A UX Framework for Onchain Lending Products

Onchain lending is a core component of crypto’s market infrastructure, and the user experience it delivers is determined by structural choices that shape how risk, liquidity, and incentives behave under stress.

Lending rails and protocols like Aave now support a wide range of institutional and retail money movements, including basis trades, treasury stablecoin flows, and CEX Earn programs. As usage has expanded, key frameworks such as pooled versus isolated markets, risk-parameter management, and rate-curve kink design introduce different trade-offs in risk and capital efficiency. These mechanics are often invisible to end users, yet they experience the outcomes:

- Is there capacity to borrow or deploy size without breaking the market?

- Are yields reasonably stable and consistent over time?

- Is liquidity available when it matters most?

Under the hood, lending markets are based on a simple economic reality:

Depositor yields are paid by borrowers, and borrowers draw liquidity from lenders.

Any design that favors one side of this equation at the expense of the other degrades the experience for both. In this piece, we outline four structural levers that shape lending product UX, regardless of the implementation approach (e.g. retail CEX product or institutional platform).

1. Governance & Risk Management

A strong onchain lending product UX starts with predictable risk, and in DeFi this predictability is anchored in a decentralized governance system.

Fundamental choices about what risk the protocol can take (e.g. supported assets, overall risk posture, oracles, and parameter ranges) should be made by the DAOs that govern the protocol.

However, deliberative governance, like any democratic process, is slow and markets are not. Crypto is prone to volatility spikes, liquidity shocks, and asset-specific events, and these typically unfold faster than any onchain vote. To protect users, any product built on lending markets should ensure the venue maintains continuous and adaptive risk management.

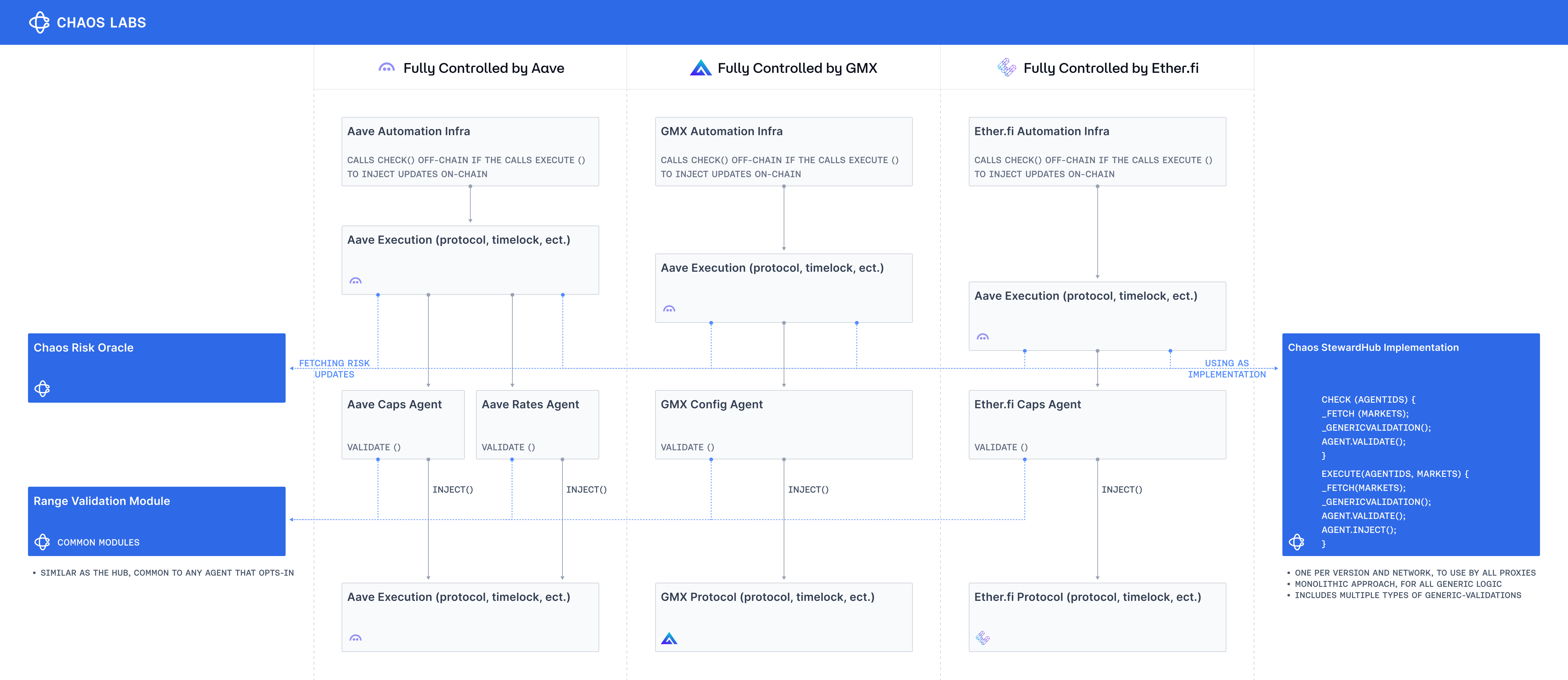

Our response to this need for balance is the use of Risk Oracles, designed to bridge the decentralized control of the protocol with real-time risk management, while preserving governance as the ultimate source of protocol control.

Risk Oracles provide responsive risk parameter adjustments within governance-defined bounds:

- Protocol governance defines the “shape” and risk limits,

- Risk Oracles dynamically adjust these parameters (e.g., LTVs, caps, rate slopes)

Standardized governance and risk automation provide the foundation for capital efficiency, stable rates, and dependable liquidity across all lending products.

2. Incentive Alignment: Backstops, Junior Tranches, and Protocol-Owned Capital

Incentive alignment is one of the most important and overlooked lending UX primitives.

A protocol's payoff structure determines what the system optimizes for over time. If fees accrue to the protocol, curators, or other stakeholders, while tail losses fall primarily on depositors, incentives naturally drift toward riskier configurations that appear attractive in normal conditions but externalize their downside risk. Under this model, competing on headline APY is rational since the actors creating risk exposure have limited economic accountability if/when market conditions deteriorate.

Mechanisms such as backstops, insurance funds, junior tranches, other forms of first-loss capital, or protocol-owned liquidity can rewire this payoff function. Incentive alignment provides two things at once:

- A buffer that helps protect depositors

- Ensures that poor risk decisions create direct, quantifiable losses for the protocol or curators themselves

Once skin is in the game, the optimization target shifts. It becomes rational to favor more conservative, risk-managed configurations. From a UX standpoint, alignment is critical. Without this, yields drift toward marketing metrics at the cost of tail risks.

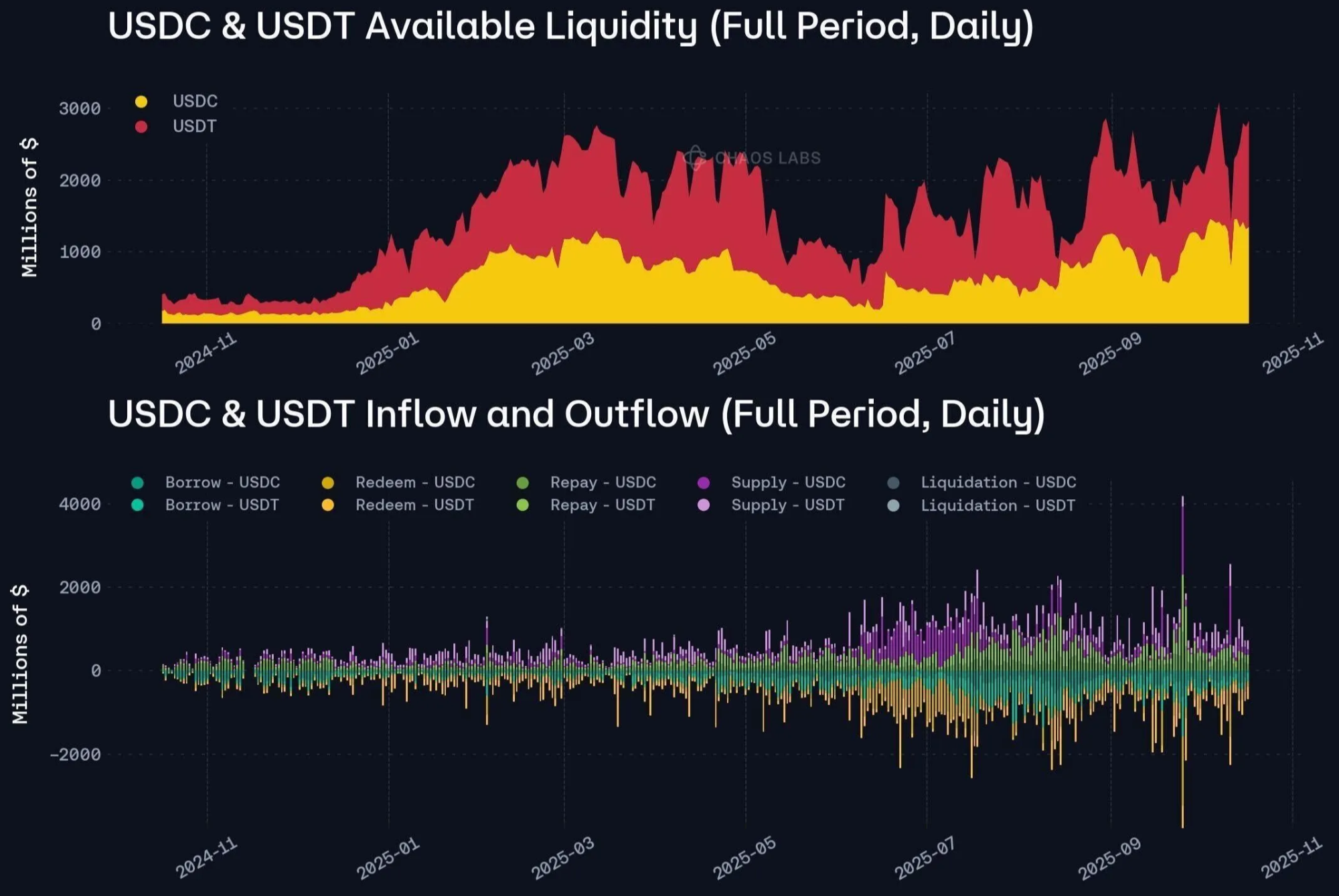

3. Liquidity Depth and Rate Stability

Two UX properties matter more than any single APY snapshot to lenders and borrowers:

- Ability to exit across all market conditions

- Stability of rates over time

For lenders, a strong UX means being able to deploy into a market and exit at size without any delays. It also means relying on stable supply rates capable of accommodating large deposits without nuking. Unreliable withdrawal capacity, especially during periods of volatility, creates not only a bad UX but also regulatory and reputational risks for retail-facing products.

Borrowers want the same predictability. They need to draw size without utilization or APR spikes, and they also want stable, predictable borrowing costs.

Deep, shared liquidity pools support both sides by absorbing large supply and borrow flows without extreme swings in rates. The result is lower rate volatility and deeper liquidity to draw from as needed.

4. Capital Efficiency

Capital efficiency determines the amount of useful leverage a market can support.

When efficiency is low, users are forced into heavy over-collateralization that compresses their revenue margins. Shared liquidity pools are often viewed as less capital efficient because they must accommodate a range of assets and risk profiles. Modern designs, however, show that most of the benefits of isolation can be achieved without fracturing liquidity into a mesh of micro-pools.

One approach is the use of correlated-asset modes. Assets that move closely together, such as stablecoins or LSTs and their underlying assets, can be grouped into specialized configurations that allow higher LTVs and more aggressive parameters while still drawing on the same deep, shared liquidity. This preserves the UX advantages of a large shared pool. Routing becomes simpler, books grow deeper, and rates become more stable, while still enabling targeted efficiency where correlation and liquidity support it. Isolated markets can also deliver high efficiency, but they must manage the trade-off directly.

Increased fragmentation creates more surfaces for liquidity to dry up or for localized risks to emerge.

Building “Boring” Infrastructure That Scales

Onchain lending now hosts a wide range of use cases and user groups. Across every dimension, the pattern is the same: a strong UX emerges when design choices are made to reinforce each other.

- For protocol designers, this means treating lending UX as market structure, not UI.

- For integrators, it means choosing venues that remain reliable under stress.

- For users, it means answering three questions clearly: What risk am I taking? Who am I sharing that risk with? Can I exit when it matters most?

In summary: DeFi’s winning product designs will look boring from the outside.

Vault Management = Risk Management

In this article, we outline our approach to vault risk management, identify current sources of systemic fragility, and highlight how the limited use of data-driven frameworks introduces unnecessary risk in today’s vault designs.

DeFi’s Contagion Loop: The Cost of Hidden Dependencies

Opaque dependencies, poor risk management, and missing public data have turned a few isolated design choices into systemic risk.

Risk Less.

Know More.

Get priority access to the most powerful financial intelligence tool on the market.