Benqi Integrates Chaos Price Oracles

Benqi has integrated Chaos Price Oracles across its lending markets, securing over $300 million in TVL on Avalanche.

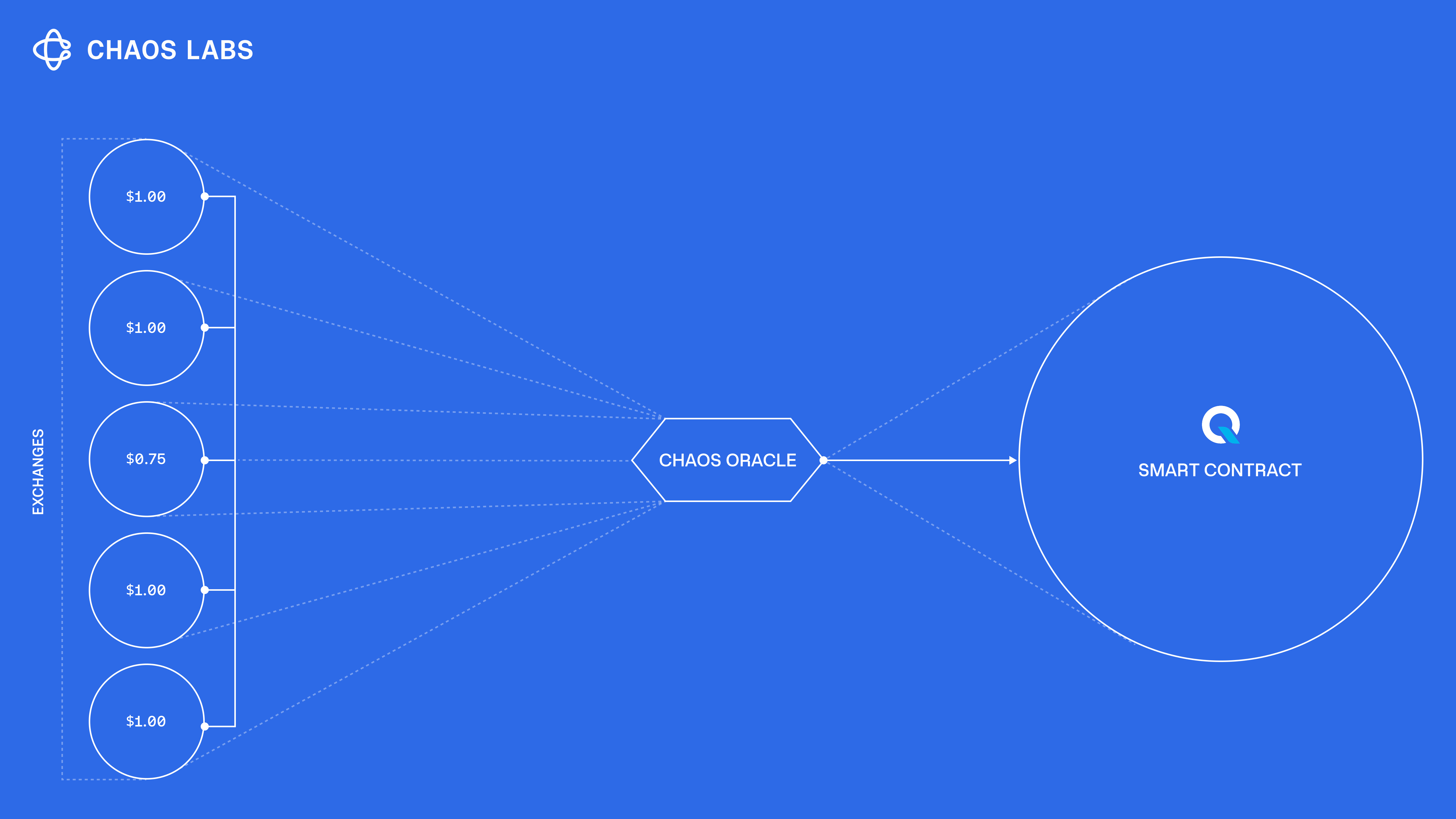

Chaos Price Oracles will deliver low-latency, reliable feeds to support collateral valuations, liquidation logic, and borrowing for one of Avalanche's largest DeFi protocols.

Chaos Price Oracles

Benqi is a leading protocol in Avalanche DeFi, powering liquidity for lending, borrowing, and liquid staking. Markets of this scale require oracles that withstand volatility, resist manipulation, and operate continuously.

Chaos Price Oracles deliver this through:

- Baked-in Risk Engine: Advanced anomaly detection filters suspicious inputs in real time, ensuring high-quality data

- Ultra Low-Latency: Optimized infrastructure processes price data at exceptional speeds with direct connections to liquidity providers.

- Cross-Chain Intelligence: Aggregates data from diverse source to deliver accurate pricing.

With these capabilities, Benqi maintains stable lending and liquidation systems across all supported assets, from BTC, ETH, AVAX, to stablecoins and emerging tokens.

Infrastructure That Scales

Oracles are critical infrastructure for DeFi. Inaccurate or delayed data can trigger liquidations, enable attacker arbitrage, and market resilience. By integrating Chaos Price Oracles, Benqi secures its $300M lending markets on Avalanche with accurate valuations, resilient liquidations, and the confidence needed as tokenized markets scale.

Powering the Risk Infrastructure for Ethereal

Chaos Labs is building the risk management framework for Ethereal, a high-throughput perp DEX appchain settling on Arbitrum. Ethereal combines sub-20 millisecond latency and capacity for 1M orders per second with onchain settlement and custody, delivering a CEX-level experience for users.

Avalanche Integrates Chaos Proof of Reserves

Avalanche has integrated the Chaos Proof of Reserves (PoR), enabling real-time verification of bridged asset backing across the network. This integration brings transparent, onchain monitoring of key assets including BTC.b and WETH.e.

Risk Less.

Know More.

Get priority access to the most powerful financial intelligence tool on the market.