Introducing the Aave Slope2 Risk Oracle

A mechanism for dynamic risk adjustments that adapts to real-market conditions. Now live across Aave v3 markets, with initial collateral coverage USDC, USDT, USDe, and wETH on Ethereum Core and Linea, and a full rollout path under our Risk Steward framework.

Time-Dependent Rate Dynamics

Aave DAO has approved the deployment of our time-based Risk Oracle, a mechanism that transforms the slope2 segment of Aave’s interest-rate curve into a dynamic function of utilization persistence.

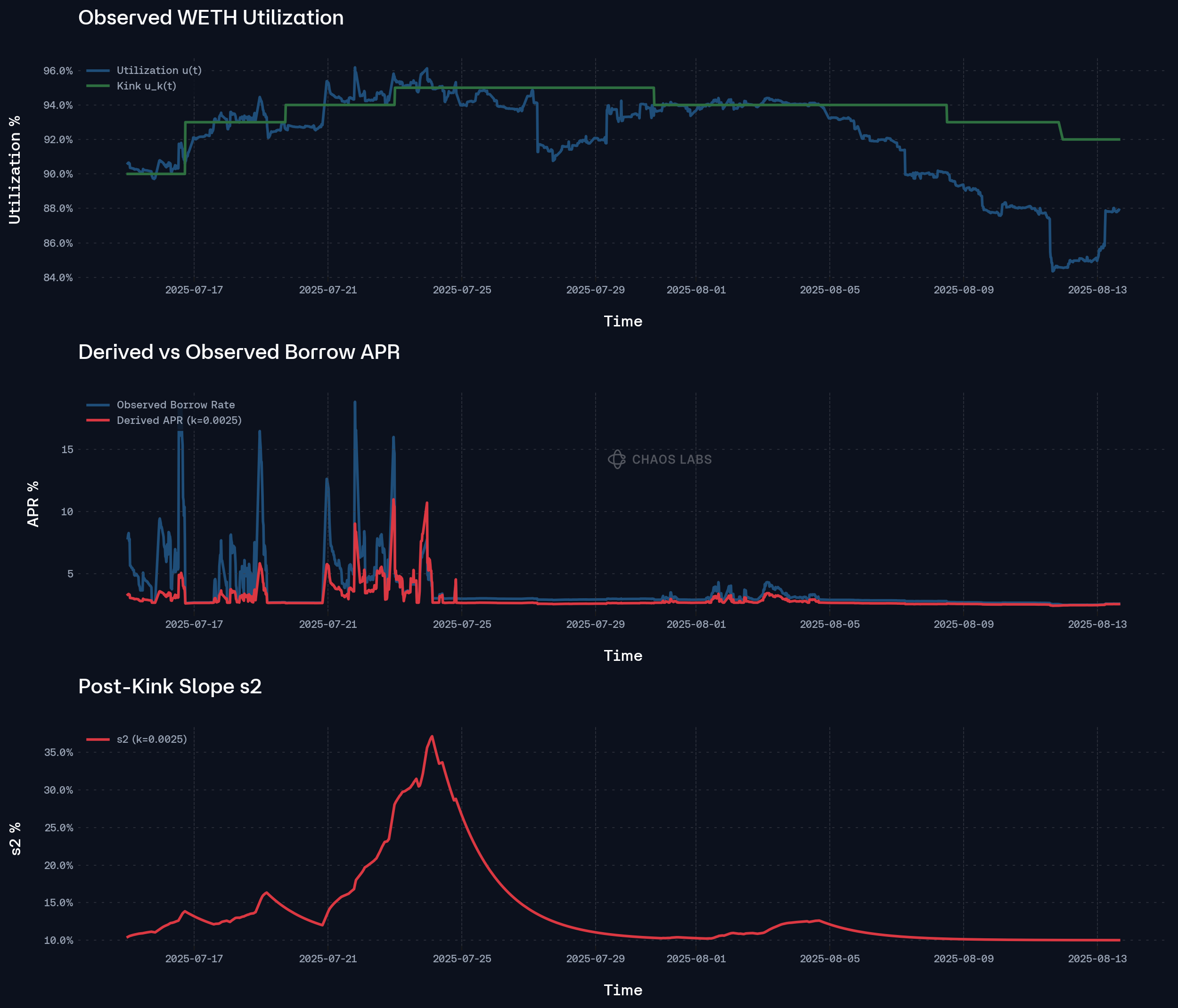

Under the previous configuration, slope2 values were static. In cases of sudden, sharp increases in utilization (caused by large supply withdrawals or otherwise), borrow rates would spike immediately, often triggering deleveraging cascades and exacerbating short-term liquidity stress.

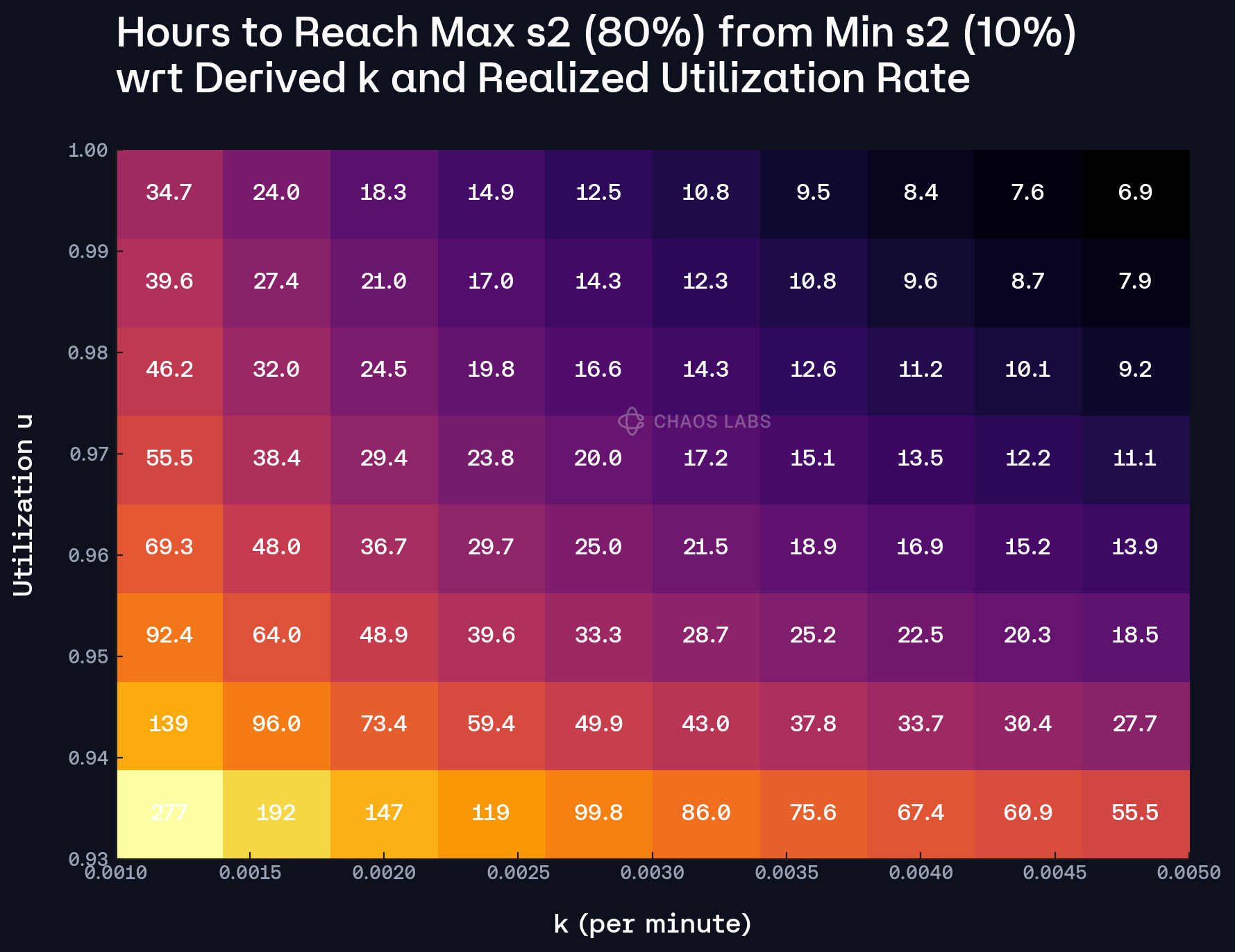

Our Slope2 Risk Oracle introduces convex, time-aware rate escalation. Once utilization surpasses the threshold, slope2 increases gradually based on both duration and magnitude of over-utilization. When utilization normalizes, the parameter automatically decays back to its baseline.

This design creates a smoother interest-rate curve that distinguishes between short-term volatility and sustained stress. It reduces the likelihood of sudden rate shocks while maintaining market liquidity and capital efficiency.

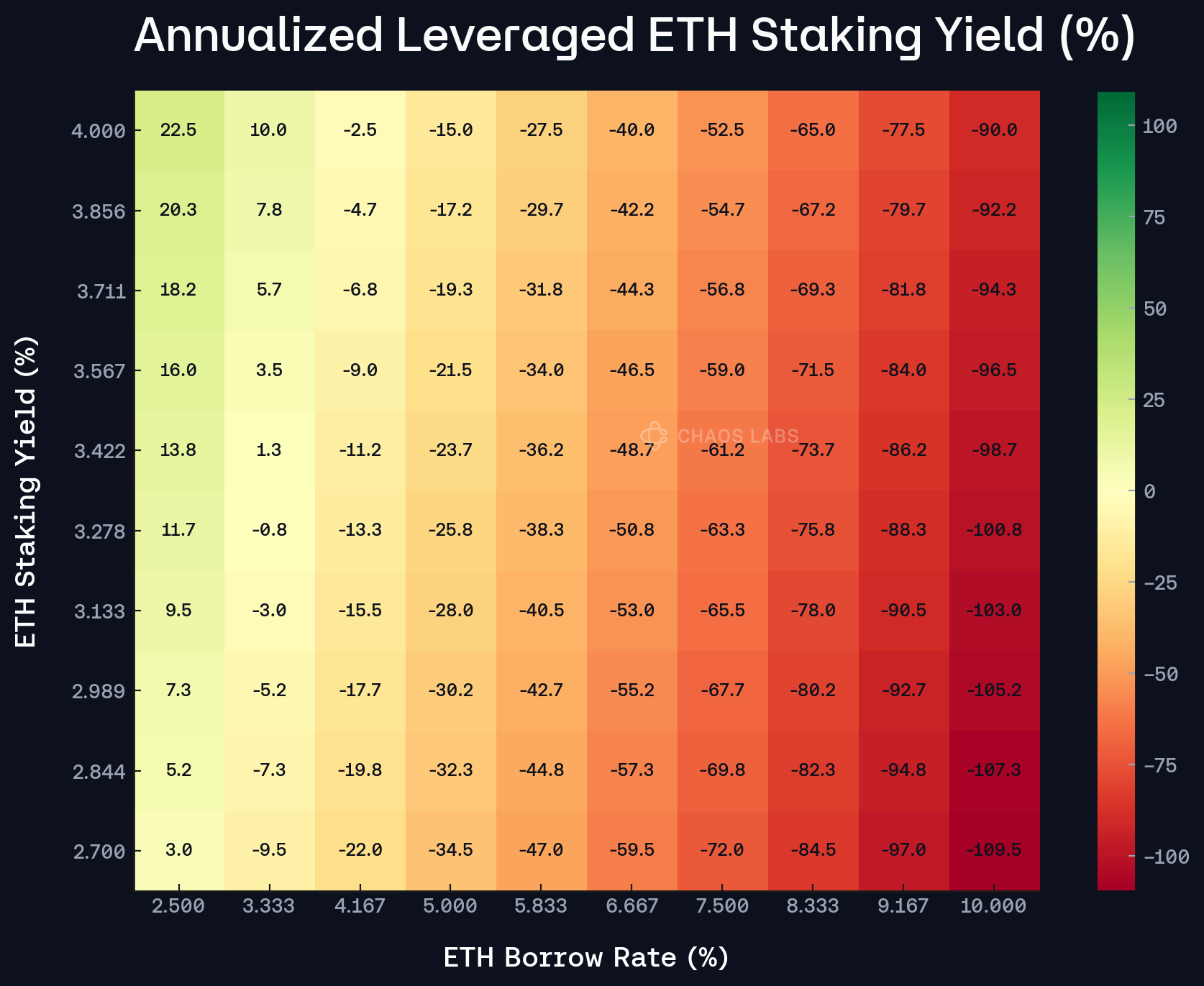

- Stablecoin markets: USDC, USDT, USDe, and USDT0 now target 10–12 percent slope2 values.

- ETH markets: WETH and its variants standardized at 8%

- Networks: Slope2 Risk Oracles will be going live on Arbitrum, Avalanche, Base, BNB, Ethereum, Gnosis, Linea, Optimism, Polygon, Plasma, Scroll, and Sonic. Coverage will expand to all major collateral assets in the coming weeks as the oracle infrastructure scales across Aave v3 deployments.

Oracle Architecture

The Risk Oracle operates through the Aave Risk Steward framework, executing bounded parameter adjustments without requiring new governance votes.

Each adjustment references onchain utilization and volatility metrics, using time-weighted averages to infer sustained stress conditions. When thresholds are met, the oracle updates slope2 within predefined limits, ensuring safety and transparency across all supported markets.

This architecture enables continuous and verifiable parameter optimization, which remains governed by consensus but is executed autonomously.

By combining simulation-derived thresholds with automated onchain controls, the Slope2 Risk Oracle minimizes governance latency and improves the protocol’s ability to self-correct in volatile environments.

Adaptive Risk Framework

Aave’s Slope2 Risk Oracle fundamentally smooths the interest-rate curve and raises the utilization ceiling at which stress occurs, allowing markets to operate with higher capital efficiency without increasing risk exposure.

Borrowing becomes more expensive only when stress is sustained, not during short-lived spikes, ensuring fairer and more stable market behavior.

- For suppliers, the mechanism preserves solvency guarantees and reduces the risk of rapid liquidity drain.

- For borrowers, it minimizes abrupt rate surges, providing predictability even under elevated utilization.

At the protocol level, the Slope2 Risk Oracle strengthens Aave’s ability to withstand volatility while maintaining deep liquidity and a consistent user experience.

Read the full research: https://governance.aave.com/t/arfc-automation-of-the-slope2-parameter-via-risk-oracles/22919

DeFi’s Black Box: How Risk & Yield Are Repackaged

DeFi has entered another phase of structuring, where institutional trading strategies are being abstracted into composable, tokenized assets.

Proof of Reserve as Risk Infrastructure

Chaos Labs is helping set standards through Chaos Proof of Reserves, which deliver automated attestations that meet strict data quality benchmarks.

Risk Less.

Know More.

Get priority access to the most powerful financial intelligence tool on the market.