Chaos Labs Unveils Parameter Recommendation Platform.

Introduction

Widely heralded as one of the most exciting new frontiers in finance, crypto is changing everything from the nature of money to the basic mechanisms groups use to govern themselves and coordinate around shared goals.

One consequence is that there are now unprecedented opportunities for both good and evil innovation. For example, there have been remarkable developments in peer-to-peer lending, which have brought about concerningly inventive new ways of executing attacks against protocols.

For most traditional companies, getting hacked likely meant attackers were looking for exploitable software or attempting a SQL injection. In the crypto world, nefarious actors don’t only search for flaws in code but also find ways to exploit a protocol’s market mechanisms.

Some protocol dependencies, such as its liquidity pool, can be manipulated in a way that is profitable to malicious actors at the expense of the protocol’s users. This has been seen recently in the attacks on UST, Moola, and even attempted on Aave via the CRV attack.

Risk management is just as crucial in crypto as traditional finance, but crypto has more dimensions and technical dependencies. Protocols have to worry about basic security just like everyone else, but they also have to think about tweaking their market parameters to minimize vulnerabilities in reaction to ever-changing markets. A carefully-engineered (and audited) protocol like Aave might not be immediately vulnerable to a traditional hack, but unanticipated changes in liquidity and market efficiency could nevertheless leave markets open to manipulation if there are no corresponding parameter updates.

Any protocol wanting to safeguard its user’s funds while realizing the potential of blockchain technologies must therefore think carefully about setting parameters to mitigate downside risk as much as possible.

That’s where Chaos Labs comes in.

Background

In November 2022, Chaos Labs officially joined the Aave community following a successful governance vote. The team at Chaos Labs had one main goal in mind upon onboarding - protecting the Aave protocol while providing the community with an extensive suite of risk products.

Since then, the team has been committed to managing risk in V3 markets and has expanded its engagement to service V2 markets during the transition to V3. Over the last few months, we produced numerous recommendations that were successfully implemented across all markets.

Additionally, various analyses and methodologies have been shared to facilitate discussions within the community. Moreover, the Chaos Labs Asset Protection Tool was launched to help gain insight into potential market manipulation attacks on Aave markets.

Our team has been diligently delivering risk management services while building out our parameter tooling and risk analytics to better support and provide transparency to our recommendations. Today, we proudly reveal the Parameter Recommendation Platform and make it available to the community.

Our platform aims to provide ongoing and automated risk management, allowing the community to reduce risk and maximize efficiency when it comes to capital. Today, we launch a public dashboard accessible to the community, which makes it easier for users to identify the tradeoffs between specific parameters. This platform will further contribute to a better understanding of transparency in the parameter recommendation process.

Parameter-Tuning At The Protocol Level

Two key features make our parameter recommendation platform unique.

The first is our innovative, industry-leading simulation framework. At the heart of our methodology is Chaos Labs’ high-fidelity agent-based simulation platform, which we use to simulate on-chain debt and liquidation behaviors. We run hundreds of thousands of simulations using different price trajectories to measure the impact of key variables such as Value at Risk and Borrow Usage at statistically significant confidence. The result is an unmatched view of the different configurations of assets and chains, exposing the optimal parameters irrespective of possible market conditions. With this knowledge, the Aave community can proactively set its parameters to better protect the protocol from potential bad debt.

The second is our absolute commitment to transparency. We are continuously opening our tools and methodologies to the broader Aave community, where possible so that everyone can explore our simulations, grapple with the results, and see first-hand what the consequences of different parameter configurations could be. The ability to access and view clear and concise information provides a level of accountability and trust that sets our platform apart. The combination of transparency and data availability makes it a valuable tool for decision-making and continuous community education.

The launch of Chaos’ parameter recommendation platform is a testament to these two principles. It marks the beginning of a new chapter in the Aave community’s ability to analyze, understand, and enhance capital efficiency for the protocol. We hope the community sees this as an opportunity to collaborate as we refine our methodology to match the protocol’s evolution.

Platform Deep Dive

Since our engagement started in November 2022, we have worked tirelessly to finetune protocol parameters alongside other contributors using our internal tooling. We now focus on offering ongoing parameter recommendations that help Aave minimize its risk.

The primary goals of the Parameter Recommendation Portal are to:

- Deliver ongoing and automated (proactive) risks management tools to empower the community to mitigate risk and optimize for capital efficiency (and thus protocol revenue) with a high degree of transparency.

- Create a community-facing, public application allowing users to better understand the tradeoffs between specific parameters.

We will use this section to showcase the platform in its current state. Besides providing a community update, this should help you navigate the application as we continue to iterate on the data surfaced and user interface.

You can access the risk parameter recommendations dashboard here. At launch, the home page only contains recommendations for the Avalanche blockchain, but Arbitrum, Ethereum, Optimism, and Polygon will be added in the weeks ahead.

Home Page

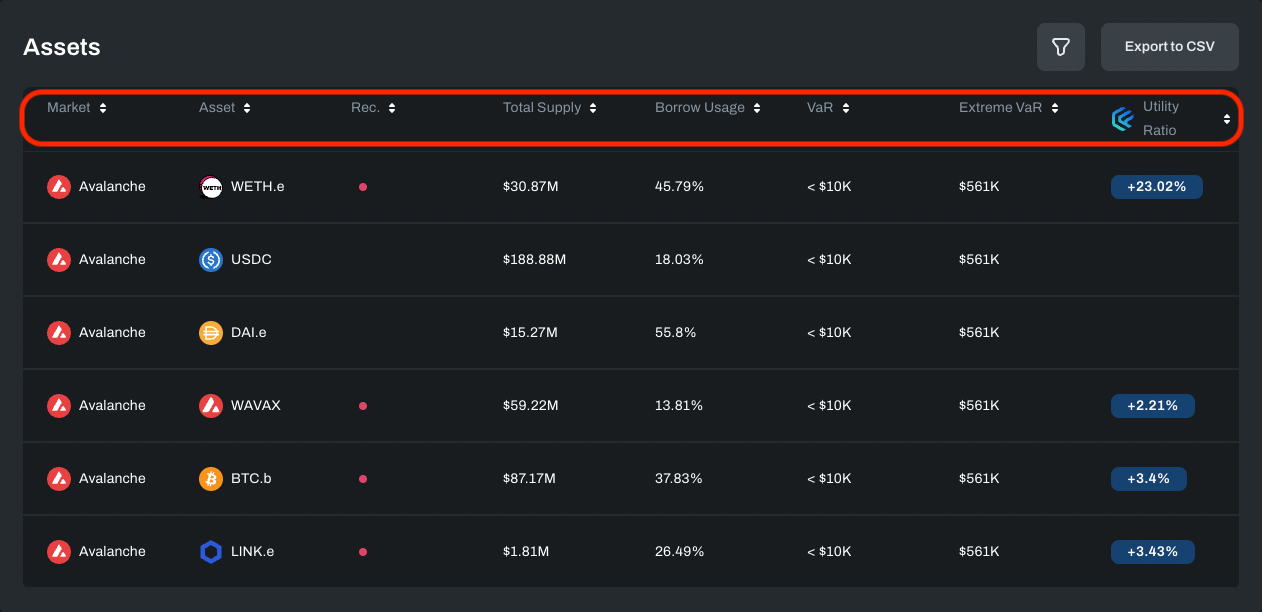

On this page, you can see an overview of all supported markets and assets, with a filter option to find the assets you are most interested in (Seeing as only Avalanche is supported at launch, that’s the only chain you see here).

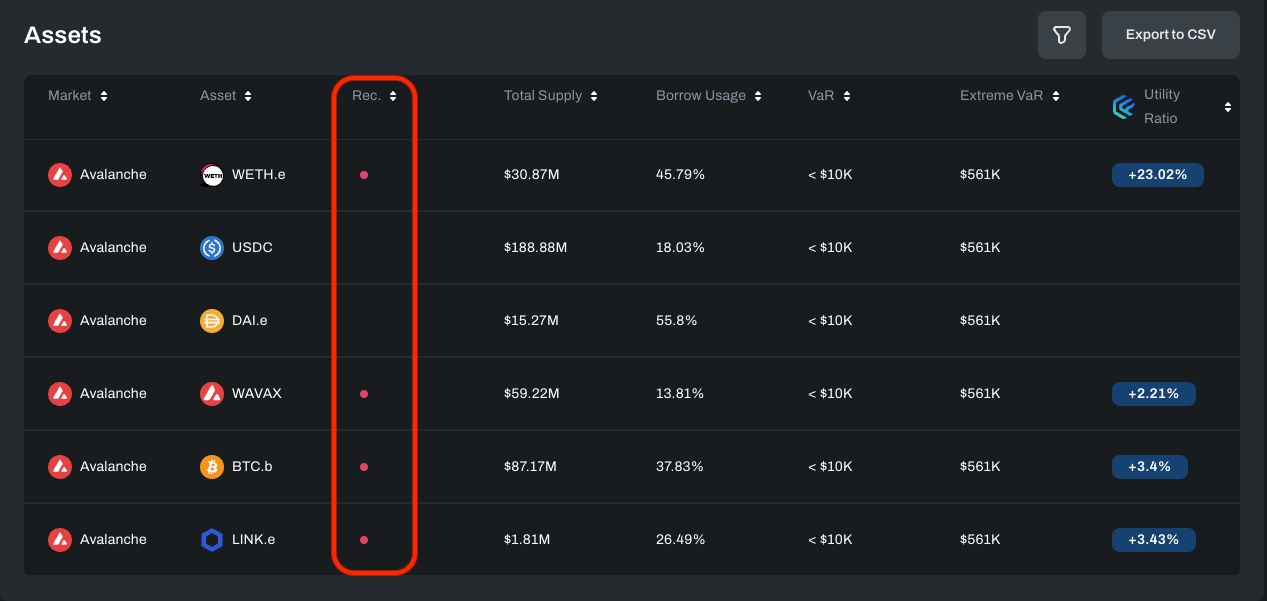

The Rec. column indicates whether Chaos recommends updating parameter values for that specific asset (represented by a red dot)

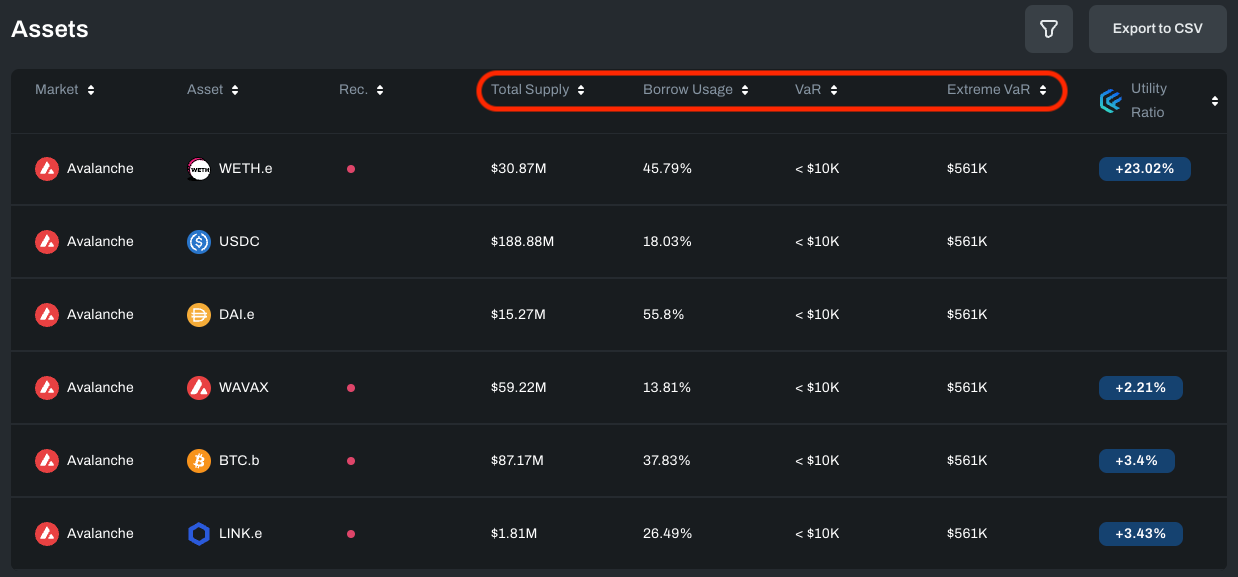

The next four columns highlight the current state of Total Supply, Capital Efficiency (Borrow Usage), and risk (VaR). The Extreme VaR is the 99th percentile of Bad Debt observed through simulations of extreme market conditions.

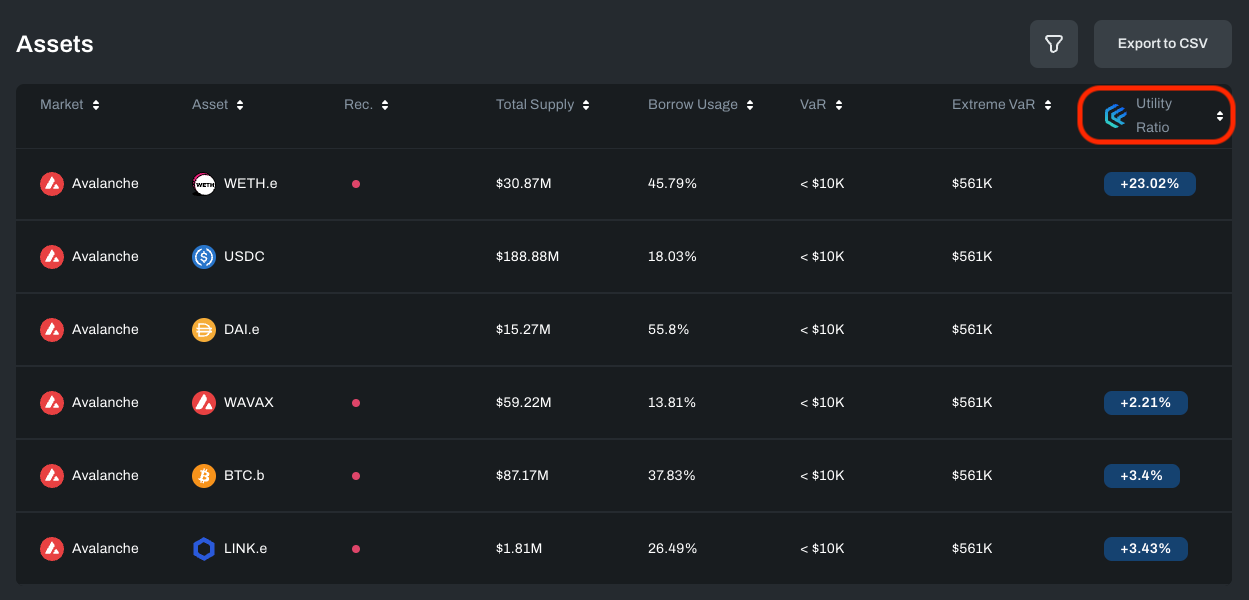

The last column, “Utility Ratio,” is the key metric Chaos uses to show the potential improvement in asset Risk / Return ratio compared to the current state.

💡 You can click into the different rows, which will take you to a dedicated Asset page, diving deeper into specific parameter recommendations from Chaos for that asset on the respective market.

Asset Recommendations

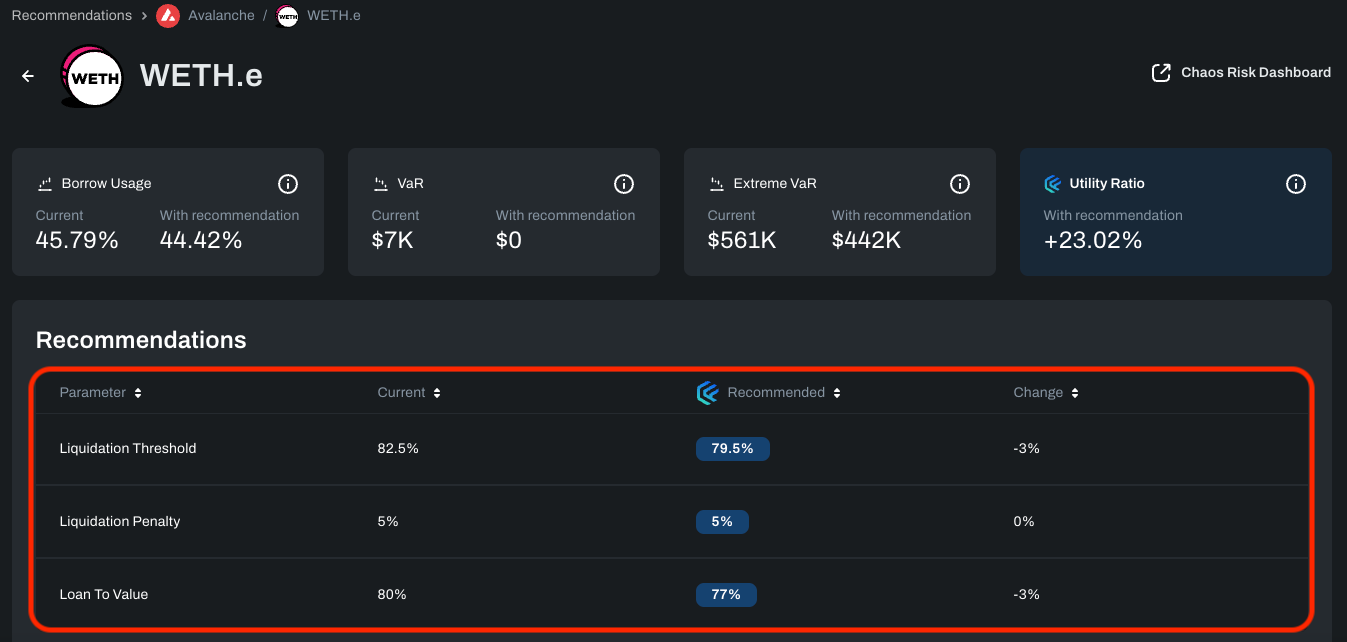

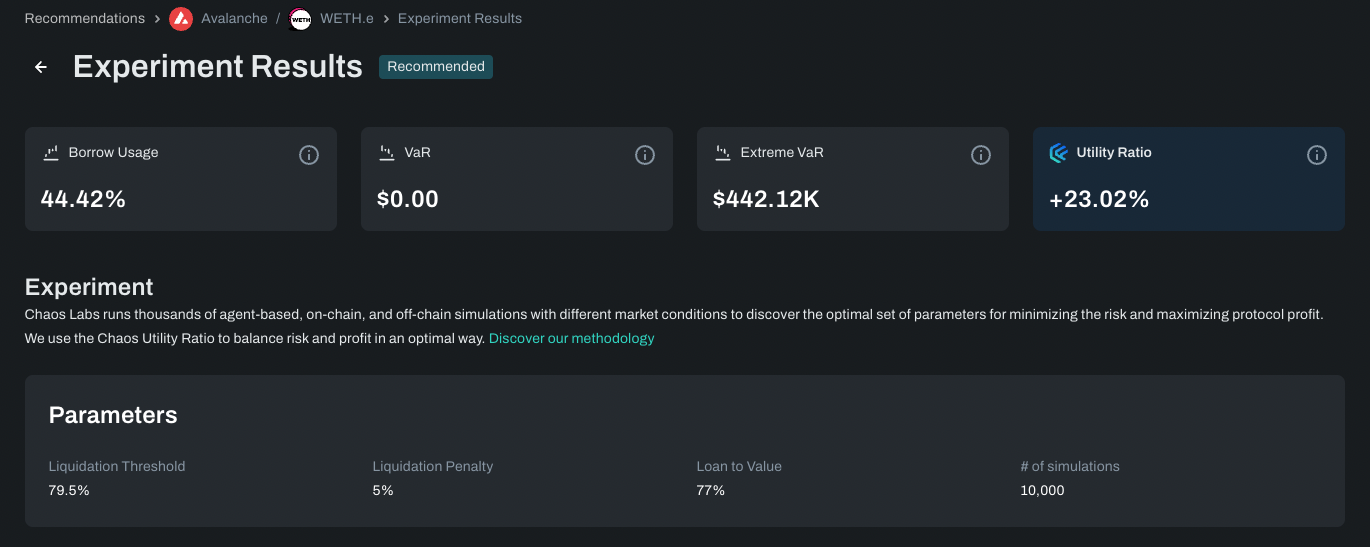

The Asset page highlights the recommended values for Liquidation Threshold, Liquidation Penalty, and Loan-to-Value. In addition, users can see the simulated Borrow Utilization, VaR, and Extreme VaR under the recommended parameters.

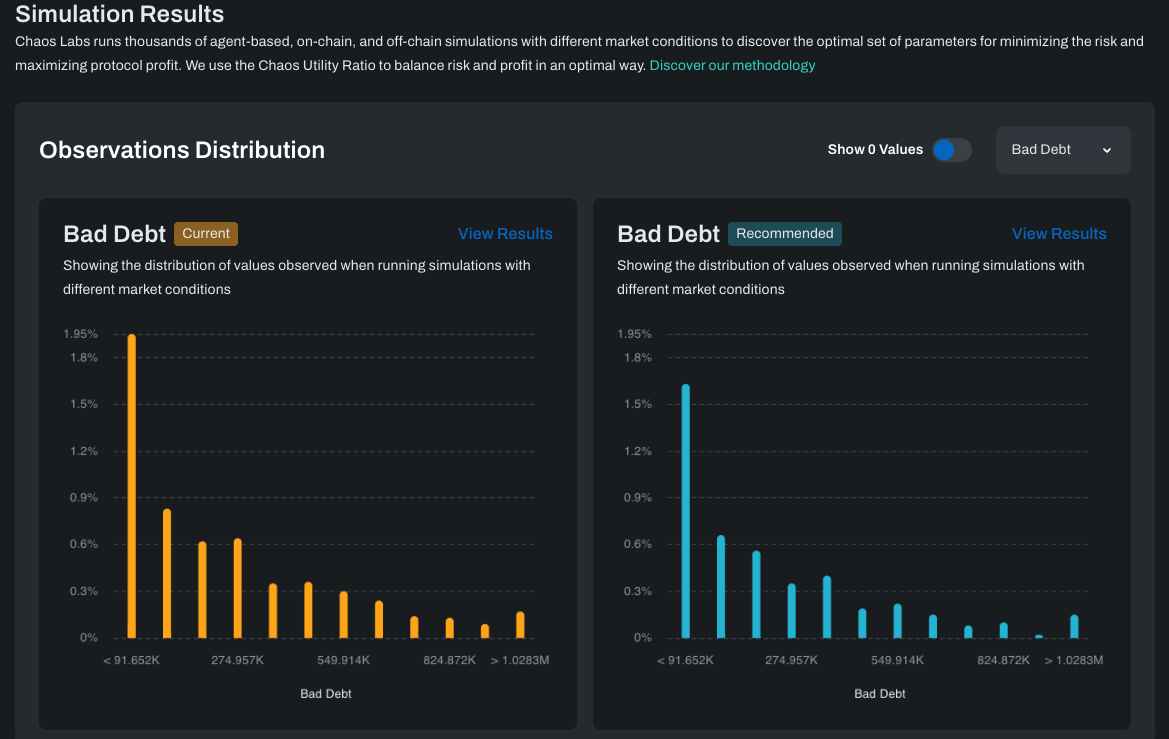

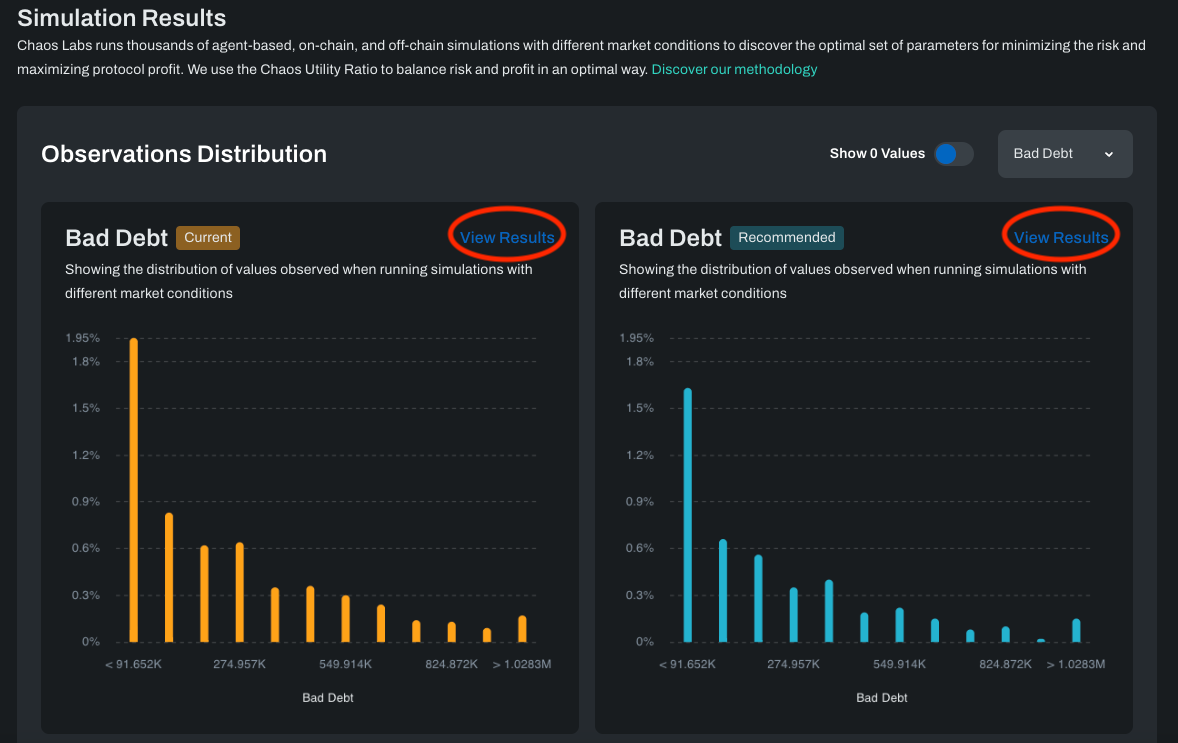

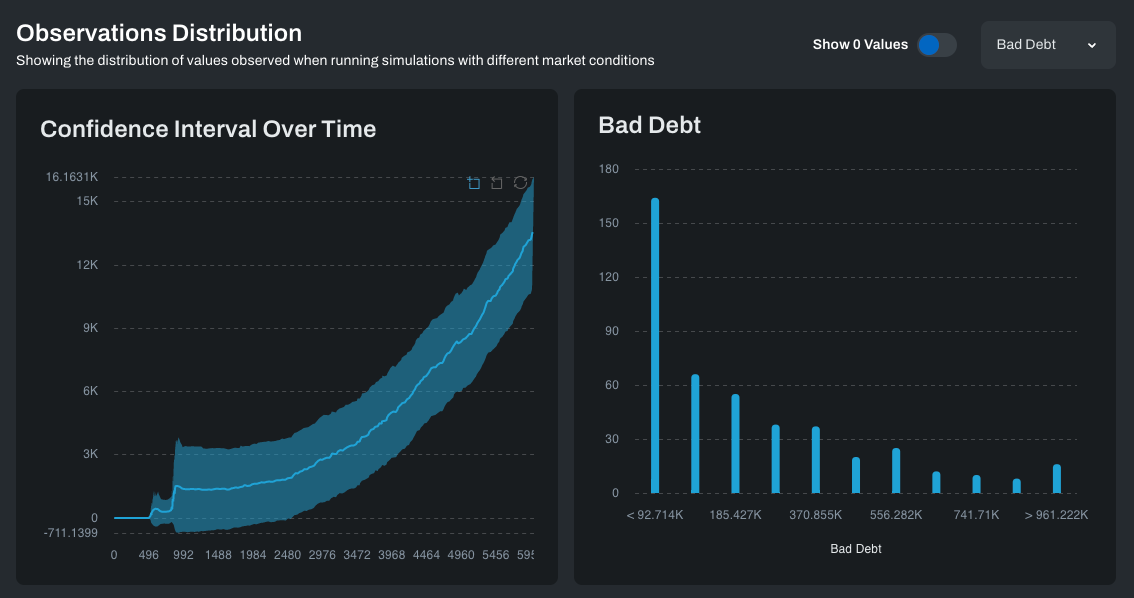

Scrolling down a little bit, we get to the simulation results graphs. The first pair of graphs displays the distribution of bad debt observed given the current and recommended parameters over the course of thousands of simulations of different market conditions.

The chart on the left is the pattern of simulation results given the current parameters in place, and the chart on the right is the pattern of values given the recommended parameters.

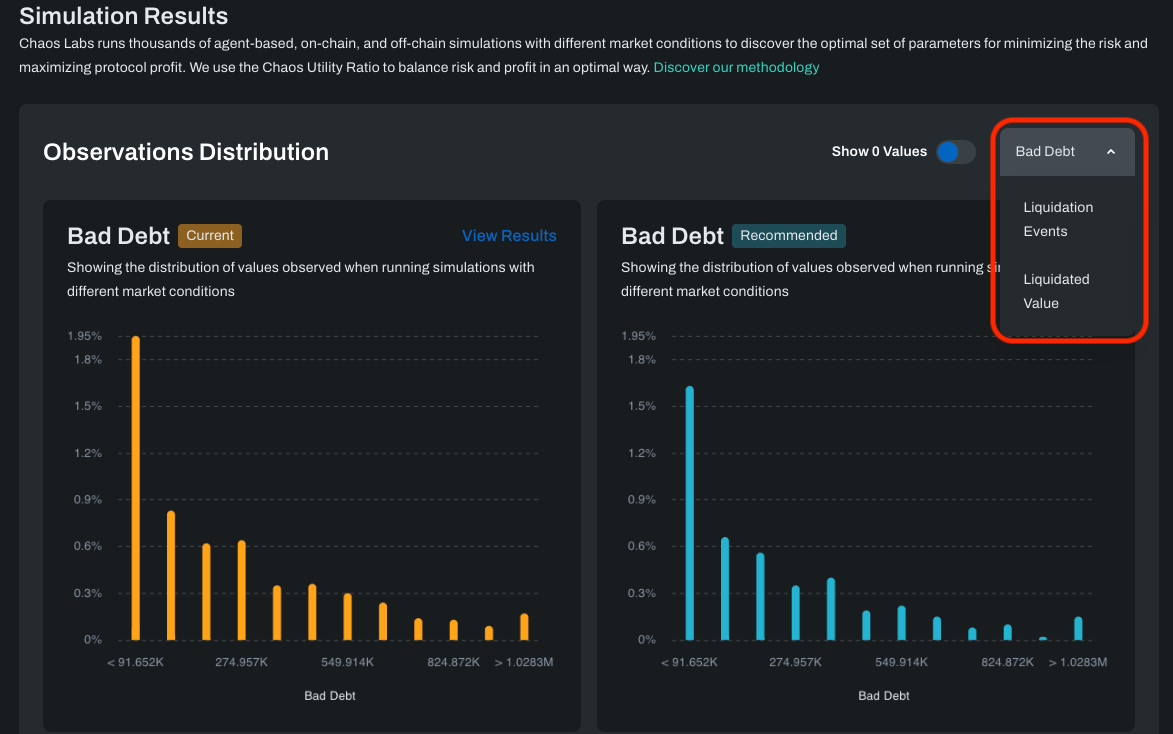

The default graphs observed are ‘Bad Debt.’ By using the drop-down menu, users can also look at ‘Liquidation Events’ or ‘Liquidated Value:

By default, Observer Distribution filters out all 0 results, so focusing on the non-zero values is easier. To see all values, including 0 samples, use the ‘Show 0 values’ toggle.

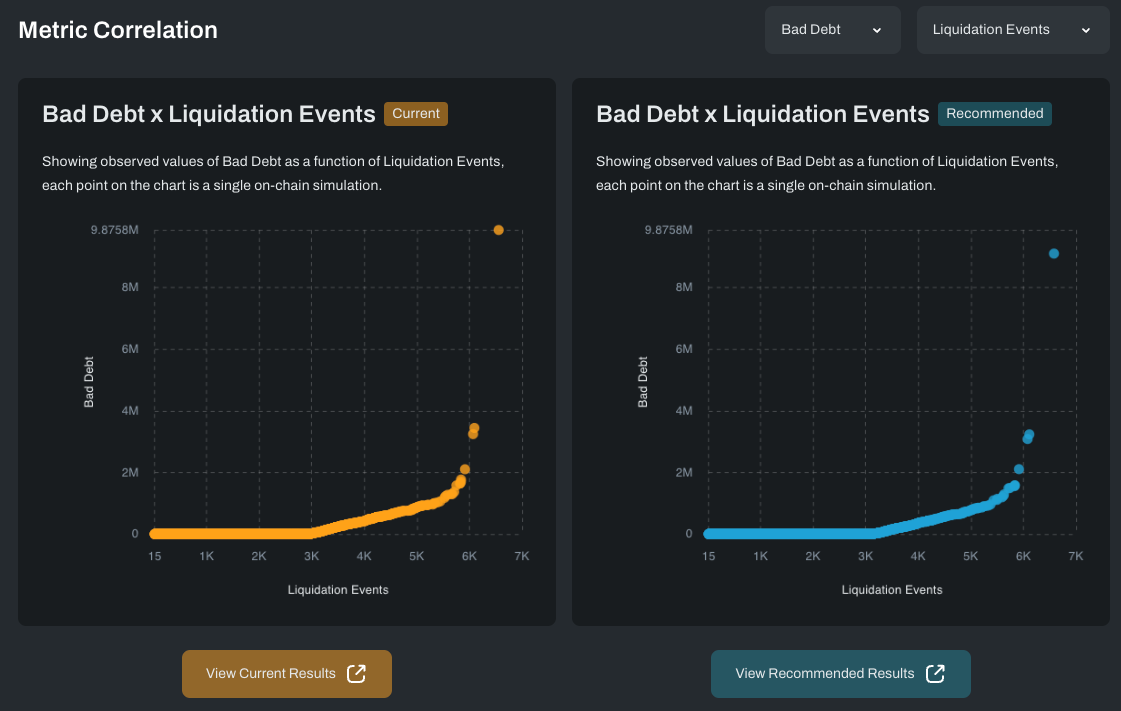

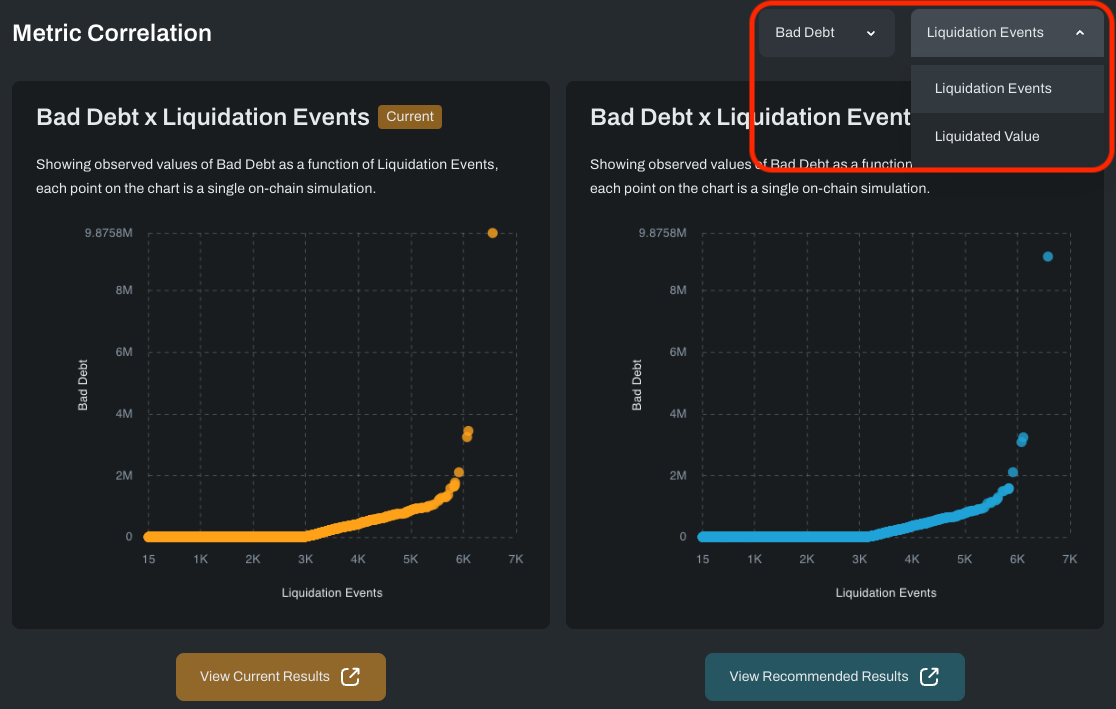

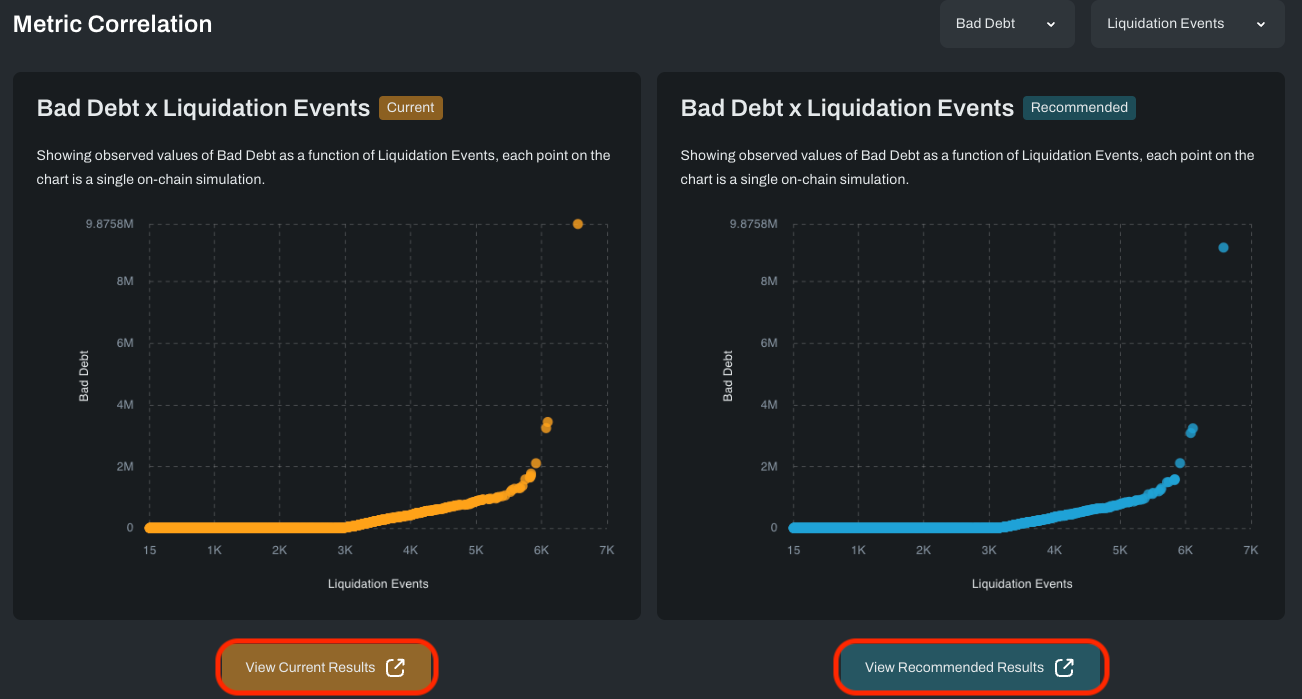

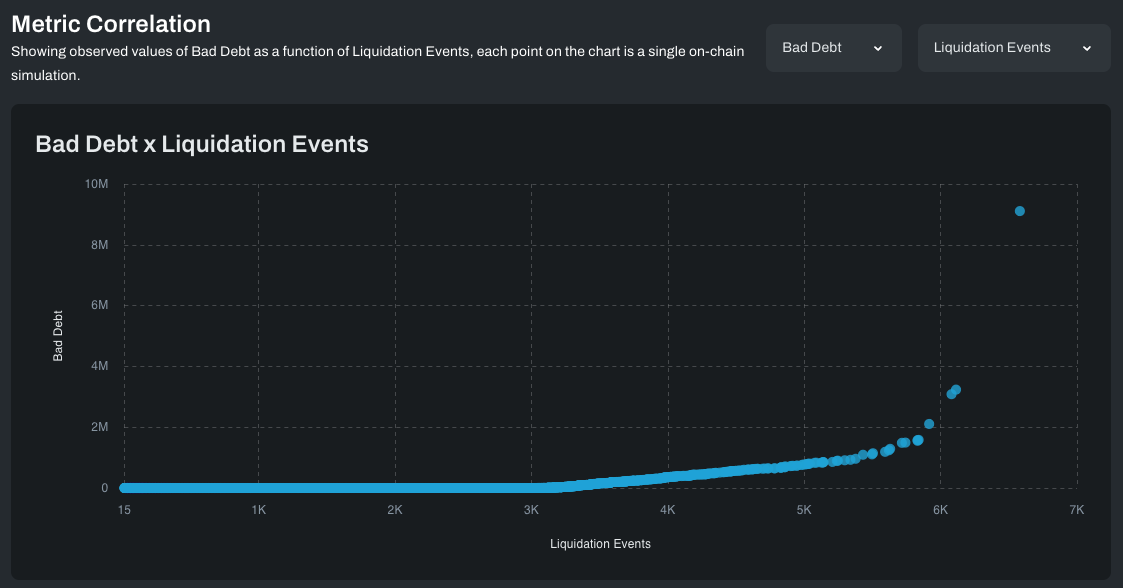

Directly below, we have a set of panels showing correlations between two values within the simulations. As before, the chart on the left shows correlations between, i.e., the current values for ‘Bad Debt’ and ‘Liquidation Events,’ while the chart on the right shows correlations between those same metrics, but on simulations run with the recommended parameters.

If you want to display correlations between two different values, you can use the drop-down menu:

We can go even deeper. We’ve spoken throughout this piece about the many simulations we run to arrive at our insights. Though correlations and charts will be fine for most people, some hardcore power users will want to dig into the results of these simulations. You can click ‘View Results’ in the simulation results graphs to do that.

Or click ‘View Current Results ’/ ‘View Recommended Results’ in the correlations panels.

Experiment Results

This page gives you information on the relevant parameters:

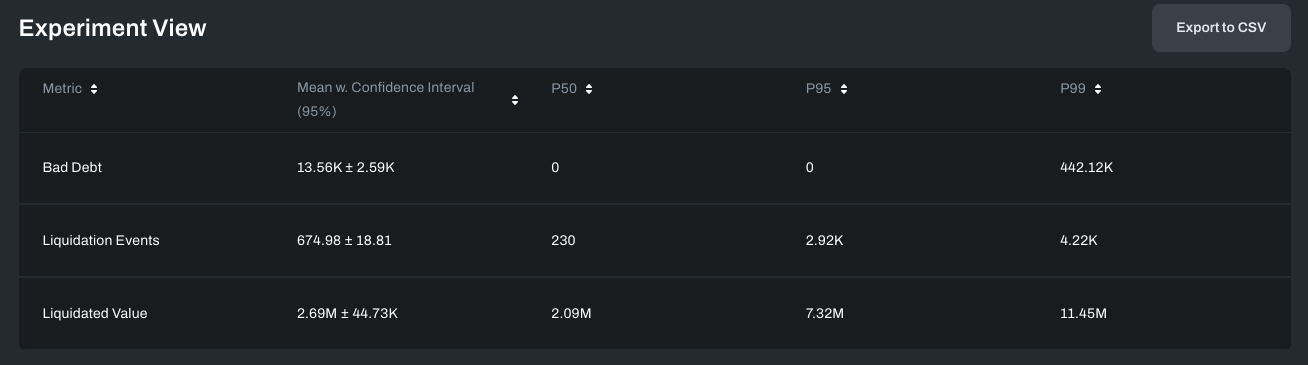

As well as some statistical information on the experiment's results (i.e., its mean w. Confidence interval (95%) and 50%/95%/99% thresholds across all experiments). Risk is not an absolute certainty but a probabilistic one. This table highlights the confidence the Chaos simulation has within given ranges of data output:

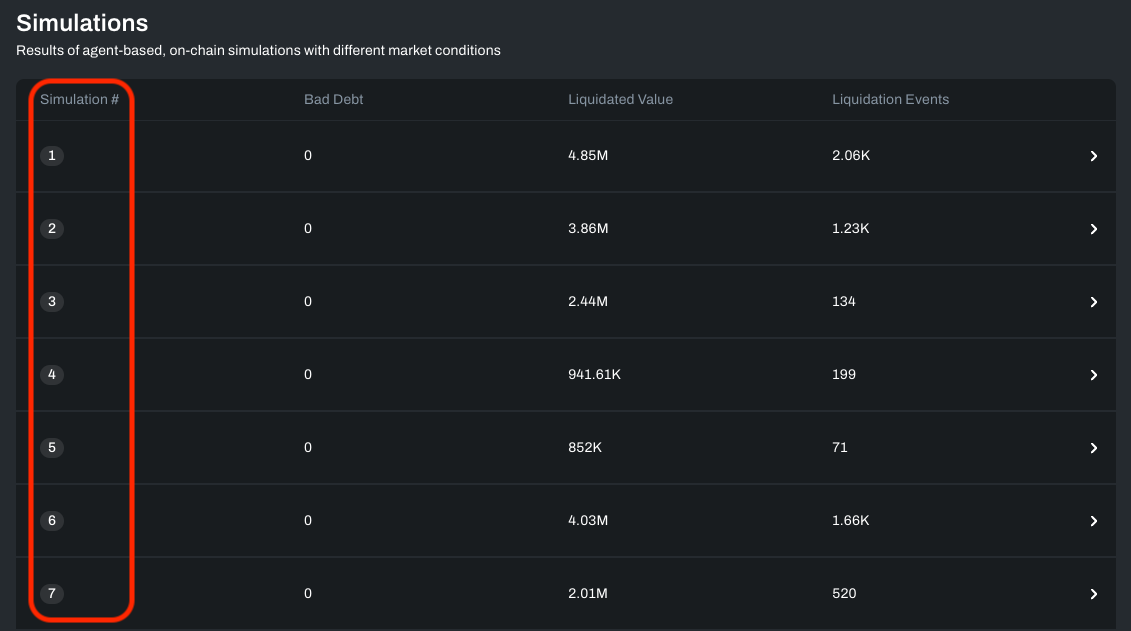

If that’s not enough and you want to inspect the outcomes of each individual experiment, scroll down to the ‘simulations’ panel:

Clicking into a specific simulation allows you to see exactly what happened on a block-by-block basis to the protocol (and its oracles) within the simulation of those parameters in a given market state.

If you keep scrolling down, you will see the Observer Distribution charts show the distribution of values observed when running simulations with different market conditions.

What’s Next

We couldn’t be more excited for the opportunity to work more closely with the remarkable Aave community or more proud of the work we’ve done so far. But we’re only just getting started. In the coming months, we’re looking to roll out the following:

- Continuous parameter recommendations, incorporating community feedback into our models and simulations;

- Enhancements and additional features to the Parameter Recommendations Portal;

- An ‘Asset Listing Portal’ through which we’ll deliver tools to help streamline new collateral onboarding to the Aave protocol;

As always, we warmly invite the community to reach out with feature requests or questions.

Related Posts

- Chaos Labs helps navigate DeFi volatility with an expanded Aave V2 risk partnership (January 11, 2023)

- Chaos Labs joins Aave as full-time contributor (November 17, 2022)

- Chaos Labs launches Aave v3 risk bot (September 15, 2022)

- Chaos Labs launches Aave v3 risk application (September 7, 2022)

- Aave simulation series: stETHdepeg (pt. 0) (August 29, 2022)

- Chaos Labs dives deep into Aave v3 data validity (August 20, 2022)

- Chaos Labs receives Aave grant (August 2, 2022)

Chaos Risk Dashboard Launches Live Alerts for Real-Time Risk Management

Chaos Risk Dashboard has rolled out new functionality that provides real-time alerts covering crucial indicators on the Aave v3 Risk Dashboard and BENQI Risk Dashboard.

Chaos Labs Asset Protection Tool

Chaos is unveiling a new tool to measure price manipulation risk and protect against it. Introducing the Chaos Labs Asset Protection Tool

Risk Less.

Know More.

Get priority access to the most powerful financial intelligence tool on the market.