Aave Emerges Net Positive After Market Stress

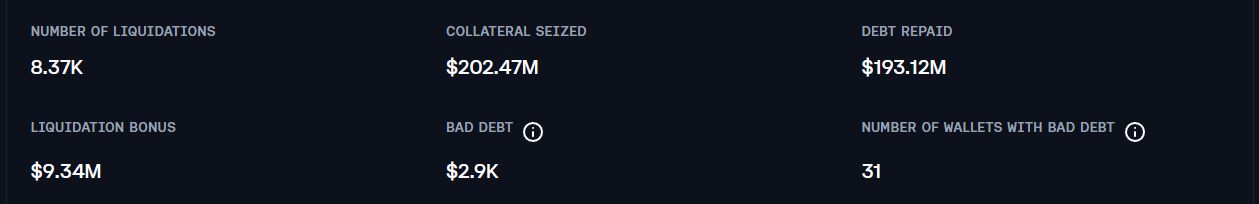

- A 10–20% market drawdown triggered elevated liquidations across Aave, with $202.47M of collateral seized against $193.12M of repaid debt over the 7-day period.

- The Aave DAO captured $980K in liquidation fees and 804 ETH ($1.85M) via SVR recapture, while the only realized deficit was ~$30K from a BAL-collateralized position.

- On a net basis, liquidation activity was economically positive for Aave, with SVR revenue alone exceeding deficit realization.

Overview

Over the last 7 days, broad crypto prices experienced significant volatility, with major assets dropping by 10–20%, triggering substantial liquidation volume across Aave deployments.

During the event, the Aave DAO captured $980K from liquidation fees and 804 ETH ($1.85M) from SVR recapture, with a minimal deficit of $30K stemming from a BAL-collateralized position. The Aave liquidation engine performed as designed during the liquidation cascade, ensuring timely execution and a net profitable outcome.

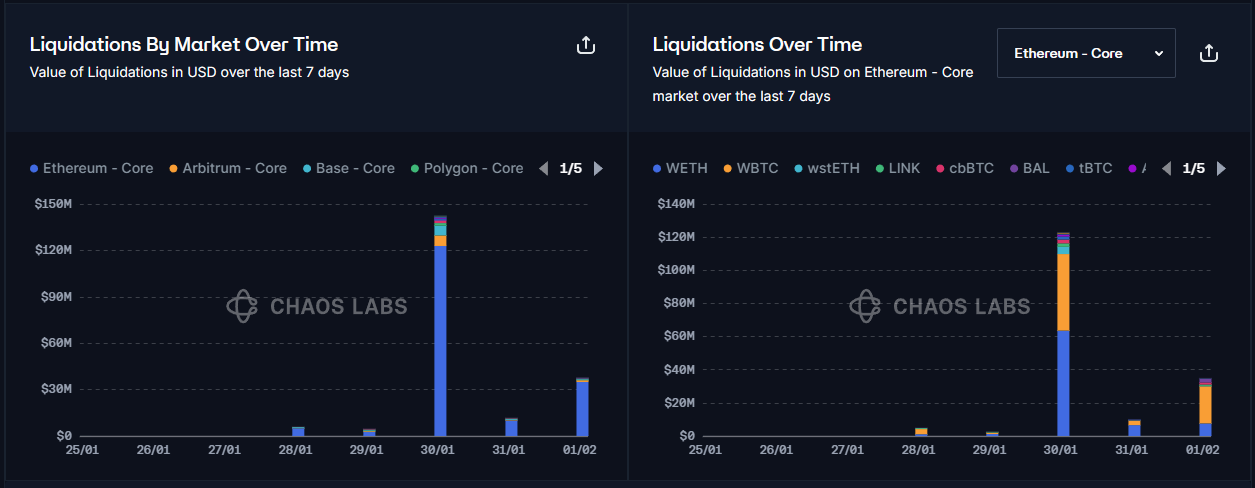

Liquidation Volume

Liquidations were concentrated in the Ethereum Core market, with the largest daily notional occurring on Jan 31st, 2026 and additional elevated activity on Feb 2nd, 2026.

Across the full 7-day window, total collateral seized reached $202.47M against $193.12M of repaid debt, with $9.34M paid out in liquidation bonuses. The primary assets affected were WETH, WBTC, and cbBTC across all Aave instances, with additional liquidation volume driven by AAVE collateral.

Bad Debt and Deficit Realization

Protocol losses were minimal relative to the size of the liquidation volume. The only material deficit during the event was an approximately $30K realized shortfall from a BAL-related position, tied to the following transaction hash.

This deficit was caused by a sharp drop in the BAL price, which declined by approximately 60% over a two-hour period. The move was driven by the liquidation of the BAL holder humpy.eth, which represented the majority of BAL-collateralized exposure across lending markets. Following this liquidation, the size of the BAL market shrank by over 95%, leaving minimal remaining BAL-collateralized debt exposure.

The realized deficit against BAL collateral is consistent with the deprecation efforts pursued over the past two months. As liquidity and demand for the asset decline, liquidation execution quality can deteriorate during volatile market conditions, increasing the likelihood of residual deficits even when the broader system clears efficiently.

As a result, we recommend an additional deprecation step following the event and will propose reducing the BAL supply cap to 1 in an upcoming Risk Steward update.

SVR Performance and Revenue Attribution

SVR liquidations contributed meaningful value capture during the last 7-day period. With liquidation volume executed through SVR accounting for 118.37M collateral seized, along with generating $2.8M of value recaptured over the duration of the event, of which 65% ($1.85M) represents Aave’s profit split.

Conclusion

This drawdown generated large liquidation volumes without any significant execution issues. The only realized deficit from the event was limited to approximately $30K and was concentrated in BAL.

In contrast, total liquidation-related revenues reached $2.83M, accounting for both liquidation fees and SVR recapture. On a net basis, SVR revenue alone exceeded deficit realization, rendering the event economically net positive for Aave.

Yield as a Risk Signal: Part II

In Part 1, we introduced a simple idea: yield is a risk signal. In this piece, we put data behind these claims.

Yield as a Risk Signal

Yield is the price paid to hold risk. In tradfi, an investor would typically start with a base “risk-free” rate, usually government bills, and understand that anything above this rate represents compensation for incremental bundles of risks, including credit, liquidity, duration, geopolitical, funding, and others. DeFi is no different, except it lacks a true risk-free asset.

Risk Less.

Know More.

Get priority access to the most powerful financial intelligence tool on the market.