DeFi’s Contagion Loop: The Cost of Hidden Dependencies

Table of Contents

Opaque dependencies, poor risk management, and missing public data have turned a few isolated design choices into systemic risk.

After Stream Finance disclosed a $93M loss on November 4th, contagion and fear have spread across DeFi:

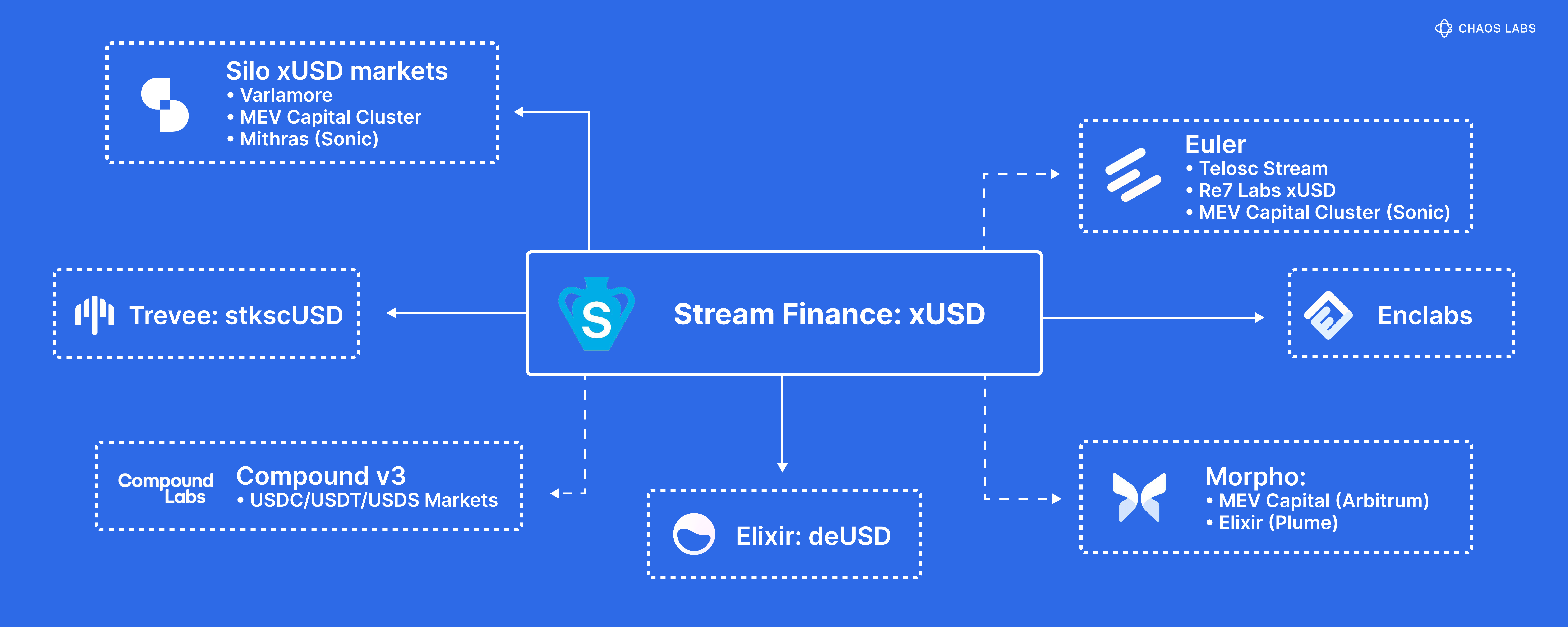

- Elixir's synthetic dollar pair (deUSD & sdeUSD) collapsed. Elixir was a key participant in Stream’s recursive xUSD minting loop and held $68M in exposure to Stream (approx 65% of deUSD’s backing).

- Stables Labs' USDX, a $600M synthetic dollar, fell to $0.34 after redemption attempts exposed a likely shortfall in reserves dating back to the October 10th market crash.

- A few other synthetic assets have encountered direct or indirect exposure to xUSD or s/deUSD, including Trevee's scUSD, with approx $13M through Silo Finance & Euler Finance.

A growing web of concentrated dependencies, collateral reuse, and commingled funds, fuelled by limited real-time transparency, continues to amplify systemic fragility across DeFi’s structured product markets.

A Chain of Failures

This was not a single-point failure.

Multiple protocols and risk curators onboarded these assets while overlooking obvious risks. Elixir and Stream engaged in recursive looping and commingling practices, extending exposure far beyond direct holders of Stream’s xUSD.

Risk curators failed to act quickly to offboard or cap exposure as fundamentals changed. Elixir moved from a relatively simple delta-neutral design to increasingly leveraged strategies, eventually adopting Stream’s uncollateralized borrowing model. Some argue that this was not just a professional failure; users should have done their due diligence before depositing into these products.

But were they really in a position to do so?

As we mentioned in our last article, DeFi’s new class of risk curators and OCCAs have blurred the boundaries between risk curation and risk creation. Many operate with limited transparency, reusing collateral and layering strategies across protocols without real-time disclosure. The same systemic gaps are being exposed once again.

Onchain analysts exposed Stream’s co-dependencies; however, that level of monitoring cannot be expected from the average retail user of these products. PoR and real-time transparency are intended to make this information transparent. It is noteworthy that:

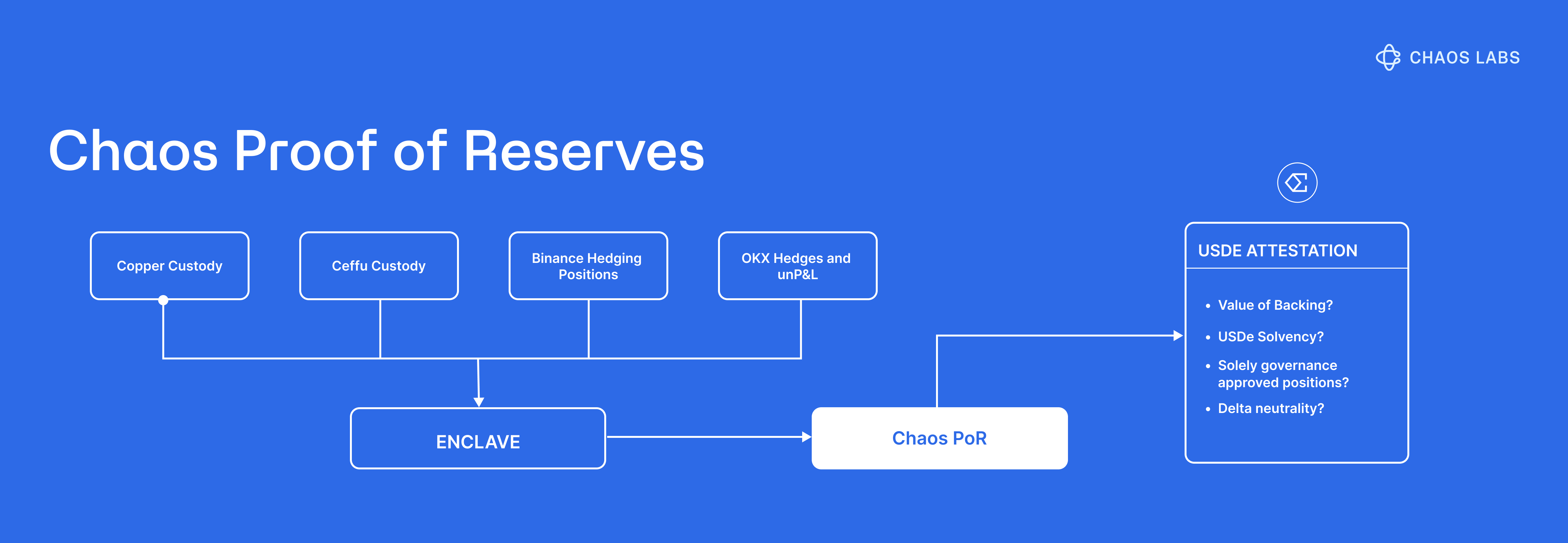

- Stream disclosed neither Proof of Reserves nor real-time collateral composition for xUSD.

- Stables Labs also lacked proper Proof-of-Reserves and disclosures. Its “Transparency” page listed most of its backing as “USDT on Binance” with no further details, no liabilities view, and no independent attestations. Just documentation claiming that reserves were “hedged across a variety of assets.”

When Oversight Fails

As crypto grows more complex, both technical and systemic risks will continue to surface.

Transparency should not be limited to CEXs or stablecoins. Any product that requires users to trust its solvency should maintain a publicly accessible reserve or provide equivalent disclosure. This includes bridges, wrapped assets, LSTs, LRTs, and increasingly, tokenized yield products that often operate as black boxes.

When a Proof of Reserve is not feasible, i.e. for products that use dynamic positioning or hedging, such as for Stream’s LLP strategy, a structured transparency dashboard can be helpful to surface risky co-dependencies. This enables users to make informed decisions about risk while enabling protocols to monitor curator activity and enforce limits in real-time.

As the events of this week have shown, tokenized yield products can be deeply interconnected across DeFi. Failures in one layer can cascade through dependencies, exposing protocols, vaults, and users that never directly interacted with the source asset.

Transparency will not prevent every failure, but it enables risk to be measured, monitored, and managed effectively.

A UX Framework for Onchain Lending Products

Onchain lending is a core component of crypto’s market infrastructure, and the user experience it delivers is determined by structural choices that shape how risk, liquidity, and incentives behave under stress.

DeFi’s Black Box: How Risk & Yield Are Repackaged

DeFi has entered another phase of structuring, where institutional trading strategies are being abstracted into composable, tokenized assets.

Risk Less.

Know More.

Get priority access to the most powerful financial intelligence tool on the market.