dYdX Chain: A Comprehensive Overview of the Launch Incentives Program

Table of Contents

Introducing the dYdX Chain Launch Incentives Program

In a move to foster early adoption and ensure a smooth transition to the new dYdX Chain, Chaos Labs, in collaboration with dYdX Governance, is launching a $20 million liquidity incentives program. The dYdX Chain Launch Incentives Program, approved by the dYdX Governance via Snapshot and an on-chain vote, is tailored to expand and transition the current dYdX user base to the new protocol, emphasizing the importance of liquidity and efficient migration for the success of the dYdX Chain.

The Structure of the Program

This program spans approximately six months and is designed to encourage a diverse range of participants to migrate and engage with the dYdX Chain. Our approach involves specific objectives for different user groups, each crafted to maximize the program's effectiveness.

Incentives for Traders

Traders are at the core of this program. Rewards are based on the level of trading activity, gauged by the trading fees paid. We're also introducing a performance-based component structured to foster healthy competition and encourage participation across various levels of trading experience.

Market Maker Incentives

Recognizing the pivotal role of market makers in ensuring liquidity, the program includes specific incentives for those who exceed a maker volume threshold of 0.25%. These incentives are structured to encourage a competitive environment among market makers, leading to tighter market spreads and more robust liquidity. Risk management is also a focus in this segment, with liquidation flows incentivized more, de-risking the protocol and leaving liquidated traders with more margin due to less liquidation slippage.

Addressing Wash Trading

Maintaining the integrity of the program is paramount. Chaos Labs will deploy a proprietary algorithm at the end of each trading season to address potential wash trading. This measure aims to identify and disqualify any participants engaged in such practices, ensuring the rewards are allocated to genuine participants.

The Broader Impact

The dYdX Chain Launch Incentives Program is more than an initiative to boost early adoption. It's a strategic move to enhance the platform's market position and support the growth of the perpetual futures market. Through this program, we aim to build a stronger, more dynamic community around the dYdX Chain, setting the stage for its long-term success.

Objectives of the dYdX Chain Launch Incentives Program

Bootstrap Liquidity on dYdX Chain

A crucial short-term goal is encouraging market makers to prioritize the dYdX Chain, enhancing the trading experience through tighter spreads and larger trade sizes. We aim to promptly integrate their services with our exchange by incentivizing market makers for six months. This will mitigate risk by stabilizing markets, maintaining low funding rates, and facilitating efficient liquidations.

Bootstrap Staked DYDX

Securing the dYdX chain is essential, with trading activity directly influencing staking APYs and attracting more stakes. While this objective currently holds a 0% weight in direct incentives, adjustments may be considered based on the effectiveness of the existing mechanisms.

Governance

In the current framework, dYdX Chain validators hold governance power on behalf of stakers. While stakers have the option to override their validators' votes, we assume that those who do not actively vote are less likely to engage meaningfully with governance issues. Although currently, there are no direct incentives allocated to this objective, governance-related developments such as the potential introduction of a governance delegate program warrant a reassessment of the incentive structures in this area.

Efficient Rewards Distribution

A key focus is to minimize rewards that might be exploited by strategies not aligned with the long-term success of dYdX Chain, such as wash trading or volume pumping at the end of a trading season.

Wash trading is defined as creating a false impression of market activity by performing trades without taking on market risk, such as offsetting trades between multiple accounts held by the same or related parties.

These activities, while boosting short-term numbers, do not contribute to the platform's sustainable growth and should be discouraged. Our approach aims to maximize the efficiency of rewards, directing them towards users genuinely engaged with the product.

Principles Guiding the dYdX Chain Launch Incentives Program

The dYdX Chain Launch Incentives Program is built upon a set of core principles, each designed to ensure that the program aligns with the strategic objectives of the platform and addresses the needs of its diverse user base. These principles are fundamental to designing and implementing the incentives, ensuring they are fair, effective, and beneficial for the dYdX Chain ecosystem.

Neutrality in Trading Activity

A fundamental principle of the dYdX Chain is to remain neutral regarding where trading activity occurs. The platform must support traders utilizing the product to maximize their value without bias towards specific markets or trading strategies. This neutrality extends to differentiating the needs of traders engaging in perpetual futures and liquidity providers who profit from market spreads. The platform’s role is to facilitate trading across all markets without preference.

Balancing Trading Volumes with Market Liquidity

While trading volumes are a crucial metric, they can sometimes underrepresent the importance of market liquidity. Sufficient liquidity is necessary across all markets to ensure efficient trading. Market makers, naturally incentivized to optimize for fees, might create disparities in liquidity, especially in less popular markets. To address this, the program includes differentiated incentives for various markets, ensuring liquidity is adequately priced, particularly in long-tail markets. This approach mitigates risks such as the failure of liquidations to clear.

Focus on Activities that Benefit the dYdX Chain

The effectiveness of the incentives program hinges on its ability to target activities that directly benefit the dYdX Chain. Each program element is purposefully designed and closely aligned with the specific activity it aims to incentivize. This targeted approach ensures that the incentives are impactful, driving meaningful engagement and adoption of the platform.

Incentives Theory Through Goal-Setting

The dYdX Chain Launch Incentives Program is grounded in the Locke & Latham theory of motivation, a renowned framework in goal setting. This theory underlines the importance of specific, measurable, and performance-related goals in driving motivation and effective incentives. The thesis suggests that goals serve to:

- Direct attention and effort toward relevant activities.

- Energize individuals with higher goals, eliciting more effort.

- Increase persistence in pursuit of objectives.

- Foster the discovery of strategies and knowledge pertinent to the task.

Application to dYdX Chain

Drawing from the above theory, we propose initial goals for the dYdX Chain Launch Incentives Program, optimized for activity within cost and risk constraints. The time-bound nature of the incentives, lasting approximately six months and divided into trading seasons, emphasizes the importance of swift action for participants seeking rewards.

Traders Goals

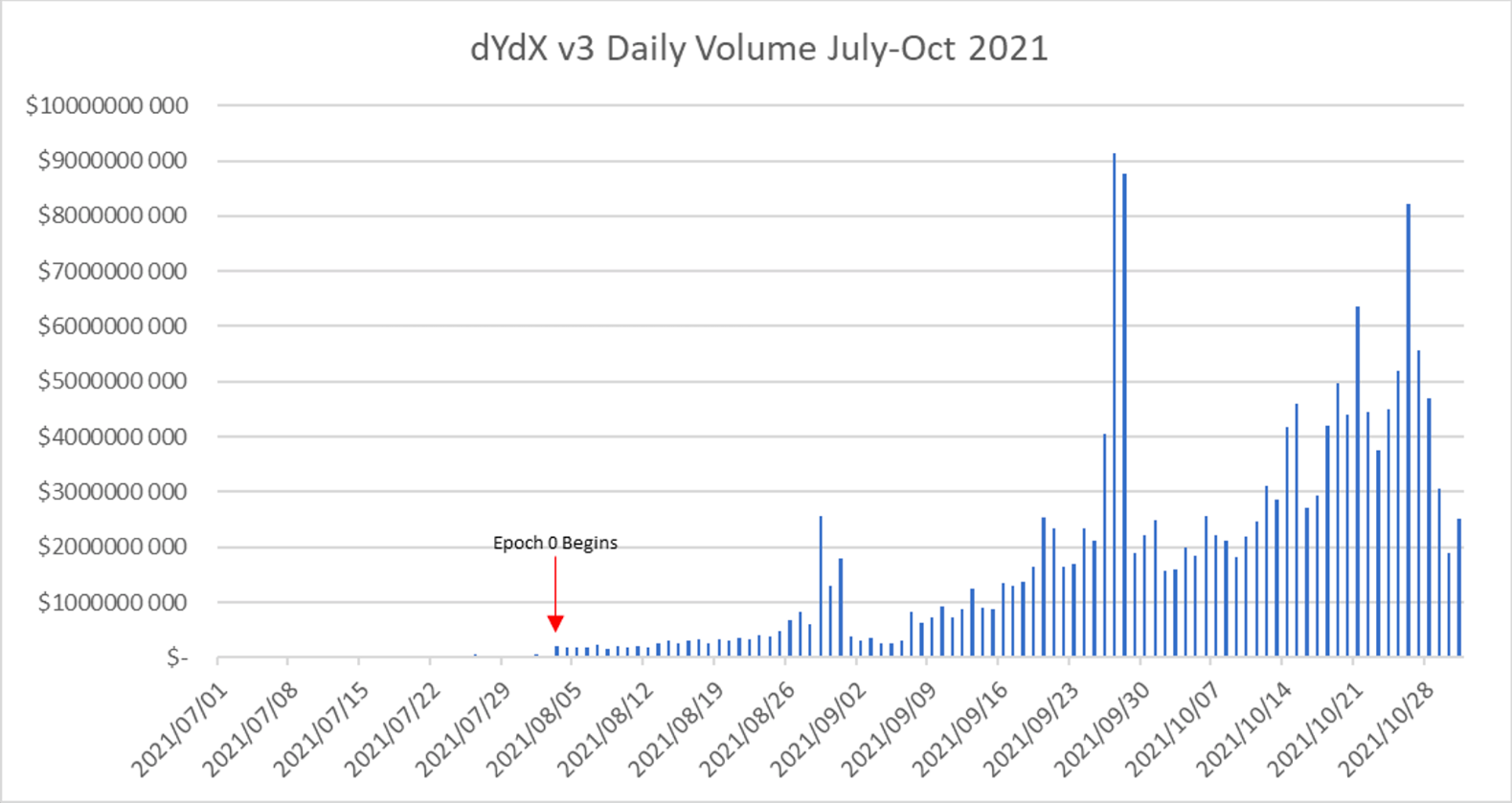

Reflecting on the success of token incentives in boosting the adoption of dYdX v3, we aim to replicate and exceed these results with the dYdX Chain.

The program focuses on two primary goals for traders:

Enhancing Profitability

Targeting the more ambitious segment of traders, we aim to incentivize improvements in trading proficiency. This approach, coupled with tiered incentives, is designed to motivate traders of all levels to invest time and effort in enhancing their skills on the dYdX Chain.

Increasing Trading Volumes

Volume-based incentives provide a clear, quantifiable target for the broader user base, mainly recreational retail traders. This strategy proved highly effective in dYdX v3 and will be a cornerstone of the dYdX Chain incentives.

Liquidity Goals

Liquidity goals are structured akin to standard corporate KPIs, focusing on increasing market efficiency and competition:

Tighter Spreads

Market makers should reduce the bid-ask spread and offer larger sizes.

Liquidity Used for Liquidations

Orderbook exchanges face the risk of bad debt when accounts are liquidated. Liquidity specifically used in liquidation flows is incentivized as another layer of protection for the protocol.

Staking Goals

Initially, the staking component of the program will not have a direct incentive weight. The focus will be monitoring the volume of DYDX staked, hypothesizing that native yield from trading fees will be sufficient to attract stakers. Adjustments, including direct incentives, may be considered based on the staking trends observed during the program.

Governance Goals

Given the current limitations in the dYdX Chain governance structure, governance goals start with zero weight. However, should some developments necessitate incentivization in this area, the program is designed to adapt and incorporate these changes.

dYdX Chain Launch Incentives: Trading Activity and Performance-Based Rewards

The dYdX Chain Launch Incentives Program is meticulously designed to reward trading activity and performance with a structured approach that encourages participation and excellence.

Trading Activity-Based Allocation

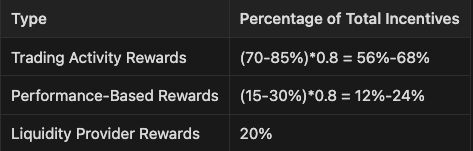

A significant portion of the incentives program’s trading rewards, totaling 70-85%, is dedicated to trading activity. This distribution method is backward-engineered to ensure that some rewards remain attractive to traders across all tiers.

Performance-Based Prizes

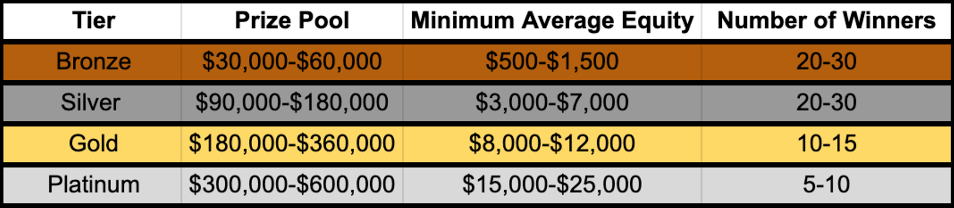

Complementing the activity-based rewards are the performance-based prizes, constituting 15-30% of the total trading rewards allocation. These prizes incentivize profitable trading, focusing on leading retail traders. Percentage returns measure performance, and the top performers in each trading season receive a share of this reward pool.

The rewards are distributed across different tiers, each with its prize pool and criteria:

The performance-based rewards will commence in the second trading season of the incentives program, allowing traders to sort themselves into tiers based on the first season's data. This approach aims to foster a competitive and rewarding environment for traders at all levels.

LP in the dYdX Chain Launch Incentives Program

The liquidity provision allocation of the dYdX Chain Launch Incentives Program is designed to supplement the existing rebate program, focusing on rewarding activities underpriced by purely volume-based measures. The goal is to motivate market makers to integrate their infrastructure with the dYdX Chain by recognizing and compensating valuable liquidity-providing activities.

Target Audience

This component of the rewards program is intended for professional liquidity providers and applies only to accounts constituting over 0.25% of maker volume in a trading season.

Approach to Liquidity Rewards

The program primarily uses maker volume as a basis for rewards, promoting competition among market makers to provide liquidity. However, it also acknowledges that certain market-making activities, especially those involving higher risk or being of more excellent value to dYdX Chain, may not adequately compensate by volume alone. To address this, the program applies weighted factors to certain types of liquidity:

- Liquidity Used for Liquidations: The program encourages market makers to compete to fulfill liquidation orders.

- Liquidity in Smaller, Less Active, or Developing Markets: To ensure the safe operation of all markets, the program includes fixed rewards to correct potential under-allocation in specific markets. This is specifically intended to bootstrap market liquidity to a minimum threshold and not to subsidize liquidity in markets that do not demand it over the long term.

The initial allocation of weights for each category is set at 80% for trading activity and 20% for market maker activity, with stakes and governance currently holding a 0% weight. However, this distribution is subject to ongoing evaluation and may be adjusted in response to the evolving dynamics of the protocol.

Supplemental LP Reward Formula

The formula for the supplemented LP rewards is structured to incentivize impactful liquidity provision on dYdX Chain:

The supplemented LP Reward formula specifically targeted at incentivizing the most impactful liquidity on dYdX Chain is as follows:

Where:

- α is a market liquidity factor that upweights volumes in less active markets.

- θ adjusts incentives to compete for liquidation flows.

Parameters:

- For BTC and ETH, α starts at 1, while for SOL, MATIC, and AVAX, it's 1.25, and 1.5 for other markets.

- θ is set to significantly increase the value of providing liquidity against a liquidation, offsetting some risks over these usually volatile periods. This liquidity is highly valuable to dYdX Chain as a risk mitigant against bad debt.

Calculating Launch Incentives Allocations Recommendations

The dYdX Chain Launch Incentives Program systematically allocates rewards across various categories, ensuring transparency and fairness.

Trading Rewards Activity Allocation

Activity Score Calculation: For each account i with positive trading volume, calculate the activity score as the sum of taker fees.

Proportional Allocation: Sum all activity scores. Each account's share of the activity score is calculated as a proportion of the total.

Reward Distribution: The actual reward allocation of each account is calculated using the formula below.

Where using the proposed 80% allocation to Trading rewards and between 70 and 85% Trading reward allocation to the volume allocation:

Performance-Based Prizes

ROI Calculation: Calculate the Return on Investment (ROI) for each trader as:

Reward Allocation: Allocate rewards to traders in each tier according to the predefined tables based on their ROI.

Liquidity Provider Rewards

- Eligibility Determination: Identify eligible market makers, focusing on those contributing over 0.25% of maker volume.

- Reward Calculation: Assign a reward score to each trade and sum these for each eligible market maker. The reward share for each market maker is then determined as a proportion of the total reward score.

Summary of Incentives Distribution

Note: The percentage for each type of incentive will be established at the start of each trading season, allowing for adaptability and integrating insights from past seasons to enhance the allocation of incentives.

Wash Trading Detection

Utilize the Chaos Labs wash trading detection algorithm to identify and exclude any accounts engaged in such practices.

Sanity Checks

Conduct manual checks on performance-based rewards and plot LP rewards against the volume of eligible market makers to detect any irregularities or potential abuses.

Success Metrics

The program's success will be evaluated based on several metrics, comparing them to recent dYdX v3 metrics to assess the effectiveness of the rewards program in driving migration to the dYdX Chain:

- Trading Activity: Target average daily volume in the first trading season to exceed 40% of the average trading volume in dYdX v3 over specified epochs.

- Liquidity Metrics: Aim for the median order book liquidity to be within 50% of dYdX v3 levels over comparable periods.

Additional metrics will be monitored to gauge the nuanced impact of the incentives and guide potential adjustments to the program.

Conclusion

A Strategic Approach to Incentivizing Early Adoption of dYdX Chain

As we embark on the exciting journey of launching the dYdX Chain, our incentive methodology is meticulously crafted to catalyze the platform's growth during its initial phase. This approach is tailored to resonate with diverse stakeholders, ensuring each participant finds value in engaging with the platform.

For Traders

Traders are at the heart of the dYdX Chain. The program's activity-based rewards are designed to provide tangible benefits that likely surpass the fees paid, creating a compelling incentive for participation. Additionally, the innovative structure of trading leagues offers a unique opportunity for traders to enhance their skills. By rewarding top performance, these leagues motivate traders to explore new strategies and improve their profitability, fostering a dynamic and competitive trading environment.

For Liquidity Providers

The success of the dYdX Chain is also closely tied to the robustness of its liquidity. Recognizing this, our program incentivizes liquidity providers to integrate their infrastructure with the dYdX Chain. The LP reward program is thoughtfully structured to compensate market makers significantly contributing to trading volume. By applying multipliers to impactful liquidity contributions, such as those in less active markets or during periods of volatility, we ensure that rewards are aligned with the platform's needs. This approach aims to attract high-quality liquidity providers, providing a smooth trading experience for all users.

A Holistic Approach to Growth

The dYdX Chain Launch Incentives Program represents a holistic approach to fostering early adoption and sustained engagement with the platform. By thoughtfully aligning the incentives with the needs and behaviors of different user groups, we are confident that this program will drive significant early adoption, establishing dYdX Chain as a leading platform in the decentralized finance landscape.

Disclaimer

This post is for informational purposes only and does not constitute an offer to sell, a solicitation to buy, or a recommendation for any security, nor does it constitute an offer to provide investment advisory or other services by Chaos Labs. No reference to any specific security constitutes a recommendation to buy, sell, or hold that security or any additional security. Nothing in this post shall be considered a solicitation or offer to buy or sell any security, future, option, or other financial instrument or offer or provide investment advice or service to any person in any jurisdiction. Nothing contained in this post constitutes investment advice or offers any opinion with respect to the suitability of any security, and the views expressed in this post should not be taken as advice to buy, sell, or hold any security. The information in this post should not be relied upon for investing. In preparing the information in this post, we have not considered any particular investor's investment needs, objectives, and financial circumstances. This information has no regard for the specific investment objectives, financial situation, and particular needs of any specific recipient of this information, and the investments discussed may not be suitable for all investors. Any views expressed in this post were prepared based on the data available when such views were written. Changed or additional information could cause such views to change. All information is subject to possible correction. Information may quickly become unreliable, including market or economic changes.

Throughout the program, Chaos Labs' role is confined to providing recommendations regarding the allocation of rewards. The actual implementation and distribution of said rewards are subject to the formal approval process of the dYdX Chain governance votes. Any actions pertaining to reward distribution shall only be executed following affirmative governance votes within the dYdX Chain framework.

sBNB Oracle Exploit Post Mortem

Chaos Labs summarizes the snBNB oracle exploit affecting the Venus LST Isolated Pool. The post-mortem focuses on the event analysis and risk management efforts following the exploit.

The Role of Oracle Security in the DeFi Derivatives Market With Chainlink and GMX

The DeFi derivatives market is rapidly evolving, thanks to low-cost and high-throughput blockchains like Arbitrum. Minimal gas fees and short time-to-finality make possible an optimized on-chain trading experience like the one GMX offers. This innovation sets the stage for what we anticipate to be a period of explosive growth in this sector.

Risk Less.

Know More.

Get priority access to the most powerful financial intelligence tool on the market.