BGT/BERA: When the Basis Breaks

High-yield basis trades rarely fail because their mechanics are wrong. More often, they fail because the risks they embed only show up once positions are forced to unwind, usually after funding conditions, liquidity, and correlations have already shifted.

One rule of thumb: a “100%+ APR” that appears close to market neutral warrants caution. The yield is real, but so are the risks.

The BGT/BERA trade is a clear example of how that dynamic plays out.

An Overview of BGT, BERA, and iBGT

- $BERA is Berachain’s volatile base asset and represents direct exposure to the chain.

- $BGT is the yield-bearing side and captures incentive flows + governance power. The token is designed to be structurally scarce since it cannot be minted by purchasing $BERA.

In practice, most discussion around BGT centers on Infrared’s iBGT, which is the most liquid and actively traded BGT wrapper. Most importantly, iBGT can be redeemed permissionlessly.

The key mechanical anchor is the 1:1 redemption. BGT can be redeemed for 1 BERA, creating a soft peg. This does not require iBGT to trade at parity, but it establishes a credible floor denominated in BERA. When the market values iBGT’s yield stream and optionality, it often trades at a premium to that floor.

Trade Construction: Long iBGT, Short BERA

The trade is simple enough:

- Long iBGT to earn yield

- Short BERA to hedge directional exposure to the base asset

The result is a “pseudo-neutral” carry position (at least under stable market conditions).

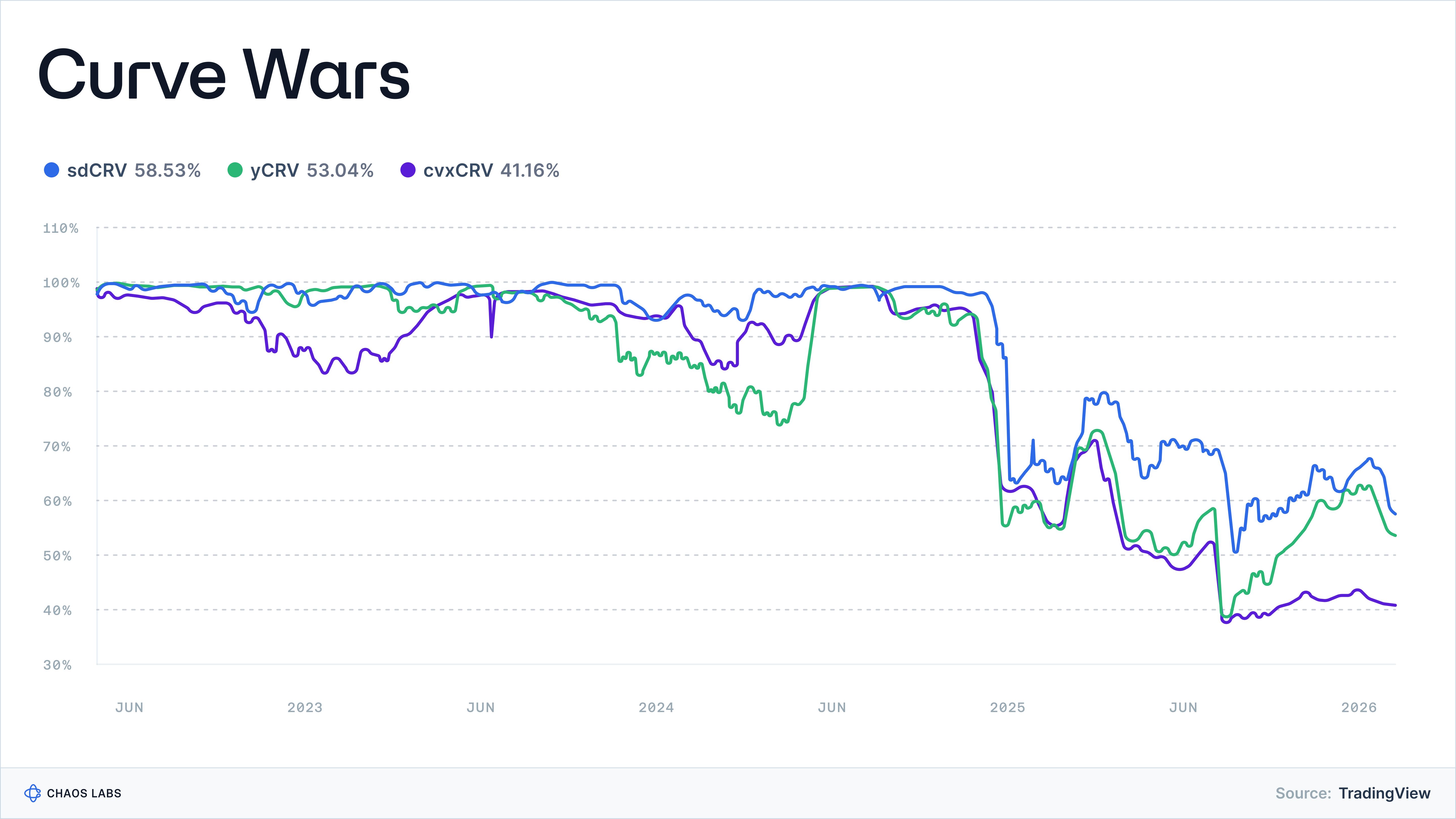

This trade setup is not novel and is directionally similar to most carry-style trades on liquid black holes like cvxCRV/CRV or yCRV/CRV (but of course, the mechanics differ). The main difference is that iBGT has a clear price floor through BGT→BERA redemption, while Curve-style liquid black holes lack an enforceable downside floor and can remain dislocated from their base assets for long periods.

These assets mirror BGT in another important way. They have a hard floor on issuance, either through rebasing or minting costs, but no enforceable floor on the downside. iBGT, by contrast, has a defined exit into BERA.

Despite that difference, the trade structure is similar. It involves two correlated assets split between base exposure and yield, with returns driven by harvesting the spread.

Dissecting BGT/BERA Risk

At a high level, the payoff profile is:

- Upside: iBGT’s yield (currently ~113% APR) + long iBGT/BERA premium

- Downside: funding costs on the BERA short and compression of the iBGT premium

Because BGT is redeemable 1:1 into BERA, the theoretical maximum loss on the iBGT leg is the premium paid at entry. Buying iBGT at 1.02 BERA and exiting at parity implies a 2% loss before fees. In practice, the path can be much rougher than a simple 2% loss.

- If the iBGT premium compresses while BERA rallies, the hedge moves against the position as collateral requirements increase.

- When leverage is applied to the BERA short, margin pressure can force deleveraging. In practice, this often means selling iBGT into unfavorable liquidity conditions.

- Funding on the BERA perps can shift regimes quickly. A position that begins with neutral or negative funding can turn into a sustained cost that erodes the headline yield.

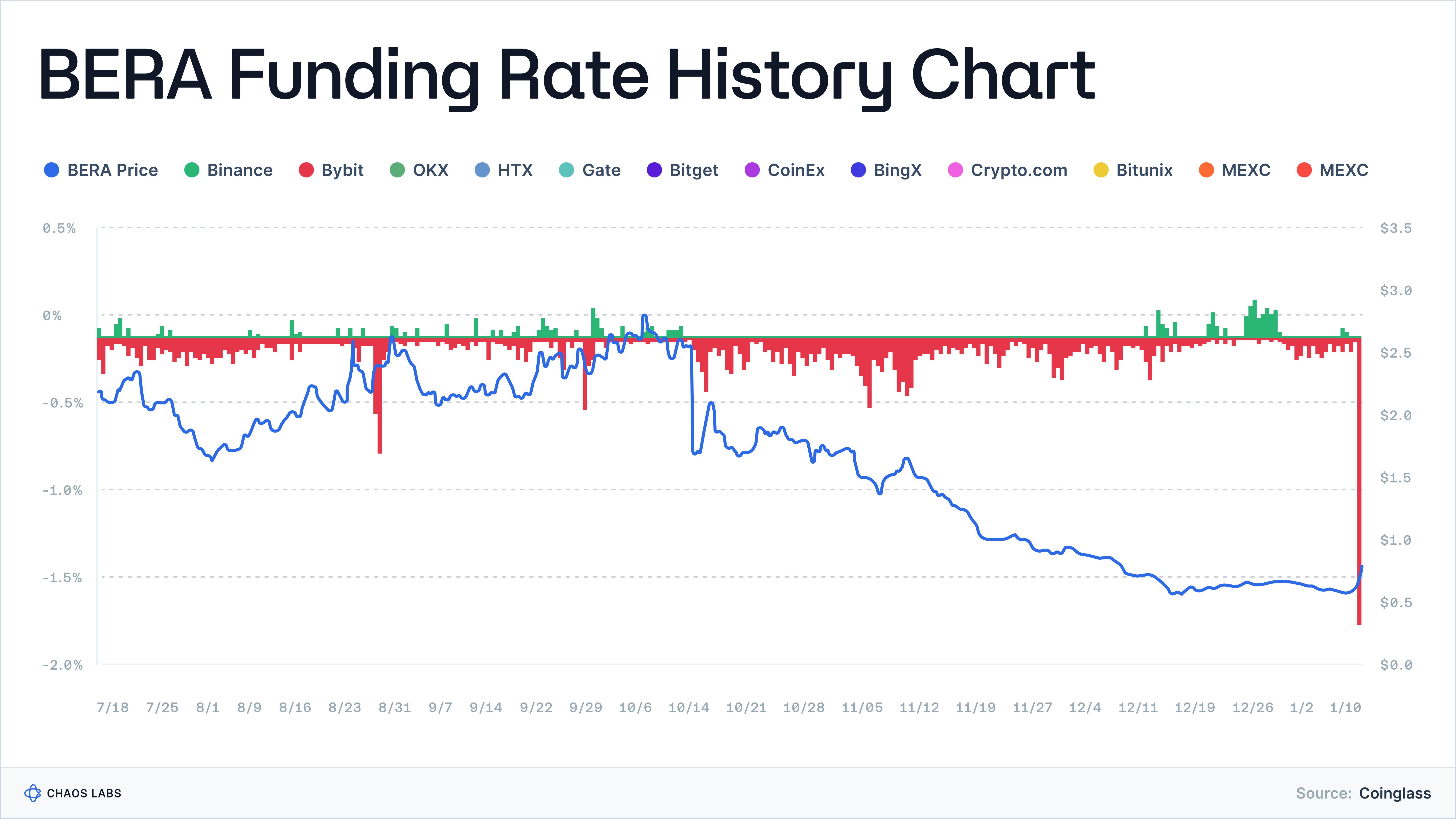

BERA has historically experienced volatile, deeply negative funding periods driven by unlock hedging, basis positioning around iBGT, and shifts in market sentiment. These dynamics become decisive precisely when positions are forced to move.

Layering in platform risks, including perp venue exposure, smart contract risk on iBGT, and unwind liquidity, the trade’s asymmetry becomes clear: the upside is easy to quote, while the downside reflects premium, funding, and execution risk that surfaces on exit.

When the Risk Materializes

The last few days have been a live stress test of the iBGT/BERA basis.

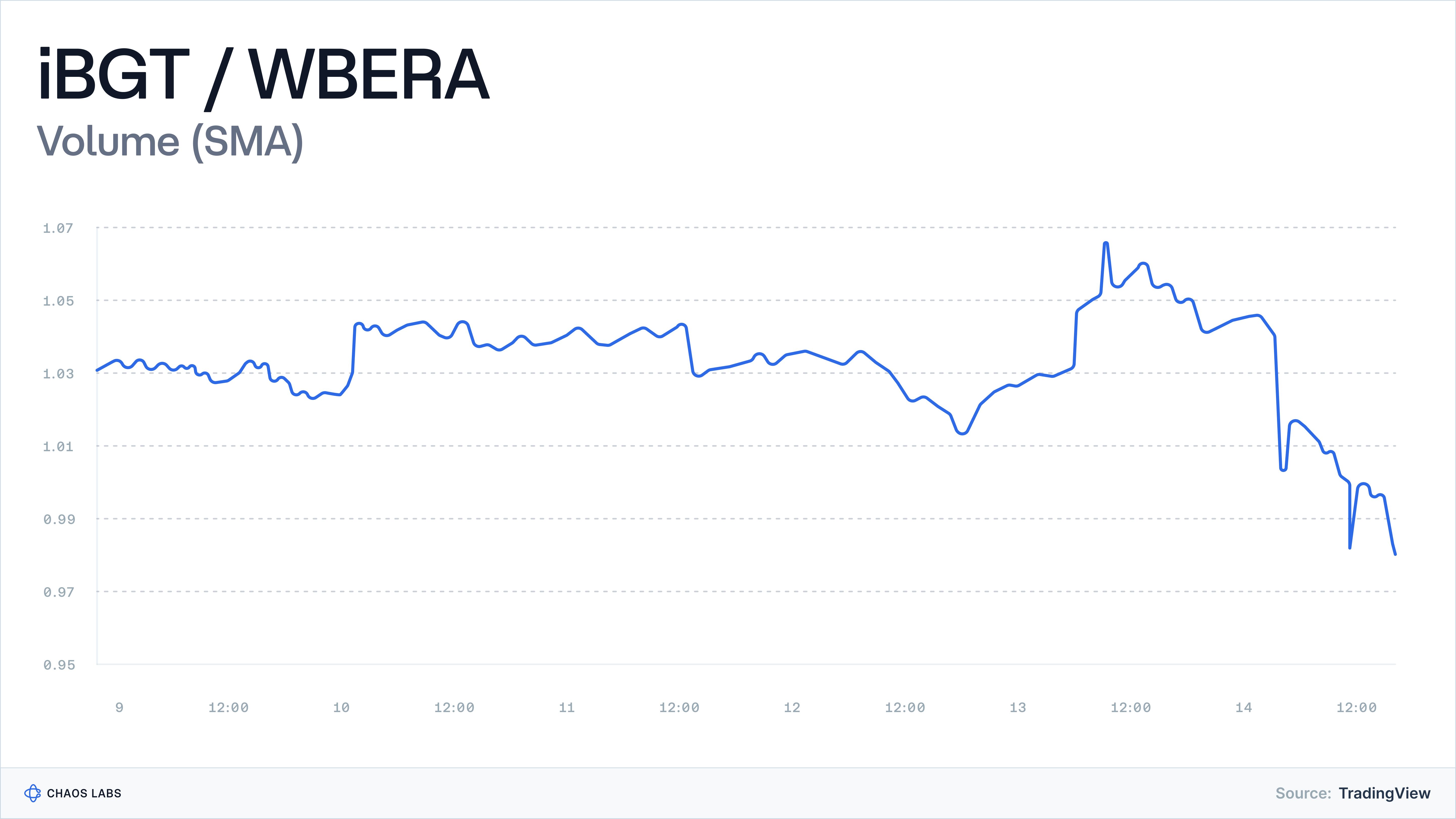

BERA appreciated ~40% over a short window and more than 60% over a month. Perp funding followed, rising sharply and remaining above 1,000% APR on several venues. As funding costs increased, crowded iBGT/BERA carry positions began to de-risk. Covering BERA shorts required capital, which in practice meant selling iBGT into thin liquidity.

Roughly $100,000 of net sell pressure in the iBGT/WBERA pool, alongside a near 300% increase in daily volume, was sufficient to collapse the premium and briefly push iBGT through parity.

The trade didn’t “break” structurally, i.e., the redemption floor remains intact, and yield continues to accrue.

What these episodes expose instead is path risk.

A position that screens as “neutral 113% APR” can produce significant drawdowns when the unwind coincides with a funding spike and rapid premium compression.

The headline yield was never free; rather, it reflected compensation for absorbing funding volatility, liquidity constraints, and execution risk under stress.

Conclusion: Yield Has a Price Tag

The iBGT/BERA basis is straightforward. It is a leveraged expression of a single view: that Berachain’s PoL yield will, over the holding period, out-earn funding costs and premium volatility. When the position is understood as explicitly long that view rather than as a stable carry or quasi-cash product, it can make sense.

What recent price action makes clear is where this framing fails.

A “neutral 113% APR” is not neutral in practice. The position is long a reflexive yield token, short a perp, and dependent on thin liquidity and a soft redemption floor holding under stress; assumptions that all tend to break down precisely when the trade is forced to move.

From our perspective, this episode reflects a broader pattern across most onchain strategies where structure and redemption mechanics do not eliminate risk but push it into the path, allowing unmonitored funding sensitivity, liquidity depth, and execution constraints to turn neutrality into drawdowns.

(Part 3) The Missing Surfaces: What Google Doesn’t Know About Capital Markets

Markets operate on surfaces that never touch the open web. These aren't just "private data", they're fundamentally different data primitives requiring specialized infrastructure to observe and interpret.

US Crypto Market Structure: A Quiet Bill With Loud Consequences

The US Congress is negotiating the first serious attempt to define what a digital asset is, who regulates it, and which obligations apply to the venues and intermediaries that move it.

Risk Less.

Know More.

Get priority access to the most powerful financial intelligence tool on the market.