Chaos Labs Smart Value Recapture (SVR) Monitoring Platform

Table of Contents

Overview

Chaos Labs is pleased to announce the launch of the Smart Value Recapture (SVR) monitoring platform, enabling granular monitoring of SVR liquidation performance within the Aave Protocol.

SVR is an oracle mechanism designed to enable DeFi protocols to capture the surplus value—known as Oracle Extractable Value (OEV)—that arises during liquidations. In typical liquidation scenarios, protocols offer a fixed liquidation bonus, which is often larger than what is necessary to incentivize liquidators. This surplus incentivizes searchers to backrun oracle price updates, creating a form of MEV (Maximal Extractable Value). SVR modifies the price update mechanism by using Dual Aggregator Price Feeds: one feed updates through the public mempool, while the other uses Flashbots MEV-Share, which allows searchers to bid for inclusion of their transactions along with the oracle update in private bundles. The winning bid is included in the block, enabling part of the MEV to be directed to the protocol rather than external parties.

This document outlines the features of the SVR monitoring platform to support effective use in navigating its underlying complexities and the implications for the Aave Protocol. For a detailed analysis of the SVR integration—including expected recapture rates and the associated tradeoffs—refer to our comprehensive report here.

Identifying SVR liquidations presents a non-trivial technical challenge, as they are indistinguishable from standard on-chain liquidations, and the associated revenue is distributed in raw, aggregated values at the block level. Leveraging our deep expertise, we developed a robust algorithm to accurately trace and attribute SVR activity, discretizing all relevant metrics at a highly granular level for each individual liquidation event. This work reinforces Chaos Labs’ position at the forefront of protocol analytics and provides meaningful transparency to the entire Aave ecosystem.

High-Level SVR Metrics

The widgets at the top of the dashboard provide a high-level overview of key aggregated metrics, including SVR profits for Aave, Chainlink and Block Builders, the average recapture rate, and associated liquidation volume and frequency statistics.

Cumulative OEV and Recapture Rate Over Time

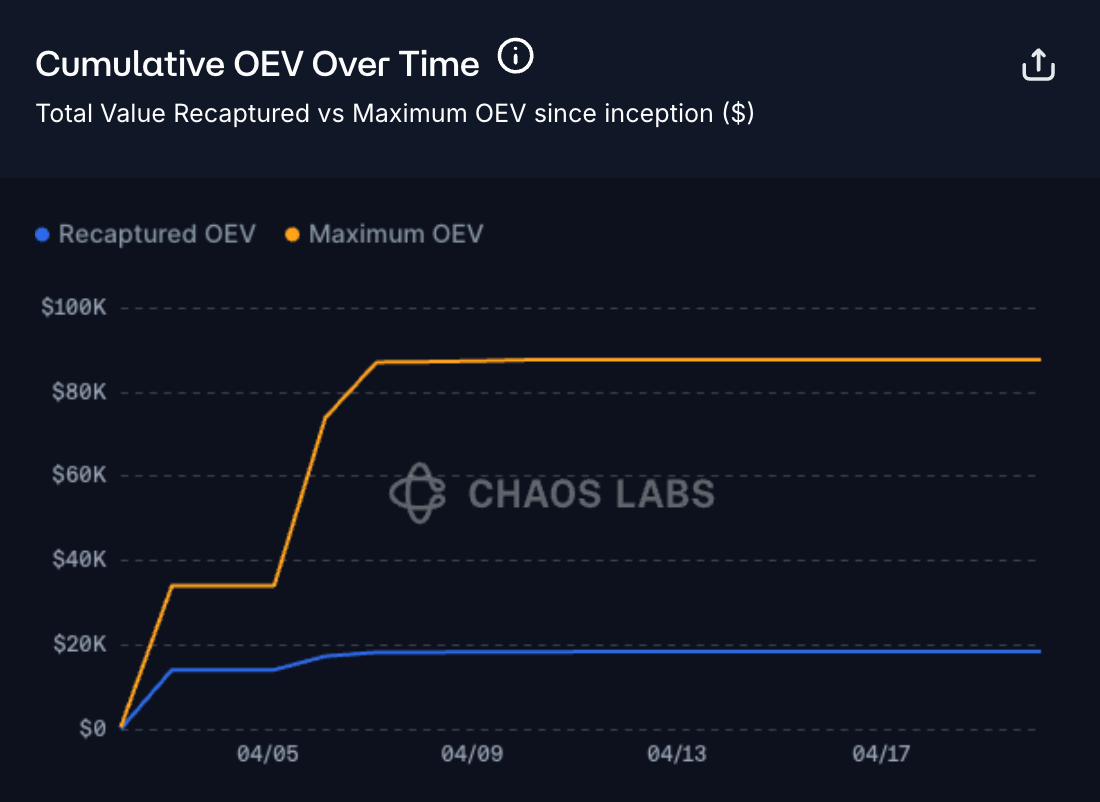

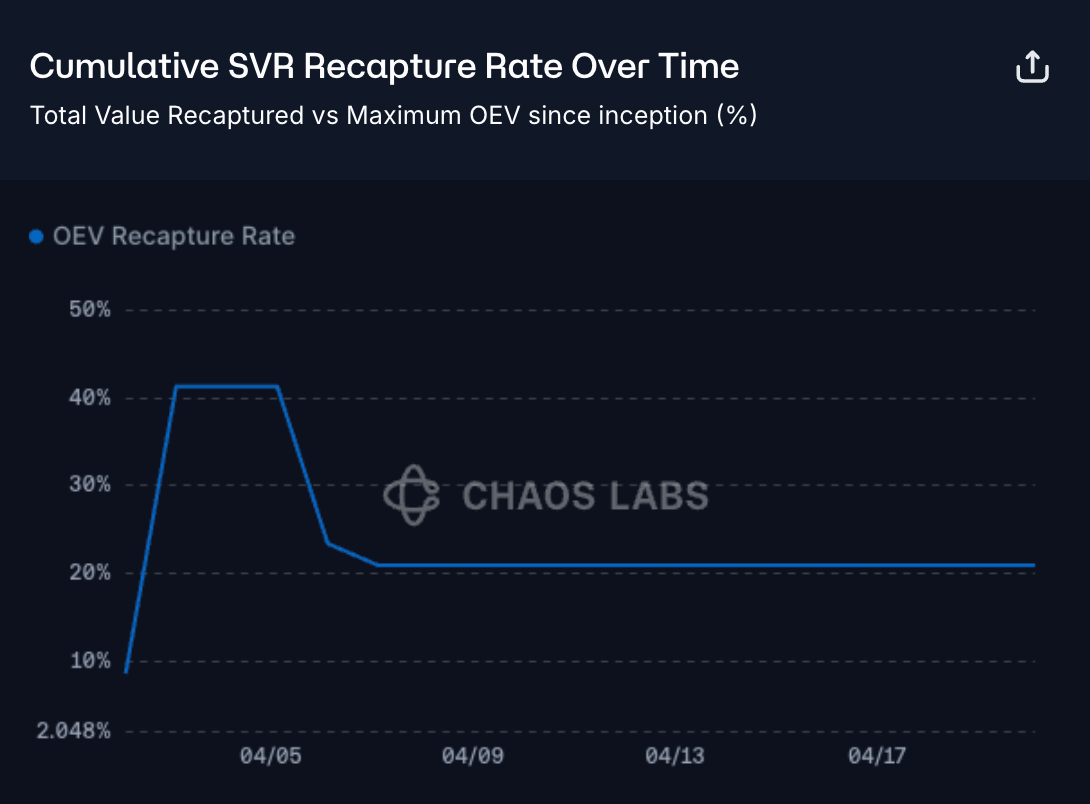

The following chart represents the cumulative OEV over time since the integration's inception. Maximum OEV represents the raw liquidation revenue extractable by searchers through back-running the SVR Oracle update, while recaptured OEV represents the cumulative amount searchers paid in the SVR auction to win the liquidation opportunity, i.e., protocol revenue. As of now, $87.6K in maximum OEV has been identified, with $18.3K accrued by the protocol.

The accompanying recapture rate chart tracks the ratio of recaptured OEV to maximum OEV over time. To date, the recapture rate has remained relatively low at only 20.9%, with the majority of value being captured by liquidators rather than the protocol. While current performance has fallen short of expectations, Aave anticipates that the competitiveness and effectiveness of the SVR auction will improve over time as more searchers integrate and the ecosystem matures.

Value Recaptured Over Time

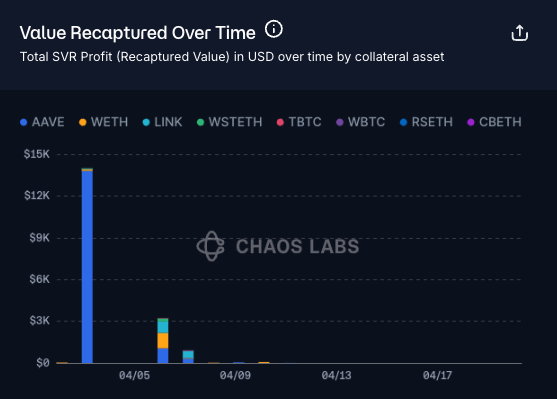

Currently, SVR feeds are whitelisted for AAVE, LINK, tBTC, and LBTC. However, liquidations involving these assets may result in the acquisition of a variety of collateral types, either due to debt appreciation triggered by oracle updates or through cross-margin positions where one of the whitelisted assets contributes to the position’s liquidation eligibility. As of April 20, the AAVE feed has been the most significant revenue source, generating approximately $15K for Aave.

This chart illustrates the daily SVR profit realized, segmented by collateral asset. The total SVR profit represents the combined revenue generated by Aave, Chainlink, and block builders. Of this total, 10% is allocated to the builder. Chainlink ultimately receives 31.5% of all liquidation fees, while Aave receives the remaining 58.5%.

Recapture Rate by Liquidation Revenue Size and Collateral Asset

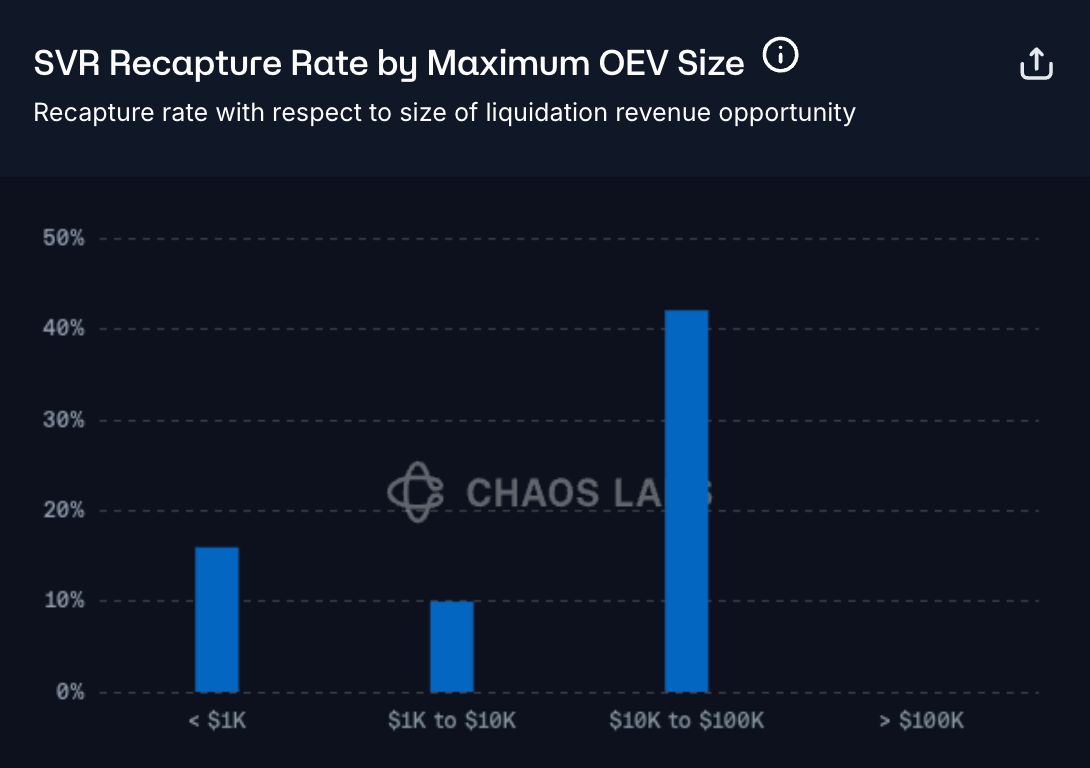

The SVR Recapture Rate by Maximum OEV Size chart illustrates the recapture rate segmented by the size of the OEV opportunity, calculated as the total recaptured OEV divided by the maximum OEV within each category. The size of an SVR liquidation—and the corresponding liquidation bonus—directly impacts the maximum OEV, with recapture rates varying due to external factors such as slippage and gas costs, which influence liquidator bidding behavior. Based on our historical backtesting presented in the full analysis, smaller OEV opportunities tend to yield lower recapture rates due to fixed gas overheads, while larger categories generally converge to similar recapture levels, albeit for different underlying reasons.

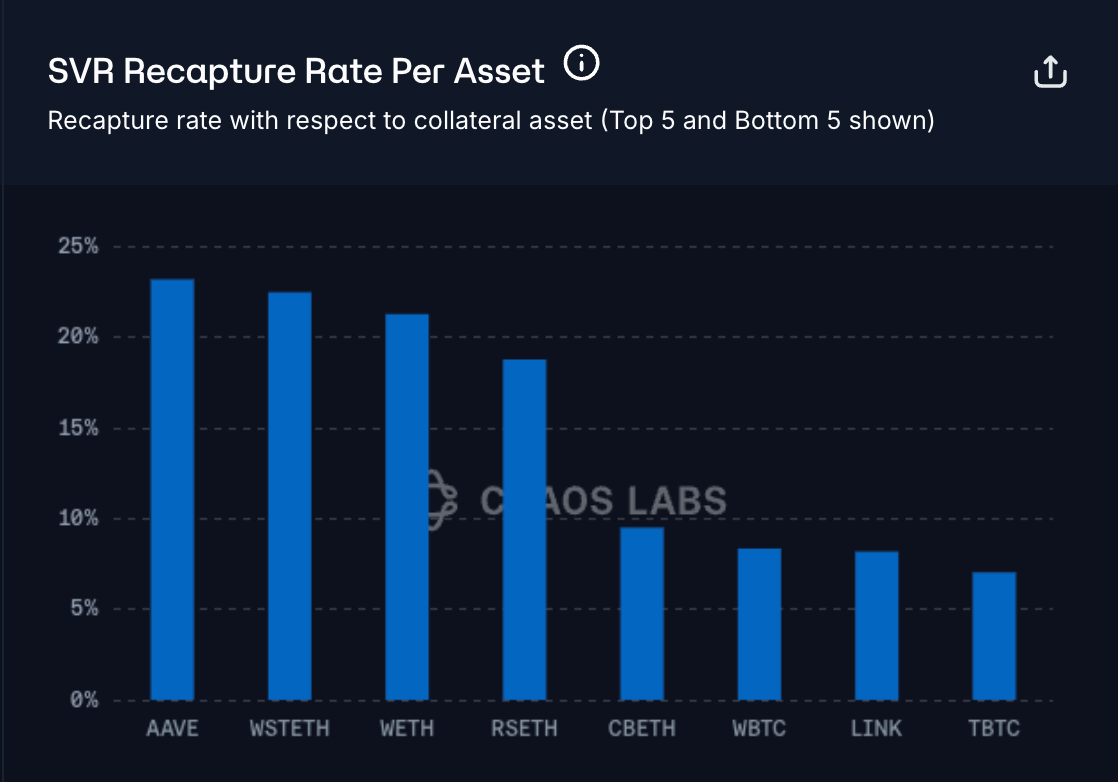

The SVR Recapture Rate Per Asset chart presents the recapture rate categorized by the collateral asset obtained, calculated as the total recaptured OEV divided by the maximum OEV for each asset. Recapture rates vary based on asset-specific factors such as oracle structure, price deviations, and market liquidity, all of which influence liquidator bidding behavior. As shown in our analysis, assets with more complex oracle mechanisms—such as those involving exchange rates (e.g., LSTs and LRTs) or pegged feeds (e.g., tBTC and cbBTC)—tend to exhibit lower recapture rates compared to simpler, more conventional oracle setups.

Events Table

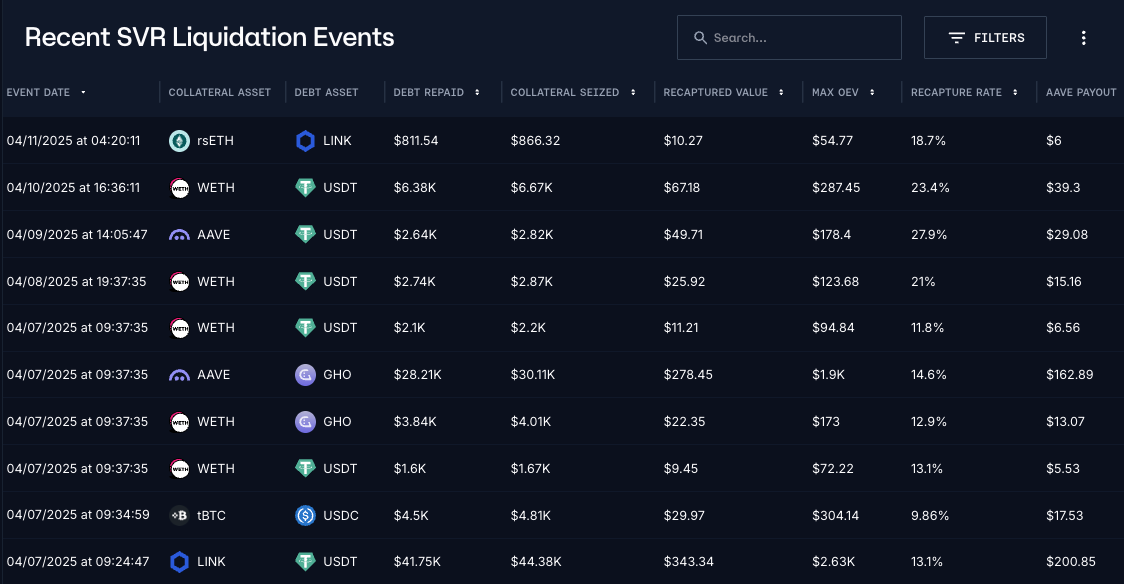

Finally, at the bottom of the page, the events table provides detailed metrics for individual SVR liquidation events, enabling close tracking of key parameters including liquidation size, OEV realized, and the share of value recaptured.

Community Feedback

The launch of the Smart Value Recapture (SVR) monitoring platform marks a key milestone in supporting the Aave community's ability to monitor and evaluate SVR liquidation performance with greater transparency and precision, as the associated on-chain SVR events otherwise remain difficult to track effectively on-chain. By offering detailed analytics and visualizations across OEV opportunities, recapture dynamics, and asset-specific trends, this platform equips risk managers with the data needed to better understand and optimize the value flow within the SVR mechanism.

We encourage the Aave community to explore the platform, track its evolution, and share feedback using the Contact Us button. Your insights are invaluable in refining the platform and maximizing its impact on the long-term efficiency and resilience of the Aave Protocol.

Introducing Pendle PT Risk Oracle

Chaos Labs has developed the Principal Token Risk Oracle, a purpose-built framework that reimagines how PTs are priced and risk-managed in DeFi protocols such as Aave. This unlocks a new paradigm of capital-efficient, resilient lending infrastructure.

Ethena Integrates Chaos Proof of Reserves

Ethena has officially integrated Chaos Proof of Reserves (PoR). With this integration, reliable, independent reserve verification is now live for USDe, providing a higher-frequency, programmatic alternative to traditional attestations.

Risk Less.

Know More.

Get priority access to the most powerful financial intelligence tool on the market.