Introducing the GHO Risk Monitoring Dashboard by Chaos Labs

Table of Contents

Overview

As Aave prepares to launch its decentralized, overcollateralized stablecoin, GHO, Chaos Labs has launched a GHO Risk Monitoring Dashboard.

This new dashboard, currently in Beta and available for the Goerli testnet version of GHO, provides real-time monitoring of the stablecoin and allows users to dive deep into GHO data and usage. It enables Aave community members and developers to easily get real-time access to GHO information on the testnet, ensuring everything runs smoothly and efficiently.

The GHO Risk Monitoring Dashboard. is part of Chaos Labs' comprehensive risk coverage approach for Aave, which includes the Aave Collateral at Risk Dashboard launched in September 2022 and our Parameter Recommendations Platform launched in February 2023.

GHO is programmatically pegged to the U.S. Dollar and is initially minted through borrow positions in the Aave V3 Protocol, with additional minting options expected to be available in the future. Although GHO is currently under development, an alpha version was released on the Ethereum testnet (Goerli) just weeks ago.

To support Aave developers, specifically GHO development, Chaos Labs has launched a new version of the Aave Collateral At Risk Dashboard that monitors Aave on the Ethereum testnet (Goerli). This version of the dashboard includes full monitoring of GHO as a borrow asset and the dedicated GHO Risk Monitoring Dashboard.

By providing real-time monitoring of GHO, this new tool helps users and developers stay informed and make data-driven decisions.

Platform Deep Dive

Overview

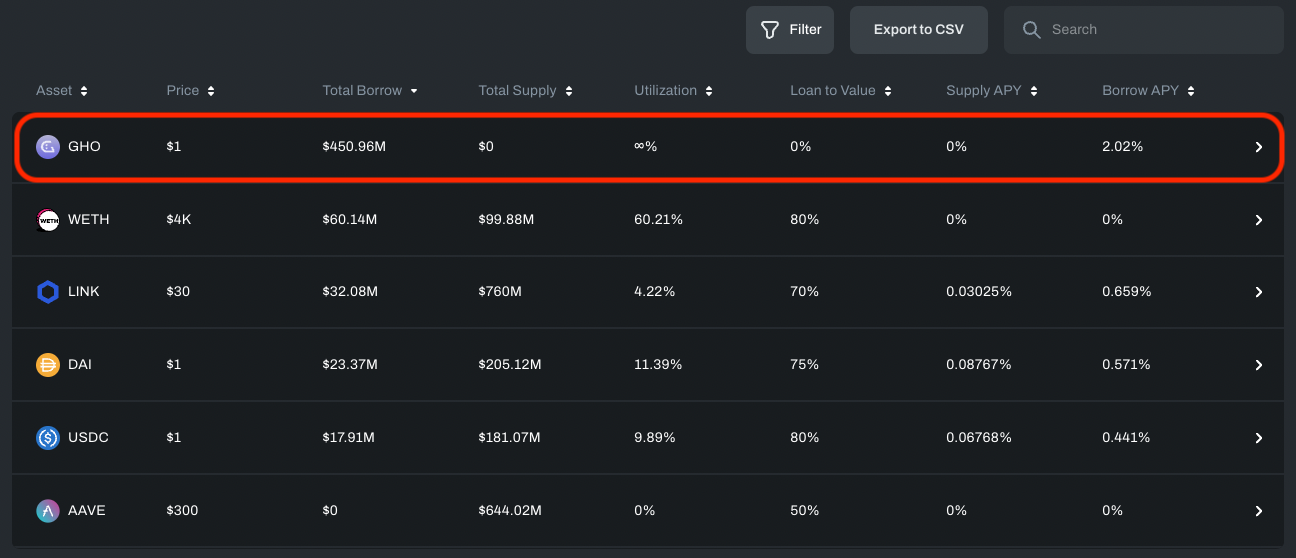

The GHO Risk Monitoring Dashboard. presents GHO alongside all other existing assets with the full functionality provided in the Aave Risk Dashboard, such as borrow positions and risk assessment. This view offers visibility to how GHO acts as an asset across borrow positions and specifically its risk exposure.

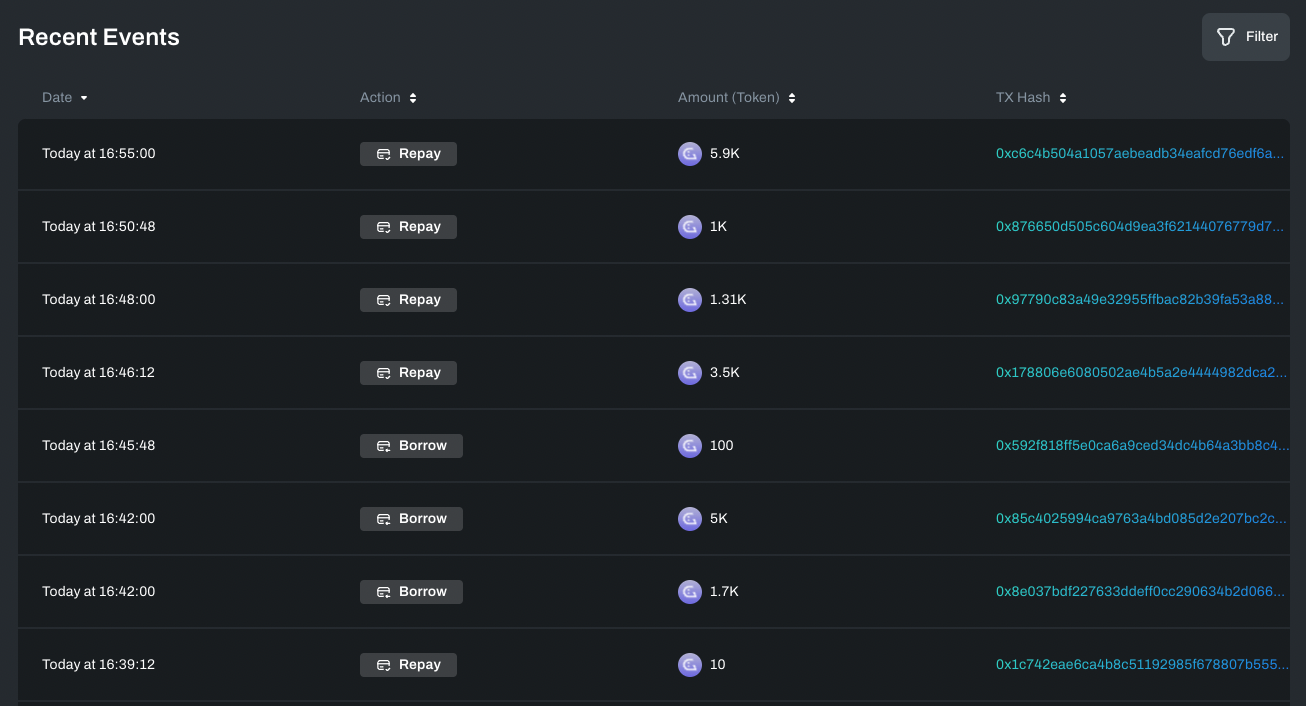

We added new visibility to recent events related to GHO to make it easier to debug and look into transactions. We are rolling this capability to all assets across testnet and mainnet versions of the dashboard.

GHO [Beta]

We’ve launched a new page (currently in Beta version) showing additional, in-depth GHO-specific analytics. This page provides a holistic view of GHO across different risk vectors beyond insolvency risk, including Collateral Risk, Market Risk, and Liquidity Risk.

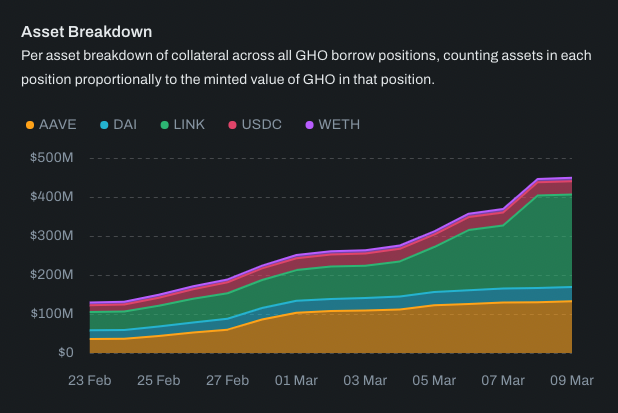

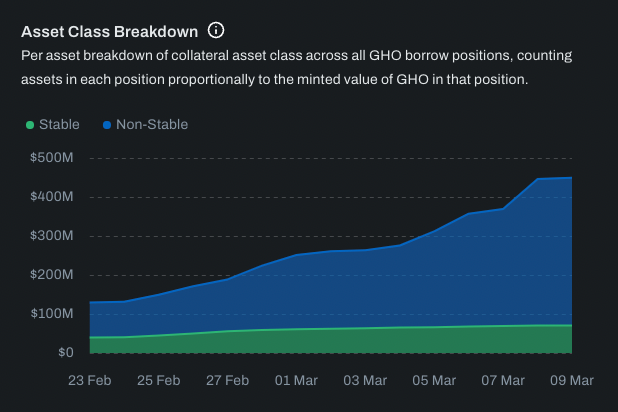

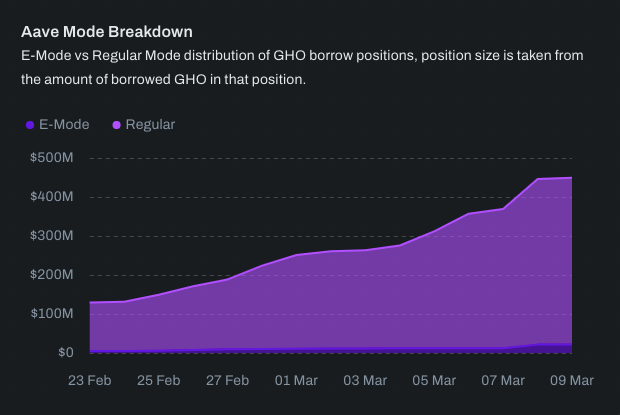

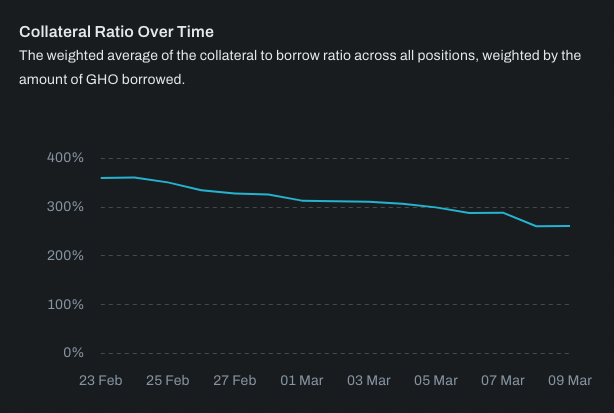

The Beta product provides visibility into the collateral provided to borrow GHO from a few viewpoints:

- Asset breakdown

- Asset class breakdown

- Aave mode breakdown (E-Mode vs. Regular Mode)

- Collateral-to-borrow ratio across all positions over time

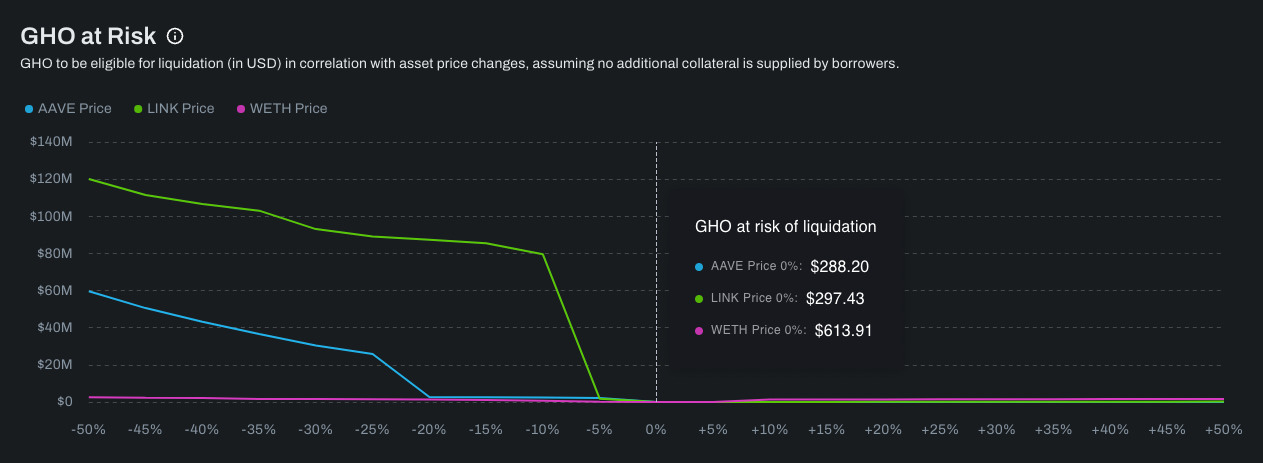

Similar to the “Liquidations” tool in our v3 Risk Dashboard, we can highlight the amount of GHO eligible for liquidation (in USD) for different changes in the price of provided collateral.

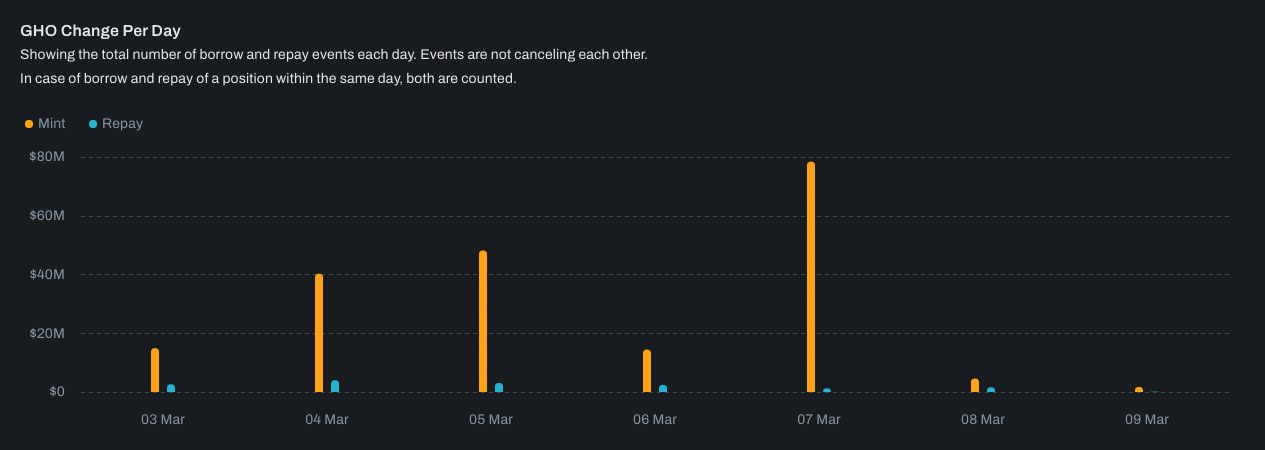

Users can scroll down to view the total amount of borrowing ("Mint") and the daily repayment events.

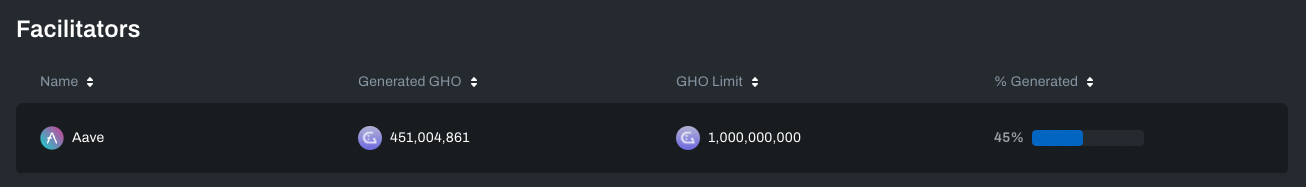

Lastly, users can view data regarding GHO generation by Facilitators.

Next steps

We launched the GHO Risk Monitoring Dashboard. for GHO developers and community members who borrow GHO on the testnet. We plan to extend this dashboard as the GHO ecosystem grows in two major areas:

- Facilitators - the GHO dashboard is built as an overarching portal to view risk vectors across all facilitators. We will add support for facilitator-by-facilitator granularity once additional facilitators are onboarded.

- Secondary Markets - once GHO is open to be traded in secondary markets (across DeFi and CeFi), the GHO risk dashboard will provide visibility to liquidity trends and risks across all markets.

We invite the Aave community to explore this new dashboard! If you've got a question or comment, don't hesitate to contact us on Twitter or email [email protected].

Related Posts

- AAVE v3 Collateral At Risk Dashboard Expands Deployments Support to Ethereum v3 (February 13, 2023)

- Chaos Labs Unveils Parameter Recommendation Platform (February 1, 2023)

- Chaos Labs helps navigate DeFi volatility with an expanded Aave V2 risk partnership (January 11, 2023)

- Chaos Labs joins Aave as a full-time contributor (November 17, 2022)

- Chaos Labs launches Aave v3 risk bot (September 15, 2022)

- Chaos Labs launches Aave v3 risk application (September 7, 2022)

- Aave simulation series: stETHdepeg (pt. 0) (August 29, 2022)

- Chaos Labs dives deep into Aave v3 data validity (August 20, 2022)

- Chaos Labs receives Aave grant (August 2, 2022)

Chaos Risk Dashboard Launches Live Alerts for Real-Time Risk Management

Chaos Risk Dashboard has rolled out new functionality that provides real-time alerts covering crucial indicators on the Aave v3 Risk Dashboard and BENQI Risk Dashboard.

Chaos Labs Asset Protection Tool

Chaos is unveiling a new tool to measure price manipulation risk and protect against it. Introducing the Chaos Labs Asset Protection Tool

Risk Less.

Know More.

Get priority access to the most powerful financial intelligence tool on the market.