Chaos Labs Partners with TapiocaDAO for Risk Management and Optimization

Overview

Chaos Labs is excited to share a strategic partnership with TapiocaDAO, centered around risk management and parameter optimization for the imminent launch of the omni-chain money market protocol and USDO.

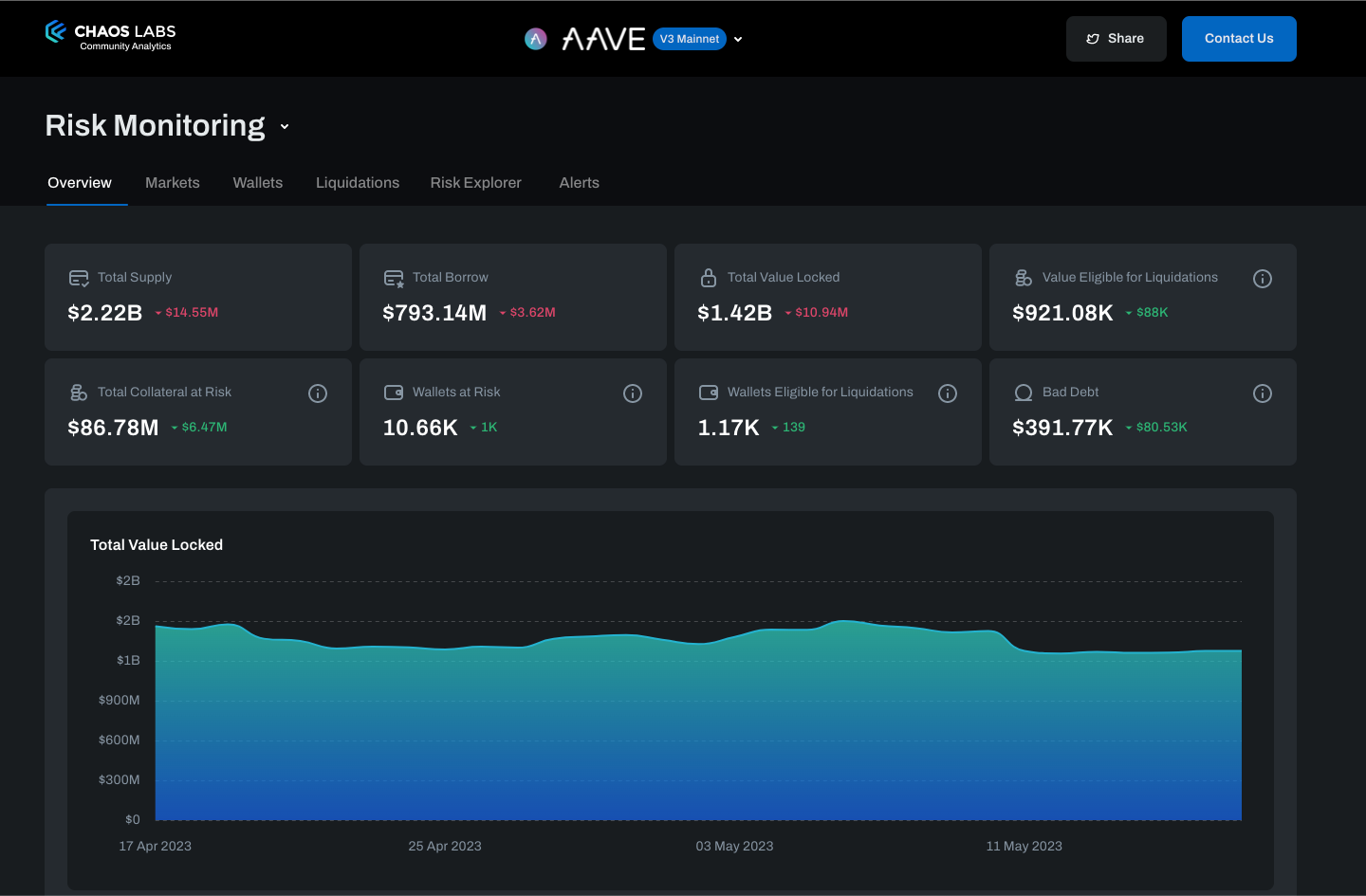

Risk Surveillance and Market Intelligence

Chaos Labs will deploy our Risk Platform for advanced observability, monitoring, and alerting for Tapioca, which will encompass the following:

- Monitoring of protocol-wide systemic risk and individual wallets

- Evaluating the health and activities of assets

- Instituting alerting and notification mechanisms

- Exposure to market manipulation

- Modeling user scenarios

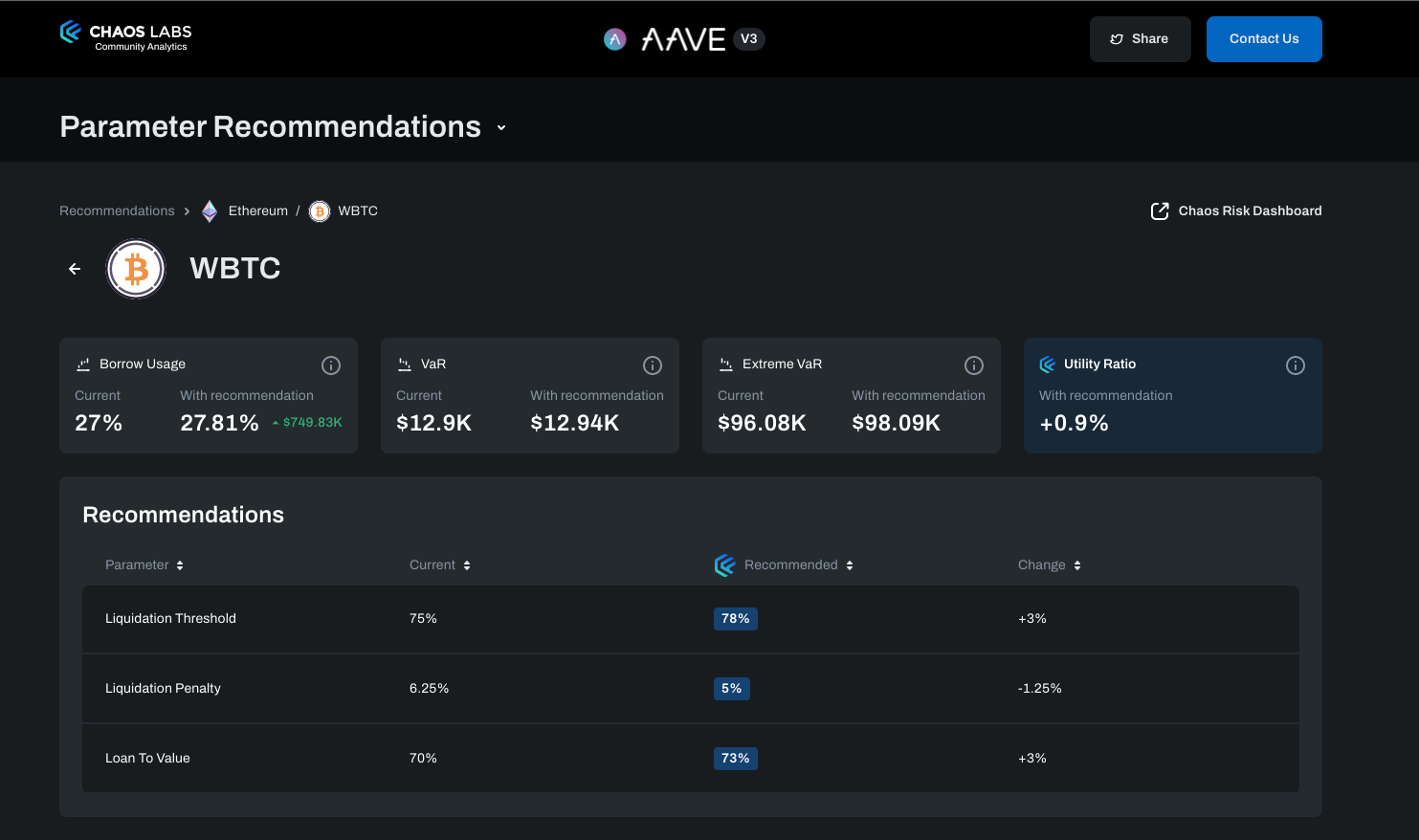

Optimization of Money Market Risk Parameters

Chaos Labs will employ its industry-leading Agent-Based simulation platform to execute Tapioca-tailored agent-based simulations. The objective is to optimize risk parameter suggestions for the borrow/lend markets on Tapioca.

USDO Risk Optimization and Surveillance

USDO holds the distinction of being the first stablecoin to be composable across various blockchains. USDO is backed by fully decentralized assets, immutable, over-collateralized, and non-algorithmic. Chaos Labs will facilitate the design of risk monitoring dashboards, recommend parameters, and more, to ensure the robustness and security of USDO.

Continuous Risk Partnership

The Chaos team will offer support regarding the following:

- Onboarding of new assets

- Launches of new markets

- Interpretation of parameter recommendations

- Understanding the repercussions of abnormal and volatile market conditions.

What's Next

We're just starting with the Tapioca community and are excited to contribute! In the following weeks, we will gradually unveil additional details and insights. The Chaos Labs Tapioca Risk Platform is around the corner, so stay tuned!

About Chaos Labs

A frontrunner in the cloud-based platform sector, Chaos Labs excels in developing risk management and economical security solutions for decentralized finance (DeFi) protocols. The platform conducts stress testing on protocols under adverse and volatile market scenarios with cutting-edge, scalable simulations. As a reliable partner to many DeFi protocols, Chaos Labs is devoted to devising groundbreaking solutions that amplify the efficiency and fortify the security of DeFi marketplaces.

Chaos Labs' esteemed partnerships include Aave, GMX, Osmosis, Benqi, dYdX, Uniswap, Chainlink, and others.

The Role of Oracle Security in the DeFi Derivatives Market With Chainlink and GMX

The DeFi derivatives market is rapidly evolving, thanks to low-cost and high-throughput blockchains like Arbitrum. Minimal gas fees and short time-to-finality make possible an optimized on-chain trading experience like the one GMX offers. This innovation sets the stage for what we anticipate to be a period of explosive growth in this sector.

Uniswap V3 TWAP: Assessing TWAP Market Risk

Assessing the likelihood and feasibility of manipulating Uniswap's V3 TWAP oracles, focusing on the worst-case scenario for low liquidity assets.

Risk Less.

Know More.

Get priority access to the most powerful financial intelligence tool on the market.