Aave Integrates Chaos Labs’ Edge Risk Oracles

Aave Integrates Chaos Labs’ Edge Risk Oracles

Following community discussions and voting, Chaos Labs, the industry-leader in onchain risk management, received approval from the Aave DAO to deploy its Edge Risk Oracles to the WETH on v3 Lido Ethereum. The Aave protocol will utilize Edge for automated, real-time risk management. Edge Oracles have secured more than $60B in volume, now delivering dynamic, real-time risk management to Aave.

This integration with Edge marks a major industry milestone showcasing the evolution of DeFi from manual to automated, and static to real-time.

For Aave users, Edge unlocks:

- Enhanced protocol stability

- Optimized capital efficiency

- Improved responsiveness to market changes

Aave is widely regarded as the most secure market for supplying and borrowing capital onchain, often cited for the DAO’s best-in-class approach to economic security and risk management. The Chaos Labs Edge integration sets a precedent for how innovative risk management tools can reshape the way protocols address challenges, manage volatility, and build dynamic resilience during market fluctuations.

The Edge Risk Oracle

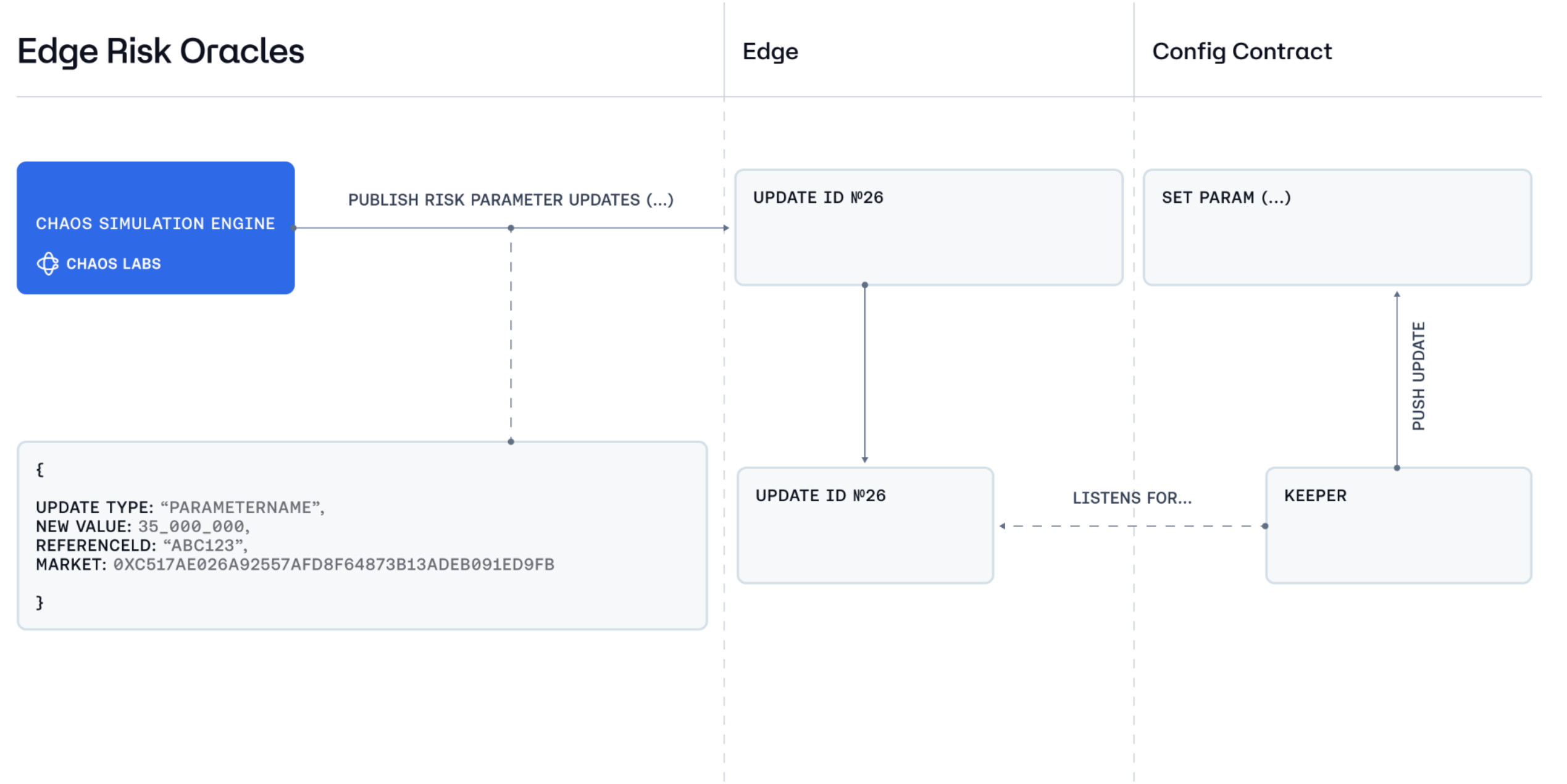

The Edge Risk Oracle is designed to provide real-time, data-driven risk parameter recommendations. Traditional risk processes can take days, creating bottlenecks that leave protocols exposed to market shifts. With Edge, the Aave protocol now optimizes key parameters in minutes, not days, ensuring faster responses to market volatility and enhancing the protocol’s agility.

Key features of Edge include:

- Dynamic Adaptability: Parameters such as Base Variable Borrow Rate, Slope 1, Slope 2, and Optimal Point (Kink) are continuously optimized to reflect real-time market conditions.

- Precision with Guardrails: Strict constraints and time delays built into the system, updates are permissionless yet highly controlled, ensuring only accurate and appropriate changes are implemented.

- Seamless Integration: Through the AaveStewardsInjector, Edge recommendations are securely propagated to the AGRS system, focusing exclusively on WETH for this initial phase.

These step-level improvements drive a safer and more efficient user experience in all market conditions.

"Chaos Labs has been a core contributor to the Aave DAO for a few years, and we've had the privilege of watching this community grow from a grassroots initiative into one of the most prominent DeFi protocols,” said Omer Goldberg, CEO & Founder of Chaos Labs. “We couldn’t be more thrilled to see the integration of Edge Risk Oracles—it’s a milestone that marks a new era in decentralized risk management. As a risk manager, this opens the door to real-time, adaptive parameter optimization, enabling protocols like Aave to respond faster to market dynamics while maintaining stability and efficiency. It’s an exciting step forward for both Aave and the broader DeFi.”

"Edge Risk Oracles are an important step forward for the DeFi space, and the integration within Aave is a testament to the DAO's commitment to building a resilient and industry-leading DeFi platform,” said Stani Kulechov, Founder and CEO of Aave Labs. “This innovative solution by Chaos Labs redefines how financial risk can be managed onchain, setting a new standard for the industry.”

"The integration of Edge Risk Oracles marks a significant technical advancement for Aave. By enabling real-time optimization of key risk parameters, the Aave DAO can enhance protocol stability, improve liquidity, and provide a more secure and efficient user experience," said Emilio Frangella, VP of Engineering, Aave Labs.

Corn Network Integrates Edge Price Oracles

Corn Network, an Ethereum Layer 2 protocol redefining Bitcoin’s role in DeFi, has integrated Edge Price Oracles. With over $60 billion in secured volume, Edge delivers intelligent, context-aware price data to the Corn Network, significantly boosting Corn’s resilience and operational efficiency in dynamic market conditions.

Chaos Labs Secures $55M in Series A Funding

We're excited to announce our $55M Series A led by Haun Ventures to accelerate the development of our advanced risk management platform.

Risk Less.

Know More.

Get priority access to the most powerful financial intelligence tool on the market.