Dynamic Price Impact on GMX Powered by Edge Risk Oracles

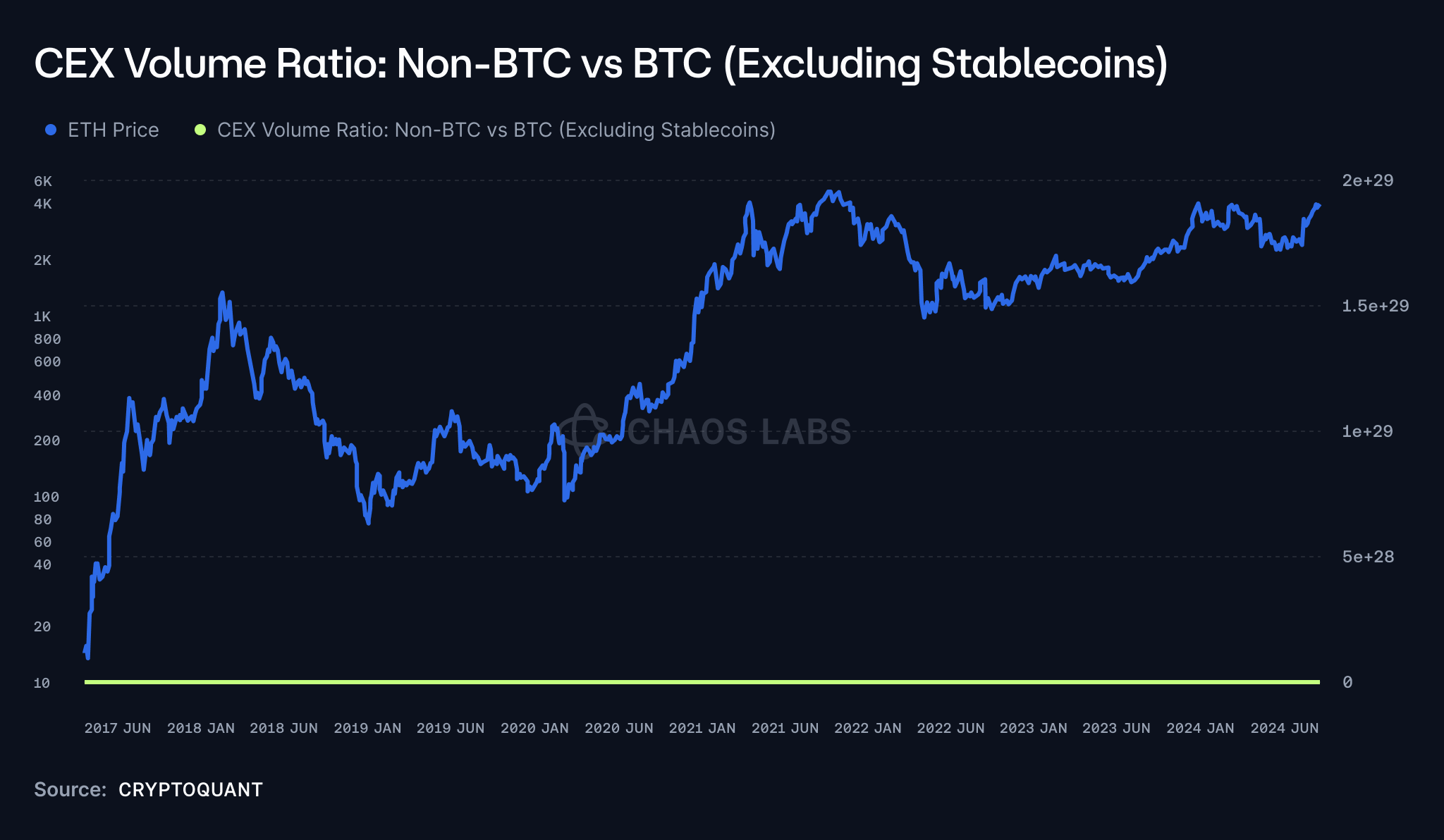

Decentralized derivatives exchanges (DDEXs) are under constant pressure to deliver a seamless user experience that rivals centralized exchanges (CEXs). To remain competitive, they require robust core infrastructure, the ability to list long-tail assets, and a comprehensive suite of derivatives and spot market products.

Scalable infrastructure capable of handling high trading volumes with minimal latency is essential. Cost-effective execution, particularly during increased market volatility, is critical. Any delays or inefficiencies can quickly become deal breakers for users accustomed to the reliability of CEXs.

The Role of Risk Oracles in a DDEX

Precision is even more critical for long-tail assets, which attract users trading on market narratives and speculative trends. These assets drive significant trading activity, offering DDEXs a competitive edge and a chance to capture new market segments.

Long-tail assets offer significant trading potential but have heightened risks like lower liquidity and higher volatility, requiring more dynamic risk management. GMX addresses this on v2 by transitioning from a monolithic GLP token to asset-specific GM tokens, enabling granular risk parameters for individual assets. This evolution enhances risk management and unlocks new integration opportunities across lending markets and structured yield products, leveraging DeFi composability to meet diverse user needs.

GMX Integrates Edge Risk Oracles

Edge Risk Oracles provide accurate, real-time data, enabling GMX to manage long-tail assets effectively while supporting integrations across lending markets and structured yield products. By providing granular price updates with minimal latency, Edge Risk Oracles enable:

- Enhanced UX for Traders

Real-time parameter adjustments significantly reduce execution costs for traders' by dynamically adjusting price impact settings. Tighter spreads during low volatility and reduced slippage for high-volume trades make GMX more competitive with centralized exchanges (CEXs).

Here's what @coinflipcanada had to say about dynamic pricing on GMX enabled by Edge Risk Oracles.

- Additional Safety Features

Ultra-high-frequency, low-latency feeds protect against price manipulation, a longstanding issue in DDEXs. Dynamic risk recalibrations based on liquidity, volatility, and trading activity ensure a secure trading environment without compromising performance. For example, recalibrating open interest caps in real-time optimizes liquidity management, reducing traders’ costs while maintaining robust risk parameters.

- Governance Sovereignty (Optimistic Updates)

Edge Risk Oracles leverage an optimistic update mechanism, automating risk parameter adjustments within governance-approved bounds. This balance ensures efficiency while preserving community control. Governance retains the ability to override or refine automated settings, enhancing rather than replacing decision-making

Phase 3: Advancing Risk Management on GMX

The integration of Edge Risk Oracles on GMX is executed through a 3-step implementation plan. Currently, Edge Risk Oracles support:

- Maximum Open Interest updates

- Dynamic Price Impact adjustments

Phase 3 will extend the integration to include:

- Dynamic Management of Swap Price Impact: Automatically adjust swap price impact to ensure efficient trade execution and improved user experience.

- Maximum Pool Size: Optimize liquidity allocation to prevent over- or under-allocation, protecting liquidity providers and enabling the expansion of GMX’s asset offerings.

- Funding Rates: Dynamically balance funding rates to prevent extreme long or short imbalances, improving platform stability and reducing the need for frequent position adjustments by traders.

- Borrowing Rates: Adjust borrowing rates in real-time based on liquidity and demand, minimizing capital inefficiencies and ensuring fair rates for leveraged positions.

Edge Risk Oracles represent a key advancement for GMX — narrowing the gap with trading experiences offered by centralized exchanges. Through our collaboration, GMX is reducing execution costs, enabling long-tail asset listings, and automating critical parameters.

As Phase 3 unfolds, these upgrades will bring the GMX platform closer to a CEX-like experience while preserving decentralization and composability — setting a new standard for performance and user experience in the DDEX space.

Chaos Labs: How We Work

The most interesting problems don't come with instruction manuals. In 3 years, we went from 0 to managing hundreds of billions in on-chain value. Not through fancy pitch decks or advertising. Through relentless execution and an uncompromising culture.

Corn Network Integrates Edge Price Oracles

Corn Network, an Ethereum Layer 2 protocol redefining Bitcoin’s role in DeFi, has integrated Edge Price Oracles. With over $60 billion in secured volume, Edge delivers intelligent, context-aware price data to the Corn Network, significantly boosting Corn’s resilience and operational efficiency in dynamic market conditions.

Risk Less.

Know More.

Get priority access to the most powerful financial intelligence tool on the market.