Introducing Aave's Chaos Labs Risk Oracles

Table of Contents

Overview

In the fast-paced and volatile environment of DeFi, managing risk parameters across Aave's extensive network—spanning over ten deployments, hundreds of markets, and thousands of variables such as Supply and Borrow Caps, Liquidation Thresholds, Loan-to-Value ratios, Liquidation Bonuses, Interest Rates, and Debt Ceilings—has evolved into a critical, yet resource-intensive, full-time endeavor. Chaos Labs aims to streamline this paradigm by integrating Risk Oracles to automate and optimize the risk management process, achieving scalability and near-real-time risk adjustment capabilities.

Motivation

Today, updating on-chain risk parameters involves manually creating payloads before being presented for voting by the Aave community. Given the abundance of networks and assets on the Aave protocol, this manual and cumbersome process significantly burdens teams across Chaos Labs, ACI, BGD Labs, and more. Our solution, grounded in guarded automation, alleviates these operational inefficiencies by seamlessly translating governance-approved risk parameters into actionable, on-chain updates.

Introduction to Risk Oracles

Risk Oracles represent an advancement designed to automate the laborious process of updating risk parameters. The conventional approach to monitoring blockchain risk is challenging and marred by significant delays from risk signal detection to implementing protective measures by risk managers and the DAO. This latency is untenable, especially considering the billions in TVL and the inherent market volatility. Risk Oracles serve as the crucial linkage between the analytical prowess of the Chaos Labs Cloud and the practical application of governance-validated recommendations on the blockchain, extending the capabilities of the existing Risk Steward System developed by BGD Labs.

Operational Mechanics of Risk Oracles

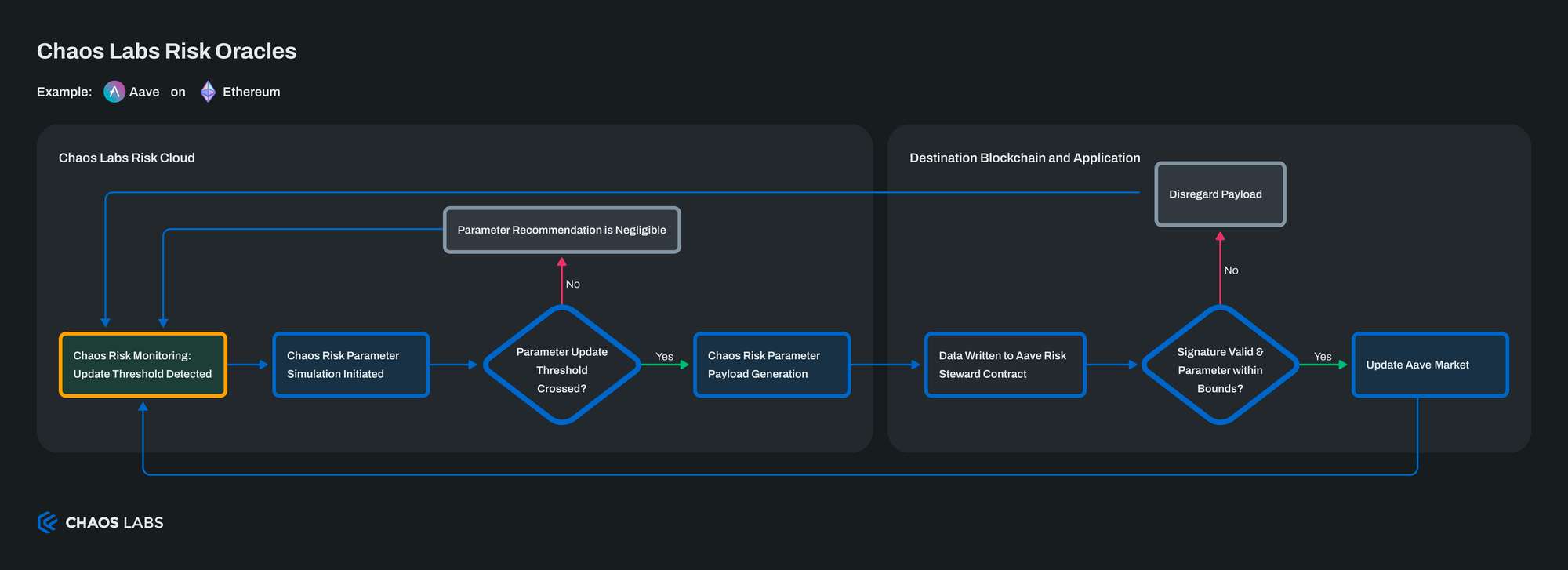

The Risk Oracle introduces a bifurcated operational framework, encompassing both off-chain and on-chain workflows to ensure dynamic and secure risk parameter updates.

Offchain Workflow

Situated within the Chaos Cloud, this segment is the analytical engine where various risk indicators are continuously monitored. These include but are not limited to, utilization of supply and borrowing caps, debt ceiling thresholds, market volatility, and patterns indicative of anomalous user behaviors. A simulation is triggered upon exceeding specific, pre-established thresholds, computing the newly optimized parameter settings. Following rigorous internal validation, these recommendations are prepared for on-chain submission.

Onchain Workflow

Recommendations validated off-chain are funneled to the Aave Risk Stewards Contract, embodying sophisticated business logic to authenticate the proposed parameter adjustments. Each parameter update is bounded by governance-established limits to facilitate "optimistic updates"—that is, updates enacted without necessitating an entire governance cycle. The updates are enacted upon successful validation, dynamically refining the Aave Market's operational parameters.

Pilot Implementation: Version 0

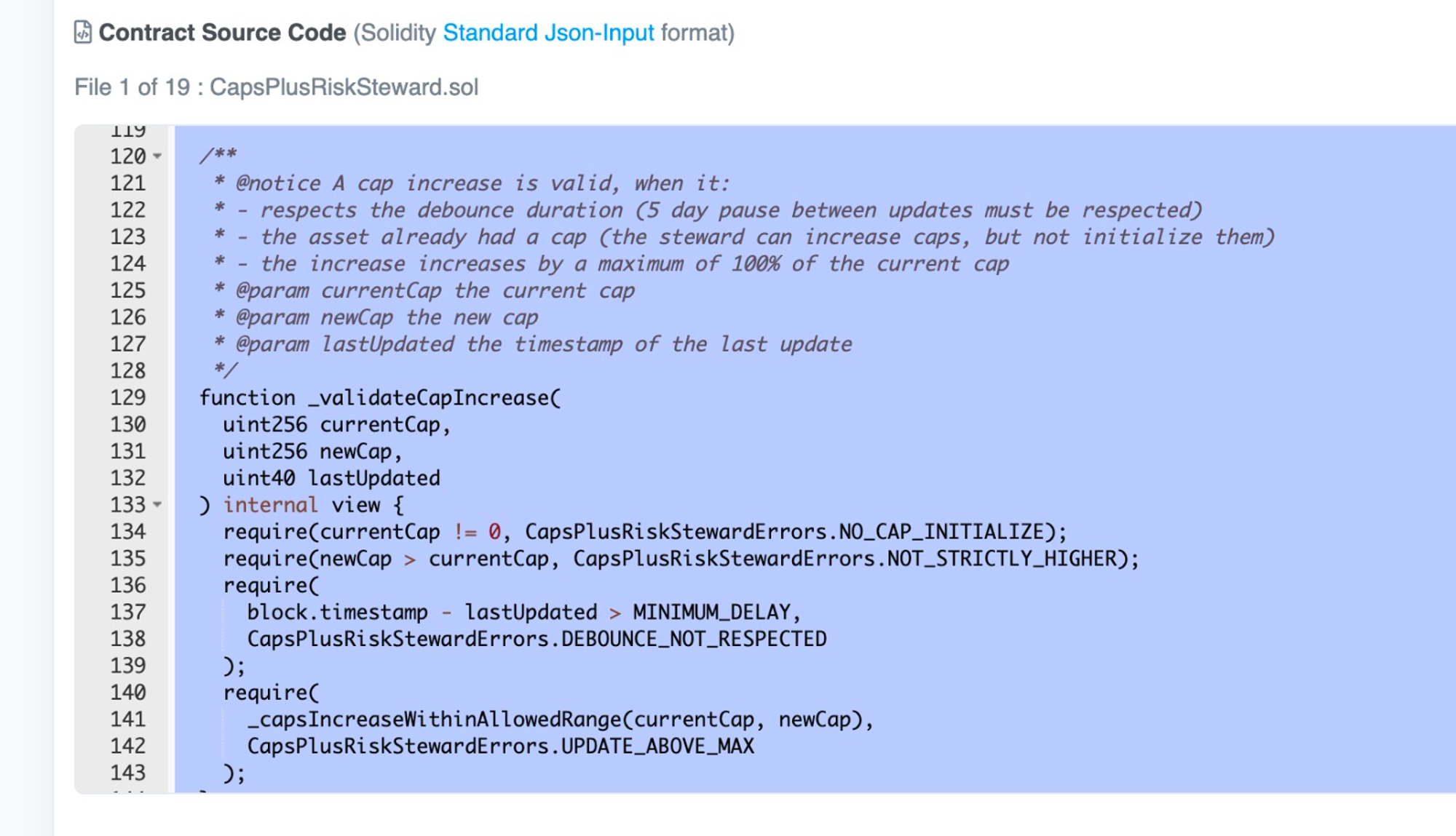

We focus on low-risk and high-adjustment frequency parameters for Aave's pilot phase. We will utilize the current Risk Steward framework, which is functionally limited to increasing supply and borrowing caps up to 2x their current configuration.

Leveraging the existing infrastructure developed and deployed by BGD Labs, alongside the new off-chain systems engineered by Chaos Labs, this pilot represents a controlled, scalable approach to validating the Risk Oracle's efficacy and operational integrity.

Next Steps

In the upcoming weeks and months, Chaos Labs will concentrate on extending support for additional protocols and risk parameters through the Chaos Risk Oracle. This initiative aims to refine and streamline the risk parameter update process. By enhancing our Risk Oracle capabilities, we aspire to automate further and optimize risk management, ensuring dynamic, real-time adjustments to protocols in complex ecosystems. This focus aligns with our commitment to streamlining operations, reducing manual intervention, and elevating protocols efficiency and security in the volatile DeFi landscape.

dYdX Chain: End of Season 3 Launch Incentive Analysis

Chaos Labs presents a comprehensive review of the third trading season on the dYdX Chain. The analysis encompasses all facets of exchange performance, emphasizing the impact of the Launch Incentive Program.

Oracle Risk and Security Standards: Network Architectures and Topologies (Pt. 2)

Oracle Network Architecture and Topologies provides a detailed examination of how Oracle Networks are structured, data’s complex journey from source to application, and the inherent security and risk considerations within these systems. Through a deep dive into architectures, the data supply chain, and network topology, readers will understand the critical components that ensure the functionality and reliability of Oracles in DeFi, providing context for the challenges and innovative solutions that define the landscape.

Risk Less.

Know More.

Get priority access to the most powerful financial intelligence tool on the market.