Ethena Integrates Chaos Proof of Reserves

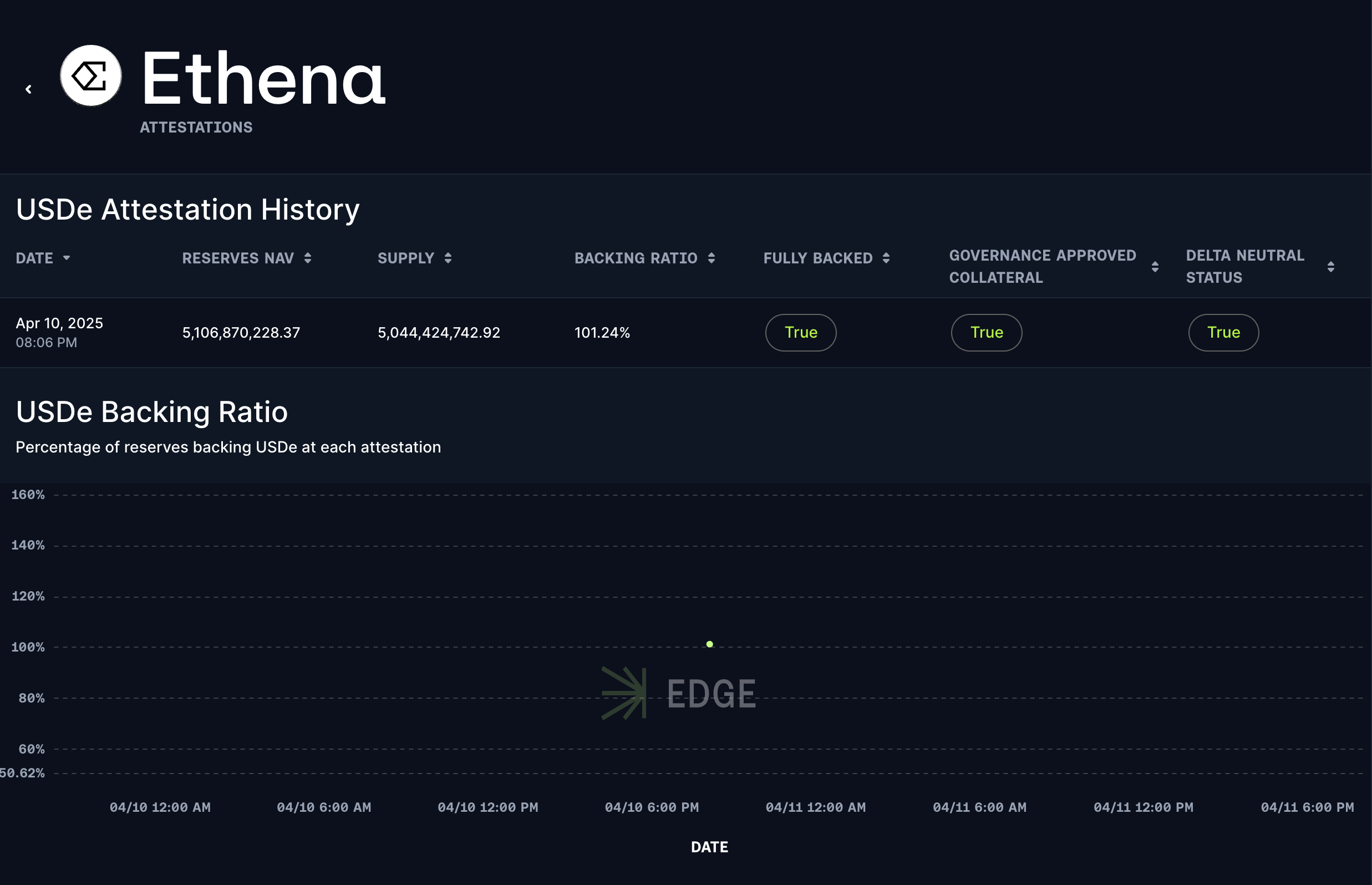

Ethena has officially integrated Chaos Proof of Reserves (PoR). With this integration, reliable, independent reserve verification is now live for USDe—providing a higher-frequency, programmatic alternative to traditional attestations.

Check out the Ethena PoR Dashboard.

USDe’s Proof of Reserves

The stability of USDe fundamentally depends on three critical factors:

- Collateral quality

- Delta neutrality

- Risk controls.

The newly implemented Proof of Reserves (PoR) system adds an essential transparency layer by:

- Verifying the total USD value of USDe's backing assets and reserve fund

- Confirming that reserves consist only of governance-approved assets

- Validating that the reserve coverage meets or exceeds the USDe supply

- Ensuring positions backing USDe maintain delta neutrality in USD terms

This verification process builds trust with users and the broader crypto ecosystem by providing continuous, independent confirmation that USDe maintains its stability mechanisms. This integration marks the first implementation of Chaos Labs' Proof of Reserve technology, creating valuable opportunities for the broader onchain trading market.

Exchanges can now incorporate USDe's verified PoR data into their price indexes, which could reduce USDe's haircuts when used as margin collateral. This development demonstrates how verification systems can directly enhance the utility and market positioning of synthetic dollars with transparent backing mechanisms.

Technical Implementation: How Chaos Proof of Reserves Works

The Chaos PoR solution employs a sophisticated, secure architecture to provide trustworthy verification:

1. Data Collection:

A secure enclave application queries asset balances and derivatives exposures from custodians, exchanges, and onchain sources via a proxy server using secure API connections.

2. Business Logic:

Inside the enclave, open-source code processes the incoming data, validating compliance with asset rules, reserve sufficiency, and delta neutrality—all against the current USDe supply.

3. Proof Generation & Verification:

- The enclave outputs a cryptographic proof, signed using AWS Nitro’s attestation mechanism

- Proxy-signed responses and certificate fingerprints are included for auditability

- Chaos Labs verifies and publishes the proof weekly to the Ethena PoR Dashboard

Check out the Ethena PoR Dashboard for additional details.

Chaos Labs Smart Value Recapture (SVR) Monitoring Platform

Chaos Labs is pleased to announce the launch of the Smart Value Recapture (SVR) monitoring platform, enabling granular monitoring of SVR liquidation performance within the Aave Protocol.

AVS Risk Assessment Methodology

This model quantifies maximum slashing risk, referred to here as Value at Risk (VaR), by analyzing slashing behavior across multiple node operators and AVSs. Notably, slashing one operator on a particular AVS does not guarantee that others will be slashed simultaneously, nor does slashing on one AVS imply slashing on all AVSs secured by the same operator.

Risk Less.

Know More.

Get priority access to the most powerful financial intelligence tool on the market.