Risk Oracles: Real-Time Risk Management for DeFi

Our last article discussed what modern oracles should look like: active, context-aware, intelligent feeds for protocols.

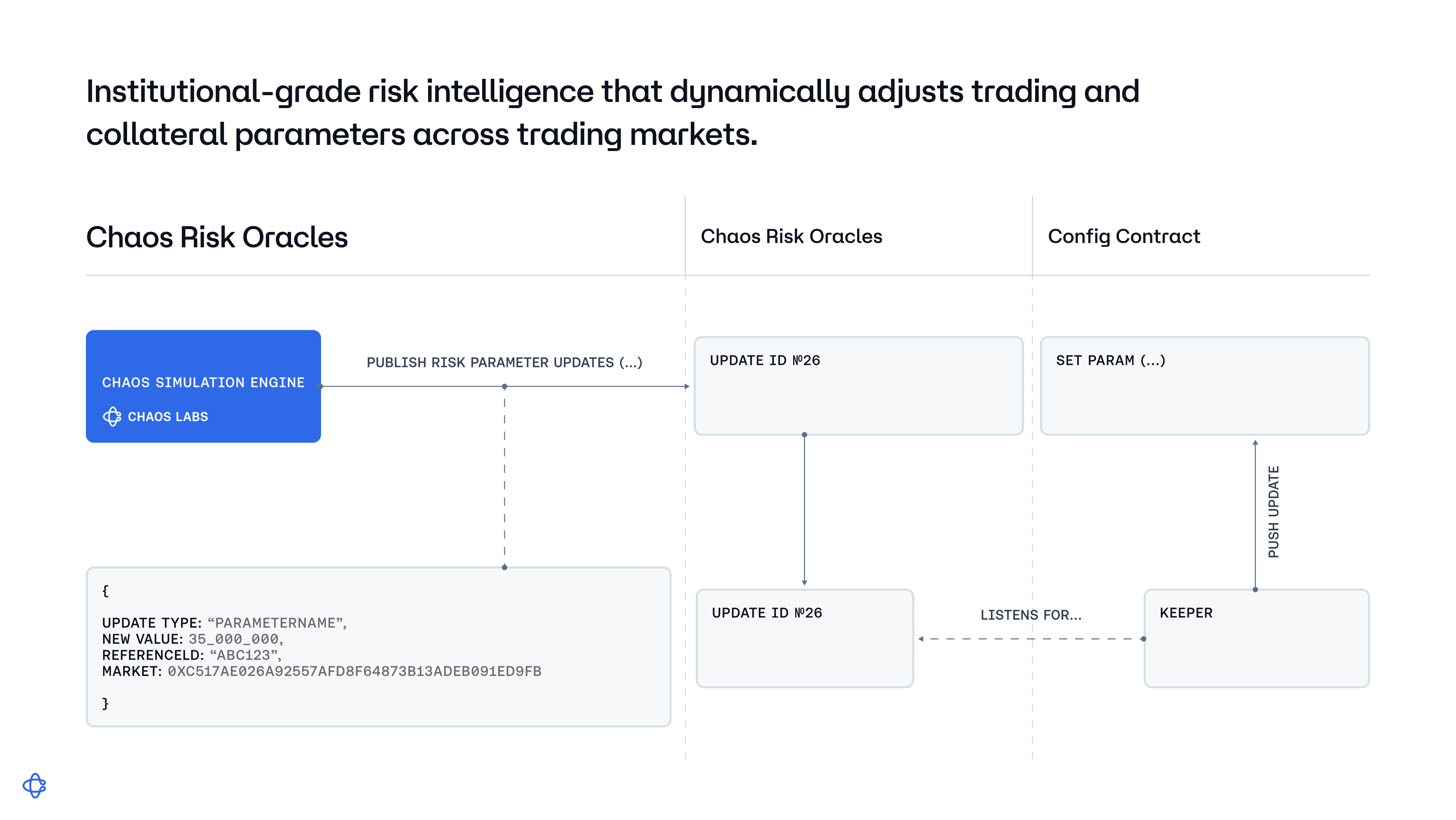

At Chaos Labs, our oracle development extends beyond enhancing price feeds. A second critical direction is the development of risk oracles. Risk oracles represent the natural evolution of oracle infrastructure, combining our expertise in risk management with protocol-level automation.

At their core, risk oracles enable protocols to automate risk curation and parameter adjustments. These are processes that would otherwise require constant manual oversight by DeFi teams. Risk oracles monitor key risk indicators in real time and adjust protocol parameters whenever a significant variation is detected.

Importantly, risk oracles do not override protocol governance. They operate within predefined, governance-approved limits. This is made possible through optimistic updates, which reverse the typical governance flow: proposed changes within the allowed boundaries enter a challenge window during which DAO stakeholders can contest or veto them. If unchallenged, the changes are applied automatically.

This mechanism preserves full governance authority over protocol risk management while delivering the speed and responsiveness required for crypto markets.

Leading DeFi protocols have already adopted this model, including Pendle, Aave, and GMX.

Pendle's PT Risk Oracles

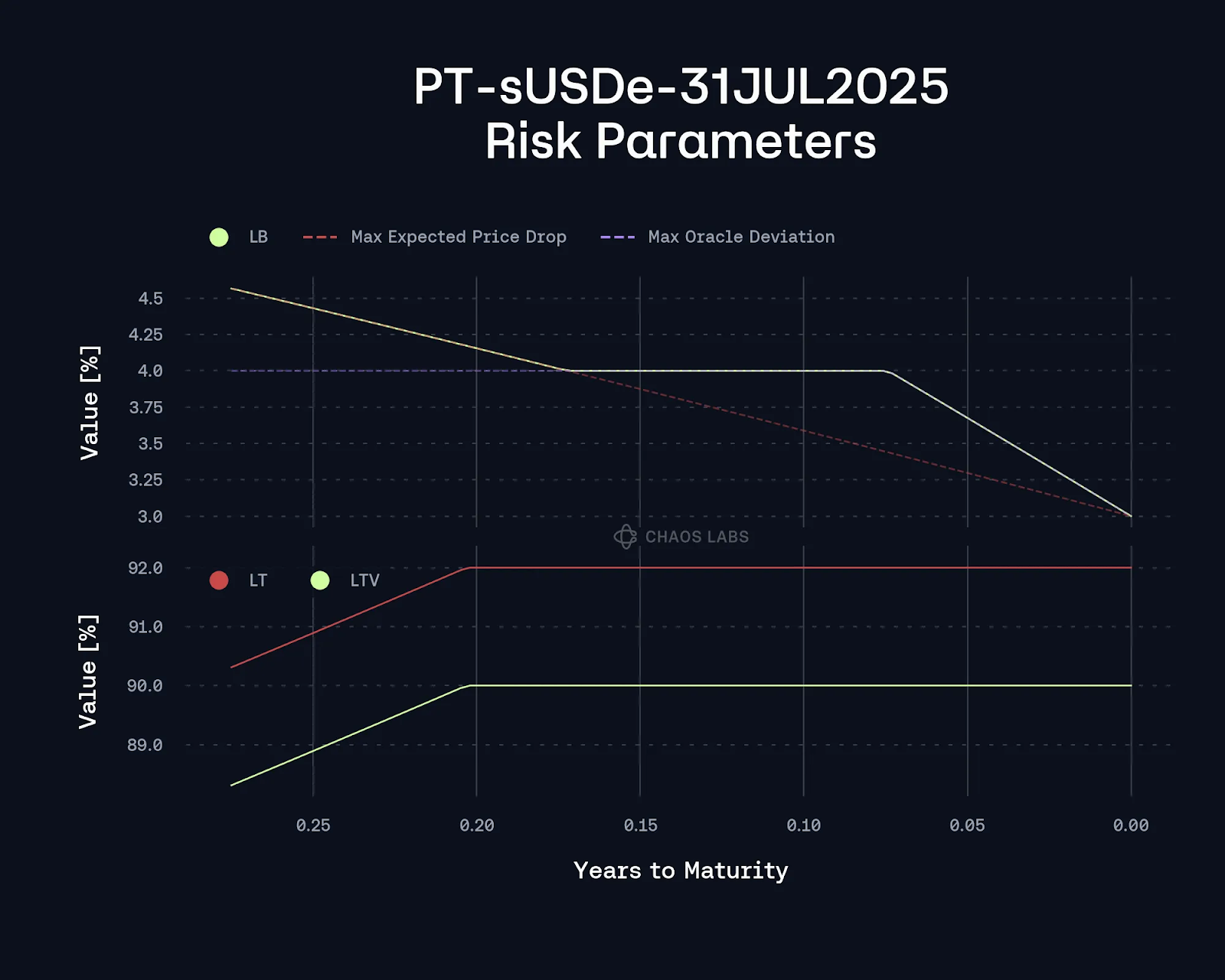

Pendle integrated risk oracles for its Principal Tokens (PTs), an asset class with increasing importance in DeFi (~$2B in PTs have been deposited on Aave, Morpho, and Euler). Using PTs as collateral introduces unique challenges compared to standard assets: PTs have defined maturity dates, after which holders can redeem the underlying asset. As the maturity date approaches, PTs typically appreciate in value, although price fluctuations can still occur depending on the yield and performance of the underlying asset.In lending markets, PT pricing has traditionally relied on two primary methods:

- LinearDiscountOracle: Calculates PT value through a consistent discount rate applied over time, but this linear approach tends to undervalue PTs, especially when yields are high or durations are long.

- AMM-based TWAP feeds: These feeds rely on Pendle AMM data and are more vulnerable to manipulation and price inflation, particularly in volatile or low-liquidity environments.

Both methods also rely on static risk parameters such as fixed Loan-to-Value (LTV), Liquidation Threshold (LT), and Liquidation Bonus (LB), regardless of a PT's remaining time until maturity. This mismatch fails to account for the decreasing volatility and increased price predictability of PTs as they near redemption. Additionally, these approaches don't adequately protect protocols from tail risk scenarios, such as extreme PT liquidity imbalances.

The Principal Token Risk Oracle addresses these challenges by introducing a multidimensional pricing and risk framework that evolves over time, adapts to changing market conditions, and maintains resistance to price manipulation.

GMX's Risk Oracles

Risk Oracles can serve different protocols in different ways.

GMX integrated the Chaos Risk Oracles to enhance execution efficiency and platform competitiveness. In a market where GMX competes with CEXs and other DEXs, execution speed and cost are critical.By dynamically adjusting risk parameters like price impact, GMX reduces execution costs for traders. Key benefits include:

- Tighter spreads during low volatility

- Lower slippage on high-volume trades

Additionally, Open Interest caps are adjusted in real time through the risk oracles, enabling GMX to adapt quickly to volatile conditions with limited manual intervention.

Aave's Risk Oracles

Aave's implementation highlights how risk oracles can scale to complex ecosystems.

With deployments across multiple chains, hundreds of markets, and thousands of variables, Aave’s risk management process has traditionally been labor-intensive. Parameter updates required manual payload creation, input gathering, and governance voting. Chaos risk oracles automate this process. Risk indicators are continuously monitored. When thresholds are breached and internal validation is complete, updates are submitted on-chain to the Aave Risk Stewards Contract.

This approach enables Aave to retain its safety-first posture while improving agility in a volatile environment, all without bypassing governance-defined constraints.

Conclusion

Risk oracles represent a pivotal advancement in DeFi infrastructure. By bridging the gap between passive data delivery and active, automated risk management, they empower protocols to adapt dynamically to ever-changing market conditions.

Integrations with leading protocols like Pendle, GMX, and Aave highlight how risk oracles enhance security, efficiency, and user experience. As DeFi continues to scale and its markets grow more complex, risk oracles will play an increasingly central role. They offer a new standard of resilience and adaptability for the next generation of onchain protocols.

(Part 1) The Rise of Context Engineering and Why SoTA Agents Need Specialized Search

LLMs are already good enough for 95% of what businesses need them to do. When they fail, it's almost never the model's fault. It's ours.

The Modern Role of Crypto Oracles: From Price Messengers to Intelligent Feeds

The recent oracle incident involving the deUSD Euler market reignited a critical debate: What’s the purpose of an oracle, and where should its responsibilities begin and end?

Risk Less.

Know More.

Get priority access to the most powerful financial intelligence tool on the market.