The Modern Role of Crypto Oracles: From Price Messengers to Intelligent Feeds

The recent oracle incident involving the deUSD Euler market reignited a critical debate: What’s the purpose of an oracle, and where should its responsibilities begin and end?

The Original Oracle Model and the Evolution of DeFi

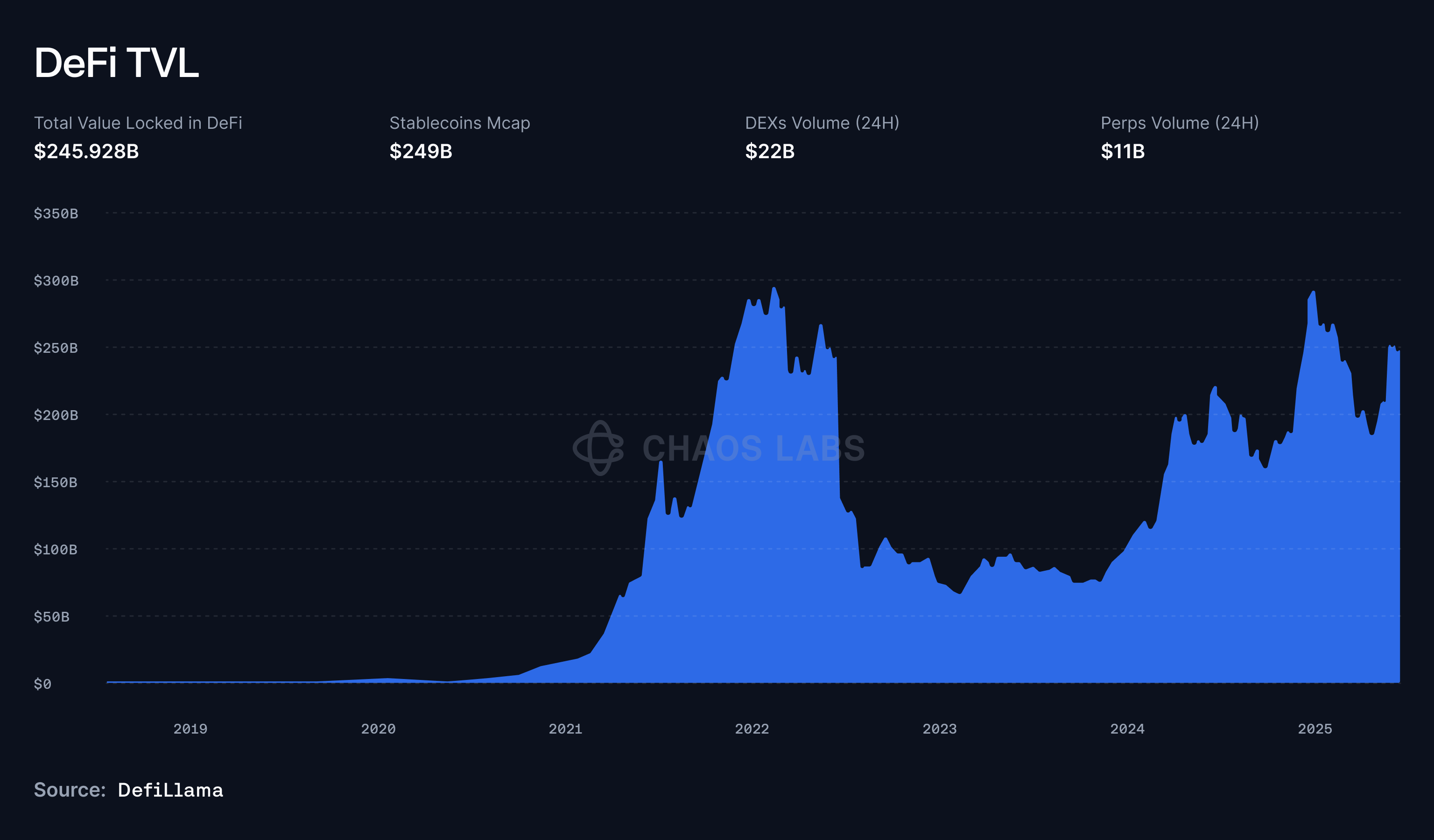

Traditionally, oracles were data pipelines that fetched prices from off-chain sources like CEX price data or news sources and pushed them on-chain for use by DeFi protocols. These "price messengers" enabled DeFi’s early growth by solving the "oracle problem," i.e. the lack of access to off-chain data. This basic model worked when DeFi was a $600M niche. However, in a new world with DeFi TVL exceeding $250B, this simplistic approach does not meet the sector’s complexity and scale.

The “data pipeline” oracle model was foundational, offering a critical solution to the “oracle problem” by enabling DeFi protocols to access off-chain data, unlocking the first wave of growth. But thinking this is where oracles should stop evolving ignores how far the ecosystem has come. Today, $600M in TVL wouldn't even earn a protocol a spot in the top 50.

TVL isn’t the only metric that has grown.

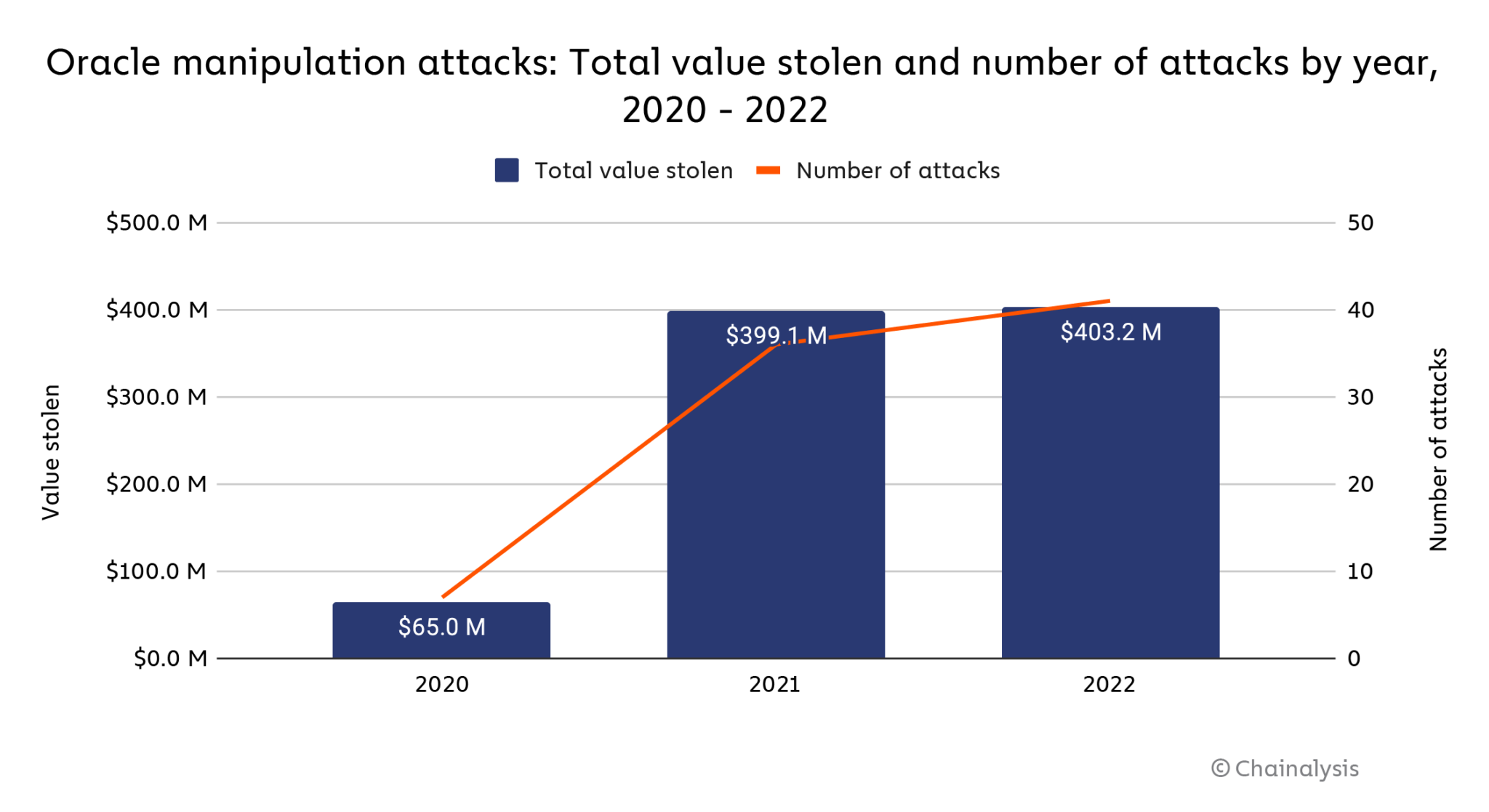

As the industry has matured, there’s also been a rise in oracle manipulation attacks. In turn, more protocols are asking for guidance on how to defend against these attacks. Most of these exploits aren't caused by simple pricing errors. Instead, they stem from protocols utilizing illogical reference data provided by oracles using simplistic or inadequate methods.

These outdated methods essentially shift the entire burden of data interpretation to protocols, just as these protocols are becoming more sophisticated. Lending, for example, is far more complex and competitive than it once was. Protocols must now navigate cross-chain dependencies, RWAs, correlated assets, and potential contagion effects. Derivatives DEXs face increasing competition among themselves and with CEXs. Also, in a post-FTX and SIVB-USDC world, stablecoin and RWA issuers must offer transparent collateral reporting and deliver oracle feeds that continuously attest to the presence and composition of backing assets.

In this complex environment, users expect protocols to maximize capital efficiency without compromising on security. The original oracle design puts DeFi protocols in a precarious position: they must innovate and compete while independently managing data curation and securing billions in TVL. This is unsustainable.

We've written about this before, but protocols should never blindly ingest oracle data without any validation. While incumbents have optimized for availability and scale, the industry now demands more (i.e. actionable, risk-aware insights). We believe oracles can, and should, deliver much more.

Before launching Edge Oracles, protocols had two choices:

- Use basic price data from oracles (not enough)

- Ingest raw, noisy data directly from exchanges (too much)

What’s actually needed is context-rich data synthesized from diverse market indicators that provides a holistic view of asset risk.

The Era of Intelligent Feeds

This belief has guided us in creating our oracle feeds. We’ve built intelligent data feeds that contextualize relevant market data and capture the market’s true liquidity conditions. Edge oracles don’t just deliver raw data, they make aggregated, curated data available, leveraging our long-standing expertise in risk management for leading DeFi protocols like Aave, Jupiter Exchange, GMX.

Characteristics of a Modern Oracle

- Decentralized Validation: Relying on multiple entities helps prevent single points of failure. We’ve written extensively on decentralized oracle networks and decentralized oracle network infrastructures.

- Aggregated Price Sources: Oracles must combine data from several venues to prevent manipulation. Single data sources are a known manipulation vector.

- Advanced Price Methodology: Use liquidity-weighted pricing, outlier detection, and data normalization instead of flawed metrics like Last Trade Price or VWAP.

- Opinionated Oracles: "Opinionated" oracles assess and refine data before delivery. In today’s DeFi and macro environment, unopinionated oracles are no longer viable.

- Redundancy: Fail-safes are critical to avoid disruptions from individual data failures.

- Low Latency, High Accuracy & Data Freshness: Feeds must be real-time, precise, and fresh, without sacrificing reliability. We wrote about the oracle trilemma and the strategic design choices to address it.

As DeFi matures, oracles must evolve beyond basic data delivery. They should become intelligent, risk-aware partners that understand the context of their data, protect users from anomalies and manipulation, and empower protocols to be efficient and secure.An MEV-driven price spike in a single pool shouldn’t affect lending markets or liquidations on another chain. That’s not capital efficient or safe.

DeFi needs oracles that think.

Risk Oracles: Real-Time Risk Management for DeFi

Risk oracles represent the natural evolution of oracle infrastructure, combining our expertise in risk management with protocol-level automation.

Introducing Pendle PT Risk Oracle

Chaos Labs has developed the Principal Token Risk Oracle, a purpose-built framework that reimagines how PTs are priced and risk-managed in DeFi protocols such as Aave. This unlocks a new paradigm of capital-efficient, resilient lending infrastructure.

Risk Less.

Know More.

Get priority access to the most powerful financial intelligence tool on the market.