dYdX Chain: End of Season 6 Launch Incentive Analysis

Overview

Chaos Labs is pleased to provide a comprehensive review of the sixth trading season on the dYdX Chain. This analysis encompasses all facets of exchange performance, emphasizing the impact of the Launch Incentive Program.

We are diligently fine-tuning the incentives, ensuring they effectively meet their intended goals. By monitoring a broad spectrum of indicators, we aim to understand the rewards program's dynamics and outcomes.

Key Stats:

- dYdX Chain has seen over $30bn in trading volume across 133 live markets.

- Over 4000 traders actively earn points through season 6 of the launch incentive program.

- Funding rates in major markets continue to be muted on the dYdX Chain this season. This can be attributed to low volatility and a maturation of the ecosystem.

- The dYdX Chain has grown to approximately $141m USDC in TVL deposited on the exchange at the end of season 5, up 4% from the beginning of the season.

dYdX Chain Trading

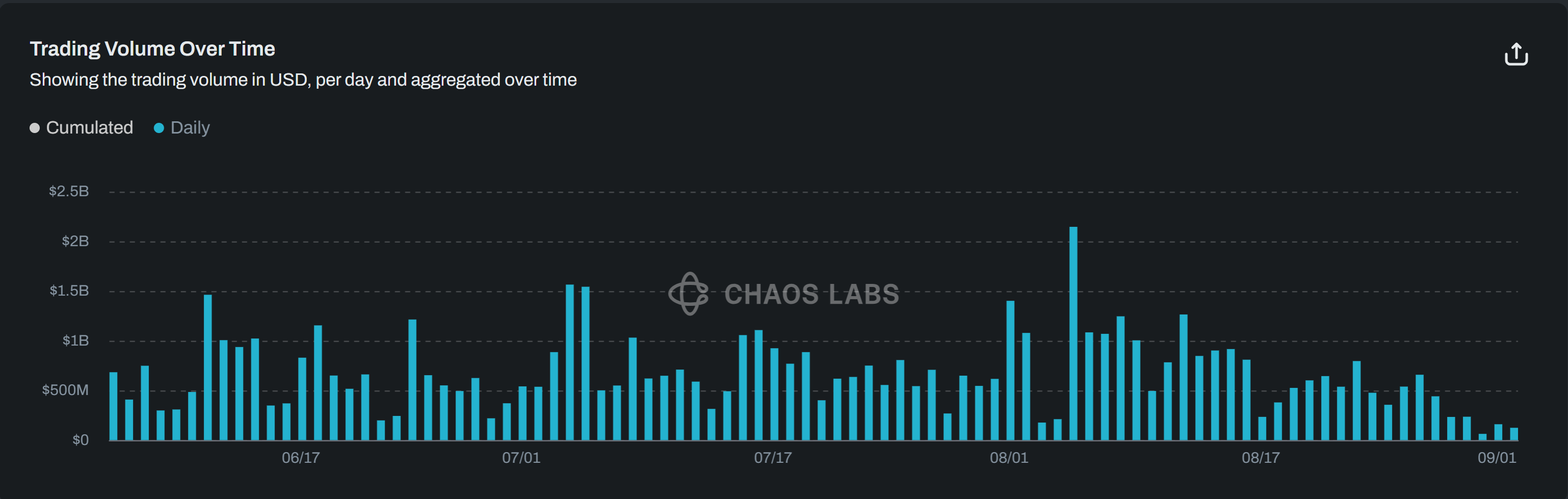

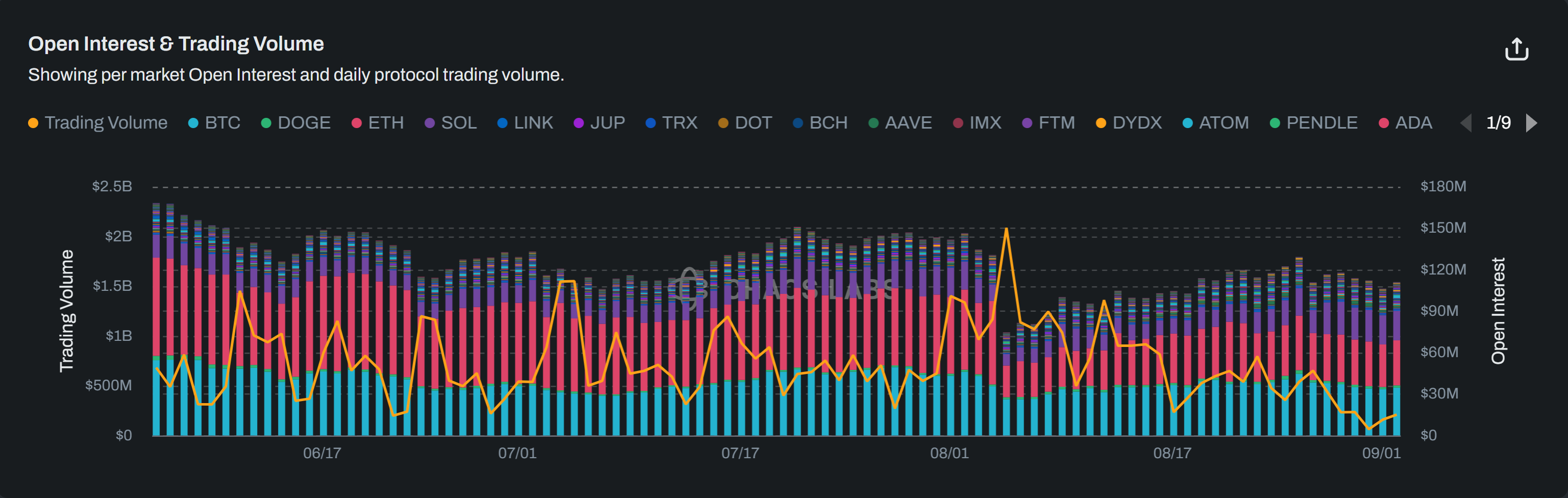

The dYdX Chain has seen over $30bn in trading volume across 133 live markets. This is a decrease of 9% on season 5 volumes.

Open interest has decreased slightly over the season from $135m to $129m.

Open interest fluctuates significantly with market conditions, but the overall trend is consistently higher peaks and higher troughs.

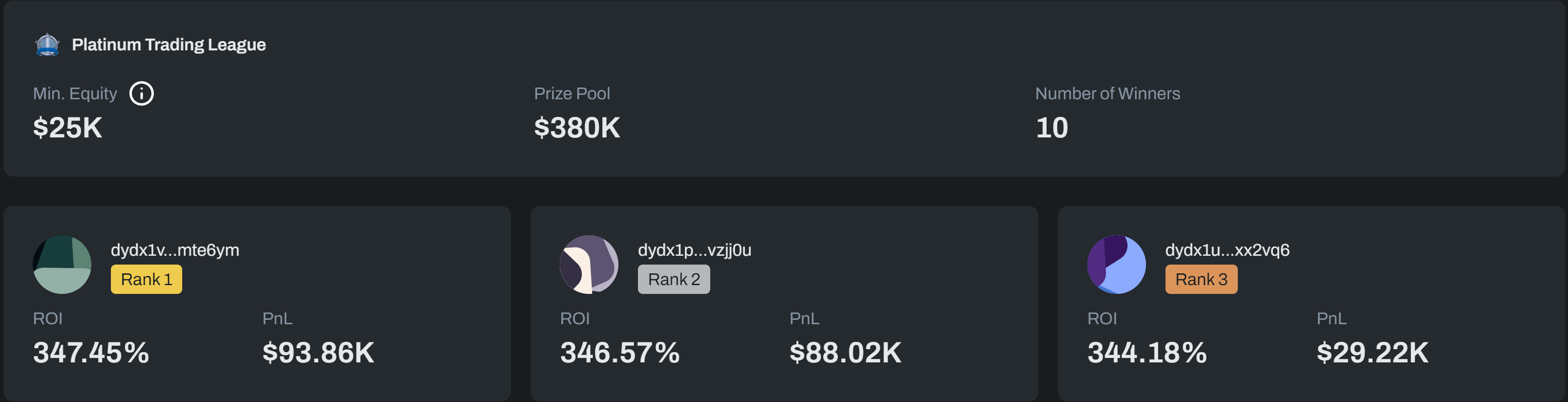

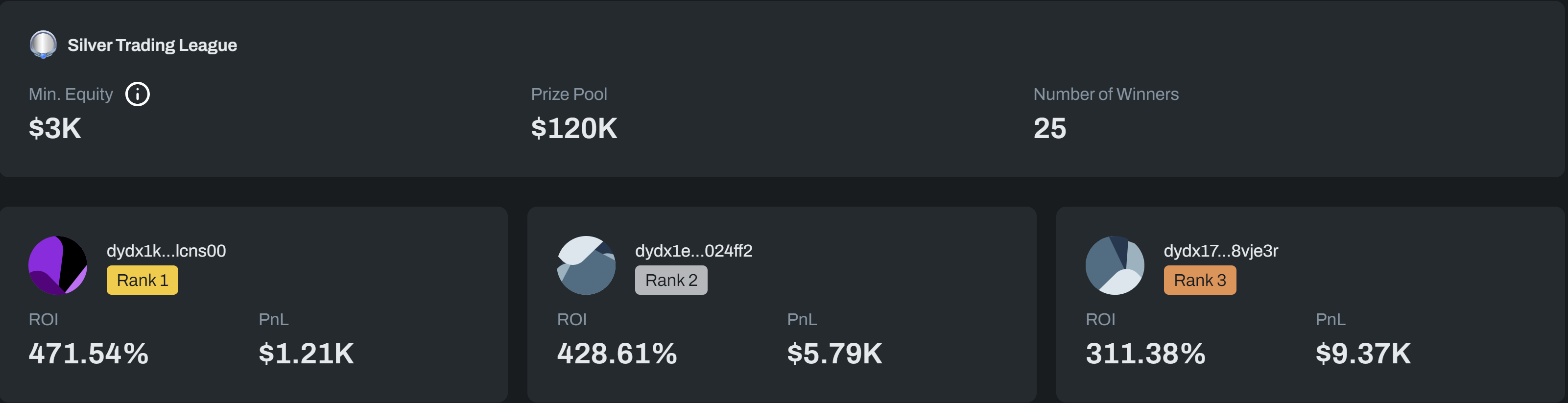

And there have been some incredible trading performances in the leagues as a result. The leagues are intended to motivate traders to invest their time and energy into improving their trading performance. This leads to them gaining more enjoyment and utility from the dYdX Chain.

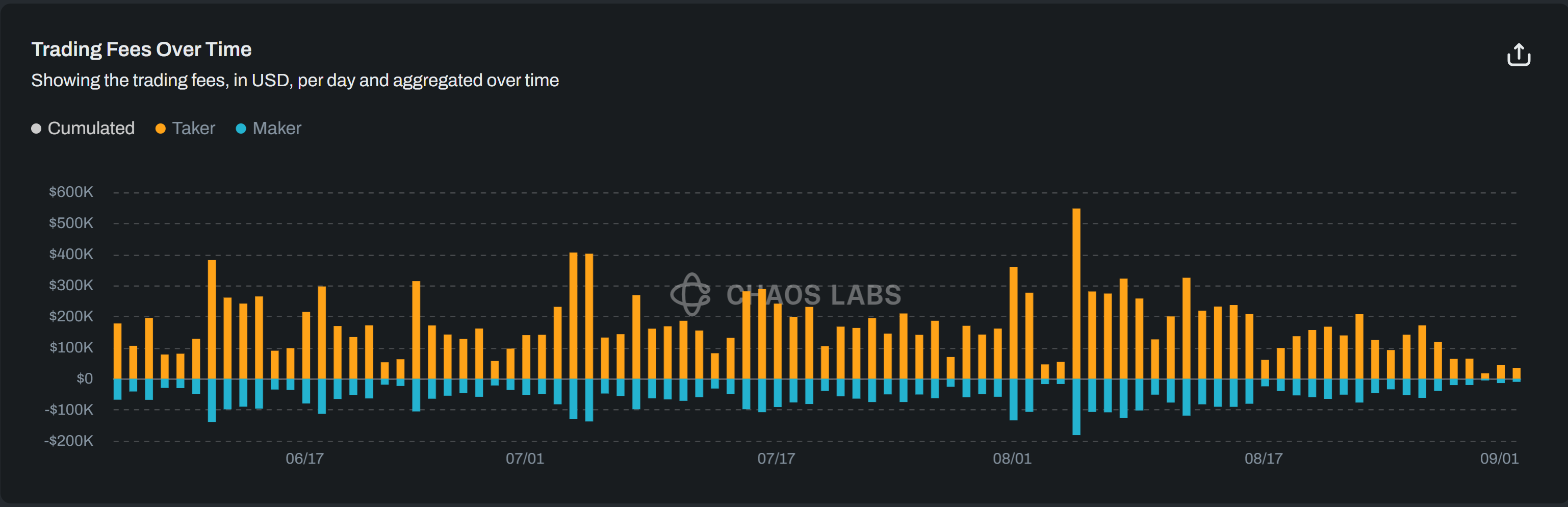

Traders have paid almost $36m in fees to stakers securing the dYdX Chain since inception. $5.1m of this came in season 6 of the launch incentive program.

dYdX Chain Liquidity

Liquidity in the majors, as measured by median liquidity within 100bps, has continued improving over season 5, particularly in the more developed markets. Large markets' now have over $100 000 in liquidity within 100bps most of the time.

See the table below for liquidity trends in some major markets.

| Market | Current | Season 5 |

|---|---|---|

| ETH | $2,260,000 | $1,940,000 |

| BTC | $2,830,000 | $2,200,000 |

| SOL | $1,050,000 | $817,290 |

| LINK | $196,710 | $203,610 |

| AVAX | $204,790 | $190,910 |

| MATIC | $152,490 | $155,110 |

| ATOM | $136,790 | $137,430 |

| UNI | $131,720 | $118,480 |

| APE | $111,290 | $112,450 |

| OP | $113,610 | $117,930 |

| MKR | $102,830 | $122,000 |

Funding

Average funding rates in most major markets have been well contained in season 6, reducing in magnitude and volatility from the early seasons. This has been relatively in line with funding rate behavior elsewhere, and we continue to take comfort in the convergence to the broader market as a sign of maturation. The following summary statistics cover the largest dYdX Chain markets:

| Market | Average | Median | Max. | Min. |

|---|---|---|---|---|

| ETH | 7.2% | 6.2% | 56.5% | -20.3% |

| BTC | 6.3% | 5.0% | 33.7% | -15.5% |

| SOL | 8.4% | 7.1% | 41.0% | -14.2% |

| DOGE | 0.1% | 0.0% | 1.2% | 0.0% |

| AVAX | -2.6% | -0.4% | 1.3% | -24.7% |

| LINK | -4.1% | -1.6% | 5.9% | -32.2% |

| MATIC | -4.0% | -0.4% | 0.0% | -55.1% |

| OP | 0.0% | 0.0% | 0.3% | -0.5% |

| ARB | -1.1% | 0.0% | 0.7% | -42.5% |

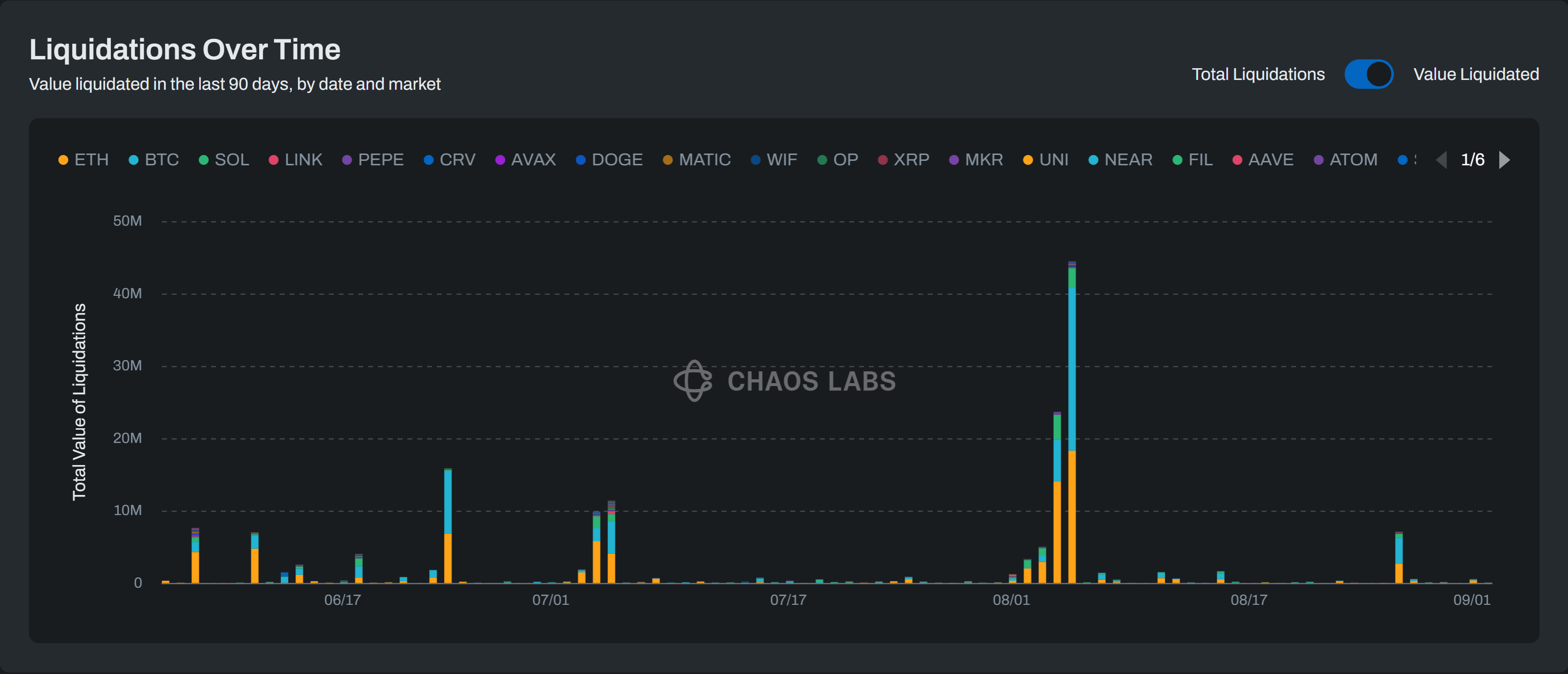

Liquidations

The market crash over 4-5 August caused a spike in liquidations. Otherwise liquidations have been mostly muted over most of season 6.

The insurance fund now sits at over $7m, bootstrapped predominantly by protocol liquidation fees.

TVL and Deposit Metrics

USDC deposits continue to grow, providing a potential leading indicator to further growth in trading volumes.

At the end of Season 6, approximately 156m USDC was deposited in the app on the dYdX Chain, up from 151m USDC at the start of the season.

Much room still exists to grow towards the approximately $216m TVL still in dYdX v3.

Program Efficiency Metrics

Much of the above analysis focuses on aggregate metrics, which can be influenced by a small number of traders. Our analysis of the program also encompasses a bottom-up assessment of the impact it has in growing the number of active traders.

This section provides a deep dive into trader-level metrics to highlight the program's impact across a range of dimensions. This, in turn, forms the basis for the long-term projections around the program’s impact and efficiency.

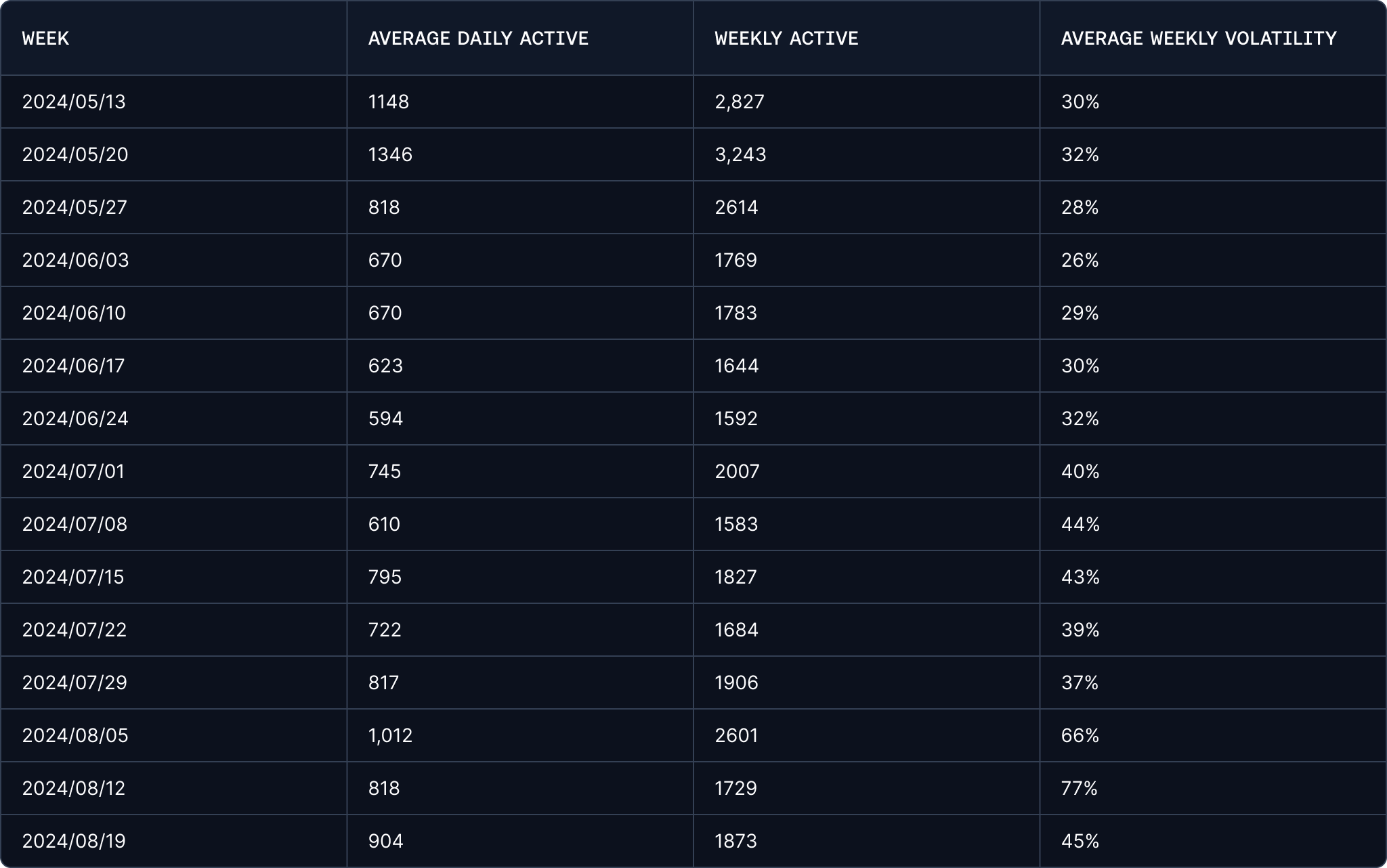

Daily and Weekly Active Traders

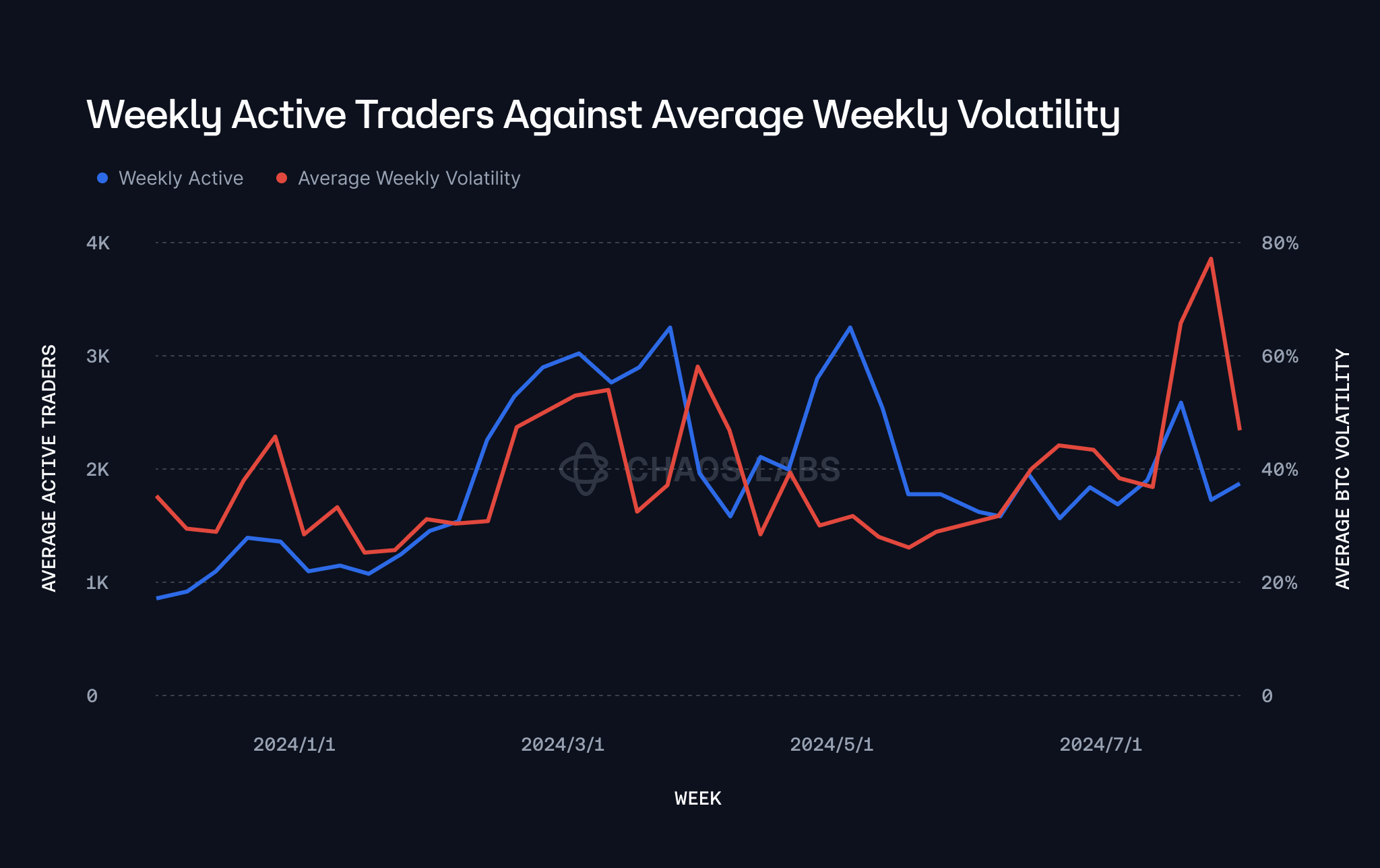

The number of weekly active traders in season 6 has been fairly consistent, and marginally higher than season 5. The reduced new deposit bonus numbers and removal of streaks bonuses have been the biggest drivers in the reduction vs earlier seasons.

Growing the number of average daily and weekly active traders on dYdX is a guiding principle of the Launch Incentive Program, and significant care is taken to ensure that the incentives appeal to a diverse segment of traders.

- Weekly active traders are defined as traders who make at least one trade during a week.

- Volatility is measured as the variance of minute-by-minute log returns of BTC. This short time frame accurately measures the volatility experienced by dYdX Chain traders in its largest market better than the traditional daily volatility.

Trader Engagement

Trader engagement is defined as how frequently the active user interacts with the dYdX Chain. This is analyzed across a few dimensions. The ratio of average daily active users to weekly active users broadly signals what portion of weekly active traders make a trade on a given day in the week. When this ratio is high, more traders find value in the product and return for this utility.

From a Launch Incentive Program perspective, the incentives should appeal to traders who are likely to become more regular traders and, therefore, likely to be stickier over the long term.

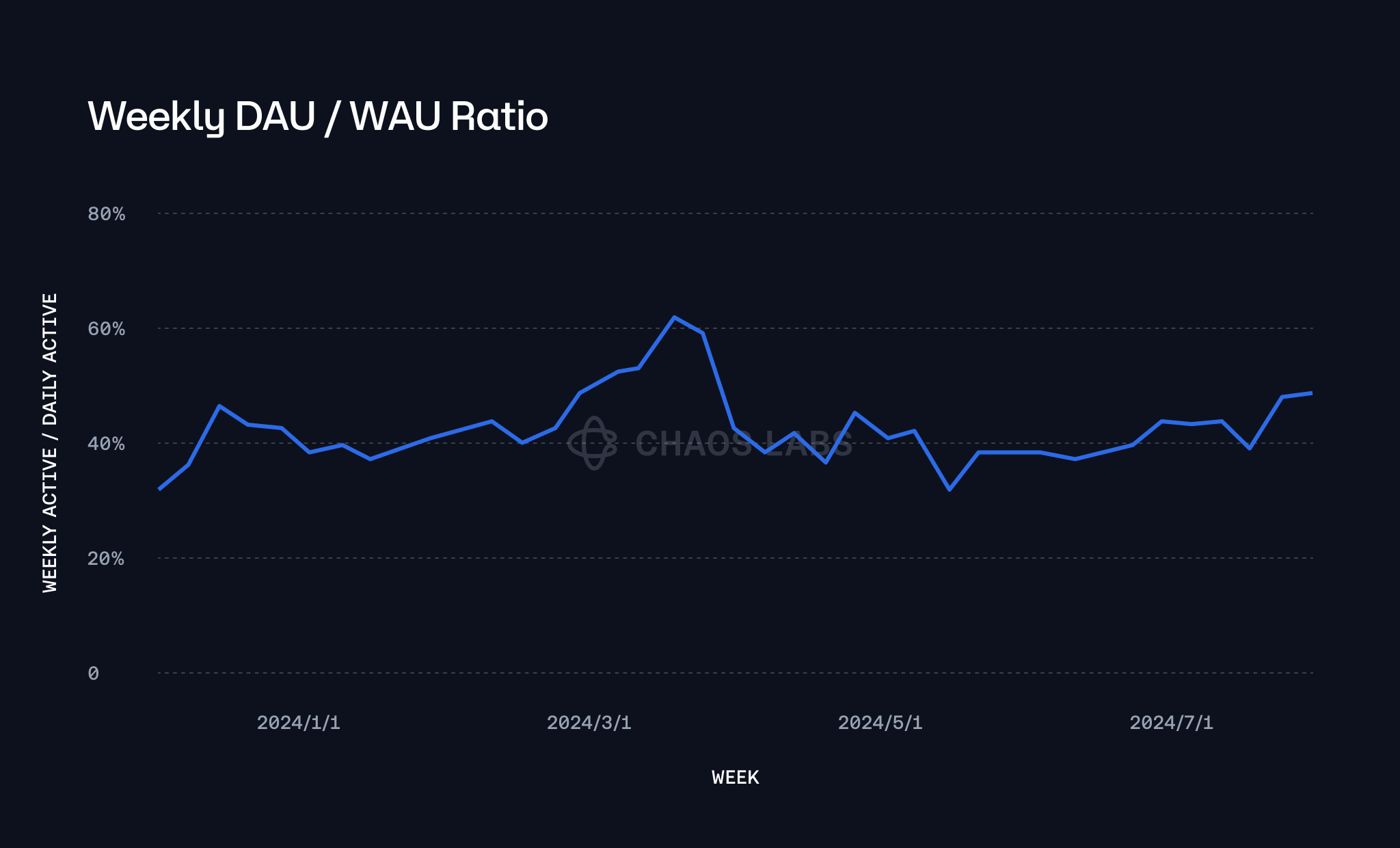

This ratio remained steady between 38% and 45% during seasons 1 and 2. It increased throughout season 3, peaking at over 60% in late March when trading streaks were directly incentivized. The past three seasons has seen the ratio steady around its long term average of around 40% with a recent uptick to 50%.

Another measure analyzed is the number of days traders have been active during season 6.

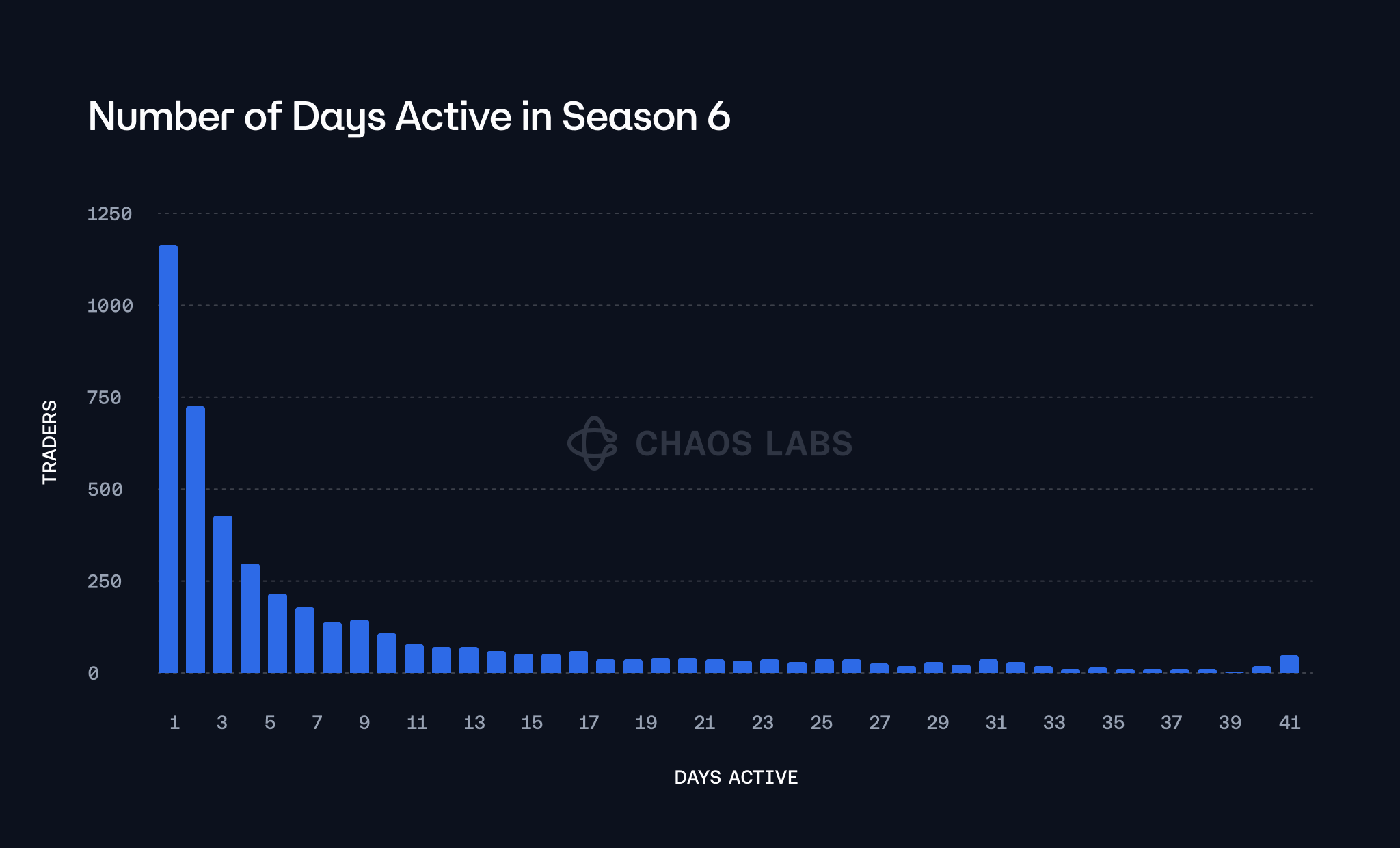

This long-tailed distribution is typical of trading exchanges. We take encouragement that only 26% of traders traded on a single day and 16% on two days. This is in line with the previous two seasons and a significant further improvement on seasons 1 and 2. Most traders are trying out the dYdX Chain over multiple days, potentially aspiring to score well in one of the trading leagues.

Data on the number of days each trader has been active in season 6 drops off quickly from 1 day to 9 days before flattening out significantly. 8% of traders have traded on at least half the days this season. 50% have traded at least three times.

There have been 49 traders active every day this season so far, roughly in line with previous seasons. 513 traders, making up over 11% of the total, have been active on at least half the trading days in season 6. This is up from 326 (7%) in season 5.

Weekly Trader Breakdown and Retention

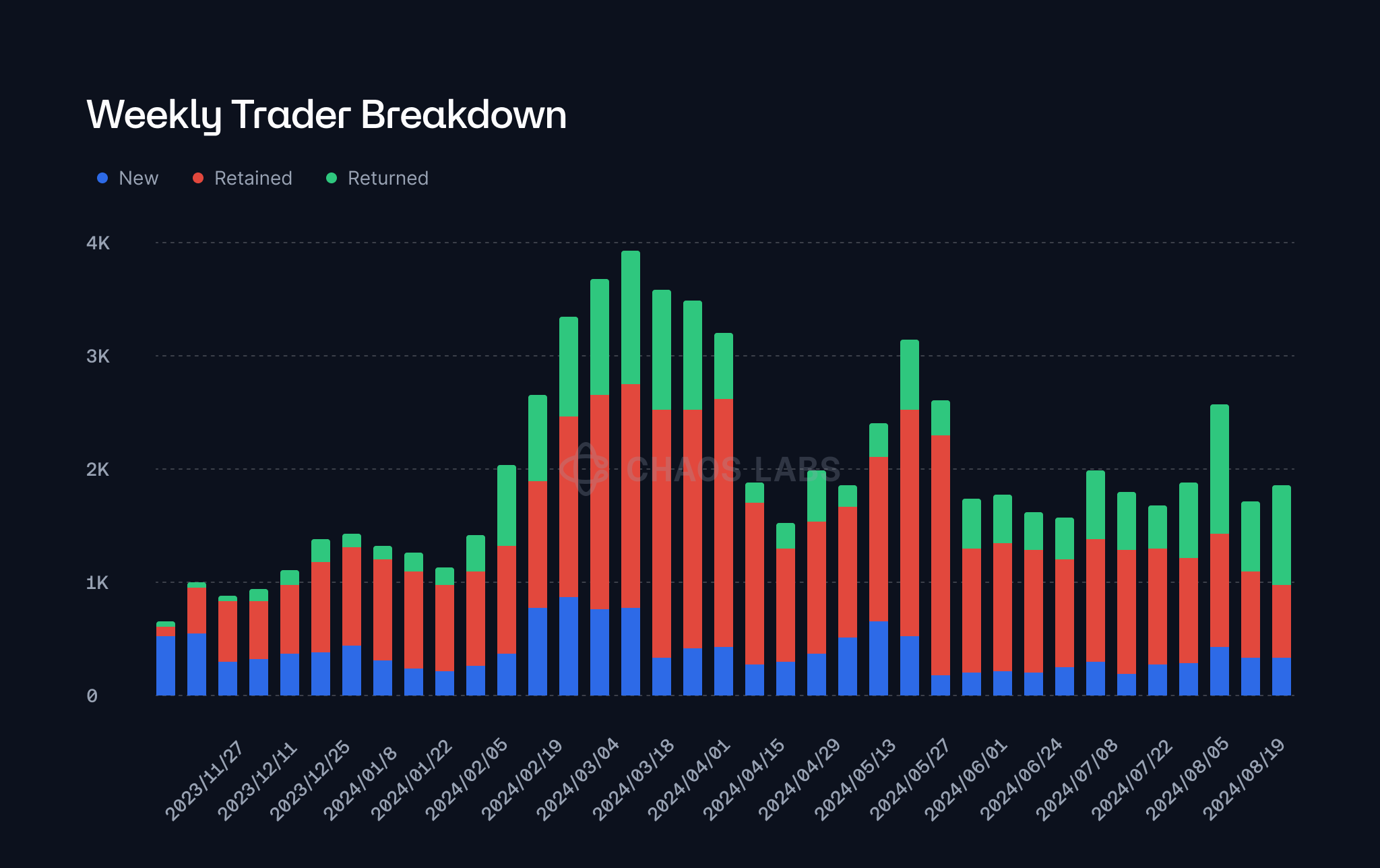

Season 6 has seen a further increase in the number of returning traders, and a stabilization in the rate new traders are using the exchange. The stabilization in new traders can be attributed to base effects after the reduction in new trader bonuses.

The data indicates a segment of traders that trade on the exchange in volatile or otherwise interesting weeks, leaving on quieter weeks. This can be seen in the increase in the first week of August.

The nature of a trading exchange makes retention metrics challenging, as there can be cases of traders missing a week but remaining loyal users. To avoid mismeasurement of these traders as a churn (as one would in a SaaS business, for example) while retaining granular measurement of weekly behavioral trends, we separate retained traders (traded in the previous, and current week), and returned traders (traded in at least one week prior to the previous, and the current week). This highlights the compounding nature of growing these engaged users as the base continues to grow with them due to their relatively lower churn than newer traders.

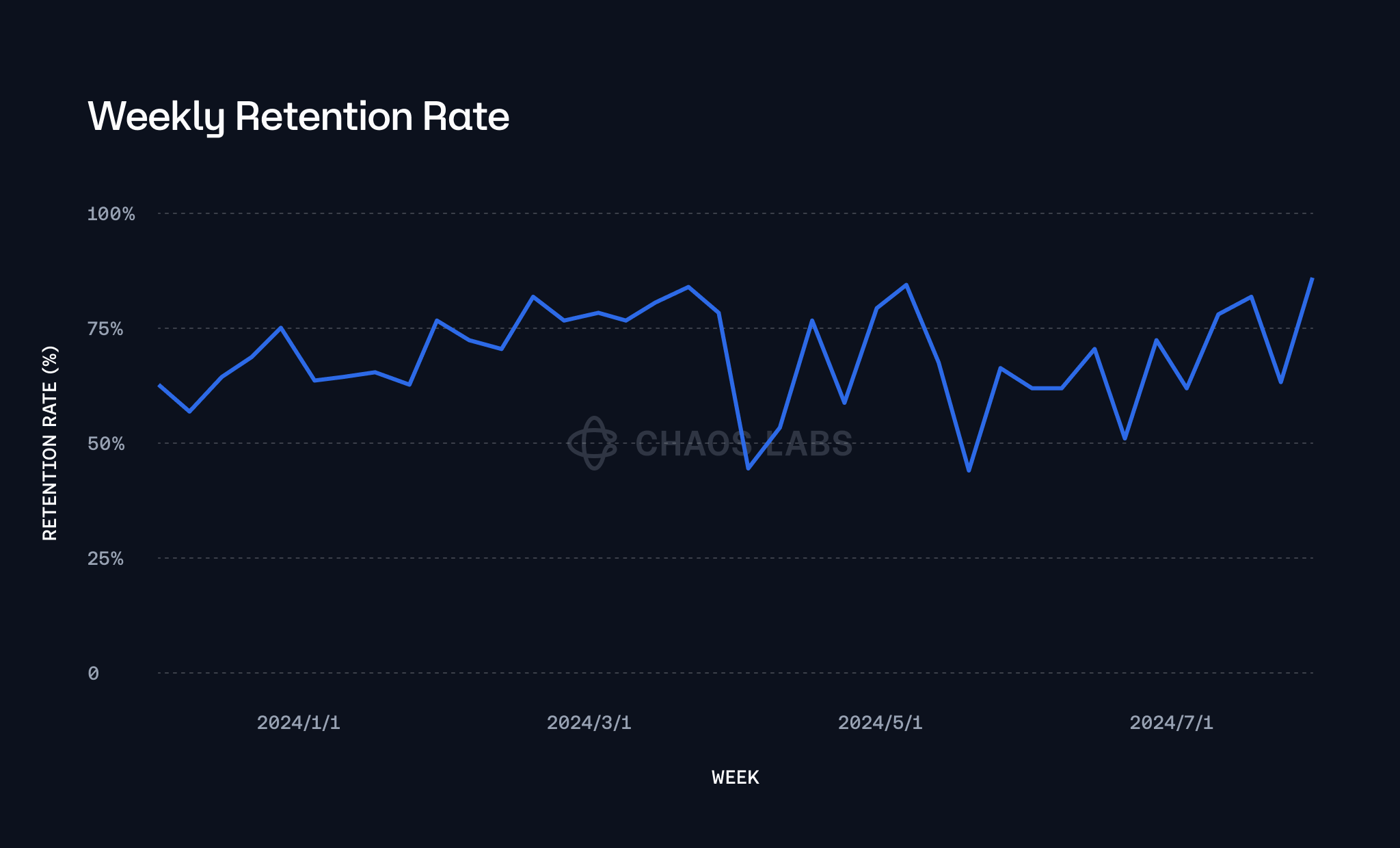

The weekly trader retention rate has remained volatile and increased slightly over season 6. The increase in returning traders seen above combined with the changing weekly retention rate and low volatility indicate that traders remain active on dYdX, but choose to trade only when markets are interesting.

The marginal weekly trader retention rate shows how likely it is for a trader who has traded for a certain number of weeks to trade for one more. This is a slightly different methodology from the retention rate above, as returning traders are treated the same as retained traders here, hence the higher retention numbers.

What is apparent is how much better traders retain the more weeks they have been active. The goal is to get a trader active for at least six weeks, as the data suggests traders are incredibly sticky.

This also quantitatively represents what the Launch Incentive Program intends to achieve. Bring traders on board who come from the rewards but end up staying for the utility of the dYdX Chain.

Marginal Weekly Trader Retention Rate

| Week | Retention Rate |

|---|---|

| 1 | 73% |

| 2 | 80% |

| 3 | 84% |

| 4 | 86% |

| 5 | 85% |

| 6 | 90% |

| 7 | 89% |

| 8 | 93% |

| 9 | 91% |

Summary

There are many aspects contributing to the growth in the dYdX Chain since the Launch Incentive Program began. Attributing growth to specific factors is not an exact science, and we acknowledge the impact market conditions have on trading activity. Given that, here are some highlights from our analysis:

- Stakers have earned over $5.1m in fees during season 6, and the program will pay out $5m in rewards.

- Over 4000 traders used dYdX Chain during season 6.

- Retention rates have improved slightly and remained volatile week on week. This is likely due to market conditions and traders only trading when market events occur.

- Traders who trade for 6 weeks or more retain at over 90%. The impact of trader acquisition from the rewards will be felt long after the program ends.

Disclaimer

This report is for informational purposes only and does not constitute an offer to sell, a solicitation to buy, or a recommendation for any security, nor does it constitute an offer to provide investment advisory or other services by Chaos Labs. No reference to any specific security constitutes a recommendation to buy, sell, or hold that security or any additional security. Nothing in this report shall be considered a solicitation or offer to buy or sell any security, future, option, or other financial instrument or offer or provide investment advice or service to any person in any jurisdiction. Nothing contained in this report constitutes investment advice or offers any opinion with respect to the suitability of any security, and the views expressed in this report should not be taken as advice to buy, sell, or hold any security. The information in this report should not be relied upon for investing. In preparing the information in this report, we have not considered any particular investor's investment needs, objectives, and financial circumstances. This information has no regard for the specific investment objectives, financial situation, and particular needs of any specific recipient of this information, and the investments discussed may not be suitable for all investors. Any views expressed in this report were prepared based on the data available when such views were written. Changed or additional information could cause such views to change. All information is subject to possible correction. Information may quickly become unreliable, including market or economic changes.

Throughout the program, Chaos Labs' role is confined to providing recommendations regarding the allocation of rewards. The actual implementation and distribution of said rewards are subject to the formal approval process of the dYdX Chain governance votes. Any actions pertaining to reward distribution shall only be executed following affirmative governance votes within the dYdX Chain framework.

Introducing Edge: The Next Generation Oracle Protocol

At Chaos Labs, we've always believed that robust risk management and reliable data are the foundations of a thriving DeFi ecosystem. With Edge, we're putting that belief into action, providing a solution that doesn't just report prices but actively contributes to the security and efficiency of on-chain finance.

Oracle Risk and Security Standards: Data Replicability (Pt. 4)

Data replicability is the capacity for third parties to independently recreate an Oracle’s reported prices. This requires transparency into two key components of the Oracle’s system: its data inputs and its aggregation methodology.

Risk Less.

Know More.

Get priority access to the most powerful financial intelligence tool on the market.