frxUSD Token Review

Summary

Between the 14th and 30th of August 2025, Chaos Labs conducted a risk assessment of frxUSD.

frxUSD is a fiat-redeemable, fully collateralized stablecoin issued by the Frax Finance Protocol. It is coupled with sfrxUSD, a yielding stablecoin with a dynamic yield strategy that provides the best returns to holders and adapts its strategy based on market conditions.

Key Findings

Chaos Labs’ assessment concludes that frxUSD’s overall architecture is thoughtfully designed, balancing robust solvency with innovative cross-chain interoperability. Continued improvement in redemption pathways and exit liquidity depth will further strengthen its resilience and adoption potential.

- All frxUSD supply is fully backed by fiat-equivalent reserves across regulated U.S. custodians (e.g., BlackRock, Superstate, WisdomTree), reducing single-entity exposure. Given their regulatory standing, custodian failure risk is extremely low.

- FraxNet and an on-chain RWA redeemer contract provide additional pathways to convert certain reserve tokens (e.g., USTB, BUIDL) directly into USDC, reducing whitelist-dependent frictions associated with the underlying reserve tokens.

- Redemption pathways remain custodian-dependent and fragmented, with most exit liquidity concentrated in Curve. Exit liquidity is improving but still lighter in USDC/USDT and ETH pairs versus FRAX/sUSDS on some venues, which can add extra routing in exits.

- LayerZero OFT implementation ensures a unified supply, aggregated liquidity, and fast cross-chain transactions.

Introduction

This report will comprehensively review all relevant risk factors of frxUSD. Our approach involves quantitative and qualitative analysis to help users, integrators, or other stakeholders better understand the token’s risks.

At Chaos Labs, our approach to reviewing frxUSD covers the following risk areas:

- Solvency Risks: Risks that could permanently impair the backing and, therefore, the solvency of frxUSD as a stablecoin

- Liquidity Risks: Risks associated with the ability to enter and exit frxUSD as expected.

Each of these risk categories will be covered separately. We discuss all relevant risks investigated, identifying mitigants where applicable to give a clear picture of which scenarios are potentially harmful and which are not.

frxUSD Overview

frxUSD is a fiat-redeemable, fully collateralized stablecoin issued by the Frax Finance Protocol.

frxUSD can be minted and redeemed 1:1 for cash-equivalent reserves through governance-approved “enshrined custodians.” As of 30th of August 2025, these custodians are regulated entities that custody U.S. dollar–denominated assets such as Circle (USDC), BlackRock (BUIDL), Superstate (USTB/USCC), Agora (AUSD), Centrifuge (JTRSY), and WisdomTree (WTGXX). Each custodian operates under a governance-set limit that defines the maximum supply of frxUSD it can mint against its collateral base.

Minting and Redemption

The minting and redemption of frxUSD operate through the custodian framework:

Minting:

- Custodians deposit cash-equivalent reserves (e.g., USDC, USTB, BUIDL) into their custody.

- For each $1 deposited, they can mint one frxUSD through their on-chain frxUSDCustodian contract.

Redemption:

- Holders burn frxUSD through a custodian contract.

- In return, they receive $1 of the custodian’s reserve asset (subject to availability and custodian requirements).

- There is no guarantee that redemption is spread evenly across custodians.

The presence of multiple custodians ensures diversification of frxUSD’s redeemability pathways while maintaining the stablecoin’s accessibility. Any user can interact with a custodian’s on-chain frxUSDCustodian contract.

Fiat-backed stablecoins such as USDC and USDT provide a helpful benchmark for understanding redemption mechanics. These tokens can always be minted against a dollar received or redeemed for a dollar. As a result, if secondary-market prices drift sufficiently off their peg to cover transaction costs, arbitrageurs have a simple trade to profit until parity is restored. This mechanism usually keeps such tokens trading extremely close to $1. However, USDC and USDT have experienced periods of trading below peg when redemption processes became impaired or delayed, highlighting that operational frictions can weaken the arbitrage mechanism even in fully fiat-backed models.

Currently, frxUSD can only be minted and redeemed through enshrined custodian contracts tied to approved collateral assets. Current custodians include Circle (USDC), Securitize (BUIDL), Superstate (USCC, USTB), Agora (AUSD), Centrifuge (JTRSY), and WisdomTree (WTGXX), each governed by a Frax Improvement Proposal and associated with a specific on-chain custodian address.

Circle Internet Group, Inc.

- Asset: USDC

- Governance Proposal: N/A

- frxUSDCustodian Address: 0x4F95C5bA0C7c69FB2f9340E190cCeE890B3bd87c

Securitize Markets, LLC

- Asset: BUIDL

- Governance Proposal: FIP - 418

- frxUSDCustodian Address: 0xe827abf9f462ac4f147753d86bc5f91e186e4e9c

Superstate Inc.

- Asset: USCC

- Governance Proposal: FIP - 420

- frxUSDCustodian Address: TBD

Superstate Inc.

- Asset: USTB

- Governance Proposal: FIP - 421

- frxUSDCustodian Address: 0x5fbAa3A3B489199338fbD85F7E3D444dc0504F33

Agora

- Asset: AUSD

- Governance Proposal: FIP - 425

- frxUSDCustodian Address: TBD

Centrifuge

- Asset: JTRSY

- Governance Proposal: FIP - 426

- frxUSDCustodian Address: TBD

WisdomTree, Inc.

- Asset: WTGXX

- Governance Proposal: FIP - 427

- frxUSDCustodian Address: 0x860Cc723935FC9A15fF8b1A94237a711DFeF7857

Importantly, frxUSD is not guaranteed to be always redeemable from every custodian. Once reserves at a custodian are fully withdrawn (e.g., all BUIDL tokens redeemed from the BlackRock custodian contract), redemptions must instead occur through other custodians holding eligible collateral. Even though Frax contracts are permissionless, using the underlying RWAs often requires KYC/AML and whitelisting. The on-chain RWA redeemer contract introduces additional pathways to convert certain reserve tokens (e.g., USTB, BUIDL) directly into USDC, reducing whitelist-dependent frictions.

Mint/ Redemption via FraxNet

To combat the issues above, the Frax team has introduced FraxNet. FraxNet is a cross-chain interoperability layer built to enable trust-minimized minting and redemption of frxUSD across supported networks and custodians.

The FraxNetDeposit is a cross-chain deposit and redemption contract used in the FraxNet ecosystem. It enables the minting of frxUSD from USDC, and its transfer to another chain using LayerZero’s OFT mechanism and Circle’s CCTP. It also supports redemption of frxUSD back to USDC using either a custodian or RWA-based redemption path.

Minting

- Users deposit USDC into a FraxNetDeposit contract.

- The contract mints an equivalent amount of frxUSD through an approved custodian.

- frxUSD is then delivered either directly on Ethereum or bridged to other networks using LayerZero’s OFT standard

Redemption

- Users send frxUSD to their FraxNetDeposit contract for redemption

- Redemptions are routed conditionally:

- Custodian redemption- for smaller amounts provided custodian liquidity is available

- RWA redemption- frxUSD is converted into USTB and redeemed back into USDC using Superstate’s USTB liquidity buffer which maintains $10 million in USDC liquidity for redemptions against USTB.

- Settlement is then completed:

- On Ethereum- USDC is transferred directly to the redeemer.

- On other chains- USDC is delivered through Circle’s CCTP

This path provides same-day liquidity for redemptions, mitigating delays typically associated with RWA settlement cycles and helping to stabilize peg dynamics under stress.

Reserve Analysis

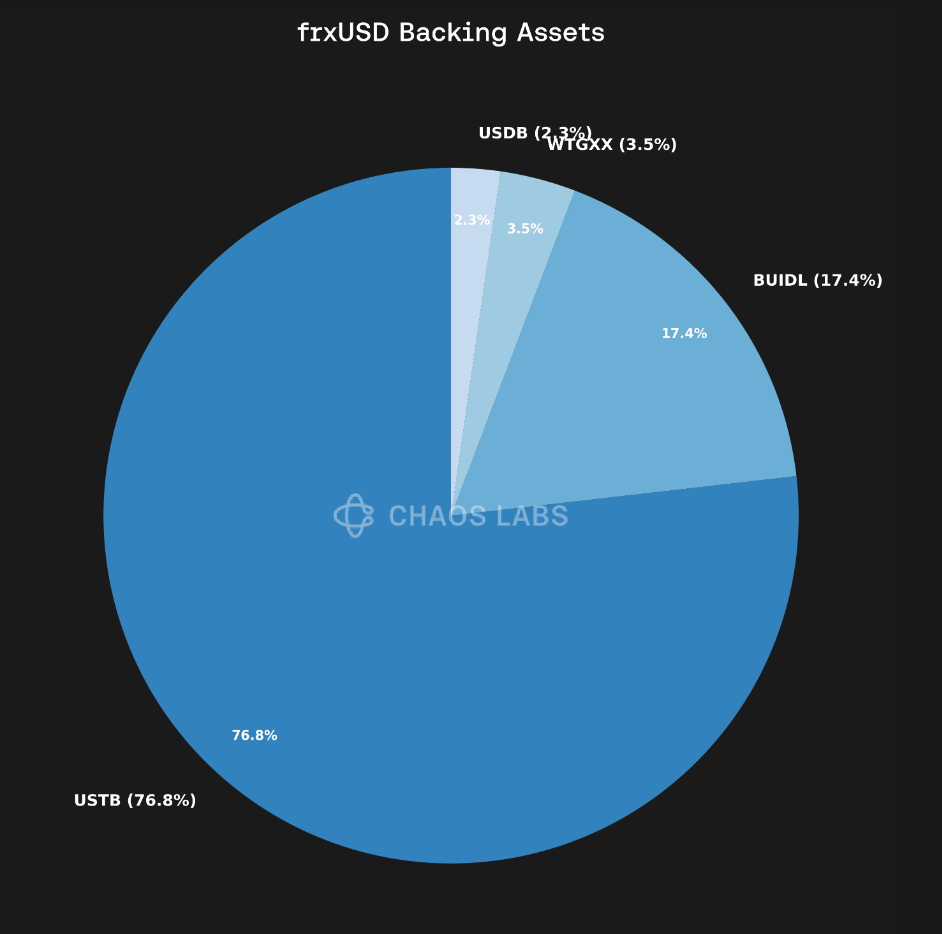

frxUSD reserves are currently diversified across multiple collateral assets that limit exposure to any single issuer. At the time of writing, the reserve composition was as follows:

USTB

Issuer: Superstate Inc.

Tokenization / Placement Agent: Federated Hermes (~$800B AUM), with Susan Hill, CFA managing ~$300B in fixed income

Custodian / Administrator: UMB Bank, N.A.

Auditor: Ernst & Young LLP

Fund Composition: ≥95% in short-duration U.S. Treasury Bills, ≤5% in cash for liquidity

USTB is designed to be a native on-chain issuer, with ≥95% of assets in short-duration U.S. Treasuries and ≤5% in cash for liquidity. The structure is bankruptcy-remote, custodied at UMB Bank, and overseen by Federated Hermes, NAV Fund Services, and Ernst & Young. Unlike traditional funds, USTB offers continuous NAV accrual and real-time yield accounting on-chain. Operationally, redemption speed is subject to UMB Bank and Federated Hermes execution windows, though the $10m USDC instant redemption buffer helps to mitigate near-term liquidity stress.

The main risk is structural: redemptions are permissioned to qualified purchasers, transfers restricted to whitelisted wallets, and peg maintenance depends on a narrow set of intermediaries executing arbitrage efficiently.

BUIDL

Issuer: BlackRock Financial Management, Inc

Tokenization / Placement Agent: Securitize Markets, LLC

Custodian / Administrator: Bank of New York Mellon

Auditor: PwC

Fund Composition: 100% in U.S. dollar cash and cash-equivalent instruments — U.S. Treasury bills, notes, obligations, and repurchase agreements.

BlackRock’s scale ($11.5T in total AUM, $849B in liquidity products), Bank of New York Mellon’s custodial role, and PwC’s independent audits collectively provide institutional-grade assurances. The fund composition is entirely in short-dated U.S. Treasuries and repo agreements which represents one of the lowest credit-risk profiles available in the market. In addition, built-in liquidity mechanisms such as USD redemptions and Circle’s USDC conversion channel further enhance stability and access. Subscriptions and redemptions are limited to accredited investors whitelisted by Securitize, with flows passing through transfer-agent and banking rails.

Similar to USTB, the risks come from the permissioned structure and operational dependencies, as arbitrage relies on a small set of qualified participants rather than open markets.

WTGXX

Issuer: WisdomTree Digital Management, Inc

Tokenization / Placement Agent: Voya Investment Management Co. LLC (~$336B AUM)

Custodian / Administrator: Bank of New York Mellon

Auditor: Ernst & Young LLP

Fund Composition: 100% U.S. Treasury & government securities; repo fully collateralized by gov’t securities

WTGXX is a 1940-Act regulated money market fund custodied at BNY Mellon, managed by Voya IM, and audited by EY. The portfolio is invested entirely in Treasuries, government securities, and fully collateralized repo, targeting a stable $1 NAV with daily dividends. Redemption is designed for same-day (T+0) or next-day (T+1) settlement depending on the time of request. Access, however, is restricted: only investors who onboard via WisdomTree Connect can participate, and wallet eligibility is controlled via a Soulbound Token.

Here too, the risks lie in the permissioned access and dependency on operational cut-offs, with peg stability hinging on institutional actors rather than broad retail redemption.

USDB

Issuer: Bridge.xyz. (Acquired by Stripe)

Custodian / Administrator: Segregated bank accounts (cash), BlackRock (U.S. Treasuries)

Auditor / Attestations: BPM (monthly reserve attestations, not yet publicly released)

Fund Composition: 5–10% USD cash held in segregated bank accounts; 90–95% invested in short-duration U.S. Treasuries managed by BlackRock

USDB is a fiat-backed stablecoin fully collateralized 1:1 with a mix of cash and short-term U.S. Treasury securities. The reserve composition prioritizes liquidity through a small cash buffer sized to meet ordinary redemption flow, with the remainder earning yield in Treasuries.

Redemptions are processed through Bridge’s orchestration APIs and adhere to NYDFS guidance requiring settlement within T+2 business days. In practice, most redemptions settle same-day from cash reserves, with larger redemptions completing within T+1 using Treasury liquidation.

There is a heavy reliance on Bridge’s internal orchestration system to execute redemptions. Monthly attestations are conducted by BPM but are not yet publicly disclosed, which limits external transparency.

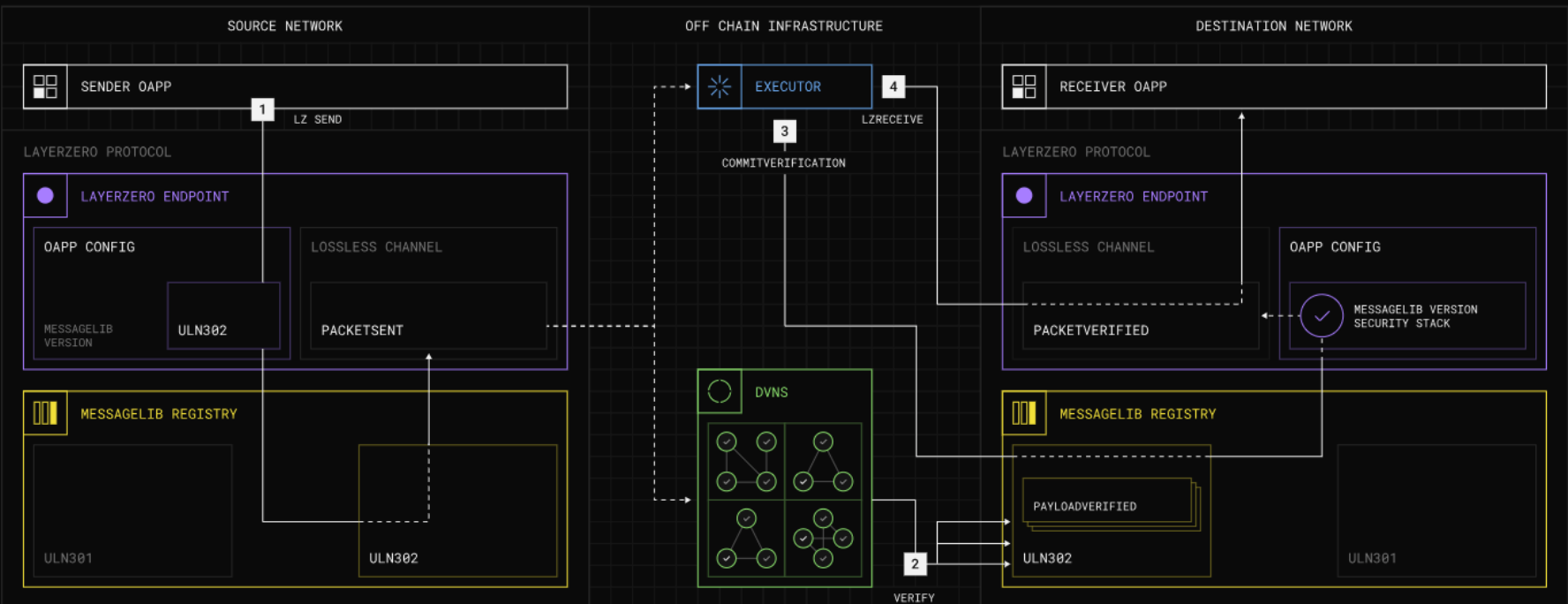

Cross chain transfers

The Omnichain Fungible Token (OFT) standard, developed by LayerZero, enables fungible tokens to move seamlessly across blockchains without wrapping, middlechains, or fragmented liquidity pools. Transfers are achieved by burning or locking tokens on the source chain and minting or unlocking an equal amount on the destination chain, ensuring a unified supply across networks. This is implemented through the OFT.sol contract, an extension of the ERC-20 and OApp standards, with the OFT Adapter acting as the intermediary for sending and receiving tokens across chains.

frxUSD adopts this standard directly on non-native chains it exists as an OFT token, while Ethereum and Fraxtal serve as the base chains for minting, redemption, and cross-chain routing. Frax further simplifies bridging with a hub-and-spoke architecture via Fraxtal, so cross-chain transfers pass through a central hub (A → Fraxtal → B), reducing complexity and ensuring unified liquidity.

Security in this process is provided by Decentralized Verifier Networks (DVNs), which independently verify cross-chain messages before they can be executed. Frax’s DVNs on Layer Zero are LayerZero endpoints and configured DVNs must approve each transaction to ensure message integrity. Verified packets are then committed by the LayerZero Endpoint and executed by the receiving contract, guaranteeing that transfers are accurate, secure, and tamper-resistant. The DVNs currently securing Frax include Frax DVN, LayerZero Labs DVN, and Horizen DVN, providing a diversified stack. frxUSD enhances this further through a dual-lockbox design, which allows users to exit OFT tokens back into native frxUSD on Ethereum or Fraxtal, ensuring that all circulating supply remains fully collateralized and redeemable across chains.

frxUSD Use Cases

What frxUSD enables

frxUSD is designed to function as a fully collateralized, fiat-redeemable stablecoin with seamless cross-chain interoperability and integrated yield pathways. This design offers several key benefits to users, protocols, and institutions:

For Users

frxUSD provides the assurance of fiat-redeemability while preserving the programmability of an on-chain asset. Holders can move frxUSD across supported chains via LayerZero’s OFT standard, avoiding reliance on bridges or wrapped assets. For users seeking yield, the companion sfrxUSD vault enables effortless access to competitive, dynamically optimized yields without needing to navigate multiple venues.

For Protocols and Chains

frxUSD offers a stable, institutionally-backed reserve asset that can integrate natively into DeFi. Its diversified custodian model spreads collateral across multiple regulated issuers, reducing single-entity concentration risk. Chains benefit from OFT-based liquidity, which eliminates fragmentation and ensures tighter peg stability across venues. Because reserves include yield-bearing assets such as tokenized Treasuries, protocols integrating frxUSD gain indirect exposure to high-quality collateral.

For Institutions

frxUSD provides a regulatory-compliant stablecoin that bridges traditional finance and DeFi. By partnering with entities such as BlackRock, Superstate, Agora, and WisdomTree, Frax enables large-scale integration of U.S. Treasuries and money market instruments into on-chain environments. This framework not only enhances collateral quality but also provides institutions with a credible pathway to allocate into digital assets without compromising on risk.

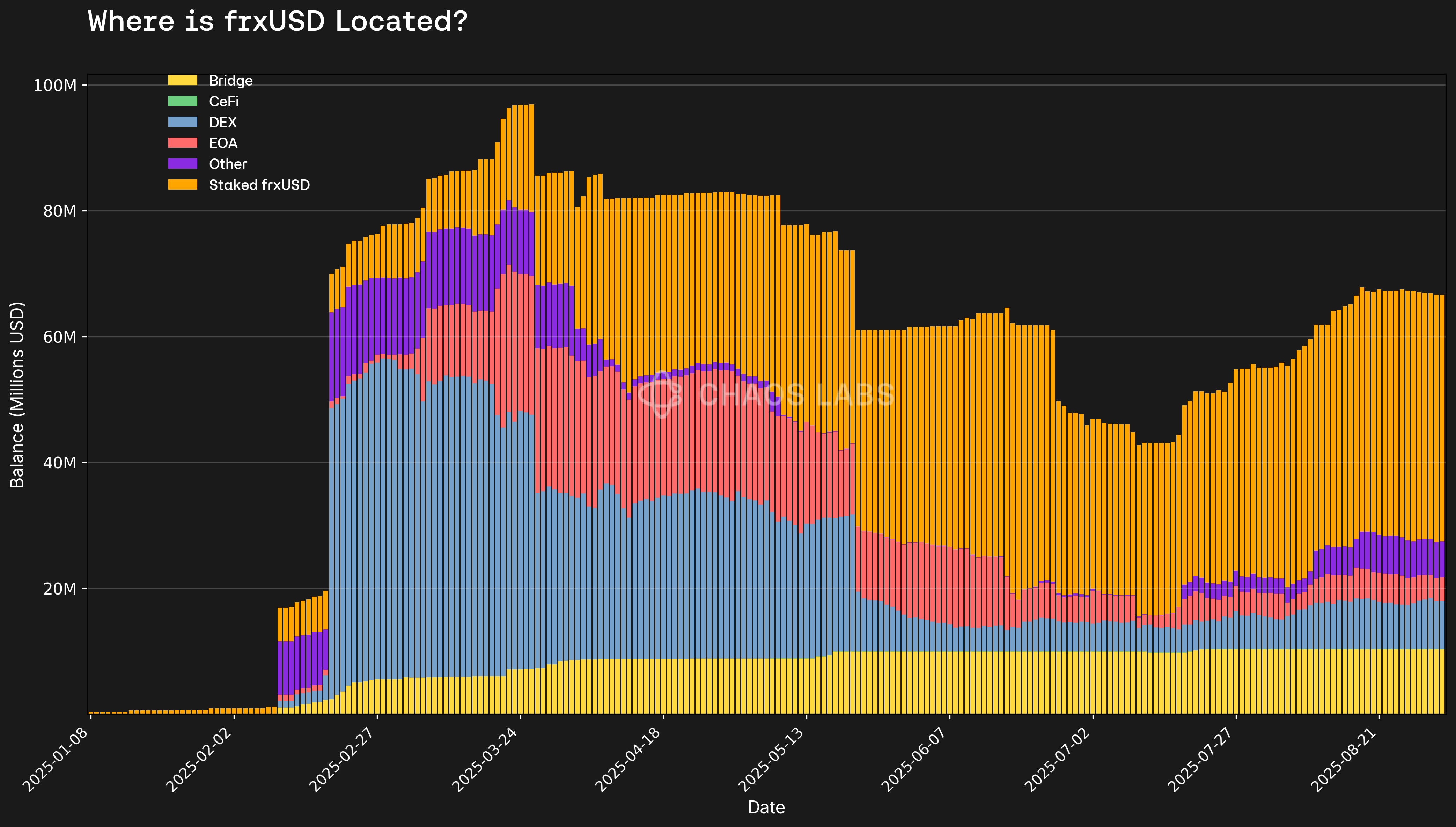

Where and How frxUSD is being Used

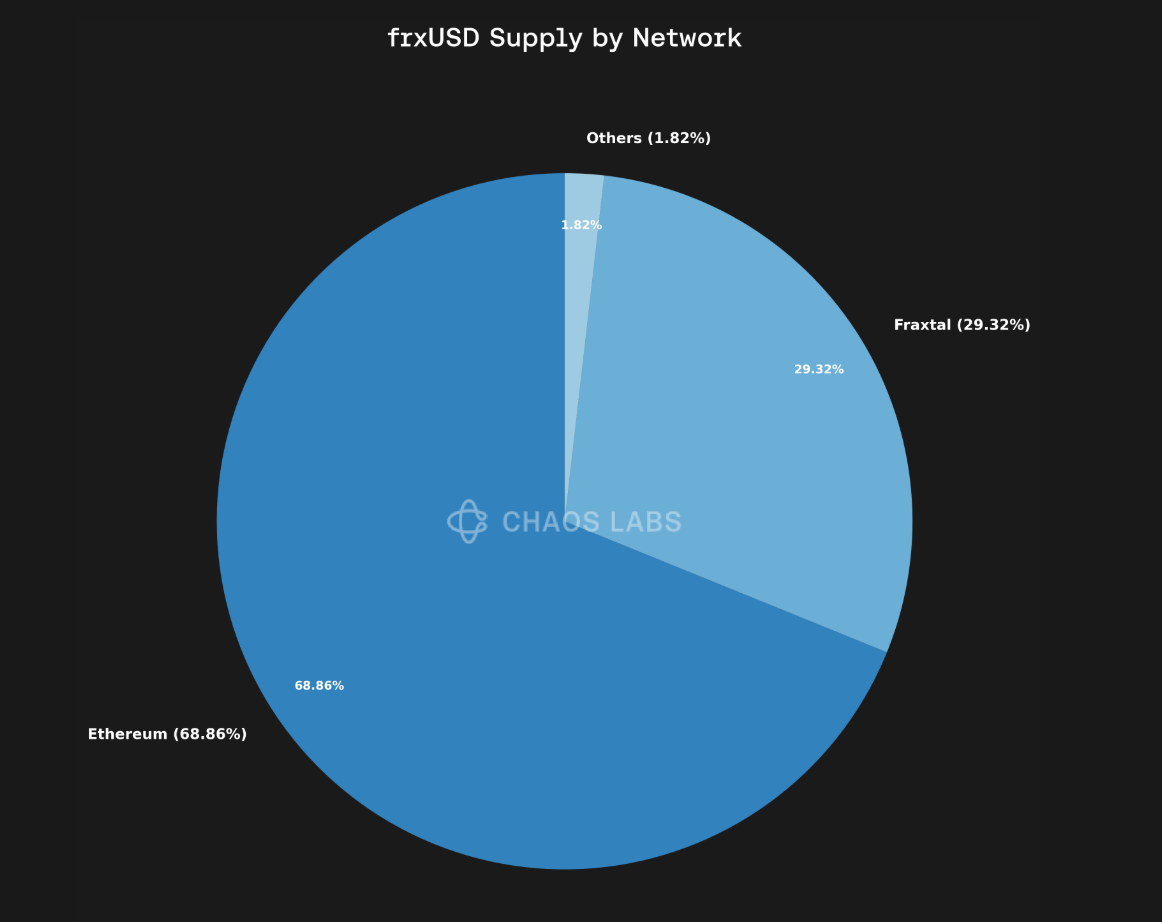

Currently, most frxUSD supply lies on Ethereum and Fraxtal.

A majority of frxUSD supply is locked up in the sfrxUSD contract and used to generate yield via differing strategies. A significant portion of frxUSD is also locked up on Ethereum to facilitate cross chain transactions via Layer Zero. Outside of this, frxUSD is mostly locked up in Curve pools for liquidity.

While frxUSD currently maintains deep liquidity in Curve pools and yield strategies via sfrxUSD, its adoption in lending and borrowing applications is still nascent but growing. Currently, only Fraxlend, Resupply and Euler offer markets with frxUSD as a borrowing asset. Fraxlend currently has over $5 million in active borrow demand for frxUSD.

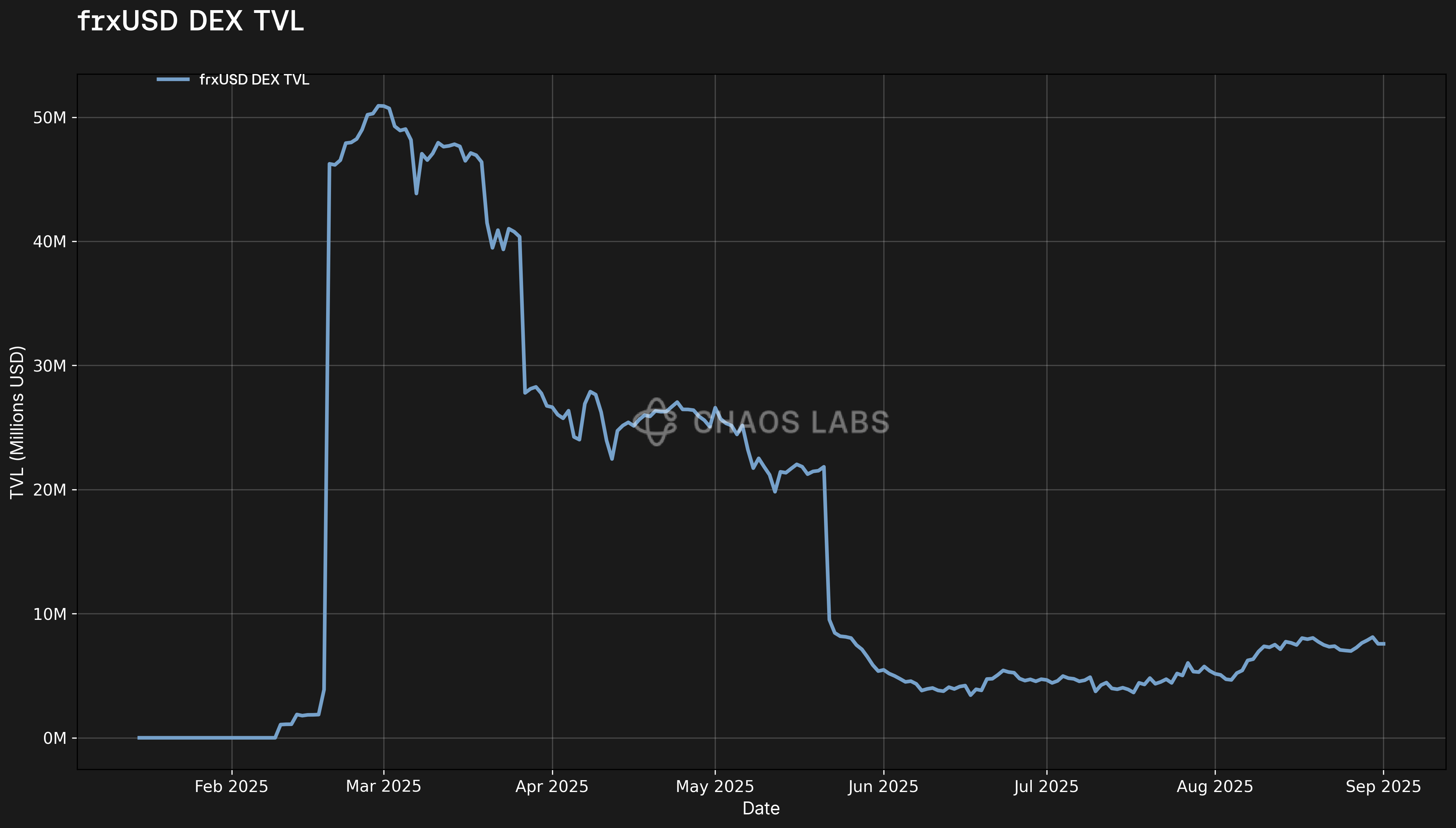

frxUSD Liquidity

Ethereum and Curve Finance are the primary venues for frxUSD liquidity, with Curve pools accounting for the majority of on-chain trading volume. Across the major pools, frxUSD has over $7 million in liquidity, which represents a relatively high percentage of its circulating supply compared to larger stablecoins such as USDC or USDT.

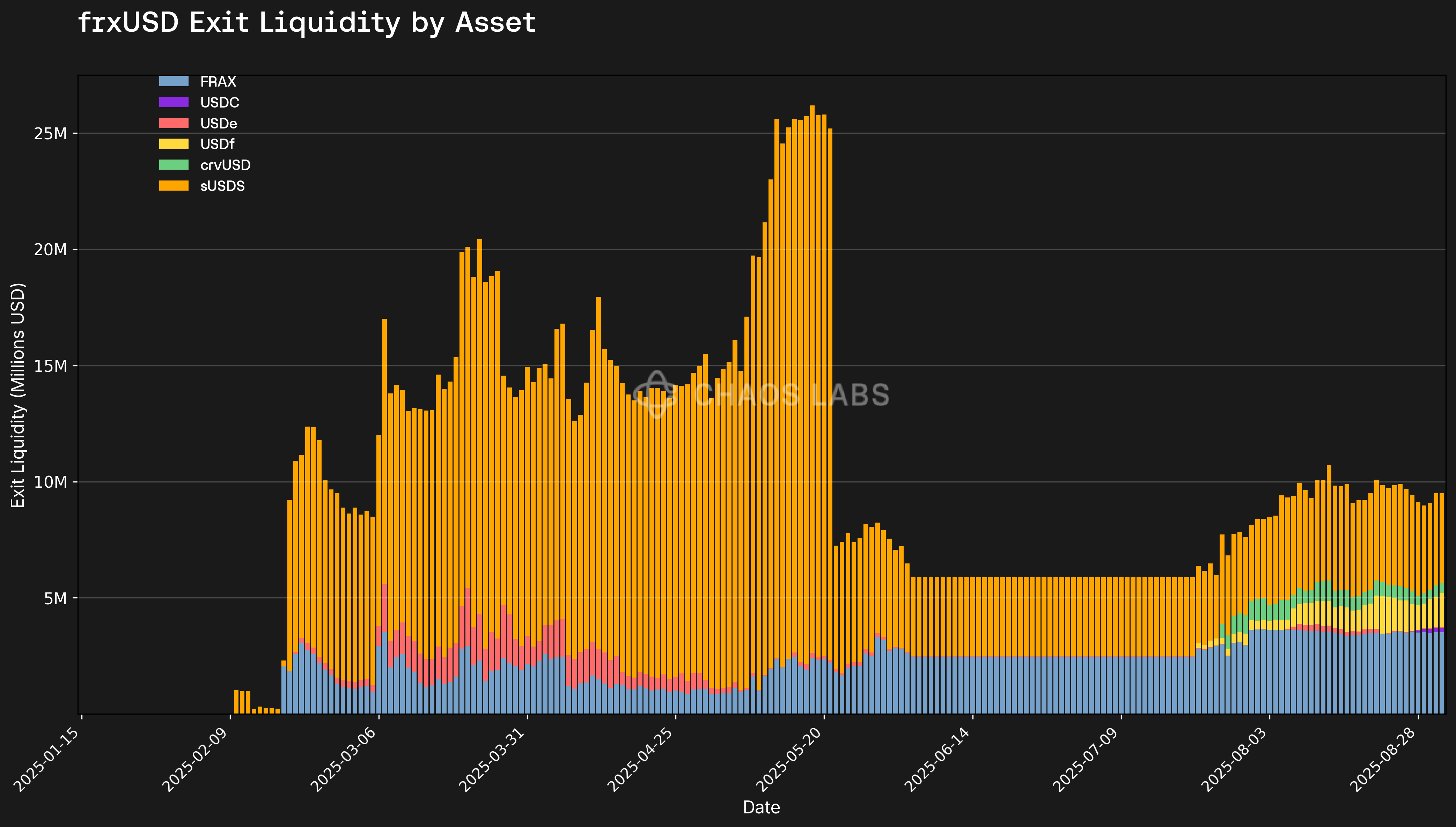

frxUSD currently offers over $9 million in exit liquidity, though half of this is paired against FRAX. The other significant pairing is with sUSDS, meaning that users lack deep redemption pathways into standard base assets such as USDC or ETH. This structure creates inefficiencies, as exiting frxUSD often requires multiple swaps or routing through less liquid assets.

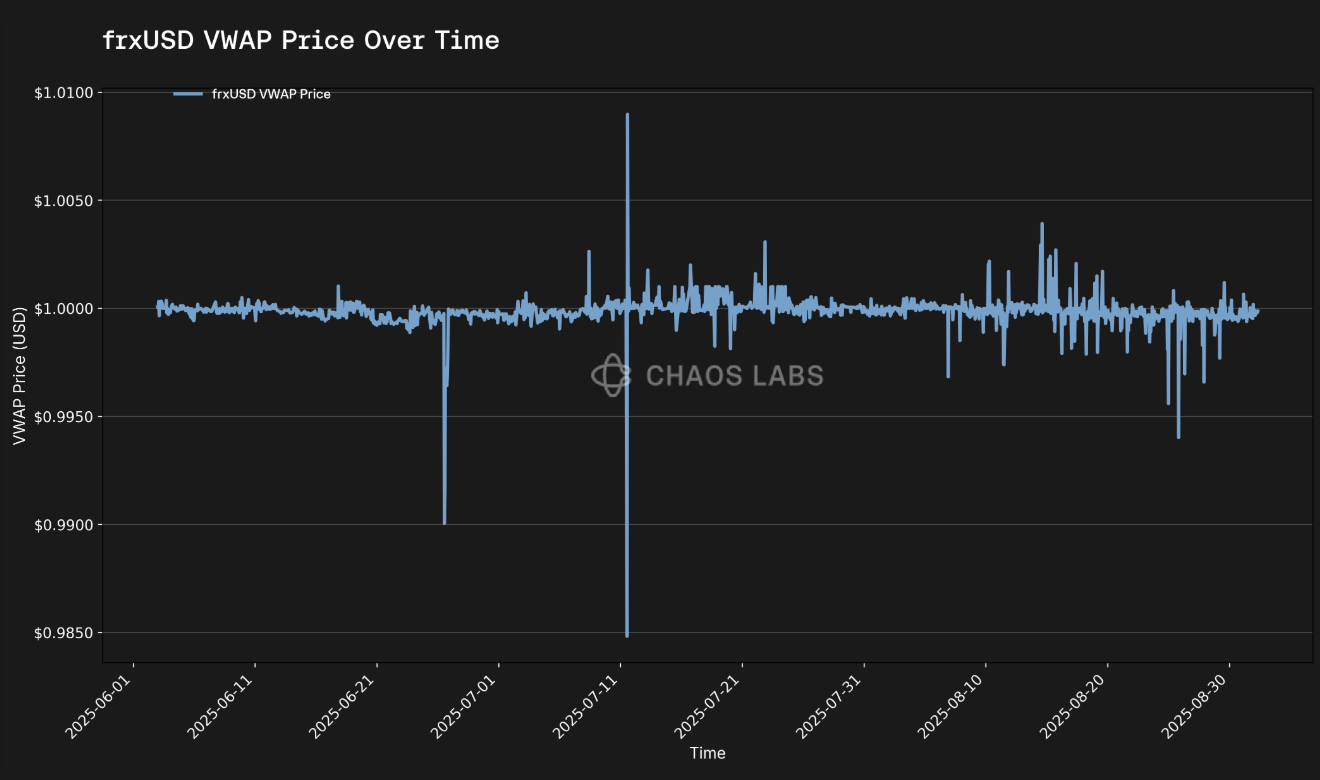

Despite these constraints, frxUSD has maintained strong peg stability over the past three months, with volume-weighted average pricing consistently close to $1 and deviations generally resolving quickly. This reflects effective arbitrage activity, custodian redemption and liquidity depth.

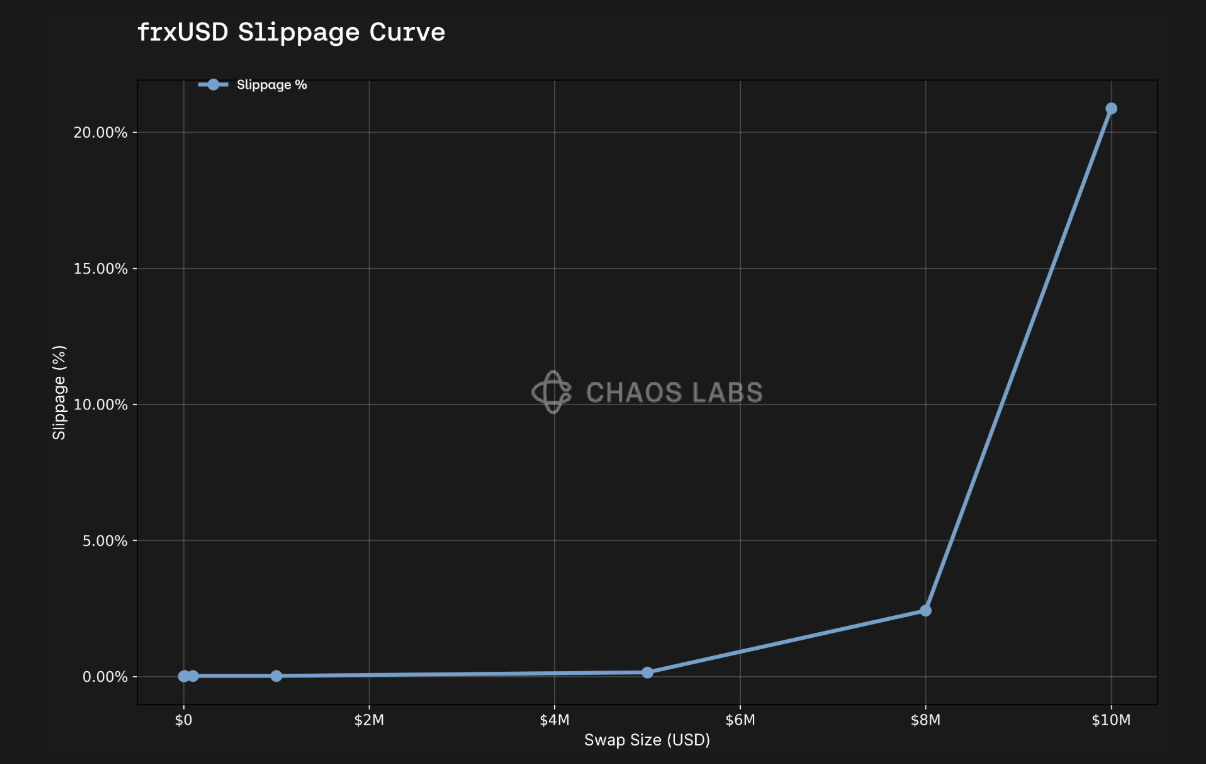

Trades up to $6 million incur minimal slippage. This indicates frxUSD is resilient under moderate stress, but liquidity could thin rapidly in extreme events or with very large trades.

frxUSD Risks

Solvency Risks

Solvency risk for a fiat-redeemable stablecoin arises when the value of its collateral no longer fully covers the outstanding supply. For frxUSD, each token is backed 1:1 by fiat-equivalent assets held by enshrined custodians, meaning solvency ultimately depends on the integrity and accessibility of those reserves.

The primary theoretical risk would be custodian impairment- if a custodian were to become insolvent, face regulatory enforcement, or experience operational failure, collateral could be delayed or frozen. However, this risk is extremely low in practice given the nature of frxUSD’s custodians. All participating entities such as BlackRock, Superstate, Agora, and WisdomTree are U.S.-based, SEC-regulated financial institutions with long operating histories, robust compliance frameworks, and strict oversight. They manage billions to trillions in assets under regulation, making outright failure or loss of client funds extraordinarily unlikely.

Liquidity Risks

Liquidity risk for frxUSD arises from structural constraints in redemption design and the composition of secondary-market liquidity. While enshrined custodians guarantee redemption into underlying collateral, pathways are fragmented and often misaligned with user demand.

- Custodian-dependent redemption pathways- Each custodian only redeems into its own reserve token (e.g., BUIDL, USTB, USCC), making redemptions non-fungible across custodians. Users cannot always redeem directly into USDC or cash unless the chosen custodian holds available collateral. This leads to uneven liquidity conditions where some custodian pools may face redemption pressure while others remain underutilized. In addition, several collateral tokens are permissioned and require whitelisting, creating further friction. The introduction of FraxNet aims to reduce some of these frictions by enabling cross-chain minting and redemption, and by settling redemptions into native USDC. However, FraxNet does not fully eliminate custodian dependence, as each redemption path remains tied to the liquidity of its underlying collateral. As a result, redemption efficiency is still contingent on availability of instant buffers such as USTB’s $10 million USDC withdrawal facility.

- Limited exit liquidity- Nearly half of exit liquidity currently exists through FRAX, and the other half through sUSDS. Absent deep liquidity in USDC/USDT or other major settlement assets, users often incur extra hops, higher slippage, and inefficiency when exiting frxUSD.

frxUSD Operations

frxUSD’s compliance, collateral management, and regulatory responsibilities are delegated to FRAX Inc (formerly FinresPBC), a U.S.-based public benefit corporation under FIP-432, a governance proposal formally ratified by Frax DAO. This delegation empowers FRAX Inc. to manage issuer functions including custodian onboarding, collateral deployment, regulatory audits, and pursuit of stablecoin licensing under forthcoming U.S. legislation. Intellectual property rights for frxUSD are also held by FRAX Inc.

FRAX Inc operates as the legal and regulatory face of frxUSD while remaining accountable to the Frax DAO. It retains only the revenue required to cover operating and compliance expenses, with all surplus profits returned to the DAO treasury for the benefit of FRAX token holders. This model ensures regulatory clarity and operational efficiency, while DAO governance retains the power to revoke or amend the delegation if necessary.

This structure creates a clear separation between operational execution (handled by FRAX Inc.) and governance oversight (retained by the DAO), aligning with regulatory best practices and strengthening the legitimacy of frxUSD’s compliance framework.

Collateral and Compliance Management

FRAX Inc is authorized to onboard and manage custodians such as BlackRock, Superstate, Agora, Centrifuge, and WisdomTree. Reserves consist exclusively of fiat-equivalent assets, U.S. Treasuries, or tokenized RWA instruments held in bankruptcy-remote structures under U.S. regulatory oversight.

By delegating these responsibilities to a regulated corporate entity, frxUSD maintains a fully compliant structure aligned with the requirements of a U.S. payment stablecoin license.

Conclusion

Chaos Labs recognizes frxUSD as a next-generation stablecoin architecture, combining fiat-redeemability with seamless cross-chain interoperability.

Operational responsibility for compliance and collateral is legally delegated to FRAX Inc under FIP-432, while the DAO retains revenue rights and revocation authority. This emphasizes a strong governance–regulatory balance, distinguishing Frax from centralized issuers.

Backed 1:1 by U.S.-regulated custodians with long operating histories and proven track records, frxUSD’s solvency risk is minimal.

Through LayerZero’s OFT standard, frxUSD avoids wrapped assets and fragmented pools, enabling unified liquidity and efficient cross-chain transfers.

That said, liquidity risks persist, with redemption pathways fragmented by custodian and exit liquidity concentrated in FRAX and sUSDS rather than major settlement assets.

Sources

Frax Cross Chain Strategy- Docs

Preparation for frxUSD Payment Stablecoin Charter- Governance Forum

BUIDL as a Backing asset for Frax USD- Governance Forum

FIP-432 – Transfer of Compliance & Collateral Management of frxUSD to FRAX Inc

FIP 32- Transfer of Compliance & Collateral Management of frxUSD to FRAX Inc- Governance Forum

Bug Bounty

Frax Finance operates one of the largest smart contract bug bounty programs in the industry, designed to protect both protocol-controlled collateral and user deposits.

Reward Structure

- Critical Exploits: Payout is the lower of 10% of the exploit value or $10 million, denominated in a mix of frxUSD and FRAX (at the team’s discretion). Both assets are liquid and rewards are delivered within 5 days (immediately when possible).

- Slow Value Extraction: Non-critical arbitrage opportunities or slow-drain vulnerabilities receive a fixed payout of 50,000 frxUSD.

- The scope excludes front-end, UI, and server-side vulnerabilities

Proof of Reserve as Risk Infrastructure

Chaos Labs is helping set standards through Chaos Proof of Reserves, which deliver automated attestations that meet strict data quality benchmarks.

XAUT0 Mechanism Design Review

This report will comprehensively review all relevant risk factors of XAU₮0. Our approach involves both quantitative and qualitative analysis to help users, integrators, or other stakeholders better understand the token’s risks.

Risk Less.

Know More.

Get priority access to the most powerful financial intelligence tool on the market.