Overview

On September 5, 2023, Circle introduced native USDC on OP Mainnet, marking a significant step towards seamless USDC transactions without the need for bridging, thus allowing direct issuance and redemption processes with Circle. This move was aimed at empowering developers with a stable and trustworthy foundation for building on the blockchain.

Chaos Labs and Optimism Foundation are now collaborating to optimize liquidity incentives and streamline the migration from bridged USDC.e to native USDC on OP Mainnet. These efforts are underpinned by a comprehensive analysis of similar migrations, assessing the current status of USDC on OP Mainnet, and developing a strategic framework for an efficient and secure transition from bridged to native USDC tokens. This migration framework is designed to quickly and seamlessly migrate the majority of USDC on OP Mainnet from bridged USDC.e to native USDC.

The migration framework outlines a multifaceted approach designed to facilitate the transition while ensuring the DeFi protocols built on OP Mainnet are operating safely throughout the process. Key strategies include incentivizing DEX liquidity for USDC pairs and collaborating with lending protocols to transition USDC.e to native USDC. This framework aims to create an ecosystem where all stakeholders are naturally motivated to migrate by leveraging market forces, thereby maximizing the efficiency of the incentive programs.

Incentives will be directed towards the most actively traded DEX pools and those boasting the highest TVL, specifically targeting Uniswap v3 and Velodrome v2 pools.

Additionally, the three largest lending protocols, Aave, Exactly Protocol, and Sonne Finance, are also incentivized to ensure that native USDC yields remain attractive across OP Mainnet to both incentivize a rapid migration and ensure that bridged USDC.e remains in the ecosystem.

Monitoring and adjusting these incentives will be crucial to address any emerging challenges and ensure the migration's success, aiming for an 80% conversion to native USDC within a specified timeline in an efficient manner. This comprehensive strategy underscores the commitment to a smooth transition and sets a benchmark for similar migrations in the blockchain space.

Bridged vs. Native USDC

USDC issued by Circle will be native to OP Mainnet and can be considered the official form of USDC for the ecosystem. It is issued directly by Circle and backed 1:1 with US Dollars. This empowers developers to build on a stable foundation they can trust.

In the case of OP Mainnet, there also exists a “bridged” form of USDC known as USDC.e, which is USDC that has been bridged from Ethereum. Bridged USDC (USDC.e) is not issued by Circle and is not compatible with Circle Account or Circle APIs.

Previous Avalanche USDC.e Migration

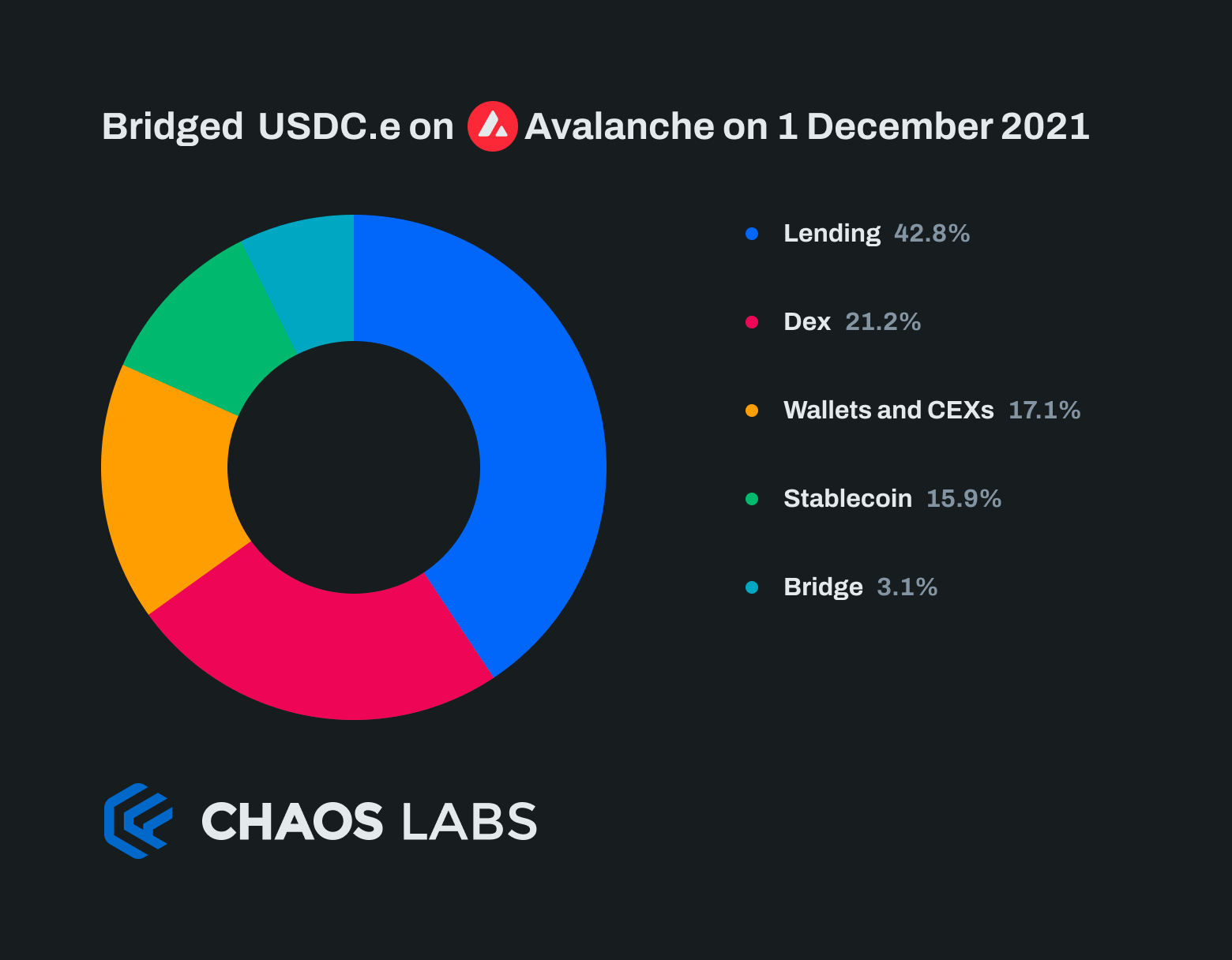

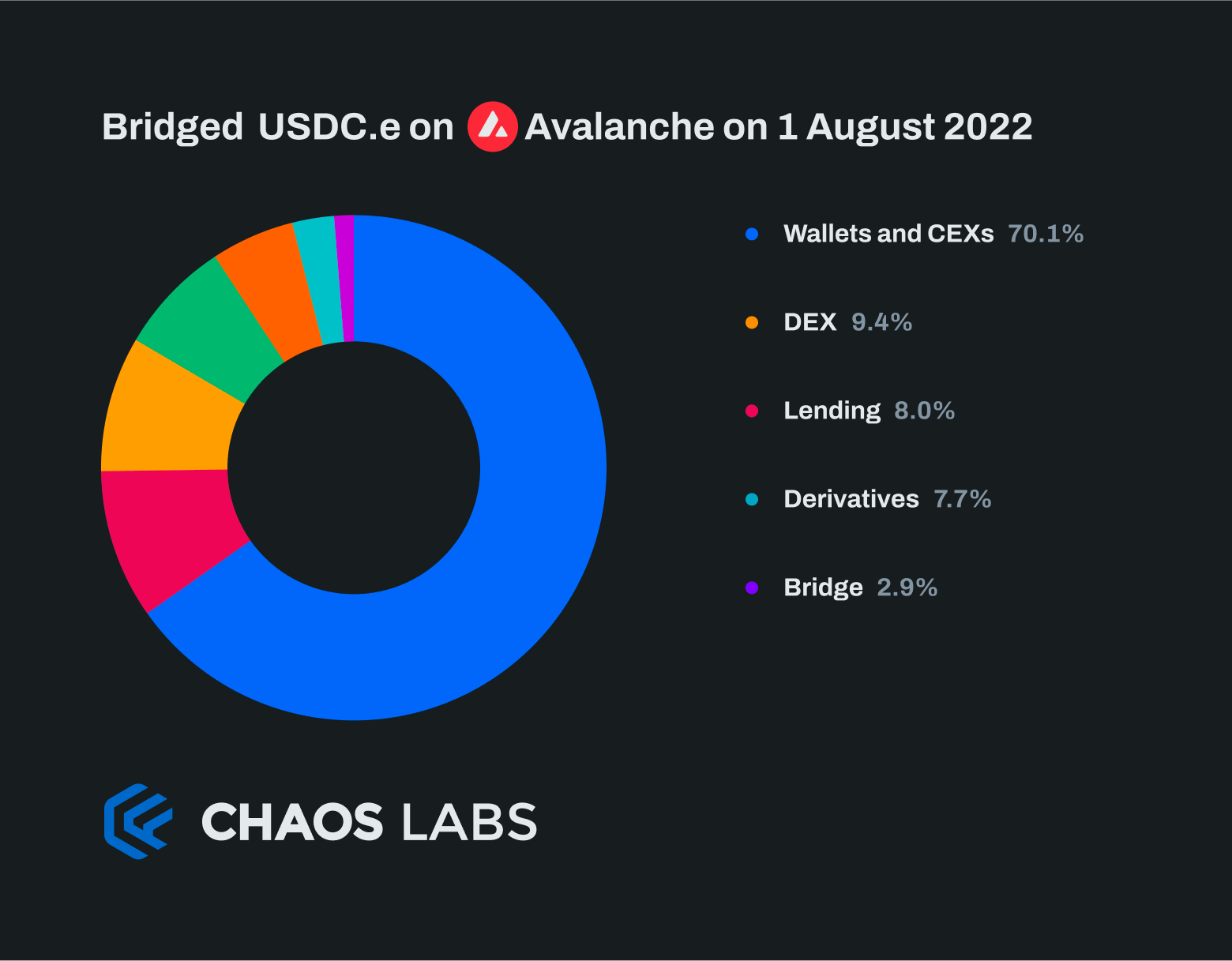

In December 2021, Circle launched native USDC on Avalanche. At the time of the migration, most of the $1.44B Avalanche bridged USDC TVL existed in lending protocols, DEXs, Wallets, and collateralizing other stablecoins. This breakdown was simpler than the current OP Mainnet breakdown of bridged USDC.e in a few ways:

- Limited derivative trading was happening at this time, meaning sticky margin collateral USDC didn’t need its own strategy.

- A much smaller share was held in wallets, which proved to be the stickiest segment to migrate.

- Generally, DeFi was less developed in 2021, with less composability, meaning more direct migrations.

The major source of USDC utility that needed to be migrated was lending pool liquidity. This was almost entirely on Aave v2 and Benqi.

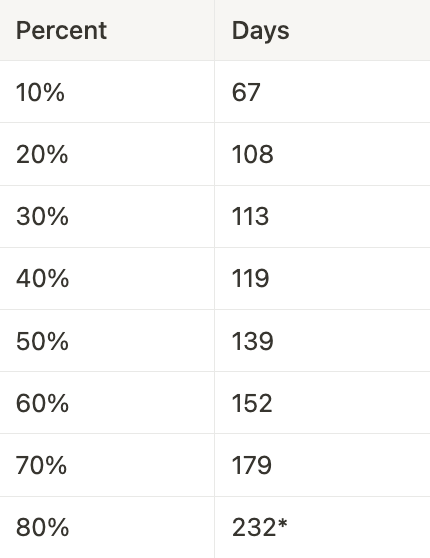

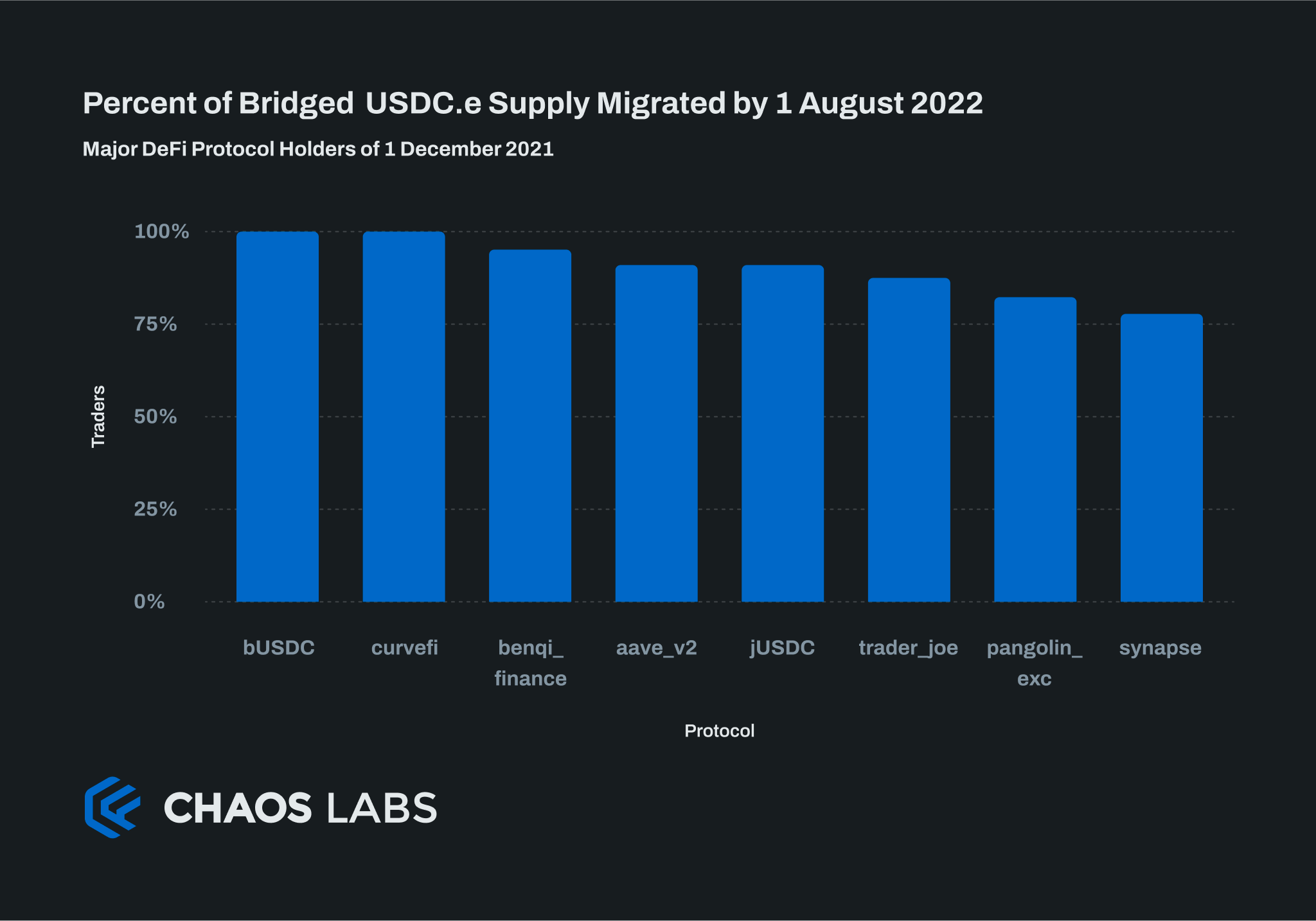

The migration from bridged to native USDC happened reasonably smoothly on Avalanche. Initially, the uptake of native USDC was gradual, requiring 67 days to reach a 10% share of the total USDC circulation. Following this initial period, the adoption pace significantly accelerated, taking another 122 days to reach 70% share and 165 days to reach 80%.

Days for native USDC to reach different market share percentages on Avalanche:

- Native USDC has not managed to sustain over 80% market share as the native supply has reduced.

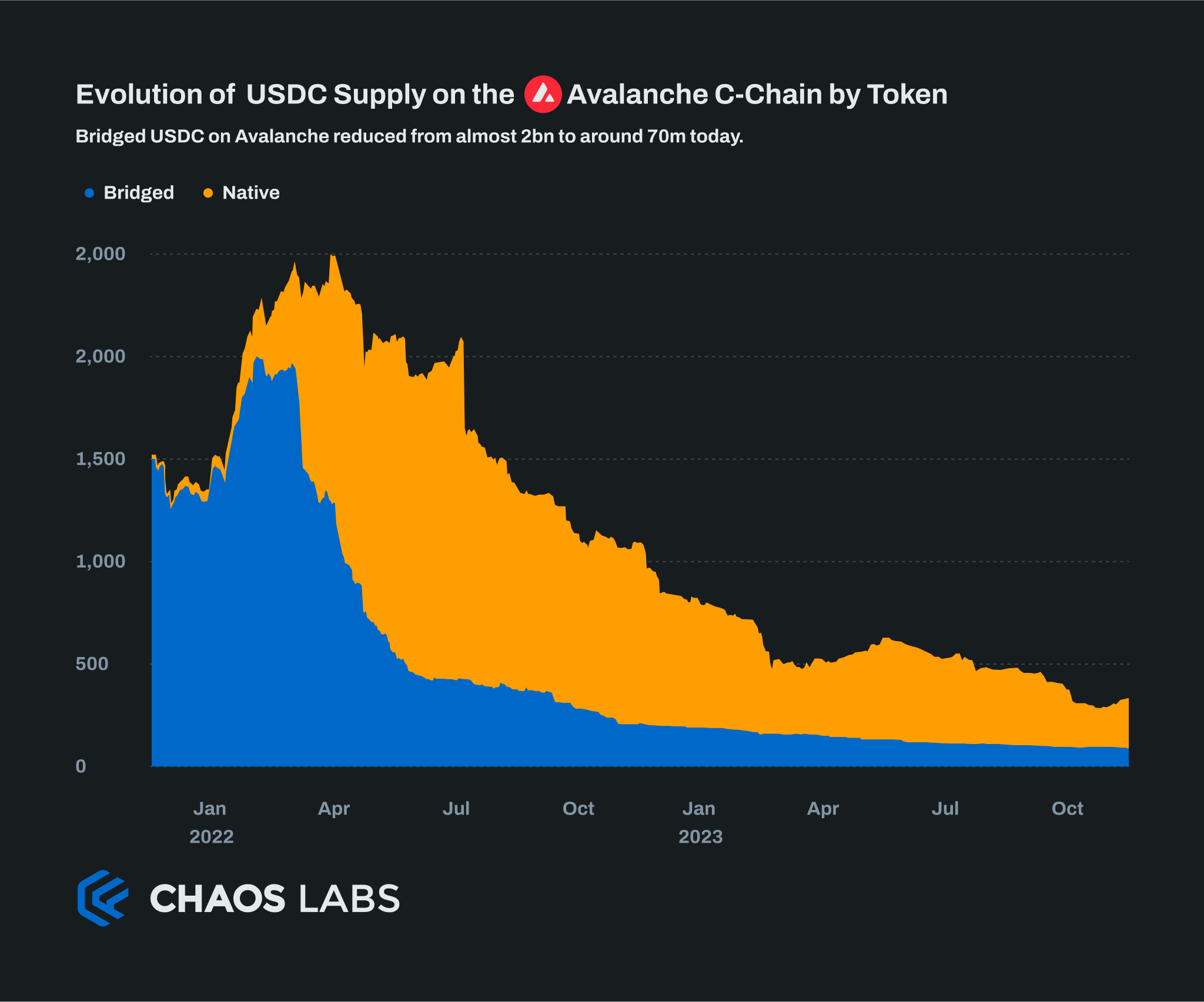

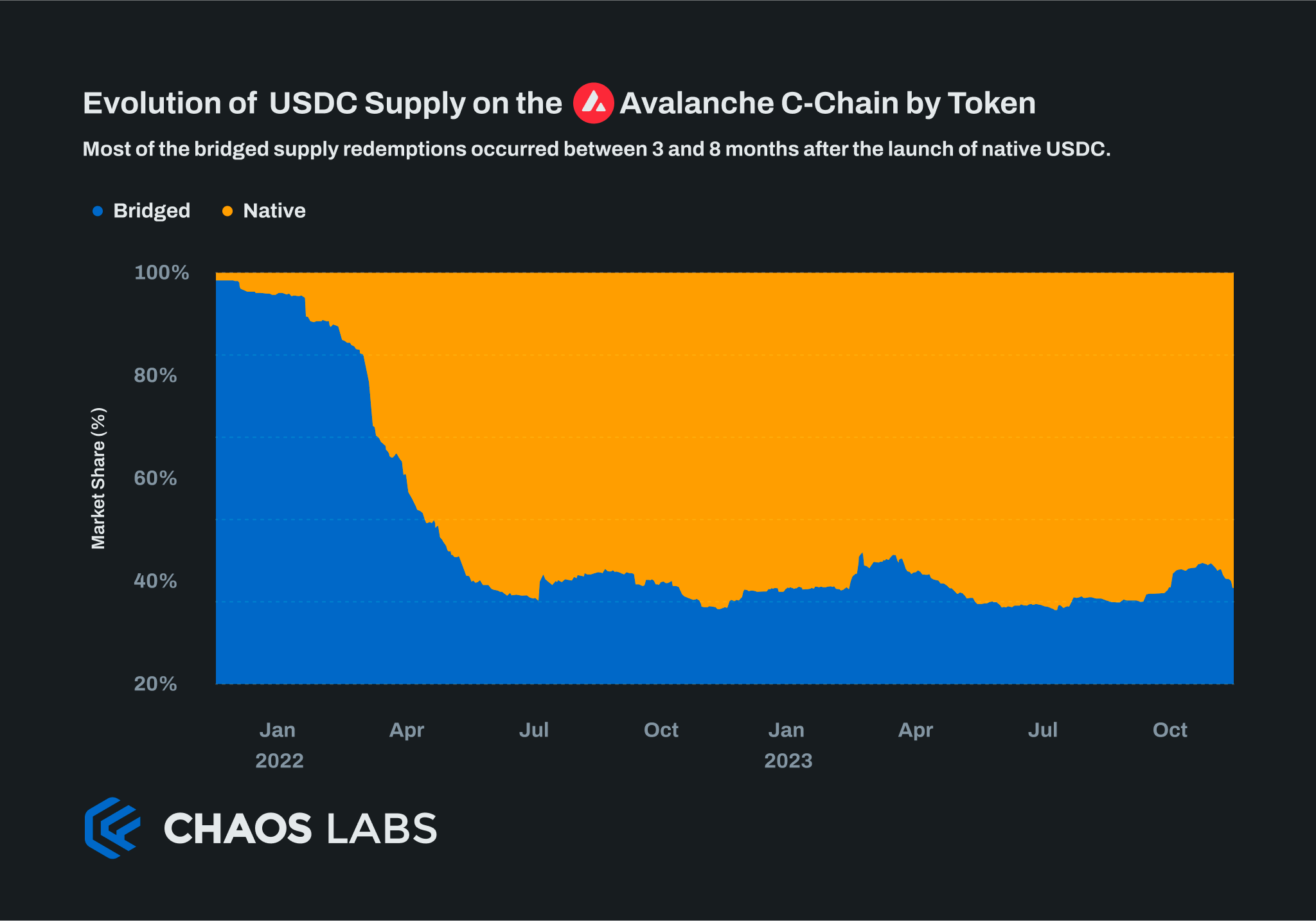

The Avalanche USDC migration has a clear acceleration phase from February to July 2022. The share of bridged USDC.e went from 80% to 5% over this period. Looking into the share of holders of bridged USDC.e at the end of this period shows a significant shift from DeFi protocols to wallets.

DeFi protocols migrated the vast majority of their TVL, with bridges and DEXs predictably migrating slower to facilitate later migrations.

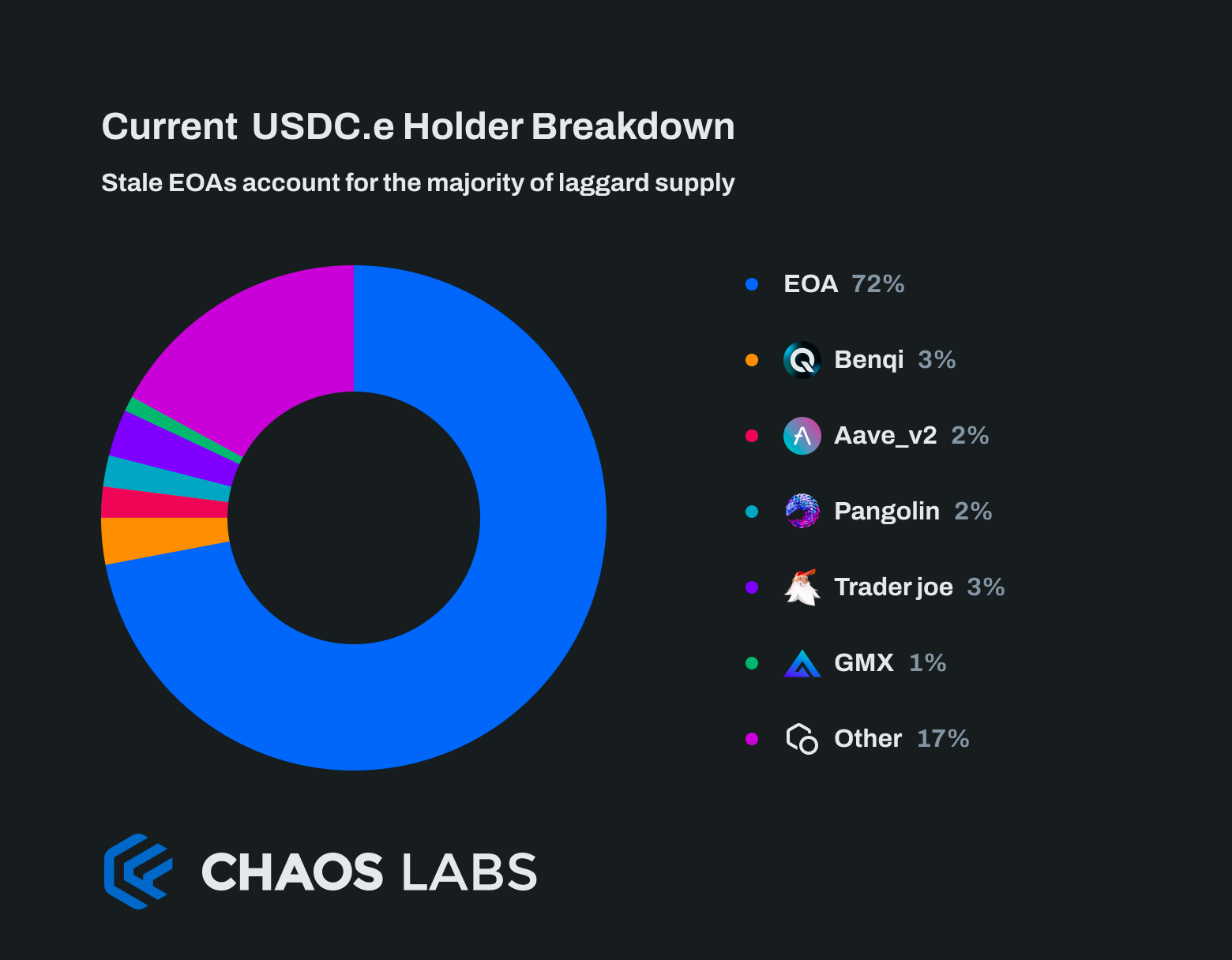

Today, most remaining bridged USDC on Avalanche is held in EOAs with small amounts in a wide range of DeFi protocols. Once the bulk of USDC.e supply was migrated, some passive holders were apathetic towards migrating their positions.

These laggards could either feel unincentivized to migrate or simply be disengaged. The relatively larger share of OP Mainnet bridged USDC.e held in wallets could pose a similar challenge.

Takeaways

- Three distinct periods can be observed during the Avalanche USDC migration:

- The first three months saw limited migration from bridged to native USDC.

- Over this period, liquidity pools were formed on DEXs to allow efficient swapping of native USDC, bridges onboarded and built native USDC liquidity, and DeFi protocols onboarded the native token through governance.

- Native USDC dominance, measured as the share of the total USDC supply made up of the native token, only reached around 5% over this period.

- Over the following four months, native USDC dominance went from around 5% to 80%.

- DeFi protocols migrated the majority of their holdings, leaving wallets holding over 70% of bridged USDC.e at the end of the period.

- Once native USDC dominance reached 80%, it fluctuated around this level.

- The first three months saw limited migration from bridged to native USDC.

- Bridged USDC.e supply has continued reducing along with native USDC.

- As the total USDC supply on Avalanche increases, it is expected that the total bridged USDC.e supply will not increase in line, and its share will decrease further.

- DeFi protocols naturally migrated as the utility of the different token versions switched. Utility is defined as the yield opportunities available.

- This migration is viewed as a success, with the native token gaining an 80% market share and extremely limited TVL remaining in DeFi.

- It is clear that some holders will continue to be insufficiently motivated to migrate. An 80% migration should be used as a benchmark to set expectations.

Current State of USDC on OP Mainnet

There is nearly $178m bridged USDC.e on OP Mainnet currently.

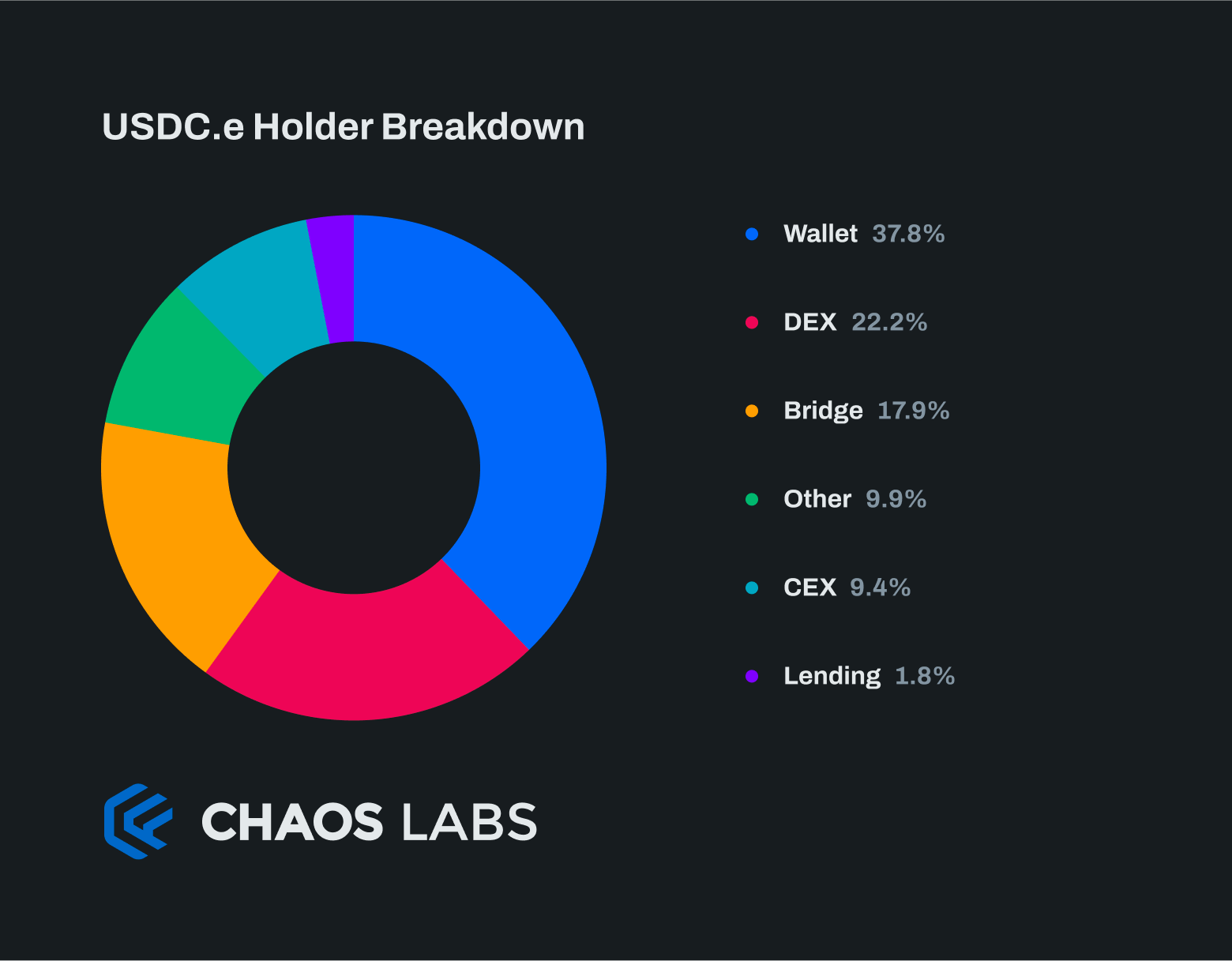

Relative to Avalanche in late 2021, DeFi on OP Mainnet is currently far more developed. As a result, bridged USDC.e is spread wider amongst different protocols, making the migration more complex.

Uses of USDC.e

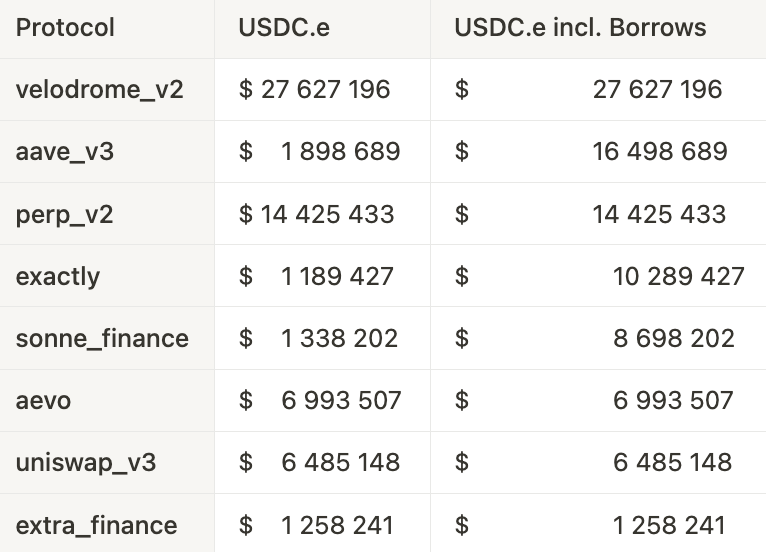

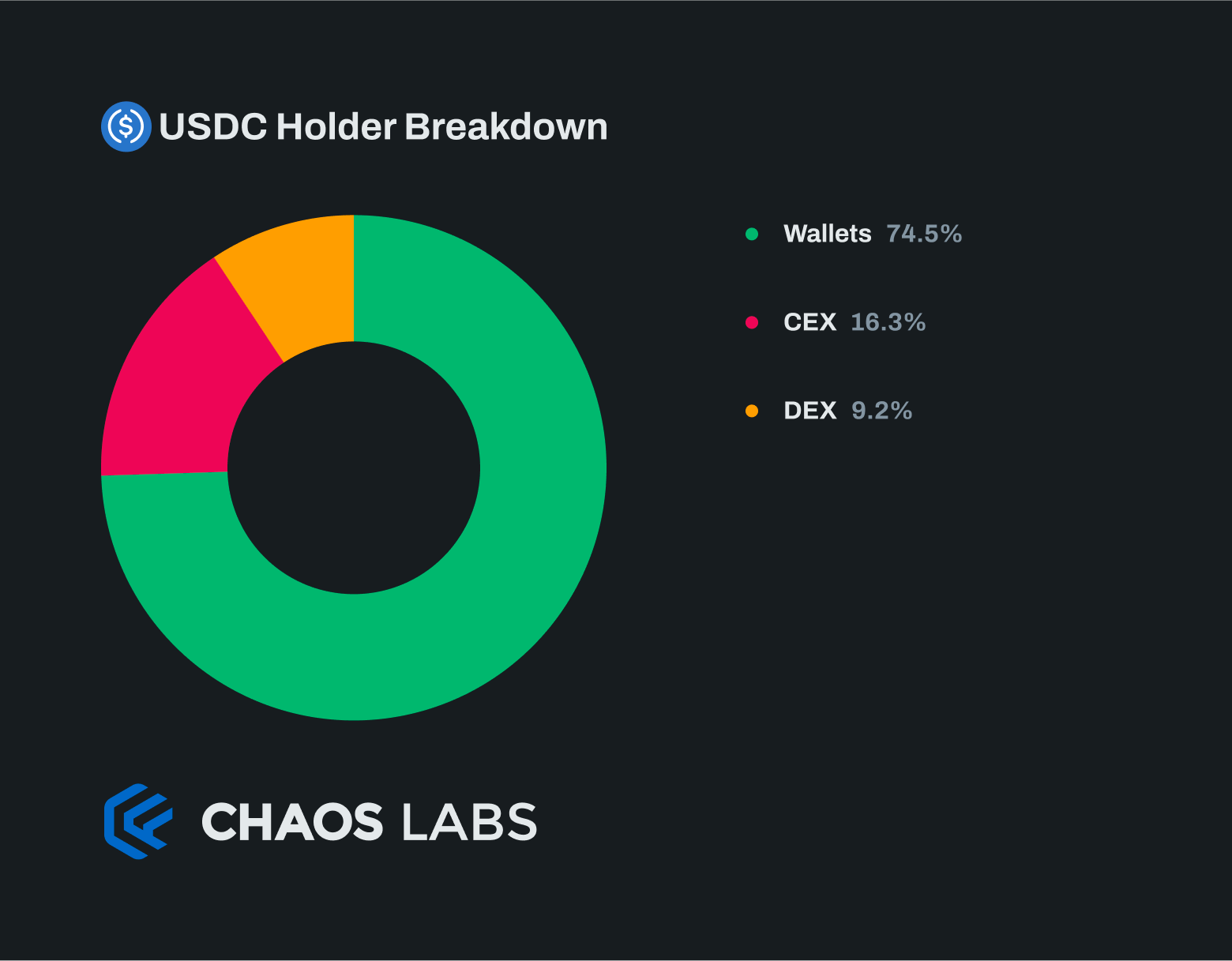

The current breakdown of where the majority of bridged USDC.e is held is shown in the chart below. USDC.e used in lending protocols is under-represented by this holder breakdown as the majority of deposited tokens are lent out.

An analysis focused on identifying the leading protocols by their holdings of USDC.e, including tokens that are lent out, reveals a concentration among a select group of substantial, non-bridge protocols. These protocols are recommended to be the cornerstone of our migration strategy.

The following are all protocols holding more than $1m bridged USDC.e in their smart contracts, or their tokens lent out. Bridges are excluded from the table below as their liquidity will likely migrate naturally.

Uses of USDC

Native USDC is mostly held in wallets and on DEXs currently. It has been onboarded to Aave v3 but currently has a less than 20% share of total USDC.

USDC.e and USDC DEX Liquidity on OP Mainnet

The most effective means of transitioning activity from bridged USDC.e pools to native USDC pools begins with a focus on the venues where USDC crosses are currently trading. This allows low-friction migrations via DEX pools and naturally makes native USDC DEX pairs more attractive, as there would be better execution in multi-hop swaps.

At the same time, high TVL DEX pools should be incentivized to speed up the migration and avoid the risk of any stalls in progress.

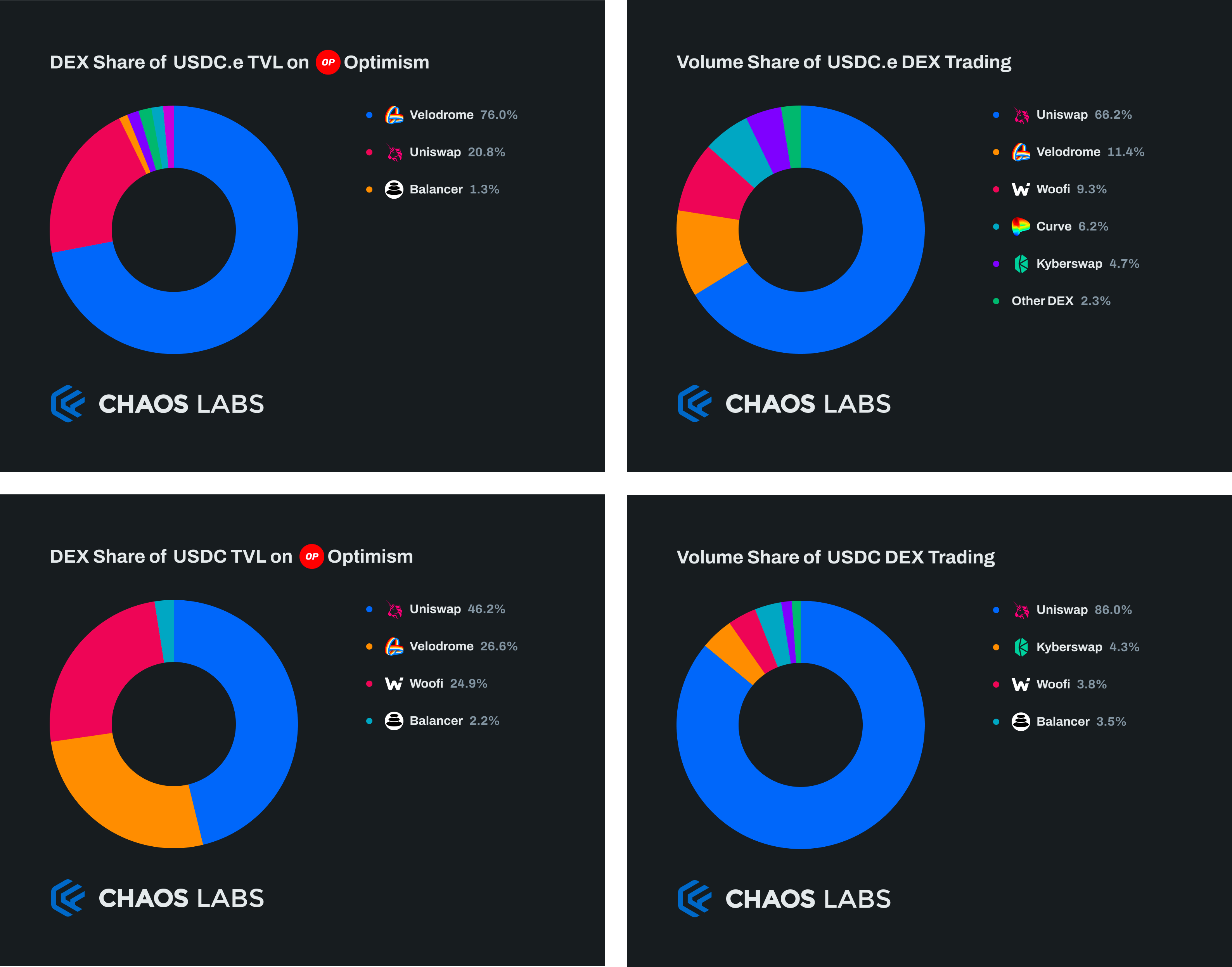

Trading data of major USDC (both varieties) pools over the past three months show the majority of activity in both forms of USDC happening on Uniswap v3.

There is $38m bridged USDC.e TVL on OP Mainnet DEXs, while only $2.8m native USDC on these DEXs.

DEX Volume Share of Major USDC and USDC.e Pairs on OP Mainnet

The majority of bridged USDC.e TVL is currently on Velodrome, while the majority of trading activity happens on Uniswap.

Native USDC DEX TVL is more evenly distributed, but an even higher share of trading activity happens on Uniswap. There is currently approximately $64m native USDC on OP Mainnet.

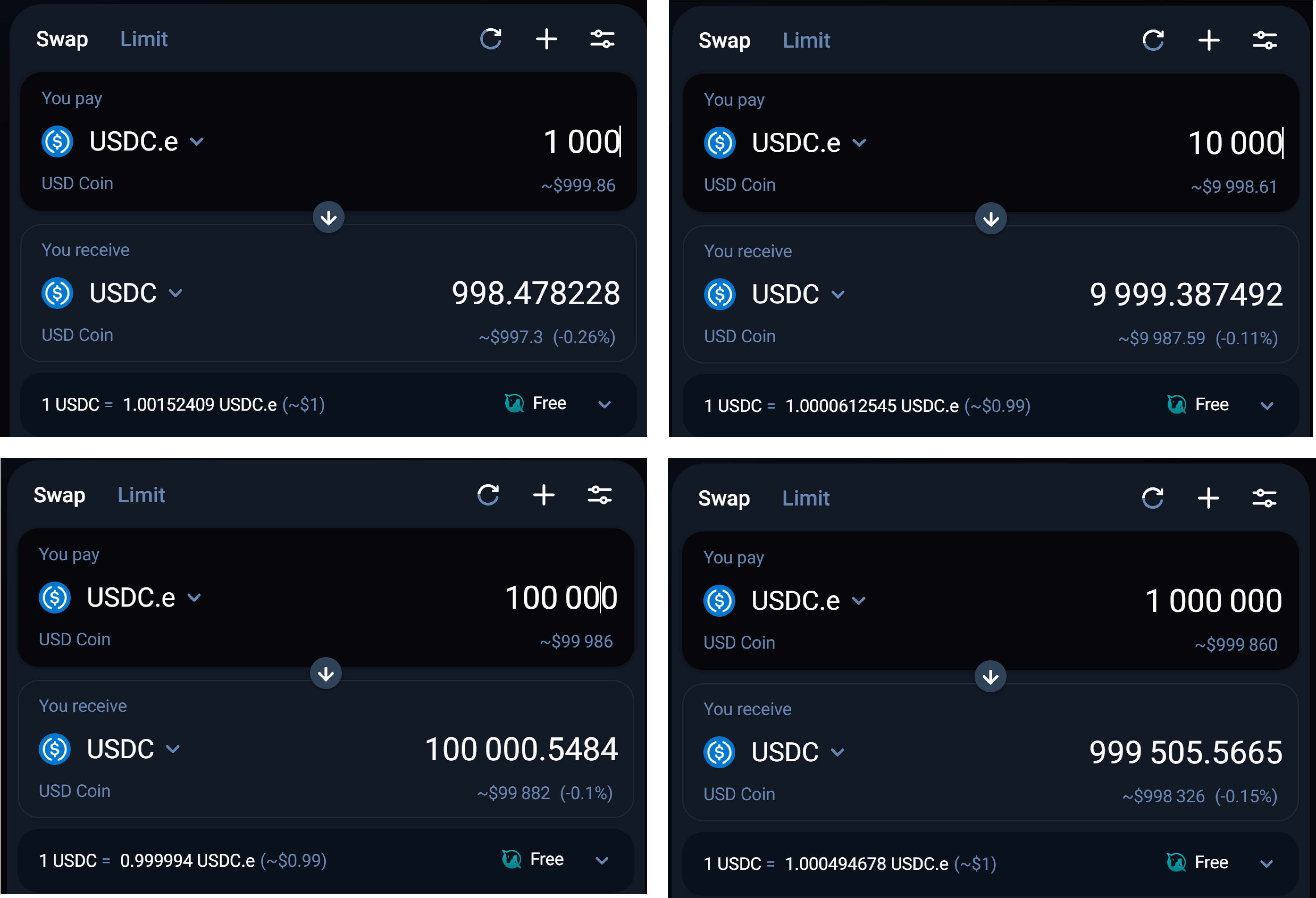

Current Slippage to Migrate

There is currently tolerable slippage to swap bridged for native USDC up to approximately $100,000. Beyond this, the low native USDC TVL becomes a limiter, and slippage increases significantly.

* Slippage as at 2024/02/16 9:30 UTC

Velodrome

Currently, only four pools on Velodrome v2 accept native USDC. None of these are major pools currently and work will need to be done to create and bootstrap new pools utilizing native USDC rather than bridged USDC.e. The current four live pools are:

- VolatileV2 AMM - USDC/TAROT

- StableV2 AMM - USDC/ERN

- StableV2 AMM - USDC/USDC.e

- StableV2 AMM - USDC/USDGLO

Most major bridged USDC.e crosses have well-developed Velodrome pools. The largest can be seen below:

The significant Total Value Locked (TVL) in Velodrome and its notable role in OP Mainnet DEX activity suggests that a tailor-made solution is necessary for transitioning these pools to native USDC.

Uniswap

Uniswap v3 is slightly further along with creating the important USDC trading pair pools. All still have relatively little liquidity, with only the top 3 having over $100k USDC.

- USDC-WETH 5bps

- USDC-USDC.e 1bp

- OP-USDC 30bps

- USDC-USDGLO 1bp

- USDC-USDC.e 5bps

- USDC-WLD 100bps

- USDC-USDT 1bp

The majority of trading involving USDC happens on Uniswap. Driving LPs towards native USDC pools is important in shifting DEX trading to this version of USDC and improving its utility in DeFi.

Takeaways

- The on-chain ecosystem around native USDC on makes the migration more complex. is significantly less developed than the bridged USDC.e ecosystem. As a result, there is more utility to holding the bridged token hindering the migration.

- Most native USDC is held in wallets and on centralized exchanges, while bridged USDC.e is held in a wide range of DeFi applications.

- There is $38m bridged USDC.e DEX TVL vs $2.8m native USDC TVL. This limits the ability of holders to migrate their tokens even if they are interested in doing so.

Migration Framework

As much as possible, this program is focused on creating an environment where all stakeholders are naturally incentivized to migrate by market forces to maximize the efficiency of the program in terms of incentives given.

This framework is specifically designed to achieve the following objectives:

De-risk the migration process for both bridged and native USDC

Ensure that there is sufficient DEX liquidity at each stage in the migration process to allow DeFi protocols to operate safely.

Create the natural incentives for DeFi protocols and their users to migrate to native USDC

Wherever possible, the focus will be on increasing the utility of native USDC relative to bridged USDC to allow market forces to convince holders to transition their holdings.

As DeFi protocols migrate to native USDC, bridges are incentivized to migrate

As the relative market share and activity level shift from bridged USDC to native USDC, bridge yields should shift in line, and TVL should move in line. This will be closely monitored to see whether external incentives are needed.

Centralized exchanges should also be naturally incentivized to migrate as users demand the more useful token

Given that centralized exchanges hold 11% of bridged USDC.e, they are expected to align their holdings with the demands of their users, favoring the token with greater utility on the network.

Holders of bridged USDC in their wallets should find little friction to migrate and naturally follow the same incentives as centralized exchanges to the more useful token

Similarly, individual holders of bridged USDC.e will find it in their interest to migrate to the token that offers them more utility, mirroring the motivations driving centralized exchanges toward the preferred token.

Execution Plan

The execution plan is focused on elevating native USDC utility to make it the preferable version of the token to hold. This should create the initial momentum in growing USDC TVL as liquidity providers chase these incentive yields while setting in motion a flywheel where increased utility increases yields driven by activity, which causes more TVL to migrate and so on.

The mechanism through which bridged USDC will be

Focus Area 1: Incentivize USDC DEX Liquidity in Major Pairs

The objectives of this focus area are:

- Create sufficient USDC-USDC.e liquidity for users to migrate their positions at a low cost.

- Migrate the USDC version in major trading pools to native USDC.

- De-risk DeFi by ensuring sufficient DEX liquidity remains in both token versions throughout the migration.

The following strategies have been specifically tailored to meet these objectives, given the current state of USDC on OP Mainnet.

Projected Incentive Yields

These incentives were designed to add approximately 14% APR reward yields to the targeted pools in peak reward weeks. This yield would be incremental to existing fee yields and should be lucrative enough to cause liquidity to migrate.

There is currently approximately $700k of liquidity in USDC-USDC.e pools. These incentives are designed to increase this to $3.5m, allowing for low slippage and seamless user migrations.

In the high volume pools, aggregate TVL across Uniswap USDC and USDC.e pools is used as a reference as this program intends to migrate all of this to USDC. The required incentives are then estimated using this aggregate USDC TVL and the incentive schedule outlined below.

The high TVL pools are calculated using their current TVL. The required incentives are then estimated using this current bridged USDC TVL and the incentive schedule outlined below.

Strategy 1: Create deeper liquidity in the Uniswap v3 USDC-USDC.e 1bp pool.

This crucial step achieves two of the objectives above in one. It reduces the cost to users of migration by decreasing slippage and allowing larger trades. It also extends the liquidity of either USDC version to the other through low slippage, multi-hop swaps. This is a crucial risk mitigant in this process, allowing lending protocol liquidations involving either token to clear seamlessly.

Currently, there is just under $700k of liquidity in this pool, which has processed approximately 75% of the total volume in this pair over the past seven days. Using Arbitrum as a comparison in current conditions, the two concentrated liquidity pools on Algebra and Uniswap combined have around $3.3m liquidity.

Concentrated liquidity pools are ideally positioned for this pool by design, where liquidity can be concentrated in an extremely tight range in stable paired pools. The state of Arbitrum USDC-USDC.e activity and the large share of stablecoin-stablecoin DEX volumes across ecosystems confirms this.

Given the low current supply of native USDC on OP Mainnet, it is anticipated that this pool will attract fresh native USDC onto OP Mainnet while absorbing bridged USDC.e initially, which shifts pools as a result of strategies 2 and 3.

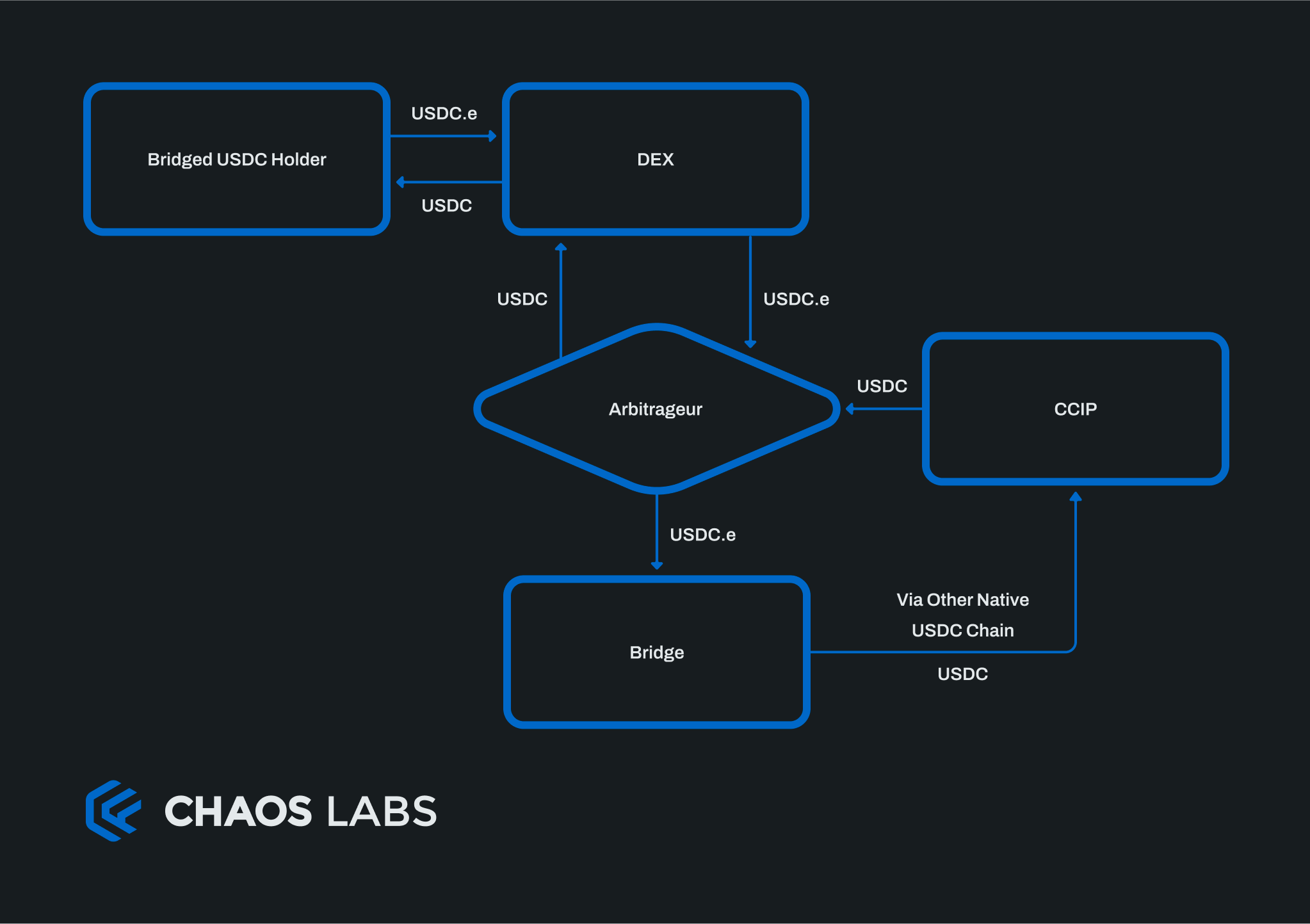

As users swap their bridged USDC.e for USDC, arbitrageurs are expected to rebalance this pool, as illustrated in the diagram above, by debridging USDC.e and minting native USDC. Over time, this pool has an important role to play in everything involved in this migration.

Strategy 2: Make the most actively traded USDC-cross pools native USDC pools

The DeFi utility of native USDC is increased by migrating the most active USDC-cross pools to that version. For example, these pools, such as the USDC-WETH pool, make up a high proportion of total DEX trading volume and are often used in multi-leg swaps. When these pools contain native USDC, it becomes cheaper and more efficient to swap native USDC, and the total amount of native USDC fees on OP Mainnet will increase.

Migrating these pools to native USDC provides another incentive for other pools and DeFi protocols to migrate. The chosen pools combined make up 80% of all DEX trading volume on OP Mainnet.

It is necessary to differentiate between high-volume and high-TVL pools, as not all the high-volume pools have high TVL. The pools meeting the criteria for this category are the most active pools by trading volume in the five highest-volume trading pairs on OP Mainnet over the past 30 days. These are all Uniswap v3 pools:

- USDC-WETH 5bp

- USDC-USDT 1bp

- OP-USDC 30bp

- DAI-USDC 1bp

- USDC-WBTC 5bp

Strategy 3: Incentivize High TVL USDC DEX Pools to Migrate

Velodrome, as the liquidity launchpad of OP Mainnet, holds by far the most bridged USDC.e in its contracts of any protocol. This USDC.e is used as the base asset in a wide range of pools. Because of the size and distributed nature of this liquidity, Velodrome requires its own dedicated migration strategy. It should also be noted that all 16 DEX pools holding over $500k in USDC.e and not falling into strategies 1 or 2 are on Velodrome.

Velodrome has a built-in incentivization mechanism used by many protocols to incentivize liquidity for their tokens. Strategy 3 will involve adding OP incentives to any pool and shifting their own incentives from the USDC.e pool to the USDC pool. The OP incentives will be used pro-rate based on pool TVL.

Velodrome pools contain approximately $28m in TVL, and migrating them will transition 16% of total OP Mainnet bridged USDC.e.

Focus Area 2: Work with Lending Protocols to Migrate USDC.e to USDC

In lending protocols, the usage of stablecoins can be notably persistent, primarily because stablecoin borrowing utilization often remains high. Consequently, lenders have limited access to only a fraction of their deposits at any given time.

The three leading lending protocols on the OP Mainnet are Aave v3, Exactly Protocol, and Sonne Finance. Aave v3 supports both bridged and native USDC, whereas Exactly Protocol and Sonne Finance currently list only bridged USDC. For Exactly Protocol and Sonne Finance, a key preliminary step is listing native USDC. This action will set the foundation for implementing a similar migration strategy, aligning Exactly Protocol and Sonne Finance with the broader transition goals.

Once each lending protocol has onboarded native USDC, it will qualify for OP incentives to ensure that liquidity remains on OP Mainnet lending protocols and does not migrate elsewhere. These rewards will be allocated according to the current USDC.e supply share of the protocols, and to qualify, the protocols will need live native USDC markets.

To migrate borrowers, additional measures will be considered in regard to risk parameter updates:

Reserve Factors

These protocols utilize a reserve factor model, wherein a specific portion of the interest accrued from borrowing is allocated to the protocol's treasury.

This reserve factor presents an opportunity to organically encourage lenders using bridged USDC to transition their lending to native USDC. The proposed method involves regular, incremental increases in the reserve factor, which would effectively reduce the yield on bridged USDC. As lenders start moving their capital from bridged to native USDC, the borrow rates for bridged USDC will naturally rise, creating a compelling incentive for borrowers to also switch their loans to native USDC.

Interest Rates

Interest rate curves can also be increased to further increase the cost of borrowing to incentivize repayment. This should be done in conjunction with reserve factor increases to ensure that USDC.e yields do not increase for lenders.

Collateral Factors

To minimize the usage of USDC.e as collateral, strategies could include lowering liquidation thresholds and loan-to-value ratios or, as an alternative measure, completely disabling the asset's use as collateral.

Focus Area 3: Single Token Protocols

Aevo and Perpetual Protocol currently hold significant balances in bridged USDC.e. As the liquidity of native USDC is expected to surpass that of bridged USDC.e, these protocols should naturally be incentivized to migrate collateral balances of their traders. This transition is not just preferred by liquidity providers for its higher liquidity, but it's also preferable from a protocol risk management perspective.

In this context, it's important to note that traders who have control over these USDC balances are typically more focused on their trades than on the specific type of USDC used as margin. Therefore, a targeted strategy is necessary to ensure that holding native USDC is more beneficial for traders compared to bridged USDC.e. This approach involves addressing specific risks and enhancing the utility for traders using native USDC.

Our strategy includes working closely with the teams and governance bodies of Aevo and Perpetual Protocol to assist them in migrating to the more liquid USDC version, thus reducing risk. The migration strategy should follow a principle similar to that used in lending protocols, where bridged USDC.e is gradually treated less favorably due to efficiency parameters. This gradual shift will incentivize the controllers of the bridged tokens to migrate, thereby improving their overall trading experience.

The first steps in this process involve introducing native USDC as an allowable form of collateral within these protocols. Following this, the protocol insurance funds that are currently in bridged USDC should be transitioned to native USDC. This initial move sets the stage for a broader and more comprehensive token migration, aligning with the overall goal of improving the relative utility of native USDC.

No rewards are projected to be needed to incentivize this segment. However, this will be closely monitored, and should the need arise, our strategy will be adjusted accordingly.

Bridges

There is not a strict need for native USDC liquidity on bridges due to the ability to mint directly from Circle. Evidence from the Avalanche migration (prior to the release of Chainlink CCIP, which Circle has adopted) shows the Stargate bridge as the second-largest holder of native USDC.

The initial strategy is thus not to incentivize bridge TVL. However, this will be closely monitored, and should the need arise, our strategy will be adjusted accordingly.

Success Metrics

Our approach to measuring the success of the USDC migration is defined by several key performance indicators, which are crafted to assess the initiative's impact:

- Migration Progress: We'll use historical migrations, such as the one observed with Avalanche, as a reference point to gauge our migration pace. Our goal is to achieve a significant conversion of OP Mainnet's USDC.e supply to native USDC, seeking gradual progress post-launch, with an increase in migration rate anticipated with the increase in incentives.

- Efficiency of Incentive Utilization: The focus here is on strategically deploying incentives to foster migration in a cost-effective manner. Efficiency will be inferred from how migration objectives are met relative to the resources allocated, emphasizing prudent resource management.

- Retention of Stablecoin Supply: A critical aspect of the migration's success will be monitoring and maintaining the overall stablecoin supply within the OP Mainnet. The initiative is designed not just for the transition but also to support the stablecoin ecosystem's health and growth on the platform. The growth in total USDC supply from the level at the start of the program will be used to measure success here.

Chaos Labs is dedicated to facilitating a smooth and effective transition from USDC.e to native USDC on OP Mainnet. Our strategy is informed by our deep experience and learnings from similar transitions, and we are eager to apply our expertise to this significant project, adjusting our approach as necessary to align with the evolving dynamics of the migration.