XAUT0 Mechanism Design Review

Disclaimer

This document is purely informational and does not constitute an invitation to acquire any security, an appeal for any purchase or sale, or an endorsement of any financial instrument. Neither is it an assertion of the provision of investment consultancy or other services by Chaos Labs Inc. References to specific securities should not be perceived as recommendations for any transaction, including buying, selling, or retaining such securities. Nothing herein should be regarded as a solicitation or offer to negotiate any security, future, option, or other financial instrument or to extend any investment advice or service to any entity in any jurisdiction. The contents of this document should not be interpreted as offering investment advice or presenting any opinion on the viability of any security, and any advice to purchase, dispose of, or maintain any security in this report should not be acted upon. The information contained in this document should not form the basis for making investment decisions. While preparing the information presented in this report, we have not considered individual investors’ specific investment requirements, objectives, and financial situations. This information does not account for the particular investment goals, financial status, and individual requirements of the recipient of this information, and the investments discussed may not be suitable for all investors. We prepared any views presented in this report based on the information available when these views were written. Additional or modified information could cause these views to change. All information is subject to possible rectification. Information may rapidly become unreliable, including market or economic changes.

Summary

Between 18 and 29 August 2025 Chaos Labs conducted an intensive risk assessment of XAU₮0, an innovative, natively cross-chain interoperable digital token, backed by physical gold reserves. Cross-chain XAU₮0 is 1:1 backed by XAUT on Ethereum.

XAU₮0 is a technical breakthrough in physical gold-backed digital token design, offering a range of benefits to users, blockchain ecosystems, and exchanges. Its innovative native cross-chain transfer mechanism enables broader DeFi access without reliance on separate bridges or fragmented liquidity pools.

Blockchains wanting XAU₮0 are able to connect effortlessly with leading blockchain networks, driving capital inflows and expanding cross-chain functionality to foster growth.

Introduction

This report will comprehensively review all relevant risk factors of XAU₮0. Our approach involves both quantitative and qualitative analysis to help users, integrators, or other stakeholders better understand the token’s risks.

At Chaos Labs, our approach to reviewing XAU₮0 covers the following risk areas:

- Solvency Risks: Risks that could permanently impair the backing and, therefore, the solvency of XAU₮0 as a token backed 1:1 by XAUT.

- Liquidity Risks: Risks associated with the ability to enter and exit XAU₮0 as expected.

- External Dependencies: We highlight and investigate any external dependencies such as oracles, rights to update protocol functioning, etc.

Each of these risk categories will be covered separately. We discuss all relevant risks investigated, identifying mitigants where applicable to give a clear picture of which scenarios are potentially harmful and which are not.

XAU₮0 Overview

XAU₮0 establishes a unified gold standard by ensuring consistent and reliable representation of Tether Gold across all supported blockchain networks. This approach eliminates the fragmentation issues that typically arise when competing or unofficial gold tokens operate within the same ecosystem, creating a more cohesive and trustworthy gold-backed digital asset environment.

It incorporates comprehensive compliance capabilities, including address blacklisting and freezing functionality, enabling blockchain networks to fulfill regulatory obligations and respond appropriately to legal enforcement requirements when necessary.

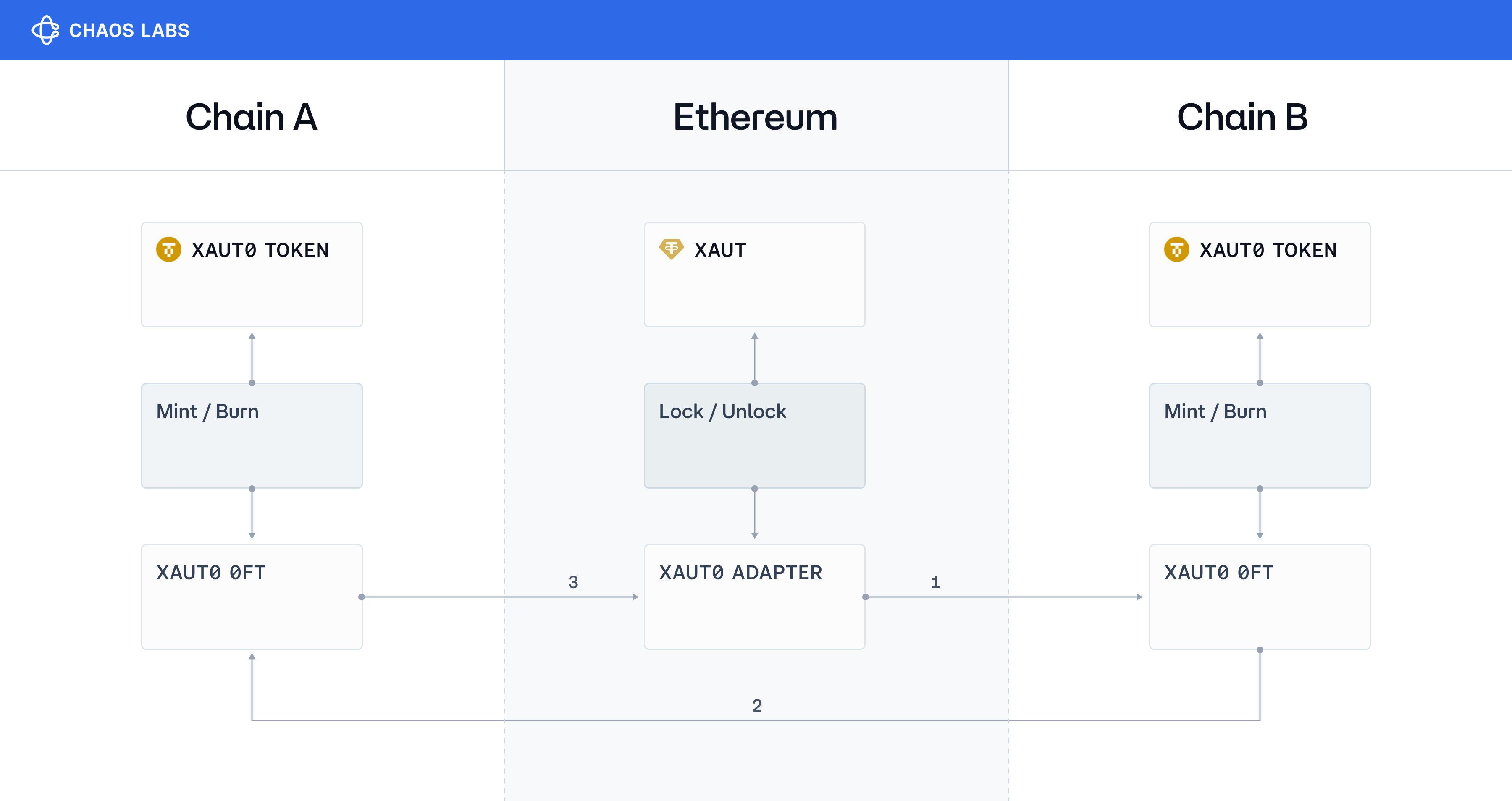

XAU₮0 is backed 1:1 by XAUT on Ethereum, held in a non-custodial smart contract system operated independently of Tether. Upon receipt of locked XAUT, XAU₮0 is then minted on any supported chain with the message carried using LayerZero’s Omnichain Fungible Token (OFT) standard. This approach effectively hard-pegs XAU₮0 to XAUT on Ethereum in a fully non-custodial manner.

Unlike traditional multi-chain XAUT deployments—where each blockchain maintains its own isolated version—XAU₮0 enables continuous liquidity and interoperability. By leveraging LayerZero’s OFT standard, it transforms XAUT into a unified, cross-chain asset without fragmentation.

Launched on June 12, 2025, XAU₮0 has grown to approximately $4.4 million in value as of August 26, 2025.

XAU₮0 is fully non-custodial in that its reserves are not held by any legal entity but rather in the OAdapterUpgradeable Contract on Ethereum.

XAUT

Each Tether Gold token (XAUT) provides digital access to one troy ounce of physical gold held in secure Swiss storage facilities. This innovative approach combines gold's time-tested value preservation properties with the efficiency and accessibility of blockchain infrastructure.

XAUT offers both individual and institutional investors a streamlined way to gain exposure to gold without the complexities of physical handling, secure storage arrangements, or insurance considerations. By tokenizing gold ownership, it creates a modern alternative that maintains the fundamental benefits of precious metal investment while leveraging digital asset capabilities for enhanced liquidity and transferability.

A differentiating factor for XAUT relative to other tokenized gold protocols is that XAUT is redeemable for physical gold bars in Switzerland.

XAU₮0 Mechanics

XAU₮0 is an Omnichain Fungible Token (OFT) standard token that enables XAU₮0 to move seamlessly across multiple blockchains using LayerZero's messaging protocol.

Minting and Redemption Mechanism

XAU₮0 is minted by depositing XAUT into the OAdapterUpgradeable Contract on Ethereum. A message is then routed via the LayerZero protocol to the destination chain to mint XAU₮0 to the specified address.

Redemptions are handled with the opposite flow. A withdrawal request is submitted on a chain supporting XAU₮0, and XAU₮0 is burnt in exchange for an equivalent amount of XAUT released from the OAdapterUpgradeable Contract on Ethereum.

LayerZero DVN and USD₮0s DVN validate every mint and redeem transaction to ensure compliance with XAU₮0's rules and maintain full collateralization at all times. This provides another mitigation against exploitation. For more details on the verification process, see the section on the XAU₮0 DVN below.

Backing

XAU₮0 is fully backed by XAUT on Ethereum, held in its OAdapterUpgradeable Contract. Reserves are viewable on the chain, providing transparency that the underlying XAUT fully backs XAU₮0, and DVN checks ensure that the contract avoids exploits.

The contract operates as an upgradeable proxy, managed by Everdawn Labs to ensure XAU₮0 remains adaptable to evolving blockchain technologies. This design enables seamless interoperability, expands functionality, and supports smart contract upgrades to align with the latest industry standards. By taking this approach, XAU₮0 remains scalable, efficient, and relevant in a rapidly evolving ecosystem.

Cross Chain Transfers

As an OFT, XAU₮0 enables native cross-chain transfers without the need for external bridges or wrapping. This is accomplished by locking or unlocking XAU₮0 on the source chain and minting or burning an equivalent amount on the destination chain for each transaction.

XAU₮0 cross-chain transfers using LayerZero incur zero slippage, as the exact amount sent is locked or burned on the source chain and minted on the destination chain.

A more detailed discussion of the OFT messaging protocol is included below.

Native cross-chain transfers establish a seamless liquidity layer, enabling swift XAU₮0 transfers between integrated chains without relying on third-party bridges. This streamlines the user experience for various stablecoin stakeholders. By eliminating the need for intermediary bridges or wrapped assets, the OFT standard reduces complexity and operational overhead.

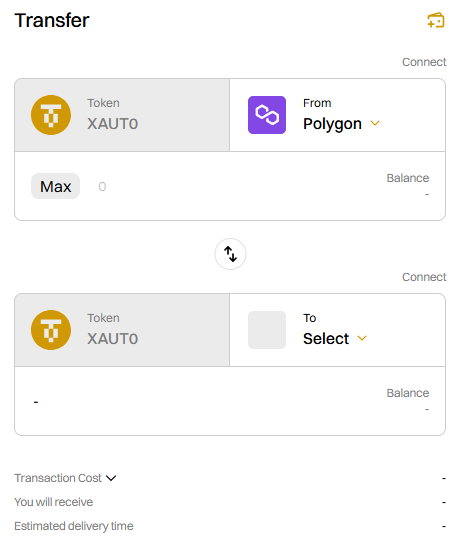

The native cross-chain XAU₮0 liquidity layer allows native cross-chain transfers. gold.usdt0.to provides a user interface to transfer to any address on any connected chain.

The Omnichain Fungible Token (OFT) standard

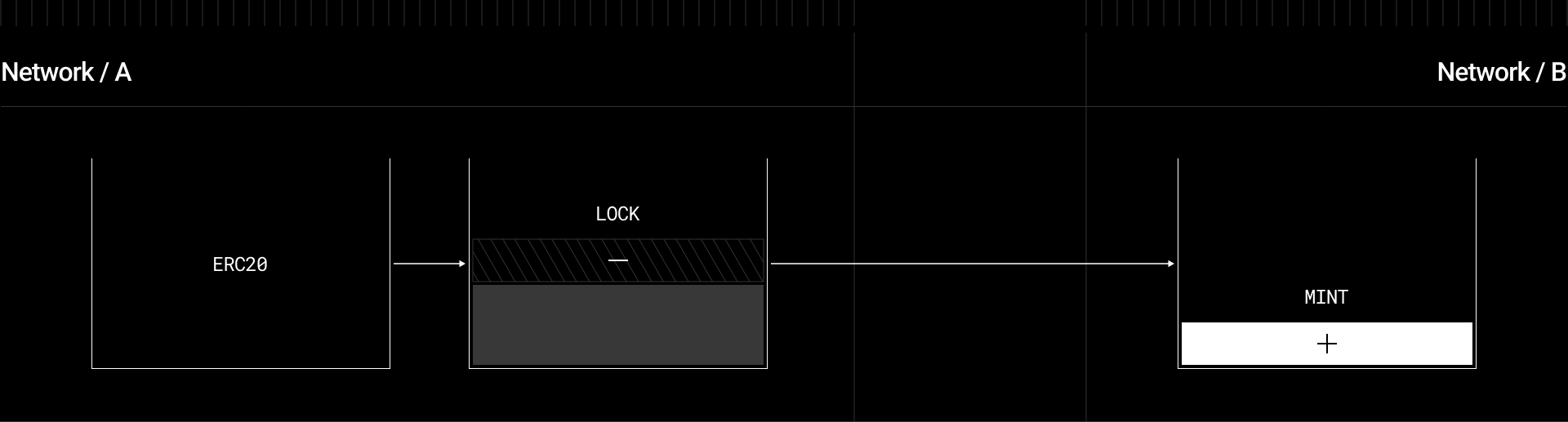

The Omnichain Fungible Token (OFT) Standard allows fungible tokens to be transferred across multiple blockchains without asset wrapping, middlechains, or liquidity pools.

This standard works by burning tokens on the source chain whenever an omnichain transfer is initiated, sending a message via the protocol and delivering a function call to the destination contract to mint the same number of tokens burned, creating a unified supply across both networks.

Using this design pattern, LayerZero can extend any fungible token to interoperate with other chains using the protocol. The most widely used of these standards is OFT.sol, an extension of the OApp Contract Standard and the ERC20 Token Standard.

OFT Adapter works as an intermediary contract that handles sending and receiving deployed fungible tokens. For example, when transferring an ERC20 from the source chain (Chain A), the token will lock in the OFT Adapter, triggering a new token to mint on the destination chain (Chain B) via the peer OFT.

The LayerZero Omnichain Fungible Token (OFT) messaging process enables the seamless transfer of fungible tokens across multiple blockchains without wrapping or middlechains. Below is a detailed breakdown of the process:

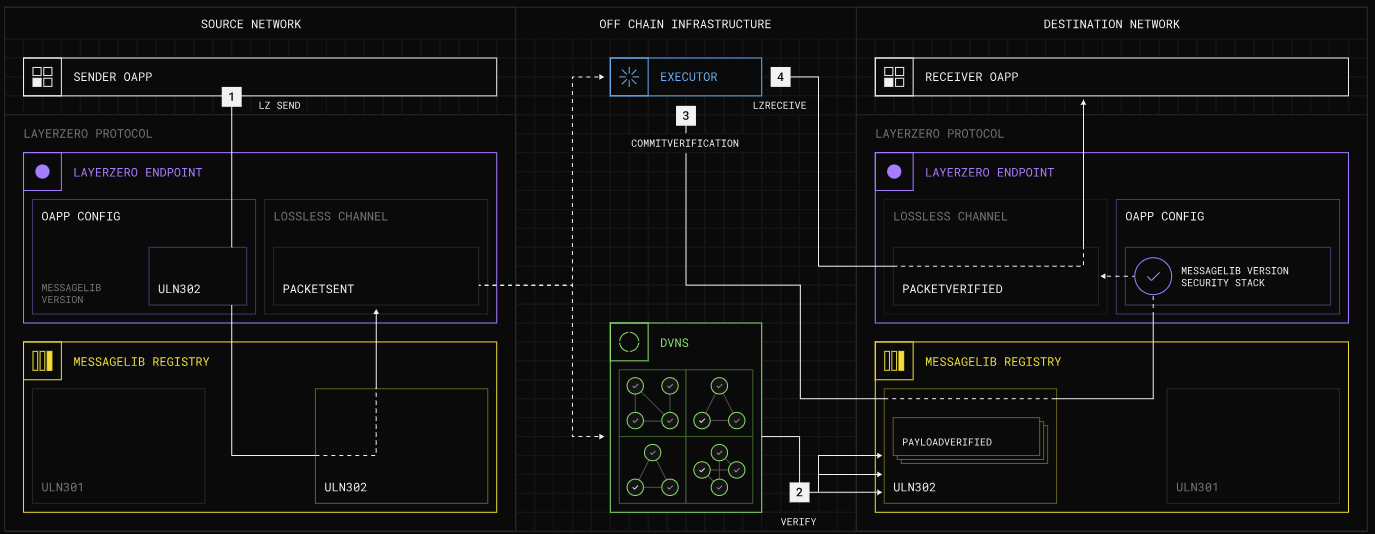

1. Sending the Message

- Sender Contract (Onchain/Source): The process begins when a user calls the

lzSendmethod on the Sender OApp (Omnichain Application) Contract. This method specifies: - LayerZero Endpoint (Onchain/Source): The source Endpoint generates a packet containing the Sender OApp’s message data. Each packet is assigned a unique, sequential nonce for identification. The Endpoint then encodes the packet using the OApp’s specified

MessageLiband emits it to the Security Stack and Executor, completing the send transaction.

2. Verifying the Message

- Decentralized Verifier Networks (DVNs) (Offchain): DVNs independently verify the message using unique methods. Only DVNs configured by the OApp can submit verifications, ensuring security and preventing unauthorized modifications.

3. Committing Verification

- Message Library (Onchain/Destination): Once all DVNs in the Security Stack verify the message, the destination

MessageLibmarks it as verifiable. - Executor (Offchain): The Executor commits this verification to the destination Endpoint, staging it for execution.

4. Receiving and Processing

- LayerZero Endpoint (Onchain/Destination): The destination Endpoint ensures that the packet delivered by the Executor matches what was verified by the DVNs. This step guarantees message integrity.

- Executor (Offchain): The Executor calls the

lzReceivefunction on the committed message, triggering its processing by the Receiver OApp logic. - Receiver Contract (Onchain/Destination): Finally, the Receiver OApp Contract processes and receives the message on the destination chain, completing the transfer.

OFT-Specific Logic

For token transfers using OFT:

- On the source chain, tokens are either burned (

_burn) or locked (_lock) viaOFT.sol. A message is sent to LayerZero, which triggers a function call on the destination chain to mint (_mint) or unlock (_unlock) an equivalent amount of tokens. - This creates a unified token supply across all supported chains without requiring asset wrapping or middlechains.

Decentralized Verifier Networks (DVNs)

The XAU₮0 DVNs represent the entities responsible for verifying messages sent across chains by XAU₮0 users.

XAU₮0 utilizes a dual-DVN security configuration requiring verification from:

- LayerZero DVN

- USD₮0 DVN

Both DVNs must verify the payloadHash before a cross-chain message can be committed for execution. This setup ensures enhanced security through independent verification of all cross-chain transfers.

XAU₮0 is built using the LayerZero interoperability stack. This allows XAU₮0 to configure a security stack comprised of a number of required and optional Decentralized Verifier Networks (DVNs) to check the payloadHash emitted for message integrity, specifying an optional threshold for when a message nonce can be committed as Verified.

Each individual DVN checks messages using its own verification schema to determine the integrity of the payloadHash before verifying it in the destination chain's MessageLib.

When both the required DVNs and a threshold of optional DVNs agree on the payloadHash, the message nonce can then be committed to the destination Endpoint's messaging channel for execution by any caller (e.g., Executor).

XAU₮0 Use Cases

What XAU₮0 Enables

XAU₮0 represents a breakthrough in cross-chain asset management, delivering a non-custodial, omnichain liquidity protocol that revolutionizes how XAUT operates across blockchain networks. By eliminating the need for new token issuances, wrapped assets, or fragmented liquidity pools, XAU₮0 creates a unified ecosystem that benefits users, blockchain networks, and exchanges alike.

Seamless Multi-Chain Experience

The protocol transforms the user experience by enabling native cross-chain asset movement without traditional bridging mechanisms. Users can effortlessly transfer assets between blockchain networks while accessing an expanded universe of decentralized finance applications and opportunities. This native interoperability opens doors to previously inaccessible financial services across diverse blockchain ecosystems.

A key architectural advantage distinguishes XAU₮0 from USD₮0: while USD₮0 requires a Legacy Mesh to accommodate existing native USDT deployments, XAU₮0 operates through a unified OFT (Omnichain Fungible Token) liquidity meshr across all supported chains. This creates a consistent, streamlined cross-chain experience from the ground up.

Enhanced Security Through Unified Standards

Security and trust receive significant reinforcement through XAU₮0's unified framework, which maintains consistent standards across every supported blockchain. This standardization builds user confidence by delivering a familiar, secure environment regardless of the underlying network. By removing dependence on third-party bridging solutions, the protocol simultaneously reduces user risk exposure while elevating the overall user experience.

Benefits for Integrating Chains

Blockchain networks gain substantial advantages from XAU₮0's innovative architecture. The protocol offers flexible ownership models that allow networks to seamlessly integrate XAU₮0 while maintaining the option for smooth contract ownership transitions to Tether when required. Advanced compliance tools are built into the framework, helping networks meet regulatory obligations and efficiently manage law enforcement requests.

The protocol's upgradable design intelligently separates token functionality from cross-chain messaging infrastructure, creating a future-proof solution that adapts to emerging blockchain technologies and evolving industry standards. Fast settlement capabilities reduce transaction processing times, supporting low-latency applications that demand quick execution.

XAU₮0 enhances ecosystem interoperability by enabling immediate, seamless interactions between different blockchain networks without additional configuration. The streamlined integration process significantly simplifies adoption, allowing networks to incorporate XAU₮0 into existing infrastructure with minimal complexity.

Benefits for Exchanges

Cryptocurrency exchanges benefit tremendously from XAU₮0's comprehensive capabilities. The protocol's native multichain support enables exchanges to process transactions across various blockchain networks without requiring extensive infrastructure modifications or custom solutions.

Cross-chain transaction complexity diminishes dramatically, leading to more efficient liquidity management and empowering exchanges to deliver seamless experiences to their users. Fast Ethereum redemption capabilities ensure users can quickly convert tokens back to Ethereum-based assets when needed.

The integration process mirrors standard ERC-20 token implementation, minimizing technical complexity and reducing operational costs associated with supporting new digital assets. This familiar integration pattern accelerates deployment timelines and reduces development overhead.

XAU₮0 Risks

Solvency Risks

Solvency risks for a pegged token like XAU₮0 arise when backing reserves become insufficient to cover the total supply. This can occur in two scenarios:

- Minting new XAU₮0 without locking an equivalent amount of XAUT.

- Redeeming XAU₮0 for more XAUT than is available in reserves.

However, the LayerZero protocol is specifically designed to mitigate these risks through two built-in safeguards, both of which must be breached simultaneously for a solvency issue to arise:

- Dual DVN Verification: Every mint or redemption request must be approved by both DVN verifiers. These verifiers ensure that any transaction leading to undercollateralization is blocked before execution.

- LayerZero Endpoint Validation: The protocol’s immutable endpoints verify all messages—including minting and redemption requests—to ensure strict adherence to the locking/releasing mechanism rules. Immutability ensures no external dependencies in this process.

Based on this design, we conclude that XAU₮0’s solvency safeguards are robust, minimizing the risk of undercollateralization in its current state.

Liquidity Risks

Liquidity risks for a stablecoin emerge when it temporarily cannot be exchanged at its par value. We assess both scenarios: instances where XAU₮0 is unable to redeem at par in its primary market and situations where it experiences a depeg in secondary on-chain DEX markets.

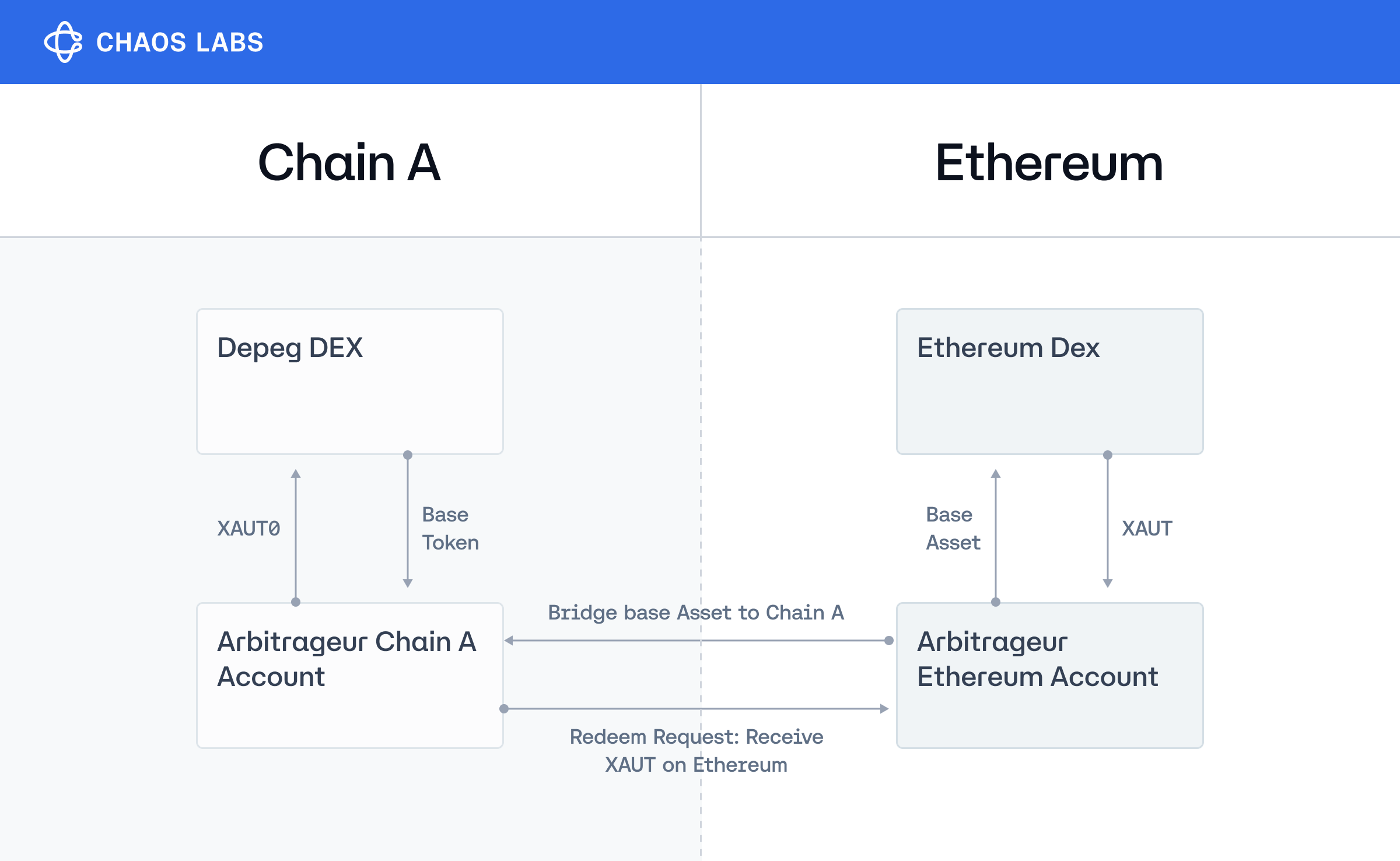

We find that the XAU₮0 liquidity layer, reduces arbitrage frictions in cases of price deviations. This likely leads to tighter peg stability and lower liquidity risk across networks.

Native cross-chain transactions create a unified liquidity layer for XAU₮0. This reduces the capital requirements needed to arbitrage any difference between the price of XAU₮0 and XAUT:

- Arbitrageurs do not need to hold XAU₮0 or XAUT balances on all active chains as in any case of a deviation in price above XAUT, XAU₮0 can be seamlessly transferred from another chain and sold on the venue with the price deviation, repegging the price.

- XAU₮0 can be natively redeemed on any chain for XAUT on Ethereum.

External Dependencies

As a fully non-custodial stable token solution, XAU₮0 operates with minimal off-chain dependencies. Its streamlined design relies on only two external components:

XAUT

XAU₮0 is fully backed by XAUT on Ethereum. A comprehensive analysis of Tether Gold is beyond the scope of this piece, but given XAU₮0’s reliance on XAUT, any significant changes in XAUT’s design, redemption mechanisms, or market behavior will influence the performance and usage of XAU₮0. As such, the integrity of XAU₮0 is directly linked to the continued trust and stability of XAUT itself.

XAUT is an upgradable contract controlled by the Tether multisig. While it has blacklist functionality, this is not likely to affect XAU₮0 in any way.

LayerZero

LayerZero powers the mint-redemption process and cross-chain transfers of XAU₮0. Endpoints on the source and destination chains process requests to transfer, mint, or redeem XAU₮0.

LayerZero separates data delivery (DVNs) from proof submission (relays), ensuring:

- No single entity controls transaction validation.

- Cryptographic proofs are independently verified against block headers.

- Modular security allows integration with decentralized verifier networks (DVNs) for additional checks

- LayerZero is immutable, providing a pureley technical solution with no external dependencies or risk vectors.

Cross-chain messages are first checked by the two DVNs before being verified by the receiving immutable endpoint to ensure compliance. Only verified messages are processed, providing comfort that the system cannot be corrupted.

XAU₮0 Operations

XAU₮0 Issuer

XAU₮0 is a non-custodial stablecoin, meaning it has no centralized issuer managing reserves. Its smart contracts are owned by a 3 of 5 multisig, ensuring a future-proof design and long-term reliability.

XAU₮0 Terms of Service

There are minimal terms of service publicly available related to XAU₮0. Chaos Labs could only find a list of prohibited activities Everdawn Labs agrees not to engage in, and a clear statement that Everdawn is not registered with the Financial Crimes Enforcement Network as a money services business or in any other capacity.

As a non-custodial stablecoin it is clearly stated that: “Everdawn Labs does not broker trading orders on your behalf, match orders for buyers and sellers of securities, nor do we collect or earn fees from your trades on the Protocol. We also do not facilitate the execution or settlement of your trades, which occur entirely on the public distributed blockchains.”

Conclusion

Chaos Labs recognizes XAU₮0 as a breakthrough in stablecoin infrastructure, assessing it as economically secure with minimal risk exposure.

The robust LayerZero OFT lock and mint mechanism, reinforced by DVN security, ensures stringent solvency checks, maintaining USD₮0’s 1:1 backing with XAUT.

By leveraging a shared liquidity layer, XAU₮0 reduces cross-chain transfer frictions, promoting more consistent pricing across networks.

Additionally, its non-custodial design minimizes external dependencies, further reducing the overall economic risk surface.

frxUSD Token Review

Between the 14th and 30th of August 2025, Chaos Labs conducted a risk assessment of frxUSD, a fiat-redeemable, fully collateralized stablecoin issued by the Frax Finance Protocol.

Institutional RWA: Powering Risk Infrastructure for Horizon

Chaos Labs is collaborating with Aave Labs to build the risk infrastructure for Horizon, an institutional DeFi platform that unlocks stablecoin liquidity for tokenized assets such as money market funds and U.S. Treasuries.

Risk Less.

Know More.

Get priority access to the most powerful financial intelligence tool on the market.