Proof of Reserves: A DeFi Primer

When protocols treat pegged assets as risk-free collateral, solvency cannot be a hidden assumption. It must be an observable input.

As risk managers, we review pegged assets listed on major lending, staking, and restaking protocols, and monitor billions in collateral each week. These assets, including USD-pegged stablecoins, LSTs, LRTs, and other wrapped tokens, all promise redemption at fixed values. Users and protocols in turn rely on these promises, which introduce trust assumptions about whether issuers can redeem the full supply.

This needs to change.

In the current model, protocols and users underwrite solvency assumptions but lack the tools and expertise that our risk analysts use to assess them. DeFi needs consistent reserve disclosures that plug directly into protocol risk frameworks.

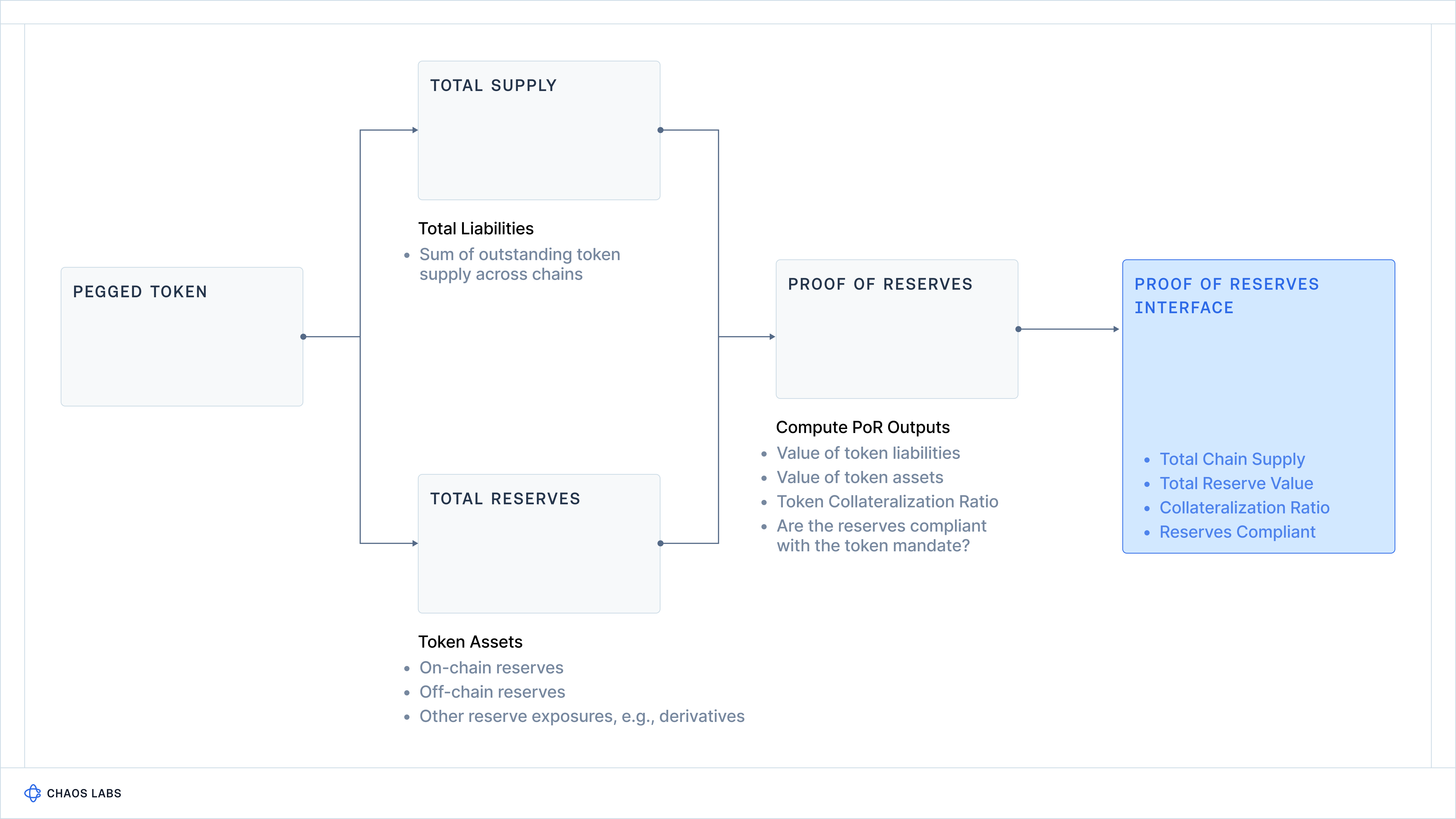

Proof of Reserves addresses this.

The key problems

DeFi silently underwrites issuer credit risk without the necessary tools to manage it, leading to two key issues:

- Hidden insolvency risk. Protocols and users are exposed to risks they cannot effectively manage, emanating from the possibility that a pegged token’s reserves are insufficient to cover its liabilities, rendering it insolvent.

- Structural capital inefficiency. Parameters are set according to static risk assessments, necessitating a margin of safety to account for potential future undercollateralization, which restricts capital efficiency. This suppresses liquidity and borrowing activity across the system.

Proof of Reserves provides a clear path to addressing these constraints. Reserve transparency enables stronger risk guardrails, higher capital efficiency, and a more scalable collateral base for DeFi.

A Useful Comparison: How ETFs Demonstrate Collateral Integrity

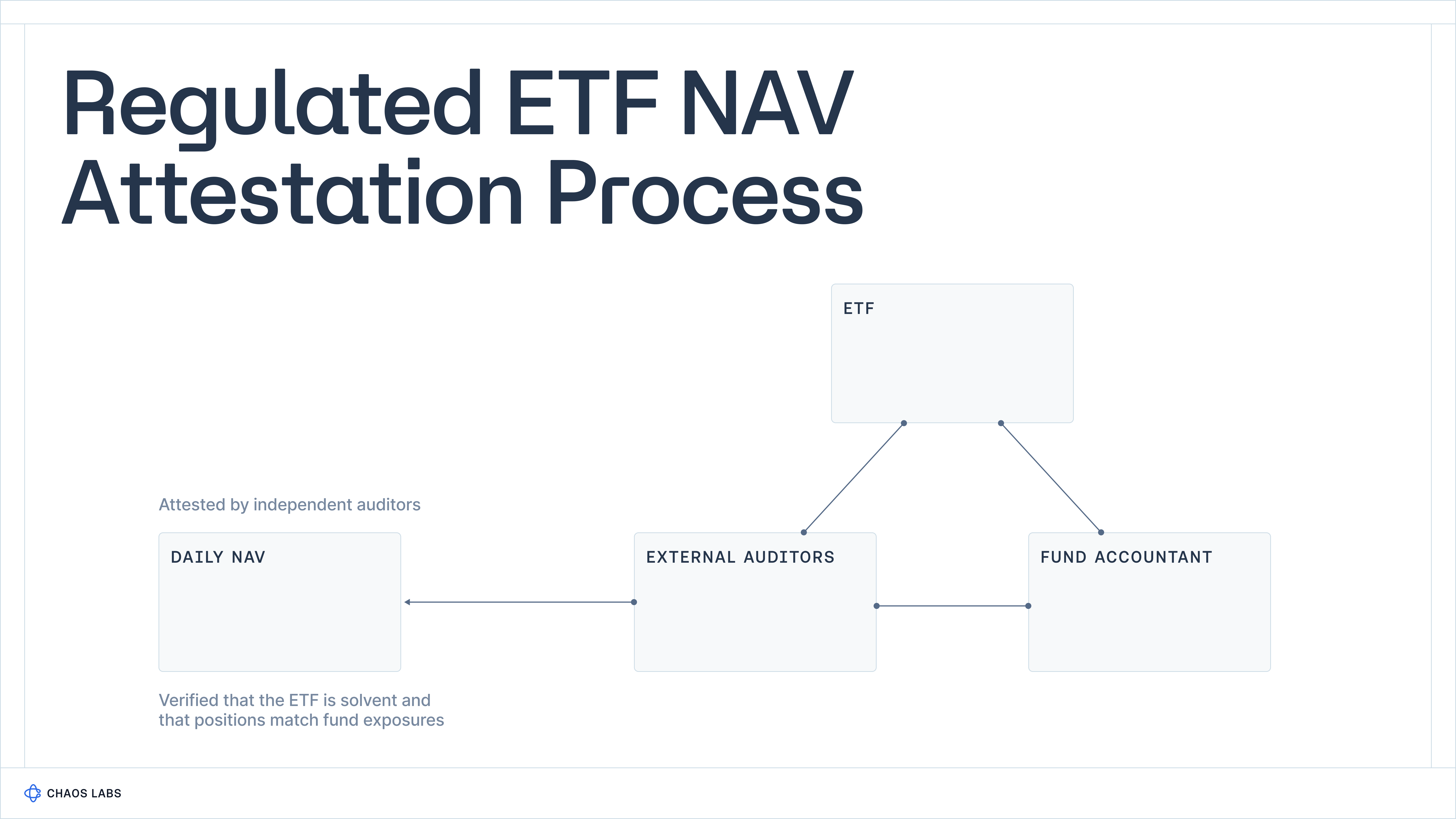

Exchange-traded funds (ETFs) hold a basket of assets as reserves and allow redemption at the basket’s market value (less fees). ETF collateral risk has been debated for years, but clear public cases of mainstream ETFs failing to hold the assets they claim are rare.

The reason is simple.

ETFs publish daily net asset values (NAVs) prepared by fund accountants, disclose their positions, and undergo independent audits. All of these reports tie directly to observable market prices for the underlying holdings. This system is not perfect, but it establishes a transparent link between assets and liabilities.

Proof of Reserves is essentially the ETF disclosure stack rebuilt for DeFi.

DeFi can go further by posting these disclosures on-chain and updating them continuously for the public’s visibility. Instead of quarterly or daily PDFs, solvency can become a live, shared data source that protocols and users consume directly.

How DeFi Underwrites Hidden Trust Assumptions

A core challenge in managing pegged assets is that oracle design cannot account for solvency risk. Protocols often rely on exchange rate oracles rather than market prices to avoid unnecessary liquidations when secondary markets drift from peg. That choice protects users during volatility but shifts the full insolvency risk onto the protocol.

This approach only works when the asset is fully backed. If reserves fall short, the oracle continues to report parity even as the asset becomes impaired, masking the problem until the protocol absorbs the loss as bad debt.

Reserve transparency changes this dynamic.

With continuous Proof of Reserves, protocols gain direct visibility into whether liabilities remain fully supported by assets. This enables risk managers to:

- Adjust parameters proactively, rather than relying on static safety margins or waiting for market prices to expose the issue, protocols can lower collateral factors, cap exposure, or disable new deposits as soon as reserve quality deteriorates.

- Differentiate assets by actual backing. Not all pegged assets are equal. Tokens with robust, verifiable reserves can be treated as higher-quality collateral, supporting higher LTVs and larger exposure. Those with weak or opaque disclosures can be limited in caps or LTVs, valued with a haircut, or excluded.

- Unlock capital efficiency. As reserve information becomes available, these buffers can be calibrated to real conditions rather than bound by uncertainty. Markets become deeper and more competitive without introducing unbounded tail risk.

The same valuations that support the setting or adjustment of risk parameters can improve token onboarding procedures, which are currently over-relying on subjective judgment. Objective structured data unlocks the capability for protocols and curators to assess whether a pegged asset can remain fully backed across market conditions. Solvency becomes an observable input rather than an assumption.

Conclusion

Taken together, these improvements create a clear path forward. Proof of Reserves reduces silent credit exposure, enables parameter decisions grounded in observable solvency, and supports scalable collateral management across DeFi.

Over time, solvency checks should sit alongside price and volatility oracles as standard inputs to every protocol’s risk framework. Our next piece will outline how these disclosures should be structured and integrated so that Proof of Reserve, and the collateral integrity it measures, becomes a default component of every DeFi protocol’s risk framework.

Vaults, Yields, and the Illusion of Safety - Part 1: The Real World Benchmark

Vaults are one of those ideas in crypto that everyone thinks they understand, mostly because they look simple. But simplicity is deceptive. Under the surface, vaults have quietly become one of the most misunderstood yet strategically important primitives in the entire ecosystem.

Vault Management = Risk Management

In this article, we outline our approach to vault risk management, identify current sources of systemic fragility, and highlight how the limited use of data-driven frameworks introduces unnecessary risk in today’s vault designs.

Risk Less.

Know More.

Get priority access to the most powerful financial intelligence tool on the market.