US Crypto Market Structure: A Quiet Bill With Loud Consequences

The US Congress is negotiating the first serious attempt to define what a digital asset is, who regulates it, and which obligations apply to the venues and intermediaries that move it.

The House has already passed the major framework bill (Digital Asset Market Clarity Act of 2025 (H.R. 3633, the “CLARITY Act”), which establishes a statutory split between the SEC and the CFTC and replaces years of regulation by enforcement with a formal market structure regime. The Senate just released an updated draft and then delayed its markup to later this month after industry pushback.

The most consequential provisions are still unresolved. That said, it’s worth breaking down what the bill is about and how it impacts crypto.

What the Draft Actually Changes

Jurisdictional Split

The bill replaces "regulation-by-enforcement" with a statutory division:

- The CFTC regulates spot markets for commodity-like tokens

- The SEC retains authority over issuance and primary market conduct

The split is more complex than it appears. Digital commodities can still trade on SEC-supervised venues, including alternative trading systems (ATSs) and national securities exchanges, giving the SEC jurisdiction over brokers and dealers handling these tokens.

So "CFTC for spot markets" doesn't mean a single, unified regulatory regime.

The boundary problem matters more than the split itself. The CFTC's commodity jurisdiction only extends as far as the "commodity bucket" reaches. But the SEC controls who enters that bucket through its certification and ancillary asset processes. If the SEC interprets those standards restrictively, it effectively limits the CFTC's domain.

This is Coinbase's core complaint. CEO Brian Armstrong withdrew support ahead of markup, arguing that SEC gatekeeping preserves uncertainty rather than resolving it. In effect, the CFTC’s mandate expands only as far as the SEC allows.

Judicial Lock-in

The bill introduces a binding judicial lock-in mechanism.

If (before the law takes effect) a U.S. court issues a final, non-appealable judgment determining that a specific digital asset transaction was not a securities offering, regulators are prohibited from later reclassifying that asset as a security under the new framework. The determination becomes binding on the agencies.

The provision is designed to prevent a recurring pattern in crypto enforcement, where years of litigation produce a definitive ruling, market participants restructure their operations, and regulators subsequently return with a revised classification theory to reopen the same question.

In practice, XRP is the only mainstream token with a credible claim to this protection, although the court’s final judgment distinguished between different categories of sales, treating some as securities transactions and others as non-securities. Other high-profile cases have reached partial conclusions, but most were resolved through dismissals without prejudice, leaving the underlying classification question legally unsettled.

Ancillary Assets & Network Tokens

The bill also formalizes a token lifecycle.

The basic idea is that a token may be distributed through a securities-style offering at launch, then later transition into a commodity-like network asset once decentralization is established.

An ancillary asset is a fungible token sold through an investment contract (i.e., securities offering) but explicitly carved out from traditional financial claims like equity, debt, dividends, or liquidation rights.

Tokens tied to networks that have not yet reached operational maturity are subject to SEC disclosure requirements, including development plans, control mechanisms, and ongoing ownership reporting. Once the blockchain matures, the issuer or a decentralized governance system can certify maturity to the SEC.

This can be interpreted as another SEC checkpoint for the CFTC’s commodity jurisdiction over digital assets.

DeFi & Safe Harbors

The bill tries to separate software-driven protocols from regulated intermediaries.

A DeFi trading protocol must meet three conditions:

- Transactions execute through predetermined, non-discretionary rules.

- Users retain control of their assets at all times.

- The system operates solely through transparent, pre-established code without unilateral or coordinated control capable of materially altering functionality.

More importantly, decentralized governance isn't auto treated as a "person or coordinated group" for this exclusion. The bill recognizes that token-holder governance can coexist with actual decentralization.

It also provides safe harbor provisions for certain activities tied to DeFi protocols, which include:

- Validating and sequencing transactions

- Providing computational work, node operation, or oracle services

- Publishing user interfaces or maintaining protocol software, so long as the operator cannot custody, reroute, or execute on the user’s behalf;

- Operating or participating in liquidity pools for spot digital commodity transactions

There are two critical constraints to the safe harbor provisions: they’re not an immunity, and they’re not perpetual.

Fraud and manipulation rules still apply, and whenever control materializes, the safe harbor collapses.

Stablecoin Rewards

The bill's prohibition on stablecoin yield is among its most contentious provisions. The draft language prohibits payment stablecoin issuers from providing "any payment, distribution, incentive, or other economic benefit to any person solely for holding, maintaining custody of, or maintaining an account balance of payment stablecoins."

In simpler terms, stablecoins designed for payments cannot pay interest or yield.

This distinguishes payment stablecoins from asset-referenced tokens (e.g. PAXG, XAUT, GHO) or investment products (e.g. sUSDe). If a stablecoin’s primary use case is transactions and settlements, as is the case for most USD-pegged tokens in crypto markets, it cannot compensate holders simply for holding.

Banks argue that yield-bearing payment stablecoins would drain deposits from the regulated banking system. Stablecoin issuers hold reserves in Treasury securities and repos earning 4-5%, and could pass through yields to holders. If stablecoins combined payment functionality with interest, while most checking accounts offer minimal yields, depositors would have a clear incentive to shift balances out of banks.

However, once again, the provision is not that simple.

The bill’s “solely for holding” language introduces additional ambiguity. Yield earned through DeFi lending, liquidity provisioning in AMMs, or yield-bearing vaults is not compensation provided solely for maintaining a stablecoin balance and may therefore fall outside the prohibition. In practice, this distinction is likely to shift yield activity away from issuers and toward structured onchain mechanisms without eliminating economic incentives.

This ambiguity was a contributing factor in Coinbase’s decision to withdraw support for the bill ahead of the scheduled markup. The company argues that the provision constrains stablecoin design, limits innovation, and weakens the competitiveness of USD-pegged tokens relative to both traditional deposits and offshore alternatives.

RWA: Tokenized Equities (and Securities)

Finally, the bill includes a straightforward provision: placing a security on a blockchain doesn't exempt it from being considered a security.

If a token represents stocks, bonds, fund shares, or debt instruments that are under SEC jurisdiction, it remains under SEC jurisdiction regardless of the technology used to issue or transfer it.

At the same time, tokens representing **physical commodities (**gold, oil, agricultural products…) are explicitly excluded from the securities treatment. The differentiator remains the Howey test and the nature of the underlying asset, not whether blockchain or tokenization is involved.

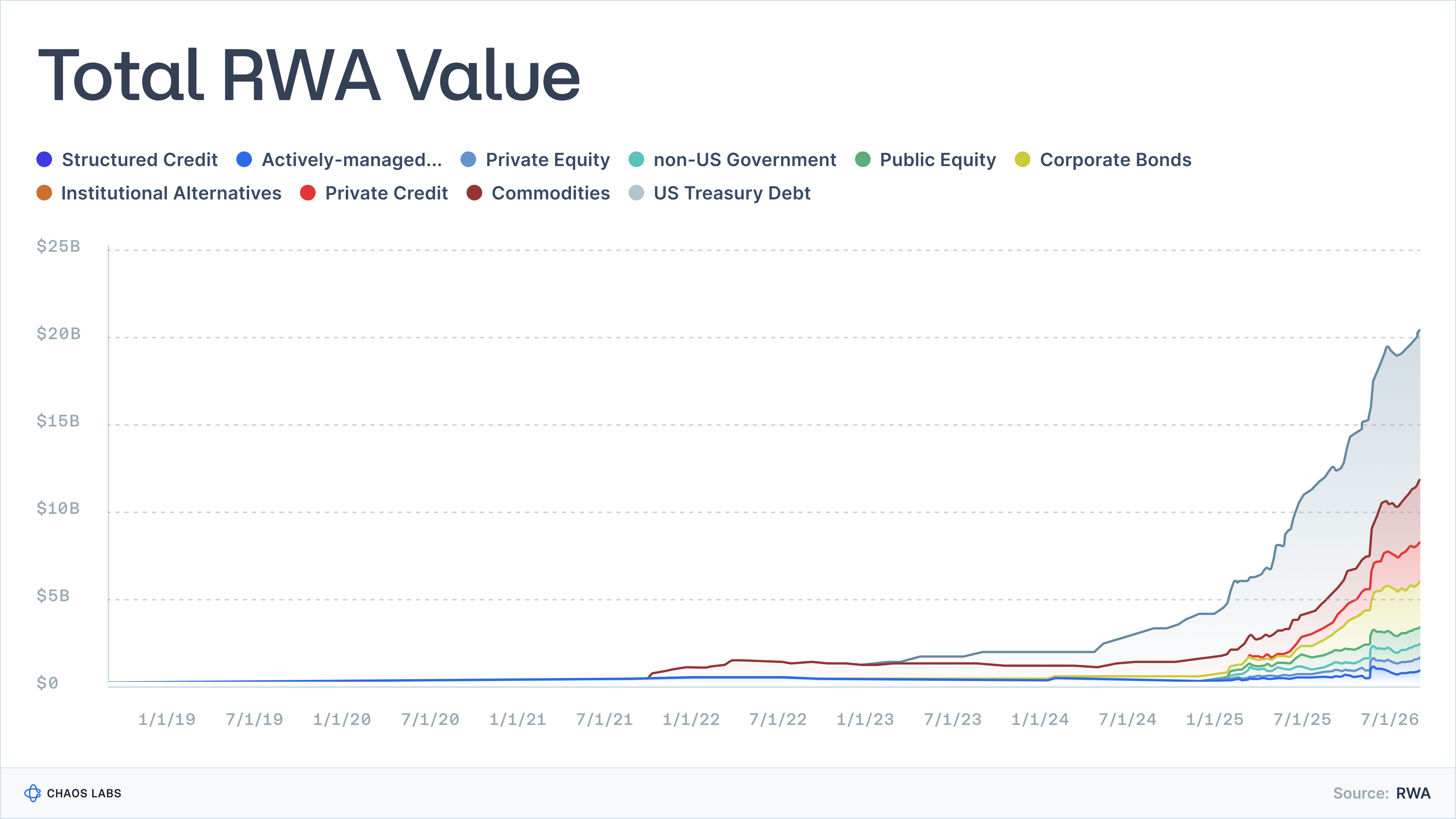

This part of the bill comes at a crucial moment. Major financial institutions are accelerating into RWAs as tokenized traditional assets attract growing interest, particularly as altcoin performance weakens and DeFi-native yields continue to compress. For context, the RWA sector grew 300% YoY.

Conclusion: Why This Bill Deserves Closer Attention

At first glance, the bill reads like technical legal infrastructure. Jurisdictional splits, ancillary assets, judicial lock-in, safe harbors, and yield restrictions are easy to dismiss as procedural detail.

In practice, these provisions determine who can list assets, how DeFi interfaces are treated, whether stablecoins can compete with bank deposits, and how tokenization integrates with existing securities law.

For builders, exchanges, and protocols, now is the time to pay close attention to this bill, as the decisions made in the next few weeks will shape crypto for the next decade.

BGT/BERA: When the Basis Breaks

High-yield basis trades rarely fail because their mechanics are wrong. More often, they fail because the risks they embed only show up once positions are forced to unwind, usually after funding conditions, liquidity, and correlations have already shifted. The BGT/BERA trade is a clear example of how that dynamic plays out.

AI as Operational Infra for Risk-Aware Execution

We propose a shift towards a system (or copilot) that maintains continuous situational awareness and translates live market state into decision-ready options within user-defined constraints.

Risk Less.

Know More.

Get priority access to the most powerful financial intelligence tool on the market.