DeFi Rate Swaps: Building Risk Infrastructure for Pendle Boros

We worked with the Pendle team on Boros, a new DeFi primitive that brings funding rate trading onchain with leverage and capital efficiency. Funding rates have never been tradeable in DeFi, requiring us to develop novel risk management systems tailored to an entirely new market structure.

DeFi Gets Interest Rate Swaps

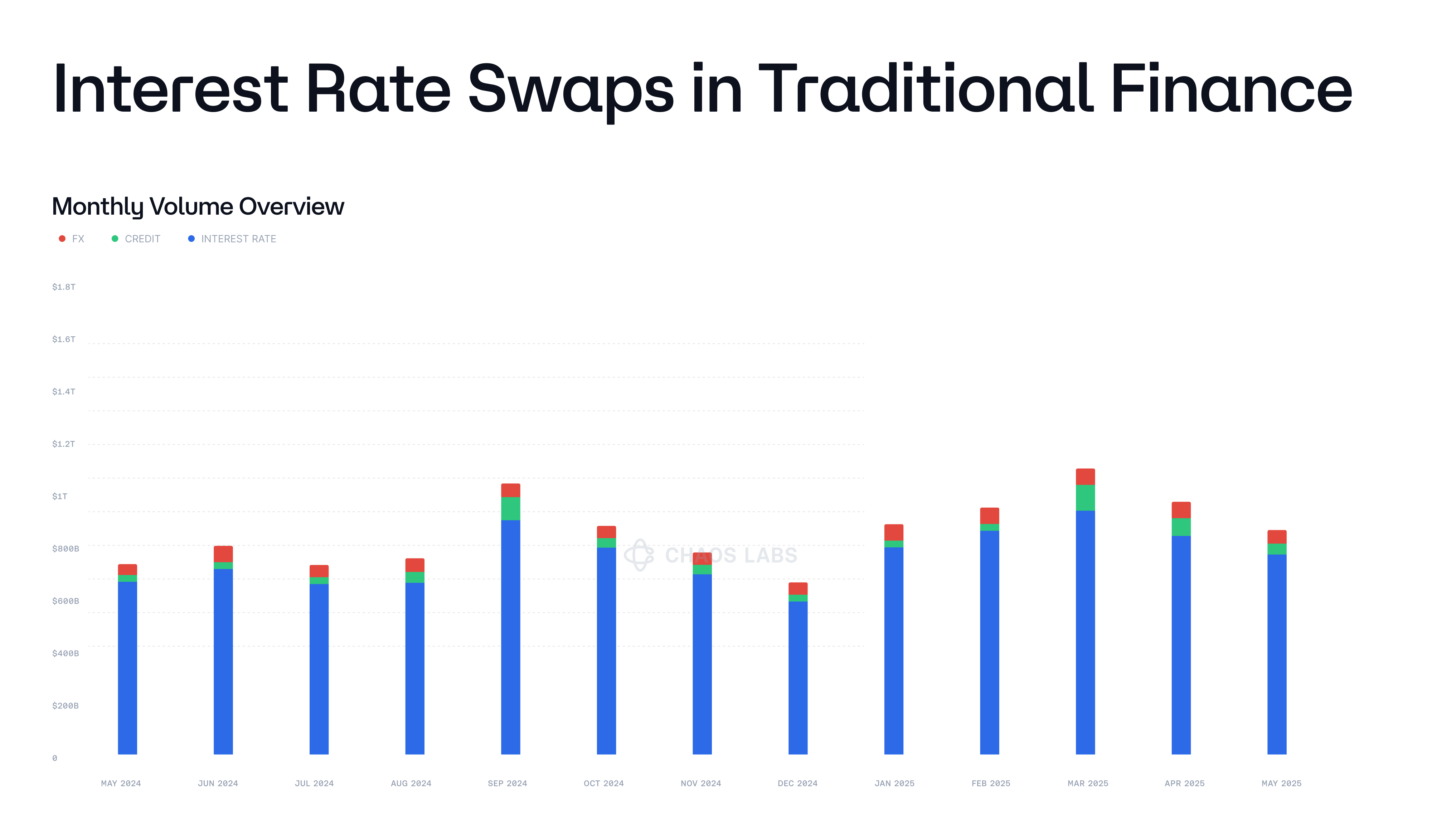

Global markets clear over $1.2 trillion daily in interest rate swaps. These instruments are essential for managing exposure to interest rate changes, hedging funding costs, and enabling macro speculation.

Boros enables fixed-for-floating agreements where users swap fixed yields against floating rates from exchanges like Binance, with cash settlement based on funding rate differences at each interval.

Technical Architecture and Infrastructure

We collaborated with Pendle to build the complete risk architecture for Boros, including:

- A dynamic maintenance margin formula that accounts for funding rate volatility and time to maturity

- Liquidation and auto-deleveraging mechanics that prevent bad debt during sharp market swings

- TWAP bands and price deviation caps to guard against oracle manipulation

- Capital efficiency design that aligns margin with expected payment risk, rather than notional exposure

- AMM architecture tailored for pricing and settling fixed–float interest rate trades

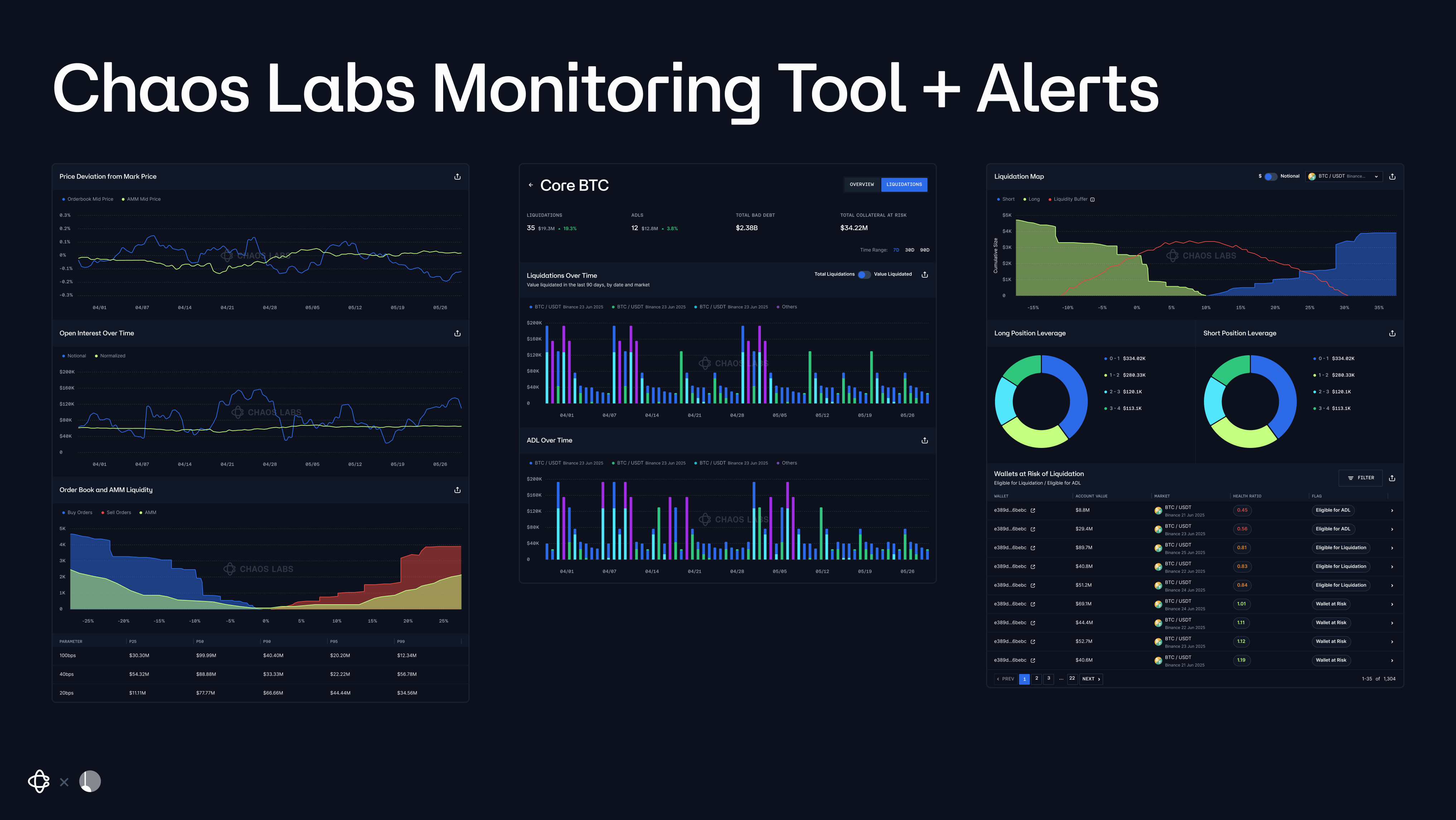

To power real-time settlement and risk management, we designed advanced monitoring tools and offchain bots that continuously track key risk metrics and respond to anomalies.

Quantitative Risk Validation

Each risk parameter was fine-tuned through close collaboration with the Pendle team using custom methodologies and extensive Monte Carlo simulations. This quantitative approach allowed us to model funding rate dynamics, position behaviors, and volatility shocks across a wide range of market conditions.

By simulating stress scenarios, we calibrated margin requirements, liquidation thresholds, and risk buffers to ensure robust balance between capital efficiency and economic safety while maintaining optimal user experience.

Market Launch and Ongoing Oversight

At launch, Boros will support trading on ETHUSDT and BTCUSDT funding rates from Binance, allowing users to hedge exchange exposure, speculate on funding shifts, or execute basis trades using DeFi-native capital. This creates an environment where institutions can hedge funding rate volatility at scale, while speculators can express directional views with precision.

Chaos Labs and Pendle will jointly monitor the system 24/7 following launch, ensuring robust oversight as Boros scales.

Boros opens up a new primitive for DeFi, enabling permissionless access to interest rate trading on any yield stream, including those originating offchain. The structure is simple, the risk controls are built-in, and the design is extensible to any fixed–float market.

More details on our risk framework, parameters, and monitoring tools will be released soon.

Risk Oracles: One Step Beyond Price Oracles

Risk Oracles automate the most critical components of protocol risk management by adjusting parameters in real time based on market volatility and liquidity conditions.

(Part 1) The Rise of Context Engineering and Why SoTA Agents Need Specialized Search

LLMs are already good enough for 95% of what businesses need them to do. When they fail, it's almost never the model's fault. It's ours.

Risk Less.

Know More.

Get priority access to the most powerful financial intelligence tool on the market.