dYdX Chain Launch Incentives Program: Wash Trading Detection

Introduction

Chaos Labs has developed a sophisticated wash trading detection algorithm designed for the dYdX Chain Launch Incentives Program. This document provides a high-level overview of the algorithm, ensuring the confidentiality of the specific formula while outlining the general approach and methodology.

Launch Incentive Program: Catalyzing Migration to dYdX Chain

The dYdX Chain Launch Incentive Program is designed to foster early adoption and ensure a smooth transition of trading activities and user base to the dYdX Chain. This program earmarked $20 million in DYDX tokens to be distributed among early adopters of the dYdX Chain over six months. The program emphasizes the importance of liquidity and efficient migration for the success of the dYdX Chain.

Objective

The program creates the incentive for wash trading, characterized as artificial trades lacking genuine market risk or competitive pricing, with the sole intention of growing trader volume, and earning rewards. To enhance the program's effectiveness and encourage genuine long-term activity, it's essential to implement a robust detection process that identifies and disqualifies traders generating inorganic flow from receiving these incentives.

Methodology

The Chaos Labs wash trading detection module plays a critical role in this program. It identifies trading patterns that result in a minimal ownership change, which is indicative of collusive activities. The module conducts a thorough analysis of all trades, employing behavioral filters to distinguish between organic and manipulative trading behaviors.

The algorithm leverages a series of sophisticated metrics and conditions, rooted in academic research, and industry best practices, to pinpoint wash trading activities on dYdX. Its methodology encompasses:

- Trade Graph Analysis: All trades concluded over a period of time are transformed into a directed graph on which graph algorithms such as depth-first-search (DFS) are utilized to detect cyclical trading.

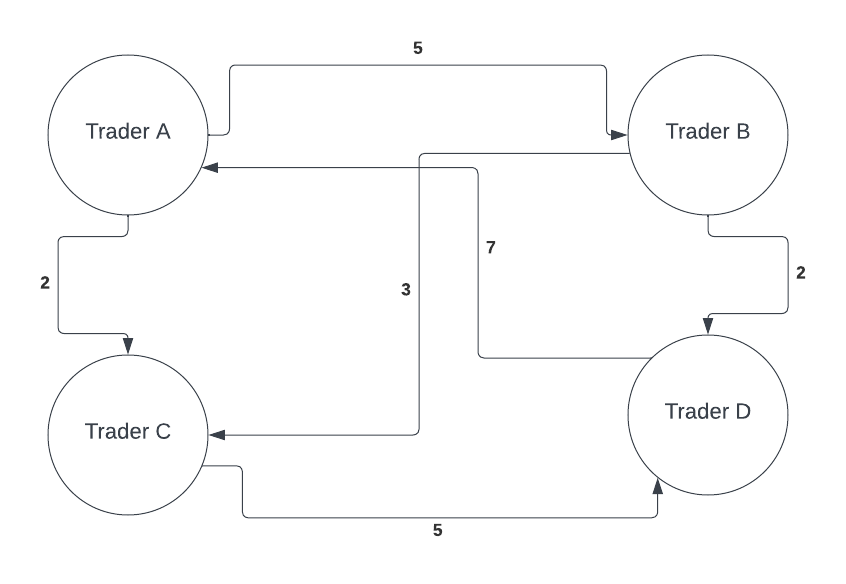

- Wash Trade Definition: Adhering to stringent criteria, the algorithm identifies wash trades based on abnormal ownership changes in relation to trade volume among clustered accounts. This extreme example shows 4 colluding traders creating 19 units of trading volume over 6 trades with no change in ownership.

- Detection Process:

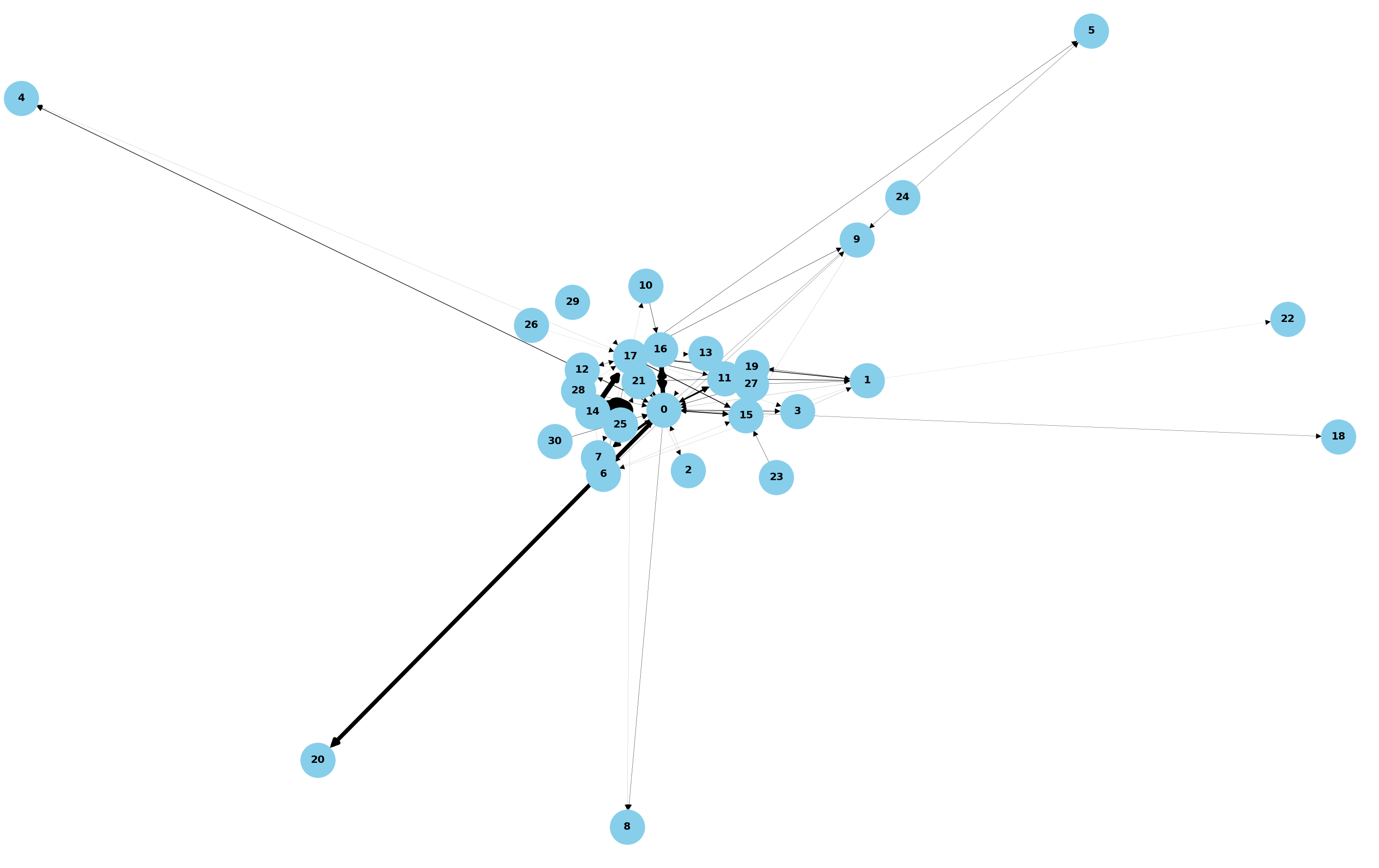

- Algorithmic Detection: Employing these trade graphs, the algorithm detects potential wash trading cycles, evaluating ownership shifts in relation to overall trade volume. Example output from Chaos Labs Wash Detection Module, depicting traders as nodes with edge weights indicating trading volumes. Nodes with heavier volumes undergo further scrutiny using the suite of Chaos Labs Anomaly Detection tools.

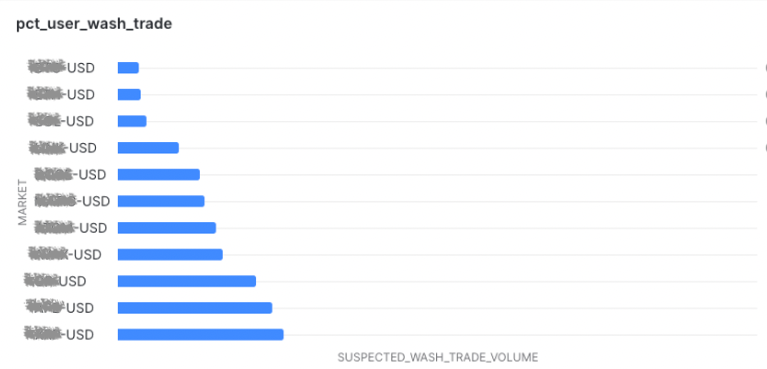

- Manual Screening: A crucial layer of manual review is incorporated to reduce the likelihood of false positives, safeguarding legitimate traders and upholding the algorithm's precision and fairness. Example output from Chaos Labs Wash Detection Module, highlighting trade cycles identified as potential wash trading instances.

- Parameters and Conditions: Operational parameters, such as limits on colluding cycles and threshold tolerances, are fine-tuned to ensure a balanced approach between effective detection and the minimization of false alerts.

Results and Reporting

The algorithm is subject to a rigorous validation procedure. When it flags accounts as potentially suspicious, these accounts undergo a comprehensive review to search for any signs of collusive trading. Any trades identified as suspicious by this algorithm are then excluded from the final calculation of rewards.

Reward Distribution isn’t a static mechanism but requires oversight based on real-time adoption metrics. We continue to invest substantial effort during and between seasons to finetune the reward strategy and enhance our capabilities to detect wash trading anomalies. As our models collect more data and calibrate, we expect them to improve precision. Our goal is a progressively refined reward distribution mechanism as we journey forward.

Trading Season 1 Outcome

The inaugural season of the dYdX Chain Launch Incentive Program revealed a modest level of suspicious cyclical trading activities, primarily executed by a limited number of traders. The metrics from this season include:

- Total Season Volume: $9.8 billion

- Detected Wash Trading Volume: $0.5 billion

- Detected Wash Trading Volume Percentage: 5.4%

- Total Traders: 2,357

- Cycle Traders: 11

- Percentage of Cycle Traders: 0.05%

Conclusion

The integration of Chaos Labs' sophisticated wash trading detection algorithm into the dYdX Chain Launch Incentives Program represents a pivotal advancement in cultivating a transparent and equitable trading environment. With ongoing refinements and enhancements based on real-time data and evolving market dynamics, the program is poised for continuous improvement. This commitment to precision and integrity in reward distribution not only bolsters the credibility of the dYdX Chain but also sets a precedent for future crypto incentive programs. As we move forward, the focus remains on adapting and optimizing our strategies to maintain a healthy, competitive, and equitable trading ecosystem.

Oracle Risk and Security Standards: An Introduction (Pt. 1)

Chaos Labs is open-sourcing our Oracle Risk and Security Standards Framework to improve industry-wide risk and security posture and reduce protocol attacks and failures. Our Oracle Framework is the inspiration for our Oracle Risk and Security Platform. It was developed as part of our work leading, assessing, and auditing Oracles for top DeFi protocols.

sBNB Oracle Exploit Post Mortem

Chaos Labs summarizes the snBNB oracle exploit affecting the Venus LST Isolated Pool. The post-mortem focuses on the event analysis and risk management efforts following the exploit.

Risk Less.

Know More.

Get priority access to the most powerful financial intelligence tool on the market.