Yield as a Risk Signal: Part III

We conclude the series with a simple question: what is the onchain risk-free rate?

1. Introduction

Previously, we argued that yield is the price paid to hold risk.

Every extra percentage point is a bundle of risks (market, liquidity, smart contract, governance, venue), alongside any temporary inefficiencies that might distort pricing. There are no exceptions to this rule.

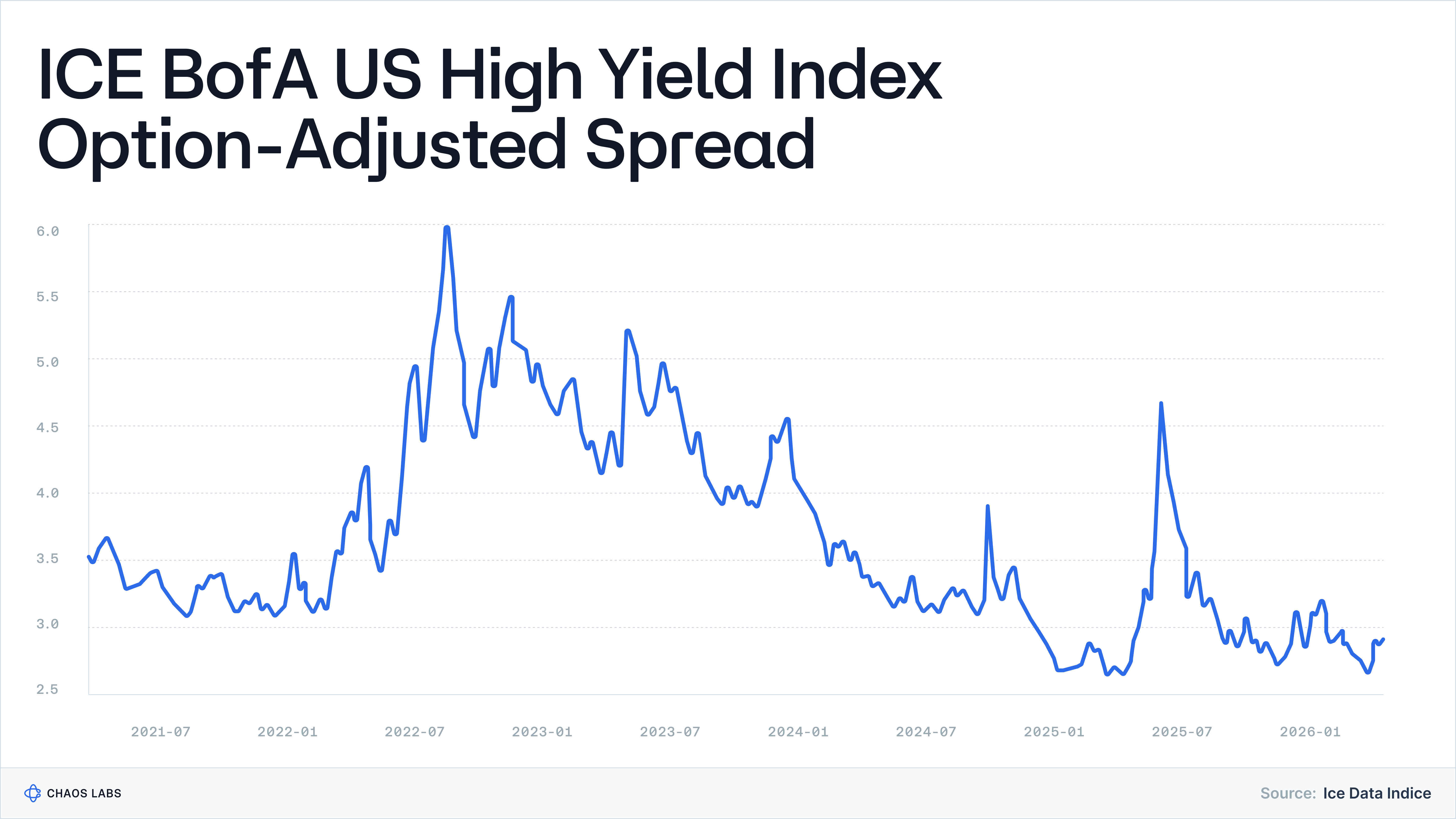

For years, this relationship has been partially blurred by altcoin token incentives and structural market inefficiencies that obscured the true risk premium embedded in onchain yield. Now, with a prolonged bear market, compounded by leaner incentive budgets, we’re seeing some yield normalization.

To be clear, distortions still exist. However, the underlying risk ladder is becoming easier to see:

- Safer venues clustered in the low/mid-single digits

- Riskier and more complex structures sitting meaningfully higher

- Synthetic cash narratives (including MM vaults) are repricing back to reality

This raises some obvious questions.

If yield is repriced risk, what is the onchain equivalent of the risk-free rate? Do we need a crypto-native benchmark, or should DeFi simply reference U.S. T-bills?

2. Why T-Bills Are Not a Sufficient Onchain Benchmark

2.1 T-Bills as the Global Risk-Free Rate

Typically, short-dated U.S. Treasury bills serve as the risk-free rate.

T-bills are backed by a sovereign issuer with taxing power, trade at scale, clear quickly, and are universally accepted as collateral. All other yields are priced as T-bills plus a spread, which compensates for additional duration, liquidity, and counterparty risk.

This system works because access to T-bills is broadly institutional, liquid, and operationally easy, i.e., capital can collapse risk instantly and rotate into T-bills without any friction.

However, crypto does not operate within this framework.

2.2 Access, KYC, and Jurisdictional Frictions

For a meaningful share of onchain users, T-bills are not realistically accessible for several reasons. These users could be:

- Trading through anonymous wallets, or

- DAOs without formal legal wrappers, or

- Entities in jurisdictions with limited access to global brokerage infra

Others might simply choose not to engage with the KYC and other documentation required to access T-bills. And for users with access to T-bills, rotating from DeFi into short-dated Treasuries requires interacting with banks, brokers, fiat rails, custody policies, cut-off windows, and, in some cases, FX conversion. Each step introduces delay, cost, operational complexity, and none of it is composable with DeFi.

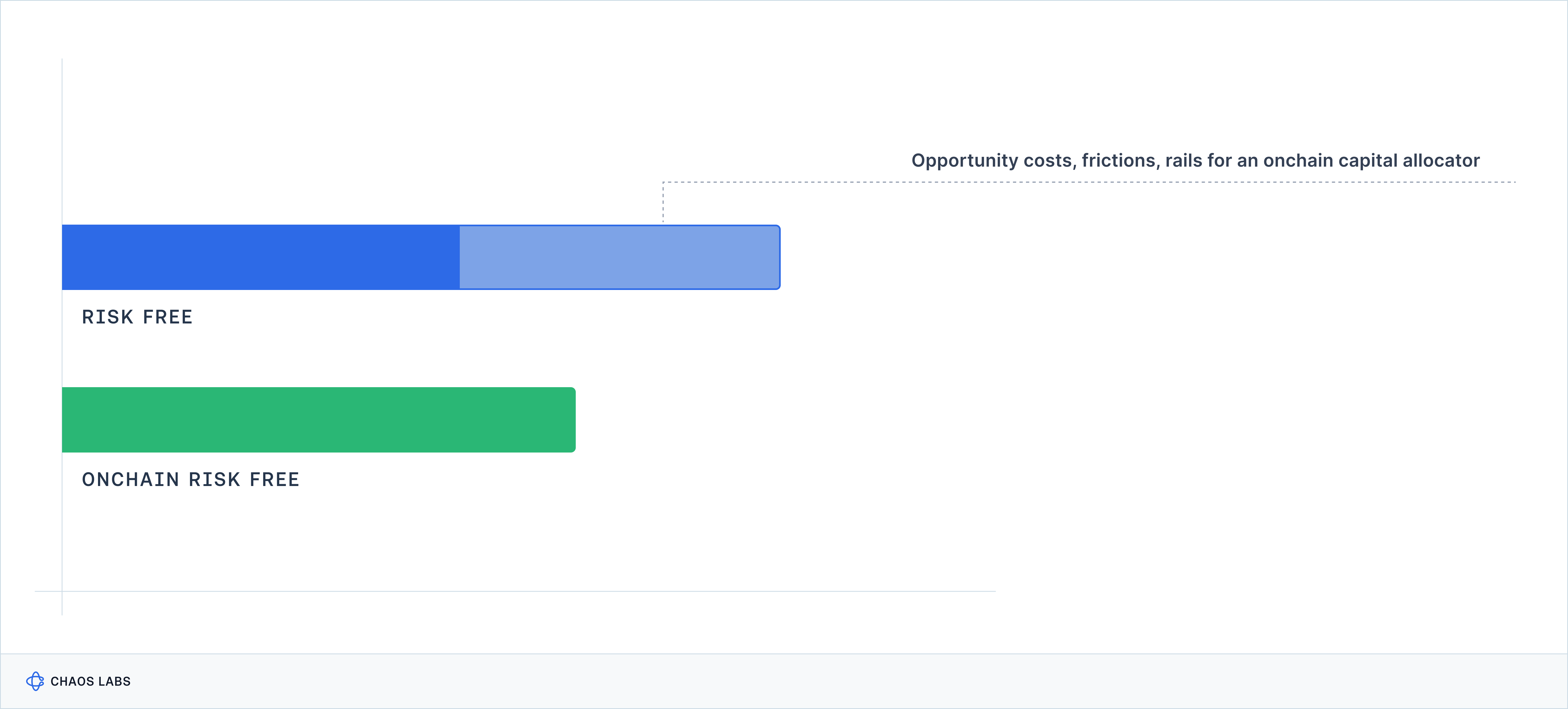

For these reasons, U.S. T-bills remain the macro risk-free rate, and a valid reference for deciding whether to deploy capital into crypto at all, but they are not the actual “go-to” alternative for most DeFi users seeking yields. If we want a meaningful benchmark for onchain yields, we need to look at assets and rates that live within the system.

2.3 Why Sub–T-Bill Yields Are Rational

Putting this together leads to a counterintuitive point: accepting a yield below T-bills is rational for most onchain users.

A KYC-less DeFi user with a realistic menu of “Aave or idle wallet” cannot, in practice, rotate into short-dated U.S. paper. A trader that prioritizes instantly reusable collateral might prefer 3-4% on an integrated onchain asset to 4-5% on a wrapped T-bill that takes days and paperwork to move. A DAO may deem the legal or operational surface of tokenized Treasuries too high relative to simply sitting in overcollateralized stables.

The search for an onchain risk-free rate is therefore not a hunt for a riskless instrument (this doesn’t exist, and less so in smart-contract systems) but for a standard, realistic benchmark: the lowest-yield, highest-liquidity primitive that permissioned and permissionless capital can use as a base case before they climb the risk ladder.

3. What “Risk-Free” Actually Means Onchain

3.1 A Benchmark, Not Zero Risk

The risk-free rate is never been truly risk free.

U.S. T-bills, as an example, carry currency risk, inflation risk, and some policy risks. What they also provide, however, is a benchmark point: the yield that large pools of capital treat as their baseline, and the bar to clear before taking on additional risk.

This is more obvious onchain, where every asset or token is packaged with smart contract and infrastructure risks. For tokens like stablecoins or RWAs, add issuer and regulatory risk on top of this base and we get a complete “risk iceberg.”

Given this context, an onchain risk-free rate is:

the safest, most liquid, most widely acceptable cash+ product that users can realistically hold inside DeFi, and against which other yields should be measured.

Everything else in the crypto stack is then “this baseline plus any additional risk premium.”

3.2 Criteria for an Onchain Risk-Free Asset

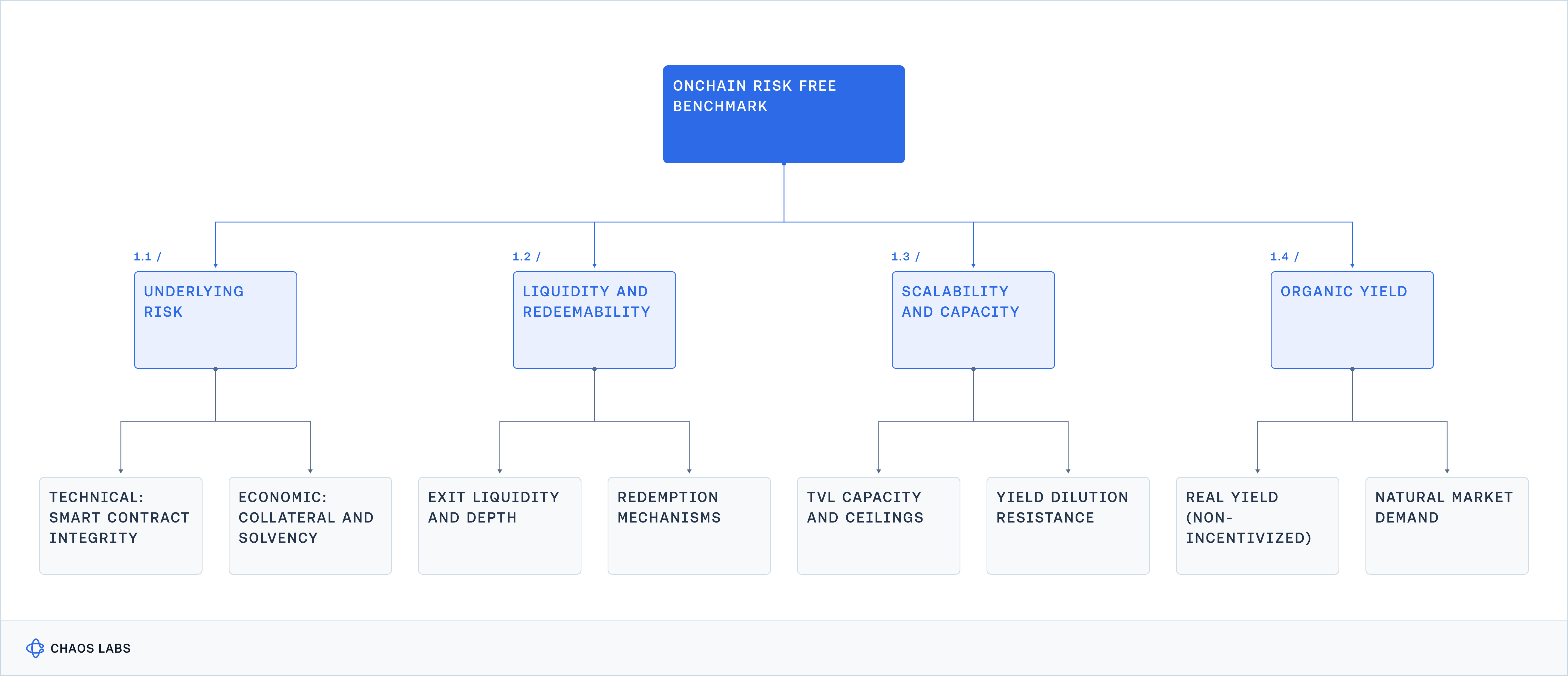

A useful benchmark needs to score well across the following four points:

Risk: the base of the curve should be anchored in something deliberately boring, with limited economic risk and limited technical fragility, which in practice means broad adoption, long production history, and multiple stress-tested regimes.

Liquidity: both in size and in time. This rate must support meaningful capital flows and remain orderly under stress; allowing exits or reallocations without any material slippage and a reasonably immediate path back into hard dollars or the reference stable. Historical stress behavior matters as much as design intent.

Scalability: a pool or venue that supports tens of millions at reasonable yields but collapses once a few hundred million arrives cannot anchor a curve. This benchmark must be capable of absorbing hundreds of millions (and eventually billions), without breaking its economics or liquidity profile.

Organic Yield: any associated yield cannot depend on temporary incentive programs or capital flows that might vanish overnight; yield should be created from structural and repeatable economic activity, i.e., not from points programs, or airdrop farming activities.

Translation: the onchain risk-free rate should be derived from the safest asset that can realistically scale to become the default parking layer for large pools of capital.

3.3 A Dual-Lane Reference Rate

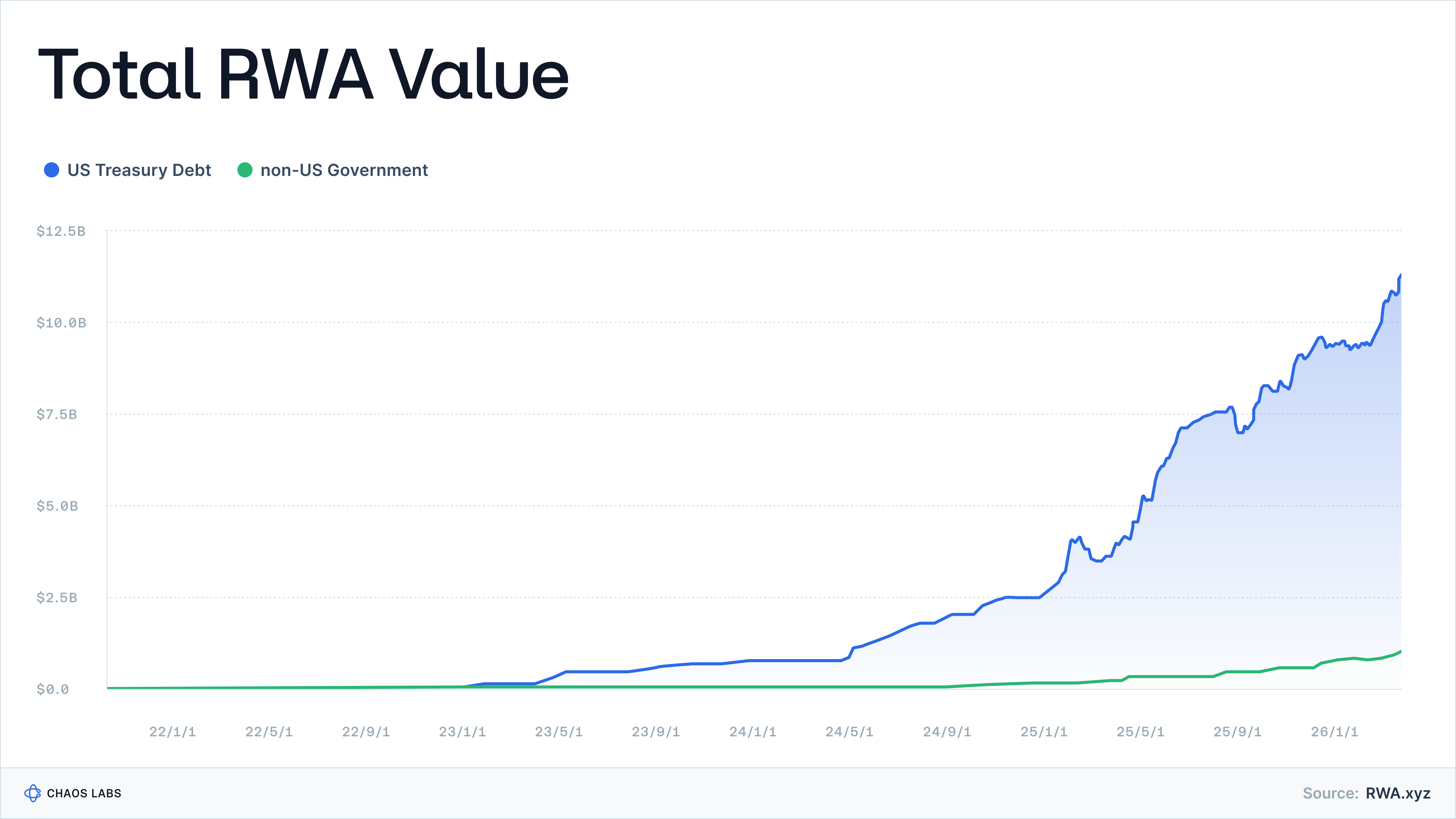

One additional layer to address: not all capital operates under the same constraints, and not all capital should share the same benchmark. Today, tokenized T-bills and money market funds such as OUSG, USDtb, VBILL, and BUIDL are live, and tokenized sovereign debt (largely U.S.) now exceeds $11B in supply.

However, even when these products sit onchain, they are not permissionless. Secondary market liquidity and borrowing against them may be open, but minting and redemption are typically KYC-gated and restricted by jurisdiction or investor status. For funds, corporates, and accredited investors, these assets are credible candidates for a permissioned onchain risk-free rate as they scale further. But they cannot serve as a universal benchmark for the broader onchain economy, since a significant portion of onchain capital cannot or will not access them directly.

So we end up with two lanes:

- A permissioned onchain risk-free lane, anchored in tokenized T-bills and regulated money market wrappers, designed for compliant capital.

- A permissionless onchain risk-free lane, anchored in the safest, most liquid primitives for use and deployment across the DeFi stack.

4. Onchain Candidate Benchmarks

4.1 The Permissioned Lane: Tokenized T-Bills and RWA

One of the most natural onchain risk-free rate candidates is the tokenized version of what traditional finance already treats as risk-free: short-dated U.S. Treasuries and money market funds.

Products such as OUSG, USDtb, VBILL, BUIDL and similar wrappers follow a similar structure. A regulated issuer holds short-term U.S. government paper or equivalent money market instruments and issues a token that tracks its NAV. Economically, this is the closest approximation to wiring your cash into a T-bill ladder while remaining on crypto rails.

The strengths are obvious: asset quality is extremely high, duration is short, and the underlying markets are deep and mature. As AUM scales, these wrappers will naturally anchor the permissioned side of the onchain curve. For funds, corporates and KYC’d capital, “risk-free onchain” increasingly means whatever the tokenized T-bill complex is yielding.

But there are trade-offs:

- Access is gated by design. Mint/redemptions are KYC-bound and restricted by jurisdiction.

- Composability is partial. These tokens can serve as collateral in selected venues, but they are not universal substitutes for USDC across money markets and perps.

- Wrapper risk remains. Exposure runs not only to the U.S. government, but also to a specific issuer, its custodian, its legal framework, and its operational stack.

For a large part of DeFi, these constraints are not minor trade-offs.

While tokenized T-bills form a strong permissioned risk-free lane, they do not solve for a universal onchain benchmark. An appropriate base rate must reflect a realistic option available to capital operating within the system. If a significant share of that capital cannot access, mint, redeem, or freely deploy the asset, it cannot serve as a true base rate.

4.2 The Permissionless Lane: Native Cash Primitives

On the permissionless side, the benchmark should be different.

It has to be an asset that anyone can hold, that behaves like money across DeFi, and that satisfies the criteria outlined earlier: low underlying risk, deep liquidity, meaningful capacity, and structurally generated yield.

First, we need to exclude rates that do not meet the benchmark criteria.

Basis products such as sUSDe, even in senior configurations, basis-trade wrappers, perp MM vaults, or JLP all sit one rung above any reasonable definition of risk-free. Their yields are structurally higher because they embed funding exposure, active market-making, venue risk, liquidation mechanics, or direct market beta. Parts 1 and 2 showed this clearly:

- MM vaults have experienced 5-10% drawdowns and multi-month underwater periods

- JLP carries spot exposure to SOL, ETH, and BTC with trader PnL layered on top

- Delta-hedged synthetic dollars depend on perp venue stability and funding regimes remaining orderly

These are all legitimate strategies, and for the right degen, attractive ones. However, they are not baseline cash equivalents and cannot anchor a risk-free curve.

The most credible permissionless candidate today is Aave v3 USDC on Ethereum Mainnet.

USDC remains one of the most widely accepted base assets in DeFi, and Aave’s money markets are among the most battle-tested onchain. USDC and USDT reserves routinely maintain hundreds of millions in available liquidity, including during stress events such as October 10, while processing multi-billion-dollar outflows and rebalancing without any structural failures. Economically, the exposure is primarily smart contract and protocol risk, with limited incremental economic risk beyond the underlying stablecoin. In exchange, users receive a relatively smooth, low single-digit lending rate and immediate, permissionless entry and exit.

A second, more theoretical candidate is the Uniswap v3 USDC/USDT 0.01% on Ethereum.

In theory, a deep stable-stable pool resembles a pure money market: minimal directional exposure if pegs hold, fee income from stablecoin flow, and substantial secondary liquidity. In practice, two constraints undermine its role as a benchmark:

- Capacity is limited: At current TVL, yields are already compressed, and meaningful incremental capital would push fee APR toward negligible levels

- Operational complexity: Concentrated liquidity requires active management and exposes LPs to idiosyncratic risks. USDC and USDT are subject to periodic micro-depegs and structural imbalances driven by exchange flows and demand.

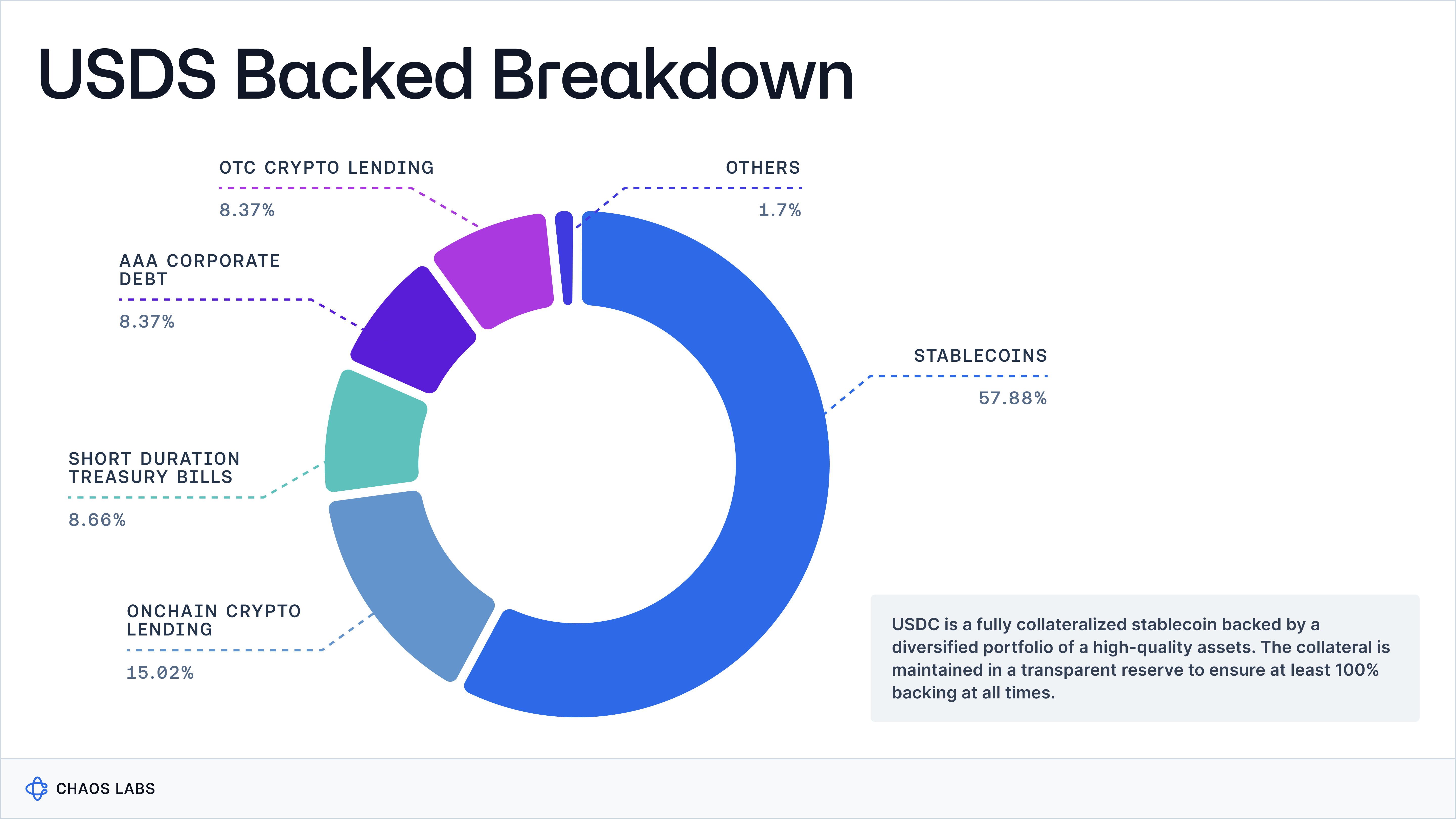

Another strong candidate is sDAI/sUSDS. USDS (and previously DAI) has functioned as a core collateral across most of DeFi, enabling leverage and liquidity. However, a CDP-backed system is structurally more complex than a pure lending market. Collateral composition has evolved over time, and sUSDS today reflects a blend of digital assets, OTC lending, corporate credit, and Treasury exposure. The result is a diversified credit basket rather than a narrow, low-risk base asset. Add standard smart contract and governance risks, and the profile shifts further away from a clean benchmark.

Bottom line: the permissionless lane currently points to Aave v3 USDC on Ethereum as the practical hard floor. Other assets, including RWA-backed stables such as sUSDS, may sit incrementally above that floor depending on their structure, behavior under stress, and market adoption. But as a working definition of the onchain risk-free rate for permissionless capital, Aave USDC remains the most defensible reference point today.

5. Conclusion

Yes, three articles later and the answer is "just use Aave USDC." However, the framework matters more than the output.

In Parts 1 and 2, that meant removing structured yield vaults from the "cash" category and placing them in the risk-asset tier where they belong. In this piece, we reversed the perspective and asked what the risk-free baseline should be. We also determined what a realistic onchain risk-free yield should provide. Once you apply that lens, we see a dual picture:

- A permissioned RF lane, anchored in tokenized T-bills and money-market wrappers, for KYC'd and institutional capital

- A permissionless RF lane, with Aave v3 Ethereum USDC as the hard floor

Everything else (tokenized basis, MM vaults, RWA baskets, structured products) should be read as: onchain RF + spread

We may never converge on a single universal onchain risk-free asset. What we can converge on is the need for clear benchmarks for each segment of capital, and the discipline to treat every basis point above them as compensation for risk.

Risk Less.

Know More.

Get priority access to the most powerful financial intelligence tool on the market.