Protocol Spotlight: Bluefin V3

Overview

Bluefin is Sui’s canonical derivative exchange, driving over 90% of on-chain volume. Bluefin aims to redefine the trading landscape, utilizing a cutting-edge cross-margining engine.

Bluefin V1 initially debuted on Arbitrum. Impressed by the distinctive architecture and benefits of the Sui blockchain, Bluefin embarked on a mission to rewrite, enhance, and fine-tune the codebase, building V2 and tailoring it specifically for the Sui blockchain. V2 has led to impressive growth thus far.

In the upcoming second quarter of 2024, Bluefin will launch V3. This latest iteration will represent a highly optimized version of the perpetual exchange platform. Among its key features are significantly reduced fees, improved trade execution latency, and the introduction of cross-margin trading accounts.

Bluefin V3 will offer sub-30 ms off-chain trade confirmations, sub-second on-chain finality (approximately 400ms), and a capacity of up to ~30,000 Trades Per Second (TPS). These capabilities are primarily attributable to the innovative use of Sui’s owned object transactions, which operate without global consensus among validators.

Bluefin has been growing steadily, capturing more and more market share. Let’s explore Bluefin’s journey thus far and discuss what comes next.

Bluefin Beginnings

Bluefin began with a vision to offer advanced, capitally efficient derivatives trading on a decentralized platform. A beta launch in 2023 on Arbitrum marked the initial success with over $2.1 billion in trades. However, the Bluefin team quickly recognized the platform's limitations on Arbitrum regarding scalability and cost-effectiveness.

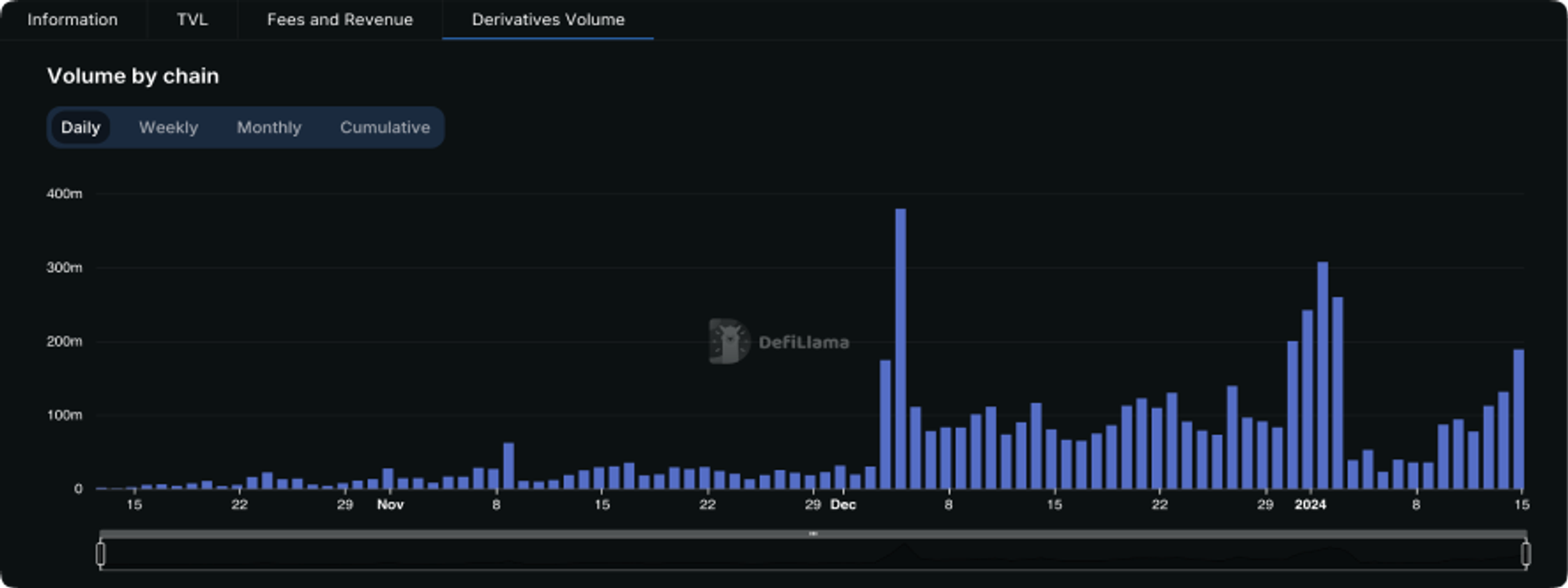

Transitioning to Sui, Bluefin found a solution aligned with its high performance and user experience goals. The platform's evolution continued with Bluefin v2, launched on Sui, which registered over $3.2 billion in trading volume in just December 2023.

Introducing Sui-Owned Object Transactions

The technical foundation of Bluefin V3 lies in its use of Sui's owned object transactions, a concept crucial for enabling parallel computation. This advanced framework significantly enhances transaction processing efficiency.

Critical Aspects of Sui-Owned Object Transactions:

- Transactions on Single-Owner Objects: These transactions, such as token transfers and smart contract publishing, are recognized by Sui and processed without consensus using Byzantine Consistent Broadcast, based on the FastPay design. This approach locks only the relevant data, not the entire chain, allowing massive parallel transaction processing.

- Low-Latency Validation: Sui processes transactions individually, avoiding traditional block batching. This results in lower latency and rapid finality certification for each transaction.

- Efficient Transaction Submission: The process involves sending transactions to a quorum driver, like a Full node, which then broadcasts them to validators. Validators check and sign valid transactions, and a quorum driver assembles these into a certificate, finalizing the transaction upon successful validation.

- Scalability through Causal Ordering: Unlike total ordering systems, Sui uses causal ordering for transactions containing only owned objects, allowing for massive parallelization and sharding across multiple machines.

Leveraging Owned Object Transactions with Bluefin V3

Bluefin V3 harnesses the power of owned object transactions to achieve its ambitious goals:

- Cross-Margin Support: Essential for modern trading platforms.

- Optimistic 30ms Trade Confirmations: Ensuring users experience rapid confirmations, irrespective of on-chain processing time (~30,000 TPS).

- 400ms On-Chain Finality: Rapid finality ensures the system remains efficient and responsive even in high-volume scenarios.

- Gas Costs Implications: Bluefin trade calls typically consume approximately 1,000 to 2,000 Gas Units, and the associated gas unit costs are determined in a 24-hour epoch incentivized to remain low and predictable. Based on the past few months, the average gas cost is expected to be around $0.01, with minimal variance. However, it's worth noting that the Bluefin Foundation will cover these gas expenses.

The platform's off-chain margining engine is central to its operation. It sequences transactions from individual accounts while allowing parallel processing for distinct accounts. This engine boasts a capacity of 2500 sequenced transactions per second per account, scaling significantly higher with unique account transactions. In testing, the engine achieved a throughput of 29,940 TPS, confirming 1000 trades from 2000 unique traders in just 34ms.

Users primarily interact with the off-chain orderbook and cross-margining engine, experiencing an impressive end-to-end p95 latency of 30ms (excluding network latency). Transactions are then processed sequentially on the Sui blockchain. Owned object transactions ensure a quick, finalized on-chain output for the confirmations provided by the Bluefin cross-margining engine.

Bluefin’s Low-Latency Trading Experience

Rabeel Jawaid, the co-founder of Bluefin, envisions a future where derivatives trading is defined by its low latency and user-centric design. He advocates for a seamless user experience where the underlying blockchain technology is virtually imperceptible to the user, ensuring that block confirmation times do not impede the rapid execution of trades. Leveraging Sui's advanced architectural capabilities, Jawaid believes that Bluefin is poised to achieve speeds comparable to centralized exchanges (CEX), pushing the boundaries of what is currently achievable in decentralized finance.

"Derivatives trading in DeFi requires high-performance blockchains, and no decentralized protocol has yet matched the success of a leading centralized exchange because of the user experience challenges with on-chain trading," said Rabeel. "We’re going to change that, and Sui enables us to do so."

Bluefin found that Sui meets its performance needs in two key metrics: transactions per second (TPS) and trade confirmation timing. Where TPS on other chains becomes a bottleneck during high-volume trading, Sui handled 5,414 TPS in 2023 without hitting its theoretical or practical limit. Equally as important, Bluefin can give an optimistic confirmation of transactions in 30 milliseconds and finalize transactions in about 550 milliseconds. Each of these metrics meets the expectations of traditional finance platform users.

What's Next for Bluefin

Advancements in Performance and Trading Features

- Enhanced Margin Functionality: Introducing cross-margining and isolated sub-accounts allows traders greater flexibility and precision. Bluefin aims to cater to diverse trading strategies and risk preferences with these features.

- Market Expansion: Bluefin is committed to expanding its offerings, offering users a broader array of tradable market options and opportunities. This expansion is critical to accommodating the evolving needs and interests of the trading community.

- Secure Account Abstraction: Allowing users to sign up, deposit funds, and trade with just a Google account brings a familiar Web2 experience. Unlike the traditional MPC approach, Bluefin leverages Sui’s zkLogin as a more secure approach to wallet-less trading, providing users the benefits of self-custody and guaranteeing privacy with zero-knowledge proofs.

Upcoming Tools and Resources

- Chaos Labs Bluefin Real-time Risk Portal: In the coming weeks, Bluefin is excited to launch the Chaos Labs Bluefin Real-time Risk Portal. This state-of-the-art tool will give the community unparalleled insights into risk management, market liquidity, and more. Users can access real-time data to understand better market positions, liquidations, and overall market dynamics.

This next phase in Bluefin's development promises to bring unparalleled performance, enhanced trading capabilities, and critical market insights, all designed to elevate the user experience and provide traders with the tools they need to succeed in the dynamic world of decentralized finance.

Oracle Risk and Security Standards: An Introduction (Pt. 1)

Chaos Labs is open-sourcing our Oracle Risk and Security Standards Framework to improve industry-wide risk and security posture and reduce protocol attacks and failures. Our Oracle Framework is the inspiration for our Oracle Risk and Security Platform. It was developed as part of our work leading, assessing, and auditing Oracles for top DeFi protocols.

sBNB Oracle Exploit Post Mortem

Chaos Labs summarizes the snBNB oracle exploit affecting the Venus LST Isolated Pool. The post-mortem focuses on the event analysis and risk management efforts following the exploit.

Risk Less.

Know More.

Get priority access to the most powerful financial intelligence tool on the market.