Proof of Reserve as Risk Infrastructure

When Bybit suffered a $1.4B exploit earlier in February 2025, uncertainty around Ethena's USDe exposure triggered over $20M in liquidations across DeFi lending markets. Following this incident, Ethena integrated Chaos Proof of Reserve to close the visibility gap and provide users with the data needed to separate verified exposure from market speculation.

This incident highlighted a broader truth: without verifiable reserve data, especially for stablecoins and asset-backed assets, markets trade on fear during periods of extreme volatility.

Despite high-profile crashes like 3AC’s collapse, which revealed significant gaps between reported and actual holdings, crypto still lacks a standardized PoR implementation.

How Proof of Reserve Works

A PoR validates that custodians, exchanges, stablecoin issuers, and protocols hold sufficient assets to back their obligations. This mechanism relies on three elements:

- Transparency: Reserve data must be publicly disclosed

- Reliability: Verification methods must be sound, with credible auditors and disclosed counterparty risk

- Verifiability: Anyone should be able to confirm accuracy independently

Without these conditions, PoR becomes a misleading signal rather than a trustworthy measure of collateralization. PoR implementation varies across two main dimensions: verification frequency and validation method.

Implementation Methods

Historically, PoR has taken two forms:

- Manual, periodic proofs providing snapshots at fixed intervals through audits or attestations

- Automated, continuous proofs delivering frequent or real-time updates, narrowing the window for errors or manipulation

Some systems incorporate cryptographic security through Merkle Trees, enabling users to verify that their balances are included in reserves without exposing sensitive data. Each balance is hashed and aggregated into a Merkle Root, and users can reconstruct the path to confirm inclusion.

However, Merkle Trees do not solve the problem of data provenance. Proofs are only as reliable as their inputs, reported reserves, and external validations. If these sources lack credibility, even cryptographically sound proofs will be misleading.

Data Provenance

The credibility of PoR depends on how reserve data is sourced and validated:

- Self-reported: Reserves are disclosed directly by the custodian without independent verification

- Third-party verified: Reserves are validated through attestations or audits by external entities

Ultimately, PoR is only as strong as the accuracy and timeliness of its inputs. Even real-time reporting cannot guarantee reliability if the underlying data is flawed.

Chaos Proof of Reserves

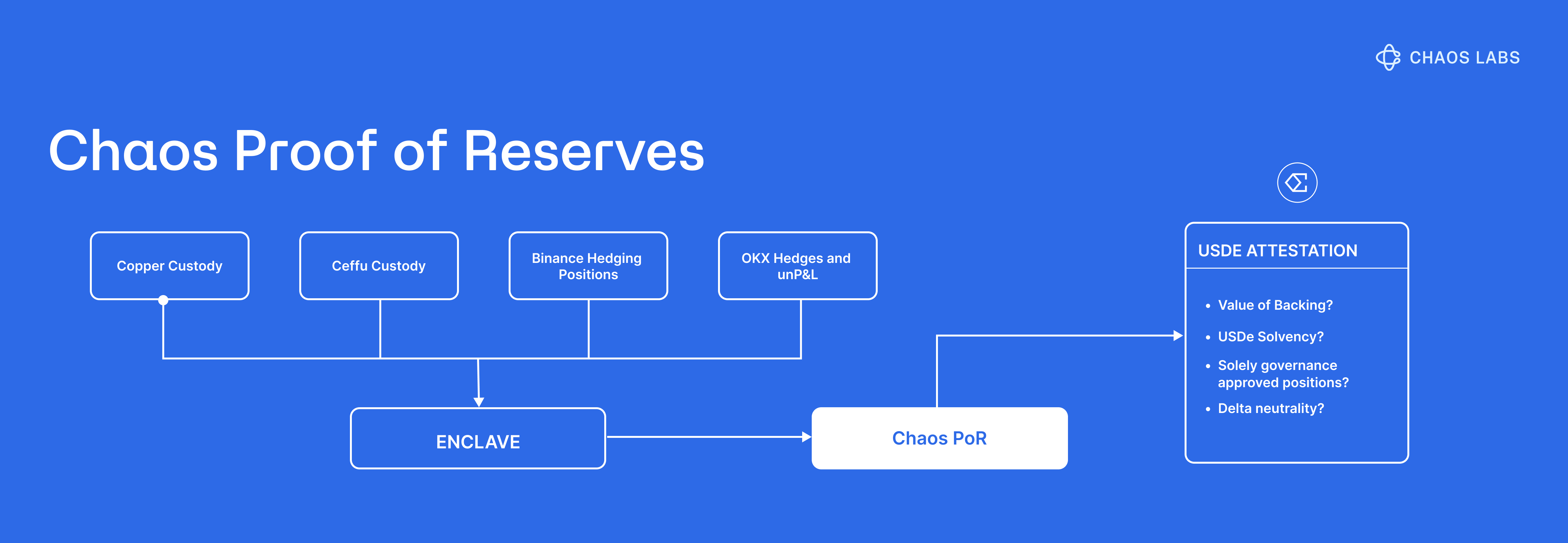

Chaos Labs is helping set standards through Chaos Proof of Reserves, which deliver automated attestations that meet strict data quality benchmarks. Chaos PoR goes beyond static attestations by introducing intelligent, multi-layer verification through the Chaos Risk Oracle framework. Rather than publishing a single aggregate number, Chaos PoR continuously tracks and updates three independent data streams:

- Locked Reserves: Onchain verification of underlying collateral across base layers.

- Issued Supply: Aggregated circulating supply across all supported chains, including per-chain breakdowns.

- Collateralization Status: A live signal confirming that total reserves meet or exceed outstanding supply.

This structure allows any smart contract, protocol, or dashboard to verify reserve integrity in a single call, removing dependency on offchain trust assumptions.

Recent Chaos PoR implementations include:

- Ethena Labs integrated PoR following the Bybit incident, reinforcing confidence in USDe, which now represents more than $10B in DeFi value

- Agora's AUSD nearly doubled in market cap after integrating Chaos PoR in May 2025, establishing itself as a leading stablecoin on Avalanche and Katana

- Avalanche partnered with Chaos Labs in June 2025 to implement PoR for bridged assets, including BTC.b

The Path Forward

The Bybit incident and October 10th flash crash highlighted that information gaps during periods of volatility can create cascading effects. As DeFi protocols scale and cross-protocol dependencies deepen, PoR is evolving from a transparency feature to essential risk infrastructure.

Protocols that implement rigorous PoR systems give users and integrators the data needed to make informed risk decisions. Those that do not leave participants operating on assumptions rather than evidence, a gap that becomes critical in volatile markets.

Check out the Chaos Proof of Reserve dashboard: https://oracles.chaoslabs.xyz/por-feeds

Introducing the Aave Slope2 Risk Oracle

A mechanism for dynamic risk adjustments that adapts to real-market conditions. Now live across Aave v3 markets, with initial collateral coverage USDC, USDT, USDe, and wETH on Ethereum Core and Linea, and a full rollout path under our Risk Steward framework.

frxUSD Token Review

Between the 14th and 30th of August 2025, Chaos Labs conducted a risk assessment of frxUSD, a fiat-redeemable, fully collateralized stablecoin issued by the Frax Finance Protocol.

Risk Less.

Know More.

Get priority access to the most powerful financial intelligence tool on the market.