USD₮0 Mechanism Design Review

Disclaimer

This document is purely informational and does not constitute an invitation to acquire any security, an appeal for any purchase or sale, or an endorsement of any financial instrument. Neither is it an assertion of the provision of investment consultancy or other services by Chaos Labs Inc. References to specific securities should not be perceived as recommendations for any transaction, including buying, selling, or retaining such securities. Nothing herein should be regarded as a solicitation or offer to negotiate any security, future, option, or other financial instrument or to extend any investment advice or service to any entity in any jurisdiction. The contents of this document should not be interpreted as offering investment advice or presenting any opinion on the viability of any security, and any advice to purchase, dispose of, or maintain any security in this report should not be acted upon. The information contained in this document should not form the basis for making investment decisions. While preparing the information presented in this report, we have not considered individual investors’ specific investment requirements, objectives, and financial situations. This information does not account for the particular investment goals, financial status, and individual requirements of the recipient of this information, and the investments discussed may not be suitable for all investors. We prepared any views presented in this report based on the information available when these views were written. Additional or modified information could cause these views to change. All information is subject to possible rectification. Information may rapidly become unreliable, including market or economic changes.

Summary

Between 14 and 28 February 2025 Chaos Labs conducted an intensive risk assessment of USD₮0, an innovative, natively cross-chain interoperable stablecoin. Cross-chain USD₮0 is 1:1 backed by USDT on Ethereum.

USD₮0 is a technical breakthrough in stablecoin design, offering a range of benefits to users, blockchain ecosystems, and exchanges. Its innovative native cross-chain transfer mechanism enables broader DeFi access without reliance on separate bridges or fragmented liquidity pools.

Blockchains wanting USD₮0 are able to connect effortlessly with leading blockchain networks, driving capital inflows and expanding cross-chain functionality to foster growth.

Introduction

This report will comprehensively review all relevant risk factors of USD₮0. Our approach involves both quantitative and qualitative analysis to help users, integrators, or other stakeholders better understand the token’s risks.

At Chaos Labs, our approach to reviewing USD₮0 covers the following risk areas:

- Solvency Risks: Risks that could permanently impair the backing and, therefore, the solvency of USD₮0 as a stablecoin backed 1:1 by USDT.

- Liquidity Risks: Risks associated with the ability to enter and exit USD₮0 as expected.

- External Dependencies: We highlight and investigate any external dependencies such as oracles, rights to update protocol functioning, etc.

Each of these risk categories will be covered separately. We discuss all relevant risks investigated, identifying mitigants where applicable to give a clear picture of which scenarios are potentially harmful and which are not.

USD₮0 Overview

USD₮0 is a multichain liquidity protocol designed to make USDT available natively across ecosystems, unifying liquidity into a cohesive and efficient structure. Simplifying asset movement between blockchains eliminates operational barriers and enhances on-chain performance.

USD₮0 is backed 1:1 by USDT on Ethereum, held in a non-custodial smart contract system operated independently of Tether. Upon receipt of locked USDT, USD₮0 is then minted on any supported chain with the message carried using LayerZero’s Omnichain Fungible Token (OFT) standard. This approach effectively hard-pegs USD₮0 to USDT on Ethereum in a fully non-custodial manner.

Unlike traditional multi-chain USDT deployments—where each blockchain maintains its own isolated version—USD₮0 enables continuous liquidity and interoperability. By leveraging LayerZero’s OFT standard, it transforms USDT into a unified, cross-chain asset without fragmentation.

Launched on January 16, 2025, USD₮0 has rapidly expanded, reaching approximately $1.57 billion in value as of March 18, 2025.

USD₮0 is fully non-custodial in that its reserves are not held by any legal entity but rather in the OAdapterUpgradeable Contract on Ethereum. This distinction is relevant from a regulatory perspective, particularly in the European Union, with the recently implemented Markets in Crypto Assets (MiCA) regulatory framework.

USD₮0 Mechanics

USD₮0 is an Omnichain Fungible Token (OFT) standard token that enables USD₮0 to move seamlessly across multiple blockchains using LayerZero's messaging protocol.

Minting and Redemption Mechanism

USD₮0 is minted by depositing USDT into the OAdapterUpgradeable Contract on Ethereum. A message is then routed via the LayerZero protocol to the destination chain to mint USD₮0 to the specified address.

Redemptions are handled with the opposite flow. A withdrawal request is submitted on a chain supporting USD₮0, and USD₮0 is burnt in exchange for an equivalent amount of USDT released from the OAdapterUpgradeable Contract on Ethereum.

LayerZero DVN and Everdawn Labs DVN validate every mint and redeem transaction to ensure compliance with USD₮0's rules and maintain full collateralization at all times. This provides another mitigation against exploitation. For more details on the verification process, see the section on the USD₮0 DVN below.

Backing

USD₮0 is fully backed by USDT on Ethereum, held in its OAdapterUpgradeable Contract. Reserves are viewable on the chain, providing transparency that USD₮0 is fully backed by the underlying USDT, and DVN checks through the upcoming Chaos Labs Pre-Crime will ensure that the contract avoids exploits.

The contract operates as an upgradeable proxy, managed by Everdawn Labs to ensure USD₮0 remains adaptable to evolving blockchain technologies. This design enables seamless interoperability, expands functionality, and supports smart contract upgrades to align with the latest industry standards. By taking this approach, USD₮0 remains scalable, efficient, and relevant in a rapidly evolving ecosystem.

Proof of Reserves

Chaos Labs’ Proof Oracle is an essential element in maintaining the integrity of the USD₮0 ecosystem by ensuring that assets backing USD₮0 and other tokenized assets are properly collateralized, secure, and consistently aligned with their respective pegs. This oracle will provide continuous, real-time verification of USD₮0 reserves and collateral integrity.

Pre-Crime Oracle

To enhance the security and trustworthiness of the USD₮0 ecosystem, the upcoming Pre-Crime Oracle tailored specifically for transactions involving the token. Based on the design of LayerZero’s OFT framework, this oracle system will monitor cross-chain transactions in real-time, identifying and flagging potentially suspicious or malicious activities before they are executed. The Pre-Crime oracle will provide the following:

- Real-Time Reporting Suspicious transactions will be identified and reported in real-time, providing actionable intelligence to relevant stakeholders, including protocol administrators and automated security measures.

- Cross-Chain Compatibility Leveraging LayerZero’s interoperability, the Pre-Crime Oracle will monitor USD₮0 transactions across all supported blockchains, ensuring comprehensive coverage and risk mitigation.

The upcoming Pre-Crime Oracle will provide significant benefits to the USD₮0 ecosystem by proactively mitigating risks and ensuring a higher level of security. By identifying and reporting suspicious transactions in real time, the oracle fosters trust among users and stakeholders, reducing the likelihood of malicious exploits and fraud. This enhanced security layer allows the ecosystem to grow with confidence, supporting seamless cross-chain interactions and scaling efforts. Furthermore, by providing actionable intelligence, the oracle empowers administrators to take swift action when necessary, safeguarding users and maintaining the integrity of the ecosystem. This not only boosts user confidence but also reinforces the token’s reputation as a secure and reliable asset within the broader blockchain space.

Cross Chain Transfers

As an OFT, USD₮0 enables native cross-chain transfers without the need for external bridges or wrapping. This is accomplished by locking or unlocking USD₮0 on the source chain and minting or burning an equivalent amount on the destination chain for each transaction.

USD₮0 cross-chain transfers using LayerZero incur zero slippage, as the exact amount sent is locked or burned on the source chain and minted on the destination chain.

A more detailed discussion of the OFT messaging protocol is included below.

Native cross-chain transfers establish a seamless liquidity layer, enabling swift USD₮0 transfers between integrated chains without relying on third-party bridges. This streamlines the user experience for various stablecoin stakeholders. By eliminating the need for intermediary bridges or wrapped assets, the OFT standard reduces complexity and operational overhead.

The native cross-chain USD₮0 liquidity layer allows native cross-chain transfers. USDT0.to provides a user interface to transfer to any address on any connected chain.

Legacy Mesh

While USD₮0 enables USDT’s expansion to new chains, the Legacy Mesh brings interoperability to chains where USDT is already deployed. Currently, Legacy Mesh Chains include chains like Ethereum, Tron, and TON.

The Legacy Mesh uses a hub-and-spoke model for seamless cross-chain transfers, with Arbitrum serving as the central hub for USD₮0. For example, when moving USDT on TON to USD₮0 on Ink, the process first involves transferring USDT on TON to USD₮0 on Arbitrum through a liquidity pool. From there, the USD₮0 is transferred from Arbitrum to Ink using OFT messaging.

This architecture ensures efficient, low-cost, and secure cross-chain movement.

The Omnichain Fungible Token (OFT) standard

The Omnichain Fungible Token (OFT) Standard allows fungible tokens to be transferred across multiple blockchains without asset wrapping, middlechains, or liquidity pools.

This standard works by burning tokens on the source chain whenever an omnichain transfer is initiated, sending a message via the protocol and delivering a function call to the destination contract to mint the same number of tokens burned, creating a unified supply across both networks.

Using this design pattern, LayerZero can extend any fungible token to interoperate with other chains using the protocol. The most widely used of these standards is OFT.sol, an extension of the OApp Contract Standard and the ERC20 Token Standard.

OFT Adapter works as an intermediary contract that handles sending and receiving deployed fungible tokens. For example, when transferring an ERC20 from the source chain (Chain A), the token will lock in the OFT Adapter, triggering a new token to mint on the destination chain (Chain B) via the peer OFT.

The LayerZero Omnichain Fungible Token (OFT) messaging process enables the seamless transfer of fungible tokens across multiple blockchains without wrapping or middlechains. Below is a detailed breakdown of the process:

1. Sending the Message

- Sender Contract (Onchain/Source): The process begins when a user calls the

lzSendmethod on the Sender OApp (Omnichain Application) Contract. This method specifies: - LayerZero Endpoint (Onchain/Source): The source Endpoint generates a packet containing the Sender OApp’s message data. Each packet is assigned a unique, sequential nonce for identification. The Endpoint then encodes the packet using the OApp’s specified

MessageLiband emits it to the Security Stack and Executor, completing the send transaction.

2. Verifying the Message

- Decentralized Verifier Networks (DVNs) (Offchain): DVNs independently verify the message using unique methods. Only DVNs configured by the OApp can submit verifications, ensuring security and preventing unauthorized modifications.

3. Committing Verification

- Message Library (Onchain/Destination): Once all DVNs in the Security Stack verify the message, the destination

MessageLibmarks it as verifiable. - Executor (Offchain): The Executor commits this verification to the destination Endpoint, staging it for execution.

4. Receiving and Processing

- LayerZero Endpoint (Onchain/Destination): The destination Endpoint ensures that the packet delivered by the Executor matches what was verified by the DVNs. This step guarantees message integrity.

- Executor (Offchain): The Executor calls the

lzReceivefunction on the committed message, triggering its processing by the Receiver OApp logic. - Receiver Contract (Onchain/Destination): Finally, the Receiver OApp Contract processes and receives the message on the destination chain, completing the transfer.

OFT-Specific Logic

For token transfers using OFT:

- On the source chain, tokens are either burned (

_burn) or locked (_lock) viaOFT.sol. A message is sent to LayerZero, which triggers a function call on the destination chain to mint (_mint) or unlock (_unlock) an equivalent amount of tokens. - This creates a unified token supply across all supported chains without requiring asset wrapping or middlechains.

Decentralized Verifier Networks (DVNs)

The USD₮0 DVNs represent the entities responsible for verifying messages sent across chains by USD₮0 users.

USD₮0 utilizes a dual-DVN security configuration requiring verification from:

- LayerZero DVN

- USD₮0 DVN

Both DVNs must verify the payloadHash before a cross-chain message can be committed for execution. This setup ensures enhanced security through independent verification of all cross-chain transfers.

USD₮0 is built using the LayerZero interoperability stack. This allows USD₮0 to configure a security stack comprised of a number of required and optional Decentralized Verifier Networks (DVNs) to check the payloadHash emitted for message integrity, specifying an optional threshold for when a message nonce can be committed as Verified.

Each individual DVN checks messages using its own verification schema to determine the integrity of the payloadHash before verifying it in the destination chain's MessageLib.

When both the required DVNs and a threshold of optional DVNs agree on the payloadHash, the message nonce can then be committed to the destination Endpoint's messaging channel for execution by any caller (e.g., Executor).

USD₮0 Use Cases

What USD₮0 Enables

USD₮0 is a non-custodial, omnichain liquidity protocol that enables the seamless use of USDT across chains without requiring new issuances, wrapped tokens, or fragmented liquidity pools. This design introduces several practical benefits for users, protocols, and exchanges.

USD₮0 provides users with a seamless experience across multiple blockchain platforms. It enables effortless cross-chain transfers, allowing users to move assets between networks natively without requiring bridges. This expands access to decentralized finance (DeFi) applications, offering a broader range of financial services and opportunities.

Additionally, USD₮0 enhances security and trust through a unified framework that maintains consistent standards across all supported chains. This consistency fosters user confidence, ensuring a familiar and secure environment regardless of the blockchain they interact with. Eliminating the need for third-party bridging reduces user risk while simultaneously enhancing the overall experience.

Chains benefit from USD₮0’s innovative design which provides several key advantages for them. It offers ownership flexibility, allowing chains to seamlessly integrate USD₮0 into their ecosystem while enabling a smooth transition of contract ownership to Tether when needed. Additionally, it incorporates advanced compliance tools, helping blockchains meet regulatory requirements and efficiently handle law enforcement requests where applicable.

The upgradable design separating token functionality and cross-chain messaging is future-proof, meaning it can adapt to evolving blockchain technologies and standards. USD₮0 also facilitates fast settlement, reducing the time required for transactions to be processed, supporting low-latency applications. Moreover, it enhances ecosystem interoperability by enabling seamless interactions between different blockchain networks straight out of the box. A streamlined integration process simplifies adoption, making it easier for chains to incorporate USD₮0 into their existing infrastructure.

Exchanges gain significant advantages from USD₮0’s capabilities. Its support for multichain operations allows exchanges to process transactions across various blockchain networks without requiring complex infrastructure modifications. This simplifies cross-chain transactions, making liquidity management more efficient and enabling exchanges to offer a seamless experience to their users.

USD₮0 also facilitates fast Ethereum redemptions, ensuring users can swiftly convert their tokens back into Ethereum-based assets. Additionally, the integration process is streamlined, functioning similarly to standard ERC-20 tokens, which minimizes technical complexity and reduces the costs associated with supporting new assets. Overall, USD₮0 delivers a powerful solution for improving liquidity management and cross-chain operations within the blockchain ecosystem.

Where and How USD₮0 is being Used

It is still early in USD₮0’s adoption across its native chains. Currently, most supply is on Arbitrum where USDT has been successfully upgraded to USD₮0.

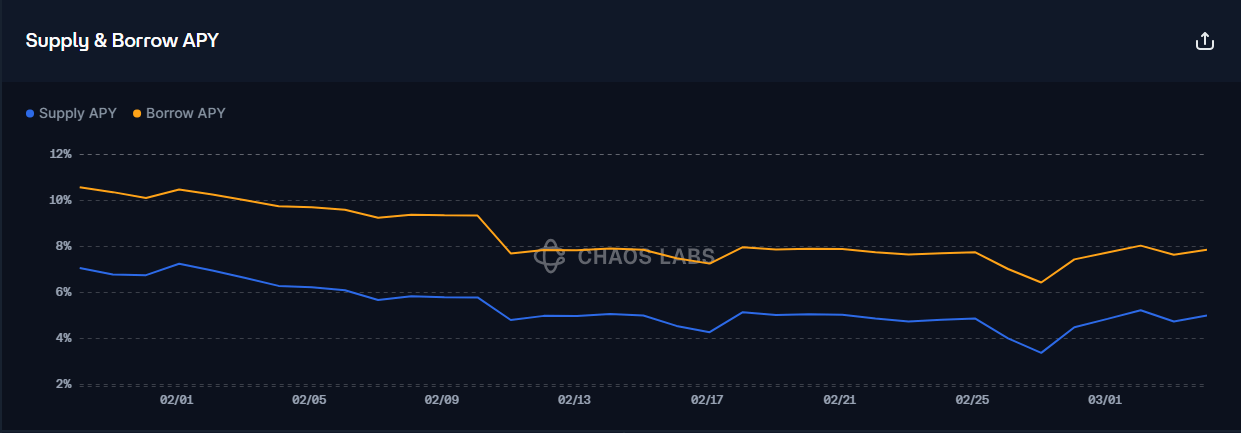

The predominant use case of USD₮0 in DeFi currently is in lending protocols, Aave in particular. Suppliers earn yield for their liquidity, while USD₮0 is borrowed to leverage BTC- and ETH-correlated positions. This trend aligns with other stablecoins in markets where high-yielding stablecoins are not prevalent.

USD₮0 Risks

Solvency Risks

Solvency risks for a pegged token like USD₮0 arise when backing reserves become insufficient to cover the total supply. This can occur in two scenarios:

- Minting new USD₮0 without locking an equivalent amount of USDT.

- Redeeming USD₮0 for more USDT than is available in reserves.

However, the LayerZero protocol is specifically designed to mitigate these risks through two built-in safeguards, both of which must be breached simultaneously for a solvency issue to arise:

- Dual DVN Verification: Every mint or redemption request must be approved by both DVN verifiers. These verifiers utilize Chaos Labs’ Pre-Crime Oracle to simulate USD₮0’s backing state, ensuring that any transaction leading to undercollateralization is blocked before execution.

- LayerZero Endpoint Validation: The protocol’s immutable endpoints verify all messages—including minting and redemption requests—to ensure strict adherence to the locking/releasing mechanism rules. Immutability ensures no external dependencies in this process.

Based on this design, we conclude that USD₮0’s solvency safeguards are robust, minimizing the risk of undercollateralization in its current state.

Liquidity Risks

Liquidity risks for a stablecoin emerge when it temporarily cannot be exchanged at its par value. We assess both scenarios: instances where USD₮0 is unable to redeem at par in its primary market and situations where it experiences a depeg in secondary on-chain DEX markets.

We find that the USD₮0 liquidity layer, combined with the legacy mesh connecting USDT chains, reduces arbitrage frictions in cases of price deviations. This likely leads to tighter peg stability and lower liquidity risk across networks.

Native cross-chain transactions and the Legacy Mesh create a unified liquidity layer for USD₮0. This reduces the capital requirements needed to arbitrage any difference between the price of USD₮0 and USDT

- Arbitrageurs do not need to hold USD₮0 or USDT balances on all active chains as in any case of a deviation in price above USDT, USD₮0 can be seamlessly transferred from another chain and sold on the venue with the price deviation, repegging the price.

- USD₮0 can be natively redeemed on any chain for USDT on Ethereum.

External Dependencies

As a fully non-custodial stable token solution, USD₮0 operates with minimal off-chain dependencies. Its streamlined design relies on only two external components:

USDT

USD₮0 is fully backed by USDT on Ethereum. A comprehensive analysis of Tether is beyond the scope of this piece, but given USDT0’s reliance on Tether's USDT, any significant changes in USDT’s design, redemption mechanisms, or market behavior will influence the performance and usage of USDT0. As such, the integrity of USDT0 is directly linked to the continued trust and stability of USDT itself.

LayerZero

LayerZero powers the mint-redemption process and cross-chain transfers of USD₮0. Endpoints on the source and destination chains process requests to transfer, mint, or redeem USD₮0.

LayerZero separates data delivery (DVNs) from proof submission (relays), ensuring:

- No single entity controls transaction validation.

- Cryptographic proofs are independently verified against block headers.

- Modular security allows integration with decentralized verifier networks (DVNs) for additional checks

- LayerZero is immutable, providing a pureley technical solution with no external dependencies or risk vectors.

Cross-chain messages are first checked by the two DVNs before being verified by the receiving immutable endpoint to ensure compliance. Only verified messages are processed, providing comfort that the system cannot be corrupted.

USD₮0 Operations

USD₮0 Issuer

USD₮0 is a non-custodial stablecoin, meaning it has no centralized issuer managing reserves. Its smart contracts are owned by a 3 of 5 multisig, ensuring a future-proof design and long-term reliability.

USD₮0 Terms of Service

There are minimal terms of service publicly available related to USD₮0. Chaos Labs could only find a list of prohibited activities Everdawn Labs agrees not to engage in, and a clear statement that Everdawn is not registered with the Financial Crimes Enforcement Network as a money services business or in any other capacity.

As a non-custodial stablecoin it is clearly stated that: “Everdawn Labs does not broker trading orders on your behalf, match orders for buyers and sellers of securities, nor do we collect or earn fees from your trades on the Protocol. We also do not facilitate the execution or settlement of your trades, which occur entirely on the public distributed blockchains.”

USD₮0 Regulatory Status

European Union

The European Union formally adopted the MiCA (Markets in Crypto-Assets) regulation in December 2024.

Chaos Labs is not qualified to give a legal opinion, the following summary of MiCA’s treatment of stablecoins serves for educational purposed only.

The MiCA regulation primarily focuses on custodial stablecoins, which are backed by assets held in custody. Non-custodial stablecoins, which do not rely on centralized custody arrangements, are not explicitly addressed in the same manner as custodial ones.

Key Points of MiCA Regulation

- Classification of Stablecoins: MiCA categorizes stablecoins into two main types: Electronic Money Tokens (EMTs) and Asset-Referenced Tokens (ARTs). EMTs are backed by a single fiat currency, while ARTs are backed by multiple assets, such as a basket of currencies, commodities, or other crypto assets.

- Licensing Requirements: Issuers of stablecoins must obtain a license as either credit institutions or electronic money institutions to operate in the EU. This includes non-custodial stablecoins if they fall under the ART or EMT categories.

- Reserve Requirements: Stablecoin issuers must maintain reserves that are fully backed by low-risk, liquid assets. For significant issuers, at least 60% of reserves must be held in deposits with credit institutions.

- Redemption Rights: Issuers must offer permanent redemption rights to token holders at par value, which can pose operational challenges for non-custodial models.

- Non-Custodial Stablecoins: While MiCA does not specifically address non-custodial stablecoins, any stablecoin operating in the EU would need to comply with MiCA's requirements if it is classified as an EMT or ART. Non-custodial models might face challenges in meeting these requirements, particularly regarding reserve management and redemption rights.

- Decentralized Exchanges: Users can continue trading stablecoins on decentralized exchanges using non-custodial wallets, which are not subject to MiCA's CASP (Crypto-Asset Service Provider) regulations5. However, this does not exempt the stablecoins themselves from compliance if they are issued or traded within the EU.

In summary, while MiCA does not directly address non-custodial stablecoins, any stablecoin operating in the EU must comply with MiCA's regulations if it falls under the defined categories. Non-custodial models may need to adapt their structures to meet these regulatory requirements.

Conclusion

Chaos Labs recognizes USD₮0 as a breakthrough in stablecoin infrastructure, assessing it as economically secure with minimal risk exposure.

The robust LayerZero OFT lock and mint mechanism, reinforced by DVN security, ensures stringent solvency checks, maintaining USD₮0’s 1:1 backing with USDT.

By leveraging a shared liquidity layer, USD₮0 reduces cross-chain transfer frictions, promoting more consistent pricing across networks.

Additionally, its non-custodial design minimizes external dependencies, further reducing the overall economic risk surface.

Useful Links

Bug Bounty

USD₮0 maintains a bug bounty program on Immunefi with rewards of up to $6,000,000 for critical vulnerabilities. Visit the USD₮0 Bug Bounty Program for complete program details, scope, and submission guidelines.

Security Audits

Contracts

A complete list of USD₮0 contracts will be maintained here.

The token contracts on each chain live as of 18 March 2025:

The implementation consists of three main components:

- OAdapterUpgradeable (on Ethereum):

- Implements LayerZero OFT functionality for Ethereum

- Handles both sending and receiving cross-chain messages

- Interfaces directly with the TetherToken contract on Ethereum

- Locks/Unlocks USD₮ for cross-chain transfers

- OUpgradeable (on other chains):

- Implements LayerZero OFT functionality for other chains

- Handles both sending and receiving cross-chain messages

- Interfaces with the TetherTokenOFTExtensoin

- Controls minting/burning for cross-chain transfers

- TetherTokenOFTExtension (on other chains):

- Offers mint/burn interface for the OFT

Ethereum Mainnet

Arbitrum One

Berachain

Ink

Ethena Integrates Chaos Proof of Reserves

Ethena has officially integrated Chaos Proof of Reserves (PoR). With this integration, reliable, independent reserve verification is now live for USDe, providing a higher-frequency, programmatic alternative to traditional attestations.

AVS Risk Assessment Methodology

This model quantifies maximum slashing risk, referred to here as Value at Risk (VaR), by analyzing slashing behavior across multiple node operators and AVSs. Notably, slashing one operator on a particular AVS does not guarantee that others will be slashed simultaneously, nor does slashing on one AVS imply slashing on all AVSs secured by the same operator.

Risk Less.

Know More.

Get priority access to the most powerful financial intelligence tool on the market.