GMX V2 Risk Portal Product Launch

Background

GMX V2 Launched On August 3, 2023. The new protocol is live on Arbitrum and Avalanche, with various assets and improvements.

Following up on our collaboration with the GMX community to set the genesis parameter values for V2, we are excited to launch the GMX V2 Synthetics Risk Hub, expanding our existing V1 GLP Risk Hub to provide complete coverage, including all protocol versions.

What is GMX V2?

A Leap Towards Efficiency and Versatility

GMX V2 is not just an upgrade; it's a new trading experience for GMX users—liquidity providers benefit from provisioning to isolated markets, decreasing delta risk exposure, with improved funding rates and price impact. Moreover, the protocol was built with security in mind and is designed to be robust to market manipulations.

The protocol's expansion to include trading prominent Layer 1 (L1) tokens such as SOL, XRP, LTC, DOGE, and ARB on Arbitrum and Avalanche is a game-changer. Additionally, its diverse collateral options for trading make it an attractive choice for a wider audience.

Empowering Liquidity Providers

GMX V2 deploys liquidity in isolated GM pools. This innovation allows liquidity providers to select their market and risk exposure to preferred assets, giving them granular control over capital provisioning.

GMX V2 Synthetics Risk Hub: Platform Deep Dive

The V2 Risk Hub is integrated with both Arbitrum and Avalanche deployments. Using the protocol selector, navigating between V2 and V1 deployments is easy.

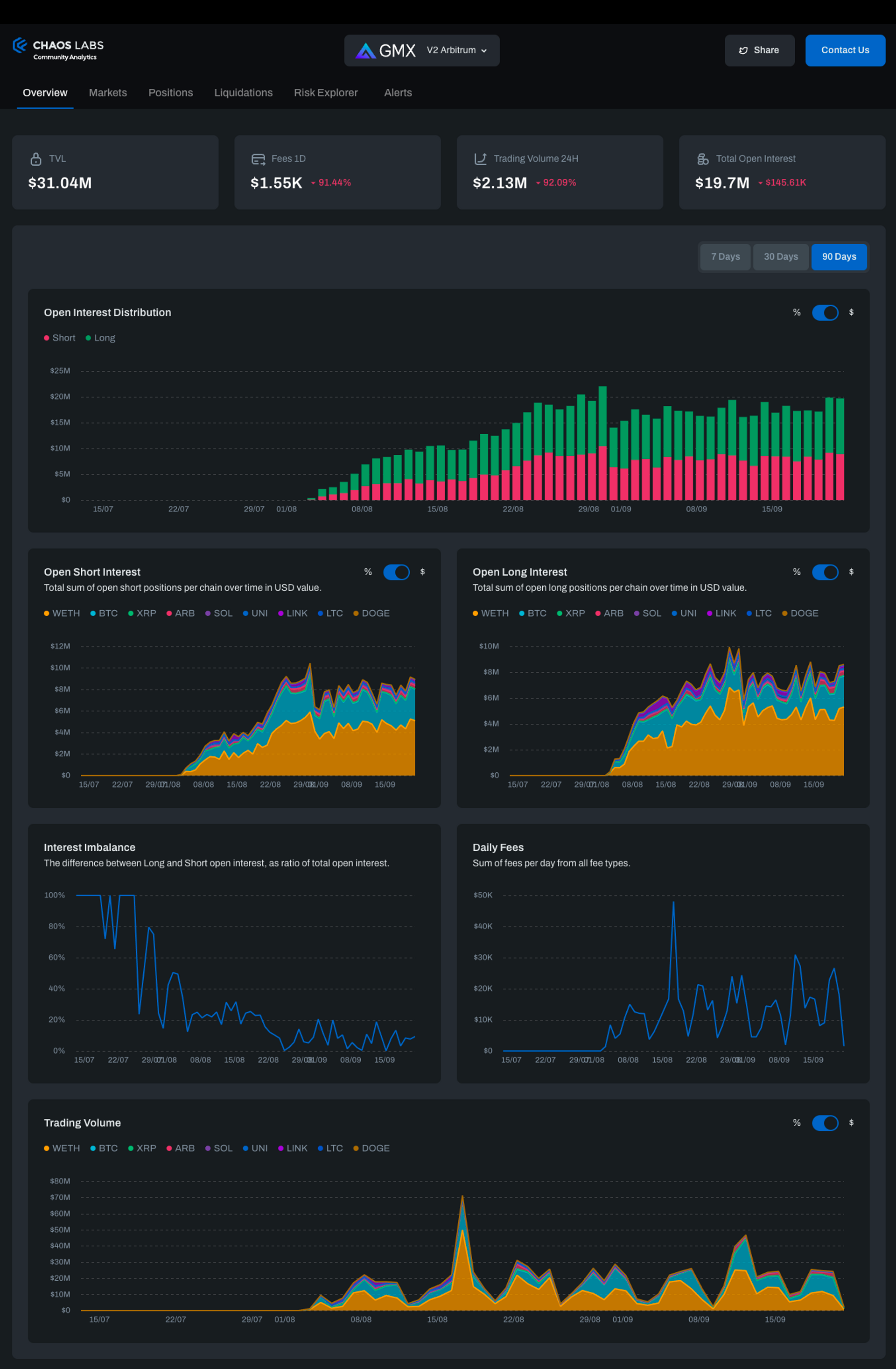

Overview Page

The Overview section provides high-level information about the protocol, including TVL, Fees, Trading Volume, and Open Interest. These are shown as aggregated metrics as well as a time series. Furthermore, the portal allows viewing granular position details (long/short) and market breakdowns, surfacing asset or market-level anomalies.

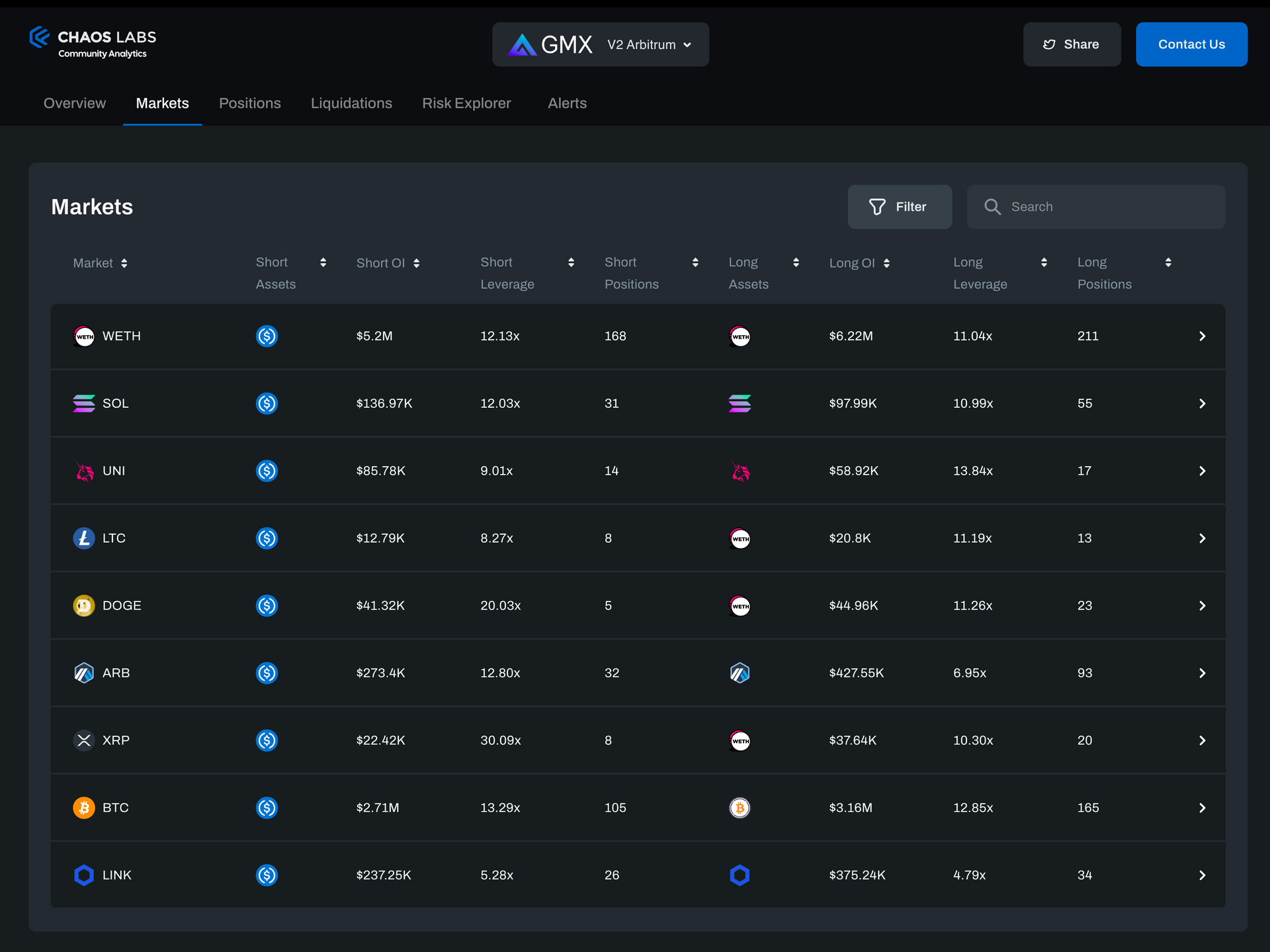

Markets Page

The markets tab offers a broad perspective on all GMX V2 markets, presenting critical data such as the short and long market assets, Open Interest, amount of Short and Long positions, and the average leverage size for each side.

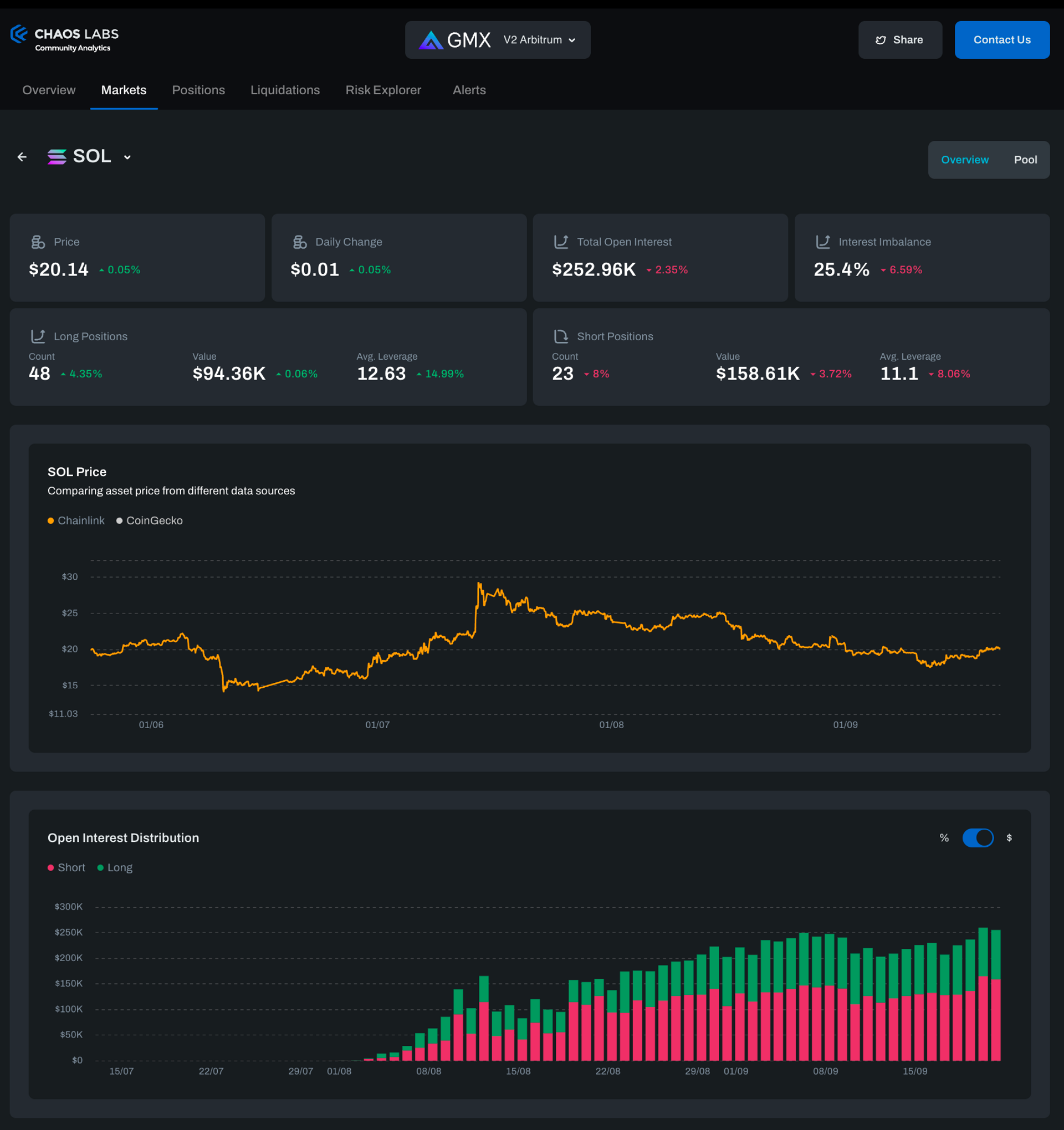

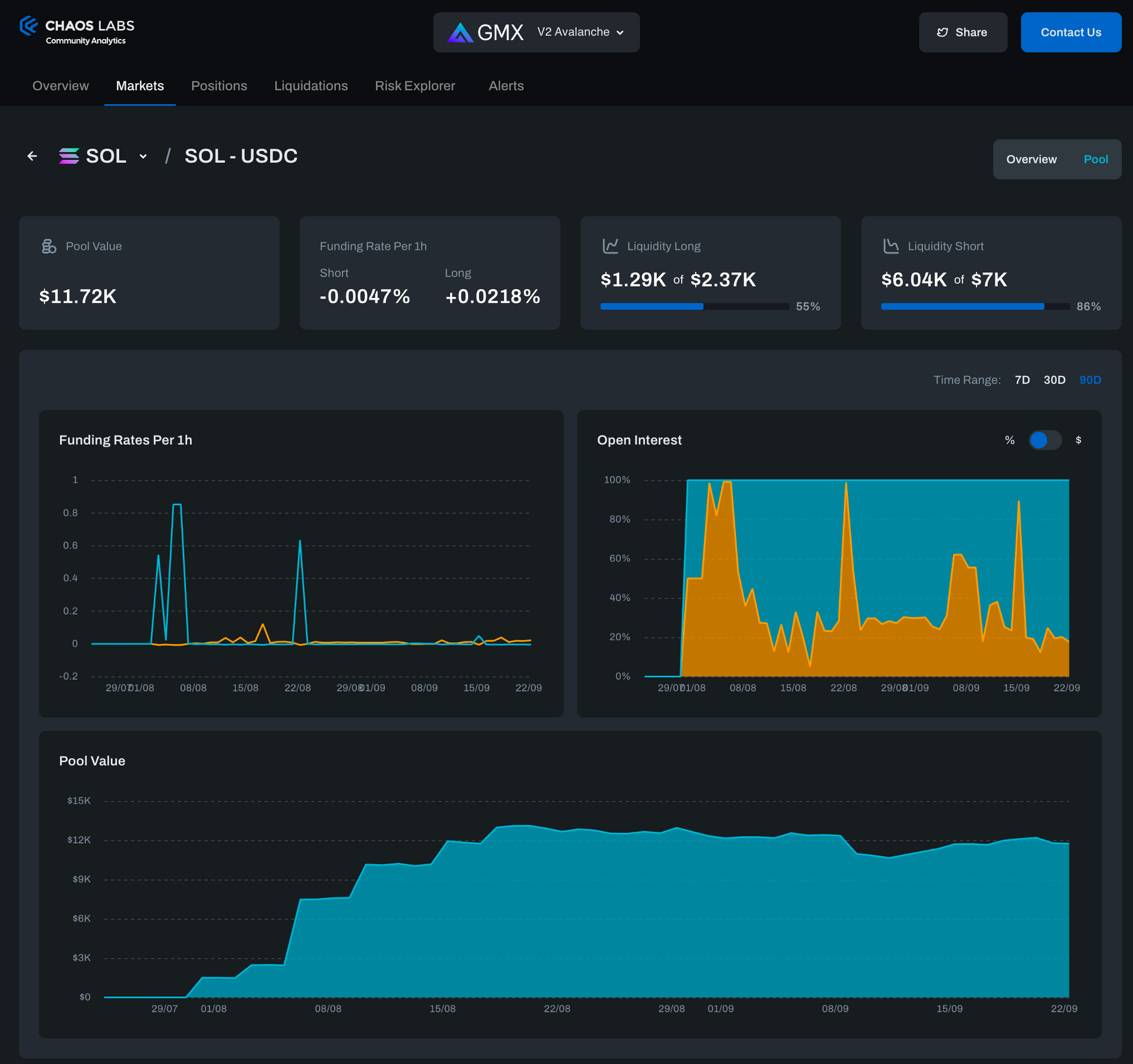

Market Detail

When users choose a specific market, they are taken to a more comprehensive view where they can access detailed analytics. The Market Detail page provides insights into short and long open interest, open interest imbalances, counters for long and short positions, and the average leverage on each side. Additionally, this page grants access to time series data for asset prices and open interest distribution, allowing for a deeper dive into market performance.

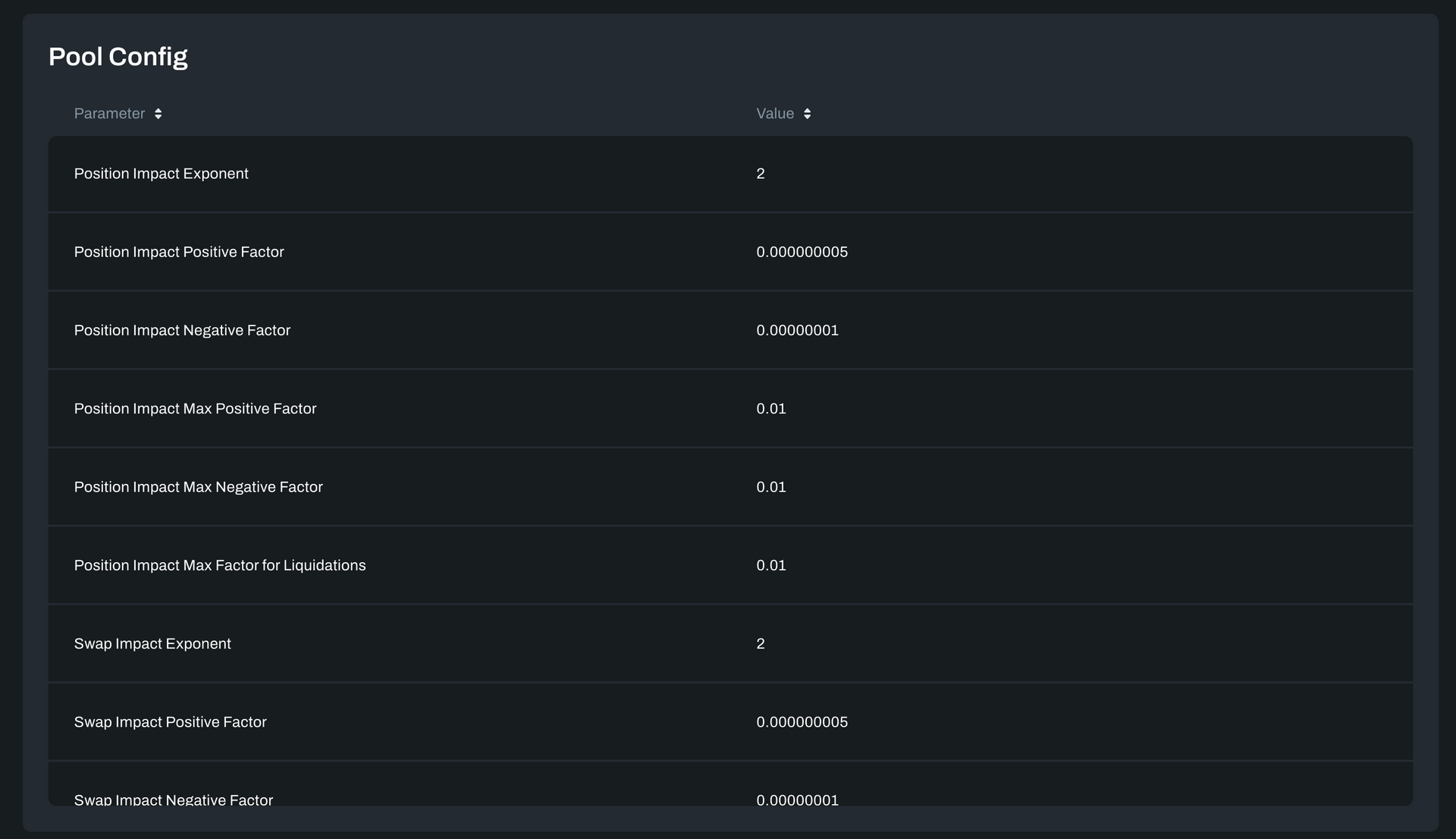

Historical and Real-Time Pools Configurations

Each GMX V2 market is backed by an isolated GM pool that provides liquidity for the market positions. To reflect that, we've introduced a brand-new feature that sheds light on the pools backing each market within the GMX V2 protocol. This screen provides users valuable insights into the liquidity supporting specific markets, offering transparency and a deeper understanding of the ecosystem. The pool page shows pool status, configuration, and usage.

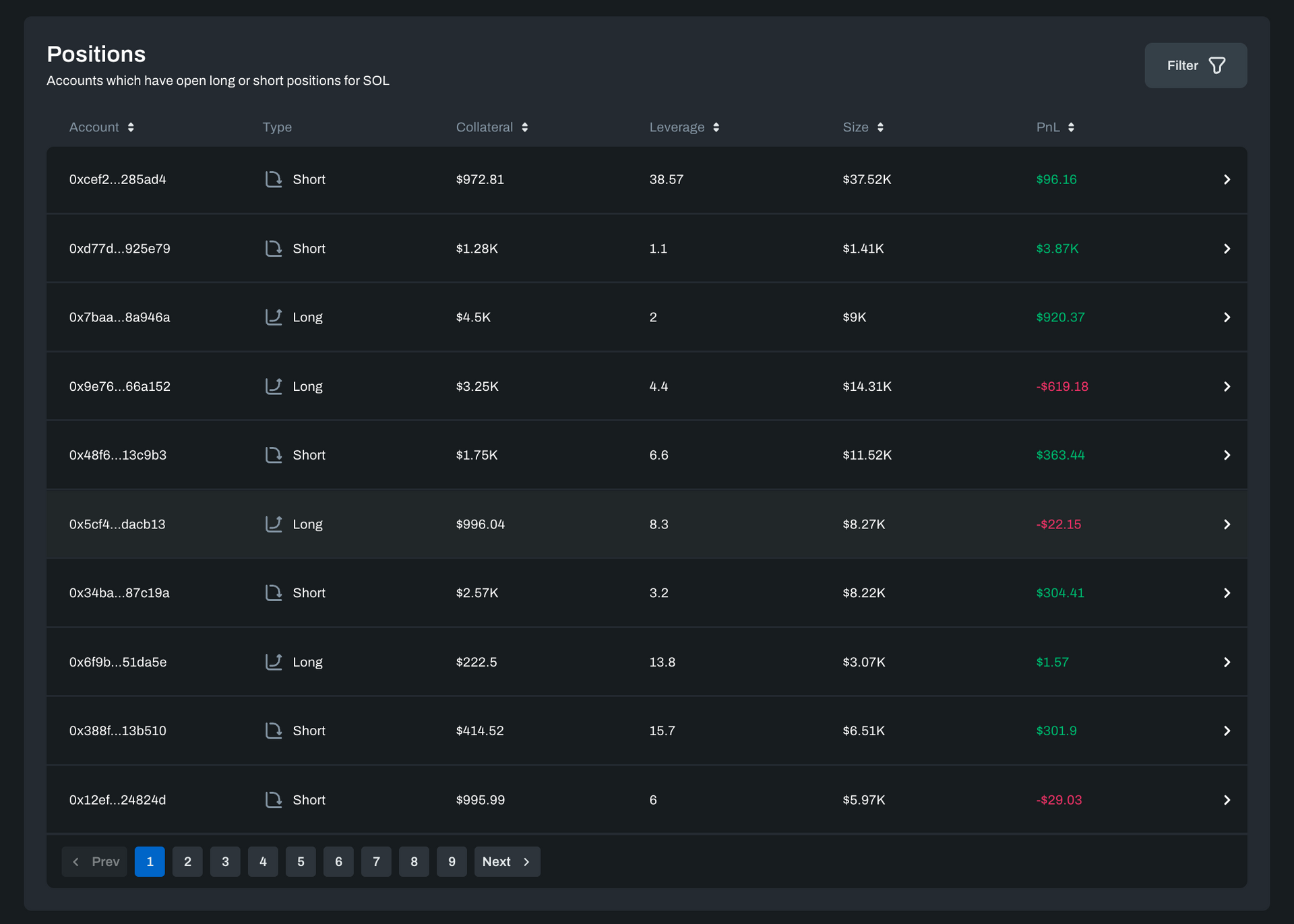

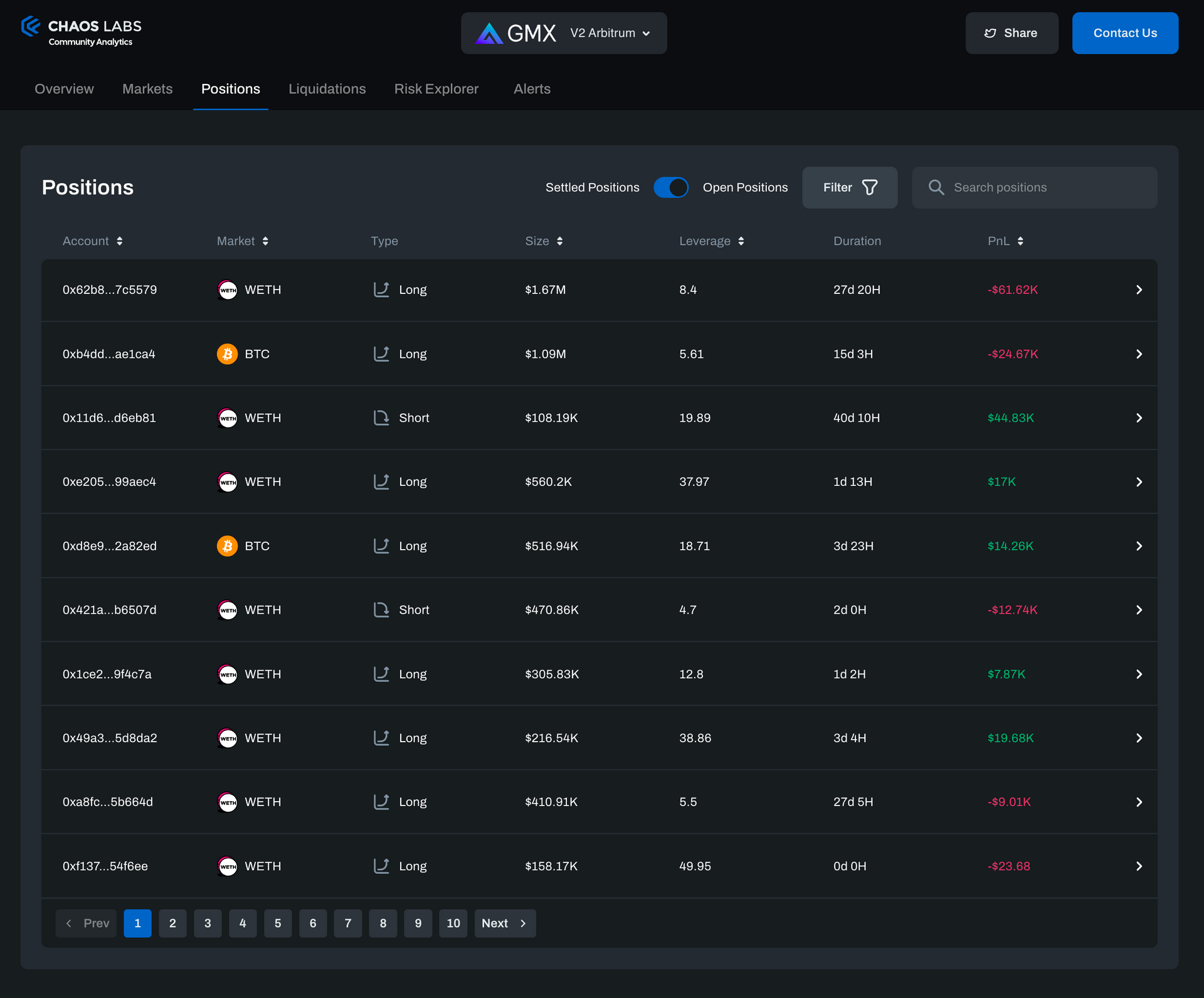

Positions

The positions page is a search engine for all positions within the GMX protocol, including open and settled positions. Users can easily search for specific wallet addresses or take advantage of the advanced filtering options, which allow filtering positions by assets, profit and loss, leverage, and type (long or short). This comprehensive view ensures users have access to all relevant data related to protocol positions.

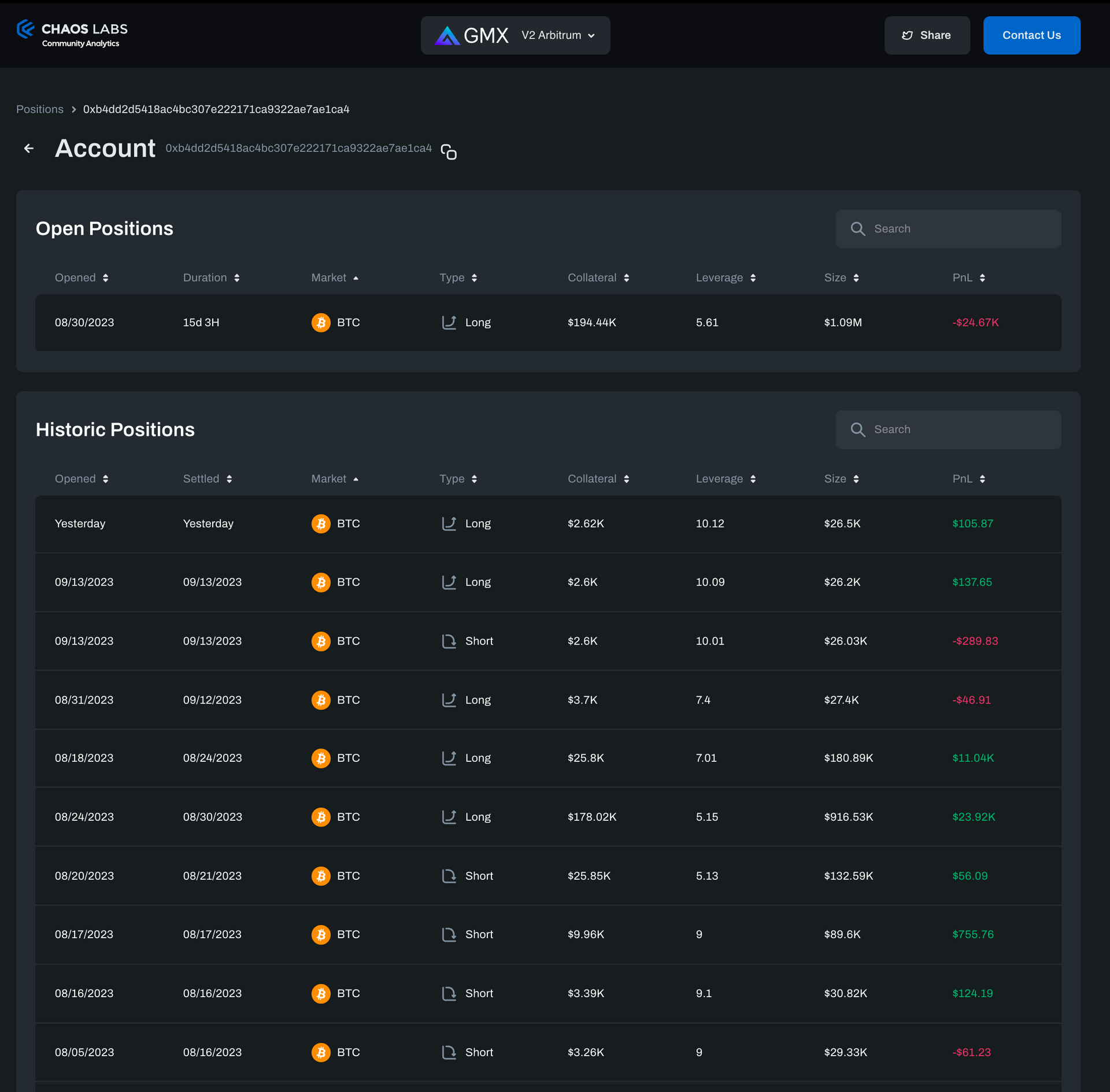

Account Details

By selecting a specific row in the positions page, users will be directed to the account details page, which displays all active and closed positions for that account, thereby enabling a comprehensive analysis of a trader's status and history.

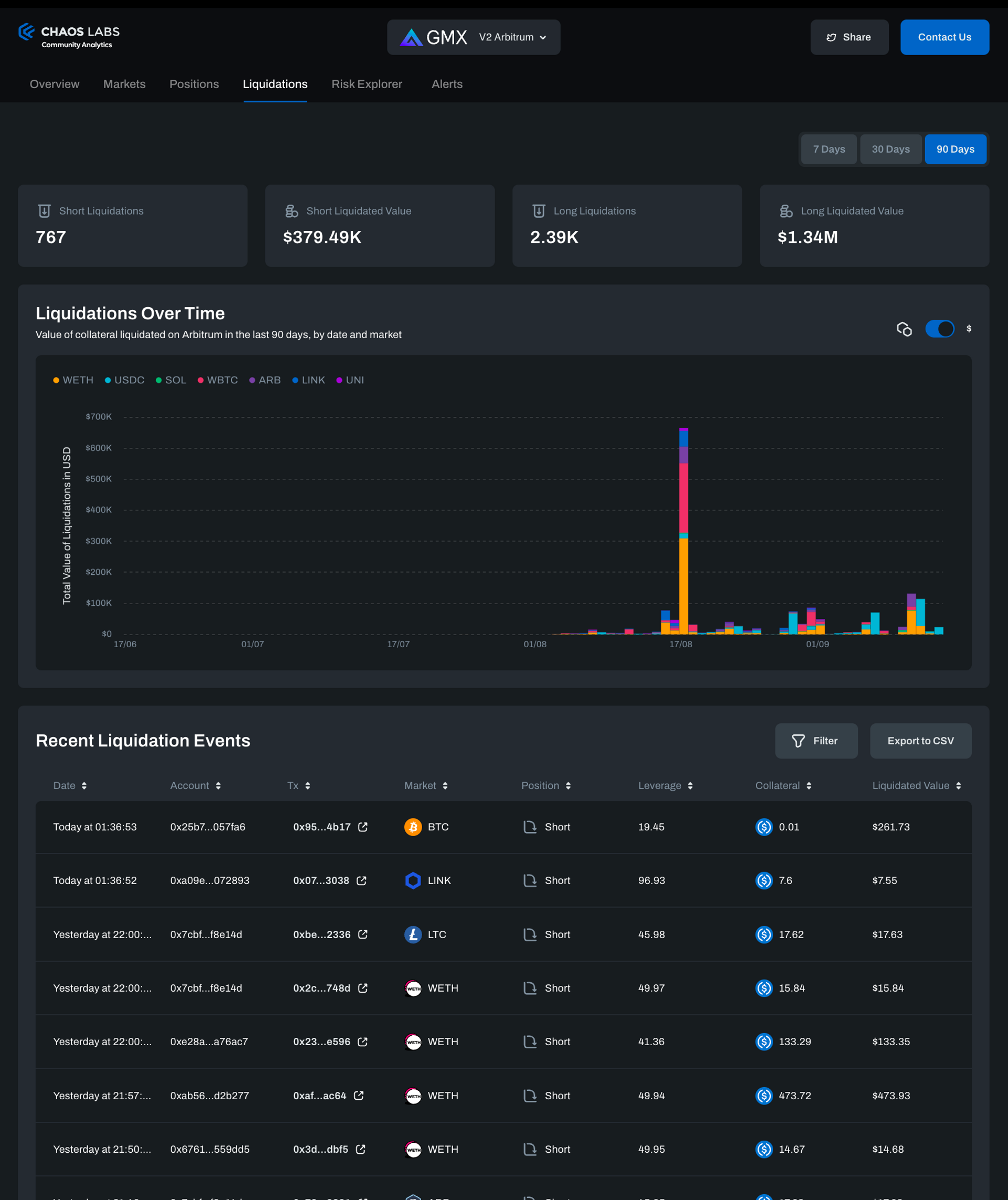

Liquidations

The liquidations page provides consolidated metadata on protocol liquidations, covering 7, 30, and 90 days. Additionally, the page includes a graphical representation of daily observed liquidation events and a table displaying relevant liquidation details. Users can choose a specific liquidation event, which will then take them to the Position Detail page of the corresponding account for a more thorough analysis.

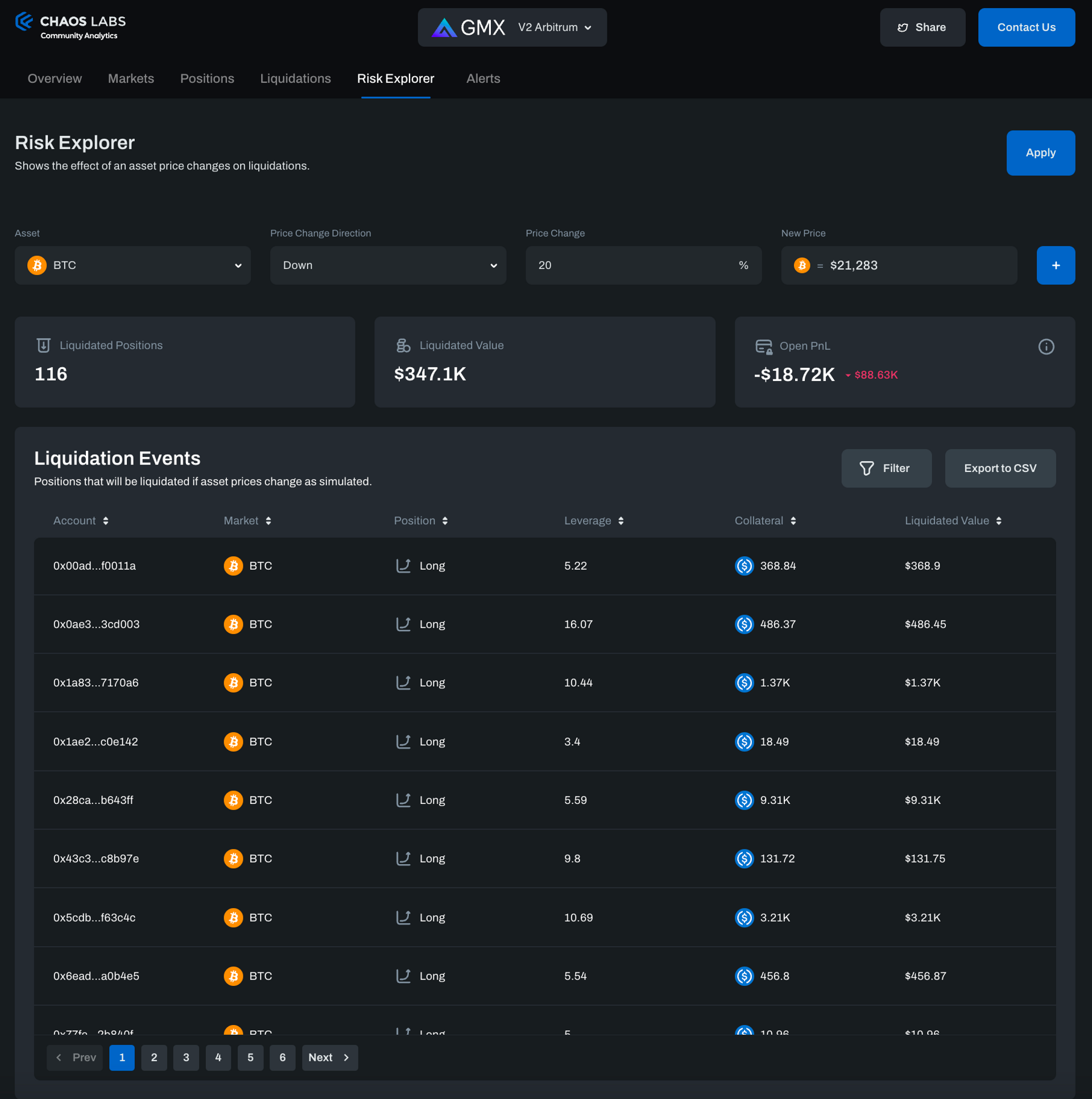

Risk Explorer

The Risk Explorer tool empowers users to run simulations on one or multiple assets, allowing them to simulate price drops and assess the potential impact on protocol positions and expected profit and loss (PnL). This functionality proves valuable for understanding the risk exposure associated with a position, particularly in market volatility.

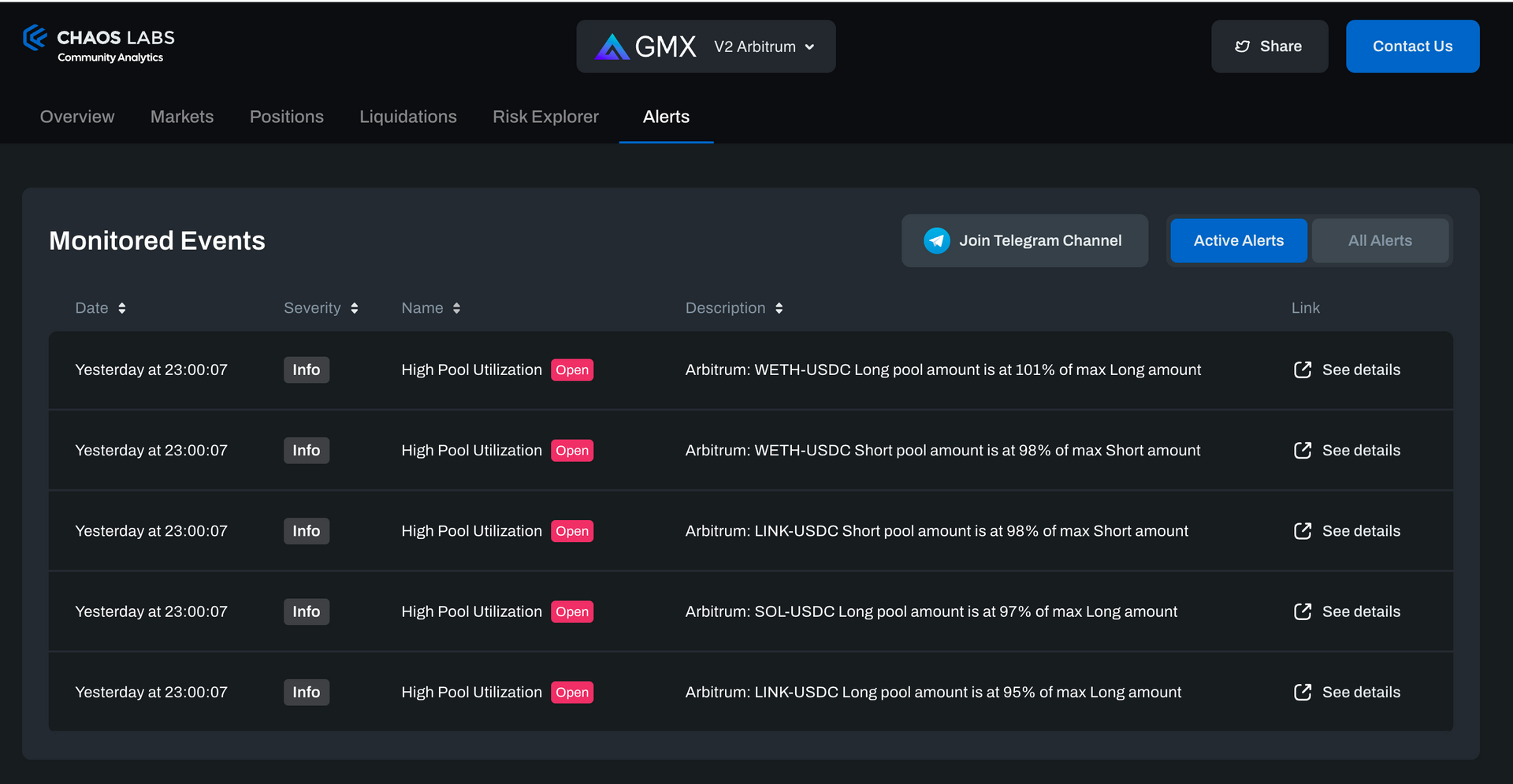

Alerts

The alerts tab offers real-time notifications on GMX protocol activity. Each alert features a link to the corresponding account detail page. Furthermore, users can click on the Join Telegram Channel button or use this link to receive updates directly in Telegram.

Currently, the following list of alerts is supported for GMX V2:

- Price Alerts for all traded assets - notifying about significant price volatility.

- Peg Stability Alerts for all protocol-supported stable-coins - notifying about any deviation from the peg. Additional information about how stable depeg is handled by the protocol can be found in the GMX V2 Docs.

- Whale Alerts - notifying about any large position opened or closed.

- Pool Utilization Alerts for all pools - notifying about any pool reaching its max Long or Short capacity, in which case no new positions can be opened.

- Pool Cap Utilization Alerts for all pools - notifying about any pool Short or Long amount reaching its Max Pool Amount.

Next steps

Our platform is constantly evolving and growing to meet our users' needs. We invite the GMX community to explore the platform and provide your feedback.

If you have any questions or comments, feel free to contact us, reach out on Twitter or email us at [email protected].

The Role of Oracle Security in the DeFi Derivatives Market With Chainlink and GMX

The DeFi derivatives market is rapidly evolving, thanks to low-cost and high-throughput blockchains like Arbitrum. Minimal gas fees and short time-to-finality make possible an optimized on-chain trading experience like the one GMX offers. This innovation sets the stage for what we anticipate to be a period of explosive growth in this sector.

Uniswap V3 TWAP: Assessing TWAP Market Risk

Assessing the likelihood and feasibility of manipulating Uniswap's V3 TWAP oracles, focusing on the worst-case scenario for low liquidity assets.

Risk Less.

Know More.

Get priority access to the most powerful financial intelligence tool on the market.