come in the major ETH, BTC, and SOL markets.

Fees

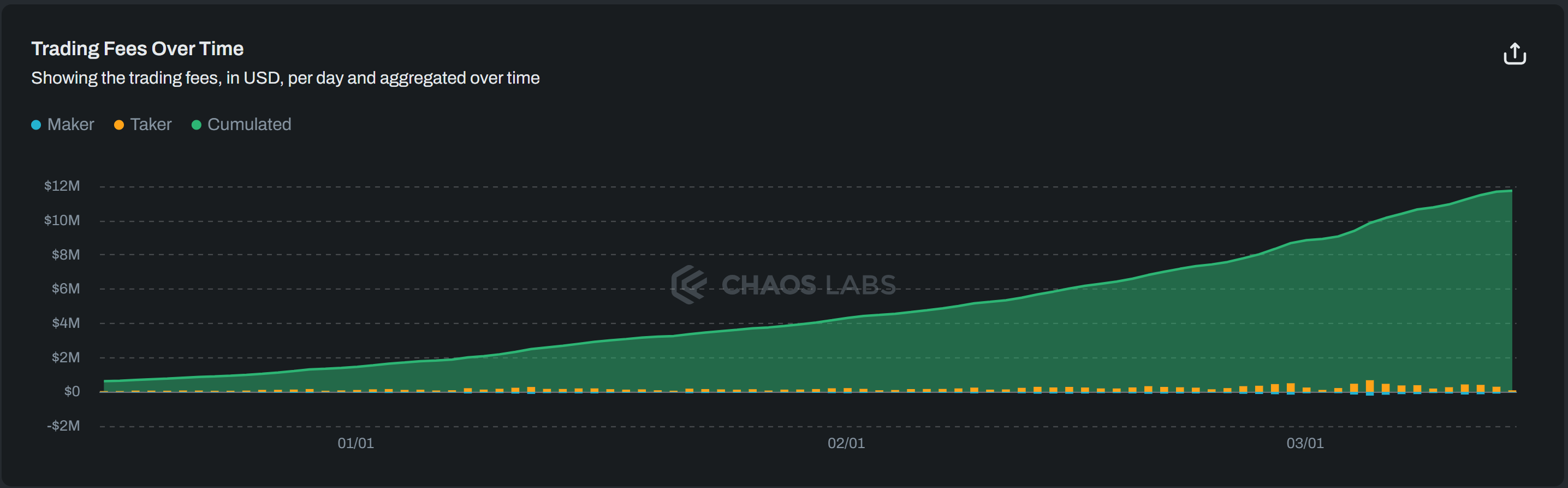

Almost $12m in fees have been distributed to stakers on the dYdX Chain since launch. $4.6m of this has come in season 3 so far.

Markets

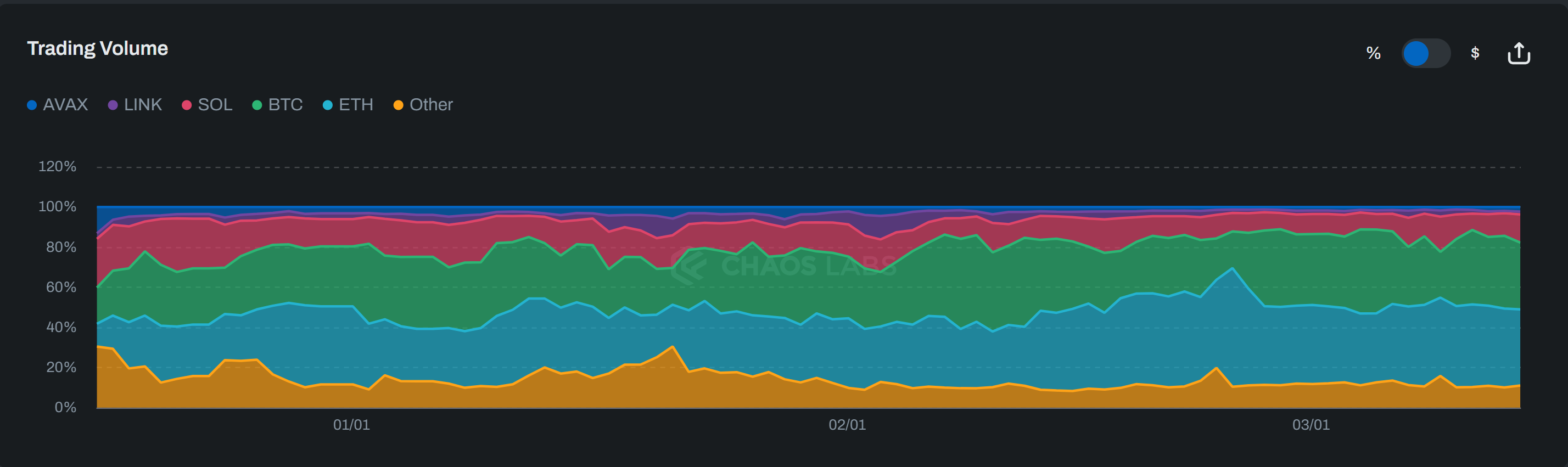

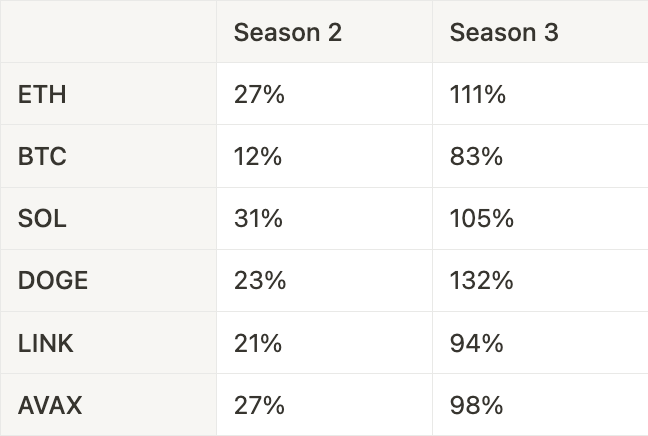

The distribution of trading volume by market typically follows market sentiment and attention. This season, we’ve seen a gradual shift from AVAX and SOL towards EH and BTC activity.

Season 3 Leagues

And there have been some incredible trading performances in the leagues. The leagues are intended to motivate traders to invest their time and energy into improving their trading performance. This leads to them gaining more enjoyment and utility from the dYdX Chain. Below we provide trading league overviews:

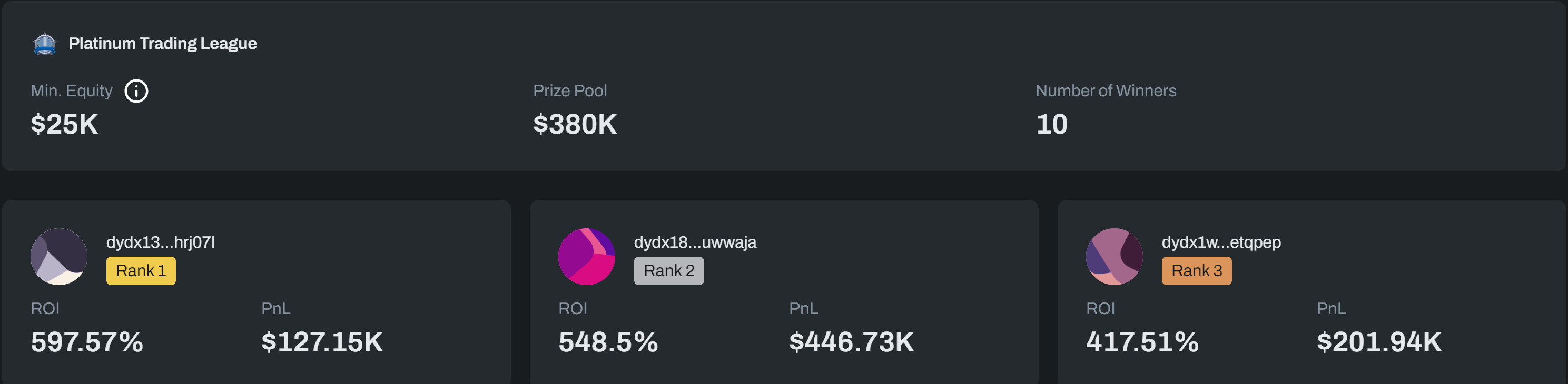

Platinum League

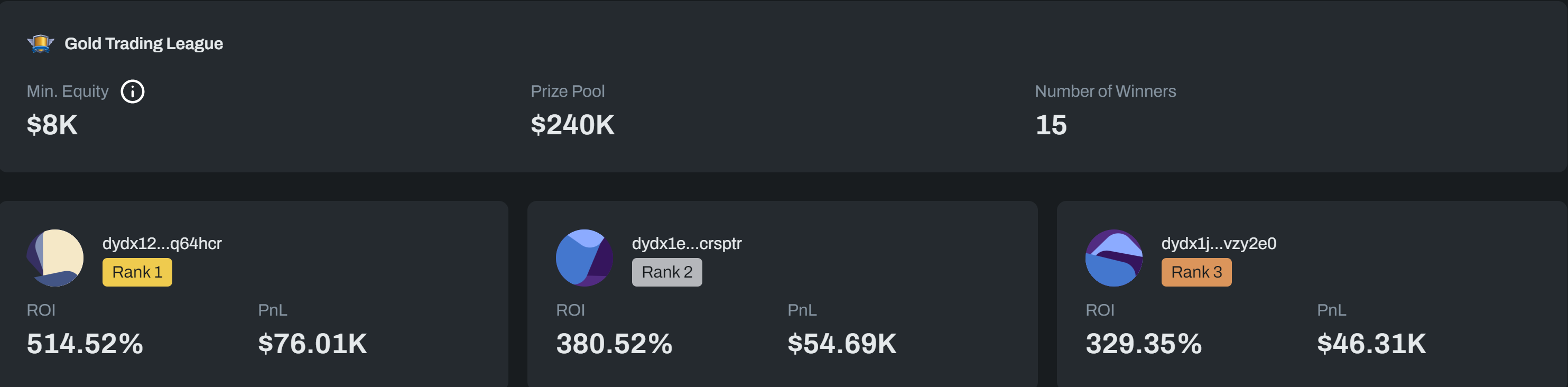

Gold League

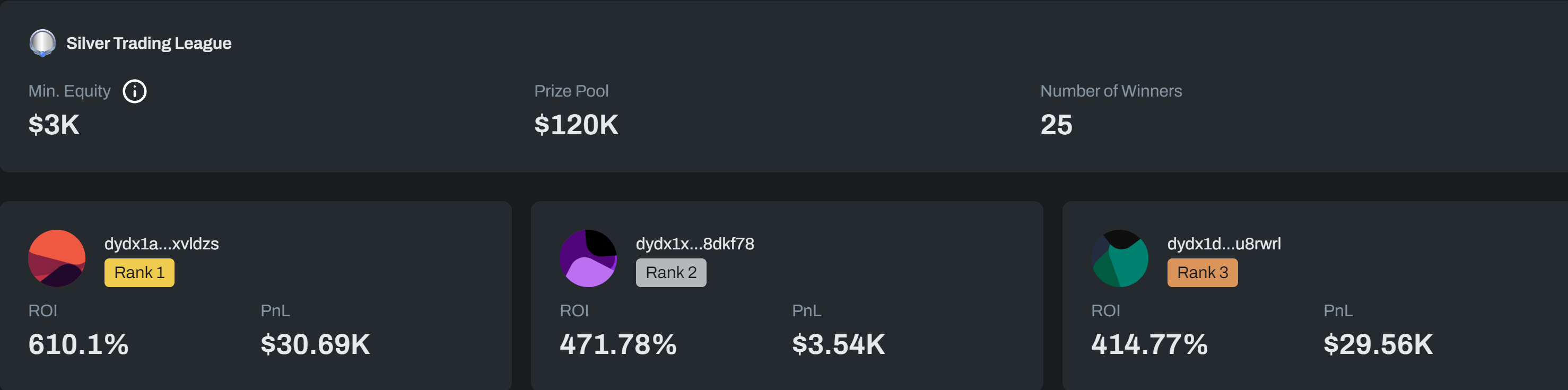

Silver League

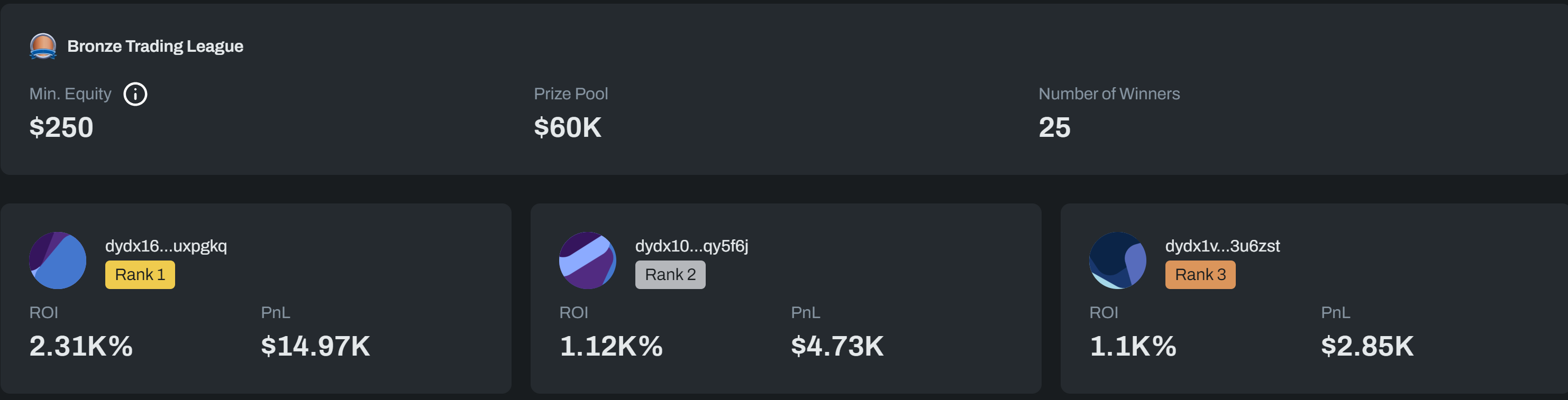

Bronze League

New Markets

There have been 16 new markets added by community members already during season 3 of the launch incentive program, with a further two currently being voted on for inclusion.

- EOS

- ICP

- STRK

- PYTH

- AGIX

- STX

- IMX

- ALGO

- DYM

- FET

- WOO

- BONK

- RNDR

- INJ

- HBAR

- GRT

It is encouraging to note that two of the new markets added last season, TIA and AAVE, now take up the top 10 markets by open interest, highlighting the value of this endeavor.

Funding

Funding rates have increased significantly in the first half of season 3 across all markets. This aligns with trends more broadly across perpetual exchanges and is not a dYdX-specific phenomenon, as traders have held an extremely long bias over the season so far. This season, the hyper-growth in dYdX Chain open interest likely amplifies the impact of the market’s long-bias.

Funding Rates in the Largest dYdX Chain Markets

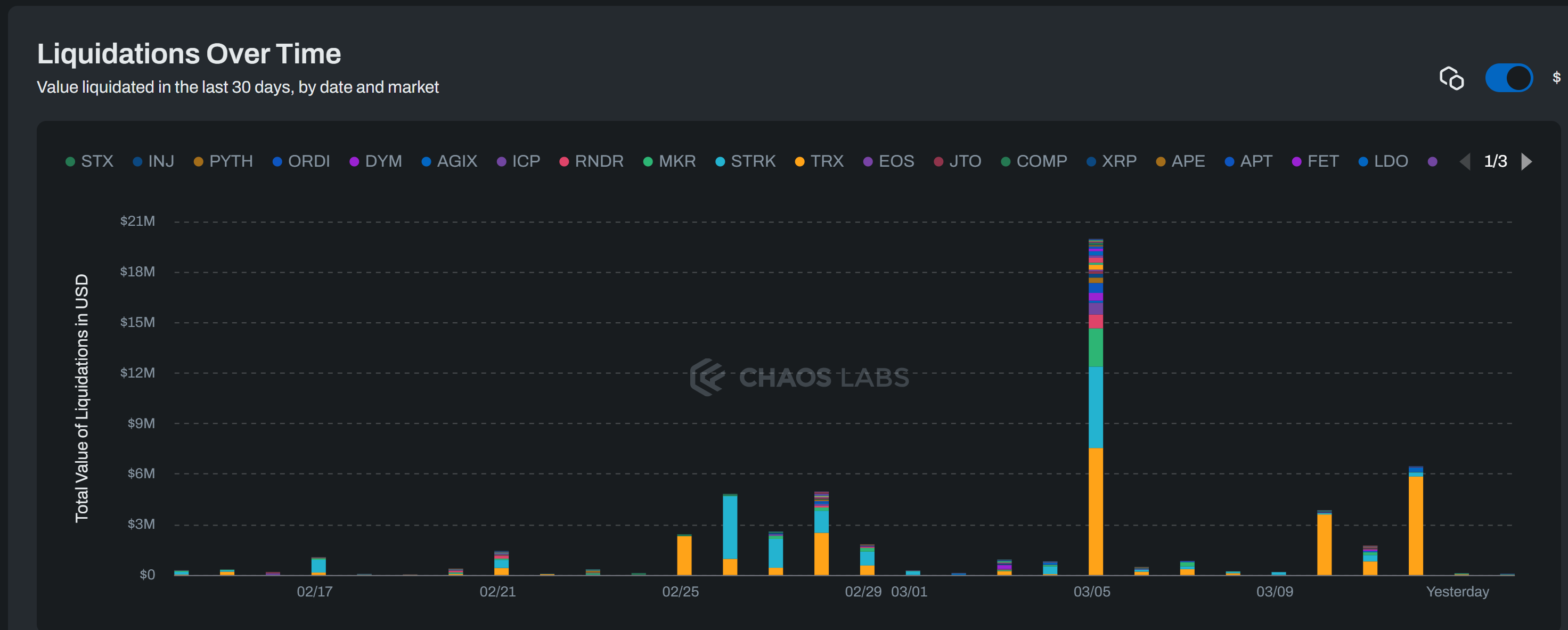

Liquidations

Around $33m of liquidations have cleared so far in season 3 of the Launch Incentive Program. The significant increase in volatility and open interest can be attributed to the increase from season 2.

These liquidations have contributed approximately $500k to the insurance fund this season so far. It now stands at $2.5m.

TVL and Deposit Metrics

The growth in USDC deposits has accelerated, providing a potential leading indicator for continued growth in trading volumes.

Total deposits on the dYdX Chain are now over $140m, up from $57m at the beginning of the season.

Given that dYdX v3 had $350m in deposits when the dYdX Chain launched, there continues to be plenty of room for TVL to grow further.

Oracle Risk and Security Standards: Network Architectures and Topologies (Pt. 2)

Oracle Network Architecture and Topologies provides a detailed examination of how Oracle Networks are structured, data’s complex journey from source to application, and the inherent security and risk considerations within these systems. Through a deep dive into architectures, the data supply chain, and network topology, readers will understand the critical components that ensure the functionality and reliability of Oracles in DeFi, providing context for the challenges and innovative solutions that define the landscape.

Oracle Risk and Security Standards: An Introduction (Pt. 1)

Chaos Labs is open-sourcing our Oracle Risk and Security Standards Framework to improve industry-wide risk and security posture and reduce protocol attacks and failures. Our Oracle Framework is the inspiration for our Oracle Risk and Security Platform. It was developed as part of our work leading, assessing, and auditing Oracles for top DeFi protocols.

Risk Less.

Know More.

Get priority access to the most powerful financial intelligence tool on the market.