AI as Operational Infra for Risk-Aware Execution

DeFi has spent years pitching itself as permissionless, composable, globally accessible finance for everyone. At the level of primitives, the pitch holds.

However, it’s important to note that the product isn’t just the protocol.

The product is the workflow, and today, the workflow assumes you’re a full-time operator with sufficient knowledge of risk, operations, security, and more. DeFi didn’t eliminate intermediaries so much as it reassigned the entire back office to the user.

We finally have a technology that can realistically change this by acting as a copilot that maintains situational awareness while keeping execution within guardrails.

The Reality of Operating in DeFi

A common misconception about DeFi UX is that it's mainly a design problem.

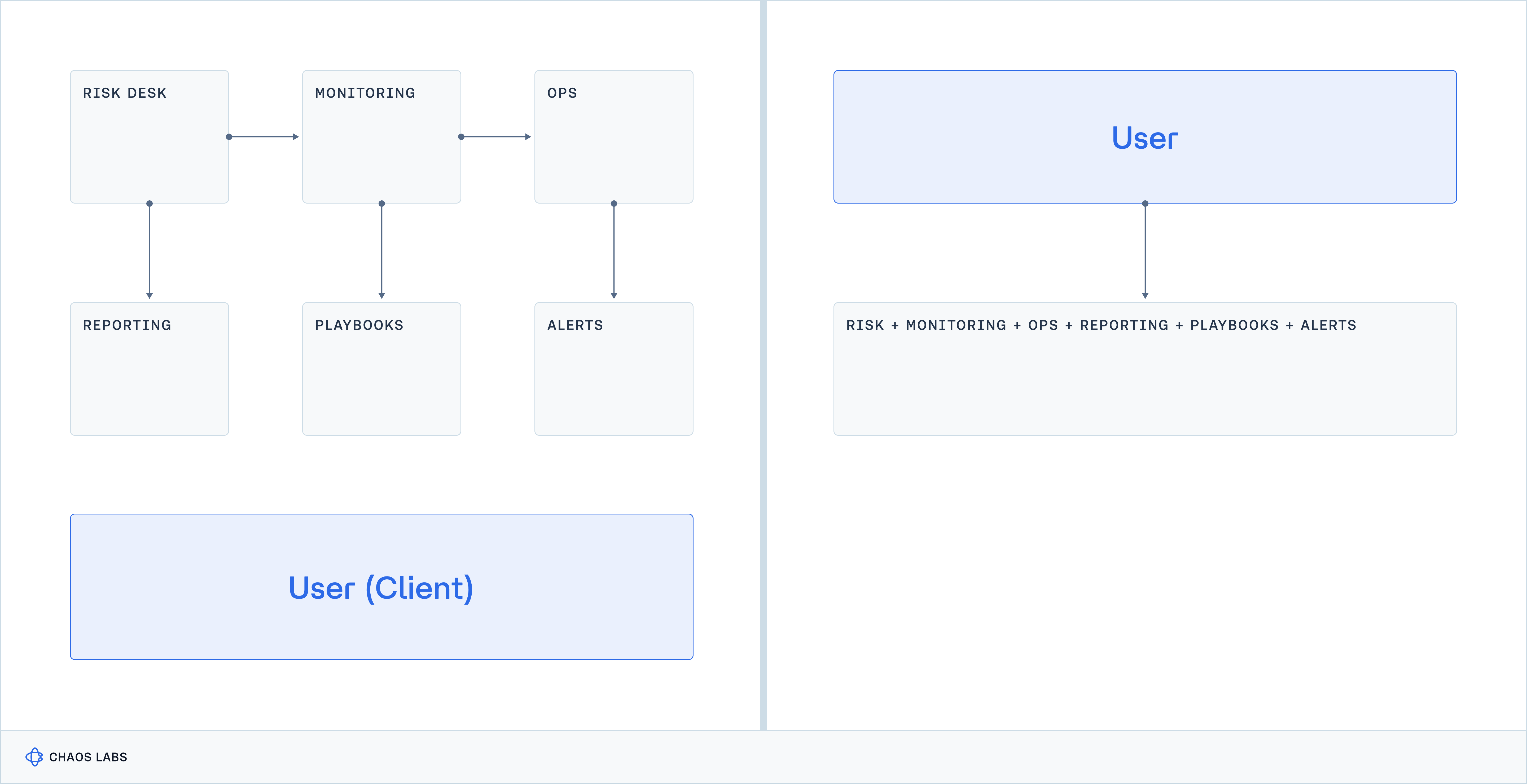

Yes, onboarding could be smoother, and as a whole, we should have simpler terminology. But that's not what's blocking adoption. A more immediate barrier is that DeFi collapses a full operating model into the lap of one person (or one team). In tradfi, risk taking and management are surrounded by an apparatus: risk limits, monitoring systems, playbooks, incident response, and reporting. Those functions are mostly invisible to the end customer because institutions absorb them.

So while DeFi’s primitives are straightforward, the lived experience often isn’t.

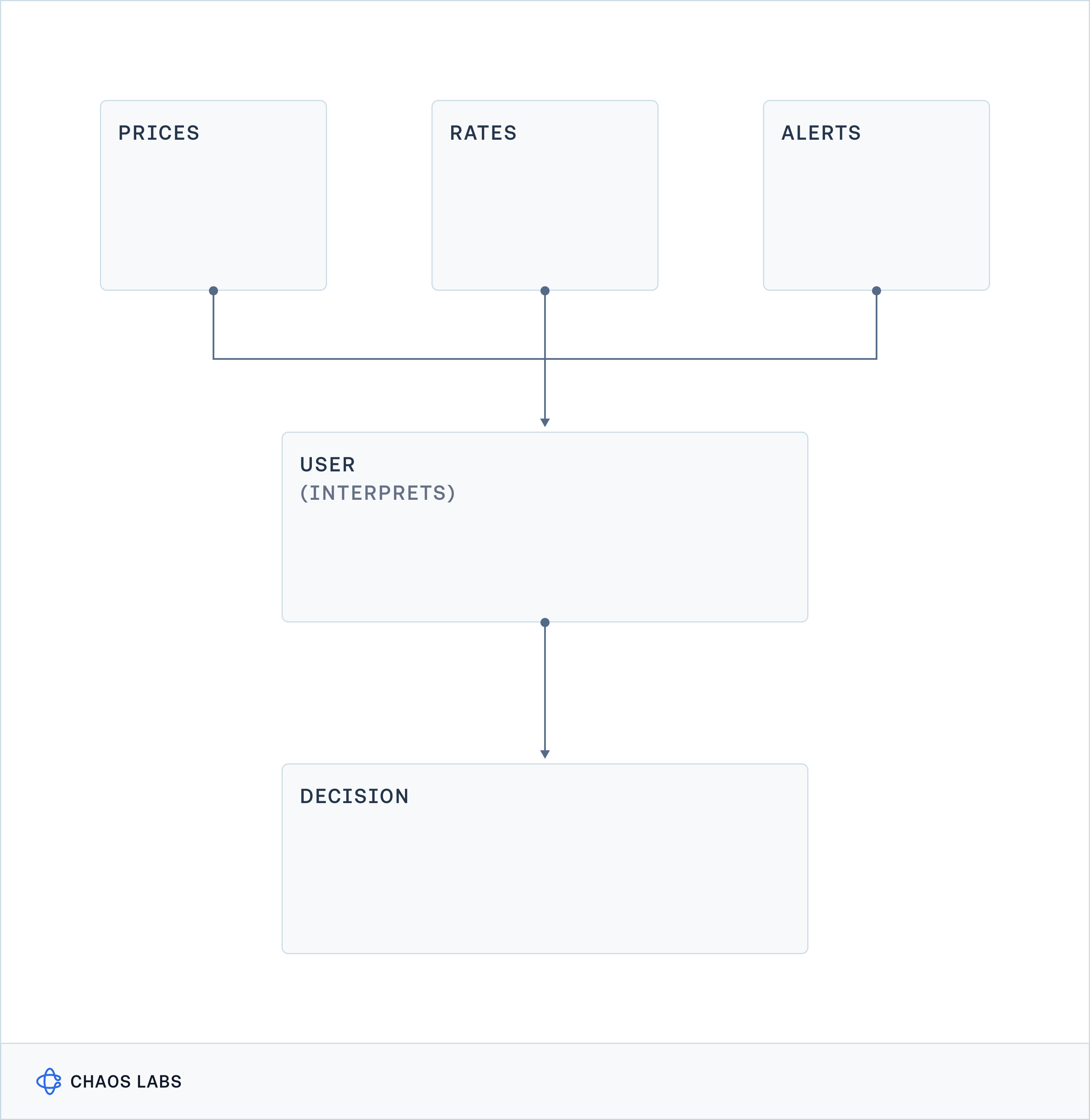

A position lives in a world that shifts continuously at breakneck speed: prices, rates, utilization, collateral quality, liquidity. All of this fluctuates while protocol parameters evolve underneath. Nothing stays still long enough for "set and forget" to be a safe default.

This quickly becomes a scaling problem.

DeFi Lending as an Example

Lending illustrates this dynamic clearly, as the mechanics are simple, while the operational demands are not.

A typical user journey is: deposit collateral, borrow against it, maintain a safety buffer, pay interest.

Complexity emerges after the position is opened, when maintaining safety depends on how multiple variables evolve together over time. These forces are particularly important:

- Liquidation risk is nonlinear. A position that appears conservative in stable markets can become fragile during sharp drawdowns or volatility spikes.

- Economic drift. Borrow rates, supply yields, and utilization can materially change the cost of capital.

- Indirect market effects. Liquidity conditions and volatility affect risk even when core parameters remain unchanged.

Safety, in this context, is not a one-time choice. It is a state that must be continuously maintained.

To be clear, DeFi’s tooling has undergone vast improvements.

There are risk dashboards and live alerts for many protocols, users can simulate positions, and automate narrow actions with scripts and bots. However, most tools either increase the volume of information users must process or assume correct decision-making under time pressure across all market conditions.

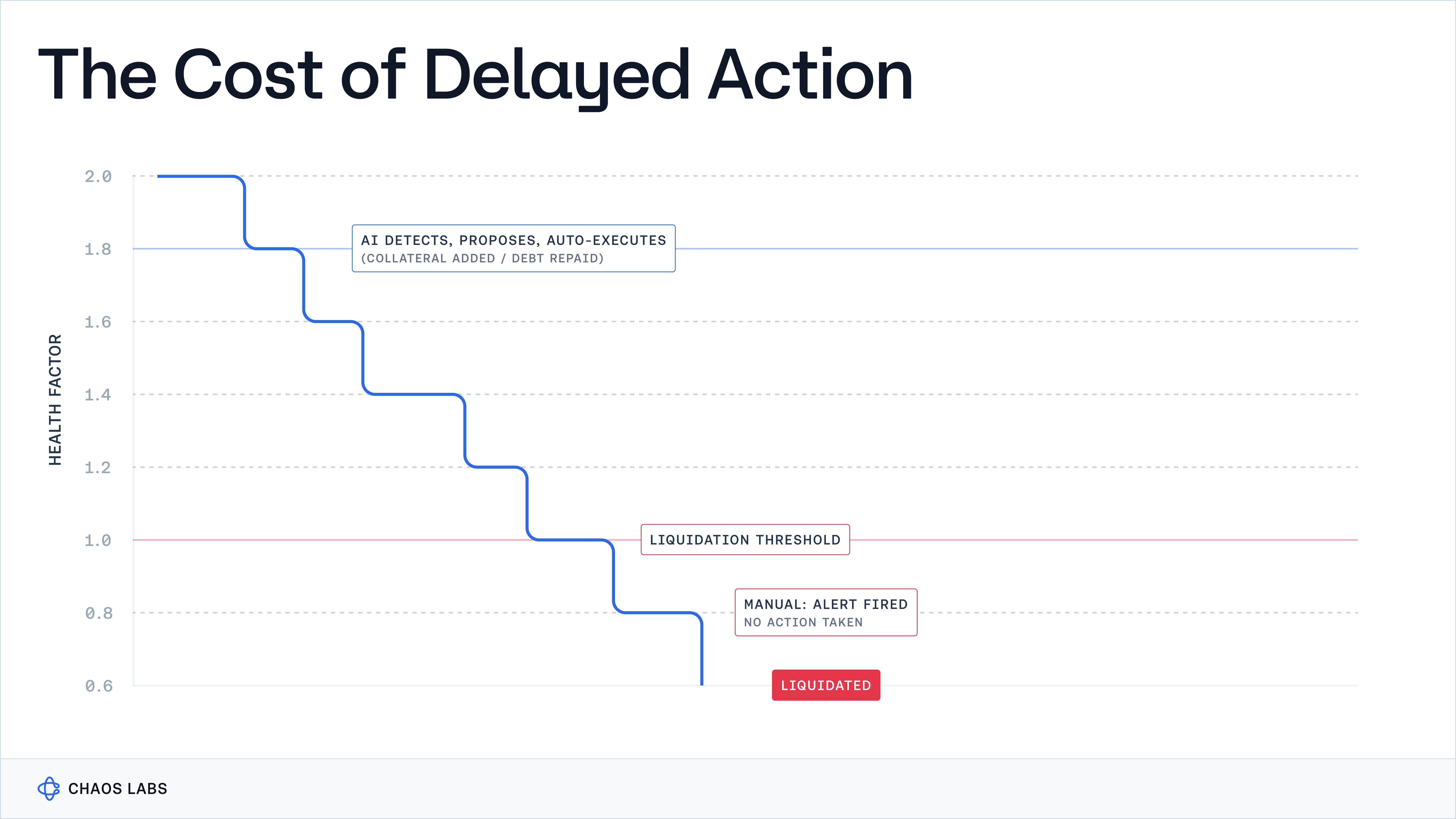

The Cost of Delayed Action

We propose a shift towards a system (or copilot) that maintains continuous situational awareness and translates live market state into decision-ready options within user-defined constraints.

This copilot will enable users to:

- Track position state. When something meaningful shifts, it explains what changed, why it matters, and proposes user actions.

- Understand tradeoffs explicitly. For example, paying down debt reduces risk but changes capital efficiency. Adding collateral improves safety but changes opportunity cost. The copilot surfaces choices with consequences attached.

- Keep execution bounded. Proposing actions, simulating outcomes, executing only within strict guardrails. The system assists without taking control.

A shift to this model requires integration, policy design, and a product mindset that treats operations as core to the user experience.

Conclusion

Every financial system that reached broad adoption made its operational complexity invisible to the end user.

DeFi inverted that model. Reducing the operational burden requires an operating layer that maintains situational awareness, surfaces decision-ready options, and keeps execution bounded by explicit constraints. Without it, the attention tax remains a structural limit on how broadly and reliably DeFi can scale.

US Crypto Market Structure: A Quiet Bill With Loud Consequences

The US Congress is negotiating the first serious attempt to define what a digital asset is, who regulates it, and which obligations apply to the venues and intermediaries that move it.

Aave v4: A Design Framework for Pooled and Isolated Bluechip Collateral Markets

The objective of this analysis is to establish a structured foundation for governance discussions on how bluechip collateral should be configured in Aave v4, and to clearly articulate the trade offs, benefits, and risk implications associated with each design approach.

Risk Less.

Know More.

Get priority access to the most powerful financial intelligence tool on the market.