Institutional RWA: Powering Risk Infrastructure for Horizon

Table of Contents

Chaos Labs continues expanding its partnership within the Aave ecosystem. We are collaborating with Aave Labs to build the risk infrastructure for Horizon, an institutional DeFi platform that unlocks stablecoin liquidity for tokenized assets such as money market funds and U.S. Treasuries.

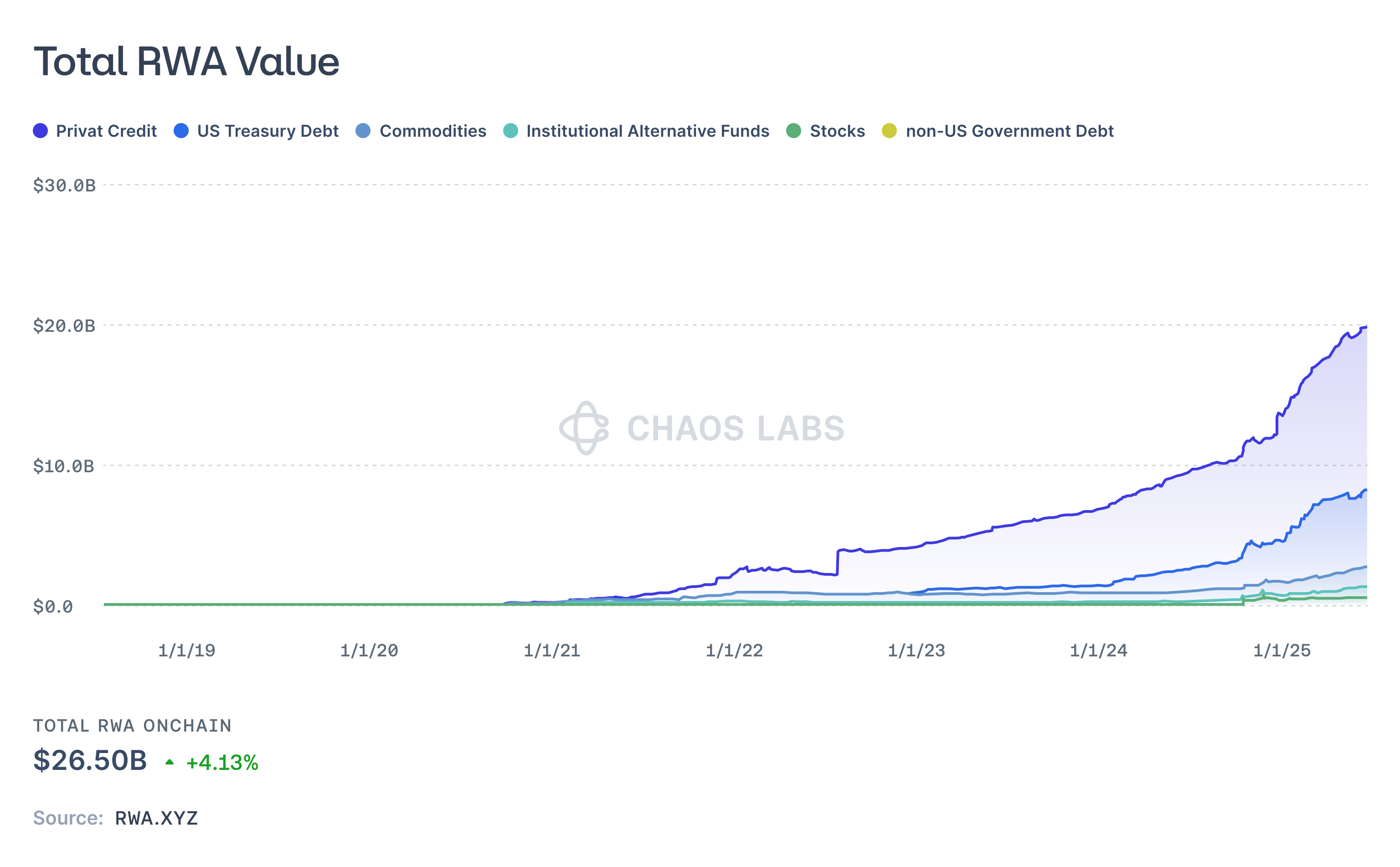

Institutions are increasingly adopting tokenization, with over $26 billion in real-world assets already onchain. Horizon allows these assets to be used as collateral for stablecoin borrowing, turning traditional instruments into active liquidity.

As Aave’s primary risk provider, we’re designing Horizon’s complete risk architecture, including Chaos Risk Oracles and institutional-grade monitoring systems.

Risk Oracles for Real-World Assets

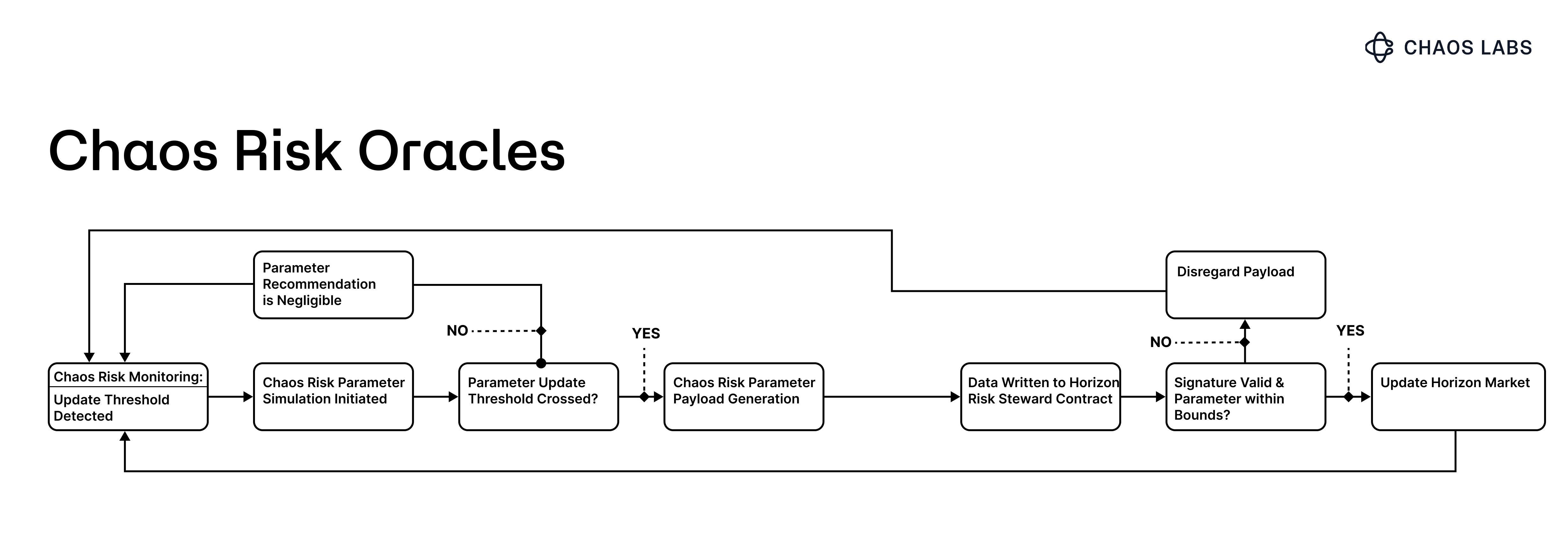

Chaos Risk Oracles will be integrated into Horizon’s governance and execution layers, enabling automated adjustments to lending parameters based on real-time market conditions. These include changes to interest rates, loan-to-value ratios, and liquidation thresholds.

Unlike crypto-native assets, real-world assets follow restricted schedules. Some money market funds update NAVs daily, while others follow weekly or auction-based pricing cycles. Markets close overnight and on weekends. Liquidations often require custodial coordination. Managing these constraints onchain requires a new approach to risk.

To address this, Chaos Risk Oracles will:

- Continuously monitor utilization, volatility, and redemption risk

- Cross-validate NAVs against external benchmarks such as Bloomberg indices and Treasury yield curves

- Enforce dynamic buffers and time-based liquidation logic during market closures

This system enables Horizon to maintain capital efficiency while navigating the operational complexity of institutional asset flows.

Full-Spectrum Risk Management

Our Risk Oracle infrastructure anchors a broader risk management framework built for institutional-scale RWA protocols. As part of our engagement, we’ll deliver:

- Agent-based simulations to model user behavior, protocol stress, and extreme redemption scenarios

- Real-time dashboards and alerts tracking collateral composition, NAV updates, market access windows, and lock-up periods

- Risk scenario modeling to anticipate asset performance under stress, enabling proactive parameter adjustments

- Custom liquidation mechanics that reflect issuer-imposed constraints, custodial delays, and qualified liquidator access

- Parameter tuning systems to ensure safe and efficient onboarding of new RWAs across asset classes

Horizon introduces a new design space for managing real-world assets in DeFi. Our work with Aava Labs will ensure that every price feed, parameter, simulation, and safeguard is engineered for institutional-grade reliability and operational scale.

XAUT0 Mechanism Design Review

This report will comprehensively review all relevant risk factors of XAU₮0. Our approach involves both quantitative and qualitative analysis to help users, integrators, or other stakeholders better understand the token’s risks.

Risk Oracles: One Step Beyond Price Oracles

Risk Oracles automate the most critical components of protocol risk management by adjusting parameters in real time based on market volatility and liquidity conditions.

Risk Less.

Know More.

Get priority access to the most powerful financial intelligence tool on the market.