Tydro (Ink) Integrates Chaos Price Oracles

Tydro is live on Ink and is the first Aave whitelabel deployment to use Chaos Price Oracles as its exclusive price feed provider

Built on Ink, an Ethereum Layer 2 on the Optimism Superchain Stack, Tydro serves as the network’s canonical liquidity engine, extending Aave v3 architecture with $INK-based incentives. At launch, Tydro supports lending and borrowing for USDT0, USDG, GHO, wETH, and kBTC, with support for yield-bearing and restaking assets to follow.

Chaos Price Oracles

Chaos Price Oracles will deliver high-precision, low-latency price data to Tydro’s markets, a first for an Aave white-label deployment. Designed for high-throughput DeFi environments, Chaos Oracles combine onchain and offchain validation to deliver accurate, manipulation-resistant, risk-aware pricing under all market conditions.

Tydro users will experience:

- Accurate pricing: Aggregated data across multiple venues ensures data precision and resistance to manipulation.

- Low latency: Sub-second price updates align onchain positions with market movements in real time, maintaining collateral integrity during volatility.

- Built-in risk filtering: Integrated anomaly detection continuously monitors feeds, filtering out irregular data to guarantee clean and trustworthy pricing inputs.

Together, these capabilities ensure reliable market data across collateral types, enabling Tydro maintain stability and responsiveness as it scales.

Real-Time Risk Management

As risk managers for Tydro, Chaos Labs will integrate Risk Oracles and data engines to provide continuous oversight across all markets. Operating as an always-on safeguard, Chaos Risk Oracles will deliver automated parameter calibration, anomaly detection, and real-time monitoring to ensure each market operates within defined limits.

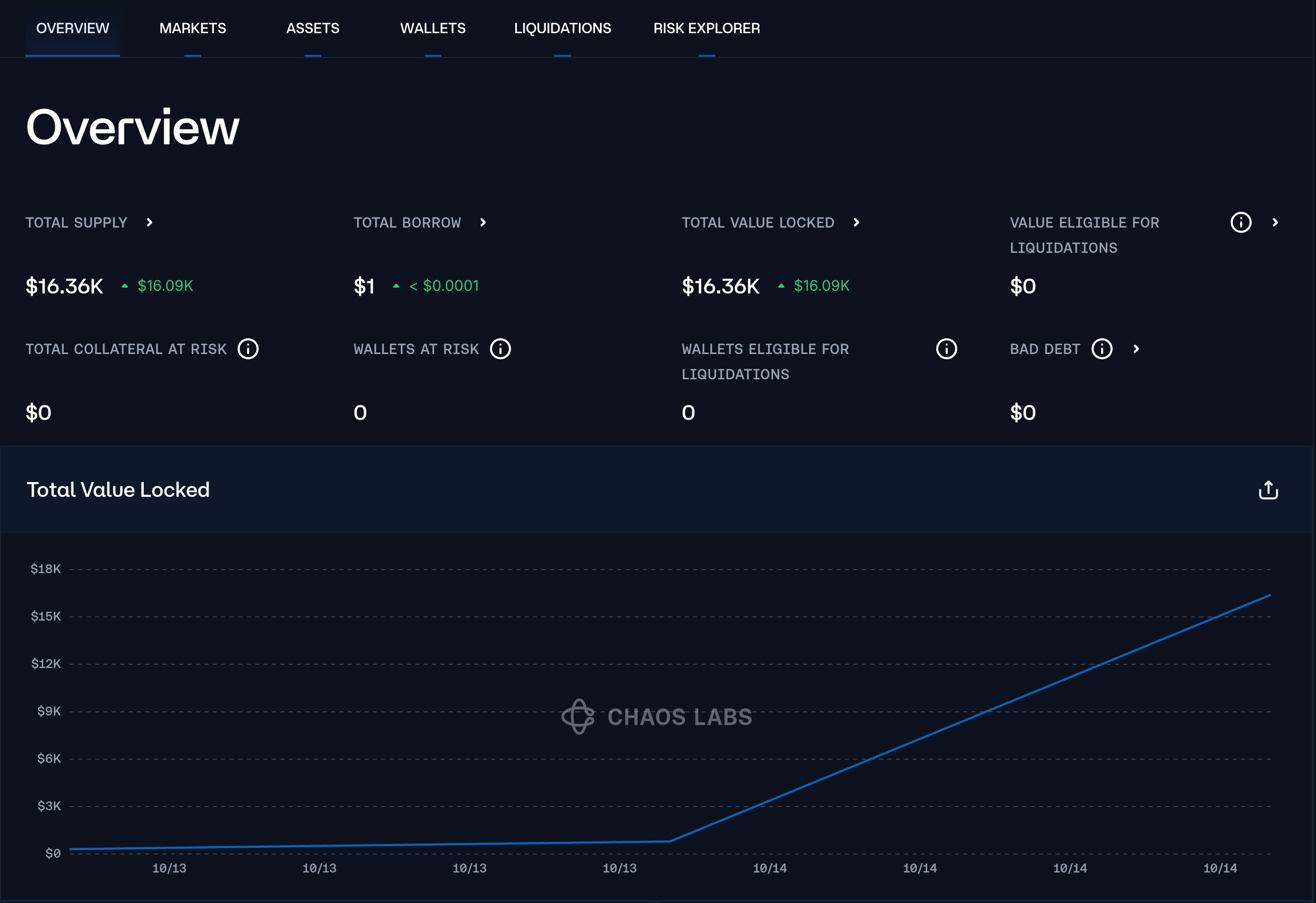

In parallel, we’ve launched community risk dashboards that provide real-time visibility into risk metrics such as supply and borrow dominance, collateral utilization, assets at risk, and liquidation exposure.

https://community.chaoslabs.xyz/tydro/risk/overview

We invite the community to explore the platform and share any feedback with us.

Arch Network Integrates Chaos Price Oracles

Chaos Price Oracles is the primary oracle provider for Arch Network, delivering institutional-grade price and risk infrastructure for Bitcoin DeFi.

Powering the Risk Infrastructure for Ethereal

Chaos Labs is building the risk management framework for Ethereal, a high-throughput perp DEX appchain settling on Arbitrum. Ethereal combines sub-20 millisecond latency and capacity for 1M orders per second with onchain settlement and custody, delivering a CEX-level experience for users.

Risk Less.

Know More.

Get priority access to the most powerful financial intelligence tool on the market.