Chaos Labs <> Benqi veQI Calculator

🔍 Overview

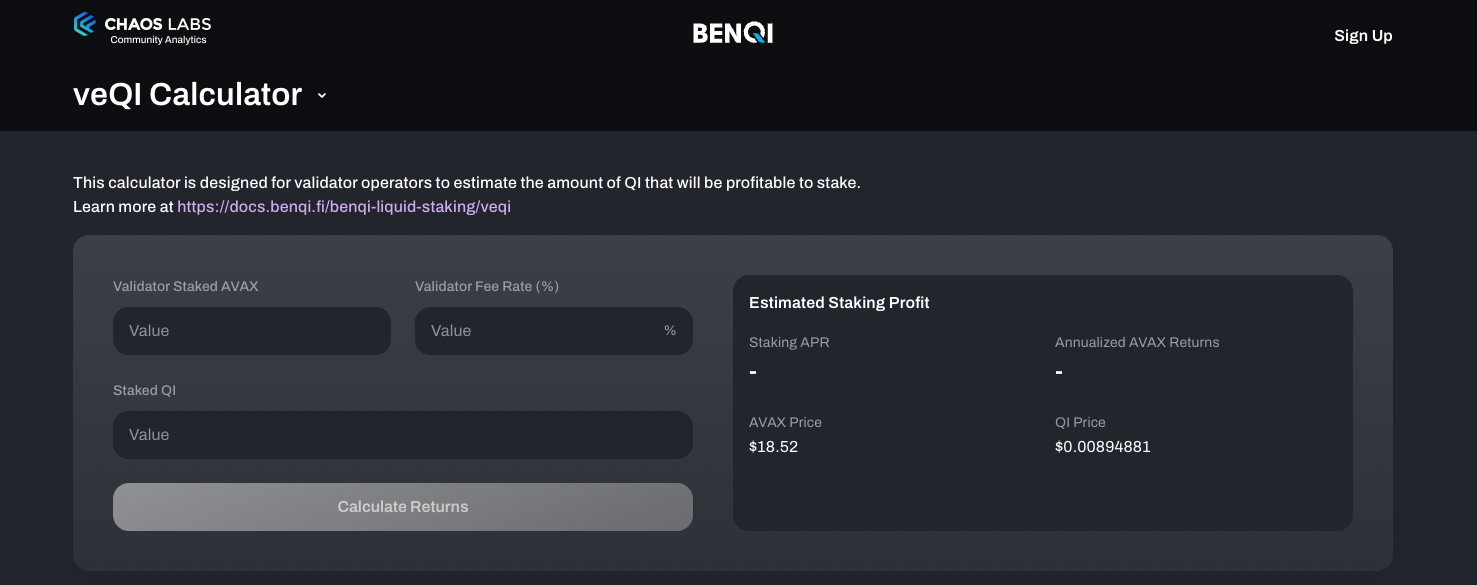

Chaos Labs is excited to announce the launch of the Benqi veQI Calculator, built as part of our collaboration supporting Liquid Staking on the Avalanche network. Benqi is one of the most prominent lending protocols on Avalanche and has become the primary provider of liquid staking on the network.

In our Benqi veQI Economic Analysis, we analyzed the potential benefits of veQI to validators and BENQI tokenholders, and the optimal model and parameterization for achieving the maximum utilization of veQI.

The veQI calculator completes this analysis, giving validators a tool to better estimate the opportunity of staking QI.

Calculator Overview

The calculator is intended to help validators estimate the amount of QI that will be profitable to stake.

The validator inserts the following inputs:

- Validator Staked AVAX

- Validator Fee Rate (%)

- Staked QI

and receives as an output an approximation of Staking APR and Annualized AVAX Returns to better grasp the opportunity.

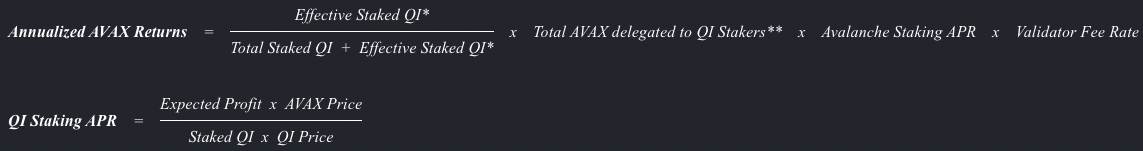

The calculation performed:

* Effective Staked QI - This is usually the Staked QI amount that was entered. If the entered amount entitles the validator to more AVAX than the amount that can be delegated to the validator then the Effective Staked QI is:

(Effective Validator QI Ratio x Total Staked QI) / (1 - Effective Validator QI Ratio) where:

Effective Validator QI Ratio = ([Validator Staked AVAX] x 4) / Total AVAX delegated to QI Stakers

** Total AVAX delegated to QI Stakers - 30% of the total supply of AVAX staked in BENQI

What's next? ⏭️

We look forward to continuing to grow our relationship with Benqi and the Avalanche community and building tools to ensure the safety and growth of the protocol. More to come soon 🙂

If you have any feedback or question, please let us know at [email protected]

About Chaos Labs

Chaos Labs is a software company building a simulation platform to allow teams to efficiently test protocols and understand how they will react to adversarial market environments. The backbone of our technology is a cloud-based, agent- and scenario-based simulation platform that allows users to orchestrate blockchain state, test new features, and optimize risk parameter selection.

Our technology allows users to:

- Orchestrate protocol/blockchain state

- Generate wallets with behavioral attributes

- Test protocol performance in chaotic market conditions

- Optimize risk parameters

Our mission is to secure and optimize protocols through verifiable agent- and scenario-based simulations.

The Chaos Labs simulation platform is built to emulate a production environment. Each simulation runs on a mainnet fork with the chain's current state so that your simulations include up-to-date account balances and the latest contracts and code deployed across DeFi. You cannot look at your protocol in a silo when you're testing adversarial environments. You must ensure you understand how external factors such as cascading liquidations, oracle failures, variable gas fees, liquidity crises, and more will impact your protocol in various situations.

Disclaimer

The material and information contained on this website are for general information purposes only. Nothing on this website constitutes professional and/or financial and/or legal and/or any other advice. It is not advised to rely only upon the material or information contained on this website as a basis for making any professional and/or financial and/or legal and/or any other decision.

Chaos Labs Asset Protection Tool

Chaos is unveiling a new tool to measure price manipulation risk and protect against it. Introducing the Chaos Labs Asset Protection Tool

Chaos Labs Dives Deep Into AAVE v3 Data Validity

Chaos Labs, a cloud security platform for DeFi applications, has discovered

Risk Less.

Know More.

Get priority access to the most powerful financial intelligence tool on the market.