GMX GLP Risk Hub: A Public Derivative Risk Monitoring and Analytics Platform

Overview

GMX, as a prominent player in the perpetual exchange domain, holds a vital position within the broader DeFi derivatives ecosystem. Boasting over 110 billion USD in total volume and a user base in the thousands, the need for robust risk management tools that offer users and developers access to reliable, accurate data is paramount. In collaboration with GMX core contributors, users, integrated protocols, and DAO members, we are proud to unveil Version 0 of the GMX GLP Public Risk Hub, an advanced platform dedicated to addressing margin at risk, real-time user metrics, alerting, and simulations that evaluate the value at risk (VaR) across volatile markets.

Goals

The primary aim of the GMX GLP Risk Hub is to facilitate informed decision-making for users and DAO members regarding their personal and protocol-wide positions. This application ensures users can confidently navigate turbulent markets by offering insights into the size and balance of long and short open interest in each market. We present an overview of the application's functionality by examining each tab in detail.

Methodology

The GMX platform is currently deployed across two distinct blockchains: Arbitrum and Avalanche. In an effort to provide a scalable, future-proof solution, we have developed an additional data layer atop GMX subgraphs. Our infrastructure persistently queries archive nodes and subgraphs, consolidating the information into a singular database and generating aggregated data collections. These collections are indexed to enable rapid querying, reduced latency, and an efficient user experience.

Platform Deep Dive

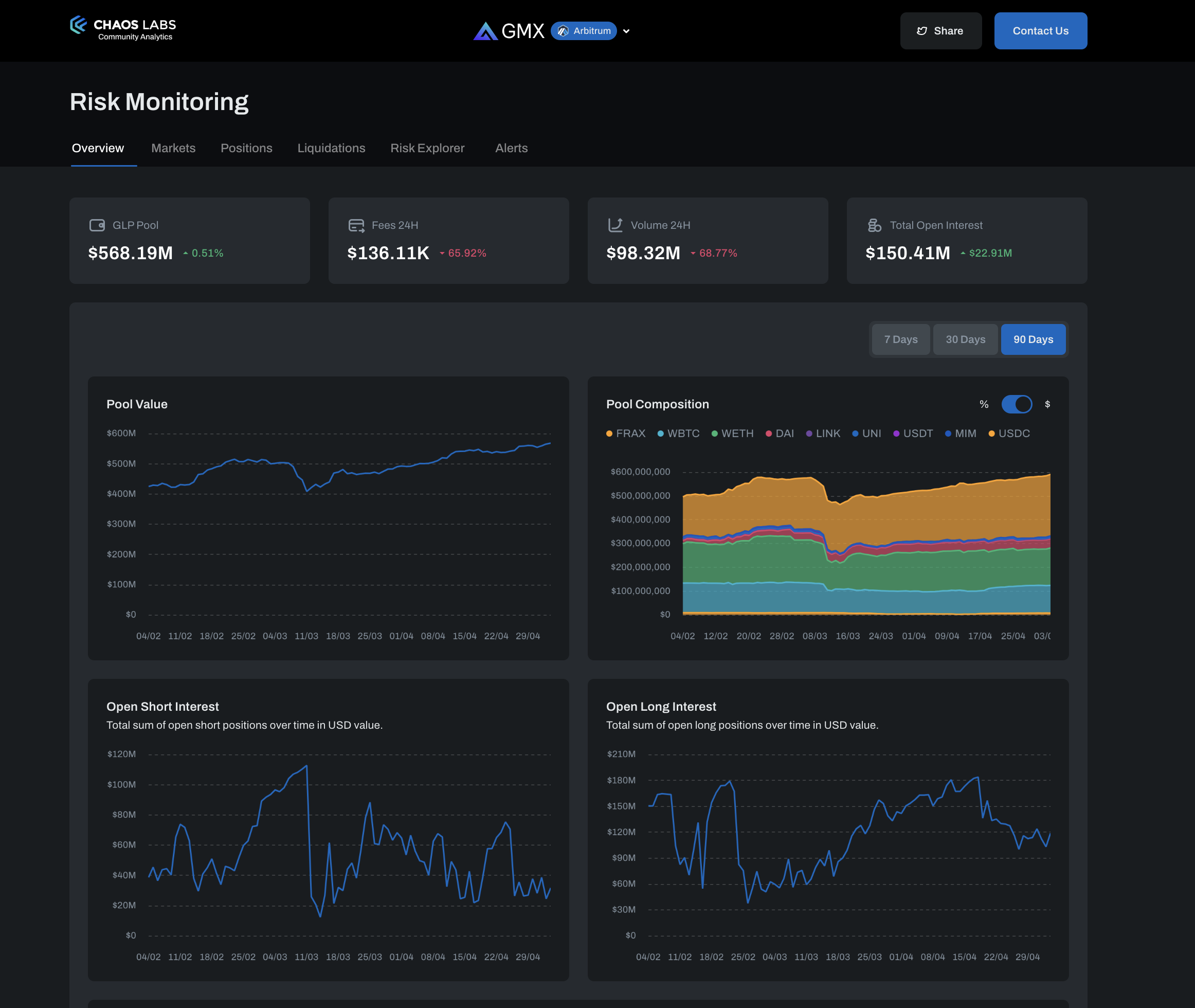

Overview

This page presents information on a per-deployment basis. The network selector at the top of the interface allows users to alternate between data and metrics for the Arbitrum and Avalanche deployments. The metrics available on this page comprise key indicators such as the total GLP pool size, 24-hour fees and volume, and total open interest. Furthermore, the page furnishes users access to time series data that displays the GLP pool value, composition, short and long open interest, and daily fees in graphical format.

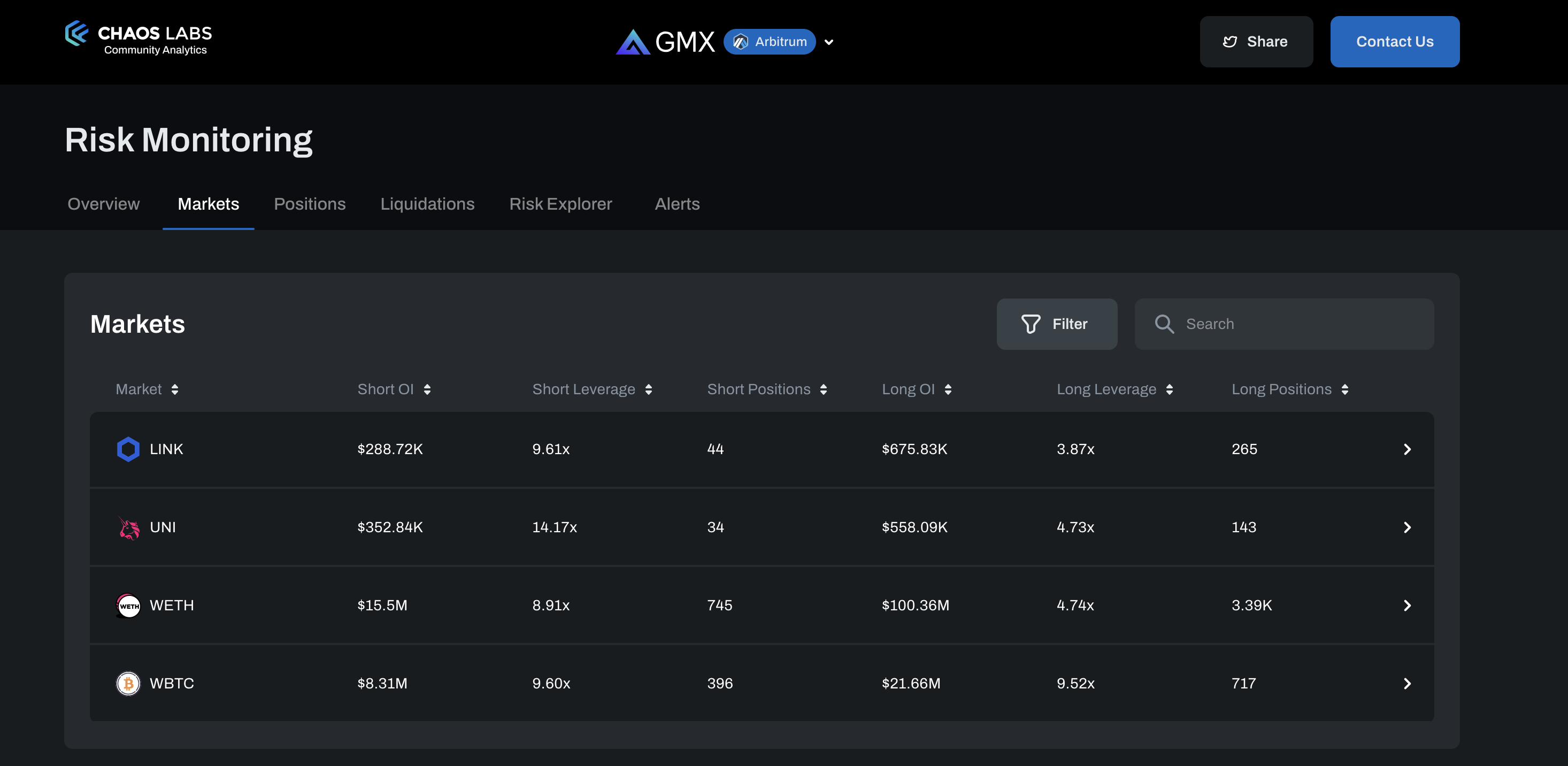

Markets

The markets page showcases all assets supported for opening a long or a short position. In its primary view, the page provides users with market metadata, including data on short and long open interest, short and long leverage, and short and long positions.

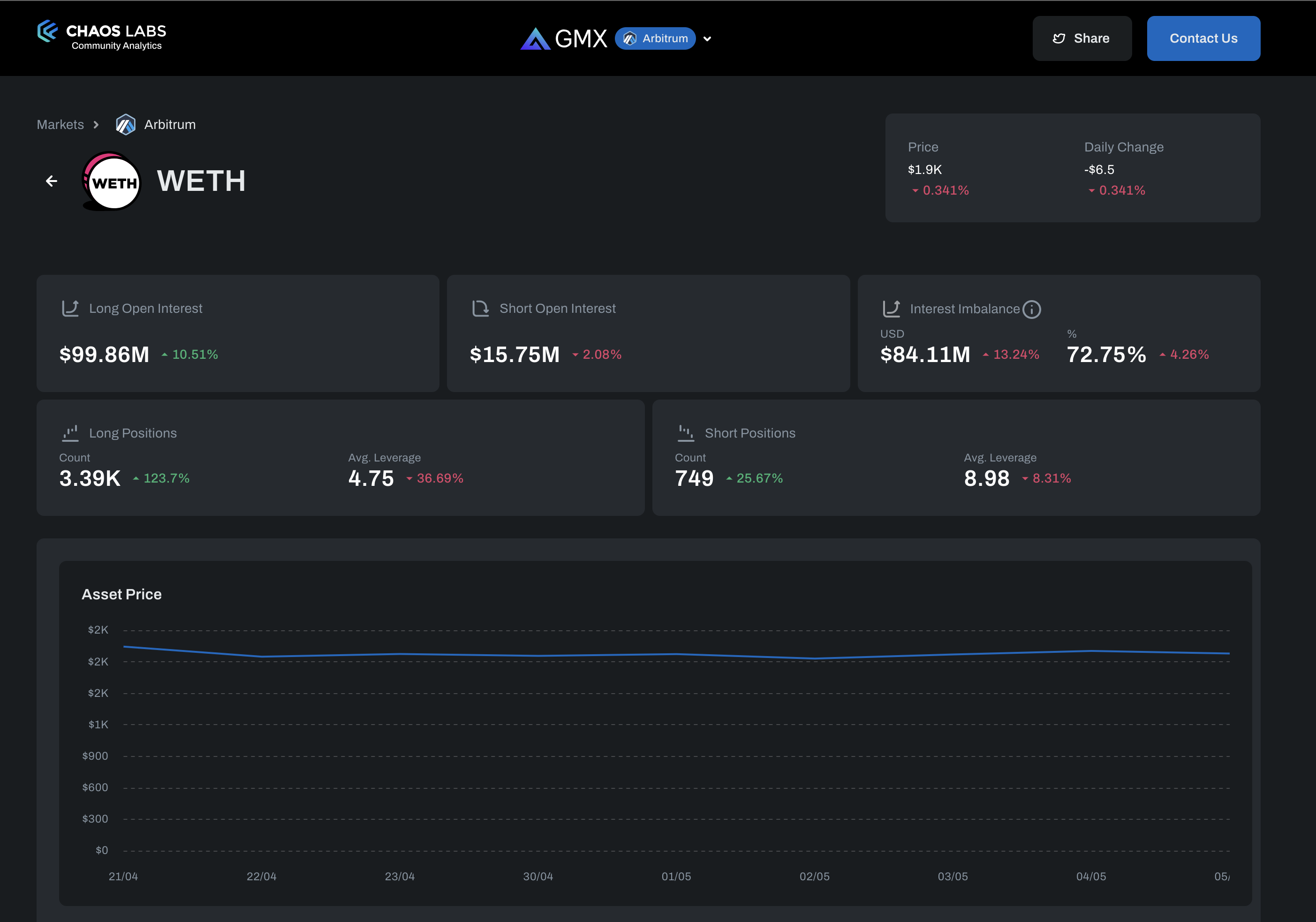

Market Detail

Upon selecting a specific market, users will be directed to a more detailed view of the market, where they can access in-depth analytics. The Market Detail page presents information on short and long open interest, open interest imbalance, long and short position counters, and average leverage for each side. In addition, the page provides access to time series data for asset price and open interest distribution. Moreover, the page features a market-specific positions table that allows users to view all positions within a given market.

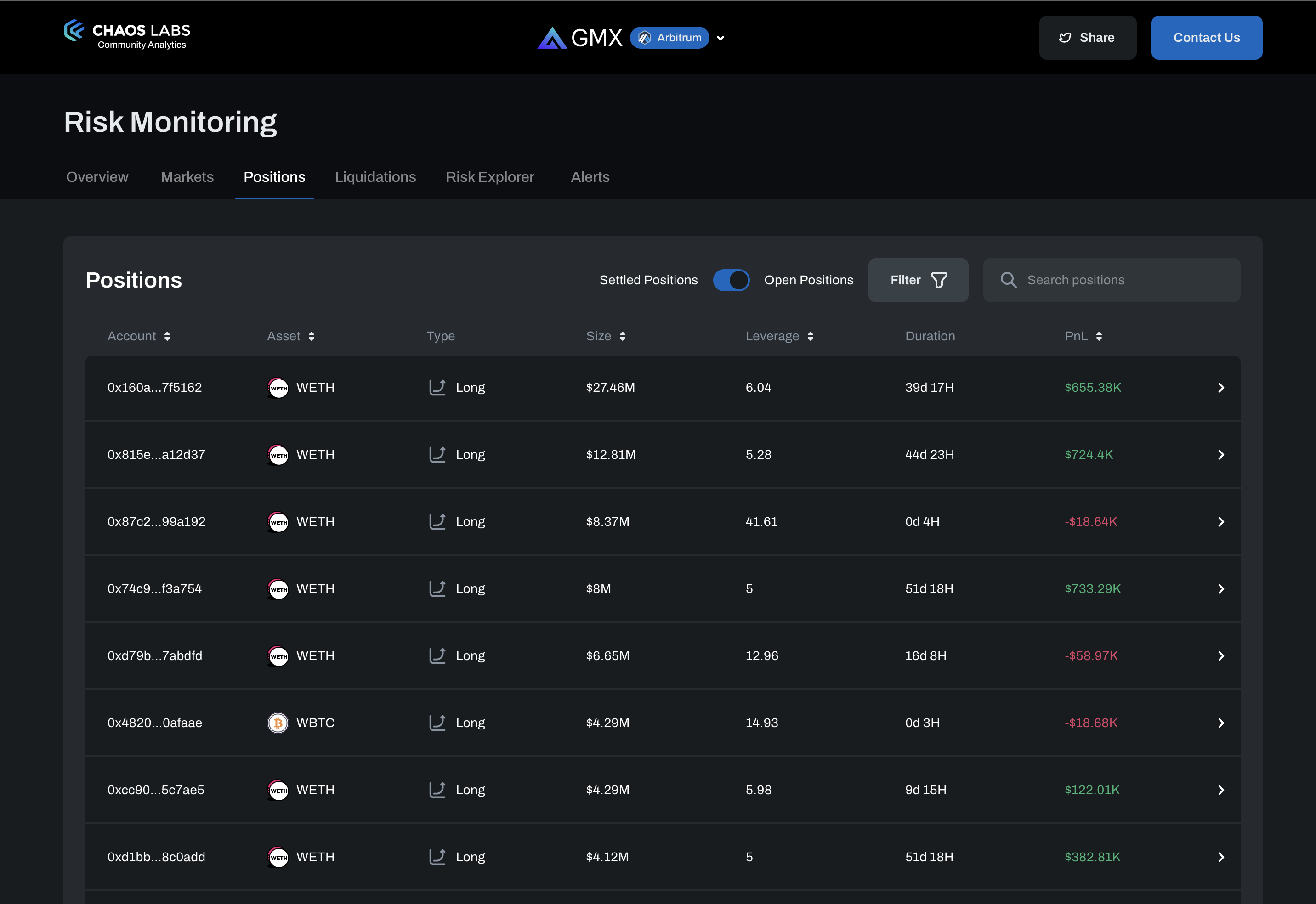

Positions

The positions page presents a comprehensive table that showcases all positions within the GMX protocol, both open and settled. Users can conveniently search for specific wallet addresses or leverage the advanced filtering functionality that enables filtering positions by assets, profit and loss, leverage, and type (long or short).

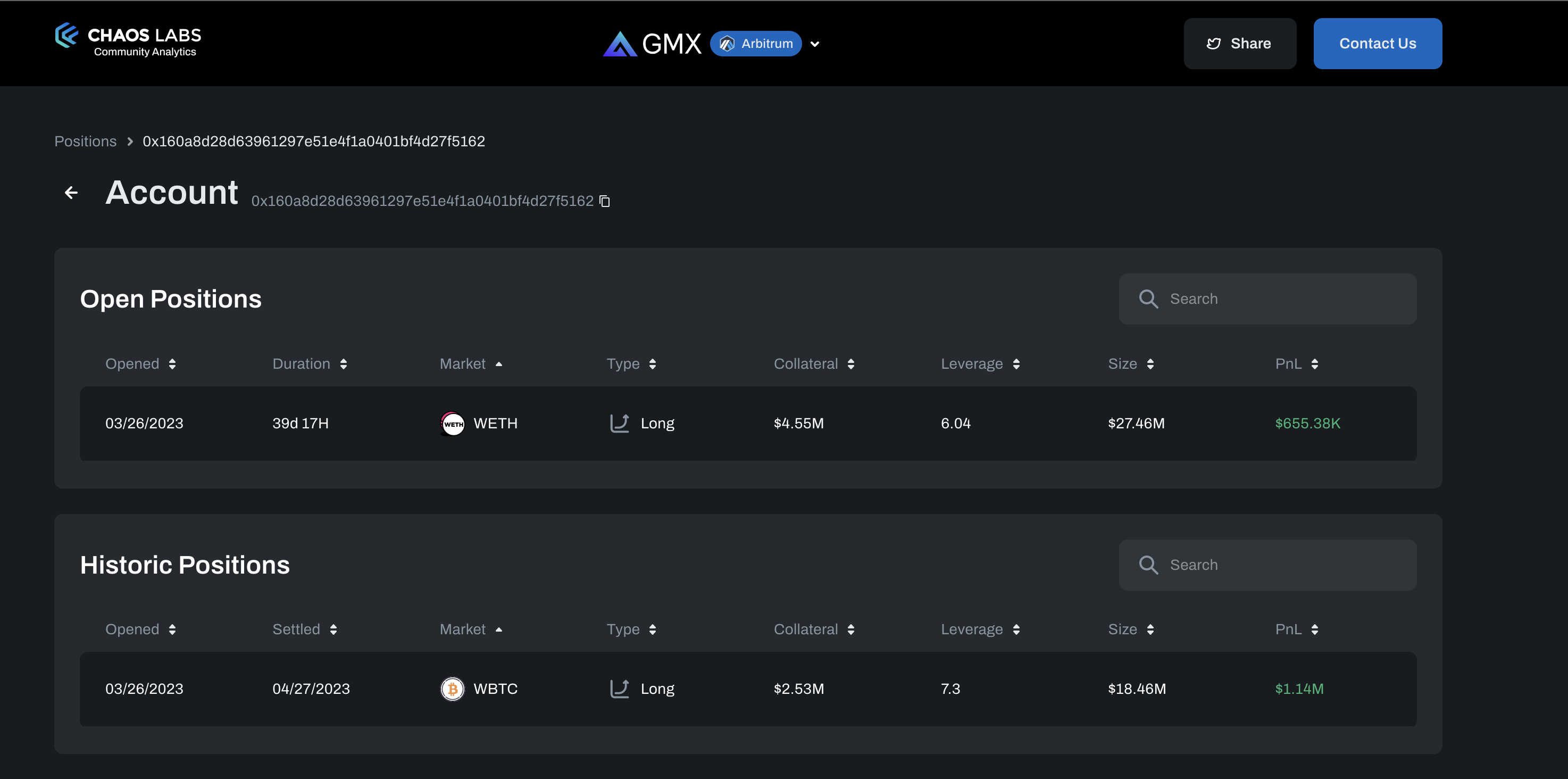

Account Detail

By selecting a specific row in the positions page, users will be directed to the account detail page, which displays all active and closed positions in GLP for that account, thereby enabling a comprehensive analysis of a trader's status and history.

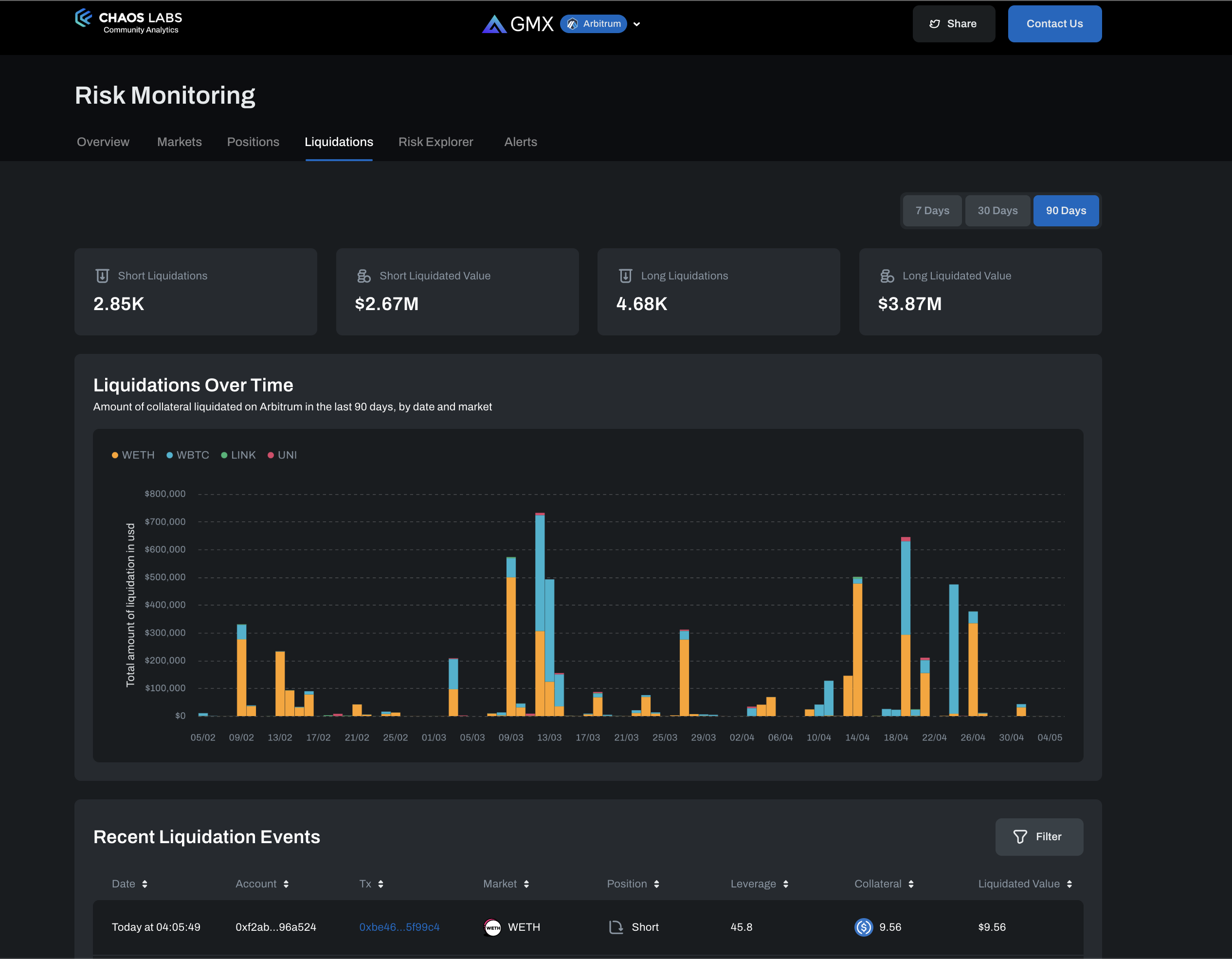

Liquidations

The liquidations page presents aggregated metadata on protocol liquidations spanning 7, 30, and 90-day time frames. Moreover, the page offers a graphical representation of observed liquidation events on a daily basis, as well as a table that displays relevant liquidation events. Users can select a specific liquidation event, which will direct them to the Position Detail page of the corresponding account for a more detailed analysis.

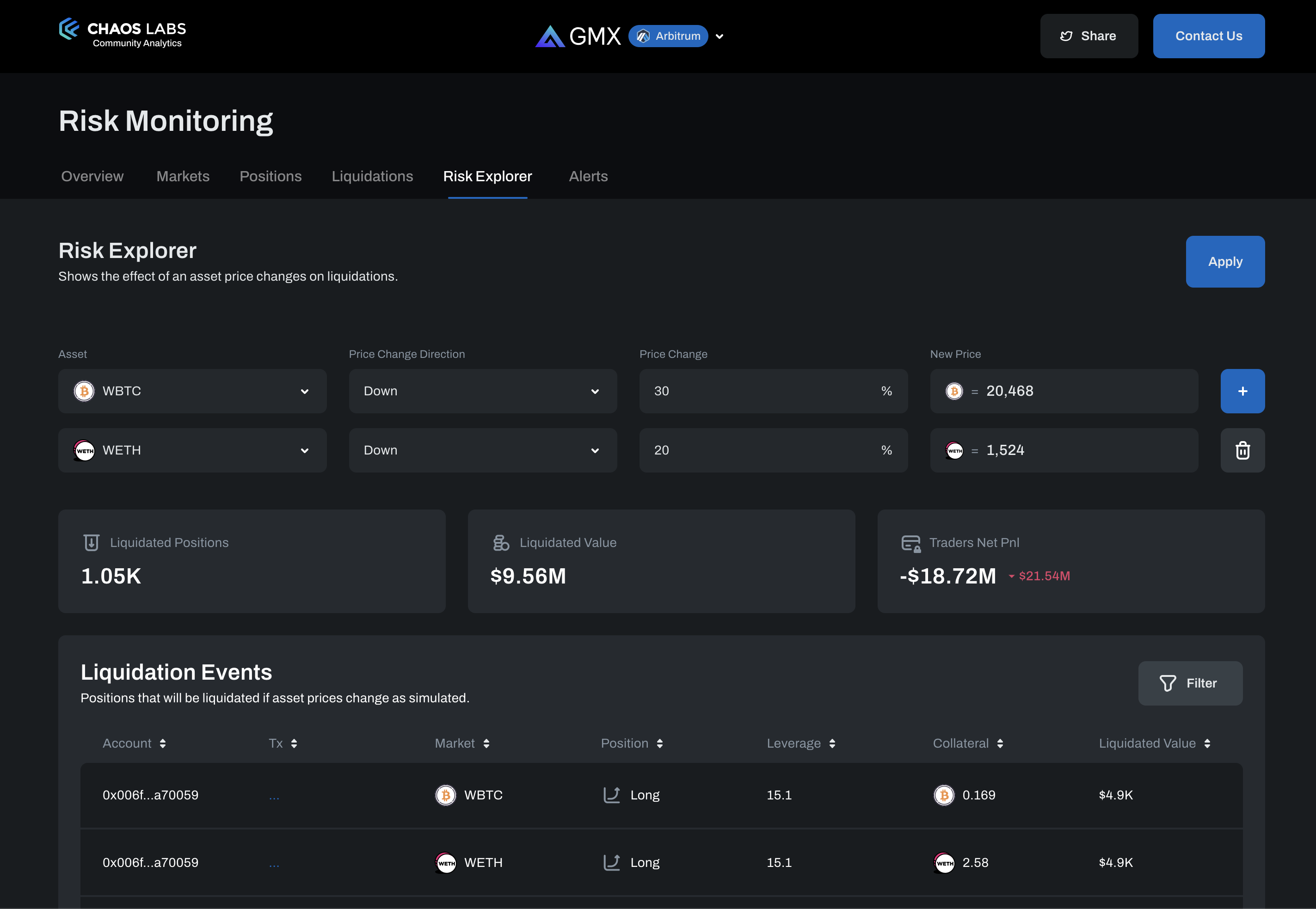

Risk Explorer

The risk explorer feature empowers users to conduct simulations on one or multiple assets, simulating price drops and gauging the impact on their positions. This functionality is particularly useful in comprehending the risk exposure of a position in light of market volatility. We will provide further information on this feature, including more simulation details.

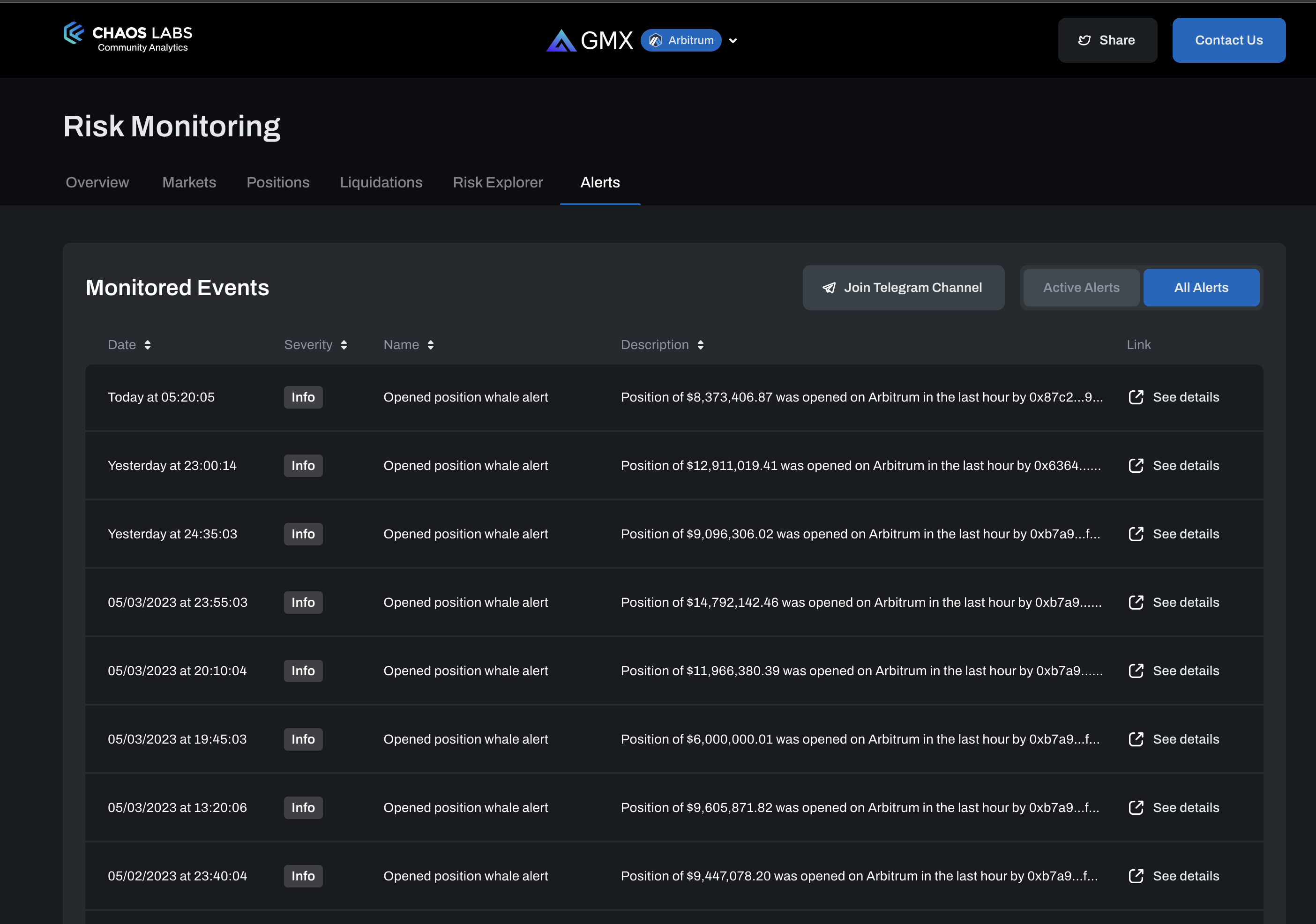

Alerts

The alerts tab offers real-time notifications on GMX protocol activity. The alerts tab offers real-time notifications on GMX protocol activity. Each alert features a link to the corresponding account detail page. Furthermore, users can click on the Join Telegram Channel to receive updates directly in Telegram. In the next iteration of the alerts page, we plan to introduce a webhook feature enabling users to integrate Chaos alerts into additional applications such as Slack and Discord.

Next steps

Our platform is constantly evolving and growing to meet our users' needs. We invite the GMX community to explore the platform and provide your feedback.

If you have any questions or comments, feel free to contact us on Twitter or email us at [email protected].

The Role of Oracle Security in the DeFi Derivatives Market With Chainlink and GMX

The DeFi derivatives market is rapidly evolving, thanks to low-cost and high-throughput blockchains like Arbitrum. Minimal gas fees and short time-to-finality make possible an optimized on-chain trading experience like the one GMX offers. This innovation sets the stage for what we anticipate to be a period of explosive growth in this sector.

Uniswap V3 TWAP: Assessing TWAP Market Risk

Assessing the likelihood and feasibility of manipulating Uniswap's V3 TWAP oracles, focusing on the worst-case scenario for low liquidity assets.

Risk Less.

Know More.

Get priority access to the most powerful financial intelligence tool on the market.