Introducing Pendle PT Risk Oracle

Table of Contents

Summary

As decentralized finance (DeFi) evolves, fixed-yield instruments like Pendle’s Principal Tokens (PTs) present a powerful opportunity to enhance yield strategies and expand the range of viable collateral assets in lending markets. However, integrating these structured assets introduces unique challenges around accurate pricing, dynamic risk management, and protection against manipulation and systemic risk. Traditional oracle systems and static risk parameters fall short in capturing the time-sensitive and yield-dependent behavior of PTs, limiting their safe and efficient adoption at scale. In response, Chaos Labs has developed the Principal Token Risk Oracle—a purpose-built framework that reimagines how PTs are priced and risk-managed in DeFi protocols such as Aave, unlocking a new paradigm of capital-efficient, resilient lending infrastructure.

Principal Token Risk Oracle

PTs are fixed-yield assets created by splitting a Pendle Standardized Yield (SY) token into two parts: a PT, which represents the principal value redeemable at maturity, and a Yield Token (YT), which captures the variable yield. Functionally similar to zero-coupon bonds, PTs offer predictable returns and reduce in volatility as they approach maturity, making them attractive for conservative yield strategies and ideal candidates for collateral in DeFi lending protocols.

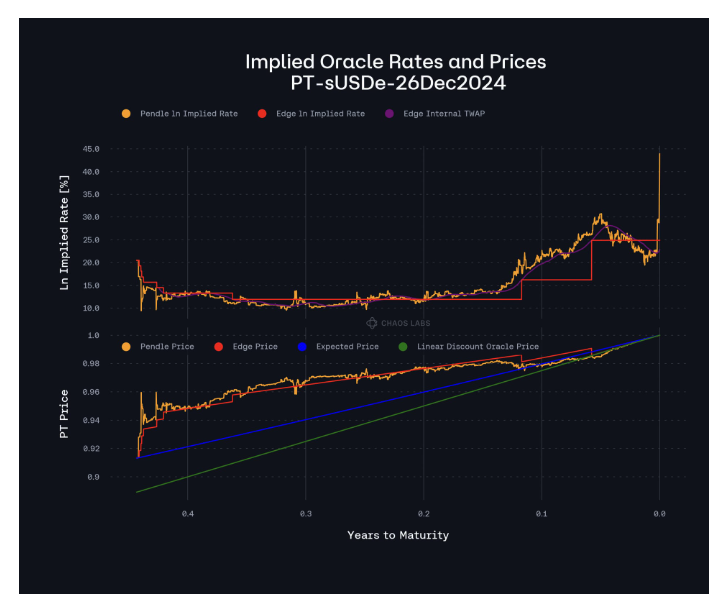

Until now, PT pricing in lending markets has relied on two primary mechanisms: the LinearDiscountOracle and AMM-based TWAP feeds. The LinearDiscountOracle estimates PT value by applying a fixed discount rate over time, but its linear structure systematically underprices PTs, particularly in high-yield or long-duration scenarios. Meanwhile, TWAP feeds, which pull prices directly from Pendle AMM data, are more vulnerable to manipulation and overvaluation, especially when markets become imbalanced or sparse. These limitations have hindered accurate collateral valuation and exposed lending protocols to undercollateralization risks.

Moreover, traditional approaches apply static risk parameters—such as fixed Loan-to-Value (LTV), Liquidation Threshold (LT), and Liquidation Bonus (LB)—regardless of the PT’s position along its maturity timeline. This misalignment fails to account for the declining volatility and increasing price certainty of PTs as they approach redemption.

As a result, protocols either take on unnecessary risk early in the lifecycle or underutilize capital near maturity when the risk is lower. To maximize capital efficiency while preserving safety, risk parameters must evolve in parallel with the asset’s dynamically improving risk profile.

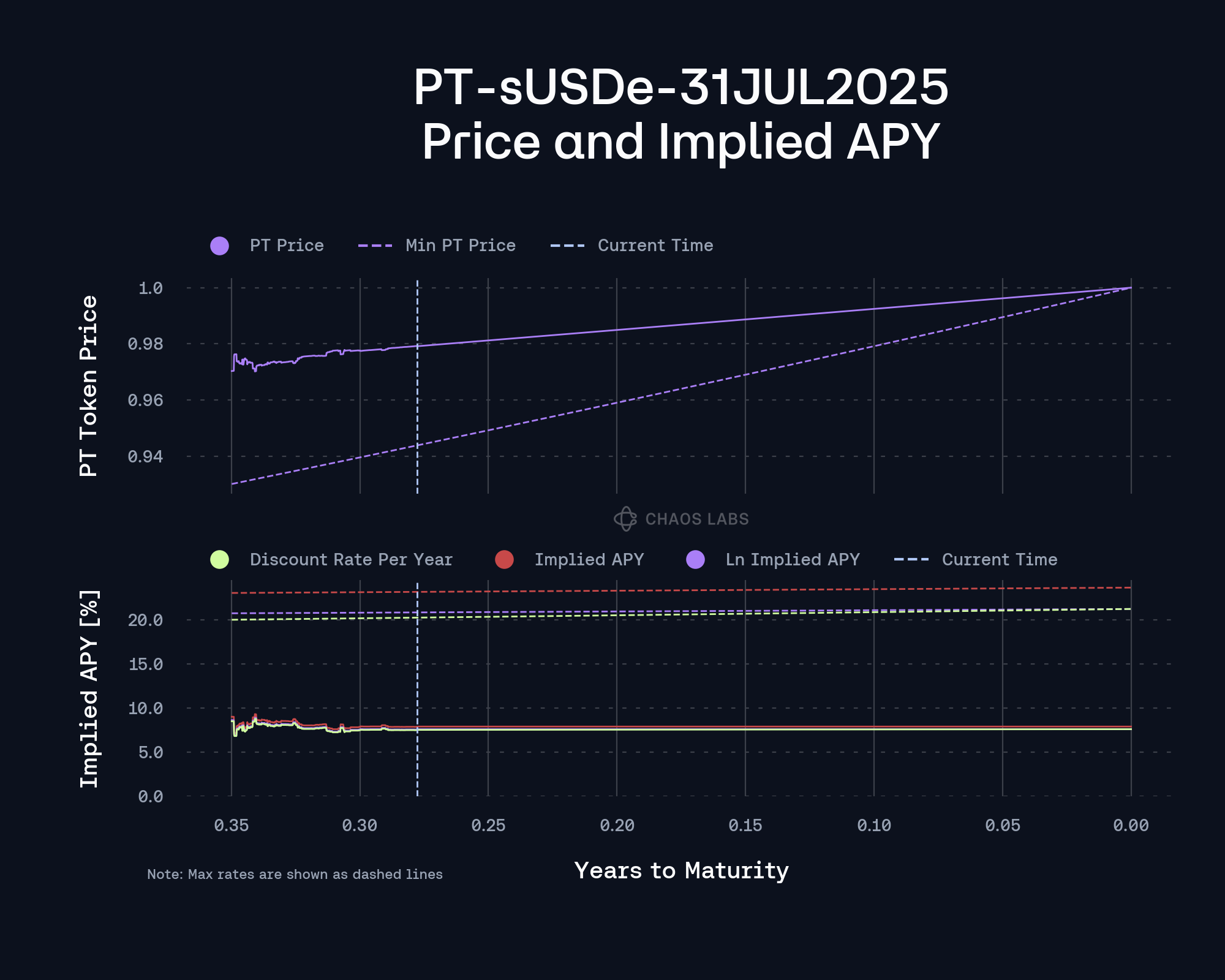

To address these challenges, Chaos Labs introduces the Principal Token Risk Oracle, a pioneering risk and pricing framework that enables the secure, capital-efficient integration of Pendle’s PTs into lending protocols like Aave. PT Risk Oracle addresses the unique dynamics of PTs—such as fixed maturity, converging value, and yield-based pricing—by introducing a multidimensional risk and pricing system that evolves over time and adapts to market conditions.

Dynamic, Market-Aligned Pricing Mechanism

At its core, the Oracle uses a volatility-structured, manipulation-resistant pricing algorithm. This determines the PT price dynamically and updates only when price movements exceed a defined threshold (e.g., 1% in PT terms). As a PT approaches maturity, price volatility declines, and the update frequency decreases accordingly, ensuring stable and convergent behavior.

- Logarithmic yield transformation ensures more accurate price-to-yield mapping.

- Avoids over-reliance on linear approximations, which systematically underprice PTS in high-yield or long-maturity environments.

Dynamic Risk Parameter Adjustments

The Oracle introduces time-dependent, volatility-aware adjustments to lending parameters:

- LTV and LT: Increases as maturity approaches, reflecting reduced risk, dynamically derived from worst-case price paths.

- LB: Decreases over time, based on concentrated liquidity range.

These evolving parameters align with PTs’ monotonic price convergence to their underlying value, enabling greater capital efficiency without sacrificing safety.

Liquidity-Responsive Killswitch Mechanism

To protect against tail risks like oracle mispricing or liquidity exhaustion, the system includes a killswitch:

- When the AMM reaches its 96% PT liquidity concentration, indicating the minimum feasible price, the system automatically sets LTV to 0.

- Lending is paused, preventing toxic debt accumulation from mispriced collateral or manipulated yields.

- Lending resumes only after sustained improvement in liquidity balance (e.g., PT/SY pool ratio drops below 90% for 80% of a 3-day window).

Protective Liquidation Design

Liquidations are calculated based on expected volatility and liquidity range, ensuring:

- Liquidators are compensated appropriately for the actual risk and slippage, through modeling worst-case PT price paths to maintain solvency

- Two-step liquidation logic accommodates PTs with correlated (but not identical) debt assets, accounting for both PT-to-SY and SY-to-debt conversions.

This preserves solvency and liquidation efficiency even in volatile or constrained market conditions.

Strategic Constraints to Minimize Risk

- No PT borrowing: Mitigates exploits via synthetic mint-and-sell loops and redeem-only liquidity crunches at maturity.

- Only correlated or underlying debt assets allowed: Reduces volatility-induced insolvency risks.

- Minimum price floors and deterministic update windows: Prevent undercollateralization from fast market moves or inactivity.

Advantages Over Existing Solutions

Compared to existing pricing models like the LinearDiscountOracle or AMM TWAP feeds and associated risk parameterization, Chaos’ Risk Oracle offers:

- Better pricing accuracy and yield alignment (avoids underpricing and yield arbitrage).

- Higher manipulation resistance (avoids TWAP-based exploits).

- Time-converging deterministic behavior near maturity, with increased capital efficiency as the risk profile diminishes.

- Reduced net interest accrual from mispriced debt due to responsive updates only when necessary.

Conclusion

The Principal Token Risk Oracle is a highly specialized, adaptive framework that merges robust market theory with dynamic on-chain risk management. By understanding the evolving risk profile of PTs and tailoring parameters in real-time, it ensures stable, secure, and efficient integration of fixed-yield assets into DeFi lending markets—setting a new standard for oracle design in volatile and structured financial environments.

PT adoption on Aave is already underway, with PT-eUSDe-29MAY2025 reaching $200M in deposits within 24 hours of launch, powered by Chaos Labs’ Edge Risk Oracle. This marks the first instance of PT collateralization on Aave, and momentum continues with the upcoming launch of PT-sUSDe-31JUL2025 this Sunday. These listings tap into a multi-billion dollar addressable market for Principal Tokens and unlock a new frontier of fixed-yield asset integration within Aave’s lending ecosystem.

The Modern Role of Crypto Oracles: From Price Messengers to Intelligent Feeds

The recent oracle incident involving the deUSD Euler market reignited a critical debate: What’s the purpose of an oracle, and where should its responsibilities begin and end?

Chaos Labs Smart Value Recapture (SVR) Monitoring Platform

Chaos Labs is pleased to announce the launch of the Smart Value Recapture (SVR) monitoring platform, enabling granular monitoring of SVR liquidation performance within the Aave Protocol.

Risk Less.

Know More.

Get priority access to the most powerful financial intelligence tool on the market.