Chaos Labs & Hathor Nodes launch platform to optimize Osmosis incentive distribution

Overview

With over $268M in total value lock (TVL), the Osmosis protocol is the largest interchain DEX platform in the Cosmos ecosystem. One of its most innovative features is a program that encourages users to act as liquidity providers (LPs) by offering incentives such as enhanced staking rewards (Superfluid Staking).

In December of 2022, we announced that we had received a grant from Osmosis to improve this incentives program through a partnership with Hathor Nodes, experts in custom blockchain analytics. We provided the infrastructure for community analytics while Hathor created the optimization model.

We are grateful to Osmosis for the opportunity to work on such an important endeavor and for enabling us to partner with Hathor Nodes.

We’d also like to mention Flipside Crypto, who helped tremendously with data collection and analysis.

Now, we’re pleased to announce that we’ve wrapped up our infrastructure work and are ready to present our results! 🦚

Getting Clarity from the Chaos

One of our great strengths here at Chaos Labs is making sense of the staggeringly-complex inner workings of crypto protocols–and that's precisely what we did here. So we built two public-facing dashboard tools, which provide an in-depth view of Osmosis liquidity pools and their performance.

Our goal is to use these dashboards to visualize and communicate recommendations on how to better structure rewards with the broader Osmosis community and LPers.

To foster transparency, we've placed both dashboards on our website. The 'Incentives Optimization' dashboard makes broad-stroke recommendations for upgrading how incentives are used. The 'Liquidity Providers' dashboard is for LPs interested in deep research and includes information on how incentive changes will impact their project APR.

These tools should be a boon to everyone in the ecosystem, helping them make data-driven decisions for incentive distribution across the protocol.

As Hathor explains further, "The Osmosis Incentives program is a key part of the Osmosis protocol. Working w/ Chaos Labs, we've been able to design and implement an algorithm that optimizes the incentives given to Liquidity Providers. This work will pave the way for Osmosis to innovate its incentives process while remaining the Cosmos Ecosystem's primary DEX."

Platform deep dive

Incentives Optimization Dashboard 🪙

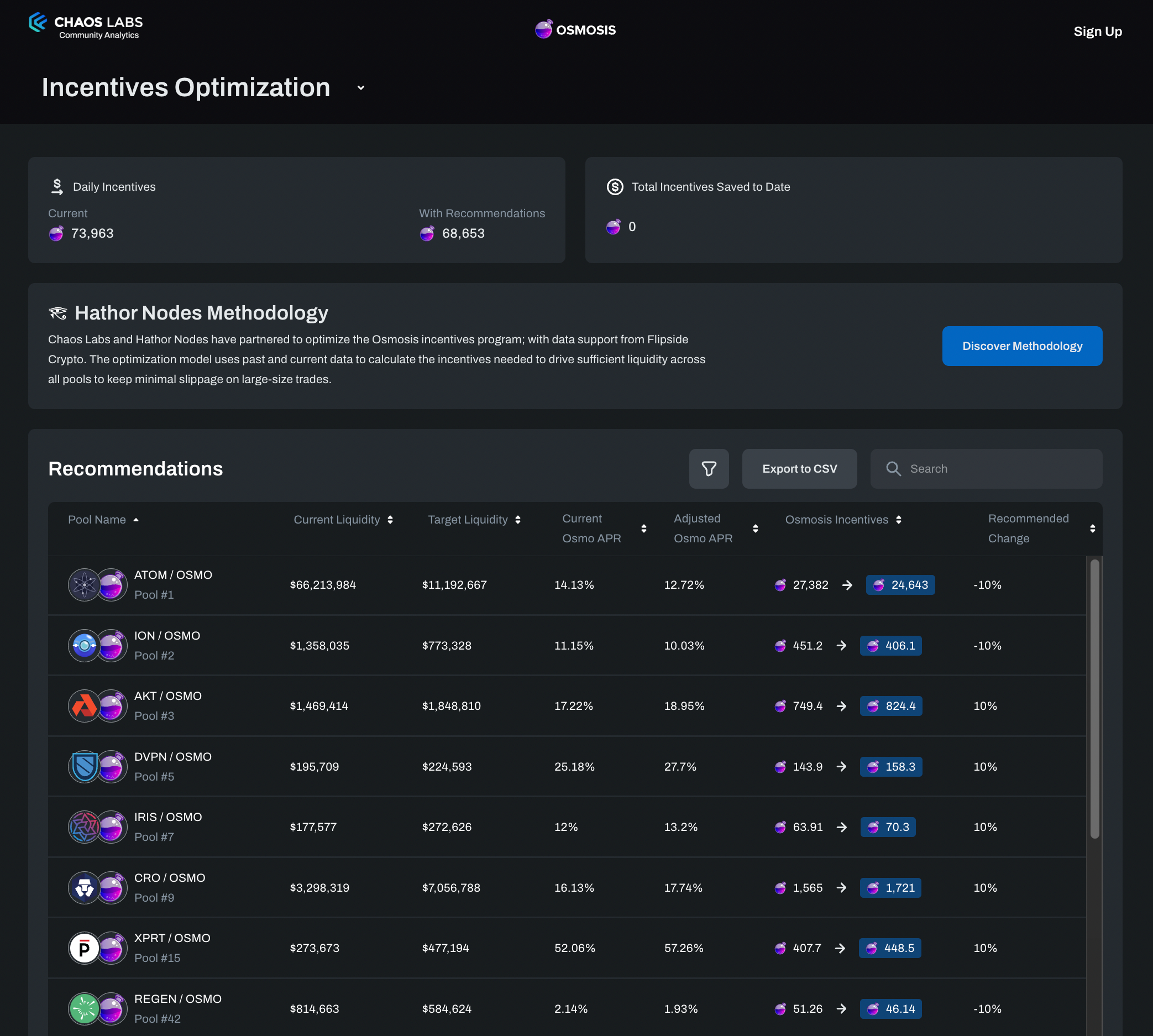

This screen presents an overview of all active Osmosis pools and the recommended incentives for each one, utilizing the optimization model. It includes the following information:

- An explanation of the optimization model developed by Hathor Nodes.

- A filterable, exportable overview of the incentivized Osmosis pools (such as ATOM/OSMO, ION/OSMO, etc.)

- Columns displaying up-to-date numbers on of liquidity, incentives APR, and daily incentives.

- ℹ️ The columns cover both pre- and post-optimization figures.

Hathor Nodes Methodology and Recommendations

Community members can view recommendations resulting from Hathor Nodes’ optimization model.

Pool Recommendation Details

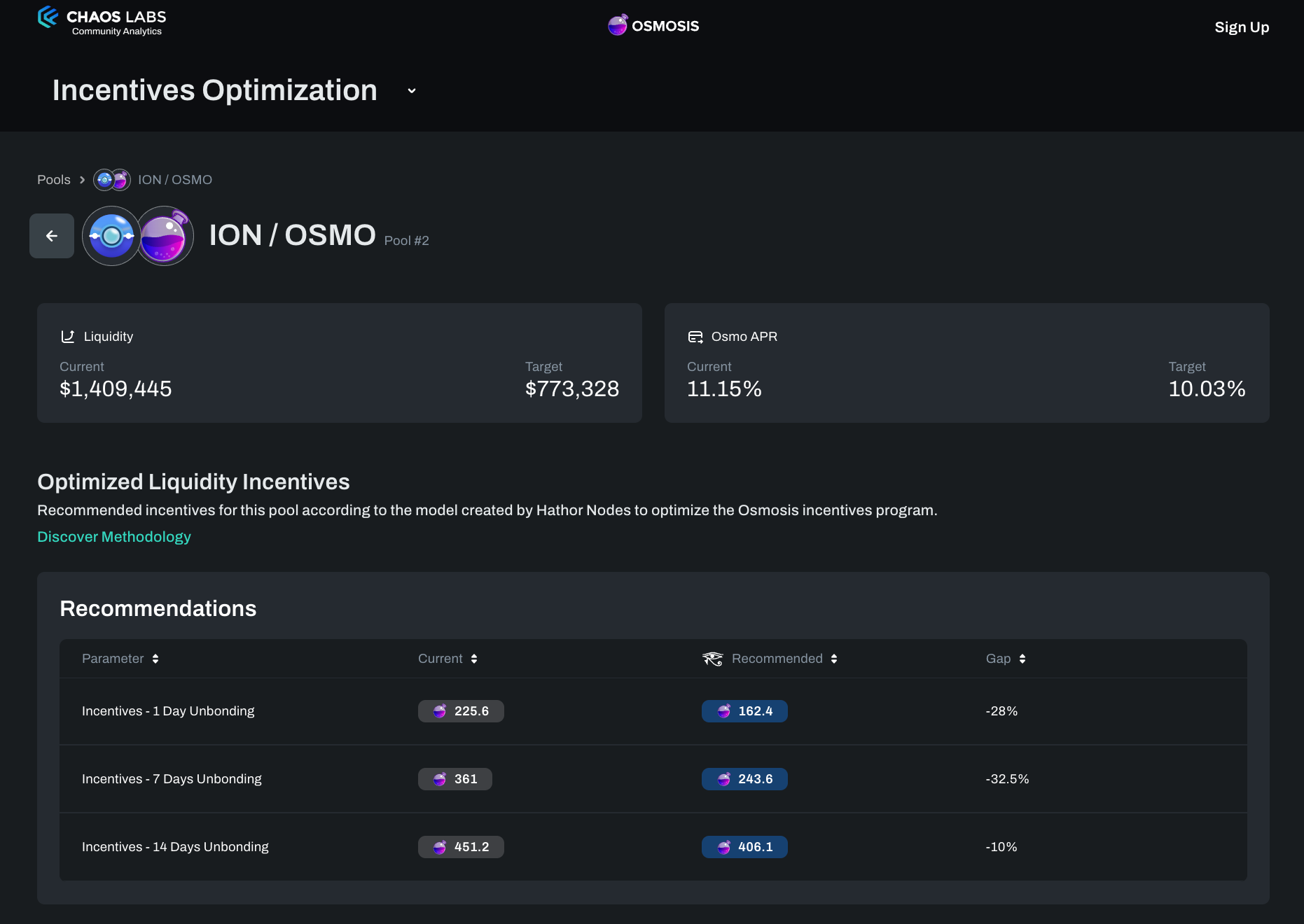

You can get a deeper look into recommendations for a specific pool by visiting its screen. There, you’ll see:

- The pool’s current liquidity and APR numbers, alongside the target figures calculated in the model.

- A current vs. recommended view of the liquidity incentives (per 1/7/14 days unbonding).

Select a pool to view detailed recommendations.

Liquidity Providers Dashboard 💸

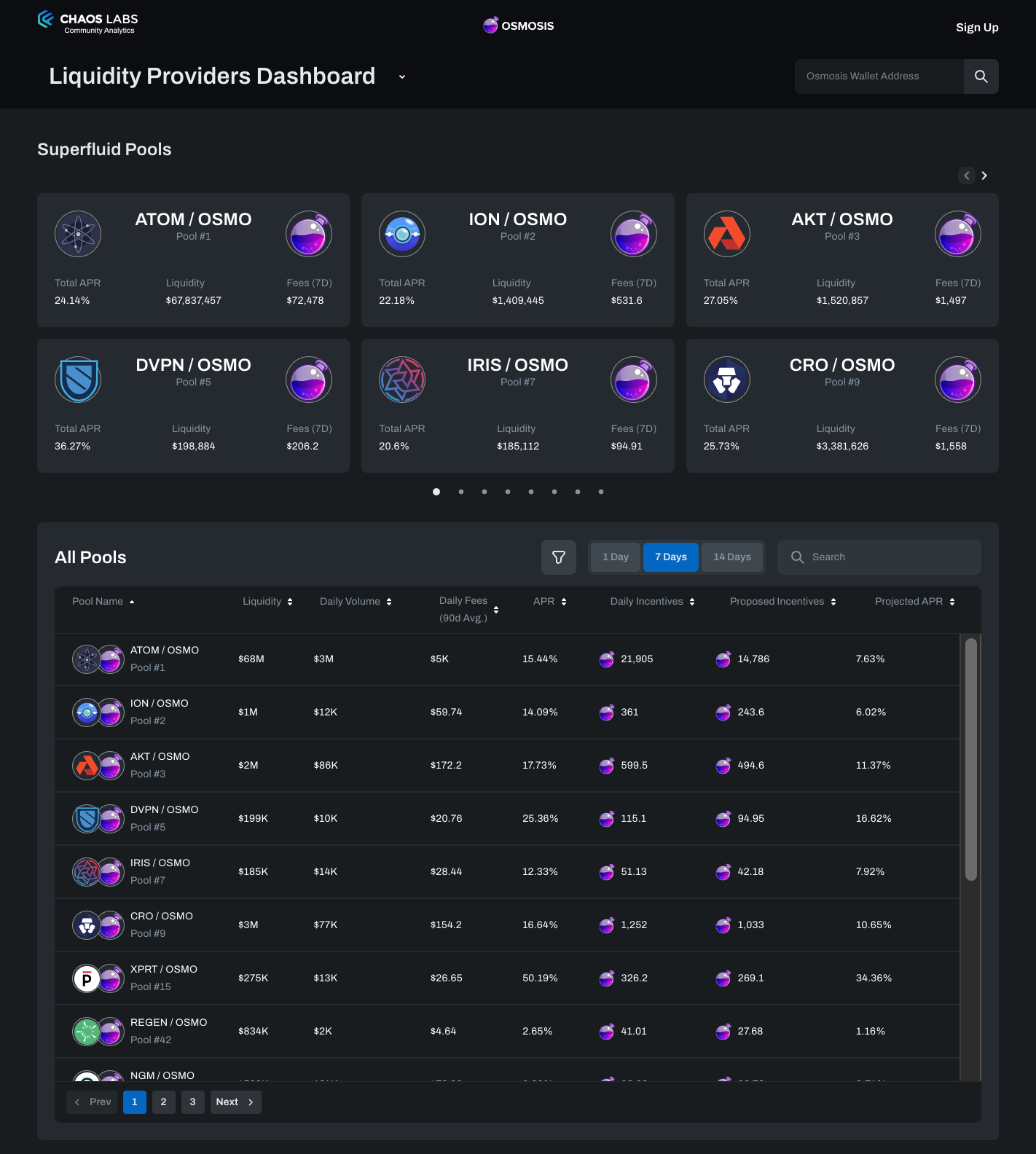

This dashboard offers optimization recommendations tailored to LPers. Here, LPers can:

- Enter a wallet address to view the effects of a particular optimization on the assets it contains.

- View the APR, liquidity, and fees of different superfluid pools.

- Browse any other pools they might be interested in.

LP Dashboard Overview

View additional recommendations for superfluid and other pools or wallets.

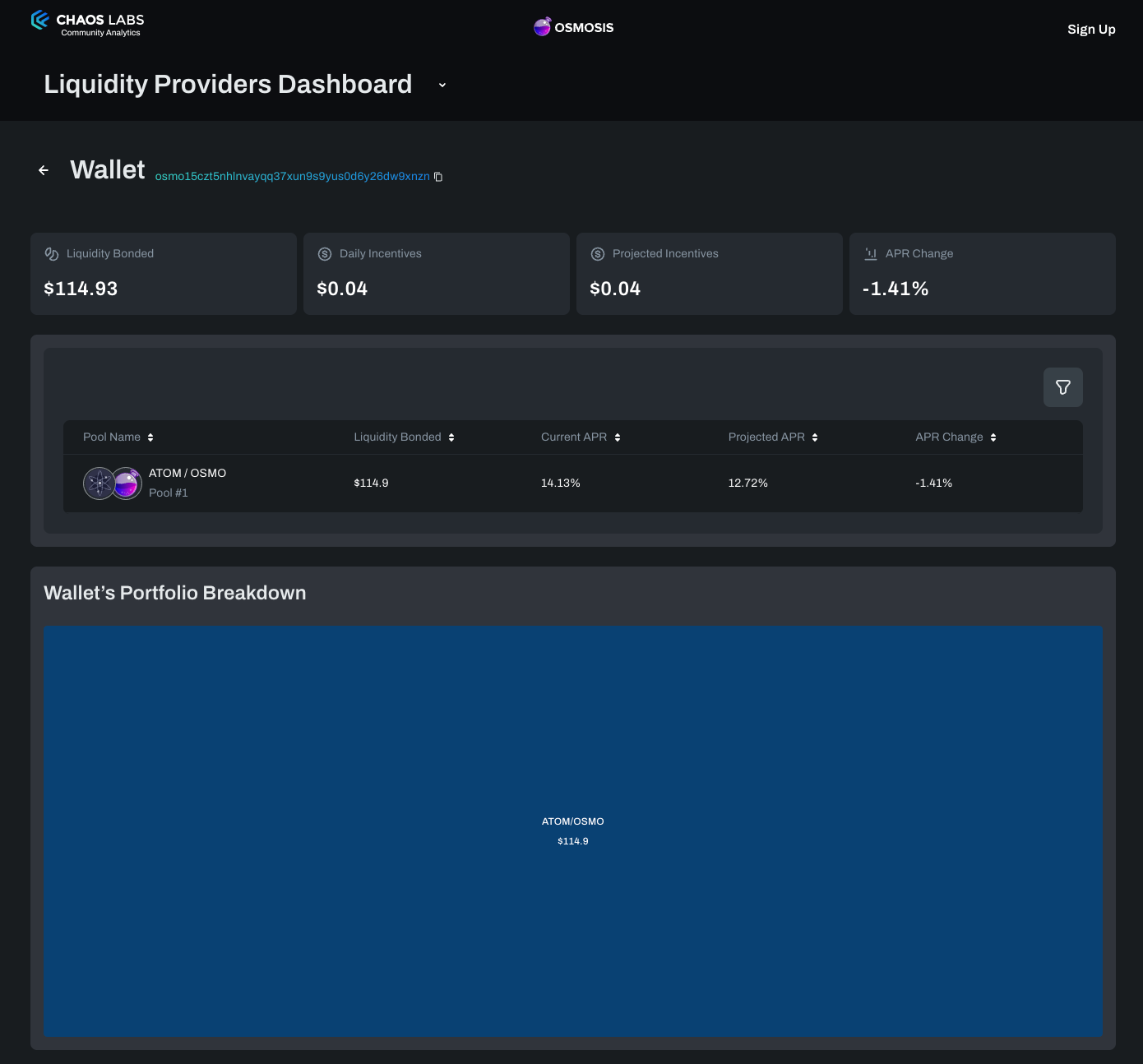

Osmosis Wallet Address

With the Osmosis wallet search, you can see the projected impact of the recommendations for Osmosis-specific portfolios. This view include information on

- Liquidity Bonded

- Current and projected Incentives

- Current and projected APR

- Portfolio Breakdown

View recommendations specific to an Osmosis wallet address.

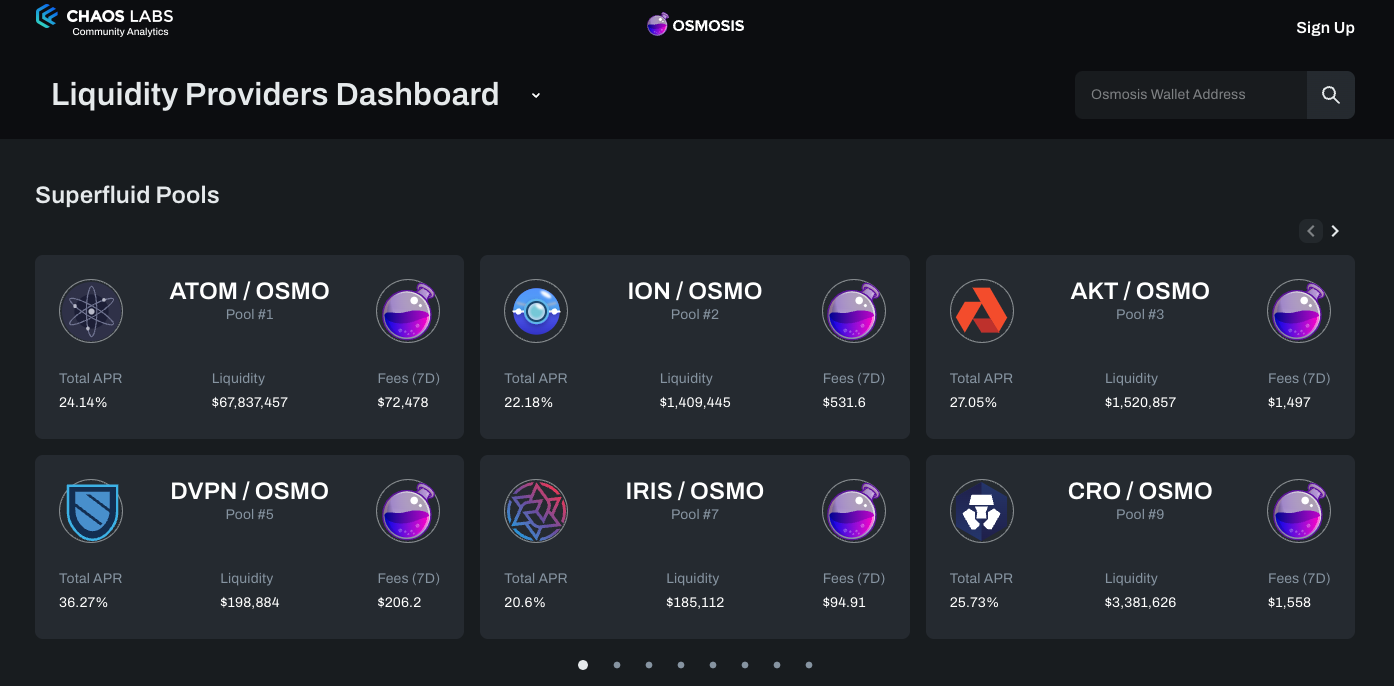

Superfluid Pools

Superfluid pools may be of special interest to LPs engaged in superfluid staking. The snapshot view of superfluid pools at the top of the screen shows the APR, liquidity, and fees (7D) of every superfluid pool.

A snapshot view of superfluid pools for LPs.

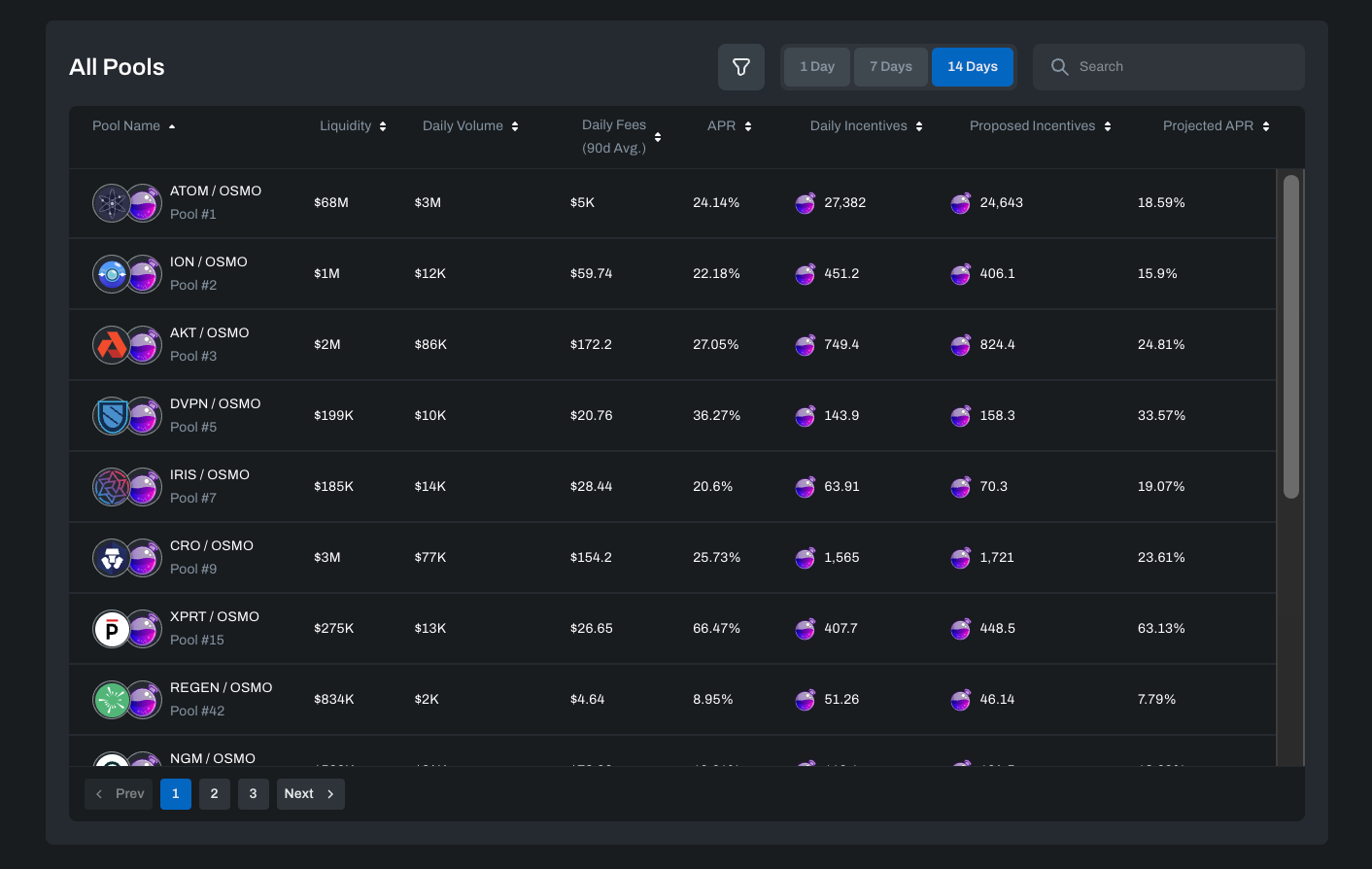

All Pools

The dashboard also includes a list overview of all Osmosis pools.

Two columns at the end display information relevant to pool status after optimization:

- Proposed Incentives

- Projected APR

The full list of pools relevant to LPs.

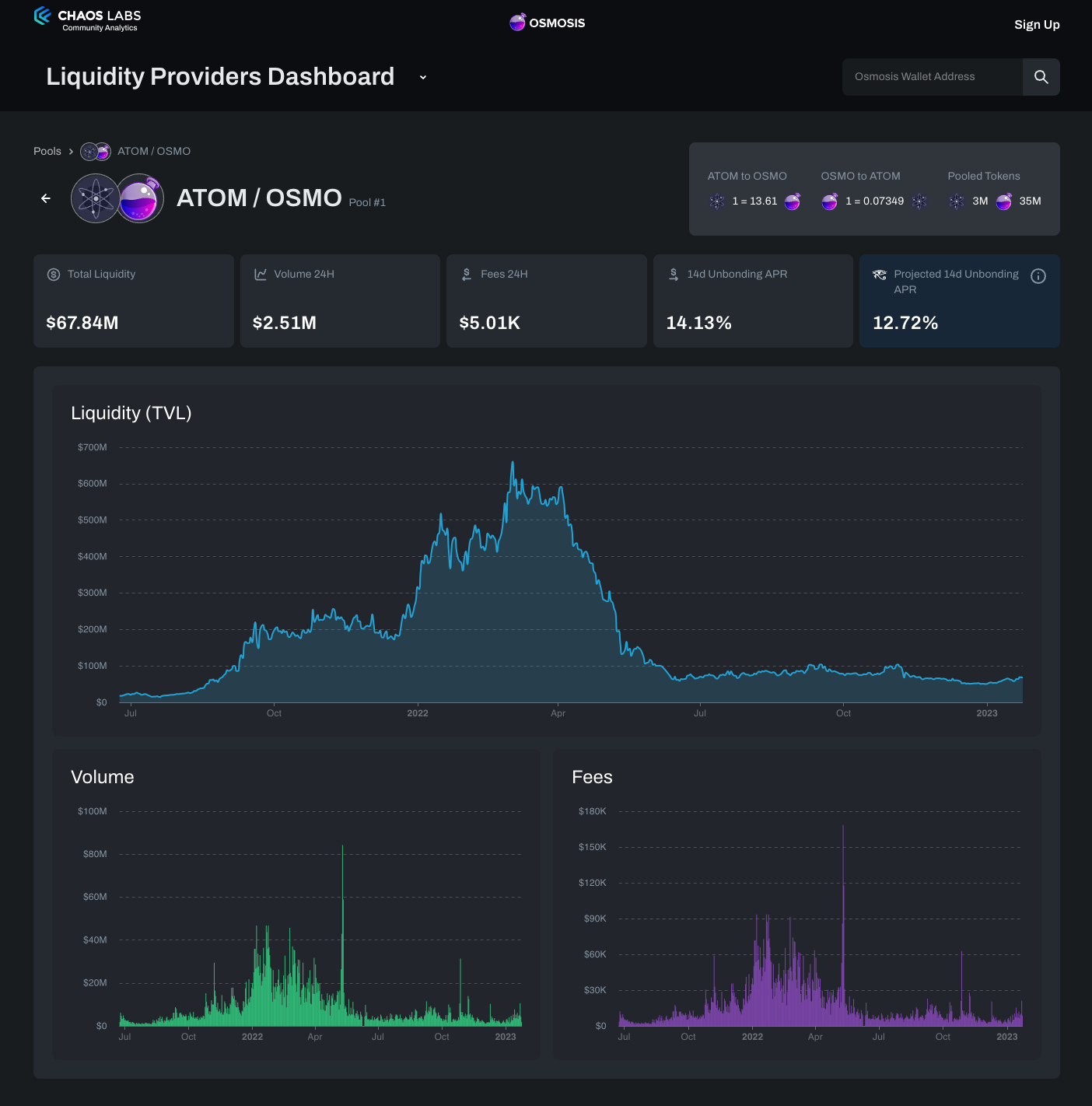

LP Pool Recommendation Details

This page is likely the most important to LPs as it visualizes the pool’s economic health. It includes a summary of key pool metrics such as:

- Total Liquidity

- Volume (Last 24H)

- Fees (Last 24H)

- Current unbonding APR and projected APR, after applying optimization

Additionally, this view provides a visual representation of value over time for:

- Liquidity (TVL)

- Volume

- Fees

View key metrics on the summary page per pool.

What’s next?

We invite the Osmosis community to explore our dashboards. As always, we welcome feedback and questions! Please reach out on Twitter** or at [email protected] for inquiries related to this project or anything else we’re working on.

About the Osmosis Grant Program

If you want to learn more about the Osmosis Grants Program, check out their blog.

Related posts 📚

- Chaos Labs Osmosis liquidity incentives portal update (December 2, 2022)

- Chaos Labs receives Osmosis grant (November 8, 2022)

Chaos Risk Dashboard Launches Live Alerts for Real-Time Risk Management

Chaos Risk Dashboard has rolled out new functionality that provides real-time alerts covering crucial indicators on the Aave v3 Risk Dashboard and BENQI Risk Dashboard.

Chaos Labs Asset Protection Tool

Chaos is unveiling a new tool to measure price manipulation risk and protect against it. Introducing the Chaos Labs Asset Protection Tool

Risk Less.

Know More.

Get priority access to the most powerful financial intelligence tool on the market.